Last updated on February 8th, 2026 at 10:31 pm

How This 2026 Tax Changes for Millennials Guide Is Organized (and How to Use It)

Most people know that tax laws are changing in 2026.

Far fewer understand what those changes actually mean for their tax bill.

That gap matters — especially for Millennials and Gen Z, who are now earning more, juggling student loans, working variable-income jobs, raising families, and trying to build long-term financial security at the same time.

The good news?

Several 2026 tax changes for millennials quietly work in your favor.

The bad news?

Most of them don’t show up in your paycheck, and many people miss them entirely.

This guide isn’t a filing checklist or a last-minute tax season article. Instead, it’s designed to help you understand how the 2026 tax changes for millennials affect real decisions — overtime, saving, healthcare costs, family expenses, and how much of your income you actually keep.

- Why this guide works differently

- A note about the calculator (important)

- How to use this guide

- 1. Lower Individual Income Tax Rates Are Now Permanent

- 2. The Higher Standard Deduction Is Here to Stay (With Extra Boosts)

- 3. The Child Tax Credit Is Larger and More Reliable

- 4. Qualified Overtime Pay Can Now Be Deducted

- 5. Interest on Qualified Vehicle Loans Becomes Deductible

- 6. Tip Income Receives New Federal Tax Relief

- 7. The SALT Deduction Cap Jumps to $40,000 (Temporarily)

- 8. Child and Dependent Care Credits Are Enhanced

- 9. Health Savings Account (HSA) Limits Increase Again

- 10. Student Loan and Pell Grant Rules Are Changing

- 11. Why These Changes Add Up More Than Most People Expect

- A quick self-check

- Final thought

- 🔹 1. Permanent Lower Individual Income Tax Rates and Brackets

- 🔹 Section 2: The Higher Standard Deduction (Permanent + Temporary Boosts)

- 🔹 Section 3: The Increased Child Tax Credit

- 🔹 Section 4: Deduction for Qualified Overtime Pay (2025–2028)

- 🔹 Section 5: Deduction for Interest on Qualified Vehicle Loans (2025–2028)

- 🔹 Section 6: No or Limited Federal Income Tax on Tips (2025–2028)

- 🔹 Section 7: Increased SALT Deduction Cap (Up to $40,000)

- 🔹 Section 8: Enhanced Child and Dependent Care Tax Credit

- 🔹 Section 9: Increased Health Savings Account (HSA) Contribution Limits (2026

- 🔹 Section 10: Student Loan & Pell Grant Program Changes

- 🔹 Section 11: Why Stacking These Changes Matters (and Where Most People Miss the Benefit)

Why this guide works differently

Rather than listing rules in isolation, this article walks through each major 2026 change one by one, explaining:

- What changed

- Who it actually applies to (and who it doesn’t)

- Common misunderstandings and exclusions

- Why the change matters in real life, not just on paper

You’ll also see how certain provisions interact with each other, which is where many households either gain or lose the most.

A note about the calculator (important)

It was created specifically to accompany this guide — not as a generic tax estimator, but as a way to model how multiple 2026 tax changes work together in real scenarios.

As you read each section, you may find it helpful to:

- Adjust income types (salary, overtime, tips)

- See how deductions affect adjusted gross income

- Understand when credits phase out

- Compare outcomes when benefits are stacked versus viewed individually

You don’t need the calculator to read this article — but if you want to see how these rules play out in your own situation, it’s there as a practical follow-through.

How to use this guide

- Skim the outline to see which sections matter most to you

- Jump to specific sections using the navigation links

- Read straight through if you want the full picture of how the 2026 tax changes for millennials connect

Each section stands on its own — but the biggest insight comes from seeing how they fit together.How to read this article

This article is intentionally laid out in two layers:

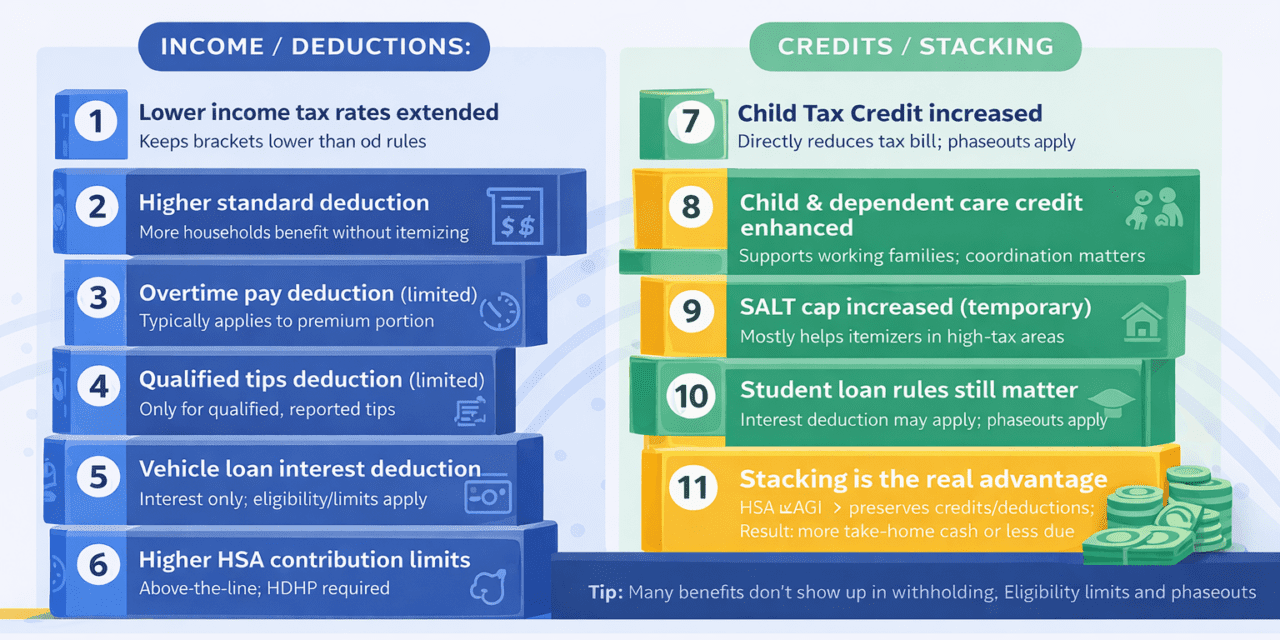

First, you’ll see a clear outline of the 11 most important 2026 tax changes that affect Millennials and Gen Z. This gives you a quick, high-level understanding of what changed and why it matters.

Next, each of those 11 items is explained in more detail below. You can:

- Scroll straight through for the full picture, or

- Use the jump buttons to click directly to the sections most relevant to your situation

Each detailed section explains:

- What changed

- Who qualifies — and who doesn’t

- Income limits, phaseouts, or exclusions

- Why the change is often misunderstood

- What it means for planning (not filing)

If you’re short on time, start with the outline.

If you want clarity, use the buttons to explore the details that apply to you.

By the end, you’ll have a much clearer picture of the 2026 tax changes for millennials — and why many people are surprised by their tax bill even when nothing “felt” different during the year.

1. Lower Individual Income Tax Rates Are Now Permanent

One of the biggest changes is also one of the least visible.

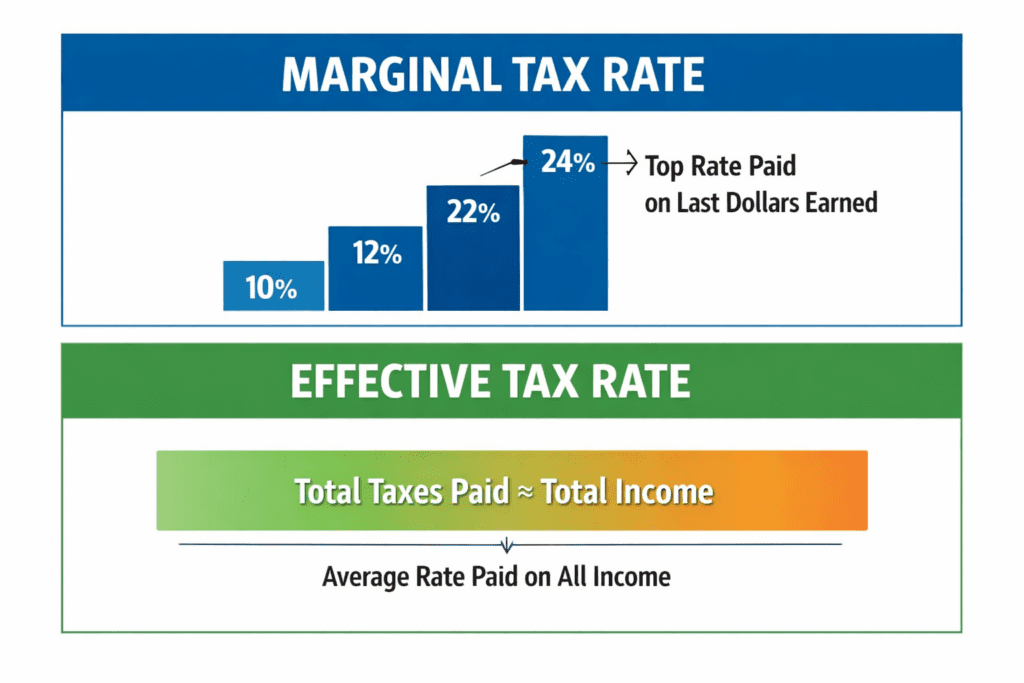

The lower federal income tax rates introduced under the Tax Cuts and Jobs Act are no longer temporary. Without this change, tax brackets would have reverted to higher pre-2017 levels.

What this means:

- The top rate stays at 37%, instead of jumping back to 39.6%

- Most working Millennials stay in lower effective tax brackets

- More of your income is taxed at lower marginal rates

This doesn’t eliminate taxes — but it reduces long-term tax liability, especially for middle- and upper-middle-income earners.

2. The Higher Standard Deduction Is Here to Stay (With Extra Boosts)

For years, the standard deduction has quietly replaced itemizing for most people. Now it’s permanent.

For 2026:

- The nearly doubled standard deduction remains in place

- Temporary boosts add extra value through 2028

- Filing is simpler for renters and non-itemizers

This matters because many of the most valuable 2026 tax benefits stack on top of the standard deduction — not instead of it.

Quick questions people ask here

Does this mean itemizing is pointless?

Not always — but for many Millennials, the standard deduction plus above-the-line deductions now beats itemizing.

Does the standard deduction lower my tax bracket?

No. It lowers taxable income, which can reduce how much of your income is taxed at higher rates.

3. The Child Tax Credit Is Larger and More Reliable

For Millennial parents, the Child Tax Credit is more than symbolic.

Under the new rules:

- The credit increases to $2,200 per child

- Refundable portions are enhanced for some households

- Higher levels are locked in long-term

This directly reduces tax liability dollar-for-dollar, making it one of the most powerful benefits available during family-building years.

4. Qualified Overtime Pay Can Now Be Deducted

This is one of the most misunderstood changes — and one of the most valuable.

From 2025 through 2028:

- Qualified overtime premium pay can be deducted

- Limits reach $12,500 (single) or $25,000 (joint)

- Phaseouts apply at higher incomes

This benefits workers in health care, tech operations, public safety, manufacturing, and service roles where overtime is common.

Important clarification

This does not reduce withholding automatically.

The benefit usually shows up when you file, which is why many people underestimate its impact.

5. Interest on Qualified Vehicle Loans Becomes Deductible

With vehicle prices and interest rates still elevated, this change matters.

For eligible personal-use vehicles:

- Up to $10,000 in annual interest may be deductible

- Applies primarily to U.S.-assembled vehicles

- Income phaseouts apply

- Available 2025–2028

This deduction sits above the line, meaning it works even if you take the standard deduction.

6. Tip Income Receives New Federal Tax Relief

Tipped income is no longer treated as a blind spot.

Under the new law:

- Qualified tips can be deducted up to set limits

- Phaseouts apply at higher income levels

- Applies to food service, delivery, rideshare, and similar work

For Millennials and Gen Z with side hustles or service income, this can materially reduce taxable income — even if withholding didn’t reflect it.

7. The SALT Deduction Cap Jumps to $40,000 (Temporarily)

For years, the $10,000 SALT cap hit people in high-tax states hard.

Now:

- The cap rises to $40,000

- Phaseouts apply for higher earners

- The increase is temporary

This primarily benefits homeowners and itemizers in high-cost areas — and plays directly into relocation, housing, and long-term planning decisions.

Quick questions people ask here

Does this help everyone?

No. It mostly helps itemizers in higher-tax states.

Is this permanent?

No. It’s scheduled to revert unless extended.

8. Child and Dependent Care Credits Are Enhanced

Childcare costs didn’t go down — but the tax treatment improved.

Enhancements to the Child and Dependent Care Tax Credit:

- Increase eligible percentages

- Expand qualifying expenses

- Provide more relief to working parents and caregivers

For households balancing careers and care responsibilities, this can meaningfully reduce annual tax bills.

9. Health Savings Account (HSA) Limits Increase Again

HSAs remain one of the most tax-efficient tools available — and the limits increase in 2026.

2026 contribution limits (calendar year):

- Individual HDHP: $4,400 (up $100)

- Family HDHP: $8,750 (up $200)

- Catch-up (age 55+): $1,000 (unchanged)

That means eligible contributors can reach:

- $5,400 (self-only) with catch-up

- $9,750 (family) with catch-up

HSA contributions reduce taxable income, grow tax-free, and can be used for medical care now or later — making them especially powerful for Millennials planning ahead.

10. Student Loan and Pell Grant Rules Are Changing

Student loans remain a defining financial issue for Millennials.

While not all changes show up directly on your tax return:

- Repayment options are shifting

- Pell Grant structures are being adjusted

- Long-term planning assumptions may change

These changes affect cash flow, saving capacity, and tax strategy, even when they don’t alter a single line on Form 1040.

11. Why These Changes Add Up More Than Most People Expect

Here’s the part most articles miss:

Each change on its own looks modest.

Together, they can dramatically alter taxable income and tax liability.

Overtime deductions + HSA contributions + student loan interest + higher credits can stack — even if you take the standard deduction.

That’s why so many people expect their tax bill to stay the same… and are surprised when it doesn’t.

A quick self-check

You don’t need to answer all of these “yes” for the 2026 changes to matter.

- You work overtime, earn tips, or have variable income

- You take the standard deduction

- You contribute (or could contribute) to an HSA or retirement plan

If any of these apply, planning matters more than filing.

Final thought

Tax software helps you report what already happened.

Tax planning helps you decide what to do before it happens.

The 2026 tax changes reward people who understand how deductions, credits, and income interact — not just those who file early.

Understanding these rules now gives you options.

And options are what financial security is built on.

🔹 1. Permanent Lower Individual Income Tax Rates and Brackets

What changed

Under the One Big Beautiful Bill, the lower federal income tax rates and bracket structure originally introduced by the Tax Cuts and Jobs Act (TCJA) are now permanently extended.

Without this change, federal income tax rates would have reverted to higher pre-2017 levels starting in 2026. Instead, the current bracket structure remains in place, preserving lower marginal tax rates across most income levels.

For example:

- The top marginal rate stays at 37%, rather than increasing to 39.6%

- Middle-income brackets remain lower than they would have been under prior law

- Bracket thresholds continue to adjust for inflation

This change affects nearly all working taxpayers, but its impact varies depending on income level and filing status.

Who this applies to

This change applies broadly to:

- Single filers and joint filers

- Salaried employees and hourly workers

- Business owners reporting pass-through income

- Millennials and Gen Z earners whose incomes are rising into higher brackets

Anyone earning taxable income in the United States benefits from the continued lower rate structure compared to what would have occurred under a reversion to pre-2017 law.

Your employer may or may not have adjusted your federal income tax withholding to reflect the new, lower tax brackets.

Many financial professionals recommend reviewing your withholding so it more closely matches what you expect to owe by year-end. When withholding is much higher than your actual tax liability, a large refund often means you’ve effectively given the government an interest-free loan.

- Adjust withholding to be closer to your expected tax bill

- Set the difference aside in a low-risk money market fund

- Keep funds accessible in case you need to cover a small shortfall

If your federal income tax withholding ends up more than 10% short of what you owe, you may be subject to an underpayment penalty.

You generally have from January 1 through April 14 of the following year to pay any balance due. This approach isn’t about underpaying taxes — it’s about aligning withholding with reality while keeping flexibility.

Who this does not meaningfully affect

While universal in scope, this change has less impact for:

- Very low-income filers whose effective tax rates were already minimal

- Individuals whose income is largely sheltered by credits or deductions

- Taxpayers whose income falls entirely within the lowest brackets

In other words, the benefit grows as taxable income increases.

What this does not do

It’s important to be clear about what this change does not mean:

- It does not eliminate federal income taxes

- It does not flatten the tax code

- It does not mean all income is taxed at lower rates

The U.S. tax system remains progressive, meaning income is still taxed in layers, with higher portions taxed at higher marginal rates.

Why Millennials often underestimate this change

Many Millennials assume:

“If my paycheck hasn’t changed, this must not matter.”

But tax brackets don’t change how withholding looks — they change how income is ultimately taxed.

As incomes rise over time, staying in lower marginal brackets for longer:

- Reduces lifetime tax liability

- Makes deductions and credits more valuable

- Amplifies the effect of stacking strategies later in this article

This is especially relevant for Millennials moving from early-career earnings into peak earning years.

Planning takeaway (not advice)

The permanent extension of lower tax rates doesn’t require action on its own — but it changes the backdrop for every other tax decision.

Deductions, credits, overtime income, and savings strategies all work within this bracket structure. Understanding that the brackets themselves are now more favorable is the first step in understanding why the 2026 tax changes add up differently than many people expect.

If you want to see how these changes interact in your own situation, the 2026 Tax Scenario Calculator for Millennials lets you model how overtime pay, HSA contributions, vehicle loan interest, and credits may affect your taxable income and estimated federal tax — without requiring tax software or a full return.

Deeper scenario modeling and planning tools are available inside the Millennial Financial Lab, where members can explore how tax decisions connect to budgeting, savings, and longer-term financial goals.

🔹 Section 2: The Higher Standard Deduction (Permanent + Temporary Boosts)

What changed

The nearly doubled standard deduction introduced under the Tax Cuts and Jobs Act is now permanent, removing the risk that it would be cut back to pre-2017 levels. In addition, temporary enhancements increase the value of the standard deduction through 2028.

For 2026, this means:

- More income is automatically shielded from federal income tax

- Fewer taxpayers benefit from itemizing deductions

- Filing remains simpler for most households

This change disproportionately benefits Millennials, many of whom:

- Rent rather than own

- Don’t have large mortgage interest or charitable contributions

- Prefer predictable, low-friction tax filing

| Scenario | Standard Deduction | Itemizing Deductions |

|---|---|---|

| Filing complexity | Simple and predictable | More complex, requires documentation |

| Best for | Renters, younger households, moderate deductions | Homeowners with large mortgage interest, property taxes, or charitable giving |

| Upfront tax benefit | Fixed amount guaranteed | Varies year to year |

| Works with overtime, HSA, student loan interest | Yes — these stack on top | Yes — but requires more tracking |

| SALT limitation impact | Not affected | Limited by SALT deduction cap |

| Common outcome for Millennials | Lower taxable income with less effort | Often higher taxable income than expected |

Who this applies to

The higher standard deduction applies to:

- Single filers

- Married couples filing jointly

- Heads of household

It benefits both salaried and hourly workers and applies regardless of whether income comes from wages, self-employment, or a mix of sources.

Who this does not meaningfully help

The standard deduction may be less beneficial for:

- High-income taxpayers with substantial itemized deductions

- Homeowners with large mortgage interest and property tax payments

- Individuals with unusually high medical expenses or charitable contributions

However, even many taxpayers who could itemize still find that the higher standard deduction produces a lower tax bill.

Why this change is often misunderstood

A common misconception is that taking the standard deduction means you’re “missing out” on tax planning opportunities.

In reality, many of the most valuable 2026 tax benefits:

- Apply above the line

- Reduce adjusted gross income (AGI)

- Stack on top of the standard deduction

This includes deductions for:

- Student loan interest

- Qualified overtime pay

- Vehicle loan interest

- Health Savings Account (HSA) contributions

As a result, the standard deduction has become the foundation, not the limitation, of modern tax planning.

How this affects Millennials differently

For Millennials, the permanence of the higher standard deduction changes the planning mindset:

- There’s less pressure to itemize

- More focus shifts to income timing and pre-tax contributions

- Planning moves earlier in the year, not just at filing time

This aligns with how Millennials actually live and work — with variable income, side projects, and employer-sponsored benefits playing a larger role than traditional itemized deductions.

This guide is part of the Millennial Financial Hub for 2026, which focuses on the real-world financial decisions Millennials and Gen Z are facing as incomes rise and tax rules evolve.

Planning takeaway (not advice)

The higher standard deduction doesn’t eliminate the need for tax awareness — it changes where the leverage is.

Instead of trying to generate itemized deductions, many Millennials benefit more from understanding which deductions reduce income before the standard deduction is applied and how those deductions interact with tax brackets.

Not all tax deductions work the same way. One of the most important distinctions in the tax code is whether a deduction applies above the line or below the line.

Above-the-line deductions reduce your income before the standard deduction is applied. These deductions lower your adjusted gross income (AGI) and are available whether you itemize or not.

- Health Savings Account (HSA) contributions

- Student loan interest

- Qualified overtime pay deductions

- Certain vehicle loan interest

Below-the-line deductions come after AGI is calculated and generally require you to itemize instead of taking the standard deduction.

- Mortgage interest

- State and local taxes (SALT)

- Charitable contributions

- Some medical expenses above thresholds

Why this matters: most modern tax planning for Millennials happens above the line. That’s why many valuable 2026 tax benefits still apply even if you take the standard deduction.

🔹 Section 3: The Increased Child Tax Credit

What changed

The Child Tax Credit (CTC) has been increased and stabilized, making it more valuable and more predictable for families with qualifying children.

For the 2025–2028 period:

- The credit increases to $2,200 per qualifying child

- A larger portion of the credit may be refundable for some households

- Enhanced levels are designed to continue beyond the temporary window

Unlike deductions, which reduce taxable income, the Child Tax Credit reduces your tax bill dollar for dollar, making it one of the most powerful tax benefits available to Millennial families.

Who this applies to

The increased Child Tax Credit applies to:

- Single filers, married couples filing jointly, and heads of household

- Taxpayers with qualifying children under age 17

- Families with earned income, including wages, self-employment, or a mix

It is especially impactful for:

- Millennials in their prime child-raising years

- Dual-income households balancing work and childcare

- Families whose income places them above basic assistance thresholds but below high-income phaseouts

Who this does not fully benefit

The full value of the Child Tax Credit may be reduced or unavailable for:

- Households above certain income thresholds (phaseouts apply)

- Taxpayers without qualifying children

- Families whose tax liability is already very low (depending on refundability rules)

It’s also important to note that:

- Children must meet age, residency, and dependency tests

- Claiming the credit requires a valid Social Security number for the child

As income rises, the Child Tax Credit doesn’t disappear all at once. It phases out gradually, which means planning decisions can affect how much of the credit you keep.

Income limits and phaseouts (high-level)

While exact thresholds depend on filing status, the Child Tax Credit:

- Begins to phase out at higher income levels

- Is reduced gradually rather than disappearing all at once

This means:

- Many middle- and upper-middle-income families still receive partial benefits

- Planning matters even if you assume you “make too much”

Because phaseouts interact with taxable income, other deductions — such as HSA contributions or overtime deductions — can indirectly affect how much of the credit you keep.

Tax deductions and tax credits both reduce what you owe — but they don’t work the same way, and the difference matters.

Deductions reduce your taxable income. The actual benefit depends on your tax bracket. For example, a $1,000 deduction saves about $220 if you’re in the 22% bracket.

Tax credits, on the other hand, reduce your tax bill directly. A $1,000 credit reduces what you owe by a full $1,000.

That’s why credits like the Child Tax Credit can have a much larger impact than deductions, especially for families managing tight cash flow.

Why this credit is often misunderstood

Many parents mentally treat the Child Tax Credit as:

“Something that just shows up at filing time.”

That mindset misses two important realities:

- The credit directly offsets tax owed, not just income

- Its value depends on how your income is structured, not just how much you earn

Families who don’t account for phaseouts, refundability limits, or income timing are often surprised — sometimes pleasantly, sometimes not.

How this affects Millennials differently

For Millennials, the increased Child Tax Credit intersects with:

- Rising childcare costs

- Student loan obligations

- Housing affordability challenges

- Dual-income planning decisions

Because the credit reduces tax liability directly, it can:

- Free up cash flow for savings or debt reduction

- Offset the tax impact of higher earnings

- Change the after-tax cost of working additional hours

This makes the credit especially relevant when evaluating overtime, job changes, or childcare arrangements.

Planning takeaway (not advice)

The Child Tax Credit isn’t just a filing-season benefit — it’s a planning variable.

Understanding how income levels, deductions, and credits interact can help families avoid surprises and make more informed decisions throughout the year, not just in April.

Not all tax credits work the same way once your tax bill reaches zero.

Nonrefundable credits can reduce your tax bill to zero — but no further. Any unused portion is lost.

Refundable credits can reduce your tax bill below zero, meaning you may receive part of the credit as a refund even if you owe little or no tax.

This distinction matters for Millennials with lower or fluctuating income, because refundability determines whether a credit provides cash back or simply reduces taxes owed.

🔹 Section 4: Deduction for Qualified Overtime Pay (2025–2028)

What changed

For tax years 2025 through 2028, eligible taxpayers may be able to claim a new above-the-line deduction for qualified overtime pay. This is designed to reduce taxable income for workers who routinely earn overtime — especially in industries where extra shifts are common.

The most important detail: the deduction generally applies to the overtime premium portion of pay (the “extra” part of time-and-a-half), not the entire overtime paycheck.

So if you earned overtime hours, the deduction is typically tied to the amount that represents the premium above your regular hourly rate.

Who this applies to

This deduction is most relevant for Millennials and Gen Z who:

- Are paid hourly and earn overtime under federal or state overtime rules

- Work in roles where overtime is common:

- health care

- public safety

- manufacturing

- operations/maintenance

- hospitality/service industries

- Have variable schedules (busy seasons, shift work, on-call rotations)

It can also matter for workers with multiple jobs where overtime is earned at one employer.

Who this does not apply to

This is the section where most people get tripped up. The deduction generally does not apply to:

- Salaried employees who do not receive overtime premiums

- Bonuses, commissions, or performance pay that aren’t classified as overtime

- Shift differentials (extra pay for nights/weekends) unless the employer classifies it as overtime premium pay

- Contractor/self-employment income (1099) that doesn’t have overtime classification

- Overtime that is not reported or documented through payroll systems

In plain terms: if your paystub doesn’t separate or identify overtime premium pay, you may not have “qualified overtime” in the way the deduction defines it.

Limits and phaseouts (high-level)

This deduction is subject to:

- Annual caps (with different limits for single filers vs joint filers)

- Income phaseouts at higher earnings levels

What that means in practice:

- Middle-income workers who regularly earn overtime are more likely to benefit

- Higher earners may see reduced or eliminated benefit depending on income

Because phaseouts are based on income measures used in the tax code, deductions like HSA contributions or traditional retirement contributions may affect whether you remain eligible.

Documentation and what to look for

This deduction lives or dies on documentation.

You don’t need to become a payroll expert, but you should know what to look for:

- Check your paystub for a line item like:

- “OT”

- “Overtime”

- “Overtime Premium”

- “1.5x”

- Keep year-end forms and pay records together

- If you work multiple jobs, track overtime separately by employer

If you’re paid in a way where overtime is “blended” and not shown clearly, it may be harder to validate qualified overtime amounts.

Why this is often misunderstood

Three common misunderstandings show up constantly:

- “All overtime wages are deductible.”

In most cases, the deduction focuses on the premium portion, not the entire overtime amount. - “My paycheck withholding will automatically reflect this.”

Withholding often won’t change. Many people only see the benefit at filing. - “If I worked overtime, I’ll definitely qualify.”

Caps, income phaseouts, and payroll classification can reduce or eliminate the benefit.

How this affects Millennials differently

For Millennials, overtime often isn’t a permanent lifestyle — it’s a temporary financial lever:

- building a down payment

- catching up on debt

- offsetting childcare costs

- bridging gaps between job changes

This deduction changes the economics of overtime by reducing its tax drag, especially when combined with:

- HSA contributions

- student loan interest deductions

- child-related credits

In other words, overtime becomes more valuable after tax in some scenarios — and this is exactly the kind of question your 2026 Tax Scenario Calculator will be built to answer.

Planning takeaway (not advice)

If overtime is part of your income, the 2026 tax rules may change your effective tax outcome — but only if:

- your overtime is properly classified through payroll

- you remain within the income limits

- you understand the deduction applies to specific portions of pay

Even small planning adjustments (timing overtime, adjusting withholding, or stacking above-the-line deductions) can change what you keep.

If you want to see how these changes interact in your own situation, the 2026 Tax Scenario Calculator for Millennials lets you model how overtime pay, HSA contributions, vehicle loan interest, and credits may affect your taxable income and estimated federal tax — without requiring tax software or a full return.

Only the overtime premium portion (the “extra” above your normal hourly rate) typically qualifies for the overtime deduction — not your entire overtime paycheck.

🔹 Section 5: Deduction for Interest on Qualified Vehicle Loans (2025–2028)

What changed

For tax years 2025 through 2028, taxpayers may be able to deduct interest paid on qualified vehicle loans as an above-the-line deduction. This means the deduction can reduce taxable income even if you take the standard deduction.

This change is aimed at offsetting the higher cost of financing vehicles during a period of elevated prices and interest rates.

Who this applies to

This deduction is most relevant for Millennials and Gen Z who:

- Financed a personal-use vehicle with a qualifying loan

- Pay interest as part of their monthly car payment

- Are within the applicable income ranges (phaseouts apply)

- Use the vehicle primarily for non-business purposes

It can be especially helpful for households that:

- Recently purchased or refinanced a vehicle

- Carry higher interest rates due to market conditions

- Do not itemize deductions

Who this does not apply to

The vehicle loan interest deduction generally does not apply to:

- Leases (since there is no loan interest)

- Vehicles used primarily for business or self-employment (those follow different rules)

- Interest on loans for vehicles that don’t meet qualification requirements

- Payments where interest cannot be clearly identified or documented

- Taxpayers whose income exceeds phaseout thresholds

If your payment is a flat lease or your statement doesn’t separate interest from principal, this deduction likely won’t apply.

Your monthly payment usually includes principal (paying down the loan) and interest (the cost of borrowing). Only the interest portion is potentially deductible, and only for qualified loans—subject to limits and income phaseouts.

Qualified vehicles and loan requirements (high-level)

While specific definitions can change, qualifying vehicles typically:

- Are personal-use vehicles

- Meet certain manufacturing or classification criteria

- Are financed through a recognized lender (bank, credit union, or dealer financing)

The deduction applies to interest paid, not:

- Principal

- Down payments

- Fees, insurance, or extended warranties

If you’re unsure how much interest you paid, your annual loan statement or lender’s year-end summary is the place to look.

Limits and phaseouts (high-level)

This deduction is subject to:

- Annual caps on deductible interest

- Income-based phaseouts

What this means in practice:

- Middle-income households with typical auto loans are more likely to benefit

- Higher-income earners may see the benefit reduced or eliminated

- Other above-the-line deductions (such as HSA contributions) can affect eligibility by lowering income used for phaseout calculations

Why this deduction is often misunderstood

Common misconceptions include:

- “I can deduct my entire car payment.”

Only the interest portion may qualify — not principal or other costs. - “This only works if I itemize.”

This is an above-the-line deduction and can apply even with the standard deduction. - “My withholding will automatically reflect this.”

Like many deductions, this typically shows up at filing, not in your paycheck.

Many of these tax decisions tie into broader life choices. RetireCoast explores those connections in the Life & Wealth Decisions series, which looks at how income, timing, and priorities interact over time.

How this affects Millennials differently

Vehicle financing is often unavoidable for Millennials:

- Commuting to work

- Managing family logistics

- Living in areas without reliable public transit

Because many Millennials don’t itemize, this deduction provides rare relief for an expense that’s both common and unavoidable — especially when paired with other above-the-line deductions.

When stacked with:

- Overtime deductions

- HSA contributions

- Student loan interest

…the after-tax cost of vehicle ownership can be meaningfully lower than expected.

Planning takeaway (not advice)

If you’re financing a vehicle during the 2025–2028 window, the interest portion of your loan may reduce taxable income — but only if:

- The loan and vehicle qualify

- You stay within income limits

- You track interest accurately

Understanding how this deduction stacks with others can help you evaluate the true after-tax cost of a vehicle, rather than focusing only on the monthly payment.

If you want to see how these changes interact in your own situation, the 2026 Tax Scenario Calculator for Millennials lets you model how overtime pay, HSA contributions, vehicle loan interest, and credits may affect your taxable income and estimated federal tax — without requiring tax software or a full return.

A car payment is made up of two main parts, and only one of them may qualify for the vehicle loan interest deduction.

Principal is the portion of your payment that reduces the amount you borrowed. This part of the payment is not deductible.

Interest is what you pay the lender for borrowing money. This is the portion that may qualify for the deduction — subject to annual limits and income phaseouts.

Tip: If your monthly statement doesn’t clearly separate interest from principal, check your lender’s year-end summary or loan amortization schedule. The deductible amount is based on interest paid during the year, not your total payment.

🔹 Section 6: No or Limited Federal Income Tax on Tips (2025–2028)

What changed

For tax years 2025 through 2028, certain workers may be able to deduct qualified tip income from their federal taxable income, subject to limits and income phaseouts.

This change is often described informally as “no tax on tips,” but the reality is more precise:

it allows a deduction for qualified tips, rather than exempting all tip income from taxation.

The intent is to reduce the tax burden on workers in tipped occupations, many of whom have variable income and limited control over withholding.

Tipped income is common for Millennials and Gen Z. Under the 2026 tax changes, properly reported tips may qualify for deductions—making accurate reporting more important than ever.

Who this applies to

This provision is most relevant for Millennials and Gen Z who:

- Earn tips as part of their regular income

- Work in industries such as:

- food and beverage service

- hospitality

- delivery and rideshare

- personal services

- Receive tips that are reported through payroll or otherwise documented

It can also apply to workers who:

- Rely on tips as supplemental income

- Combine tipped work with salaried or hourly roles

- Experience large income swings from month to month

Who this does not apply to

Despite the headlines, this provision does not apply universally.

It generally does not apply to:

- Income that is not classified as tips

- Cash tips that are not reported or documented

- High-income earners beyond phaseout thresholds

- Bonuses, commissions, or incentive pay mislabeled as tips

- Self-employment income that does not meet the definition of qualified tips

In other words, documentation and classification matter. If income isn’t reported as tips, it typically can’t be deducted as such.

Limits and phaseouts (high-level)

The deduction for qualified tips is subject to:

- Annual limits on deductible amounts

- Income-based phaseouts

This means:

- Lower- and middle-income tipped workers are more likely to benefit

- Higher earners may see partial or no benefit

- The value of the deduction can change year to year as income fluctuates

Because the deduction reduces taxable income, other deductions (such as HSA contributions or overtime deductions) can indirectly affect eligibility by lowering income used in phaseout calculations.

Cash tips vs. reported tips (why this matters)

One of the biggest points of confusion is the difference between:

- Tips you receive, and

- Tips that are reported

For tax purposes:

- Only reported tips generally count toward deductions

- Employers typically report tips through payroll

- Unreported tips don’t create a deduction — and can create compliance issues

This change doesn’t eliminate the need to report tip income. Instead, it changes how reported tips are treated when calculating taxable income.

Why this is often misunderstood

Three common misconceptions show up repeatedly:

- “All my tips are tax-free now.”

In reality, the deduction applies only to qualified, reported tips and is capped. - “I don’t need to track tips anymore.”

Accurate reporting is still essential — possibly more so than before. - “This won’t matter much because my income is low.”

For workers with tight margins, even modest reductions in taxable income can meaningfully affect take-home pay or refunds.

How this affects Millennials differently

Tipped income plays a unique role for Millennials:

- Side hustles and flexible work are more common

- Income volatility is higher

- Withholding is often imperfect or inconsistent

This deduction can soften the tax impact of variable income, especially when paired with:

- Overtime deductions

- Student loan interest

- HSA contributions

- Child-related credits

For many households, the benefit isn’t obvious until everything is viewed together — which is why scenario-based planning is especially valuable here.

Tips only affect your taxes once they are reported. The 2026 tax changes don’t remove the need to report tips — they change how reported tips are treated when calculating taxable income.

Planning takeaway (not advice)

If tips are part of your income mix, the 2026 tax rules may change how much of that income is ultimately taxed — but only if:

- Tips are properly classified and reported

- You remain within applicable limits

- You understand how the deduction interacts with the rest of your income

This is a classic example of a rule that sounds simple in headlines but works best when viewed in context.

The idea of allowing large deductions for mortgage interest and state and local taxes has long been debated.

Prior to 2018, there was no limit on how much taxpayers could deduct for state and local taxes. This was especially beneficial for higher-income individuals and households living in high-cost, high-tax states.

Critics argued that taxpayers in lower-cost areas were effectively subsidizing higher-cost regions through the federal tax code. As a result, a $10,000 combined cap on SALT deductions was introduced, significantly increasing taxes for some households.

During the 2025 congressional negotiations, the SALT cap was raised, but not eliminated. The higher limit provided relief to taxpayers in high-tax areas while still preserving a cap—allowing both sides to claim partial victory.

🔹 Section 7: Increased SALT Deduction Cap (Up to $40,000)

What changed

For tax years beginning in 2026, the long-standing cap on the State and Local Tax (SALT) deduction is temporarily increased to up to $40,000, replacing the much lower limit that applied in prior years.

The SALT deduction allows taxpayers who itemize to deduct certain:

- State income taxes (or sales taxes), and

- Local property taxes

This increase is one of the most significant changes for taxpayers living in high-tax or high-cost areas, but it does not apply equally to everyone.

Who this applies to

The higher SALT cap is most relevant for:

- Itemizers, not standard-deduction filers

- Homeowners paying significant property taxes

- Taxpayers in higher-tax states or localities

- Married couples filing jointly with combined state and local tax burdens

Millennials who:

- Recently purchased homes,

- Live in coastal or urban markets, or

- Have experienced rising property assessments

are more likely to encounter SALT limits and therefore benefit from the higher cap.

Who this does not meaningfully benefit

The increased SALT cap provides little or no benefit for:

- Taxpayers who take the standard deduction

- Renters without property taxes

- Households with low state and local tax exposure

- Taxpayers whose income triggers phaseouts that reduce itemization benefits

In short, if you don’t itemize — or your state and local taxes are relatively low — this change may have little impact.

Itemizing still matters (and is still a choice)

A key point often missed in headlines:

The SALT deduction only matters if itemizing makes sense overall.

Many Millennials:

- Still take the standard deduction

- Benefit more from above-the-line deductions

- Don’t cross the threshold where itemizing exceeds the standard deduction

For others, especially newer homeowners, the higher SALT cap can:

- Tip the balance toward itemizing

- Increase the value of mortgage interest and charitable contributions

- Change year-to-year filing strategy

This is not an “always on” benefit — it’s conditional.

Limits, phaseouts, and timing (high-level)

While the cap is higher, it is:

- Temporary, not permanent

- Subject to income-based phaseouts

- Still limited to eligible state and local taxes

That means:

- Some higher-income households will see reduced benefit

- Timing of payments (such as property tax payments) can matter

- The deduction may change again in future years

Because of these moving parts, SALT is one of the deductions most affected by planning — and most misunderstood when viewed in isolation.

Why this change is often misunderstood

Common misconceptions include:

- “Everyone can deduct $40,000 now.”

Only itemizers with sufficient state and local taxes can benefit. - “This replaces the standard deduction.”

It doesn’t — it only matters if itemizing produces a better result. - “This only helps high earners.”

It primarily helps people in high-tax areas, not simply those with high income.

How this affects Millennials differently

For Millennials, SALT intersects with:

- First-time homeownership

- Rising property tax assessments

- Relocation decisions

- Rent vs. buy tradeoffs

A Millennial moving from a low-tax state to a high-tax metro area — or vice versa — may see their tax profile change significantly, even if income stays the same.

This makes SALT less about filing mechanics and more about location-driven financial planning.

Planning takeaway (not advice)

The higher SALT cap can meaningfully reduce taxable income — but only for households that itemize and remain within eligibility limits.

Understanding whether SALT actually helps you requires looking at:

- Your total deductions,

- Your filing status,

- Your location, and

- How this deduction interacts with others.

It’s a classic example of a benefit that looks generous in isolation but works best when evaluated alongside the rest of your tax picture.

The SALT deduction increase sounds simple in headlines, but whether it helps depends on itemizing, location, and overall deductions—not income alone.

🔹 Section 8: Enhanced Child and Dependent Care Tax Credit

What changed

The Child and Dependent Care Tax Credit has been enhanced to provide greater relief for working households that pay for care in order to earn income.

While this credit has existed for years, recent changes increase:

- The percentage of qualifying expenses that can be credited

- The maximum expenses that can be taken into account

- The relevance of the credit for dual-income and single-parent households

Unlike deductions, this credit directly reduces your tax bill, making it especially meaningful for families facing high childcare or dependent care costs.

Who this applies to

This credit applies to taxpayers who:

- Pay for care so they (and, if married, their spouse) can work or look for work

- Have qualifying dependents, including:

- Children under age 13

- A spouse or dependent who is physically or mentally incapable of self-care

- Incur care expenses from eligible providers

For Millennials, this often includes:

- Daycare and preschool

- Before- and after-school programs

- Summer day camps (but not overnight camps)

- In-home care or babysitting, when properly documented

Who this does not apply to

The credit generally does not apply to:

- Care expenses incurred while not working or seeking work

- Overnight camps

- Tuition for kindergarten or higher grades

- Payments made to a spouse or another dependent

- Informal or undocumented care arrangements that don’t meet reporting requirements

In short, the expense must be directly tied to enabling work, and it must be properly documented.

The Child and Dependent Care Tax Credit can reduce your tax bill, effectively offsetting part of what you paid for care. The size of the offset depends on eligibility, income, and how expenses are documented.

Income limits and how the credit scales

The value of the Child and Dependent Care Tax Credit:

- Scales based on income

- Is generally more generous at lower and moderate income levels

- Decreases gradually as income rises

This means:

- Many middle-income households still receive a meaningful benefit

- Higher earners may receive a smaller credit rather than none at all

- Planning decisions that reduce taxable income can indirectly increase the credit’s value

Because the value of the Child and Dependent Care Tax Credit depends on income, work status, and other deductions, many families benefit from modeling scenarios. The 2026 Tax Scenario Calculator for Millennials can help estimate how childcare costs, credits, and income changes may affect your overall federal tax liability.

Why this credit is often overlooked

Many families overlook this credit because:

- It doesn’t show up in payroll withholding

- The rules feel restrictive or confusing

- Care costs are often paid monthly, not tracked annually

As a result, households sometimes assume childcare expenses are simply “non-deductible,” when in fact a portion may directly reduce their tax bill.

How this affects Millennials differently

For Millennials, childcare and dependent care costs often arrive:

- At the same time as peak career growth

- Alongside student loan payments

- During periods of housing and relocation decisions

This credit can:

- Offset the tax impact of returning to work after parental leave

- Reduce the after-tax cost of dual-income households

- Influence decisions about part-time vs full-time work

Because the credit is tied to earned income, it interacts closely with overtime, job changes, and career timing.

Some employers offer childcare-related benefits, such as a Dependent Care Assistance Program (DCAP) or a Dependent Care Flexible Spending Account (FSA). These programs can reduce your taxable income — but they interact with the Child and Dependent Care Tax Credit in important ways.

In most cases, you cannot use the same childcare expenses to claim both an employer benefit and the tax credit. Coordinating the two can affect how much tax relief you ultimately receive.

For official guidance, see the IRS overview of the Child and Dependent Care Tax Credit and IRS Publication 503 , which explains how employer-provided dependent care benefits interact with the credit.

Interaction with employer benefits

Some employers offer dependent care assistance programs (DCAPs) or flexible spending arrangements.

Important considerations:

- Employer-provided benefits can reduce the expenses eligible for the credit

- The credit and employer benefits generally can’t be claimed on the same dollars

- Coordinating these benefits requires awareness, not just filing software

This is another area where planning ahead can make a noticeable difference.

Because childcare expenses are paid throughout the year, many families incorporate expected tax credits into their monthly planning. RetireCoast’s Millennial Budget Guide explores how tax credits can factor into real-world budgeting decisions.

Planning takeaway (not advice)

The enhanced Child and Dependent Care Tax Credit is one of the most practical tax benefits for working families — but only if:

- Expenses are eligible and documented

- Income limits are understood

- Employer benefits are coordinated properly

Because childcare costs are ongoing, this credit is most powerful when considered during the year, not after it ends.

For official guidance, see the IRS resources on how qualifying childcare expenses and earned income are defined — including how the credit is calculated, Publication 503, and the IRS FAQs for practical eligibility answers.

🔹 Section 9: Increased Health Savings Account (HSA) Contribution Limits (2026

What changed

Health Savings Account (HSA) contribution limits increase again in 2026, continuing a steady upward trend that reflects rising healthcare costs.

For the 2026 calendar year (employee + employer contributions combined):

- Self-only HDHP coverage: $4,400 (up from $4,300)

- Family HDHP coverage: $8,750 (up from $8,550)

- Catch-up contribution (age 55+, not enrolled in Medicare): $1,000 (unchanged)

That means the maximum possible contributions in 2026 are:

- $5,400 for self-only coverage (with catch-up)

- $9,750 for family coverage (with catch-up)

These contributions are made on a calendar-year basis, and you generally have until the tax filing deadline to complete them.

HSA contributions reduce taxable income and apply whether or not you itemize. Employer contributions count toward the annual limit.

Who this applies to

HSA contribution increases matter most for Millennials and Gen Z who:

- Are enrolled in a qualifying high-deductible health plan (HDHP)

- Receive employer HSA contributions (which count toward the annual limit)

- Pay for medical care out of pocket

- Want tax-advantaged flexibility for future healthcare costs

HSAs are especially relevant for:

- Healthy individuals with lower current medical spending

- Families planning for rising healthcare costs

- Households balancing healthcare expenses with retirement savings

Who this does not apply to

You generally cannot contribute to an HSA if:

- You are not enrolled in a qualifying HDHP

- You are enrolled in Medicare

- You are claimed as a dependent on someone else’s tax return

It’s also important to note:

- Contributions beyond the annual limit may trigger penalties

- Employer contributions reduce how much you can add personally

Eligibility matters more than intent — simply wanting an HSA is not enough.

Why HSAs are often misunderstood

HSAs are frequently confused with:

- Health Flexible Spending Accounts (FSAs)

- “Use-it-or-lose-it” benefits

- Short-term medical reimbursement accounts

In reality, HSAs:

- Are owned by you, not your employer

- Carry forward year to year

- Can be invested

- Provide tax benefits at multiple stages

This combination makes HSAs one of the most tax-efficient tools available — yet many eligible households don’t fully use them.

For official IRS guidance on Health Savings Accounts — including eligibility, contribution limits, and qualified medical expenses — see IRS Publication 969 (Health Savings Accounts) .

How HSAs interact with your taxes

HSA contributions are above-the-line deductions, meaning:

- They reduce adjusted gross income (AGI)

- They apply whether or not you itemize

- They can affect eligibility for other deductions and credits

In practical terms, contributing to an HSA can:

- Lower taxable income

- Reduce exposure to phaseouts

- Increase the value of other tax benefits indirectly

This stacking effect is one reason HSAs often appear prominently in tax planning discussions.

How this affects Millennials differently

For Millennials, HSAs often serve multiple roles:

- A buffer for unexpected medical expenses

- A way to smooth cash flow during high-expense years

- A long-term healthcare planning tool

Because many Millennials change jobs, relocate, or move between employer plans, the portability of HSAs is particularly valuable.

HSAs can also complement:

- Overtime income planning

- Childcare-heavy years

- Periods of variable income

Planning takeaway (not advice)

The 2026 increase in HSA limits doesn’t require action by itself — but it expands the amount of income that can be sheltered from federal taxes for eligible households.

Understanding whether you qualify, how employer contributions count, and how HSAs interact with other deductions is far more important than simply knowing the dollar limit.

Because HSA contributions reduce taxable income and can affect eligibility for other deductions and credits, their impact is often best understood in context. The 2026 Tax Scenario Calculator for Millennials can help model how different HSA contribution levels may affect your overall federal tax outcome.

🔹 Section 10: Student Loan & Pell Grant Program Changes

What changed

The 2026 tax and education landscape includes adjustments to student loan rules and Pell Grant programs that affect how borrowing, repayment, and tax benefits interact. While these changes don’t eliminate student debt challenges, they do alter how interest deductions, repayment structures, and education benefits fit into a broader tax picture.

For Millennials and Gen Z—many of whom are still carrying education debt—these updates matter less as headlines and more as cash-flow and planning mechanics.

Even as education policy changes, the student loan interest deduction continues to reduce taxable income for eligible borrowers — especially when coordinated with other above-the-line deductions.

What still applies (and why it matters)

Despite changes elsewhere, one provision remains especially relevant:

- Student loan interest may still be deductible up to $2,500 per year

- The deduction is above-the-line, meaning it applies even if you take the standard deduction

- Eligibility is subject to income phaseouts

This deduction doesn’t erase loan balances, but it can:

- Reduce taxable income

- Lower effective borrowing costs

- Improve year-end tax outcomes for borrowers making consistent payments

For many households, it’s one of the few remaining education-related tax benefits available after leaving school.

Changes affecting repayment and education aid

Beyond the tax code, policy changes affect:

- Repayment structures and eligibility

- Pell Grant funding and rules

- How education costs are shared between borrowers, employers, and government programs

These shifts can influence:

- Whether additional borrowing makes sense

- How aggressively to repay loans

- The tradeoff between loan repayment and other financial priorities (saving, childcare, housing)

The key takeaway: student loans don’t exist in isolation. Their impact depends on income, family status, and how other tax benefits are used.

Who this affects most

These changes are most relevant for:

- Millennials still repaying undergraduate or graduate loans

- Households balancing loan payments with childcare or healthcare costs

- Borrowers whose income fluctuates year to year

- Individuals considering additional education or credentialing

Even modest adjustments in income or deductions can change whether the student loan interest deduction applies—and how valuable it is.

Why this area is often misunderstood

Common misconceptions include:

- “Student loan changes don’t affect my taxes anymore.”

In reality, interest deductions and income thresholds still matter. - “Pell Grants are only for current students.”

Changes to education aid can indirectly affect future borrowing and repayment decisions. - “Repayment decisions are separate from tax planning.”

They’re often tightly connected—especially when income-based phaseouts are involved.

Planning takeaway (not advice)

Student loan rules in 2026 don’t offer a single “right answer.” Instead, they reinforce the importance of coordinating repayment with tax planning.

In some scenarios:

- Paying interest sooner increases deductions

- Reducing income through HSAs or other deductions preserves eligibility

- Timing matters more than total dollars paid

Seeing these interactions together is often more useful than focusing on any single rule.

For official IRS guidance on student loan interest deductions and eligibility, see IRS Tax Topic 456 — Student Loan Interest Deduction .

🔹 Section 11: Why Stacking These Changes Matters (and Where Most People Miss the Benefit)

The mistake most people make

Most taxpayers evaluate 2026 tax changes one provision at a time:

- “Do I qualify for this deduction?”

- “Does this credit apply to me?”

- “Will this show up in my refund?”

That approach misses the real opportunity.

The biggest gains in 2026 don’t usually come from a single rule — they come from stacking multiple changes togetherin a way that reduces taxable income, preserves eligibility for credits, and improves cash flow across the year.

Stacking isn’t a loophole or aggressive strategy. It’s the cumulative effect of understanding how deductions and credits interact — often resulting in more take-home pay or a smaller year-end balance due.

What “stacking” actually means

Stacking isn’t a loophole or aggressive strategy. It simply means understanding how different provisions interact.

For example:

- An HSA contribution lowers adjusted gross income

- Lower AGI can preserve eligibility for:

- student loan interest deductions

- child-related credits

- overtime or tip deductions

- Those benefits reduce your tax bill directly or indirectly

- The result is more take-home cash or a smaller year-end balance due

Individually, each change may feel modest. Together, they can materially change outcomes.

Why this matters more for Millennials and Gen Z

Stacking matters most for households with:

- Variable income (overtime, tips, side work)

- Student loans still in repayment

- Childcare or dependent care expenses

- Employer benefits that interact with tax credits

- Frequent life changes (job shifts, relocation, growing families)

This is exactly the financial profile many Millennials and Gen Z households share.

In these cases, tax outcomes are rarely static — they’re sensitive to timing, income mix, and benefit coordination.

Why withholding often doesn’t reflect reality

One reason people miss stacking benefits is that withholding doesn’t adapt well to these interactions.

Employers typically:

- Withhold based on base wages

- Don’t account for HSAs, childcare credits, or loan interest

- Can’t see household-level factors

As a result, many benefits only become visible at filing time, long after decisions were made.

That gap between planning and filing is where most value is lost.

This is where scenario modeling helps

Because stacking is contextual, there’s no single chart or rule that applies to everyone.

Seeing how:

- income changes,

- deductions,

- credits, and

- filing status

interact in one place is often more useful than reading individual rules in isolation.

That’s why tools like the

2026 Tax Scenario Calculator for Millennials

focus on what changes when you combine decisions, not just whether you qualify for something in theory.

Connecting tax decisions to bigger financial choices

Taxes don’t exist on their own. They influence:

- how quickly debt is paid down,

- how affordable childcare feels,

- whether overtime is “worth it,”

- how much flexibility a household actually has.

That’s why these 2026 changes are also explored in the broader context of:

- the Millennial Financial Hub and

- longer-term perspectives on how tax policy affects wealth-building over time, such as the long-term impact of taxes.

Final takeaway

The 2026 tax changes aren’t just about compliance or refunds.

They shape:

- how much income you actually keep,

- how flexible your budget feels,

- and how quickly you can move toward financial stability.

Most people won’t miss out because the rules are hidden — they’ll miss out because they looked at each rule separately.

Stacking is simply the act of seeing the full picture. Thank you for reading our 2026 tax changes for millennials.

This “big picture” view is why modeling matters: small changes can compound when multiple deductions and credits interact.

- The biggest benefits come from stacking. Individual deductions and credits may feel modest on their own, but their interaction can materially change your tax outcome.

- Above-the-line deductions matter more than ever. HSAs, student loan interest, overtime, tips, and vehicle loan interest can reduce taxable income even if you take the standard deduction.

- Credits are often more powerful than deductions. Child and dependent care credits reduce your tax bill directly, but eligibility depends on income and coordination with employer benefits.

- Location and life stage matter. SALT changes, childcare costs, healthcare expenses, and education debt affect households differently depending on where you live and what phase of life you’re in.

- Withholding rarely tells the full story. Many 2026 benefits don’t show up in your paycheck and only become visible when everything is evaluated together.

- Planning beats guessing. Understanding how these rules interact is often more valuable than focusing on any single tax provision.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.