Types of Investments in a 401(k)

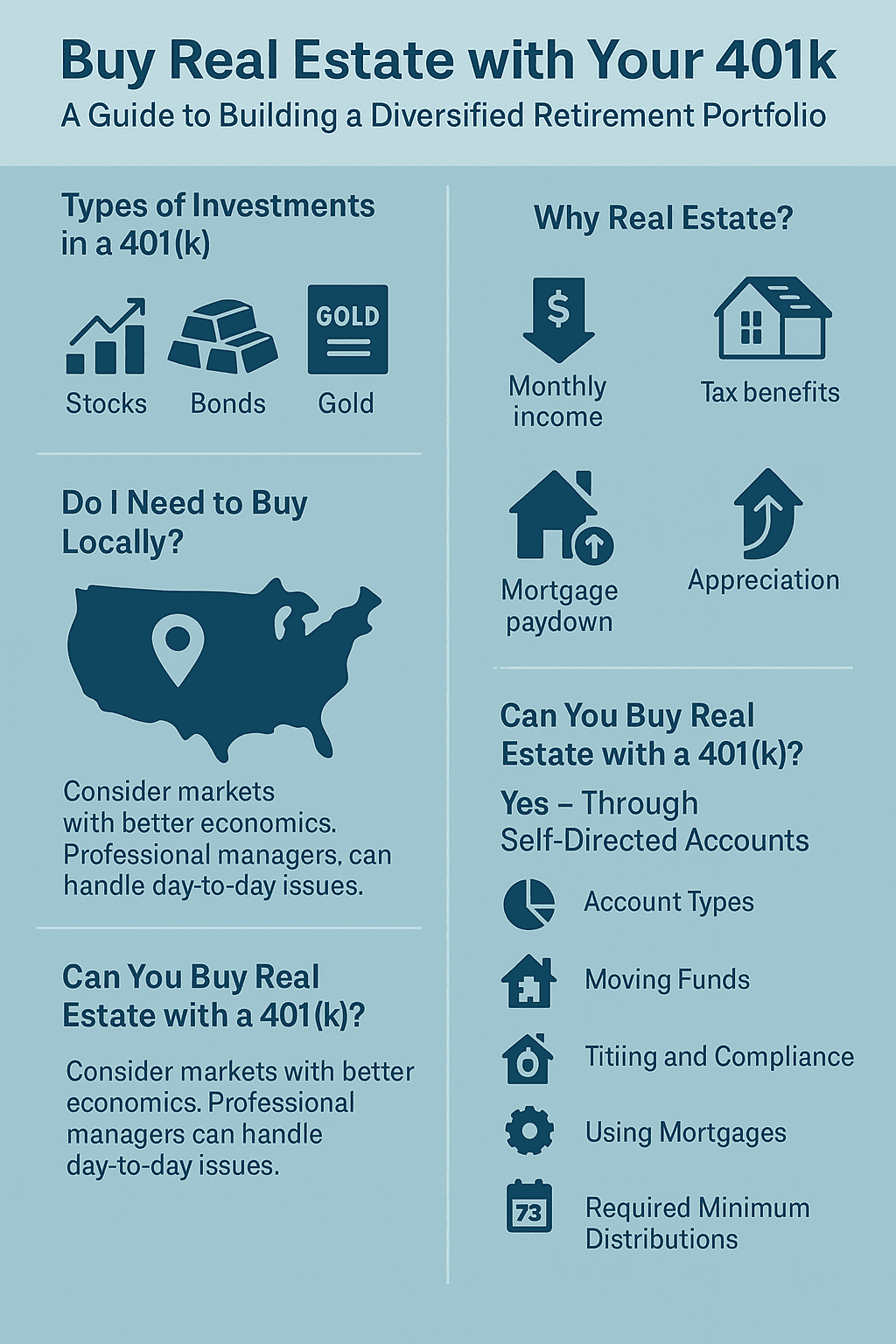

Most retirement savers concentrate their wealth in a 401(k), but few realize that you can also buy real estate with your 401k if structured correctly. A standard plan typically offers a selection of mutual funds or target-date funds that invest in stocks and bonds. Some plans include a brokerage option, which allows participants to purchase individual equities, ETFs, or commodity-based funds like gold.

Don’t forget about a ROTH IRA, read more here.

Understanding these choices — and their strengths and weaknesses — is the first step to building a retirement strategy that preserves and grows your money.

Stocks

Stocks offer growth potential and, historically, have outpaced inflation over the long term. But the ride can be bumpy. Market downturns close to retirement can severely impact account balances when withdrawals are just beginning. Stocks should be part of a retirement portfolio, but relying on them exclusively exposes you to significant volatility. Mutual funds are a grouping of stocks. Most 401(k) programs focus on mutual funds.

Bonds

Bonds are typically chosen for stability and income. They can cushion portfolios during stock market downturns. The challenge is that bond prices fall when interest rates rise, and many bonds yield less than the long-term average rate of inflation. That means bonds alone may not preserve your purchasing power in retirement.

Gold

Gold is often viewed as a store of value and a hedge against inflation or currency risk. Within a 401(k), gold exposure usually comes through ETFs or mutual funds that track bullion prices. While gold can protect against sharp declines in other markets, it doesn’t generate income or build equity. Its value depends solely on market perception, which limits its effectiveness as a long-term wealth-building tool.

Real Estate

A Real estate investment is less common inside traditional 401(k) plans, but it can be accessed in several ways:

- REITs and real estate funds offered through the plan menu.

- Brokerage windows that permit real-estate-focused ETFs.

- Self-directed IRAs and Solo 401(k)s that allow direct ownership of property.

Real estate offers something unique: it produces income today and equity growth tomorrow. Unlike gold or bonds, rental properties provide monthly cash flow. Unlike stocks, their value is supported by tangible demand for housing. And unlike most other assets, real estate combines tax benefits, leverage, and appreciation in one package.

Why Real Estate Belongs in Your Retirement Mix

Four elements make rental real estate especially attractive:

- Monthly income. Rent checks supplement Social Security or pensions.

- Tax benefits. Depreciation can reduce taxable income.

- Mortgage paydown. Tenants help build your equity by reducing loan balances.

- Appreciation. Property values rise with both demand and inflation over time.

This blend of income, equity growth, and inflation protection is difficult to match in other asset classes.

Do I Need to Buy Locally?

Not necessarily. Many investors live in high-cost markets where rental properties are too expensive to produce a profit. Fortunately, real estate is a national and even global market.

You can buy in areas where the economics make sense — where rental income exceeds expenses and housing demand is strong. With a professional property manager, you don’t need to live near your investment.

Personal Experience: Many years ago my wife and I traveled to Spain on vacation and found that people from England were buying vacation rental properties on the Mediterranean. We decided to do the same, taking another trip and finding two great properties.

Through referrals from our bank, we secured excellent property managers. Buying outside of our immediate area made financial sense, and relying on our property managers proved to be the right call. Our properties generated very good returns, while the managers handled all the issues — maintenance, tenants, and day-to-day operations. All we had to do was find a home for the income.

🌍 Personal Experience: Investing Abroad

Many years ago my wife and I traveled to Spain on vacation and noticed that people from England were buying vacation rental properties along the Mediterranean. We decided to do the same, returning on another trip where we purchased two great properties.

Using referrals from our bank, we found excellent property managers. Buying outside of our immediate area made financial sense, and relying on our property managers proved to be the right call. The properties generated strong returns, while the managers handled everything — maintenance, tenants, and day-to-day issues.

The result: all we had to do was find a home for the income, while our managers took care of the rest.

Many successful investors never set foot in their rental properties. Managers handle tenant issues, maintenance, and rent collection, allowing you to benefit from ownership without day-to-day stress. This makes real estate accessible even if your local market isn’t favorable.

Can You Buy Real Estate with a 401(k)? Yes — Through Self-Directed Accounts

The IRS permits retirement funds to invest in real estate, but most employer 401(k) plans restrict the menu to funds and equities. To purchase property directly, you typically need a Self-Directed IRA (SDIRA) or a Solo 401(k) (for the self-employed).

Here’s how it works:

1) Account Types

- Employer 401(k). Most do not allow direct property ownership.

- Self-Directed IRA. Allows nontraditional assets like real estate, provided the custodian permits it.

- Solo 401(k). Designed for self-employed individuals; often allows direct real estate purchases.

2) Moving Funds

If your current 401(k) doesn’t allow real estate, you may roll funds into a self-directed account:

- Direct rollover from a former employer’s 401(k) to an SDIRA avoids taxes and penalties.

- Solo 401(k) rollovers allow greater control if you’re self-employed.

3) Titling and Compliance

- The property is titled in the account’s name (e.g., “XYZ Trust Company FBO Jane Doe IRA”).

- All income and expenses must flow through the account — not your personal bank account.

- You and close family members (spouse, parents, children) cannot use or live in the property.

Violating these rules creates a prohibited transaction, which can collapse the account’s tax advantages.

Important note about SDIRAs:

When using a Self-Directed IRA, understand that 100% of the income after expenses earned from your real estate investments must go back into the SDIRA. You may not touch any of this income unless you are willing to pay early withdrawal penalties and income taxes, depending on your situation.

Withdrawing funds before age 59½ generally triggers a 10% penalty plus ordinary income taxes. Even after retirement age, any distributions you take from a traditional SDIRA are taxed as ordinary income, because the funds originated from a tax-advantaged account.nt’s tax advantages. Check out the IRS rules for Self-Directed IRA

⚠️ Important SDIRA Withdrawal Rule

When using a Self-Directed IRA (SDIRA), 100% of the income earned from your real estate investments after expenses must stay inside the account. You cannot withdraw this income for personal use until you qualify for distributions.

- Withdrawals before age 59½ usually trigger a 10% penalty plus income taxes.

- Even after 59½, distributions from a traditional SDIRA are taxed as ordinary income.

- Removing funds early could collapse the tax-advantaged benefits of your account.

Bottom line: Let the income compound inside the SDIRA until retirement age to preserve your tax advantages.

4) Using Mortgages

- Self-Directed IRA: You may use a non-recourse mortgage, but debt-financed income may trigger UBTI (Unrelated Business Taxable Income) and require filing Form 990-T. Read our article on self employment plans here.

- Solo 401(k): Often avoids UBTI on leveraged real estate under IRC §514(c)(9), giving it a significant advantage for investors planning to borrow.

💡 Pro Tip: Solo 401(k) Advantage

If you plan to use financing when buying real estate with retirement funds, consider a Solo 401(k). Unlike an IRA, a Solo 401(k) often avoids the Unrelated Business Taxable Income (UBTI) tax on debt-financed property under IRS rules.

This means you can use non-recourse leverage to grow your portfolio without facing the extra tax burden that can apply to IRAs. For self-employed investors, this can be a significant advantage.

Bottom line: The Solo 401(k) is often the better vehicle if you want to borrow money for real estate inside a retirement plan.

5) Management

You can make high-level decisions (buy, sell, hire managers), but you cannot provide “sweat equity” by personally repairing or improving the property. Expenses must be paid from the retirement account, and rents must flow back into it.

6) Required Minimum Distributions (RMDs)

Traditional IRAs and 401(k)s require withdrawals starting at age 73 (75 beginning in 2033). If your retirement account owns property, you’ll need to ensure enough cash is available for RMDs — which may require planning sales or partial distributions.

Pros and Cons

Pros:

- Tax-deferred or tax-free growth (Roth)

- Diversification away from Wall Street

- Potential for steady cash flow and appreciation

Cons:

- Complex IRS compliance rules

- Illiquidity — property isn’t as easy to sell as stocks

- Risk of UBTI for IRAs using debt

- RMD planning challenges

Diversification

It’s very important to own a balanced portfolio. Diversification protects against swings in economic cycles and market corrections. Don’t put all of your funds into real estate — or into any single asset class.

Even within equities, spread investments across sectors and risk levels. Always ask yourself, “What if?” before concentrating too heavily in one place.

The same logic applies to real estate. You can diversify within the asset class by owning different types of properties. For example, a duplex or fourplex can provide multiple streams of income under one roof, while adding single-family rentals spreads out risk from tenant turnover. A thoughtful mix reduces volatility and helps ensure steady cash flow.

Final Thoughts

Your 401(k) is more than just a savings plan. It’s a platform for multiple investment types — stocks, bonds, gold, and yes, real estate. While each category has its strengths, residential rental real estate offers a unique combination of income, appreciation, and inflation protection. Buy real estate with your 401k.

With the right structure — especially through a Self-Directed IRA or Solo 401k — you can put your retirement dollars to work in tangible assets that build wealth for the long haul. If you are Gen X, this article will provide more information about your 401k.

FAQ: Real Estate, 401(k)s, and Diversified Retirement Investing

1) What types of investments can I hold inside a typical 401(k)?

2) How do stocks, bonds, gold, and real estate each help in retirement?

- Stocks: Highest long-term growth potential, but volatile.

- Bonds: Income and stability, but sensitive to interest rates.

- Gold: Store of value/hedge, but no income or equity build.

- Real estate: Cash flow (rents) + equity growth (paydown & appreciation) + tax benefits.

3) Can I buy real estate with retirement funds?

4) What are the key IRS rules when a retirement account owns property?

- Title property in the account’s name (not yours personally).

- All income/expenses must flow through the retirement account.

- No personal use or self-dealing by you or “disqualified persons.”

- No sweat equity (don’t personally perform repairs/rehabs).

5) What’s the difference between buying with an SDIRA vs. a Solo 401(k)?

SDIRA: Can use non-recourse loans, but debt-financed income may trigger UBTI and require filing Form 990-T.

Solo 401(k): Often avoids UBTI on leveraged real estate under specific rules, which can be advantageous if you plan to borrow. (Still must use non-recourse debt and follow plan rules.)

6) How do Required Minimum Distributions (RMDs) work if my account owns real estate?

7) Do I need to buy rental property locally?

8) How should I diversify within real estate?

9) What’s a simple framework to evaluate a rental before buying?

- Cash flow test: (Rents – all expenses) should be positive with a vacancy reserve.

- Cap rate: Net Operating Income ÷ Purchase Price.

- Debt coverage: NOI ÷ Annual Debt Service (target ≥ 1.20–1.30).

- Sensitivity: Stress-test for lower rents, higher vacancies, and higher repairs/insurance.

10) Should I move everything from stocks and bonds into real estate?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.