Last updated on October 13th, 2024 at 05:38 pm

That sign on the side of the road that looks like a fifth grader made it. “I will buy your house for cash!” Sounds good particularly if you are struggling to make ends meet and may be behind on your mortgage. Perhaps your last parent just passed away and someone at the funeral starts discussing how you can make a quick sale of their home. Ask yourself, why would someone make an offer when my property is not listed for sale? You have come to the right place to understand what is going on with this type of approach. By the way, everyone needs a term for something so this effort is called “wholesaling”.

First, I am writing this article not to support or detract from what these people do. You are smart, you came here so come to your own conclusions. Let’s start with the term “wholesaling” or real estate wholesaling. Someone needed a term somewhere so this one seems to fit the best.

What is a wholesaler?

A wholesaler of anything is a person or business that typically buys a product from the manufacturer and then sells it to a retailer. I have been in the real wholesale business in the past so I know something about the process. The term for purposes of this discussion has been hijacked from the original meaning as I just described.

Real estate wholesaling does have some similarities though. This is how the system works when you are approached by someone who wants to pay cash for your house. The same is true when you call the number “hand” written on that sign (these are printed in bulk). Back to the approach which I will get into a bit more later. Essentially, someone makes contact with you or you make contact with them and discuss how your house can be purchased by this person.

The process is fairly straight forward. You meet and the person looks around at the house. Remember, most say in any condition so you will receive an offer regardless of the condition. This person, will usually avoid talking price until the last moment or next visit or call. Before they “buy your house for cash”, they need to be sure they have a market for it.

They rarely give you a price outright

He or she may spend an hour or more looking at the property asking questions and seeming to be very interested in the house and your situation. At the end of the conversation the person will usually ask you what you want for your house. They rarely give you an outright price. Part of the approach is to get you to undervalue your house.

If the price that you give the real estate wholesaler seems acceptable you go to the next stage. That price will however rarely be acceptable. The actual purchase price for your home is very likely to drop considerably as they explain the terrable condition of your home. It needs a new roof and on and on. Every approach is different so if this one does not sound the same, well, at least you have the basic idea.

Assume that through the negotiation the wholesaler has agreed to buy your house for what may be sold to you as a fair cash offer. At this point, you will be asked to sign a purchase contract which would be the normal course of action.

The purchase contract permits them to sell it to another party

This purchase contract is not like the one that you would sign if you were working with a real estate agent. There is a provision in the agreement that permits the wholesaler to sell your contract to another party for the same price, terms and conditions. The wholesaler becomes the new buyer of your property and provides you with an earnest money deposit to secure the deal.

You will feel releived that you sold the house. Often the houses are inherited so anything that is received is extra and wholesalers know this. Often they know much more about your property and you than they reveal. There is a bit of psychology involved in this process.

These wholesalers learn their trade by paying a fee to take a course where they are taught how to approach would be sellers. More about that later. Let’s get back to the “cash deal”. Well, every sale is a cash sale when it comes down to it. No sale can take place at your dinner table in the sense that the wholesaler and now buyer can bring in a briefcase of cash. I have seen this in Spain but not in the U.S. because of currency controls.

Cash is not immediate

That “buy your house for cash” sale will take time to complete. Generally 30 days or more. Why? Because the person that you signed a contract with has to shop around for interested buyers of his contract. There are many local investors who pay a finders fee to the wholesaler for bringing them a contract.

Successful wholesalers will be good at determining real value of the house so that the real potential cash buyers can take over his wholesale contract. Sellers who attend a closing which is required in some states will meet the real buyer and they are almost always suprised. They wre not aware that the wholesaler was not the real cash investor. Instead a local real estate investor has acquired your house.

Sometimes there is a double closing. This means that the initial sale is made to the wholesaler at the closing table and the wholesaler signs a quit claim deed then and there. The real buyer then closes minutes later. The result in the end is the same, you get a check for the equity in the house, the wholesale fee is paid to the person who found you and the buyer is out the door to repair and flip your house.

The wholesale buyer is not the end of the process

The next step is for the end buyer to make necessary repairs and sell the house at the highest market price. These people can be called house flippers as well. It is entirely possible that the person at the actual closing table has obtained a loan from hard money lenders in order to make the purchase. After they buy your property and flip it, they pay the hard money lenders back. The wholesale buyer receives a spiff or finder’s fee from the party that actually purchase the property.

Some houses require very little work. Often a coat of paint is applied and your house is put on the market often listed on the Multiple Listing Service with a real estate agent. Local real estate agents will sell it and the flipper makes money. There is nothing wrong or illegal with any of this process in most states. There are some states (see the list below) that prohibit wholesaling.

Now let me explain the alternative to the “Buy your house for cash” sale. Assume that you placed your property with someone who held a real estate license, an agent or broker. The property was listed at fair market value on the multiple listing service. What happens at this point is that anyone now has the opportunity to make you an offer, not just the wholesaler.

Why would someone want to pay cash for your house?

New investors may want to buy your property at this point. The open market approach means that with more exposure, you are likely to obtain the highest price.

Ask yourself why someone would be willing buy your house for cash and under the circumstances I just described above? It’s because they must buy it under market as “distressed property” for the system to work. You are in essence paying a real estate commission to an unlicensed person in an around about way. Wholesaling is a legal way to circumvent the traditional way property is sold so that the seller receives the most for the property and the buyer pays a fair price.

Listing your house with a real estate agent is almost always the best way to sell a property if you want to make the most from the sale. That wholesaling deal is not always the easiest way to sell a property. It still takes time. No end buyer will buy a property without a title search and this takes time.

A termite evaluation and full inspection of the propety by the end buyer is necessary. This is why the time it takes to receive that “cash” from the end investor is about the same as the time it takes after a conract has been signed with a buyer found through working with an real estate agent.

What states require wholesalers to disclose the lack of real estate license?

As of 2024, there are 14 states where real estate wholesaling is legal and wholesalers are required to disclose their lack of a real estate license or using terms such as listing or selling:

- Arizona

- California

- Colorado

- Florida

- Georgia

- Illinois

- Indiana

- Maryland

- Michigan

- Nevada

- New Jersey

- New York

- Ohio

- Pennsylvania

- Texas

In these states, wholesalers are considered to be real estate salespersons or brokers, even if they do not have a license. This means that they are required to follow all of the same laws and regulations as licensed real estate professionals, including the requirement to disclose their lack of license.

The disclosure requirements vary from state to state, but they typically include the following:

- The wholesaler must disclose their lack of license in writing to all parties involved in the transaction, including the seller, the buyer, and the real estate agent.

- The disclosure must be made before any money changes hands.

- The disclosure must be clear and conspicuous.

In addition to disclosing their lack of license, wholesalers in these states may also be prohibited from using certain terms or phrases that are associated with real estate brokerage, such as “listing” or “selling.”

If a wholesaler fails to disclose their lack of license or uses prohibited terms, they could be subject to fines, penalties, and even jail time.

It takes longer to list and sell but you may sell if for more

It does take time for your house to be sold on the listing market. You will probably have to wait longer but it’s very likely your wait will be worth your time. Particularly if the value in the home is your own money. Consult with a real estate agent about the real estate market in your area .

How much work if any does the agent suggest you put into your property before you offer it for sale. At this point, I will give you real experience of mine. A few years ago, I received a call from someone that I know who knew I was looking for properties to convert to short term rentals.

He offered to sell his rental house to me for $82,500 in cash. He was in the process of replacing flooring and had just painted it inside. The house was in good condition, the yard required work including creating a real driveway and fencing. I invested about $25,000 in new flooring, stone kitchen counter, new farmer sink, barn doors, new front and rear doors and other items.

This amount included furnishing the house. When it was finished, there was a gravel driveway for four cars a 6′ wood fence around the back yard, white picket fence in the front yard and new sod in front and back.

An example

About six months later I had an opportunity to buy two houses side by side so the thing that made sense was to obtain a mortgage on the house I had recently bought and improved. The appraisal came back at $189,000. The point I am making here is that the seller could have done the same thing.

Not everyone has the cash or ability to obtain a second mortgage to do what I did but some do. Those that do should give serious consideration about how much money they are leaving on the table by not making some improvements that make sense then offering it for sale through a real estate agent.

One of the areas where wholesalers often state as part of their wholesale deal is that there are no commissions to be paid to a real estate agent. That’s true. However, the fees that the wholesaler earns in the real estate deal must be paid from a short fall in the amount that the seller could get for their home. Also, what about the profit that the flipper makes?

Discounting the amount they put into the house, many wholesale deals are straight flips. The sale is concluded and the property is sold quickly earning the end investor income that could be yours.

What is a cash sale?

In real estate, property is rarely exchanged for real cash. the buyer offering to buy your house for cash means that the offer is not contingent on obtaining financing. this is because someone in the transaction has the funds to close the sale

Take a look at the math

Example: Selling a 50-Year-Old House

Let’s say you own a 50-year-old house that needs some work. You have two options:

- Sell to a Wholesaler for $300,000 and avoid any repair work.

- List with a Real Estate Agent, make the repairs, and sell at a higher price.

Scenario 1: Sell to a Wholesaler

- Sale Price: $300,000

- Repair Costs: $0 (no repairs made)

- Net Income: $300,000

Scenario 2: Sell After Repairs Through a Real Estate Agent

- Estimated Sale Price (Before Repairs): $320,000

- Estimated Sale Price (After $20,000 in Repairs): $390,000

- Real Estate Commission (6%): $23,400

- Net Income After Commission: $366,600

- Repair Costs: $20,000

- Final Net Income: $366,600 – $20,000 = $346,600

Comparison:

| Option | Sell to Wholesaler | Sell After Repairs via Agent |

|---|---|---|

| Sale Price | $300,000 | $390,000 |

| Repair Costs | $0 | $20,000 |

| Real Estate Commission (6%) | $0 | $23,400 |

| Net Income Before Repair Costs | $300,000 | $366,600 |

| Net Income After Repair Costs | $300,000 | $346,600 |

Conclusion:

- Sell to Wholesaler: You receive $300,000 immediately with no additional effort.

- Sell After Repairs: You invest $20,000 for repairs but receive a final net income of $346,600 — an additional $46,600 compared to selling to a wholesaler. Moreover, this profit may be tax-free, increasing the overall benefit.

This chart visually demonstrates that while selling to a wholesaler might be faster and more convenient, putting in the extra effort for repairs can significantly increase your net income.

The above example is very real. Good wholesalers will convince you that walking away with $300,000 is a good option. It may if you urgently need the money but I would suggest that you at least contact a real estate agent and give them an opportunity to lay out your options and the timing of those options.

Many real estate agents know real estate investors who may be able to step in if a foreclosure is upon you. If you are in the position of an immenent forclosure, your real estate agent can work with the bank to hold them off while the property is listed for sale. This is called a “deed in lieu of foreclosure”.

Get a loan to make repairs

While I am on the topic of houses in need of repairs which is the main reason that people may choose to take a lower price, let’s run through this. If you have a first mortgage on your house and it needs to be repaired. Contact your mortgage company and ask if they can create a new mortgage and give you the cash you need to make repairs.

If not, ask if they can give you a second mortgage to make the repairs. I am assuming that the repairs will actually improve the sale of the property. Some thing you can do to a house will not improve it’s value but make make selling it easier. Your real estate agent can discuss this with you.

If you receive unsolicited offers for your house, contact a real estate agent or at the very least a title company who can evaluate the real estate contracts they present. I mentioned above that I was not going to offer an opinion about wholesaling and that’s true, I will not but I will tell you about some tacicts that are unsettling.

The best way to get a loan to make home repairs before selling depends on your financial situation, the amount you need, and how quickly you plan to sell. Here are the most common and effective loan options:

1. Home Equity Loan

- How it works: You borrow against the equity you’ve built in your home. The loan is a lump sum with a fixed interest rate and set repayment terms.

- Pros: Fixed monthly payments, potentially lower interest rates.

- Cons: You’re putting your home up as collateral, which could be risky if you can’t repay the loan.

- Best for: Significant repairs with long-term value.

2. Home Equity Line of Credit (HELOC)

- How it works: Similar to a home equity loan, but you borrow as needed (like a credit card) rather than a lump sum. The line of credit has a variable interest rate.

- Pros: Flexibility to borrow only what you need when you need it.

- Cons: Variable interest rates, and you risk your home if you can’t repay.

- Best for: Ongoing repair projects with uncertain costs.

3. Personal Loan

- How it works: An unsecured loan from a bank, credit union, or online lender. The loan amount is repaid with fixed payments over a set period.

- Pros: No need for collateral, faster approval process.

- Cons: Higher interest rates compared to home equity loans.

- Best for: Moderate repairs if you don’t want to risk your home as collateral.

4. Cash-Out Refinance

- How it works: You refinance your mortgage for more than you owe and take the difference in cash. This gives you funds for repairs, but it also resets your mortgage with a new interest rate.

- Pros: Low interest rates, ability to borrow a large sum.

- Cons: Closing costs and extending your mortgage term. It may be risky if home prices fall or you sell soon after refinancing.

- Best for: Large-scale renovations or when current interest rates are lower than your existing mortgage rate.

5. FHA 203(k) Rehab Loan

- How it works: A government-backed loan specifically designed for home buyers or homeowners to finance repairs. It combines the cost of the home and renovations into a single mortgage.

- Pros: Includes renovation costs in your mortgage, backed by the FHA, potentially lower down payments.

- Cons: More paperwork and slower approval.

- Best for: Homes that need significant work and qualify for FHA loans.

6. Credit Card

- How it works: You can use a credit card with a high credit limit to fund repairs, especially if you can pay it off quickly or use a card with 0% introductory APR.

- Pros: Fast access to credit, no collateral.

- Cons: Very high interest rates if not paid off quickly.

- Best for: Small, short-term repairs.

7. Contractor Financing

- How it works: Some contractors offer financing options directly through their business or through a third party. You pay in installments for the work done.

- Pros: Convenient, as it’s tied directly to the project.

- Cons: May come with high interest rates, and contractors may not always offer favorable terms.

- Best for: Quick repairs when contractor financing is available.

Choosing the Best Option:

- For large-scale renovations: A Home Equity Loan, HELOC, or Cash-Out Refinance are good options if you have sufficient equity in your home.

- For smaller, less costly repairs: A Personal Loan or Credit Card (if the balance can be paid off quickly) may be simpler and quicker.

- If you plan to sell soon: You may want to avoid loans with high fees or long terms (like cash-out refinancing) and instead opt for something faster, like a Personal Loan or HELOC.

Before choosing, carefully consider your current financial situation, how much you need for repairs, and how soon you plan to sell your home.

Where is wholesaling is illegal?

As of 2024, there are 10 states that prohibit wholesalers from engaging in real estate transactions without a license:

- Illinois

- Oklahoma

- Ohio

- Oregon

- Tennessee

- Texas

- Utah

- Virginia

- Washington

- West Virginia

Here are some of the reasons why wholesaling is illegal in some states:

- It can be used to mislead sellers into thinking that they have a buyer for their property when they do not.

- It can be used to take advantage of sellers who are desperate to sell their property quickly.

- It can lead to fraud and misrepresentation, such as when wholesalers misrepresent the condition of a property or the terms of a contract.

- It can create confusion and uncertainty for all parties involved in a real estate transaction.

Sometimes the process is unsettling

Property owners are often approached by wholesalers who learn about them from their “bird dogs”. People such as a package delivery person, handyman or other person who has a good reason to be in a residential neighborhood. If they see an empty house or learn of a funeral or a death, they pass this information along.

The cash home buyer learning of a death at a house will look for a death notice in a local publication. The wholesaler then looks up public records about the property at the county website and in some areas can find the amoaunt due on a mortgage. This contact information available to anyone is a great way for the wholesaler to know you first.

This person will then come to the house or funeral home and find a family member. No one asks who attends funerals or wakes. I learned this at a meeting about wholesaling where the person giving the presentation actually did the following:

The wholesaler went to the house learning that there would be a gathering there after the cemetary. He knocked on the door and was greeted by a family member. The wholesaler said he was in the neighborhood and noticed all of the cars. He realised someone had died and wanted to offer condolences.

I was just in the neighborhood

At that point the conversation turned to his reason for being around, looking for properties to buy. This family member actually invited him in and told him that the family was just discussing selling the house. To make a long story short, the wholesaler got his deal.

If you want to become a good wholesaler, you have to leave your emotions at home. These people look for newly divorced people and anyone who has suffered a tragedy. A moment of weakness is to be exploited.

They offer a hassle-free sale, quick and cash. Just the thing a grieving widow may need at that moment. The point is to get to the grieving party before friends and relitaves can intervien. Wholesale properties must always be purchased at below the market. Often substantially below the market.

When I attended that meeting the speaker was giving an explanation about what happens when the wholesaler can not find an investor. The answer is simple. They have a contract to buy and if they can not fufill the contract, they lose their earnest money.

What if they can’t close?

This can be a big hit for the average wholesaler who has almost no money to work with. Their entire nest egg is the money they give to secure the contract. Their finders fee is usually small a couple of thousand dollars at most. They have to work hard to earn a living and there is no residuals. Every deal is on its own.

Assume that you sold your house to a wholesaler in a short amount of time then later your friends and neighbors tell you that you left X thousand dollars on the table for acting without more information. How would you feel?

What if your husband died and you quickly sold your family house just to find that had you listed it, you could have made many thousaands more after paying the real estate agent? That’s the point I am trying to make, there are no repeat sales.

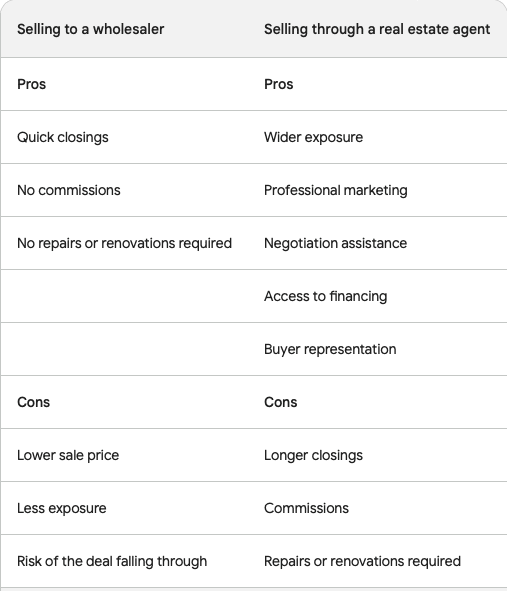

There are a number of pros and cons for listing with a real estate agent or selling to someone who offers to buy ugly houses. The table below provides a good side by side view:

Institutional Buyers (Ebuyer)

Some big companies will make an offer when contacted through the internet. Zillow was buying houses this way in Las Vegas and Phoenix for a while. They lost big money because of their inability to judge the market and understand the closts involved wiht filpping.

The time it takes to close with one of these buyers is about the sames as a regular sale through a real estate agent. When you contact them, they will make you an offer via email. Subject of course to an inspection of your house. In my actual experience, their inspection is designed to lower the price they are willing to pay. Just when you are excited you have sold your house, they start to “nickle and dime you”.

Flipping your own home

Why not flip your own house? This work is not difficult. If you are gong to sell your house anyway, why not consider a flip. Start with contacting a good real estate agent that specializes in working with investors.

These agents know contractors who can work on a house and bring it to maximum value. As long as you own the property and there is equity in it, a good real estate agent can get make connections with a real estate loan broker who can work with you.

Credit unions and some banks will make home repair loans. If someone else including a wholesaler and the end buyers can flip, you can as well. Just something to think about before you decide to sell your property to a stranger or even list it. Get the facts first. Know your options. Don’t give away money, no one wants to do that.

Market conditions that favor advertising on the market

As of the date this was written, many markets around the country are sellers markets meaning that with a tight housing supply, sellers will have offers when their houses are priced well. It also means faster closings and the opportunity to find real cash buyers working with a real estate agent.

In areas where the market has switched to a buyers market, your property may be one of many and it may take a bit longer to sell. This is the type of market where selling to a wholesaler or an I buyer may speed up the process of the sale.

Your decision

In the end, it’s your decision about using a real estate agent or selling to a wholesaler. If selling to a wholesaler is legal in your state (see the list above), this may be the fastest way to get out of the property. I recall a story from years ago where a couple were in an angry divorce.

The husband had put the house in the wife’s name because of some potential legal issues from years before. She just wanted cash to run so she sold it to a wholesaler who was able to get cash to her in a week (pretty fast). She sold it for about 1/2 of its value.

Before you make a decision, look at the alternatives described here. At least take the time to contact a real estate agent or if you are in financial trouble, a loan broker first. It seems that selling to a wholesaler should be a last resort.

Resources

Knowledge is power. Read some of the following blog articles that can help you understand more about financial issues.

Millennials: Your best practical guide to financial literacy 2023

How Gen-Xers can build wealth through homeownership vs renting

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.