Last updated on November 24th, 2025 at 08:56 pm

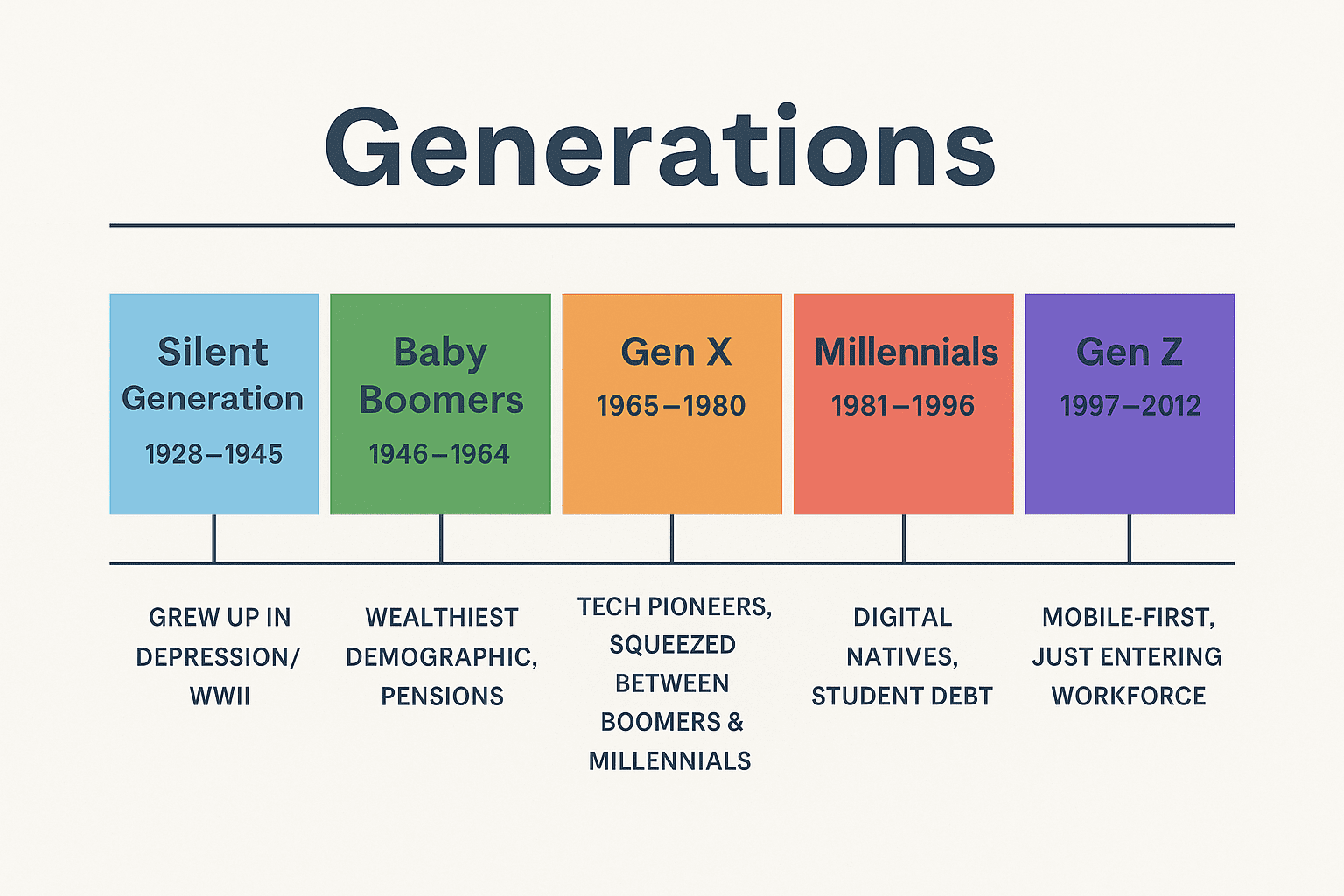

Retirement is coming faster than you think — especially for Generation X. Unlike Baby Boomers, who often benefited from pensions, or Millennials, who still have decades to save, Gen Xers are caught in the middle with only 15–20 years left to prepare. Rising healthcare costs, debt, and family responsibilities make it more important than ever to plan smarter. Consider this to be your Gen X retirement guide.

Gen X includes individuals born between 1965 and 1980. If you’re part of this generation, welcome — this guide was written for you. (And don’t worry, Millennials — your series is coming soon on RetireCoast.)

As a Gen Xer, you face unique retirement challenges. You are the children of Baby Boomers, the wealthiest demographic in U.S. history, whose lives were shaped by parents who lived through World War II and the Korean Conflict.

⏳ Your Gen X Retirement Countdown Interactive

Target date

Your age today

Time remaining

Progress to target

Gen Xers grew up

Gen Xers grew up in more comfortable environments, with better healthcare, education, and access to technology. You also carry the distinction of being the first generation to embrace computers and recognize their power to shape the future.

Meanwhile, your children grew up with smartphones and social media, creating new pressures for Gen X parents. Now, as you balance raising kids, caring for aging parents, and advancing careers, retirement planning often feels like a moving target.

This article is part of the RetireCoast Gen X Series, created to help you prepare for retirement with practical strategies, financial tools, and lifestyle guidance. Here, we’ll explore how to build your retirement portfolio, maximize Social Security, manage debt, plan for healthcare, and create a clear action plan so you can retire on your terms. Our series is part of the Gen X retirement guide.

How Much Should Gen X Have Saved by Now?

This is one of the most important questions Gen Xers face. With less than 20 years until retirement, your savings window is shrinking fast. If you’re like many in Generation X, most of your energy (and money) has gone toward raising children, helping them through college, or even supporting them as young adults with families of their own.

With all those responsibilities, saving aggressively for retirement may not have been your top priority — and that’s understandable. But now is the time to shift your mindset. Even if you feel “behind,” it’s not too late to make progress.

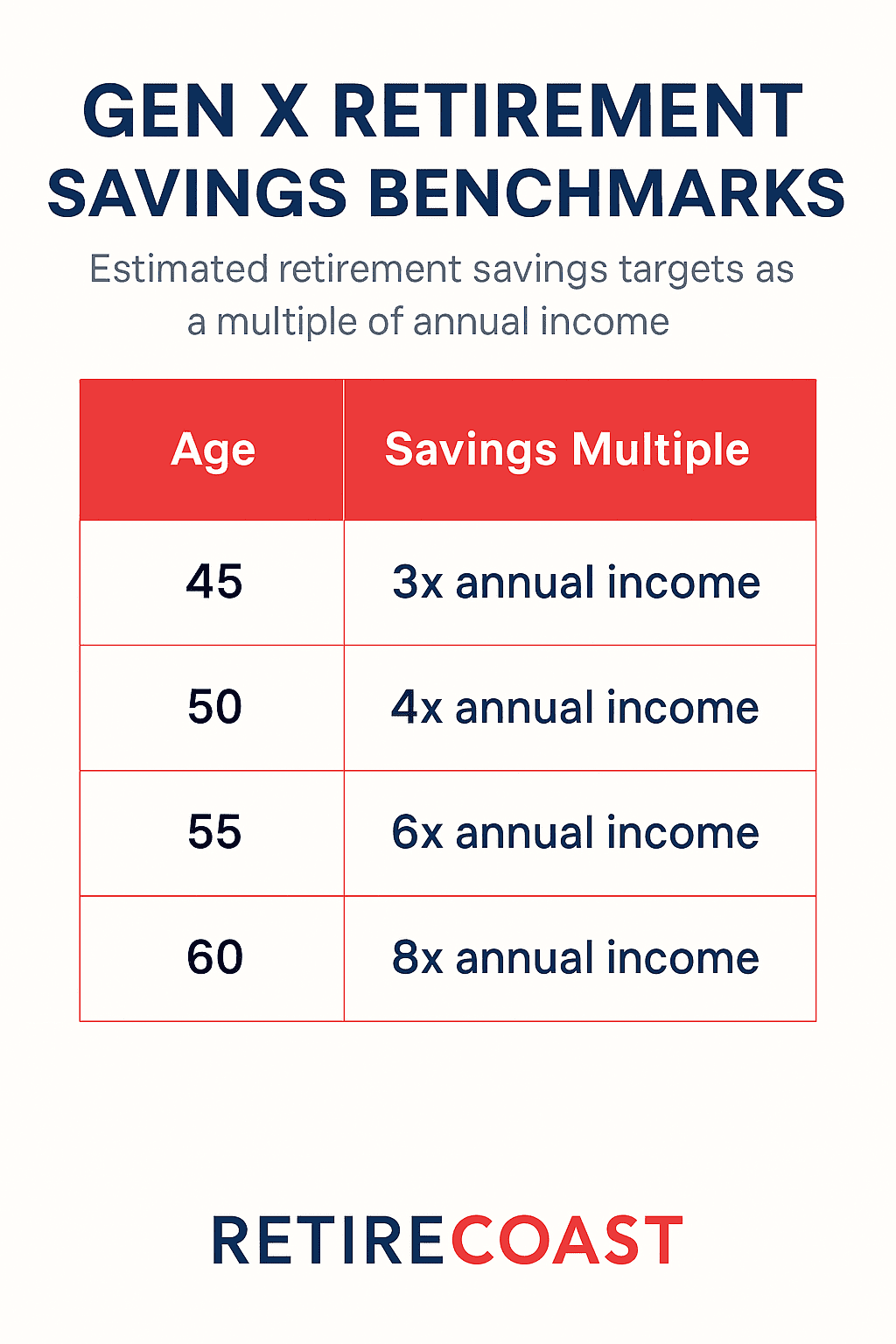

Financial advisors often publish benchmarks for how much you “should” have saved by certain ages. While I don’t believe those rules fit everyone, benchmarks can give you a useful reference point. In this article, we’ll share savings targets by age that you can compare against your own situation, then adjust to match your goals.

Get your Best Free Gen-X Retirement Budget Planning Tool-Calculator👉 To help you get started, we’ve also created a budgeting and net worth checkup tool (see our article: The Best Free Gen X Retirement Budget Planning Tool Calculator). You’ll find this and other planning tools throughout the RetireCoast Gen X Series, designed to guide you step by step toward financial security.

Its one thing to know you need to save — it’s another to learn the best way. We’re not going to leave you hanging by just telling you how much you should have saved. In this series, we’ll also show you practical strategies and proven approaches to help you grow your wealth and increase your retirement readiness.

Building the Right Retirement Portfolio for Gen X

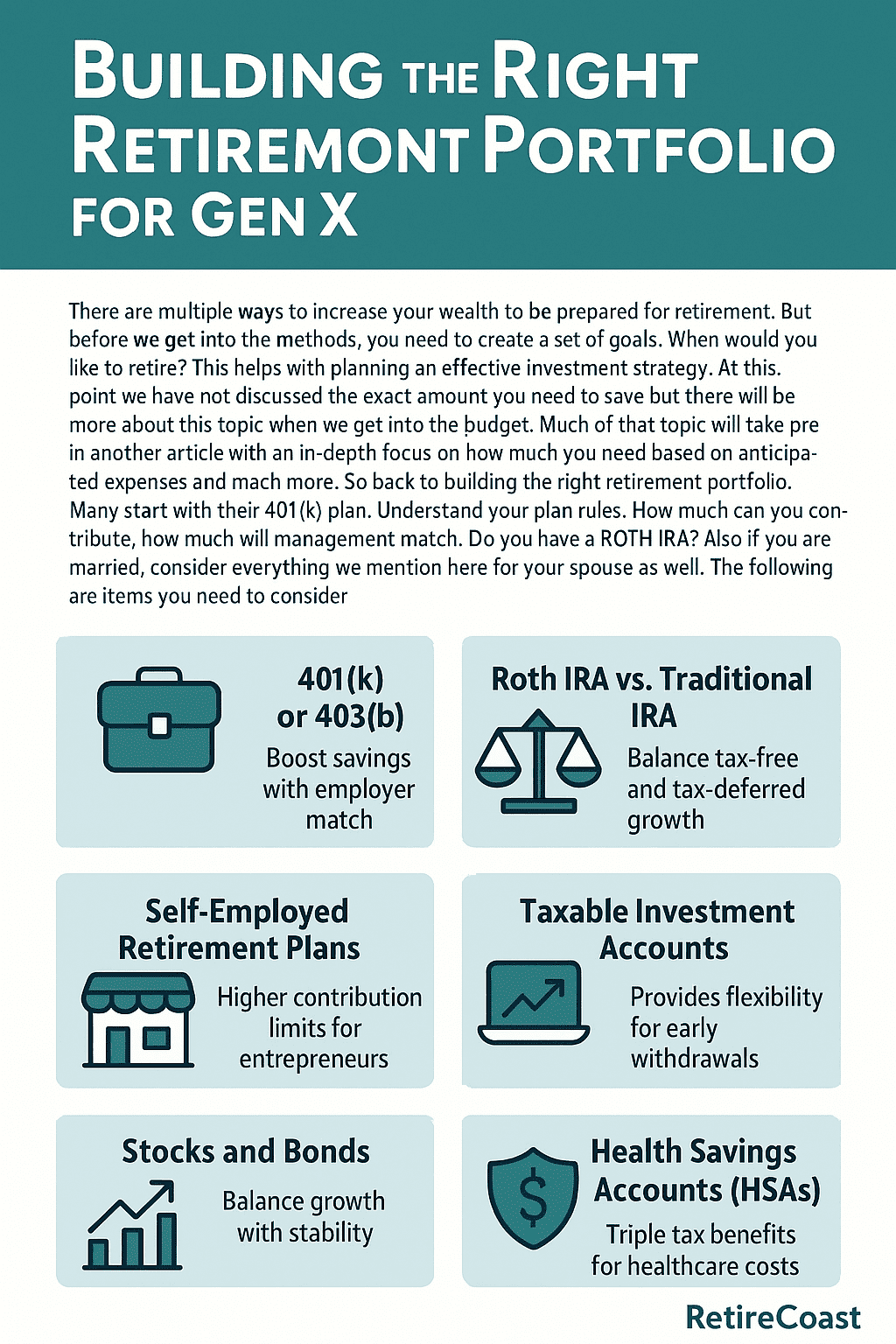

There are multiple ways to grow wealth and prepare for retirement, but before diving into strategies, you need to start with a clear set of goals. Ask yourself: When would I like to retire? Your target age will shape the investment strategy you choose and the level of risk you can take. Let’s create a Gen X retirement guide.

We haven’t yet covered the exact amount you’ll need to save — that’s addressed more fully in our budgeting article, where we focus on anticipated expenses, income sources, and personalized savings goals. For now, let’s turn to how to structure the right retirement portfolio.

For most Gen Xers, the starting point is the 401(k). Understand your plan rules thoroughly:

- How much can you contribute each year?

- What percentage does your employer match?

- Are there investment options you can diversify into within the plan?

Next, look at other account types. Do you have a Roth IRA or Traditional IRA? If not, consider opening one, especially if you’ve maxed out contributions to your 401(k). And if you’re married, remember to think about both your accounts together — planning for your household’s retirement as a unit, not just individually.

Here are the key portfolio elements Gen X should consider:

401(k) or 403(b) Plans

For most Gen Xers, a workplace retirement plan is the foundation of savings. These tax-advantaged accounts allow you to contribute pre-tax income, lowering your taxable earnings today. Many employers also offer a matching contribution — essentially free money that boosts your savings. If you’re 50 or older, you can take advantage of catch-up contributions, which allow you to put away more each year.

Why it matters: You’re in your peak earning years, so maximizing contributions now can significantly grow your nest egg before retirement.

Roth IRA vs. Traditional IRA

Both IRAs provide tax advantages, but in different ways. A Traditional IRA gives you a tax deduction now, while a Roth IRA grows tax-free, allowing withdrawals in retirement without taxes. Gen Xers are in a sweet spot to use both, depending on their income and tax outlook.

Why it matters: Having both Roth and Traditional accounts creates tax flexibility in retirement, letting you control taxable income when withdrawing funds.

Self-Employed Retirement Plans

If you run your own business or side hustle, accounts like a Solo 401(k), SEP IRA, or SIMPLE IRA allow much higher contributions than a standard IRA. These plans are powerful for freelancers, entrepreneurs, and small business owners who need to play catch-up on retirement savings.

Why it matters: Self-employed Gen Xers often miss out on employer-sponsored plans. These accounts allow you to save aggressively and reduce taxable income.

Taxable Investment Accounts

Unlike retirement accounts, taxable brokerage accounts don’t have contribution limits or withdrawal restrictions. You’ll pay capital gains taxes on profits, but you also gain flexibility if you need access to money before retirement age.

Why it matters: This flexibility is crucial for Gen X, especially if you’re considering retiring early or want funds available before age 59½.

Stocks and Bonds

The traditional backbone of investing, stocks provide long-term growth potential, while bonds offer stability and income. Gen Xers should consider a balanced allocation that reflects both their time horizon and risk tolerance.

Why it matters: With 10–20 years left until retirement, you still need growth, but stability becomes increasingly important.

Real Estate

Owning rental properties or investing in Real Estate Investment Trusts (REITs) can provide income and diversification outside the stock market. For Gen Xers, real estate can also serve as a hedge against inflation and a source of passive income in retirement.

Why it matters: Real estate can supplement retirement income and preserve wealth, especially if home equity or rental income becomes part of your retirement plan.

Annuities

Annuities can guarantee income for life, acting like a personal pension. While they’re not for everyone, some Gen Xers may benefit from shifting a portion of assets into an annuity to cover essential expenses.

Why it matters: Annuities provide peace of mind by ensuring you won’t outlive your money, particularly if you’re concerned about longevity. Annuitys may be part of your Gen X retirement guide.

Health Savings Accounts (HSAs)

If you have a high-deductible health plan, you can contribute to an HSA. These accounts are “triple tax-advantaged”: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified healthcare expenses are tax-free. Funds can even be used like a retirement account after age 65.

Why it matters: Healthcare is one of the largest retirement expenses. HSAs help Gen Xers prepare while enjoying unique tax advantages.

👉 For a deeper dive into retirement account strategies, see:

- The Best Gen X Retirement Guide for 401 (k) Planning Strategies

- The Best Self-Employed Retirement Plans for Gen-Xers 2025

Social Security & Medicare: What Gen X Must Know

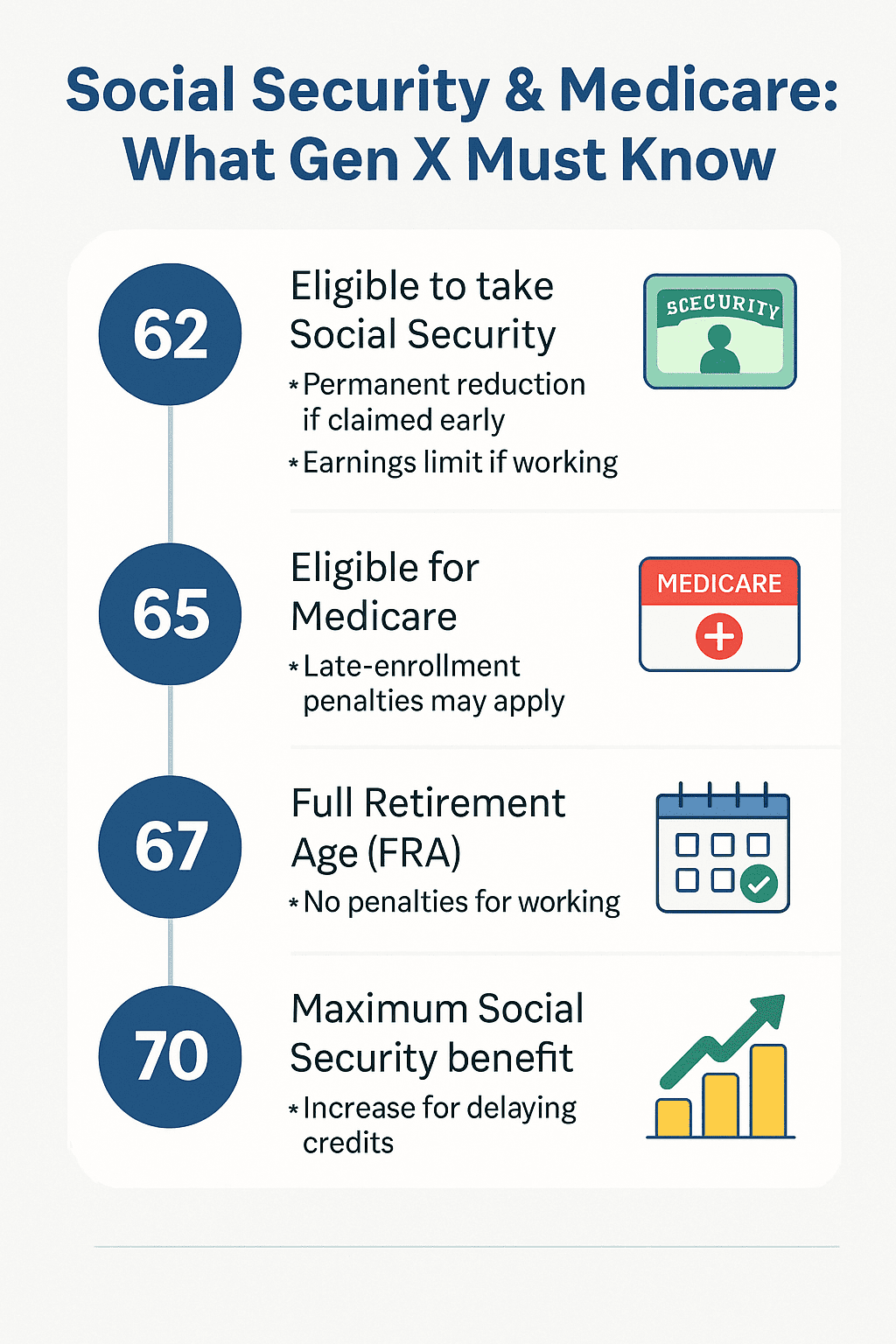

For Gen Xers approaching retirement, four key dates will shape your financial future. Understanding what happens at each milestone can mean the difference between maximizing your benefits and leaving money on the table.

Age 62 – The Earliest You Can Claim Social Security

- You’re eligible to start collecting Social Security at age 62.

- Warning: If you continue working and earn above the annual limit ($22,320 in 2024), your benefit will be reduced by $1 for every $2 you earn over the limit.

- Even if you’re not working, claiming at 62 means you lock in a permanent reduction — typically 25–30% less than your full retirement benefit.

Why it matters: Many Gen Xers are tempted to grab Social Security early, but if you expect to live a long retirement, waiting can substantially increase your lifetime payout. We will discuss how to make this decision in our article about Social Security Benefits The Best Time to Apply

Age 65 – Medicare Enrollment Begins

- At 65, you’re eligible for Medicare — the government’s health insurance program for retirees.

- Important: If you don’t sign up during your Initial Enrollment Period (a 7-month window around your 65th birthday), you may face permanent late-enrollment penalties, even if you’re still working and covered by other insurance.

- Medicare Part A (hospital insurance) is usually premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years. Part B (doctor visits, outpatient care) requires a monthly premium.

- Medicare isn’t “free.” Costs include premiums, deductibles, and coinsurance. Plus, you’ll likely need supplemental coverage for prescriptions (Part D) and out-of-pocket costs.

Why it matters: Healthcare is one of the largest retirement expenses. Signing up on time ensures you avoid penalties and have reliable coverage.

Age 67 – Full Retirement Age (FRA) for Social Security

- For Gen X, full retirement age is 67.

- If you claim at 67, you’ll receive 100% of your earned benefit with no penalties, even if you continue to work.

- Compared to claiming at 62, waiting until FRA increases your benefit by 25–30%.

Why it matters: This is the “break-even” point where benefits stabilize — especially important if you expect to keep working in your late 60s.

Age 70 – Maximum Social Security Benefit

- If you delay claiming until age 70, your benefit increases about 8% per year after FRA, thanks to delayed retirement credits.

- This means your monthly check could be 24–32% higher than at 67, and 70–80% higher than at 62.

- After 70, there’s no advantage to waiting longer.

Why it matters: If you’re in good health and can afford to wait, age 70 offers the maximum Social Security benefit available.

Other Factors Gen X Must Consider as part of the Gen X Retirement Guide

- Spousal & Survivor Benefits: Married Gen Xers should coordinate claiming strategies to maximize household benefits.

- Taxation of Benefits: Up to 85% of Social Security may be taxable depending on your retirement income.

- Cost-of-Living Adjustments (COLA): Benefits increase annually with inflation, but Medicare premiums often rise too, offsetting part of that gain.

- Healthcare Gap Before 65: If you want to retire early, you’ll need to plan for private insurance until Medicare kicks in.

👉 For a deeper dive, see:

How Can I Maximize Earnings for Gen X Social Security?

Debt, Housing & Lifestyle Choices in Your 50s

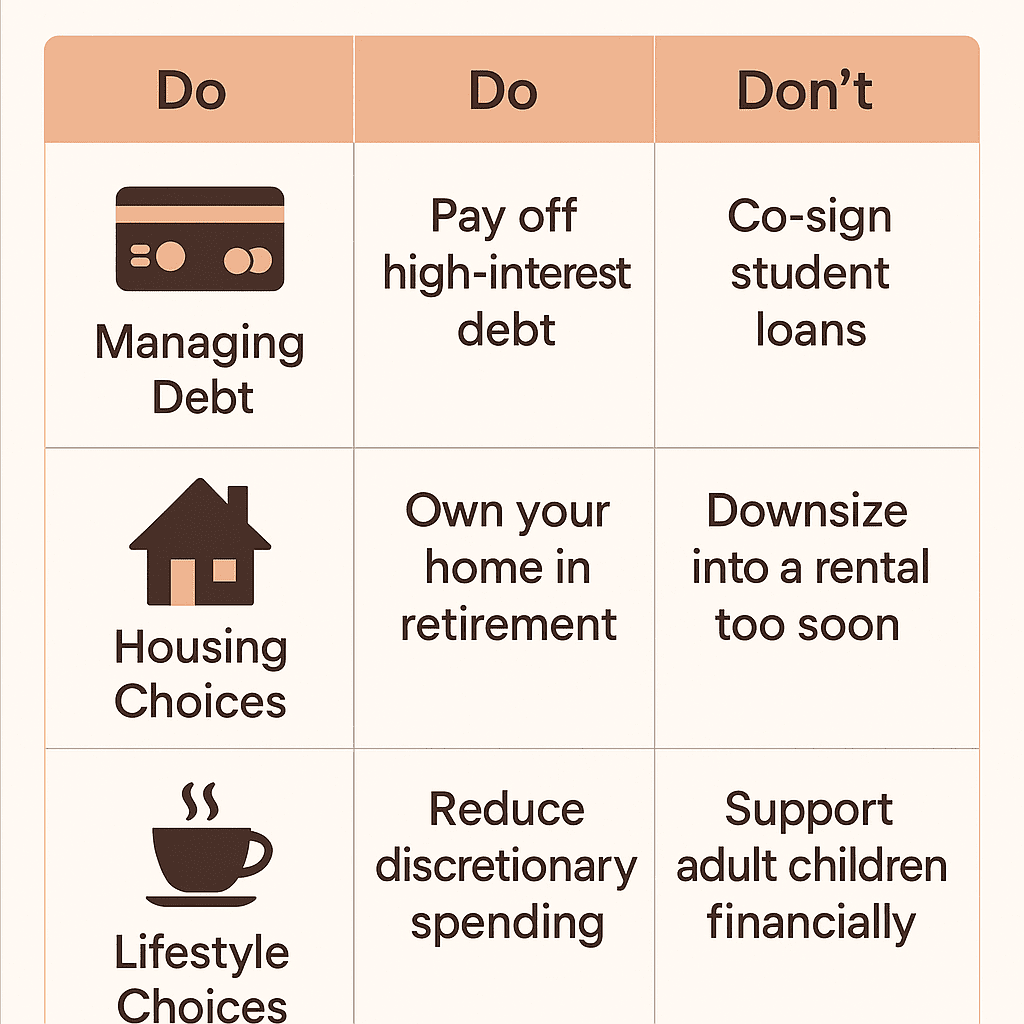

As a Gen Xer in your 50s, controlling debt and making smarter financial decisions should be top priorities. These years are critical — the choices you make now can either strengthen your retirement plan or hold it back. Let’s break it down into three major areas: debt, housing, and lifestyle.

Managing Debt Before Retirement

High-interest debt is one of the biggest threats to your financial security. Student loans, credit cards, and long-term loans can drain resources you need for retirement.

- Avoid co-signing student loans for your children. While it may feel supportive, many students struggle to repay their loans, leaving parents responsible, just as they should be saving for retirement.

- Focus on eliminating high-interest debt first. Credit cards and private student loans should go before mortgages or lower-rate debts.

- Plan for a debt-free retirement. Ideally, you should aim to pay off all long-term debt (especially your mortgage) within 20 years of retirement.

Why it matters: Every dollar you send to creditors is a dollar not invested in your future.

Housing Choices in Your 50s

Your home is not just a place to live — it’s also one of your biggest financial assets.

- Owning vs. Renting: Studies show that retirees who own their homes outright are in the best position for financial stability.

- Renting Later in Life: While owning is ideal going into retirement, moving into a rental property later can make sense if it reduces maintenance, property taxes, and unexpected repair costs.

- Run the numbers. Use our Buying vs. Renting Calculator to see which strategy makes sense for you at different stages of retirement.

Why it matters: Housing stability reduces financial stress, and eliminating a mortgage payment can free up income for healthcare, travel, or other retirement needs.

Lifestyle Choices That Impact your Gen X Retirement Guide

The small spending decisions you make today compound over the years. They may feel minor, but they can have a massive impact on your retirement readiness.

- Everyday Expenses: Daily Starbucks runs, eating out on a whim, or buying new items when old ones can be repaired add up quickly.

- Smart Substitutions: Brew coffee at home, cook more meals, and repair instead of replace when possible.

- Evaluate Family Support: Are you still financially supporting your adult children? As difficult as it may be, continuing to cover living costs for 30-year-olds can significantly derail your retirement savings. Encouraging independence is healthier for both generations.

Why it matters: Lifestyle discipline in your 50s helps you redirect money into savings, pay down debt, and set yourself up for a better retirement lifestyle later.

👉 For a deeper dive, see: How Gen-Xers Can Build Wealth Through Homeownership vs Renting

The Sandwich Generation Struggle

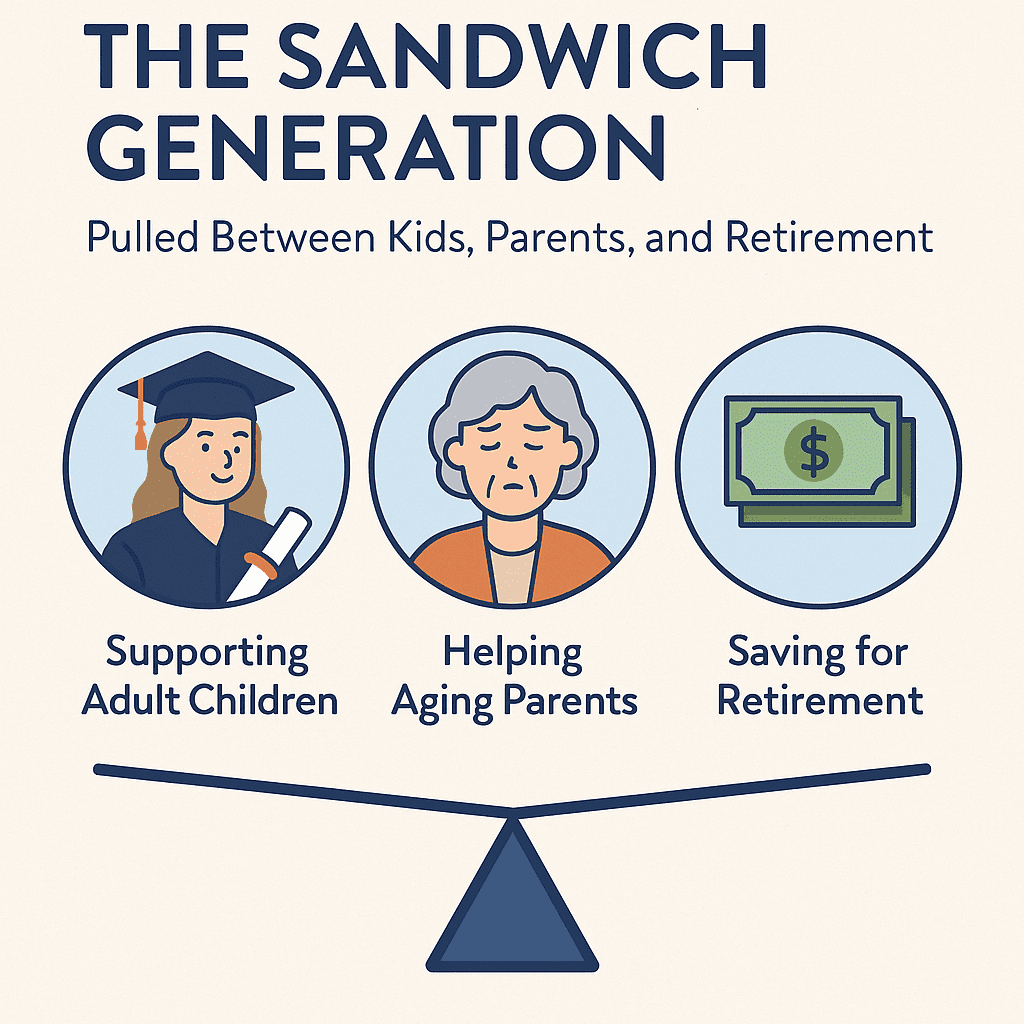

Gen Xers are often referred to as the “Sandwich Generation” — caught between supporting adult children and helping aging parents, all while trying to save for retirement. Balancing these competing demands requires tough choices and a clear plan.

Supporting Adult Children vs. Saving for Retirement

As mentioned earlier, at some point — and the earlier the better — you must encourage your adult children to become independent. For many parents, this feels like tough love, but it’s necessary.

When I was growing up with four siblings, each of us left home at 18 or 19 with jobs and a direction for our future. Our parents didn’t force us out — it was simply what was expected. We paid for our own college, and some of us went into the military. We raised our own children the same way, encouraging independence and responsibility.

If you’ve been more of a “helicopter parent,” it’s not too late to change course. Encourage your children to take responsibility for their future. Not every path requires a college degree:

- Trade schools are booming today, and many careers — electricians, plumbers, welders, HVAC technicians — offer high pay and lifelong job security.

- These trades are less vulnerable to outsourcing and automation, making them smart career choices even in the age of AI.

👉 Why it matters: Every dollar you spend supporting adult children delays your retirement savings and may jeopardize your financial security.

Helping Aging Parents Financially

The other side of the Sandwich Generation struggle is caring for your aging parents. Fortunately, many Baby Boomers — your parents — are entering retirement with resources like pensions, 401(k) accounts, and homes with significant equity. But not all parents are equally prepared, and you may be asked to help financially.

Options to consider:

- Co-living arrangements: Having a parent move in with you can reduce costs and provide companionship, though it requires careful family planning.

- Assisted living communities: These offer social engagement, medical support, and peace of mind, though they come with ongoing costs.

- Shared family support: Siblings can share financial or caregiving responsibilities to reduce the burden on one person.

In my own family, my mother lived with my sister for many years before moving into assisted living. She agreed to the move because it gave her daily interaction and a social community she valued.

👉 Why it matters: If you’re already juggling student loans, mortgage payments, and retirement savings, adding parental support requires careful planning.

Caregiving + Retirement Overlap

The greatest stress for many Gen Xers comes when caregiving responsibilities and retirement planning overlap. You may find yourself still supporting children, helping a parent, and facing the reality that you have only 15–20 years left to save for retirement.

This is where planning is crucial:

- Discuss expectations with siblings and adult children early.

- Research caregiving options and insurance for your parents before a crisis.

- Create a realistic retirement plan that accounts for both your obligations and your long-term financial security.

With communication, family support, and strategic planning, you can manage the Sandwich Generation years without sacrificing your own retirement goals.

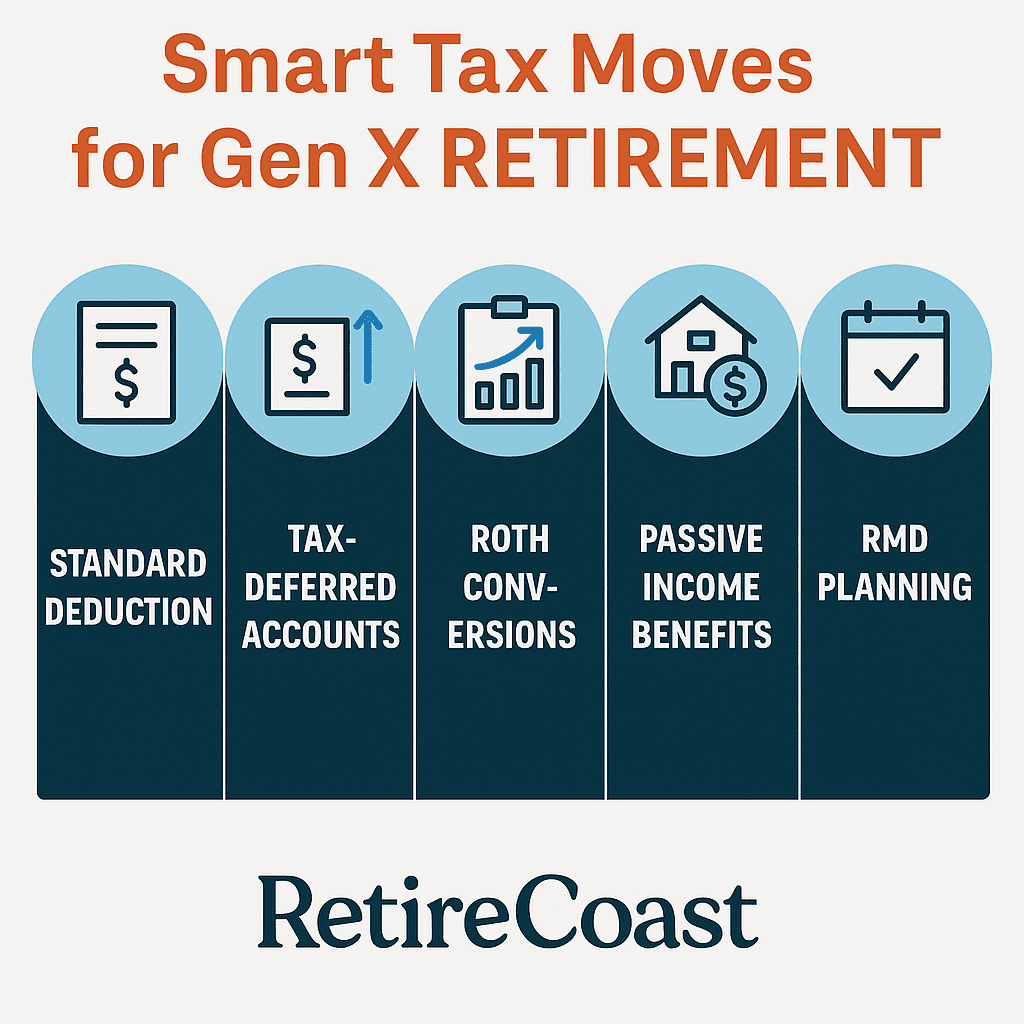

Smart Tax & Income Strategies for Gen X Retirement

Creating a retirement income strategy is just as important as building your savings. It’s not only about how much you accumulate but also how you withdraw and manage it in order to minimize taxes and maximize income. Let’s break down some of the most effective strategies for Gen X.

Take Advantage of the Standard Deduction

Thanks to the 2017 tax reforms — extended and expanded under the most recent legislation — retirees benefit from a much larger standard deduction. This means fewer people need to itemize deductions. Once you turn 65, you also qualify for an additional deduction, lowering your taxable income even further.

Why it matters: Many Gen X retirees will find they can simplify taxes dramatically and keep more money in their pockets just by using the standard deduction.

Use Tax-Deferred Accounts Wisely

Your 401(k), 403(b), and Traditional IRA accounts are tax-deferred, meaning you don’t pay taxes on contributions or growth until you withdraw funds in retirement. This allows your money to compound faster.

- During your peak earning years: Maximize contributions and catch-up contributions (available at age 50+).

- In retirement: Plan withdrawals carefully, because they count as taxable income. If structured properly, withdrawals may fall into lower tax brackets, minimizing taxes.

Why it matters: Proper timing of withdrawals can save thousands over your retirement.

Roth Conversions for Tax Flexibility

Converting part of your Traditional IRA or 401(k) to a Roth IRA before retirement means you’ll pay taxes at today’s rate, but withdrawals will be tax-free later. For Gen Xers still in their 50s and early 60s, gradual Roth conversions may create long-term tax savings.

Why it matters: This gives you more flexibility in retirement by creating a mix of taxable, tax-deferred, and tax-free accounts.

Passive Income Benefits from Real Estate

If you own rental property or other forms of real estate, you can benefit from passive income tax rules:

- Annual deductions for depreciation, interest, and expenses can offset taxable rental income.

- While annual deduction limits exist, unused losses can be carried forward and deducted later, such as when you sell the property.

Why it matters: Real estate not only generates ongoing income but can also reduce your taxable income significantly over time.

Plan Around Required Minimum Distributions (RMDs)

At age 73 (under current law), you’ll be required to take RMDs from Traditional IRAs and 401(k)s. Failing to withdraw enough results in steep penalties. Strategic planning before RMDs begin — including Roth conversions and selective withdrawals in your 60s — can reduce the tax impact.

Why it matters: Poor RMD planning can create unexpectedly high tax bills just when you want predictable income.

The Goal: Zero-Tax Retirement Years

With careful planning, it’s possible to structure withdrawals, deductions, and passive income so that in certain years you pay little to no federal income tax. This requires balancing taxable and tax-free accounts, managing Social Security benefits, and timing real estate deductions or capital gains.

👉 For more details, see our Gen X Retirement Budget Tool — designed to help you model your income, deductions, and taxes year by year.

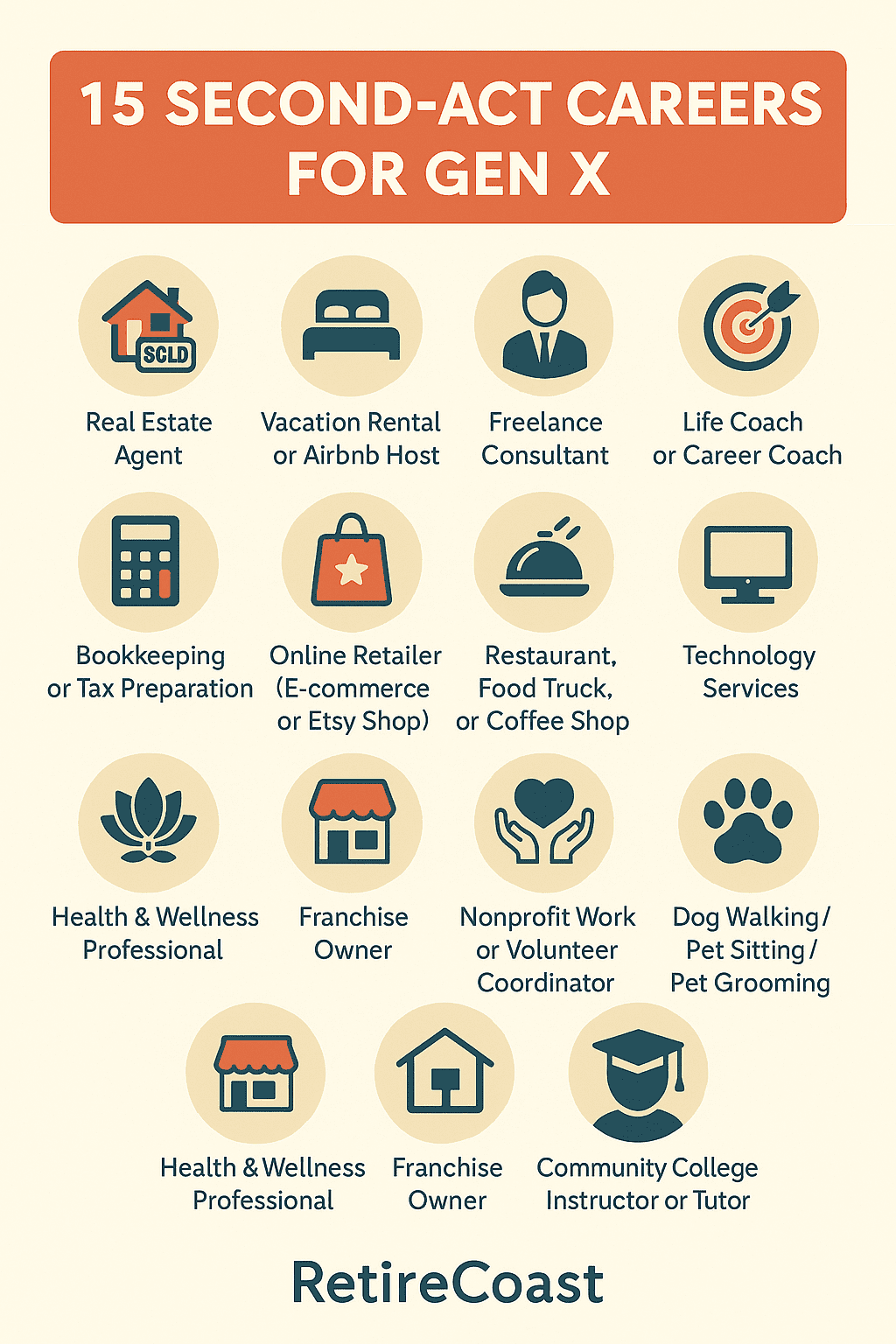

Working Longer & Second Acts for Gen X

You may have planned to retire at age 67, when you qualify for full Social Security benefits — but it may be time to reconsider what “retirement” really means. For many Gen Xers, retirement isn’t about sitting on the beach sipping umbrella drinks; it’s about creating a meaningful second act.

Some Gen Xers must keep working due to unfinished business — like unpaid student loans, supporting aging parents, or simply not saving enough in earlier years. Others choose to work because they want to stay active, learn new skills, or earn extra money for travel and hobbies.

Working longer is not a setback — it’s an opportunity. Even part-time or passion-driven work can provide purpose, extra income, and more security in retirement. And remember, if you delay Social Security until age 67 or even 70, your benefits will be higher, which can be combined with second-act income to strengthen your financial picture.

15 Popular “Second Act” Careers & Businesses for Gen X

- Real Estate Agent – Flexible, commission-based, and highly suitable for networking-driven Gen Xers.

- Vacation Rental or Airbnb Host – Turn property into semi-passive income.

- Freelance Consultant – Use your career expertise to advise businesses.

- Life Coach or Career Coach – Guide others with the benefit of your experience.

- Property Manager – Manage rentals for investors or homeowners.

- Bookkeeping or Tax Preparation – Great for detail-oriented individuals.

- Online Retailer (E-commerce or Etsy Shop) – Sell crafts, collectibles, or niche products.

- Restaurant, Food Truck, or Coffee Shop Owner – A chance to pursue culinary passions.

- Trades or Skilled Services – Open an auto mechanic shop, landscaping business, or handyman service.

- Technology Services – Mobile phone/computer repair or IT support for small businesses.

- Health & Wellness Professional – Yoga instructor, personal trainer, or nutrition coach.

- Franchise Owner – Proven business models in food service, cleaning, or retail.

- Nonprofit Work or Volunteer Coordinator – A mission-driven second act.

- Dog Walking / Pet Sitting / Pet Grooming – A growing, low-barrier-to-entry business.

- Community College Instructor or Tutor – Teach your skills to the next generation.

👉 For deeper inspiration, see our full article: Best Gen X Playbook for Building Your Second Act Business.

Estate Planning & Leaving a Legacy

Estate planning isn’t just about protecting your assets during your lifetime — it’s about ensuring that your family is cared for, your wishes are respected, and your legacy lives on. For many in Generation X, estate planning is a two-part process: planning for your own estate and helping your parents finalize theirs.

Many Baby Boomers have accumulated significant wealth through pensions, retirement plans, and home equity. If your parents haven’t completed their estate planning, encourage them to do so. Their decisions directly affect your future planning and can reduce legal and financial stress later.

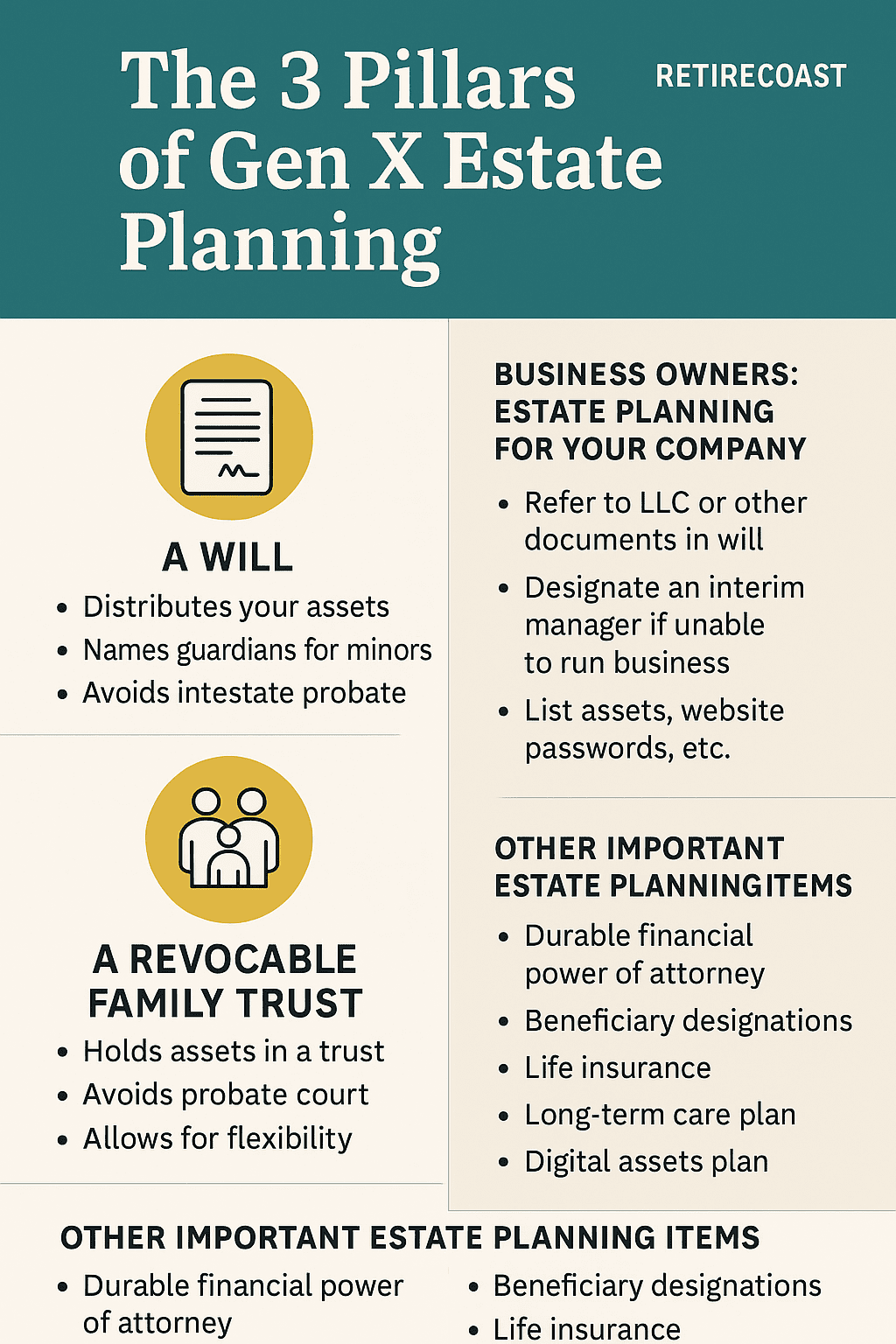

As you age, you must think carefully about what to do with the wealth you’ve built — and possibly inherited. The core of estate planning for your Gen X Retirement Guide comes down to three key documents.

1. A Will

A will is a legal document that outlines how your assets will be distributed after your death.

- It ensures your wishes are honored regarding property, possessions, and financial accounts.

- You can designate guardians for minor children.

- Without a will, your estate will go through intestate probate, where the state decides how your assets are divided — a process that is costly and time-consuming.

Why it matters: Even a simple will can save your family years of stress and thousands of dollars in legal fees.

2. A Revocable Family Trust

A revocable living trust (often called a family trust) is a legal entity that holds your assets while you’re alive and distributes them after your death according to your instructions.

- It avoids probate court, which can save time and money.

- It keeps your estate private, unlike a will, which becomes public record.

- It allows for flexibility — you can change or revoke it at any time while you’re alive.

- You can also name a successor trustee to manage your estate if you become incapacitated.

Why it matters: A trust streamlines estate transfer, protects family privacy, and can minimize disputes among heirs.

3. A Medical Power of Attorney (POA)

This document authorizes someone you trust to make healthcare decisions for you if you’re unable to do so yourself.

- It ensures that your medical wishes are followed, even if you cannot speak for yourself.

- You can combine this with a living will or advance directive to outline specific end-of-life care preferences.

Why it matters: Medical POA prevents confusion and family conflict in critical moments, ensuring decisions are made in line with your values.

Business Owners: Estate Planning for Your Company

If you own a business — perhaps one you started as a second act after retirement (see our Gen X Second Act Business Series) — your estate plan should cover both your personal and business interests.

- Include your LLC or incorporation documents in your will. Make sure ownership, succession, and control are clearly addressed.

- Decision-making authority: Your business documents should specify who will make decisions if you are incapacitated or pass away. Many spouses are not involved in the day-to-day operations and may not know how to manage the business. Appointing an interim manager from within the company (if you have employees) is essential.

- Asset list: Create a complete inventory of assets, including bank accounts, real estate, vehicles, and intellectual property.

- Digital continuity: Don’t forget IT-related assets — such as website logins, email accounts, and business software passwords — so your spouse or designated successor can continue operations without disruption.

Why it matters: Without a clear succession plan, your business could collapse overnight, losing both its income and its value as part of your estate.

🔑 Other Important Estate Planning Items

- Durable Financial Power of Attorney

- Beneficiary Designations

- Life Insurance

- Long-Term Care Planning

- Digital Assets Plan

- Charitable Giving

👉 Estate planning is not a one-time task. It should be reviewed every few years, especially after major life changes like marriage, divorce, children, or inheritance. Estate planning is part of your Gen X retirement guide.

Your Gen X Retirement Action Plan (Starting at Age 50)

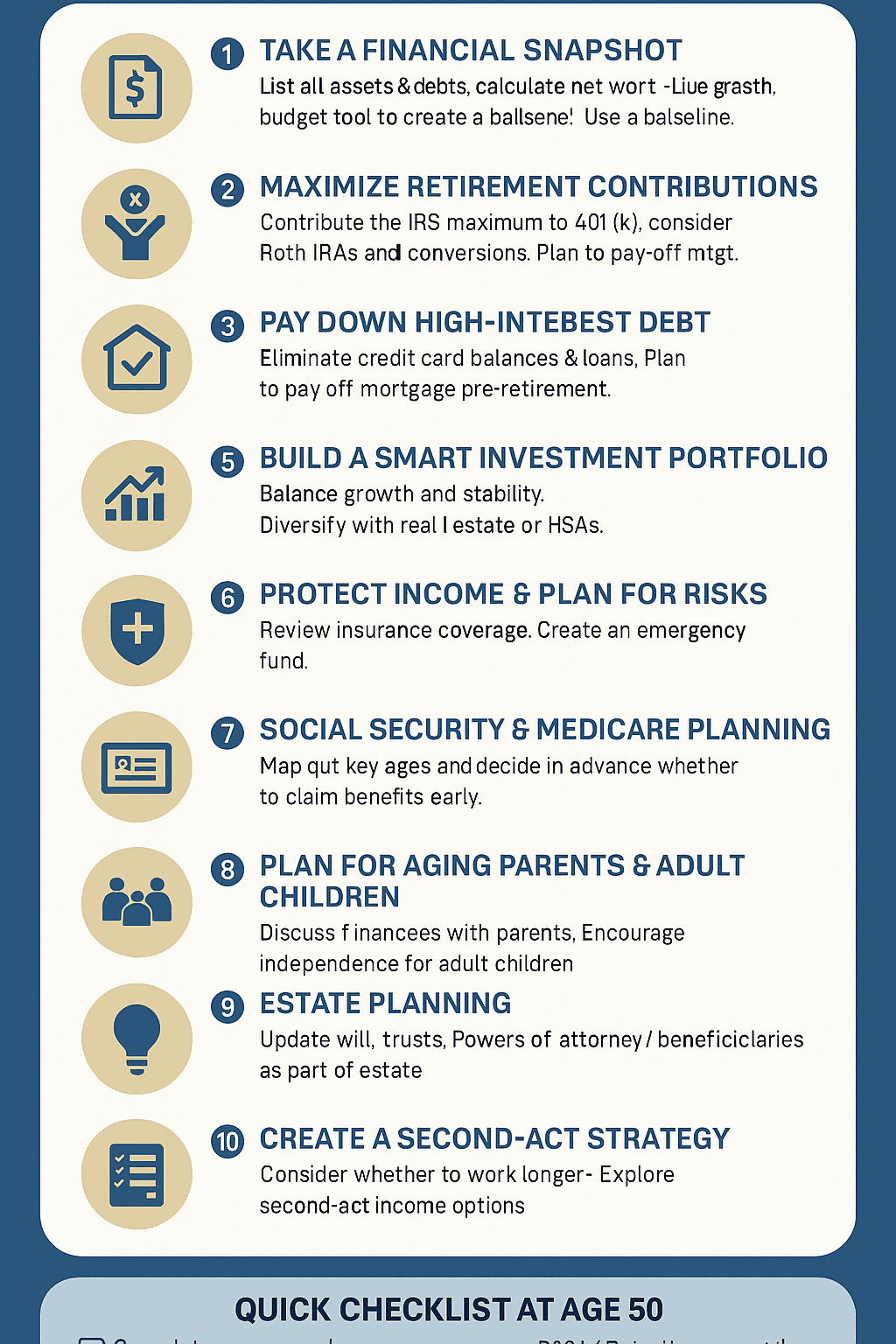

By age 50, you may only have 15–20 years left until retirement. That’s still enough time to build wealth, reduce debt, and plan smarter — but you must be intentional. Here’s a practical roadmap:

Step 1: Take a Financial Snapshot

- List all assets (bank accounts, 401(k), IRAs, real estate, business ownership, etc.).

- List all debts (mortgage, credit cards, student loans, auto loans).

- Calculate net worth (assets – debts).

- Use our Gen X Budget & Net Worth Tool to create a baseline.

Step 2: Maximize Retirement Contributions

- Contribute the IRS maximum to your 401(k)/403(b).

- Take advantage of catch-up contributions (extra $7,500 allowed for 50+ in 2024).

- Open or fund a Roth IRA if eligible — or consider Roth conversions for tax flexibility.

- Self-employed? Max out a Solo 401(k), SEP IRA, or SIMPLE IRA.

Step 3: Pay Down High-Interest Debt

- Eliminate credit card balances and private student loans first.

- Create a plan to pay off your mortgage before retirement if possible.

- Avoid co-signing student loans for children — have them take on responsibility.

Step 4: Fine-Tune Housing & Lifestyle

- If you own a home, commit to keeping it through early retirement for stability.

- Consider whether downsizing or renting later in life may be part of your plan.

- Evaluate discretionary spending — redirect “lifestyle leakage” (e.g., daily coffee runs, impulse spending) into savings.

Step 5: Build a Smart Investment Portfolio

- Balance growth (stocks, mutual funds, ETFs) with stability (bonds, annuities).

- Diversify with real estate or REITs.

- Use HSAs if you have a high-deductible plan for triple tax advantages.

Step 6: Protect Income & Plan for Risks

- Review life insurance and consider long-term care insurance.

- Maintain disability insurance if still working.

- Create an emergency fund (6–12 months of living expenses).

– Step 7: Social Security & Medicare Planning

- Know your key ages: 62 (early Social Security), 65 (Medicare), 67 (Full Retirement Age), 70 (max Social Security).

- Decide in advance whether you’ll claim early or delay.

- If retiring before 65, plan for healthcare gap coverage.

Step 8: Plan for Aging Parents & Adult Children

- Discuss finances and estate planning with parents to avoid surprises.

- Encourage adult children to be financially independent.

- Avoid draining your retirement savings to support others.

– Step 9: Estate Planning

- Draft or update your will, trust, and powers of attorney.

- If you own a business, ensure succession planning is in place (LLC documents, interim manager, digital assets).

- Update beneficiaries on all accounts.

Step 10: Create a Second-Act Strategy

- Consider whether you’ll want or need to work longer.

- Explore part-time work, consulting, franchising, or small business ownership.

- Align your second act with both your passions and financial goals.

✅ Quick Checklist at Age 50

Explore second-act income options

Complete a net worth checkup

Max out 401(k)/IRA with catch-up contributions

Pay down high-interest debt

Review housing and lifestyle choices

Diversify investments (stocks, bonds, real estate, HSAs)

Protect income with insurance coverage

Map out Social Security/Medicare milestones

Discuss financial/estate planning with parents

Encourage independence for adult children

Update estate documents (will, trust, POAs, beneficiaries)

Gen X Retirement Action Checklist

📚 Resources & Tools for Gen X Retirement Planning

When preparing for retirement, it’s important to use reliable, non-commercial resources in addition to the strategies we provide in this series. Below is a list of trusted tools and organizations that can help you build financial confidence:

🔹 Government & Public Resources

- Social Security Administration (SSA.gov) – Official calculators for benefits, retirement age planners, and application information.

- Medicare.gov – Enrollment, cost breakdowns, and coverage comparison tools for future healthcare planning.

- IRS.gov – Retirement Savings Contributions Information – Rules for 401(k), IRA, and catch-up contributions.

- Consumer Financial Protection Bureau (CFPB.gov) – Guidance on debt reduction, credit, and financial protection for retirees.

Universities & Colleges

- Stanford Center on Longevity – Research on retirement, aging, and long-term financial well-being.

- Boston College Center for Retirement Research – Free reports and calculators tailored to midlife and retirement planning.

- MIT AgeLab – Studies on lifestyle, healthcare, and technology for aging populations.

🔹 Banks & Financial Institutions (Educational Tools Only)

- Vanguard Retirement Nest Egg Calculator – Test withdrawal strategies against longevity and inflation scenarios.

- Fidelity Retirement Score – A snapshot tool to see if you’re “on track” for retirement readiness.

- Charles Schwab Retirement Savings Calculator – Helps estimate how much you’ll need and how long savings may last.

Tools From Our Articles (Internal Links)

- Budget Planning Calculator – → The Best Free Gen X Retirement Budget Planning Tool Calculator

- Homeownership vs Renting Calculator – → How Gen-Xers Can Build Wealth Through Homeownership vs Renting

- Retirement Portfolio Checklist – → The Best Gen X Retirement Guide for 401k Planning Strategies

- Second Act Business Guide – → Best Gen X Playbook for Building Your Second Act Business

🔚 Closing Thoughts

This article is part of the RetireCoast Gen X Retirement Series, created as your Gen X retirement guide to take you through the unique financial and lifestyle challenges facing your generation. Throughout this series, we’ve shared practical tools, in-depth strategies, and step-by-step guides to help you prepare for a secure and fulfilling retirement.

Our goal is simple: to equip Gen X with actionable knowledge so you can transition smoothly into your next chapter with confidence. You’ll find budgeting tools, investment strategies, housing calculators, and business planning resources in both this article and others within the series. A comprehensive list of our articles is available at the bottom of this page, and more will be added as we continue to expand this resource.

The author of this series is an experienced professional in finance, business development, and real estate who has worked extensively with retirement planning, wealth-building, and lifestyle management. These insights are not theoretical—they come from decades of real-world expertise.

That said, every person’s situation is unique. We strongly encourage you to consult with certified professionals—including Certified Public Accountants (CPAs), Certified Financial Planners (CFPs), attorneys, and estate planning specialists—to customize these strategies to your specific needs. Combining professional guidance with the tools and knowledge provided here will give you the strongest foundation possible.

👉 Whether you are just beginning to think seriously about retirement or you’re already deep into planning, this series is here to help you take control of your financial future. Stay tuned—our upcoming articles will add even more depth and resources designed exclusively for Gen X.

Frequently Asked Questions About Gen X Retirement

1. What is the average retirement savings for Gen X?

Studies show the median retirement savings for Gen X households is around $40,000–$65,000. This is far below most benchmarks, which suggest having at least 5–6 times your annual income saved by age 50.

2. Can Gen X still retire at 65?

Yes, but it depends on savings, debt, and income sources. Gen Xers with a strong 401(k), Social Security planning, and little to no debt can retire comfortably at 65. Others may benefit from working longer or starting a second-act career.

3. How much should Gen X have saved for retirement by age 50?

Financial benchmarks suggest Gen Xers should have about 5x their annual income saved by age 50, 7x by 55, and 10x by 60. These are general guidelines and should be adjusted to your personal situation.

4. What is the full retirement age for Gen X?

For Gen Xers born between 1965 and 1980, the Social Security full retirement age is 67.

5. Should Gen X claim Social Security at 62?

Claiming at 62 reduces your lifetime benefit by 25–30%. If you’re still working, benefits may also be reduced due to income limits. Waiting until 67 or 70 can significantly increase your benefit.

6. How does Medicare work for Gen X when they turn 65?

Medicare eligibility begins at 65. You must sign up during the 7-month enrollment window to avoid penalties. Medicare Part A is usually free, while Part B and supplemental plans require monthly premiums.

7. What are catch-up contributions and how do they help Gen X?

At age 50, Gen Xers can make extra contributions to retirement accounts — an additional $7,500 to a 401(k) and $1,000 to an IRA in 2024. These allow late savers to boost retirement funds quickly.

8. Is real estate a good retirement investment for Gen X?

Yes, real estate can diversify your portfolio and provide rental income. Options include owning rental properties or investing in Real Estate Investment Trusts (REITs).

9. How should Gen X manage debt before retirement?

Prioritize paying off high-interest debt like credit cards and student loans. Aim to pay off your mortgage before retirement to reduce fixed expenses.

10. What insurance should Gen X consider?

Key policies include life insurance, long-term care insurance, and disability insurance. These protect your retirement income and reduce financial shocks.

11. How does the Sandwich Generation affect Gen X retirement?

Many Gen Xers are supporting both adult children and aging parents while saving for retirement. This creates financial stress and requires careful planning to balance responsibilities.

12. Should Gen X consider a second-act career?

Yes, many Gen Xers start second careers or small businesses after leaving long-term jobs. This provides extra income, keeps them active, and delays the need to draw down savings.

13. What estate planning steps are essential for Gen X?

Every Gen Xer should have a will, a revocable trust, and medical and financial powers of attorney. These documents protect your assets and ensure your wishes are followed.

14. What tax strategies work best for Gen X in retirement?

Roth IRA conversions, tax-efficient withdrawal strategies, and using standard deductions wisely can minimize taxes. Planning around Required Minimum Distributions (RMDs) is also critical.

15. Where can Gen X find reliable retirement planning resources?

Trusted sources include SSA.gov for Social Security, Medicare.gov for healthcare, IRS.gov for contribution rules, and academic centers like Boston College’s Center for Retirement Research. Combine these with our RetireCoast Gen X Series for practical tools and strategies.

More from the RetireCoast Gen X Series

- The Ultimate Gen X Retirement Guide: Plan Smarter for Your Future

- Gen X Homeowners Dream Home: 21 Things You Must Know

- Best Gen X Playbook for Building Your Second-Act Business

- Get Your Best Free Gen‑X Retirement Budget Planning Tool & Calculator

- Gen‑X Only 20 Years to Retirement — Get Planning Now

- How Can I Maximize Earnings for Gen‑X Social Security?

- Gen X Retirement FAQ: TOP 20 Questions Answered for Your Future

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.