Last updated on November 16th, 2025 at 02:23 pm

Most Americans Will Never Keep Their Mortgage for 30 Years — Let Alone 50

Before we even discuss the 50-year mortgage proposal, we need to start with a truth that shocks most homeowners:

The vast majority of Americans never pay off a mortgage to the end of its term.

Most homeowners move, refinance, upgrade, downsize, or restructure their loans long before they reach the final payment.

- The average homeowner stays in a home 8–12 years

- Only about 1 in 3 homes in the U.S. is owned free and clear

- The typical borrower never makes all 360 payments of a 30-year loan

- And almost no one would ever make 600 payments under a 50-year loan

This matters enormously — because mortgage terms often shape how people think about homeownership. But the term itself is a tool for structuring payments, not a prediction of how long someone will remain in a home.

President Trump has issued an executive order requiring the administration to investigate the possibility of alternate investments being allowed with 401(k) funds in this release

Mortgage Comparison: $300,000 Loan (Example)

Below is a simple comparison showing how a $300,000 mortgage behaves under three different amortization schedules. This example assumes a 6% fixed interest rate for consistent comparison.

| Term | Monthly Payment* | Total Interest Paid† | Amortization Impact |

|---|---|---|---|

| 15 Years | ~$2,074 | ~$74,000 | Very fast principal reduction. Least interest paid. |

| 30 Years | ~$1,432 | ~$215,000 | Standard loan. Slow early equity growth. Much more total interest. |

| 50 Years | ~$1,027 | ~$313,000 | Lowest payment. Slowest equity growth. Highest interest cost. |

* Monthly payments exclude taxes, insurance, and HOA fees.

† Interest totals are approximate

Mortgage Terms Exist to Lower Payments — Not Predict Your Future

Here is the part most consumers never consider:

The length of a mortgage exists for one reason: to make the monthly payment affordable.

A longer term spreads out the repayment of principal, which lowers the required monthly payment.

A shorter term concentrates repayment, which accelerates equity and slashes total interest costs — but raises the monthly payment.

In other words:

- 30-year mortgage = affordability tool

- 15-year mortgage = wealth-building tool

- 50-year mortgage = payment-reduction tool (with enormous long-term interest implications)

Homeowners don’t need to stay in a property for the entire term — and most never do. But the mortgage term heavily influences:

- How much of the payment goes to interest vs principal

- How fast equity grows

- How much interest is paid over the life of the loan

- How “affordable” a property feels at the moment of purchase

This is why the discussion about the proposed 50-year mortgage proposal must begin with a basic understanding of why these terms exist in the first place.

The Forgotten Origin of the 30-Year Mortgage

Most Americans assume the 30-year mortgage has “always been there.”

It hasn’t.

In fact, the fixed 30-year mortgage is a government invention created to save the housing market during one of the worst crises in American history.

🔹 Before 1930 — Home Loans Were a Mess

Prior to the Great Depression:

- Mortgages were typically 5–10-year balloon loans

- Borrowers only paid interest

- At the end of the term, the entire balance was due at once

- Refinancing was common — until it wasn’t

- When banks failed, refinancing evaporated

Millions lost their homes simply because the structure of lending made ownership unstable and unpredictable.

The Government Intervenes: How the 30-Year Mortgage Was Born

1933 – HOLC (Home Owners’ Loan Corporation)

To prevent mass homelessness, HOLC introduced:

- Fully amortized mortgages

- Long-term repayment

- Predictable monthly payments

This was revolutionary. For the first time, borrowers paid off their homes gradually over fixed installments.

1934 – FHA (Federal Housing Administration)

The FHA standardized the modern 30-year fixed-rate mortgage and added:

- Low down payments

- Fixed interest rates

- Consistent underwriting

- Affordable monthly payments for average families

This made homeownership accessible to millions who had previously been locked out.

1938 – Fannie Mae

Created to buy mortgages from lenders, stabilizing liquidity and enabling more 30-year loans.

1970 – Freddie Mac

Expanded the secondary mortgage market.

Why this matters today

The 30-year mortgage wasn’t designed because families “needed” 30 years to own a home.

It was designed because:

- Monthly payments needed to be low

- Borrowers needed stability

- Banks needed a predictable repayment

- The economy needed a functioning housing market

The invention was payment-focused, not duration-focused — exactly like the newly proposed 50-year mortgage.

Connecting the History to Today’s 50-Year Mortgage Proposal

The proposed 50-year mortgage proposal is simply the next iteration of the same core idea:

Stretch the term → shrink the payment → increase affordability.

Just like the 1930s:

- Home prices are high

- Monthly affordability is strained

- Buyers need a lower payment to qualify

- Policymakers need a fast lever to improve access

But there is a trade-off:

50-year loans build equity painfully slowly and cost vastly more in total interest.

How Amortization Works (and Why It Matters More With a 50-Year Mortgage)

When people talk about a “15-year,” “30-year,” or “50-year” mortgage, what they’re really talking about is the amortization schedule—the way your loan is paid down over time.

What Is Amortization?

Amortization is simply the formula that breaks each monthly payment into two parts:

- Interest – the cost of borrowing the money

- Principal – the part that actually reduces your loan balance

At the beginning of a fixed-rate mortgage, most of your payment goes to interest, not principal. Only a small slice chips away at the actual debt. Over time, as the balance slowly drops, the interest portion shrinks and the principal portion grows.

The longer the term, the flatter and slower the shift becomes.

Same Interest Rate, Very Different Paths

Take our $300,000 example at 6% fixed interest:

- 15-year mortgage

- Higher payment, but the principal drops quickly.

- You build equity fast and slam the door on interest costs.

- 30-year mortgage

- Lower payment, but principal reduction is much slower.

- You pay nearly three times as much interest as the 15-year borrower.

- 50-year mortgage proposal

- Lowest payment of all, but principal barely moves in the early years.

- You pay the most interest and stay in debt the longest.

In a 50-year loan, it can take a decade or more before you’ve meaningfully reduced the balance. If you sell or refinance in years 8–10 (which many people do), you may discover that most of what you paid was interest, not ownership.

Why This Matters for the 50-Year Proposal

The proposed 50-year mortgage doesn’t magically make homes cheaper.

It stretches the amortization so the payment looks comfortable today—but pushes the real cost of ownership far into the future.

For buyers, the key questions become:

- How long do I realistically expect to keep this home or this loan?

- Am I comfortable building equity this slowly?

- Am I trading short-term affordability for long-term cost?

In other words, the debate over a 50-year mortgage proposal isn’t just about the payment—it’s about the amortization curve behind that payment.

It breaks down every monthly payment into principal and interest and shows how the loan balance decreases over time. This example uses a $300,000 loan at a fixed 6% interest rate and illustrates how much faster equity builds in a 15-year mortgage compared to longer terms like 30 or 50 years.

Payment vs. Total Cost: Why the Lowest Payment Isn’t Always the Best Deal

When buyers shop for a mortgage, almost everyone focuses on one thing:

“What will my monthly payment be?”

It’s the most natural question in the world.

Buyers budget monthly, not in decades.

But the lowest monthly payment does not equal the best financial outcome. In fact, when mortgage terms get longer—30 years, and now potentially 50 years—the gap between payment comfort and total cost becomes enormous.

The Payment Trap

A 50-year mortgage proposal can make a home feel suddenly “affordable” because the monthly payment drops.

But that lower payment comes at a price: dramatically higher total interest and a much slower climb in home equity.

Here’s what actually happens:

- You pay more total interest than with any other term

- Most of your early payments go toward interest, not ownership

- It takes years longer before the principal meaningfully decreases

- If you sell or refinance early, you may walk away with less equity than expected

In other words, a 50-year mortgage gives you today’s affordability at the expense of tomorrow’s financial flexibility.

A lower payment today almost always means a higher total cost over time.

A Useful Way to Think About It

Two buyers can purchase the same $300,000 home:

- One chooses a 15-year mortgage

- The other chooses a 50-year mortgage

Both will live in the same house.

Both will enjoy the same space.

Both will benefit from the same market appreciation.

But the financial outcomes could be hundreds of thousands of dollars apart—simply because of the amortization curve behind the scenes.

Why This Matters for Policy Discussions

When policymakers propose dramatic changes to mortgage terms—like stretching loans to 50 years—the debate often gets stuck on monthly payment affordability.

But affordability is only part of the picture.

The real question is:

What happens to the homeowner’s long-term financial health?

This is where understanding amortization becomes crucial. Because if most Americans already move or refinance long before 30 years, shifting to 50 years completely changes the stakes.

The Case for a 50-Year Mortgage Proposal

While the idea of a 50-year mortgage may sound extreme at first, there is a compelling argument for why it can benefit many buyers—especially in today’s market, where affordability is at historic lows.

1. Most Borrowers Will Not Keep a Mortgage for 30 or 50 Years—And Lenders Know It

Long-term mortgages are not created under the assumption that borrowers will actually stay in the loan for the full term. Historically:

- Homeowners move every 8–12 years

- Most refinance when interest rates drop

- Life changes — job relocations, downsizing, upsizing — force turnover

So the idea that a buyer will remain in a 50-year mortgage for half a century is unrealistic. The mortgage term is a payment tool, not a prediction.

2. A Long Mortgage Is a Payment Strategy—Not a Lifetime Contract

The entire purpose of long mortgages (first 30 years, now potentially 50) is to reduce the monthly payment today.

There is a general expectation baked into the mortgage industry:

Interest rates will eventually decline, and borrowers will refinance into shorter, cheaper loans.

A homeowner might start with:

- A 50-year mortgage

- Then refinance into a 30-year

- And possibly end up in a 15-year later

This stair-step approach has been common for decades.

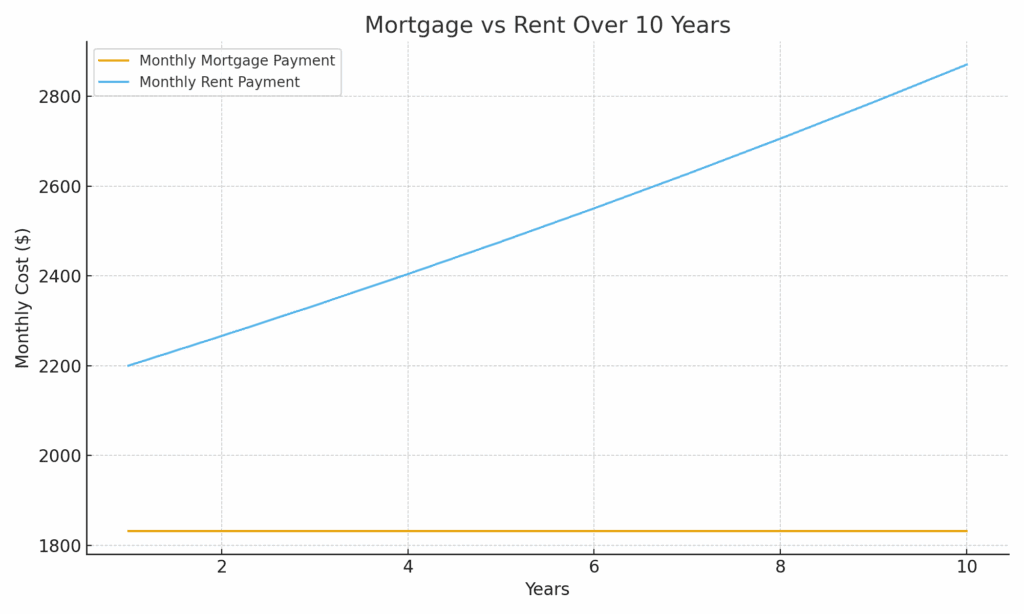

3. Mortgage Payments Are Stable—Rent Is Not

One of the strongest arguments for a long-term mortgage is stability.

- Rent increases almost every year

- Your mortgage payment does not

- Even with a 50-year term, the payment is locked in

This is why it’s critical to compare the cost of a mortgage against renting.

4. “Renting With Benefits”: The Real Advantage

With a 50-year mortgage, you are essentially renting with benefits:

- Your payment is stable

- You build equity through principal reduction

- You gain additional equity through market appreciation

- You receive tax advantages that renters do not

Even if the amortization is slow, any principal paid is more than zero, which is what you get in a rental.

As long as the mortgage payment is lower than or comparable to rent, the homeowner comes out ahead long-term.

5. The Mortgage vs. Rent Chart Makes It Clear

Your comparison chart shows exactly what happens:

- Mortgage: flat payment ~ $1,832/mo

- Rent: starts at $2,200 and climbs to ~$2,900 within 10 years

This illustrates why long-term mortgages—even 50-year ones—can make sense.

You control your housing cost instead of being exposed to annual rent increases.

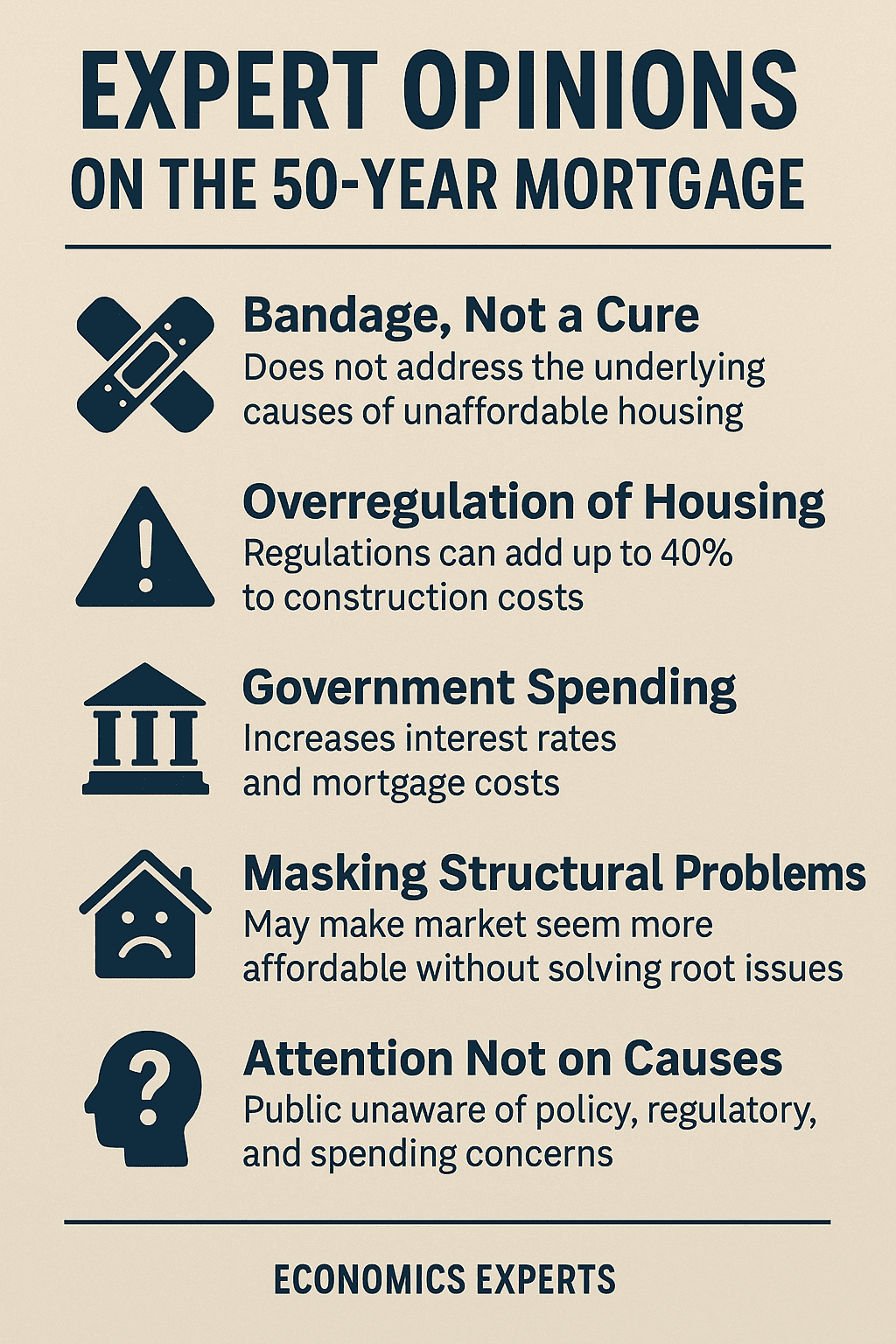

The Case Against a 50-Year Mortgage Proposal

While a 50-year mortgage may improve affordability in the short term, there are serious drawbacks that buyers, lenders, and policymakers must consider. Lower monthly payments come at a cost—and that cost grows dramatically as the amortization period stretches.

1. The Slowest Equity Growth of Any Mortgage Term

A 50-year mortgage spreads principal repayment over 600 months, which means:

- Very little principal is paid in the early years

- Most of the payment goes to interest

- Homeowners build equity far more slowly than with a 15- or 30-year mortgage

If a homeowner sells or refinances after 7–10 years (as most do), they may be surprised to see how little their loan balance has actually decreased.

On a 50-year amortization schedule, the first decade behaves much like interest-only ownership, with only small amounts of principal reduction.

2. Massive Total Interest Costs

Longer loans make payments smaller, but they inflate total interest dramatically.

Using the same $300,000 loan at 6% interest:

- 15-year mortgage: ~$74,000 total interest

- 30-year mortgage: ~$215,000 total interest

- 50-year mortgage: ~$313,000 total interest

A 50-year mortgage adds nearly $100,000 more interest compared to a 30-year mortgage — and more than four times the interest of a 15-year loan.

This is the fundamental trade-off:

Lower payment today = much higher cost tomorrow.

3. Risk of Perpetual “Locked-In Debt”

One concern with a 50-year mortgage is that it can create a cycle where homeowners:

- Can afford the home

- But have trouble building usable equity

- And remain in long-term debt indefinitely

While many buyers will refinance, there is no guarantee rates will decline in the future.

If refinancing does not become possible:

- Homeowners may feel stuck

- Loan balances decline very slowly

- Early repayment remains expensive

- The psychological burden of long-term debt increases

This may especially impact buyers entering the market during periods of high interest rates.

4. A 50-Year Mortgage Can Push Home Prices Higher

This is a concern among economists:

If buyers can afford more house because payments fall, sellers can raise prices.

The same criticism was once leveled at 30-year mortgages during the post–World War II boom.

If 50-year loans become mainstream:

- Demand may increase

- Prices may follow

- Affordability may not improve as much as expected

- First-time homebuyers may be priced out even further

This mirrors what happened when adjustable-rate mortgages and interest-only loans became popular in the 2000s.

5. Increased Risk for Lenders and Mortgage Markets

Longer terms create more uncertainty:

- More time for property depreciation

- More exposure to borrower job changes

- Greater default probability

- More sensitivity to market cycles

Investors who buy mortgage-backed securities may demand higher yields for 50-year loans — pushing rates up.

This makes the product less attractive for both lenders and borrowers.

6. Not Everyone Wants a Mortgage That Outlives Their Career

A 50-year mortgage taken out at age 40 would not be paid off until age 90.

Even at age 30, payoff arrives at age 80.

This can conflict with:

- Retirement planning

- Fixed-income budgets

- Estate planning goals

- Financial flexibility in later life

While refinancing can shorten the term, the assumption of refinancing cannot be guaranteed.

7. Borrowers Must Think Long-Term — Not Just About Today’s Payment

The biggest risk of a 50-year mortgage is psychological:

It makes an expensive home feel affordable.

But affordability should not be confused with financial strength.

Buyers must weigh:

- Payment vs. total cost

- Rent comparison

- Future refinancing options

- Likelihood of moving

- Long-term equity growth

- Retirement timeline

A 50-year mortgage works only if the homeowner is disciplined and realistic about future refinancing or future moves. The Value of Money: Why Paying Off a Mortgage Isn’t Always the Smartest Move

This brings us to a related concept that is essential when evaluating long-term mortgages — the value of money and the opportunity cost of paying off debt too aggressively.

I expand on this idea in more detail in my article:

👉 Retiring With Mortgage Debt — https://retirecoast.com/retiring-with-mortgage-debt/

Many homeowners have been taught all their lives that paying off a mortgage is “the responsible thing to do.”

But financially, that advice is not always correct — especially in a world where investment returns can outpace mortgage interest rates.

Interest Rate vs. Investment Return: The Only Comparison That Matters

The key question is simple:

Can your money earn more somewhere else than it costs you to borrow?

If the answer is yes, then aggressively paying off your mortgage may not be the optimal choice.

A Simple Example

Let’s compare:

- A mortgage at 6.5% interest

- An investment portfolio earning 8% annual returns

If you have $50,000 available, you have two choices:

Option A: Pay Down the Mortgage

You save 6.5% interest — a guaranteed return, yes, but capped.

Option B: Invest the Money

You earn 8% — which, historically, over long periods, is a realistic average for diversified investments.

The spread between 8% and 6.5% is 1.5%.

Over many years, that difference compounds dramatically in your favor.

Meanwhile, your mortgage balance continues to amortize normally. You still build equity — just at a slower rate than if you paid it off — while your investments grow faster than the loan costs you.

Flexibility Is Power: You Can Always Pay Down the Mortgage Later

One of the greatest advantages of keeping capital invested rather than paying down your mortgage is flexibility.

Any time you choose, you can:

- Sell investments

- Take profits

- Pay down a chunk of your mortgage

- Or even pay it off completely

Once you put money into the mortgage, however, you cannot get it out unless you refinance or take a home equity loan — both of which depend on market conditions.

Investments give you control.

A mortgage payoff does not.

What About the Homeowners With 3% Mortgages?

Some people were fortunate enough to lock in ultra-low interest rates during 2020–2021 — many in the 2.5% to 3.25%range.

For them, it almost never makes sense to liquidate an investment earning 6–10% annually in order to “save” 3% interest.

Financially, that is taking high-earning capital and using it to eliminate low-cost debt — the opposite of optimal wealth-building.

Yet many still do it because:

- “It’s what my parents told me to do.”

- “I want to feel debt-free.”

- “It just feels safer.”

These are emotional reasons — not mathematical ones.

How This Connects to the 50-Year Mortgage Proposal

This is where a longer mortgage term can make sense for the right person.

A 50-year mortgage:

- Lowers your monthly payment

- Increases your cash flow

- Allows more money to remain invested

- Gives you financial flexibility

- Still builds home equity slowly

- May outperform the cost of the loan if investment returns exceed mortgage interest

If you can borrow at 6–6.5% and consistently earn 7–9% (or more) in diversified investments, then:

A longer mortgage is not a burden — it’s a financial advantage.

This mindset turns the mortgage into what it truly is:

a payment tool, not a lifetime contract.

For many buyers, especially younger ones or those building wealth through investments and retirement accounts, the 50-year mortgage at a reasonable rate may be the most strategic option.

✅ When a 50-Year Mortgage Makes Sense

1. When Monthly Cash Flow Matters More Than Equity Growth

If your priority is a lower monthly payment, a 50-year mortgage achieves exactly that.

More money stays in your pocket each month, which is critical for:

- Younger buyers just entering the market

- Retirees on fixed incomes

- Families managing child-care, medical, or education expenses

- Investors who want to keep cash available for other opportunities

A smoother monthly budget often matters more than aggressive debt payoff. Fortune has weighed in with a positive view.

2. When You Expect to Refinance Later

The mortgage industry assumes that interest rates rise and fall over time.

Buyers who lock in a 50-year mortgage during a high-rate cycle can:

- Lower their payment today

- Refinance to a shorter term when rates eventually drop

- Potentially move from a 50-year → 30-year → 15-year mortgage as their financial situation improves

This “laddering down” approach mirrors what many homeowners already do.

3. When Rent Is Higher Than a 50-Year Mortgage Payment

This is one of the strongest arguments in favor of long-term mortgages:

- Rent increases almost every year

- Mortgage payments stay the same

Even if equity growth is slow, the homeowner still benefits from:

- Stable housing costs

- Principal reduction (even if small)

- Property value appreciation

- Tax advantages (depending on location and income)

This is why a 50-year mortgage can be viewed as “renting with benefits.”

As long as your payment is equal to or lower than rent, you are financially ahead.

4. When Your Investments Earn More Than Your Mortgage Costs

If a buyer can earn 7–10% in diversified investments while paying 6%–6.5% on a mortgage, the math is simple:

- Higher returns → investments grow faster

- Lower mortgage payment → more cash to invest

- Greater long-term net worth → financial freedom

And, importantly, you can always liquidate investments later and pay down the mortgage — but you cannot easily get cash out of a home once it’s locked into the loan.

5. When You Want Maximum Flexibility

A 50-year mortgage provides:

- The lowest possible payment

- The ability to invest, save, or build a cash buffer

- A safeguard against job loss or income fluctuations

- Protection against rental inflation

In many cases, flexibility today matters more than paying the home off tomorrow.

❌ When a 50-Year Mortgage Does NOT Make Sense

1. When You Have Trouble Saving or Managing Money

If a buyer is unlikely to invest the difference between the 30-year and 50-year payment, then the financial benefit disappears.

A 50-year mortgage only works when the borrower uses the saved cash wisely.

If the extra money is simply spent each month, the long-term cost of the mortgage outweighs the benefits.

2. When You Plan to Stay in the Home for 30+ Years

If you genuinely intend to live in the same home long-term:

- A 15-year mortgage

- Or a 30-year mortgage

- Or periodic lump-sum payments

…will save you a substantial amount in interest.

With a 50-year mortgage, you will pay massively more over the long run — unnecessary if you plan to stay put.

3. When You Have a Low Mortgage Rate Opportunity

If you can secure a 5% mortgage or lower, a 50-year loan becomes less attractive.

And if you have access to a 3% mortgage (like many borrowers from 2020–2021), there is no financial case for a 50-year alternative.

Taking dollars earning 8% and using them to “save” 3% interest makes no financial sense.

4. When You Want Rapid Equity Growth

A 50-year mortgage builds equity slowly — very slowly.

If you:

- Want to own your home outright as quickly as possible

- Plan to use equity for retirement

- Want the psychological security of debt elimination

…then a 15-year or accelerated 30-year payment strategy is a better fit.

5. When Long-Term Debt Creates Stress

Some people simply don’t like debt — and that matters.

A 50-year mortgage is not for someone who:

- Feels burdened by long-term obligations

- Wants the emotional relief of home ownership

- Prefers simplicity over financial optimization

Personal comfort should always be part of the decision.

Bottom Line

A 50-year mortgage is not a one-size-fits-all solution.

But for buyers who prioritize cash flow, flexibility, investment growth, and lower payments, it may be the smartest strategy — especially in market conditions where rent is rising faster than income and interest rates remain elevated.

However, for buyers who want rapid payoff, long-term stability, low total interest cost, or who already qualify for favorable shorter terms, a 50-year mortgage makes far less sense.

Why the Trump Administration Must Change Fannie Mae and Freddie Mac Rules

The most important structural barrier to a 50-year mortgage has nothing to do with banks, interest rates, or housing demand. It has everything to do with Fannie Mae and Freddie Mac — the two government-sponsored entities (GSEs) that purchase most mortgages in the United States.

Right now, Fannie and Freddie are not allowed to buy 50-year mortgages.

This is the key reason why these loans are not already available in large numbers.

Why This Matters: Lenders Must Be Able to Sell the Loans

Most mortgage lenders do not keep loans on their own books.

They originate the loan, then sell it to:

- Fannie Mae

- Freddie Mac

- Or private investors

This is how lenders free up capital to issue more loans.

Without a secondary market to sell into, lenders would have:

- Less cash

- Lower capacity

- Higher rates

- More risk

Even if lenders wanted to offer 50-year mortgages, they can’t scale them unless they can sell them off to a secondary market buyer — ideally, Fannie or Freddie.

Current Rules: Qualified Mortgages Must Fit Specific Terms

Under today’s federal rules:

A “Qualified Mortgage” (QM) cannot exceed 30 years.

This means:

- 50-year mortgages don’t qualify

- 40-year mortgages only qualify for loan modifications (not new originations)

- Fannie and Freddie cannot purchase these loans under the current guidelines

This is why the 50-year mortgage proposal cannot move forward without regulatory changes.

What Trump’s Administration Must Do

For 50-year mortgages to become widely available, the administration must:

- Update the Qualified Mortgage (QM) rule to allow terms beyond 30 years

- https://www.freddiemac.comDirect Fannie Mae and Freddie Mac to purchase 50-year mortgages

- Adjust underwriting standards to account for longer risk horizons

- Re-align capital requirements for GSE portfolios containing 50-year terms

Once these changes are implemented:

- Lenders can originate 50-year mortgages confidently

- Fannie and Freddie can buy the loans

- A large, liquid secondary market will support the new product

- Rates for 50-year mortgages will fall into predictable ranges, similar to 30-year loans

This explains why the administration has become directly involved.

Why the Administration’s Role Is Crucial

A bank can write a 50-year mortgage tomorrow — there’s no law stopping it.

But without the ability to sell it, that loan would:

- Tie up capital for decades

- Create excessive long-term risk

- Require the bank to hold higher reserves

- Potentially force the bank to charge a much higher interest rate

In short:

This is the regulatory bottleneck the Trump administration is attempting to clear.

Once These Rules Change, the Market Can Move Quickly

If Fannie and Freddie are authorized to purchase 50-year mortgages:

- Lenders will begin offering the product immediately

- Competition will lower the rates

- Buyers will gain access to lower payments

- States and localities may begin adapting underwriting rules

- Housing affordability will shift overnight

And just like the 30-year mortgage transformed the housing market in the 1930s–1950s,

The 50-year mortgage could reshape affordability in the 2020s–2030s.

How a 50-Year Mortgage Proposal Could Affect Home Prices

One of the most important effects of a 50-year mortgage proposal has nothing to do with payments, amortization, or refinancing. It has to do with home prices themselves.

Whenever policymakers introduce a tool that expands buying power, the market reacts — and not always in the way buyers expect.

1. Lower Monthly Payments Increase Buying Power

A 50-year mortgage dramatically reduces the monthly payment.

For example, on a $300,000 loan at 6%:

- 30-year payment: ~$1,432 (P&I)

- 50-year payment: ~$1,027 (P&I)

That’s roughly a 28% decrease in monthly cost.

When buyers can suddenly afford more home for the same monthly payment, their effective buying power increases. If many buyers use the 50-year product at once, their increased budgets push demand upward.

Higher demand + fixed housing supply = higher prices.

2. History Shows This Pattern Clearly

We’ve seen this cycle before:

- The introduction of the 30-year mortgage in the 1930s

- The expansion of FHA lending in the 1950s

- Low-interest-rate periods (2020–2021, especially)

- The spread of adjustable-rate mortgages in the early 2000s

Each time buyers could suddenly qualify for bigger loans, home prices rose accordingly.

A 50-year mortgage has the potential to create the same dynamic.

3. Sellers Respond When Buyers Can Afford More

Real estate pricing is not emotional — it’s mathematical:

- Buyers shop based on the monthly payment

- Sellers adjust list prices based on what buyers can afford

If 50-year mortgages become widely available:

- More buyers will qualify for homes they currently cannot afford

- Competing offers will rise

- Sellers will raise prices to capture the increased affordability

- In competitive markets, bidding wars may intensify

This is great for homeowners and investors — but challenging for first-time buyers.

4. The Biggest Impact Will Be in High-Cost Areas

Places with limited inventory and high demand—such as coastal cities, major metros, and fast-growing suburbs—will see the largest price jumps if 50-year mortgages spread.

Markets like:

- Florida

- Southern California

- Arizona

- Texas suburbs

- North Carolina

- Tennessee

…could see buyers instantly able to bid 10–20% more simply because of the lower monthly payment.

5. The Mississippi Gulf Coast Will Feel a Different Impact

This is where your local expertise becomes valuable.

Unlike high-cost states, the Mississippi Gulf Coast:

- Has lower baseline prices

- Has room for new development

- Is experiencing steady in-migration

- Is already considered a high-value affordability market

In markets like Long Beach, Gulfport, Ocean Springs, and Bay St. Louis:

- A 50-year mortgage may attract more out-of-state relocators

- It may create more demand in mid-priced homes

- Prices may rise modestly — but not at the explosive rates seen in high-cost states

- Local renters may choose to buy because the mortgage becomes cheaper than rent

This gives the Mississippi Gulf Coast a competitive advantage.

6. Price Growth May Outpace Equity Growth

One irony of the 50-year mortgage proposal model is this:

- Home prices may rise quickly

- Equity in the home grows slowly

This widens the equity gap, especially for first-time buyers using 50-year terms.

But for existing homeowners and investors, this could be a significant advantage. Rising home prices increase net worth even if the mortgage amortizes slowly.

7. The Big Picture: Prices Will Rise — But Not Evenly

Overall, the introduction of a 50-year mortgage proposal is likely to result in:

- Higher home prices nationally

- Faster price increases in high-demand markets

- More competition among first-time buyers

- A slower equity path for those using the 50-year term

- A more attractive market for investors and existing homeowners

What This Means for Buyers on the Mississippi Gulf Coast

The impact of a 50-year mortgage on the Mississippi Gulf Coast will be very different from what buyers experience in high-cost markets like Florida, Texas, or North Carolina. Our region has long been known for affordability, stability, and value — but even here, a longer mortgage term could reshape the buyer landscape in meaningful ways.

1. Lower Payments Could Attract More Out-of-State Buyers

The Gulf Coast already attracts people relocating from higher-priced states.

If 50-year mortgages reduce monthly payments even further, the region will likely see:

- Increased interest from retirees

- More relocations from Florida and the West Coast

- Younger buyers priced out of expensive metros

- Investors shifting toward more affordable coastal markets

This increase in demand could gradually push prices higher, especially for move-in-ready homes near the beach, downtown areas, or high-growth suburbs like Long Beach, Gulfport, and Ocean Springs.

2. Local Buyers May Finally Be Able to Compete

Rents in the Mississippi Gulf Coast continue to rise, often exceeding the cost of a comparable mortgage payment.

With a 50-year loan:

- The monthly payment drops

- Homeownership becomes accessible for more residents

- First-time buyers get a meaningful alternative to renting

- It becomes easier to buy instead of leasing year after year

For many families, a 50-year mortgage could be the difference between staying renters and finally owning a home.

3. Even With Rising Prices, the Gulf Coast Remains Affordable

Unlike high-cost markets, the Gulf Coast has:

- A lower baseline home price

- Strong inventory turnover

- Active new construction

- A balanced supply-and-demand environment

This means that even if prices tick up because of expanded buying power, the region will remain far more affordable than other coastal markets.

For perspective:

A home that sells for $500,000 in Florida might sell for $250,000–$350,000 in Long Beach, Pass Christian, or St. Martin — even after mild price increases.

4. A Great Time to Watch Price Trends Carefully

This is one of the reasons buyers keep an eye on LoganAndersonLLC.com — not as a sales pitch, but simply because it’s one of the most reliable ways to monitor pricing trends across Long Beach, Gulfport, Biloxi, and surrounding communities.

People checking the market regularly can see:

- How fast are prices moving

- Whether inventory is tightening

- Which areas are seeing the most activity

- Whether mortgage changes are affecting buyer competition

As the market adjusts to the possibility of a 50-year mortgage, staying informed becomes more important than ever.

5. Buyers Should Be Strategic, Not Reactive

A 50-year mortgage is a tool — not a mandate.

Mississippi buyers should think strategically about:

- How long do they plan to stay in the home

- Whether they expect to refinance

- Their monthly budget

- Their ability to invest the payment savings

- The long-term value of local real estate

Because the Gulf Coast is still undervalued compared to other coastal regions, buyers who enter the market early — even with a 50-year mortgage — could benefit from appreciation over the next decade.

6. Investors May See a New Opportunity Window

Investors will be watching this carefully.

A lower payment option means:

- Better monthly cash flow

- Stronger rent-to-mortgage spreads

- More accessible financing for rental properties

- A competitive advantage in mid-tier markets

The Mississippi Gulf Coast already performs well for long-term rentals, short-term rentals, and relocation-driven demand. A 50-year option could widen that gap even further.

7. Bottom Line for Gulf Coast Buyers

A 50-year mortgage could:

- Make homeownership more attainable

- Allow renters to transition into owning

- Attract more out-of-state demand

- Slowly raise prices but keep the region affordable

- Expand opportunities for both residents and investors

And because the Gulf Coast market remains stable and well-priced, keeping an eye on current listings at LoganAndersonLLC.com is simply a practical way to understand what’s happening now and what opportunities may appear as the mortgage landscape evolves.

Final Thoughts: Should You Consider a 50-Year Mortgage?

A 50-year mortgage is not a magic solution, nor is it a financial trap.

It is simply a tool — one more option in a housing market that has changed dramatically over the past decade.

For some buyers, especially those fighting rising rents or trying to enter the market for the first time, a 50-year mortgage could provide the breathing room needed to stabilize their finances, invest more aggressively, and control their monthly budget. For others, especially those wanting rapid equity growth or a clear path to paying off their home before retirement, it may not be the right fit.

The key is understanding your goals:

- Do you value cash flow today more than equity tomorrow?

- Will you realistically stay in the home long-term?

- Do you expect to refinance when rates drop?

- Are you disciplined enough to invest the money you save each month?

- Does your career, family, or retirement timeline support a longer-term loan?

None of these questions has universal answers — and that’s why the 50-year mortgage is both controversial and compelling.

Why This Matters Especially for Gen X Buyers

Gen X is in a unique position.

Many are:

- Supporting aging parents

- Paying for college-aged children

- Watching retirement come into sharp focus

- Rebalancing their financial priorities

- Building or protecting wealth in their peak earning years

Your Gen X-focused articles (such as your 20-Year Countdown, Gen X Retirement Guides, and the series on Starting a Business After Retirement) highlight a very important truth:

Gen X must make smarter, more strategic financial decisions than any generation before them.

Housing is one of the biggest.

A 50-year mortgage — if executed thoughtfully — may provide Gen X buyers with:

- Lower fixed payments during high-expense years

- More room to invest before retirement

- Greater flexibility as careers shift

- A hedge against rising rents

- The ability to buy now and refinance later

For Gen X buyers who feel squeezed between supporting parents, helping kids, and planning retirement, this tool could be the difference between waiting to buy and finally achieving stability.

The Big Picture

The 50-year mortgage proposal won’t be right for everyone.

But it will change the housing conversation.

It forces buyers — especially Gen X — to rethink the old rules:

- “You must pay off your mortgage as fast as possible.”

- “Debt is always bad.”

- “Longer loans mean you’re doing something wrong.”

These rules were written for a different era — one where home prices were lower, wages tracked inflation, and investment options were limited.

Today’s world is different.

Affordability is strained, rents are rising, and buyers need new tools to bridge the gap.

As the mortgage landscape evolves, the goal is not to follow the old advice — it’s to make the decision that builds the greatest long-term stability and freedom for your financial life.

Want to know more? These articles provide some depth and tools for you:

The Gen X 20-Year Countdown to Retirement

https://retirecoast.com/gen-x-retirement-20-year-countdown/

Gen X: The Most Unprepared, Yet Most Capable Generation for Retirement

https://retirecoast.com/gen-x-preparing-for-retirement/

Starting a Business After Retirement (Gen X Edition)

https://retirecoast.com/starting-a-business-after-retirement/

Best Side Businesses for Gen X to Build Wealth

https://retirecoast.com/gen-x-side-businesses/

How Gen X Can Build Wealth in the Next 10 Years

https://retirecoast.com/gen-x-build-wealth/

Key Takeaways

- Most homeowners will never keep a mortgage for 30 or 50 years — these loans are payment tools, not predictions.

- A 50-year mortgage lowers monthly payments but increases total interest significantly.

- For many buyers, especially Gen X, cash flow and financial flexibility matter more than rapid equity growth.

- Rent increases every year, but mortgage payments remain stable — making long-term loans a “renting with benefits” alternative.

- Trump’s administration must change Fannie Mae and Freddie Mac rules for 50-year mortgages to become widespread.

- On the Mississippi Gulf Coast, lower payments could attract more relocators and keep housing affordable for locals.

- A 50-year mortgage works best when buyers invest the payment difference into higher-return assets.

Frequently Asked Questions About 50-Year Mortgages

Do people actually keep 50-year mortgages for the full term?

No. Most homeowners move, refinance, or restructure their mortgage within 8–12 years. A 50-year mortgage is a payment strategy, not a lifelong commitment.

Will a 50-year mortgage lower my monthly payment?

Yes. This is the main benefit. Stretching a loan over 50 years dramatically reduces the monthly payment compared to a 30-year term.

Do 50-year mortgages cost more in the long run?

Absolutely. You will pay far more total interest. The trade-off is short-term affordability versus long-term cost.

Can I refinance a 50-year mortgage later?

Yes. Many buyers expect to refinance to a shorter term when rates drop — moving from 50 → 30 → 15 over time.

Will the 50-year mortgage raise home prices?

Likely. As buying power increases, sellers can charge more. High-demand markets will see the biggest jumps.

Does Fannie Mae or Freddie Mac currently buy 50-year mortgages?

No. They are restricted to 30-year qualified mortgages. The Trump administration would need to change these rules before 50-year loans can scale.

Does a 50-year mortgage make sense on the Mississippi Gulf Coast?

For many buyers, yes. Payments may be lower than rent, and the Gulf Coast remains far more affordable than other coastal markets.

Is a 50-year mortgage good for Gen X buyers?

Potentially. Many Gen X homeowners benefit from lower payments now while investing more aggressively for retirement.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.