Last updated on September 20th, 2025 at 10:26 pm

Every few months, headlines pop up asking: “Will Social Security go away?” The question is an attention-grabber, meant to stir fear and clicks. You skim the article only to find that the writer offers little more than speculation.

This article takes a different approach. We’ll explore what the numbers actually show, what government officials themselves are saying, how independent experts project changes, and how upcoming regulatory shifts could affect not just retirement, but disability and survivor benefits too.

The goal is not panic — it’s clarity. We updated this article for 2026 and will continue to do so.

Social Security Is Part of American Life

Social Security is not a niche program; it’s part of the bedrock of American society. For nearly nine decades, it has ensured that retirees, disabled workers, and survivors of deceased workers have a guaranteed stream of income.

Ending Social Security entirely is not a realistic outcome. Politically, the senior voting bloc is the largest and most consistent in the country. Economically, trillions of dollars in benefits fuel local businesses, pay mortgages, cover utilities, and stabilize communities. Social Security is as central to daily life as public schools and the interstate highway system.

That doesn’t mean nothing will change. The system faces real pressures, but reform does not equal abolition.

What Trust Fund “Depletion” Really Means

Much of the alarm comes from reports that the Social Security trust fund will be “depleted” in the 2030s. But depletion doesn’t mean checks stop arriving.

Here’s how the system actually works:

- Pay-as-you-go structure: Today’s workers pay payroll taxes, which immediately fund today’s beneficiaries.

- Surplus investing: When payroll taxes exceed benefit payments, the surplus is invested in U.S. Treasury securities.

- Redemption in deficit years: When benefits exceed taxes, those securities are redeemed to cover the gap.

If reserves are fully drawn down, the system reverts to a pure pay-as-you-go model. Payroll taxes would still cover about 75–80% of scheduled benefits (SSA Trustees Report). In other words, depletion means a cut — not elimination.

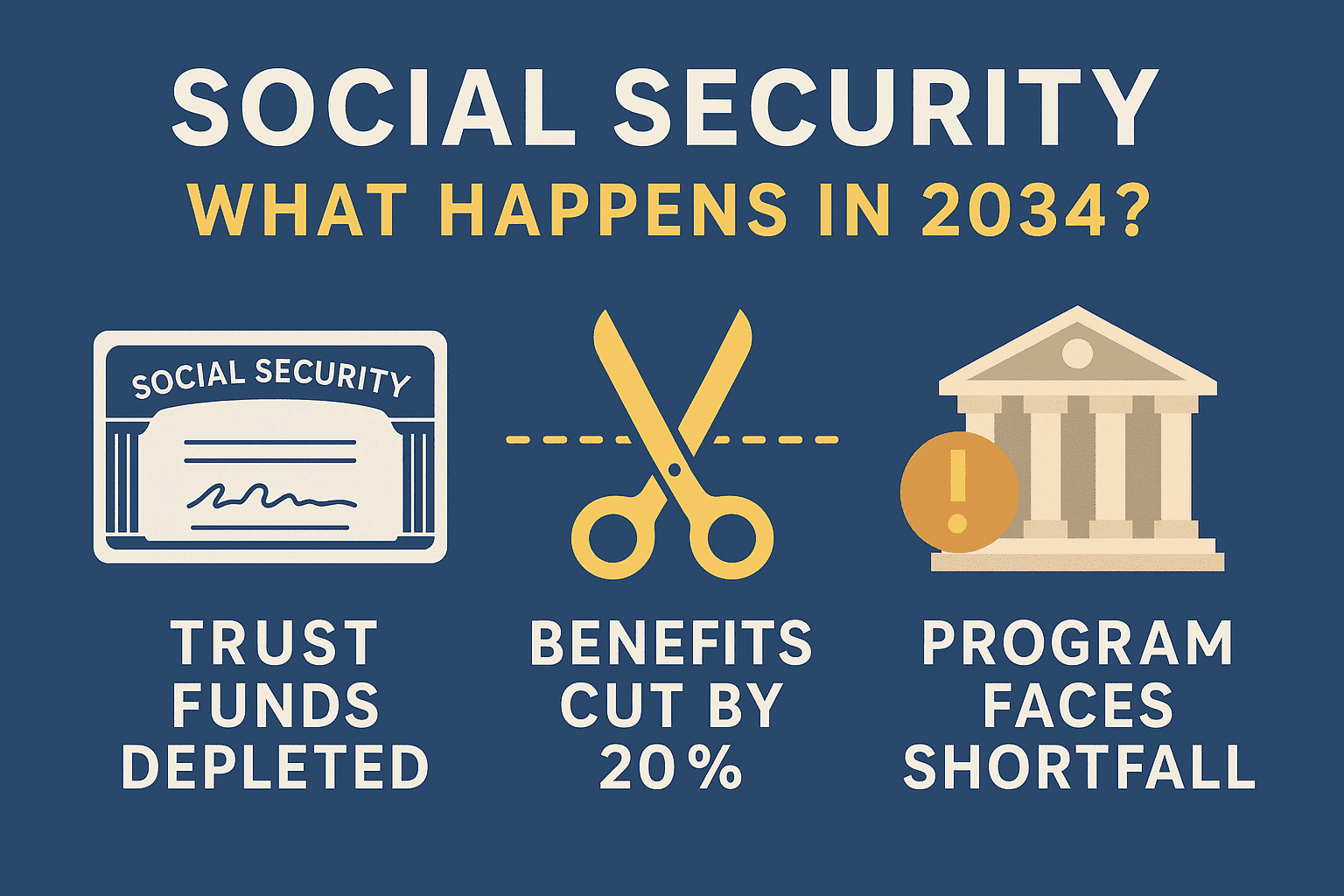

Trustees Report Confirms 2034 Timeline

The 2025 Social Security and Medicare Trustees Report was blunt:

- 2025 will be the first year since 1982 that costs exceed income.

- Full benefits can be paid until 2034.

- After that, only about 79% of benefits can be paid unless Congress acts.

As Bob Spence, a financial consultant with Raymond James, told Fox Business:

“Everybody knows something is going to have to change or, as of 2034, there will be a large percent cut [from benefits].”

The trustees calculate that if payroll taxes were raised immediately by 2.78%, the system would be fully solvent for 75 years (CRFB analysis). But if lawmakers delay until 2034, the tax would need to rise to 16.2% — nearly $1,900 extra per year for a $50,000 worker.

Administration Officials: “All Options” Will Be Considered

In 2024, Social Security Commissioner Frank Bisignano underscored the urgency in an interview on Mornings with Maria. Asked about raising the retirement age, he said:

“I think everything’s being considered, will be considered.”

He later clarified in a statement to Fox News Digital:

“President Trump and I will always protect Social Security. That’s why we have made many vital reforms, such as cutting waste, fraud, and abuse… Raising the retirement age is not under consideration at this time.”

Bisignano acknowledged, however, that younger generations may face different rules than today’s retirees. That matches the historical pattern: Congress has typically protected current recipients while phasing in adjustments for future beneficiaries.

Why the Worker-to-Retiree Ratio Matters

The math behind these warnings is straightforward: fewer workers per retiree means more strain on the system.

- 1950: 16.5 workers supported each retiree.

- 1985: 3.3 workers.

- 2013: 2.8 workers.

- Today: edging closer to 2.0 workers per retiree (SSA data).

This demographic squeeze is the driving force behind talk of raising the payroll tax, lifting the cap on taxable wages, or adjusting benefits.

The Most Likely Reforms

Based on the trustees’ data, administration statements, and financial experts’ projections, the most likely reform tools are:

- Payroll tax increases

- A modest bump now would solve most of the long-term shortfall.

- Delaying action makes the required hike much steeper.

- Raising or eliminating the payroll tax cap

- Currently, wages above $168,600 (2024) are exempt from Social Security taxes. Removing the cap would significantly increase revenue.

- Adjusting retirement age

- The full retirement age has already risen from 65 to 67. It could move to 68 or 69 for younger workers.

- Tweaking cost-of-living adjustments (COLAs)

- Policymakers could change the inflation index used, slowing benefit growth slightly.

- We’ve covered this issue in more depth in our post: Social Security Payments Increased – What About That Medicare Premium?

- Means testing or higher benefit taxation

- Wealthier retirees may see more of their benefits taxed or reduced.

- Disability and survivor program reforms

- As we’ll see, SSA is already considering major eligibility changes.

Beyond Retirement: Disability Programs in the Spotlight

In September 2025, the Urban Institute published an analysis of a proposed SSA regulation that could reshape eligibility for Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

What’s Changing

- Modern job data: SSA will replace its outdated Dictionary of Occupational Titles with the Bureau of Labor Statistics’ Occupational Requirements Survey (ORS).

- Interpreting ORS data: Decisions on thresholds — such as how many light-duty jobs exist — will directly affect who qualifies.

- Age and experience rules: SSA may adjust how age, education, and work history are weighed in eligibility, disproportionately affecting older workers.

Projected Impact

- Disability eligibility could be reduced by up to 20% overall and 30% for older workers.

- A 10% reduction would mean 500,000 fewer approvals over 10 years, including about 80,000 widows and children.

- Benefit losses could reach $82 billion, also cutting access to Medicare and Medicaid for many.

- Many denied older workers may be forced into early retirement benefits at 62, locking in 30% lifetime reductions.

Why It Matters

This shows how interconnected Social Security’s programs are. Tightening disability rules doesn’t just affect SSDI — it also pressures the retirement system as older denied workers turn to early retirement.

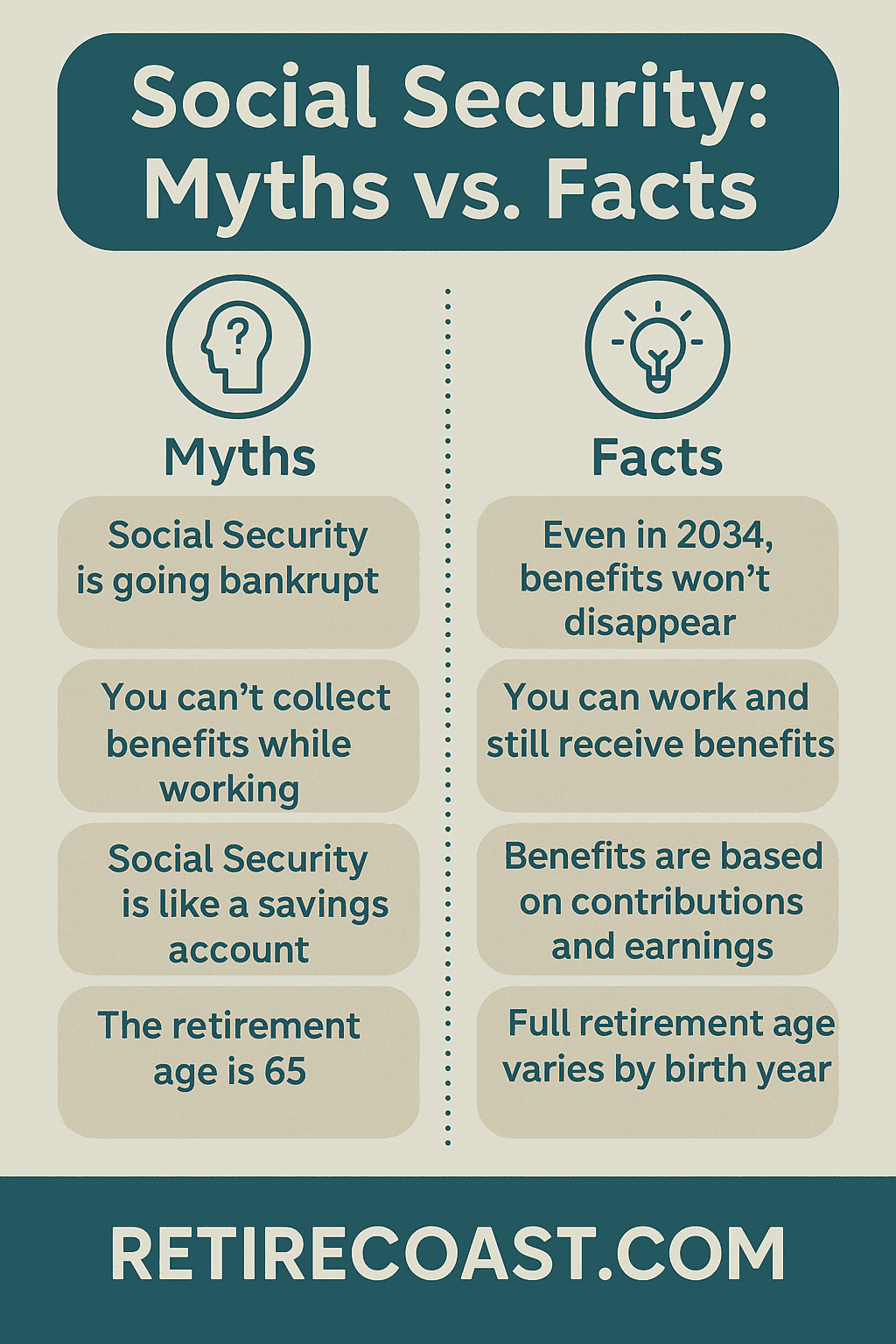

Myths vs. Facts

- Myth: Social Security will vanish in 2034.

Fact: Even without reforms, payroll taxes would still cover about 75–80% of benefits (SSA Trustees Report). - Myth: Current retirees are at risk of sudden cuts.

Fact: Historically, Congress shields current beneficiaries. Reforms typically affect future recipients. - Myth: Disability and survivor benefits are separate.

Fact: They are part of the same trust funds — and changes to one ripple across the others. - Myth: COLAs guarantee you keep up with inflation.

Fact: COLAs help, but healthcare and housing costs often rise faster than the official index (CBPP explainer).

What Retirees and Workers Should Do

- Stay informed: Follow trustee reports and legislative debates.

- Diversify retirement income: Don’t rely solely on Social Security — build IRAs, 401(k)s, or other assets.

- Stress-test your plan: Assume 75–80% of projected benefits and plan for later claiming ages.

- Understand claiming choices: Claiming at 62 reduces monthly checks permanently; waiting until 70 maximizes them. We cover this in detail in our article on Maximizing Gen X Social Security Benefits.

- Consider relocation and lifestyle: Some retirees stretch their benefits further by relocating to more affordable areas. Learn more in Retire by the Beach on Social Security.

- Plan ahead by generation: Gen X in particular should prepare for later retirement ages and higher contributions. See our full Gen X Retirement Guide.

Take Action: Protect Social Security

Everyone should get involved by urging their congressmen and senators to fix the Social Security system now — and stop kicking the can down the road.

Not sure who represents you? Find them here:

👉 House of Representatives Directory

👉 U.S. Senate Directory

The Bottom Line

So, will Social Security go away? No.

What will happen is a set of adjustments. Congress and the White House will debate how to close the funding gap, with options ranging from tax increases to eligibility tweaks. Disability and survivor programs are also on the table, with proposed rules likely to reshape who qualifies.

The key takeaway: Social Security is not vanishing. It will evolve. Today’s retirees are unlikely to face drastic changes, while younger generations should prepare for higher contributions, later retirement ages, or more targeted benefits.

The system is too embedded in American life to be dismantled. The real question is not if it survives, but how it adapts.

At RetireCoast, we’ll continue cutting through the noise so you can plan with facts — not fear.

Social Security Claiming Age Comparison

- 2025 OASDI Trustees Full Report (SSA.gov)

- Committee for a Responsible Federal Budget: 2025 Trustees Report Analysis

- Bipartisan Policy Center: Explainer on Trustees Report

- Fox Business: Social Security Insolvency Looms 2034

- Urban Institute: SSA Disability Eligibility Rule Changes

- CBPP: What the Trustees Report Shows About Social Security

Internal RetireCoast Articles:

- Social Security Payments Increased – What About That Medicare Premium?

- How Can I Maximum Earnings for Gen X Social Security

- Retire by the Beach on Social Security in 2022

- Gen X Retirement Guide

At RetireCoast, we receive a steady stream of questions from readers who are planning for retirement, worried about benefit cuts, or simply trying to understand how Social Security really works. To help cut through the noise, we’ve put together this FAQ with clear, fact-based answers — along with links to both authoritative sources and our own in-depth RetireCoast articles.

Social Security: Frequently Asked Questions

1) Is Social Security going to run out of money?

No. The 2025 Trustees Report projects full benefits through 2034; after that, ongoing payroll taxes would still cover about 79% of scheduled benefits unless Congress acts. That’s a cut—not zero. Source: SSA Trustees Report (2025).

2) How big would benefits be cut if Congress did nothing?

Roughly an across-the-board reduction of about 21–24% starting in 2034. Learn more in our article on Social Security payments and Medicare premiums, which shows how rising healthcare costs already erode benefits.

3) What’s the simplest fix lawmakers are discussing?

An immediate payroll tax increase. Trustees estimate about +2.78 percentage points (shared by workers and employers) would close the 75-year shortfall if enacted now; delay makes the needed hike larger. Source: CRFB analysis.

4) Will the retirement age go up?

Possibly for younger cohorts. The current full retirement age (up to 67) could be nudged higher. In 2024, SSA’s Commissioner said “everything’s being considered,” but clarified raising the age was not on the Administration’s agenda at that time. Source: Fox Business.

5) What about lifting or eliminating the payroll tax cap?

This is frequently discussed. Currently, wages above ~$168,600 (2024) aren’t taxed for Social Security. Removing or lifting the cap would increase revenue. For Gen X strategies to maximize earnings under current rules, see our Gen X Social Security guide.

6) Why do experts keep citing 2034?

That’s when the combined trust funds are projected to reach insolvency (reserves depleted). After that, benefits equal to payroll taxes (~79%) would be paid unless reforms happen. Source: SSA Trustees Report.

7) Do cost-of-living adjustments (COLAs) keep up with inflation?

COLAs help, but personal inflation—especially health care and housing—often runs higher. We explain this gap and its effect on retirees in our Medicare premium and COLA article. Background: CBPP.

8) Will current retirees face sudden cuts?

Historically, Congress protects current beneficiaries. Changes usually apply to younger workers. But if lawmakers took no action by 2034, automatic cuts would apply under current law. See our Gen X Retirement Guide for what younger generations should prepare for.

9) Are disability (SSDI) and SSI rules changing too?

Yes. SSA is preparing a regulation that updates disability eligibility using modern job data (BLS’s ORS) and may adjust how age/experience factor in. Analysts estimate approvals could fall by up to 20% overall and 30% for older workers. Source: Urban Institute brief.

10) What should I do now—practically?

- Diversify retirement income beyond Social Security (IRAs, 401(k)s, rentals).

- Stress-test plans assuming ~75–80% of benefits post-2034.

- Understand claiming tradeoffs: reduced checks at 62 vs. larger at 70. We cover lifestyle impacts in Retire by the Beach on Social Security.

- Follow credible updates: SSA Trustees, CRFB, and our RetireCoast Social Security series.

📺 Learn how claiming age, benefit formulas, and Social Security fundamentals work from this clear explainer.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

Great clarification on social security

Incredible! This blog looks exactly like my old one! It’s on a completely different topic but it has pretty much the same page layout and design. Excellent choice of colors!

Thanks for the reply. I usually select topics based upon conversations with others or as threads from other articles that I have written.