Last updated on December 10th, 2025 at 12:07 am

Introduction

Many retirees want to stay active, generate income, and protect their savings. One proven way to achieve all three is to start a real estate investment business after retirement. Real estate offers passive income, tax benefits, and the ability to build long-term wealth while leveraging decades of financial wisdom and life experience.

Starting a real estate investment business after retirement is one of the smartest moves you can make if you’re looking for steady income, long-term financial stability, and even a legacy to leave behind.

Unlike many small businesses, real estate investing offers a flexible entry point. You can begin with a single rental property, scale to a portfolio of vacation rentals or commercial spaces, or invest passively through REITs and retirement accounts. With proper planning, real estate can provide passive income, tax advantages, and a hedge against inflation—making it an attractive addition to your retirement portfolio.

This guide covers the entire process: defining your goals, choosing strategies, structuring your business, securing financing, and growing it into a reliable source of retirement income. How to start a real estate investment business after retirement

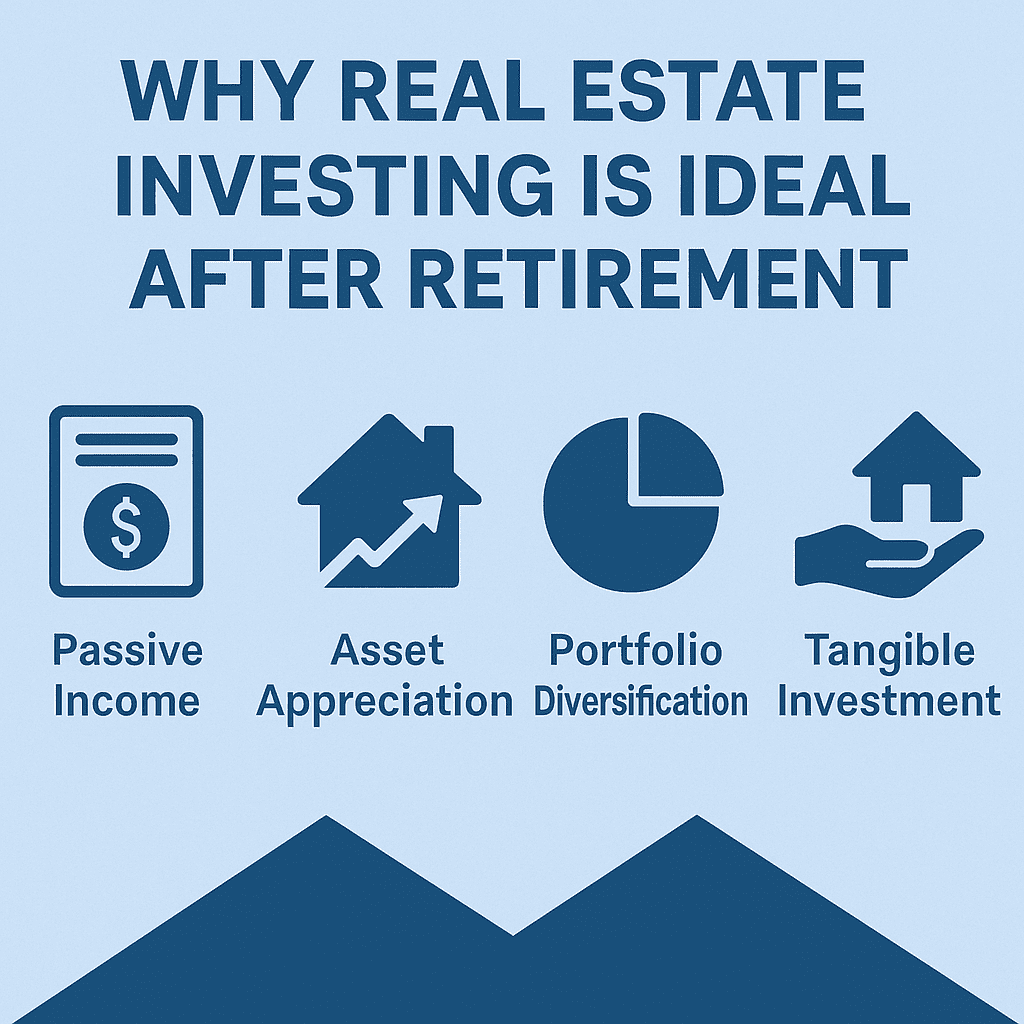

Why Real Estate Investing Is Ideal After Retirement

Steady Cash Flow

Rental properties provide monthly income that can supplement Social Security, pensions, or retirement savings. A well-managed property produces cash flow that covers expenses and adds extra income to your lifestyle. How to start a real estate investment business after retirement

Hedge Against Inflation

As living costs rise, so do rents. This makes rental properties an excellent inflation hedge, ensuring your retirement income keeps pace with expenses.

Tangible Asset with Appreciation

Unlike stocks, real estate is a physical asset that typically appreciates over the long run. Even when markets cool, good properties tend to recover and grow in value.

Tax Benefits

Real estate investors benefit from deductions for mortgage interest, property taxes, insurance, repairs, and depreciation. For retirees, these tax advantages can significantly reduce taxable income.

Flexible Management Options

If you want to be hands-on, you can manage tenants and repairs yourself. But if you prefer a passive role, a property manager can handle day-to-day tasks.

Step 1: Define Your Goals and Risk Tolerance

The first step in starting your real estate investment business is deciding what you want it to achieve. Ask yourself:

- Do I want steady passive income or the potential for higher returns?

- Am I comfortable with long-term holds, or do I want to flip properties for quicker gains?

- Do I prefer residential properties (single-family homes, vacation rentals, senior housing) or commercial properties (office buildings, retail, storage facilities)?

- Am I capable of handling repairs, leasing, and tenants myself, or will I rely on a property manager?

- How much of my retirement savings or personal funds am I willing to risk?

Clarity here ensures you invest in properties that match your financial goals and tolerance for risk.

Step 2: Choose the Right Business Structure

Operating as a retiree doesn’t mean skipping formal business planning. The right structure protects your assets and helps with taxes:

- Sole Proprietorship – Simple to start, but no liability protection.

- LLC (Limited Liability Company) – The most popular option. Protects personal assets and offers flexible tax treatment.

- S-Corp – Beneficial if you plan to grow significantly. Allows salary + dividend structures.

- Partnership – Ideal if you’re investing with a spouse, family member, or other investors.

Tip: A CPA or attorney can help select the right structure based on your goals and estate plan.

Step 3: Select Your Investment Strategy

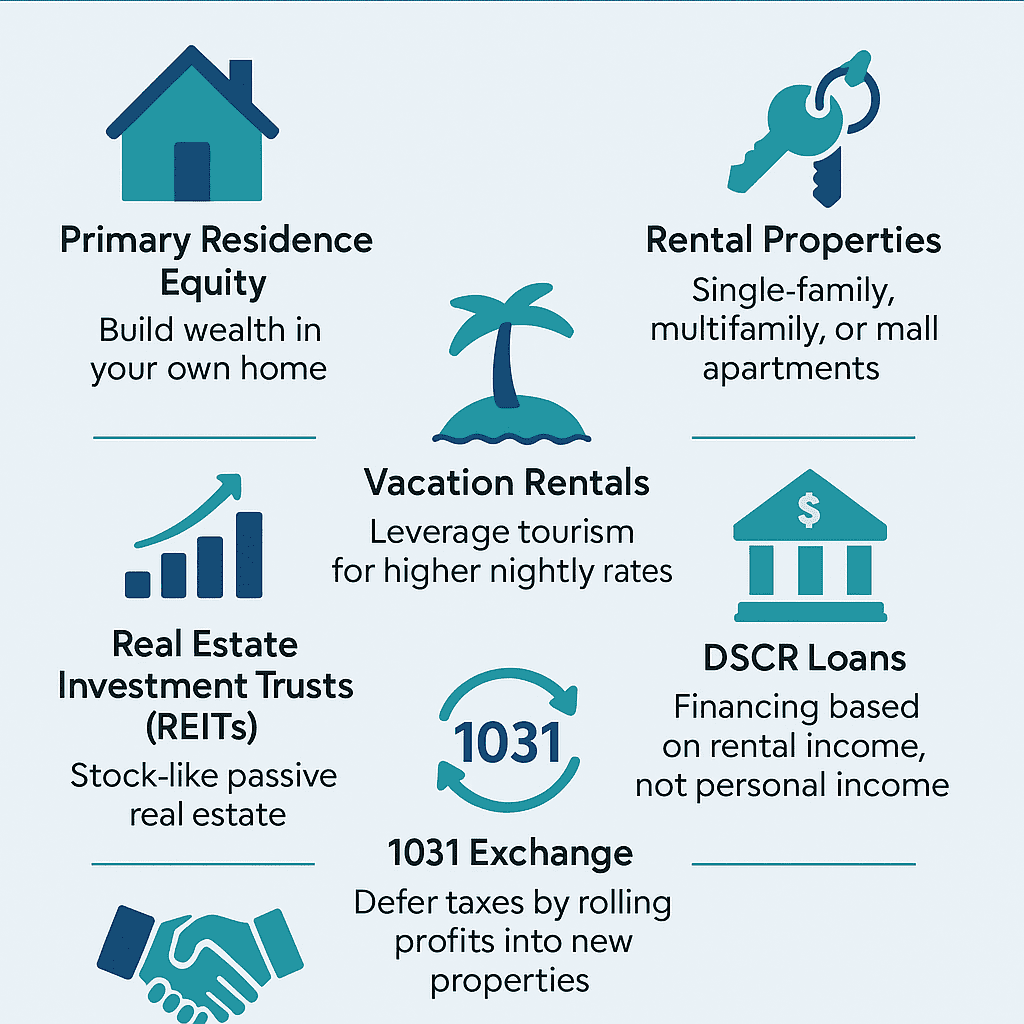

Investing in Your Own Home (House Hacking & Equity Building)

For many retirees, the home you already own is your most valuable asset. By downsizing, tapping into equity, or even adopting a house hacking strategy (new term for an old-time tested practice), you can turn that property into an income-producing piece of your retirement portfolio.

- Downsize and Rent Out: Move into a smaller home, rent the larger family home.

- Multi-Unit Strategy: Buy a duplex, live in one side, rent out the other.

- Equity Leverage: Use a HELOC or cash-out refinance to fund new purchases.

- Renovation: Strategic upgrades increase property value and rental potential.

Case Study: John & Linda’s Duplex Strategy

After retiring from education, John and Linda purchased a duplex near a university. They lived in one unit and rented the other to graduate students. The rent covered housing costs and added $1,200/month in passive income. Later, they used a cash-out refinance to purchase another duplex. Today, their rental income exceeds their pensions, proving that house hacking can turn a primary home into a thriving retirement business.

Check out the NAR site for more information here: https://www.nar.com

Rental Properties

- Single-Family Homes: Easy entry point, stable tenants, long-term cash flow.

- Multifamily Units: Duplexes, triplexes, or small apartments offer multiple streams.

- Commercial Spaces: Office or retail units provide higher returns but more risk.

Case Study: Mary the Retired Teacher

Mary used $150,000 from savings to buy a duplex. A property manager handled tenants while she earned $700/month in passive income. After five years, she refinanced and bought a second rental. Today, her real estate business generates more than her pension, proving retirees can scale steadily without active management.

Vacation Homes as Retirement Investments

A vacation rental home can serve dual purposes: personal enjoyment and income generation. Retirees who purchase in tourist areas—beaches, mountains, lakes—can offset expenses by renting the property when not using it.

Case Study: The Gulf Coast Retreat

Tom and Evelyn bought a small beach home on the Mississippi Gulf Coast. They used it during summers and rented it the rest of the year through Airbnb. After factoring in management fees and maintenance, they cleared $18,000 in net annual income. The property also appreciated $75,000 in five years, giving them both cash flow and equity growth.

REITs (Real Estate Investment Trusts)

For retirees who prefer passive options, REITs allow you to invest in large real estate portfolios without managing property.

- Income: REITs must distribute most of their profits as dividends, creating steady income.

- Diversification: Exposure to office buildings, apartments, warehouses, and more.

- Inflation Hedge: Rental increases usually track inflation.

- Risks: REIT values can fall when interest rates rise or markets weaken.

Case Study: Dividend Income in Retirement

Richard, a 72-year-old retiree, shifted $100,000 from bonds into a publicly traded REIT focused on senior housing. The REIT paid quarterly dividends of nearly 5%, adding $5,000 per year in income while also increasing in share price. Without managing tenants or repairs, Richard diversified his retirement income stream.

A good source for more information is provided here: https://www.investopedia.com/

Self-Directed IRA for Real Estate

A self-directed IRA (SDIRA) allows retirees to use retirement accounts to buy real estate.

- Traditional SDIRA: Tax-deferred growth until withdrawal.

- Roth SDIRA: Tax-free withdrawals in retirement.

- Diversification: Moves money beyond stocks and bonds.

⚠️ Caution: IRS rules are strict. Prohibited transactions can lead to penalties. Always consult a financial advisor or tax attorney.

Case Study: IRA-Backed Rental Success

Sarah rolled $200,000 from a traditional IRA into a SDIRA and purchased a single-family rental. Renters paid $1,400/month, covering all expenses. The property appreciated over time, and all gains stayed tax-deferred inside the IRA. At age 72, Sarah began taking required distributions, benefiting from both equity growth and years of untaxed rental income.

7 Ways Retirees Can Invest in Real Estate

Step 4: Secure Financing After Retirement

Retirees can still access creative financing:

- Traditional Mortgages – Possible with retirement income and strong credit.

- Cash-Out Refinance – Tap equity from your primary home.

- HELOCs – Flexible borrowing to buy or rehab properties.

- Partnerships – Team with investors seeking passive returns.

- Self-Directed Retirement Accounts – SDIRA or Solo 401(k) options.

Advanced Financing Programs

- Freddie Mac Investment Property Program – Finance up to 10 properties.

- Fannie Mae 5–10 Properties Program – For experienced investors scaling up.

- Blanket Loans – One loan for multiple properties. Efficient but risk-heavy.

- Portfolio Loans – Custom loans for investors exceeding 10 properties.

DSCR Loans (Debt Service Coverage Ratio Loans)

Another powerful option for retirees is the Debt Service Coverage Ratio (DSCR) loan. Unlike traditional loans that depend on your personal income, DSCR loans are based on the income the property produces.

How They WorkDSCR=Monthly Rental IncomeMonthly Loan Payment (PITI)DSCR=Monthly Loan Payment (PITI)Monthly Rental Income

- If DSCR > 1.0 → the property generates enough income to cover the loan.

- Most lenders want 1.20–1.25 or higher for approval.

Example: DSCR = 1.43

- Rental Income: $5,000

- Loan Payment (principal, interest, taxes, insurance): $3,500

5,000÷3,500=1.435,000÷3,500=1.43

This means the property makes 43% more income than required to pay the loan, giving lenders confidence that cash flow covers the debt even if rents dip or expenses rise.

Why DSCR Loans Are Ideal for Retirees

- Approval based on the property’s cash flow, not your job history.

- Easier to scale into multiple properties if each property’s DSCR is strong.

- Flexible underwriting for retirees with strong assets but no W-2 income.

Practical Tip

If one property rents for $4,200/month with a loan cost of $3,800, DSCR = 1.11 (likely too low). Another property renting for $4,800 with the same loan cost = 1.26 (much stronger).

👉 To simplify, RetireCoast will feature a DSCR calculator you can use to test potential investments. Enter the projected rent and loan payment, and instantly see whether the property meets lender standards.

Instructions for using the DSCR Loan Calculator:

First, click the “load sample” button below, and then make changes to individual items; you can model this way. Print the screen to save a copy

DSCR Loan Calculator

Estimate Debt Service Coverage Ratio for a rental. DSCR = Annual NOI ÷ Annual Debt Service. Lenders often look for ≥ 1.25–1.40 (your lender’s criteria may vary).

Income & Operating Expenses

Loan & Financing

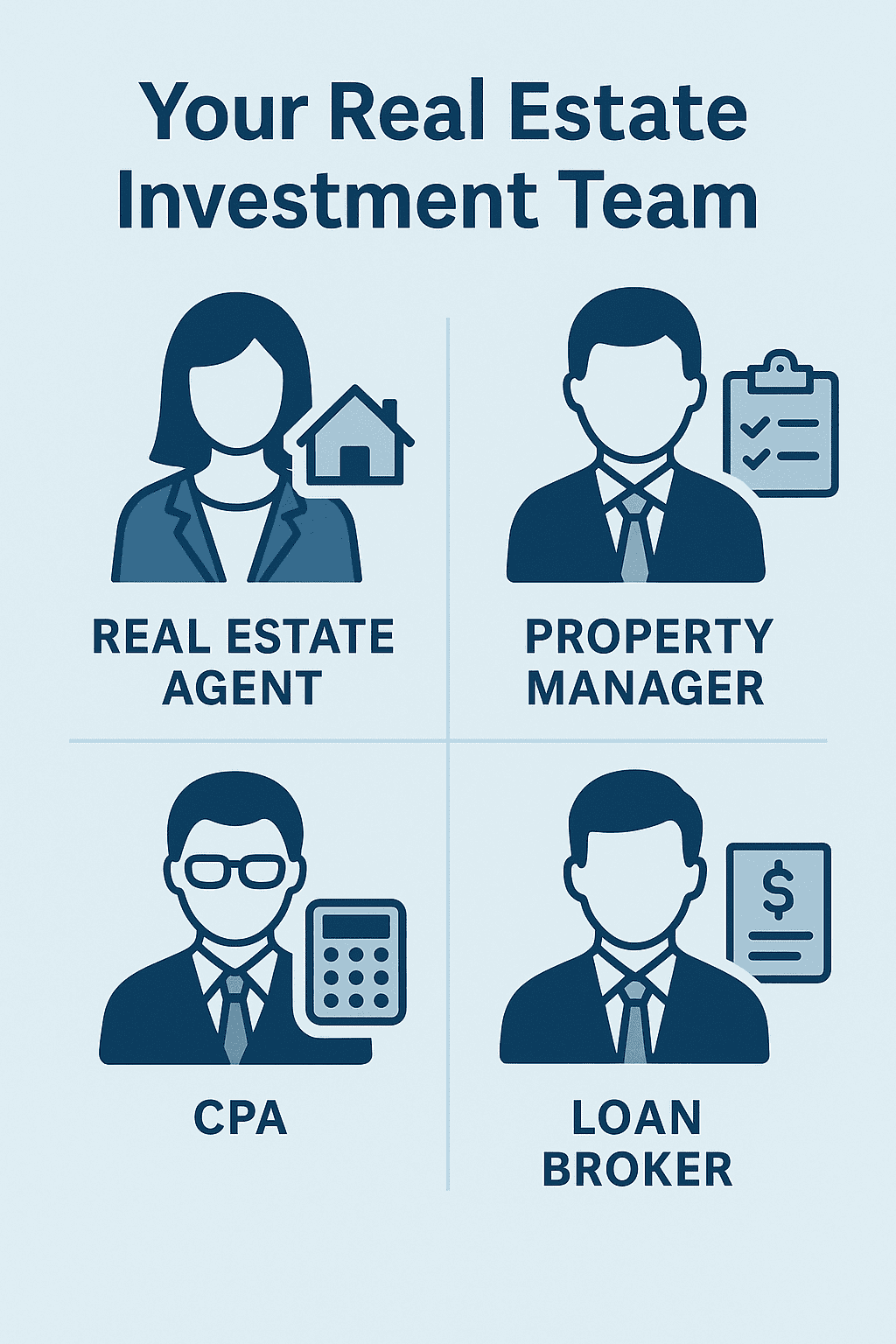

Step 5: Build Your Investment Team

If, after reading this article, you’ve decided to create a property investment business—even if it begins as a side hustle until full retirement—the next step is clear: build your team. Real estate investing is rarely a solo activity, and having the right professionals at your side can be the difference between costly mistakes and steady success.

Here are the four core roles every retiree investor should consider:

Real Estate Agent (Investor-Savvy)

Choose an agent who understands the needs of investors, not just retail homebuyers. This person works for you but is paid by the seller at closing. A good agent will:

- Spot properties with strong cash-flow potential.

- Recommend property managers and contractors.

- Provide access to “pocket listings” or off-market opportunities.

Property Manager

Your property manager is the key to turning investments into profitable, hands-off income. Their responsibilities include:

- Placing the right tenants.

- Collecting rent and handling day-to-day operations.

- Managing repairs and maintenance.

- Advising on local rental rates and tenant demand.

A strong property manager often knows which landlords in the area are preparing to sell, helping you source your next deal.

Certified Public Accountant (CPA)

Do not settle for just a bookkeeper. A CPA brings expertise beyond basic recordkeeping:

- Keeps you compliant with IRS rules.

- Advises on entity structures and tax strategies.

- Helps evaluate loans, cash flow, and financing decisions.

A CPA is your financial compass, ensuring you build wealth strategically and legally.

Loan Broker

Instead of relying on a single bank, partner with an independent loan broker who has access to multiple lending sources. Stick with one broker who learns your portfolio and goals. The right loan broker will:

- Introduce you to DSCR loans and other investor-friendly programs.

- Provide creative solutions for scaling your portfolio.

- Help maximize leverage without overextending risk.

📌 Bottom line: If you treat real estate investing like a business, you need a professional team. Together, your agent, property manager, CPA, and loan broker form the backbone of a profitable, sustainable investment strategy.

Bill had purchased and fully rehabbed a home, converting it into a vacation rental. The property was producing strong cash flow and had more than doubled in value. As a licensed real estate broker, Bill knew the comps and market performance supported that valuation.

Two nearby homes—side by side—became available at reasonable prices. The plan: acquire both and convert them into vacation rentals to build a three-property cluster in the same high-performing area.

Bill called his long-time loan broker, Tim Allen of SimpleMortgageOnline.com, to discuss options. Tim proposed a solution that most investors can’t access without an “aged” or experienced entity: a commercial loan in the LLC’s name that would:

- Refinanced Property #1 (the proven vacation rental) to pull out equity at reasonable rates (for that time).

- Funded the purchase of Properties #2 and #3 (adjacent homes) under the LLC.

- Included cash-out specifically earmarked to furnish and launch the two new vacation rentals.

- Three loans closed simultaneously with one lender for speed and consistency.

- Reasonable interest rates (for that period), improving deal viability.

- Turnkey funding: refinance + acquisitions + cash-out for furnishings.

- Portfolio scaling in one move: a high-efficiency path to multiple doors.

- A relationship-based loan broker can open doors that generic lenders won’t.

- Performance data (cash flow + appreciation) strengthens your case.

- Entity-level lending (LLC) is possible when the story is packaged well.

- Creative structures can refi today’s winner to fund tomorrow’s growth.

Instructions for Break-Even Calculator

Click the “load sample” button. Then go back and make any changes. Print the screen to save a copy.

Break-Even Occupancy Calculator (Vacation Rentals)

Find booked nights and occupancy % needed to cover monthly costs. Includes platform/management fees, cleaning, and fixed expenses.

Revenue Assumptions

Costs

Test a Target Occupancy

Step 6: Analyze Potential Investments

Evaluate properties carefully:

- Cash Flow = Rent – (Mortgage + Taxes + Insurance + Maintenance).

- Cap Rate = Net Operating Income ÷ Purchase Price.

- Vacancy Rates – Strong markets = lower risk.

- Future Appreciation – Schools, jobs, population growth.

- Tax Benefits – State and federal incentives.

Tools like DealCheck.io, MLS reports, and AirDNA (for vacation rentals) can help.

Using a 1031 Exchange to Defer Taxes

The 1031 Exchange is an advanced investment tool that allows real estate investors to sell one property and reinvest the proceeds into another “like-kind” investment property—without paying capital gains taxes at the time of the transaction. Instead, the taxes are deferred until a later date, often years down the road.

For most of our readers who are just starting out, the 1031 Exchange may not apply right away. But as your portfolio grows, this strategy can become invaluable in helping you scale into bigger, better properties without losing capital to immediate taxes.

How a 1031 Exchange Works

- Sell an Investment Property – The property must be held for investment or business use (not your personal home).

- Use a Qualified Intermediary (QI) – The sale proceeds cannot touch your personal account. Instead, they must go directly from the closing agent to a QI who holds the funds.

- Identify Replacement Property – Within 45 days, you must identify up to three potential replacement properties.

- Close on Replacement Property – You must close on one (or more) of the identified properties within 180 days of selling the original property.

- Full Reinvestment – To defer all taxes, you must reinvest the entire sales proceeds and acquire a property of equal or greater value.

Rules to Keep in Mind

- You cannot touch the funds at any point, or the exchange becomes invalid.

- All funds must flow through the qualified intermediary until they are applied toward the purchase.

- You cannot pull out equity during the process; any “boot” (cash received) will be taxed.

- The properties must both be for investment or business use—you can’t use this strategy for a primary residence or vacation home you personally use.

Why It Matters for Retirees

The 1031 Exchange allows you to keep more money working for you. Instead of losing 15–25% (or more) to capital gains taxes after a profitable sale, you can roll the entire amount into your next property—perhaps trading a small rental into a larger multifamily building or multiple vacation rentals.

Check with the IRS if you have questions at this site https://www.irs.gov/businesses/small-businesses-self-employed

Example

Imagine you purchased a duplex for $250,000 and later sold it for $400,000. Without a 1031 Exchange, you’d owe capital gains tax on $150,000 of profit (minus improvements and depreciation recapture). With a 1031, you can reinvest the full $400,000 into a new property and defer taxes, giving you more buying power.

Advanced Investor Note

If you need access to some of the capital tied up in the property being sold, the best strategy is to obtain a second mortgage or line of credit against that property before the sale. This allows you to pull out the funds you want for personal use while still qualifying the balance of the sale for a valid 1031 Exchange.

Instructions to use the 1031 Exchange Tax Savings Calculator:

It’s best to click on “load sample” then make individual changes. Use this to model results.

1031 Exchange Tax Savings Calculator

Estimate adjusted basis, realized gain, depreciation recapture, capital gain, taxes if no exchange, taxable boot, and deferred taxes. Educational estimate only.

Relinquished (Sold) Property

Replacement Property & Tax Assumptions

Step 7: Manage and Grow Your Portfolio

After acquiring your first property:

- Screen tenants carefully.

- Use landlord software to track income and expenses.

- Market aggressively on MLS, Zillow, Airbnb, or VRBO.

- Track KPIs like vacancy rates and cash flow margins.

- Reinvest profits into new acquisitions.

Step 8: Plan for the Long Run

Your retirement business should align with your future goals:

- Hold & Refinance – Build wealth while collecting rent.

- 1031 Exchange – Defer capital gains by rolling into a new property.

- Estate Planning – Pass assets to heirs for generational wealth.

Types of Real Estate Investments (Expanded)

Not all real estate is the same. Properties are typically zoned for specific uses, and understanding these categories helps retirees choose investments that fit their goals and risk tolerance.

- Residential – Properties designed for living, such as single-family homes, duplexes, and apartments.

- Commercial – Properties zoned for business use, including office buildings, warehouses, and retail.

- Vacation Rentals – Short-term rentals in high-demand tourist areas.

- Land – Undeveloped or agricultural land, offering appreciation potential or leasing opportunities.

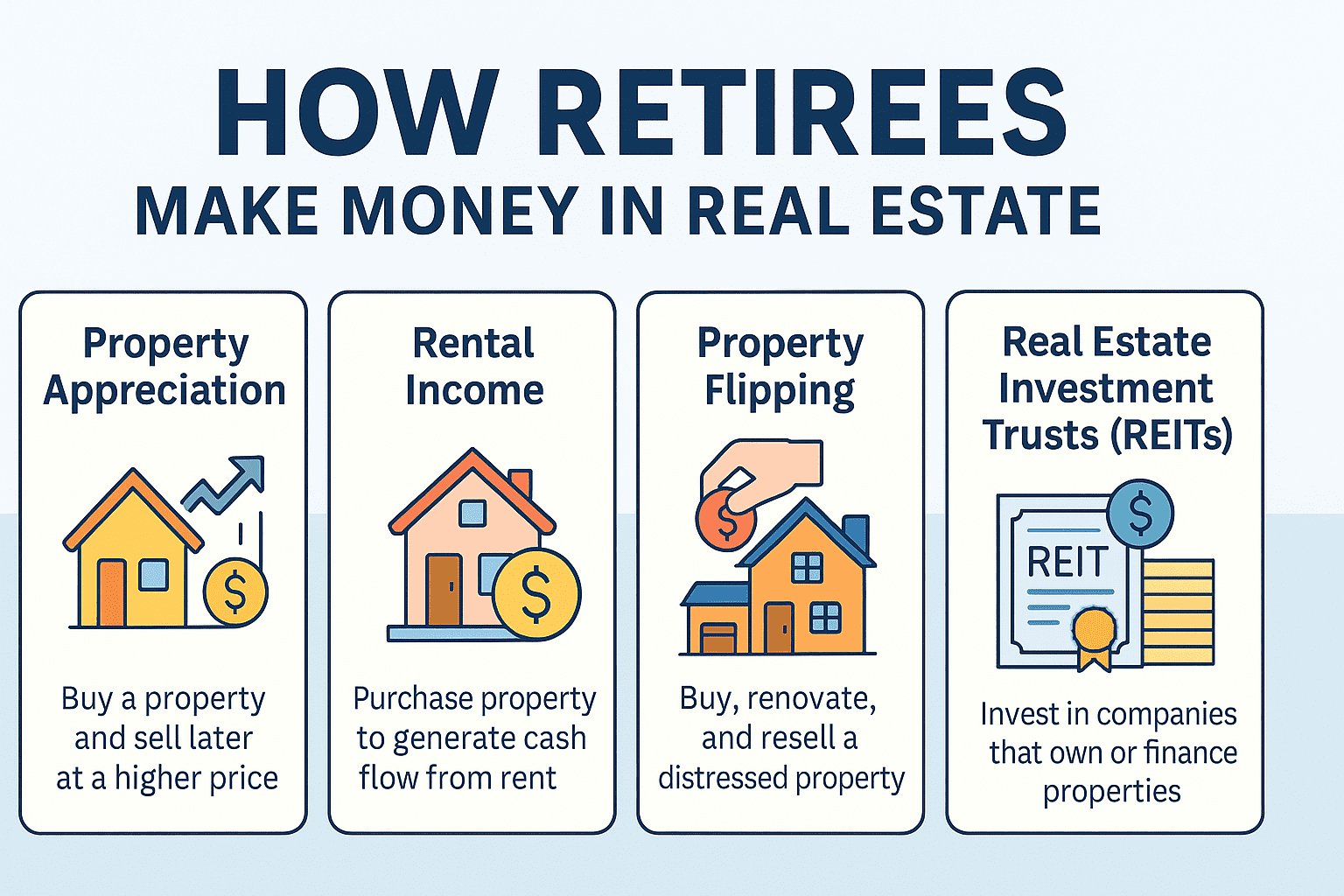

How Retirees Make Money in Real Estate

Real estate creates wealth in four main ways:

- Rental Income – Reliable cash flow from tenants.

- Appreciation – Long-term growth in property values.

- REIT Dividends – Regular payouts without owning property.

- Flipping – Buying, renovating, and reselling. Profitable but higher risk, less suited for retirees.

Most retirees benefit most from rental income + appreciation.

Flipping: High-Effort, High-Risk, Not Usually a Retiree-Friendly Path

Flipping is the practice of buying a property at a discount, making repairs/renovations to bring it to marketable condition, and then selling it for a profit. We include it here because TV shows make it look exciting—and many readers are curious.

Reality check: Successful flips require deep experience in construction, permitting, local codes, material/labor pricing, and tight project management. Most new flippers don’t make meaningful profits. TV personalities have teams, volume discounts, and years of know-how—advantages most beginners don’t have.

Why flipping is tough

- You must buy below market (often 15–30% under the “after-repair value,” or ARV) to leave room for holding costs, selling costs, and surprises.

- Scope creep is common: hidden issues (rot, plumbing, electrical, structural) can add weeks and thousands.

- Permits & codes: inspections can force rework and delay closings.

- Market risk: price shifts or slower demand while you’re mid-project can erase margins.

- Taxes: short-term gains are taxed as ordinary income (often higher than long-term capital gains).

Simple flip math (use before you buy)

Projected Profit = ARV − (Purchase Price + Rehab + Holding + Selling + Contingency)

- ARV: What similar renovated homes (true comps) sold for in the last 3–6 months?

- Rehab: Contractor bids + materials + permit fees.

- Holding: Interest, utilities, insurance, property taxes, lawn/pool service.

- Selling: Agent commissions, seller concessions, closing costs, staging.

- Contingency: Add 10–20% of rehab for surprises.

If your projected profit isn’t clearly positive after adding contingency, don’t do the deal.

Compare: flipping vs. rentals

- Flipping: One-time paycheck, no residual income, high effort, project risk, ordinary-income tax treatment.

- Rentals: Ongoing cash flow, amortization and appreciation, tax benefits (depreciation, 1031 exchanges), wealth compounding.

Candid guidance

Flipping is not a traditional route to building a retirement business and does not create residual income like rentals. Each deal stands alone and often involves long hours and disappointments. If you’re set on exploring this path, work alongside an expert—a licensed general contractor or a veteran flipper who will review the scope, budget, and ARV with you before you write an offer.

Crowdfunding and Partnerships in Real Estate

Another trend in real estate investing is crowdfunding, where many small investors each contribute money to buy a property or fund a project—often online with people you’ve never met. In exchange, each investor receives a share of the income or potential profits when the property is sold.

While this model may sound attractive, especially to younger investors seeking a low entry point, it comes with risks: limited control, potential lack of transparency, and money tied up for years with no easy exit.

Safer Alternative: Known Partners

Retirees may find it safer and more rewarding to form partnerships with people they know and trust. This can be done by creating an LLC and issuing ownership shares. Partners may contribute just money (passive investors) or both money and work (active partners). When structured correctly, partnerships provide access to larger properties while sharing risk and responsibility. How to start a real estate investment business after retirement

- Work with people you know

- Create a written management plan

- Define a clear exit strategy from day one

Career Paths vs. Passive Investing

Retirement doesn’t always mean being hands-off:

- Real Estate Agent – Earn commissions and gain access to deals.

- Property Manager – Manage rentals for others as side income.

- Pure Investor – Outsource everything for maximum passivity.

Choose the lifestyle that fits your retirement vision.

Skills Retirees Need to Succeed in Real Estate

Success requires more than money:

- Key Terms – Cash flow, DSCR, cap rate, HOA, due diligence.

- Patience – A long-term view is essential.

- Networking – Deals often come through connections.

- Negotiation – Working with agents, tenants, and contractors.

- Education – Workshops, online courses, and local training.

Land as a Retirement Investment

Land can be a smart but patient investment:

- Lease for farming or grazing. Read our article on this topic

- Timber harvesting for periodic income.

- Rezoning for residential or commercial development.

- Hold for appreciation.

Land is low-maintenance but typically offers little immediate cash flow.

Lifelong Learning and Credentials

Even in retirement, education pays. Retirees should:

- Take community college courses in real estate or finance.

- Attend local board workshops on contracts and landlord law.

- Explore online classes in property management or analysis.

- Consider becoming a licensed real estate agent for insider access.

Knowledge reduces mistakes and builds confidence.

Common Mistakes Retirees Should Avoid

- Overleveraging debt.

- Skipping inspections.

- Ignoring insurance coverage.

- Failing to budget reserves.

- Underestimating repair costs.

- Not planning for capital gains taxes.

Pros and Cons of Real Estate Investing in Retirement

Pros

- Provides passive income through rentals.

- Diversifies your portfolio beyond stocks.

- Potential for long-term appreciation.

- Acts as a hedge against inflation.

- Offers tax benefits like depreciation and 1031 exchanges.

- Scales easily with equity and creative financing.

Cons

- Requires time and management (unless outsourced).

- Market downturns can hurt values.

- Illiquidity—harder to sell quickly than stocks.

- Unexpected expenses eat into profits.

- Risk of overleveraging.

Conclusion: Your Next Step Toward Real Estate Success

Starting a real estate investment business after retirement is more than a financial move—it’s a lifestyle choice. It keeps you active, builds wealth, and creates a legacy for your family. Whether you pursue rental homes, invest in a vacation property, buy shares of a REIT, use a self-directed IRA, partner through an LLC, or even hold land, real estate offers unmatched flexibility and opportunity.

With planning, a clear strategy, and the right team, you can enjoy a steady income, tax advantages, and financial stability well into your golden years. Retirement doesn’t have to mean slowing down—it can mean building your most rewarding business yet. Read more at the HUD-FHA Website