Last updated on March 5th, 2022 at 04:15 pm

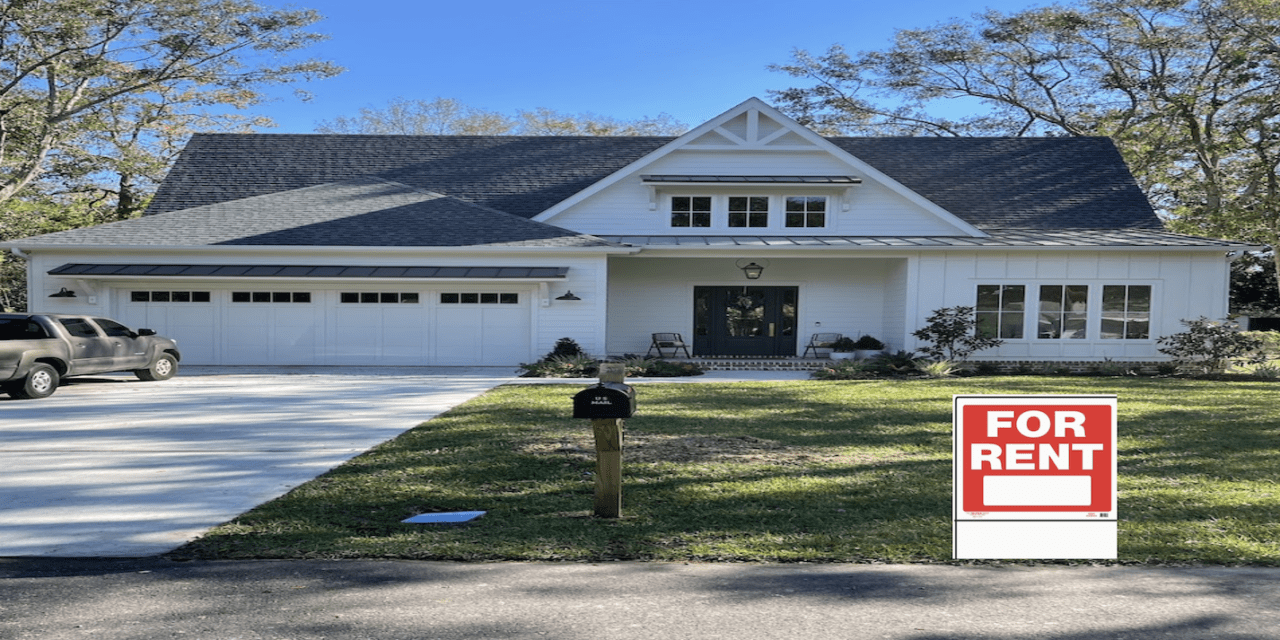

Just this afternoon, I discussed with an associate about rents. I was trying to explain to him that rent must increase to cover at minimum the costs being passed along to the property owners. He was telling me that in Mississippi, raising rents each year was not as common as it is in California and other states. He knows that I have owned several rental properties in several states including Mississippi.

My point was that I often find along the Mississippi Gulf Coast, that property owners fail to raise their rents for a variety of reasons. This is also true in many other areas so as I explained to him, this is not unique to the Mississippi Gulf Coast where the cost of living is far lower than in California and Nevada among other places where I have owned rental property. The primary point that I was trying to get across is that renting property is a business. It is not a hobby at least for most people. I recommend to clients that when they first purchase the property for rental purposes, they should hire a property manager.

Why? Because when a property owner becomes friends with the tenants, more often the tenant will take advantage of the property owner. This can happen even if the tenant does not ask for anything but the owner knows the renter will have a hard time making an increased rent payment. Over the years the owner stops asking for more money and falls further behind. Eventually, some of these owners have to sell their properties because they can no longer make the mortgage payment because of lower rents.

People have issues, it’s just life.

People have issues, that’s just life. When they are desperate for money, they often turn to the landlord for not paying the rent on time or at all. They have lots of reasons why they can not pay but without a doubt, any money they have is going to something else. This emotional attachment makes it almost impossible to run your rentals as a business. After all, who likes to evict anyone?

If you are a renter reading this you should understand that the vast majority of landlords are individuals who are investing in some cases, their retirement funds, hoping to make a good return on their investments. If they invest in the stock market they have no issues with non-payment of rents etc. so you can understand the stress that being a landlord can create.

Governments love to increase property taxes, some do it every year, some wait a few years but the cumulative effect is about the same, higher costs. Insurance premiums have been on the increase for the last few years as disasters cause them to compensate clients. Just these two drains on income alone can cause a landlord to raise their rents.

Other costs including maintenance e.g. a new roof or air conditioner can wipe out all of the income for an entire year. Owing property is a risk. When tenants pay rent on time and understand that an increase of x percent every year helps keep the landlord financially healthy, both parties benefit. Landlords can afford to keep the property in good condition and tenants enjoy living there.

Put money back into your property

Landlords who raise the rent and do not put money back into the property are doing a disservice to their tenants and reducing their property values. Most landlords understand keeping their property in good condition attracts good tenants. Just as there are tenants who fail to pay their rent on time and create damage to the property, there are landlords who could care less if the paint is peeling.

I recommend to my clients and have my property managers explain the rules to all new tenant applicants. This discussion includes the fact that rents are likely to increase each year to keep up with inflation. I want new tenants to fully understand this. I also want to be sure that before I rent my property to a tenant that they can afford to live there. My maximum threshold for rent is 50% of their gross income. If they spend more, they may not be able to make their payments if the slightest issue arises e.g. laid off from their job, getting sick, etc.

A great tool to help both tenants and landlords

A great tool to help both the tenants and landlords is to recommend that the tenants sign up with a company that reports their rent payments to credit agencies. This will help them build credit. Many people are renting because their credit prohibits them from buying a home. Particularly on the Mississippi Gulf where the mortgage payment on a home can be lower than the rental rate.

The program above is an example of one that will help tenants build credit. It also helps landlords get paid on time since the program will list late payers. This program is open to landlords as well who can pay for each tenant at a reduced rate. This can be a marketing tool to offer new tenants which in turn will help boost rent rates and improve collections.

Rents should increase every year

Rents should increase every year. Why? because owners’ costs go up every year. Utilities, property taxes, maintenance, property insurance can increase year over year. Some of these items will increase and if you fail to increase your rents, you will fall backward. For example, you are charging $1,000 per month for an apartment. The water bill goes up to $5 per month per unit. Your insurance went up to $15 per unit per month. Property taxes increased by $10 per month. Maintenance supplies and labor up to $20 per month.

A total increase of $50 per month. This is a 5% increase. If you are for example earning 15% NOI on your $1,000, you need to ensure that your margin remains the same. If you simply increase the rent by the exact amount you are paying, you will accept a reduced margin. You will need to add $7.50 to the $50 to maintain the same margin. The rate should go up by $57.50.

Inform your tenants that the rent will be going up at least three months in advance. You may not know the amount at that time so tell them you will give them the amount 30 days in advance of the end of the lease or rental term. This permits them to work it into their budgets.

Tenants income is on the rise

Tenants may be seeing an increase in their income due to many government programs and all of the media hype. Employers are increasing tenant incomes in some cases by substantial amounts. Regardless, you need the additional rent and it is their responsibility to find it somewhere.

Please read other articles on this site relating to investment property. If you want to talk with a property manager about your property, please contact Gulf Coast Property Management by clicking here. If you are interested in purchasing an investment property we refer you to Logan-Anderson, Gulf Coastal Realtors.

Please leave us some comments

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.