Last updated on December 9th, 2025 at 05:12 am

This critical financial decision affects your long-term financial security and monthly cash flow during retirement. It’s for this reason that we created this article about retiring with mortgage debt in 2025. Eliminating your monthly mortgage payment can free up significant monthly income, potentially providing greater flexibility in your golden years. But paying off a mortgage loan too soon can also mean tying up assets, reducing liquidity, and missing potential investment opportunities.

As you approach retirement age in 2026, one of the key questions is whether retiring with mortgage debt makes sense or if you should pay off your home loan first. Both strategies have valid reasons behind them—peace of mind versus financial flexibility—but the best choice depends on your overall financial situation and retirement planning.

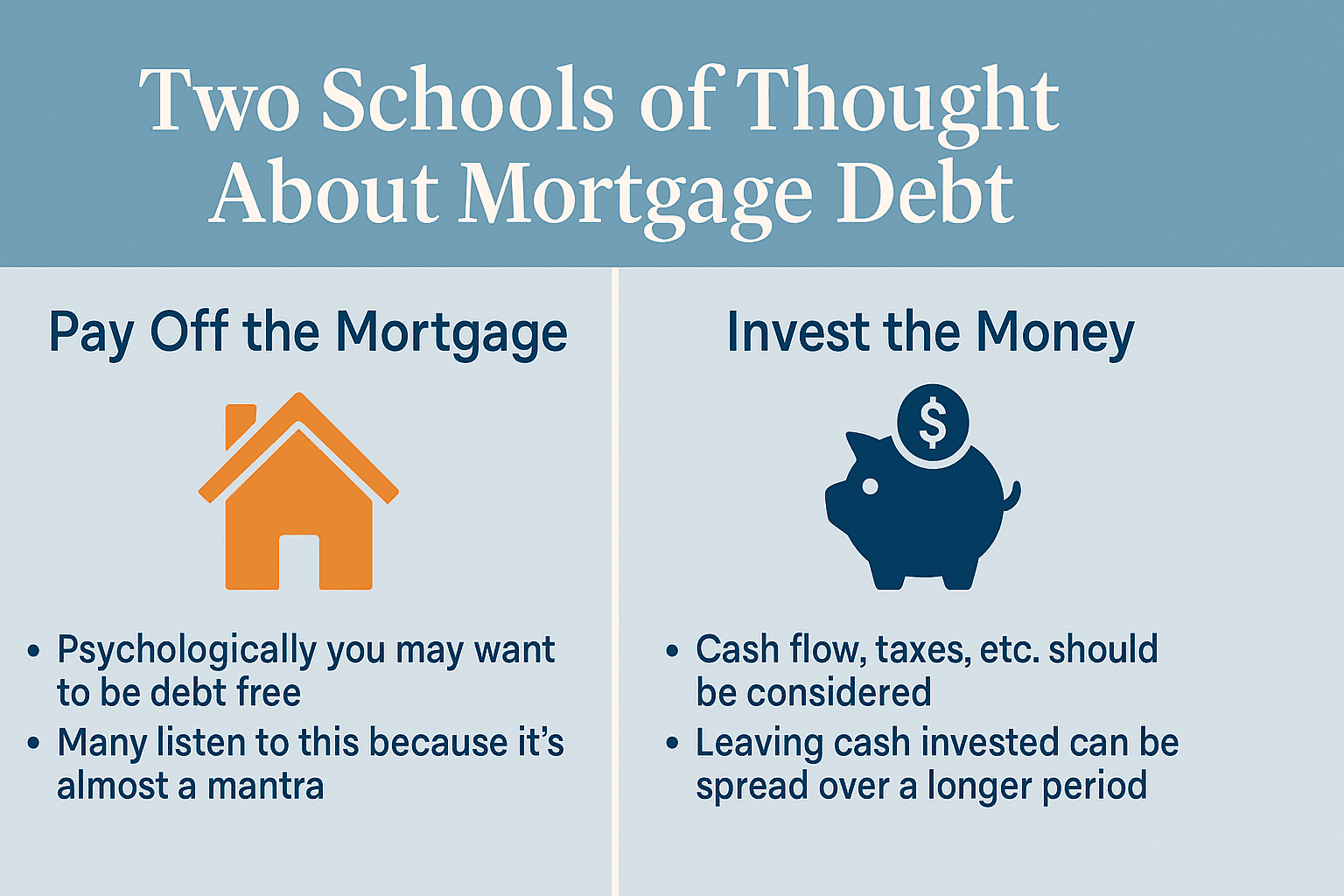

There are basically two schools of thought regarding mortgage payoff. One is “I need to pay off my mortgage before I retire,” and the other is “I can pay off my mortgage, but why would I when I can invest the money and keep the spread between the mortgage interest rate and the rate of return on investments?”

Unfortunately, many people follow the first view almost like conventional wisdom. Psychologically, being debt-free feels secure. But on the practical side, it may not be the right choice for everyone. You may need to rethink the concept of retiring with mortgage debt in 2025.

Key Takeaways

- Paying off your mortgage debt before retirement can lower monthly expenses and reduce interest payments.

- Not having a mortgage means fewer bills and can help manage unexpected expenses better.

- Using a lump sum payoff may reduce liquidity and miss investment returns from the stock market, mutual funds, or other retirement accounts.

- Think about current mortgage rates, your retirement savings, other types of debt like credit cards or student loans, and your debt-to-income ratio.

- Refinancing or making extra payments can help manage household debt without fully paying it off early.

Benefits of Paying Off Your Mortgage Before Retirement

Reduced Monthly Expenses

Eliminating your mortgage cuts down your financial obligations. Without a monthly mortgage payment, you’ll have more extra cash for ongoing costs like property taxes, homeowners’ insurance, and maintenance.

Lowering monthly expenses helps stretch your retirement income further. For older adults and senior citizens, this stability can be a good fit for a fixed-income lifestyle.

Lower Lifetime Interest Costs

By paying off early, you reduce interest payments over the life of the loan term. This builds financial stability faster. While you might lose some tax deductions from mortgage interest, lower debt levels overall are rarely a bad thing.

Increased Financial Flexibility in Retirement

Without debt, you’ll enjoy fewer bills and more choices. For many older Americans, this means more money for travel, hobbies, or family support. But remember, property taxes and insurance remain—and may increase as home values rise.

Stay with Current Loan

Refi Scenario

- Monthly savings: If payment drops meaningfully, refi may improve cash flow on fixed income.

- Breakeven months: If you won’t keep the loan past breakeven, refi may not be worth it.

- FV of cash retained: If you keep your cash (e.g., don’t pay closing costs), see what it could grow to.

- Horizon totals: Compares total paid/interest over your chosen period for each path.

Simplifies tax and fee nuances; for precise advice, consult a fiduciary financial advisor.

Drawbacks of Paying Off Your Mortgage Before Retirement

Reduced Liquidity

Paying with a lump sum from your retirement accounts (like a 401(k) or IRA) can trigger tax implications, drain liquidity, and reduce your flexibility. Once tied up in home equity, those funds are not easily accessible.

Potential Lost Investment Opportunities

Money used to pay down a mortgage could be invested in mutual funds, low-risk investments, or the stock market, potentially earning higher investment returns. In 2025, the IRS allows contributions up to $23,500 in 401(k) plans and $7,000 for IRAs—opportunities many miss if all funds go toward home equity.

Longevity Risk

With people living into their 80s and 90s, tying up savings too early could create financial difficulties later. A debt-free house doesn’t help with medical bills or long-term care if liquidity is gone.

Medical and Long-Term Care Costs

Unexpected expenses like illness can devastate finances. Medicare doesn’t cover everything, and senior citizens may face large out-of-pocket costs. Without liquid reserves, you may need to tap home equity loans or a reverse mortgage later, sometimes at a high interest rate.

Case Studies: Retiring with Mortgage Debt in Practice

Case Study 1: Downsizing to the Gulf Coast

A California homeowner sells an $800,000 primary residence with a $350,000 mortgage, clearing $394,000. They buy a $400,000 home on the Mississippi Gulf Coast with a new mortgage of $320,000 and invest the remaining $306,000.

At a 6% rate of return, investments generate $1,572/month—covering the mortgage loan payment.

Lesson: Keeping a mortgage while investing freed cash for both housing and growth.

Case Study 2: Refinancing Before Retirement

A couple with a 30-year mortgage at 6.5% debates payoff. Instead, they refinance into a lower interest rate of 5.75%. Their monthly payments drop, improving cash flow.

Lesson: A refinance can be a good idea—balancing reduced debt payments without draining savings.

📌 See: Mortgage refinance in 2025–2026.

Case Study 3: Paul & Sarah — Pitfalls of Paying Off Too Soon

Paul and Sarah used their 401(k) to pay off a 4% mortgage. Taxes on withdrawals drained savings. Three years later, Paul’s illness required costly care. They refinanced at 7% to pay bills.

Lesson: Using retirement accounts for payoff without planning can backfire, leaving retirees house-rich but cash-poor.

Case Study 4: Sally & George — Choosing Peace of Mind

Sally pushed to pay off early due to her family’s health history. By retirement, the home was debt-free. George had lower financial obligations and stability if Sally passed away.

Lesson: Sometimes peace of mind is worth more than maximizing investment opportunities.

Case Study 5: Jennifer & Bill — How Debt and Homestead Protection Saved Their Assets

Jennifer and Bill own a home with a mortgage loan that equals about 80% of the home’s value. Both also maintain growing retirement accounts in their 401(k)s. Just before retirement, their teenage son was involved in a school fight that injured another student. The injured student’s parents sued Jennifer and Bill, and the damages exceeded what their homeowners’ insurance would cover.

A judgment was entered against them. However, because they had homesteaded their home, the limited equity they held was legally protected. Their 401(k) accounts were also fully shielded under federal law. With no other attachable assets, their attorney had leverage to settle the case for what the insurance company agreed to pay.

Lesson: By carrying a mortgage and homesteading their free equity, Jennifer and Bill avoided losing their primary residence and retirement savings. Had they paid off their mortgage (which was their plan originally), the court could have taken their home to satisfy the judgment. Sometimes, keeping a mortgage is not only a matter of financial planning—it’s a matter of legal protection.

Legal Protection Considerations

- Retirement accounts (401(k), IRA) are shielded from creditors.

- Many states protect primary residence equity via homestead laws.

- Carrying a mortgage lowers exposed equity, making lawsuits less threatening.

⚖️ This varies by state; see state homestead exemptions.

Gen X Perspective

Gen X faces heavier household debt than Boomers—student loan debt, car loans, and credit card balances. Many will enter retirement with higher debt-to-income ratios.

For them, mortgage payoff decisions must be weighed against paying high-interest debt like credit cards or student loans.

📌 See: Gen X Retirement Guide

Factors to Consider Before Deciding

- Mortgage interest rate vs. potential rate of return on investments.

- Retirement savings and income streams: pensions, Social Security benefits, steady income sources.

- Other debt: prioritize credit card debt, student loan debt, or car loans first.

- Credit score: matters for refinancing or a home equity conversion mortgage (HECM).

- Debt levels: know your total amount of debt and all financial obligations.

- Cash flow: run scenarios with and without a mortgage.

Alternative Strategies to Manage Mortgage Debt

- Refinance for lower rates (FHA, Fannie Mae, and Federal Housing Administration programs may help).

- Extra payment strategies (biweekly or lump sums).

- Home equity loans or HELOCs for liquidity.

- Reverse mortgage (HECM) in later years—regulated by the federal government.

- Maintain the mortgage and invest extra money for potentially higher capital gains.

Best for

- Seeking peace of mind, simplicity, and lower monthly expenses on fixed income.

- Higher mortgage interest rate or short remaining loan term.

- Limited appetite for stock market risk or few attractive investment opportunities.

- Health/family priorities where stability for a spouse is paramount.

Benefits

- No monthly mortgage payment; fewer bills to track.

- Lower lifetime interest payments.

- Psychological relief in the golden years.

Watch-outs

- Liquidity risk: “house-rich, cash-poor” if a lump sum drains retirement accounts.

- Tax implications from large 401(k)/IRA withdrawals.

- You still owe property taxes, insurance, and maintenance.

Best for

- Low mortgage rates relative to expected after-tax rate of return.

- Need to preserve cash flow and emergency reserves; desire for financial flexibility.

- Comfort with disciplined investing (e.g., mutual funds, diversified portfolios).

- Value of legal protections (homestead + protected retirement accounts).

Benefits

- Potentially higher investment returns than the after-tax mortgage cost.

- Maintains liquidity for unexpected expenses (medical, repairs).

- Possible asset-protection advantages if equity is limited and homesteaded.

Watch-outs

- Market volatility & sequence-of-returns risk.

- Behavioral risk: staying invested through downturns.

- Ongoing monthly payments must fit your budget if retirement income drops.

- Compare after-tax mortgage interest rate vs after-tax expected investment returns.

- Stress-test your budget for: loss of one Social Security benefits check, higher ongoing costs, and medical shocks.

- Avoid large lump sum payoffs from retirement accounts without modeling the tax implications.

- Consider legal protections (homestead, 401(k)/IRA shielding) and your need for liquidity.

- When in doubt, consult a fiduciary financial advisor about your specific situation.

Work With a Financial Advisor

The right choice depends on your specific situation. A financial advisor or financial planner can help you evaluate:

- Types of debt and debt levels.

- Tax implications of a lump sum withdrawal.

- Good news vs. bad thing scenarios in your plan.

- How a payoff or refinance affects credit score and monthly expenses.

- Whether your strategy is a good fit for your financial life.

Look for fiduciary advisory services regulated under the Equal Credit Opportunity Act.

Conclusion

For older Americans and senior citizens, the decision to pay off or keep a mortgage affects financial stability for decades. A payoff lowers monthly expenses and can feel like the right choice emotionally. But keeping a mortgage often makes more financial sense, preserving liquidity and creating room for investment opportunities.

Ultimately, the smartest path balances financial planning with peace of mind. For some, being debt-free is a good idea. For others, holding a low-rate home loan while investing creates good news: stronger returns, more flexibility, and lasting security through the golden years.

Learn more by reading these articles

📌 If you’re Gen X, don’t miss our Gen X Retirement Guide.

📌 Explore refinancing options in our Mortgage Refinance 2025–2026 guide.

1) What does “retiring with mortgage debt in 2025” really mean?▸

2) Is retiring with mortgage debt in 2026 a bad idea?▸

3) How do I decide between paying it off or keeping it when retiring with mortgage debt in 2026?▸

4) Should I use a lump sum from my 401(k) or IRA to pay off the mortgage?▸

5) What budget assumptions should I test before retiring with mortgage debt in 2026?▸

6) Do property taxes and insurance go away if I pay off the mortgage?▸

7) When is refinancing better than paying off the loan before retirement?▸

8) How does sequence-of-returns risk affect keeping a mortgage in retirement?▸

9) Are there legal protections that support keeping a mortgage?▸

10) What role does credit card or student loan debt play in this decision?▸

11) How large should my emergency fund be if I’m retiring with mortgage debt in 2026?▸

12) Do reverse mortgages or HELOCs have a place in retirement planning?▸

13) How do Social Security benefits factor into this choice?▸

14) What if my mortgage rate is under 5%—should I still pay it off?▸

15) When should I talk to a financial advisor about retiring with mortgage debt in 2026?▸

Educational only—please consult a fiduciary financial advisor and qualified attorney for personalized guidance.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.