Last updated on January 23rd, 2026 at 08:28 pm

The purpose of this guide is to give you a clear path through the complexity of the Great Wealth Transfer. We’ll move beyond buzzwords and sales pitches to focus on what matters most: keeping what you’ve earned, protecting your family, and preparing the next generation to manage wealth responsibly.

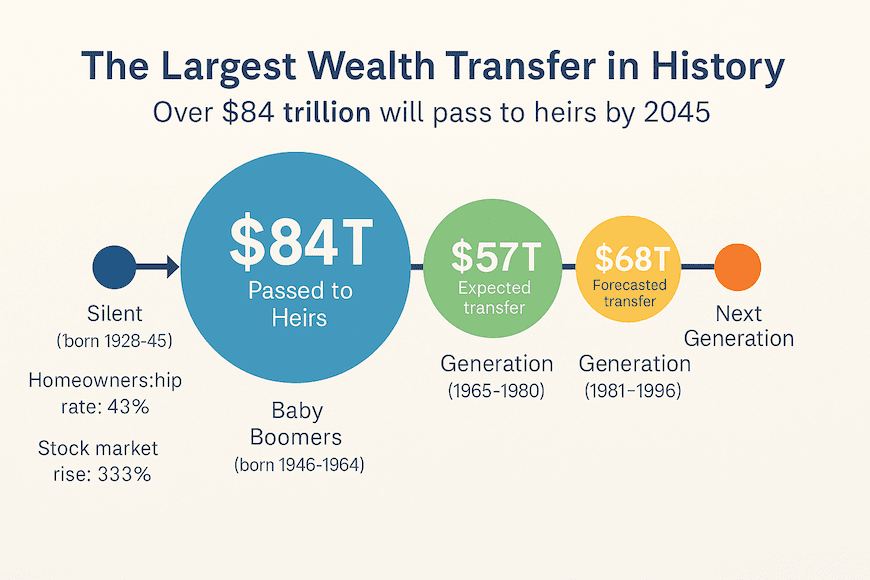

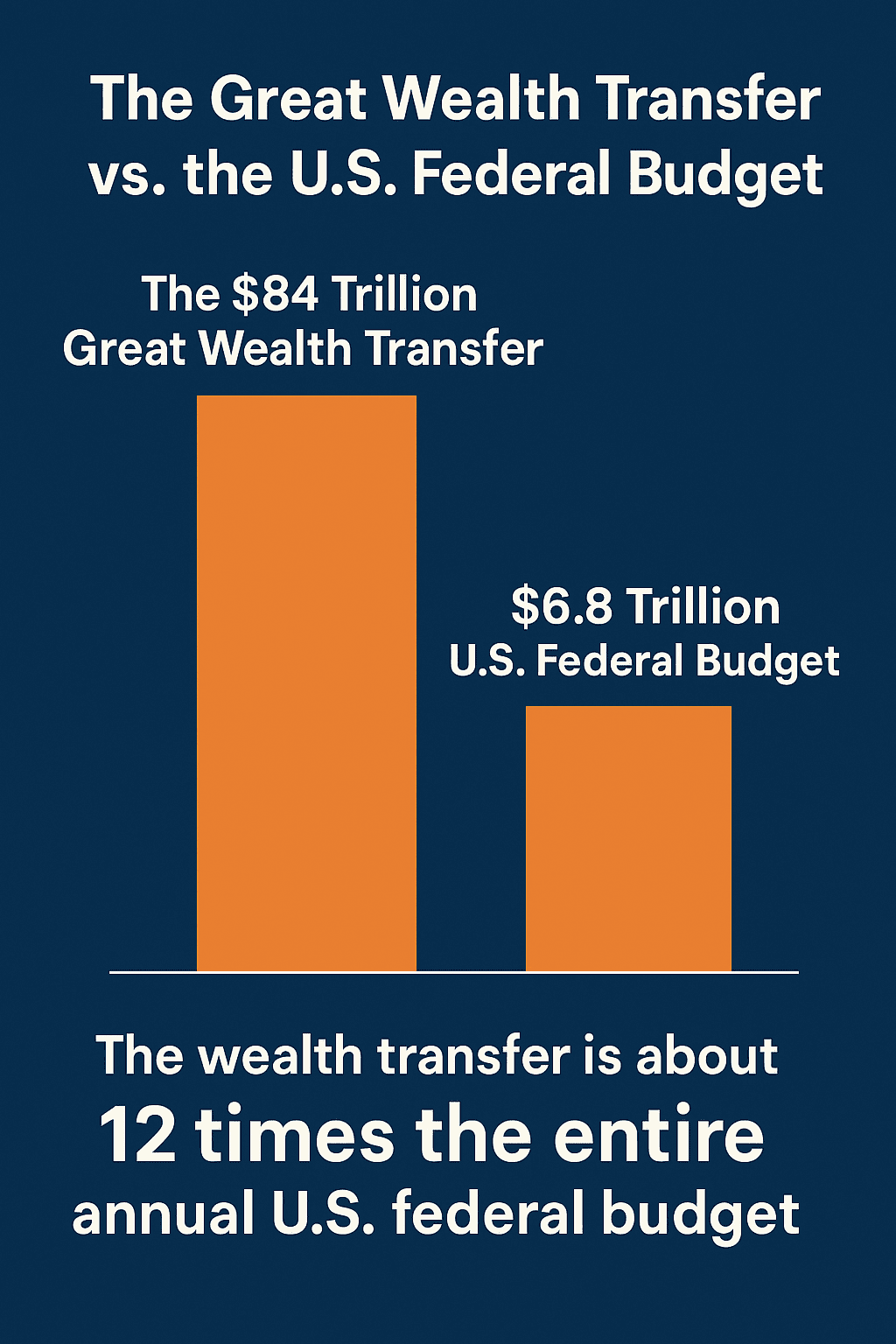

Over the next two decades, an estimated $84 trillion will shift from Baby Boomers to younger family members and charities. How that wealth is transferred—wisely or poorly—will determine the financial stability of millions of American families.

For most Boomers, this transfer won’t happen overnight. It will unfold gradually through gifts, real estate titles, trusts, business ownership changes, and investment accounts. Every step requires planning, and every mistake can be costly.

This article will walk you through each stage of the process. You’ll learn:

- How federal and state inheritance taxes affect your estate.

- Why choosing the right trust structure can prevent legal battles.

- How to plan for real-estate transfers and business succession.

- Retire in a state that won’t tax retirement incomeWhen relocation to a low-tax state such as Mississippi may make sense.

- And how to communicate your plan clearly so heirs understand your intentions.

Our downloadable tools, checklists, and infographics will help you organize your information before you meet with professionals. Think of this as your pre-planning roadmap—the work you do here will save you money later and help ensure your legacy reaches the people and causes you care about.

In 1776, our forefathers were planning to pass along their wealth as the new United States allowed them. Read this fascinating article that compares what 1776 tells us about wealth transfer.

Generational Perspectives on Wealth

Every generation builds and views wealth through a different lens. The experiences that shaped each group—war, recession, technology, inflation—also shape how they save, invest, and share what they’ve earned. Understanding these perspectives helps families find common ground when planning the Great Wealth Transfer.

The Baby Boomers: Work Ethic, Legacy, and Caution

Born between 1946 and 1964, Baby Boomers grew up during one of the most prosperous periods in American history. They benefited from post-war expansion, strong job markets, and rising home ownership. For most Boomers, wealth wasn’t inherited—it was earned.

That experience shaped a generation that values hard work, frugality, and self-reliance. Boomers tend to see wealth as something to be preserved and used wisely, not quickly distributed. They often emphasize education, work ethic, and responsible money management as part of their legacy. Many Boomers want to guide their children rather than simply hand them a check.

Surveys consistently show that Boomers prefer to retain control of their assets for as long as possible. In Schwab’s 2024 High Net Worth Investor Survey, only 19% of Boomers plan to transfer significant wealth during their lifetime. They want to help, but they also want to ensure their own financial security through retirement and potential long-term care needs.

💬 Call-Out: A Generation That Worked Hard and Gave Back Later

Baby Boomers are often remembered as parents who worked long hours and spent less time with their children compared to Gen X and Millennials. There’s some truth to that perception—Boomers inherited a powerful work ethic from their own parents.

Most Baby Boomers did far better financially than the generation before them. In many families, every sibling earned more than their parents early in life. The price for that success was time. Long workdays, lengthy commutes, and the constant pursuit of career stability left less time for family life.

Younger generations sometimes criticize that trade-off, but it’s important to view it in context. The wealth Boomers are now passing down is, in many ways, a delayed reward—a payback of sorts. While it can’t replace missed moments from childhood, this Great Wealth Transfer is a way for Boomers to give their children something lasting: financial security that may carry them into retirement and beyond.

Gen X and Millennials: Flexibility and Early Action

Gen X (born 1965–1980) and Millennials (born 1981–1996) entered adulthood under very different circumstances. Many faced recessions, housing crises, and student-loan debt. They are more open to unconventional investing—rental real estate, index funds, or multiple income streams—and they value financial flexibility over traditional retirement structures.

The same Schwab study revealed that over half of Millennials (52%) plan to transfer wealth while they’re still alive. They see sharing money with family now—as down-payment help, college funding, or business support—as part of their living legacy. They also show more comfort using technology for investing and managing estates, from digital vaults for important documents to online trusts and wills.

📊 Generation Comparison: Wealth Transfers

| Generation | Estimated Transfer Amount | Timeframe & Recipients | Notes |

|---|---|---|---|

| Baby Boomers (and sometimes including the Silent Generation) | Approx. $84.4 trillion total (of which ~$72.6 trillion to heirs) by ~2045–2048. Cerulli Associates+2Wikipedia+2 | To Gen X, Millennials & younger generations | Boomers hold ~52 % of U.S. private wealth and will transfer the majority of it. Action News Jax+1 |

| Generation X | While specific overall transfer numbers from Gen X aren’t always clearly separated, one source estimates Gen X is set to inherit the greatest portion of assets in the next 10 years (≈$14 trillion by ~2033) from the Boomers. Cerulli Associates+1 | Gen X often positioned as intermediary: inheriting from Boomers, then later passing to younger generations | Gen X will likely become the new “wealth‐holding” generation before passing on wealth themselves. |

| Future Generation Transfers (Gen X to Next Gen) | Concrete forecast numbers for Gen X → “next generation” aren’t as widely published. However, given Gen X will inherit large assets, they will subsequently transfer wealth to their children and younger heirs in coming decades. | Next generation = adult children of Gen X, Millennials, Gen Z | This upcoming transfer is part of the long-term wealth-transfer process, meaning the planning you do today will affect them too. |

🔍 Key Takeaways

- The scale of the Boomers’ transfer is unprecedented: Tens of trillions of dollars changing hands.

- Gen X is uniquely positioned: they will receive much of the Boomer wealth and later pass it on, so their decisions matter twice.

- While the headline numbers focus on Boomers, the “next frontier” is Gen X → the next generation. That means planning today for how your legacy flows through more than one step.

- The fact that Gen X heirs will inherit and then become transferors means intergenerational planning (not just one step) is critical.

- Because much of the transfer is still happening, tools like trusts, gifting strategies, and other estate-planning techniques you emphasize will matter now and later.

Want to compare retirement accounts that can help reduce taxes now or later? Use this guide to understand the most common tax-advantaged options and how they typically work.

Read the guide →Bridging Generational Gaps

These differences aren’t conflicts—they’re opportunities for conversation. Baby Boomers often have the experience, while their heirs have access to new tools and ideas. A successful wealth-transfer plan blends both: Boomers’ focus on stewardship with younger generations’ openness to technology and diversification.

When families discuss legacy planning early, everyone gains. Parents feel confident their wishes will be honored; children understand expectations and learn the mechanics of managing assets. The Great Wealth Transfer isn’t just about moving money—it’s about passing along the knowledge and values that built it in the first place.

2. The 2026 Estate-Tax Reset Has Arrived

Beginning January 1, 2026, the federal estate-tax exemption has been cut roughly in half, returning to inflation-adjusted levels of about $6.8 million per person (down from $13.61 million in 2025). This reduction—built into the 2017 Tax Cuts and Jobs Act—means that many Baby Boomers who were once safely below the limit now face potential exposure.

If the total value of your estate—including your home, retirement accounts, life-insurance proceeds, and business interests—exceeds the new exemption, the excess is taxed at up to 40 percent. Married couples can still combine exemptions through portability, but only with proper documentation.

This reset makes early action critical. Families should revisit wills and trusts, consider strategic lifetime gifts, and explore charitable or irrevocable-trust options that can remove appreciating assets from the taxable estate. The sooner these steps are in place, the more flexibility you’ll have under the new 2026 rules.

💬 Call-Out: Stay Alert—Tax Laws Can Change Again

Pay attention to proposed legislation that could further alter estate-tax rules. Many public voices argue that the “rich” are not paying enough, and unfortunately, anyone with more money than they have often falls into that category. You may not be earning billions, but what you have built, you want to keep and pass along.

For example, California is circulating a petition to impose a one-time “billionaire fee,” and similar ideas appear in national debates whenever politicians seek quick popularity. As 2026 ushers in a substantial reduction in the federal estate-tax exemption, remember that future changes are always possible.

Even if you’ve completed your planning, stay informed. Review your plan every year or two and adjust as laws evolve. Taking action promptly is the best way to preserve the wealth you’ve earned and protect your family’s legacy from shifting political winds.

3. Organize and Store Everything

Before you seek help from a professional, you must organize your life—on paper or digitally. Start by gathering every important legal document: deeds, mortgage notes, insurance policies, investment statements, wills, and trusts—the entire list we’ve provided below. Don’t assign this task to someone else unless you’re truly unable to do it yourself.

Sit down with a pad and pen and write down everything your advisor will need to know: basically, anything of significant value that you own, along with your debts and investments. Secure copies of the most recent statements. You’ll need to record in your record-keeping system (see below) information such as the name of the insurance company, type of coverage, contact details for your broker, and similar information for each asset or liability.

Your attorney or financial advisor will eventually transfer these personal assets into your trust or LLCs, so they’ll need every detail. The better job you do collecting and presenting this information, the less you’ll pay in professional fees. Use our downloadable Estate Planning Organizer tool in this section to record everything you find.

Create a Master Estate Binder—a single, well-organized file (physical or digital) that includes copies of your will, trust, account information, deeds, and insurance policies. Store it securely, and make sure your executor or trustee knows where to find it.

Digital storage options, such as encrypted cloud folders or estate-planning apps, make it easy to share updates securely with family members and advisors.

💬 Checklist: Build Your Legal Foundation

Before meeting with an attorney, gather these documents and records:

- Copies of deeds, titles, and property tax records

- Investment and retirement account statements

- Life-insurance policies and annuity contracts

- Most recent tax return

- List of all debts, loans, and credit accounts

- Current will, power of attorney, and healthcare directive

- Passwords or access instructions for digital accounts

Completing this checklist will save time and reduce legal fees. Most attorneys and financial planners charge by the hour—being organized ensures your money goes toward strategy, not paperwork.

Strategic Wealth-Transfer Tools (Plain-English Guide)

Once you’ve gathered your documents and organized your estate, the next step is to understand how your wealth can transfer efficiently.

There’s no one-size-fits-all approach — your strategy depends on the type of assets you own, who your heirs are, and your long-term goals.

The key is to use legal tools that protect your assets, minimize taxes, and preserve family harmony.

1. Gifting Strategies

One of the simplest and most tax-efficient ways to reduce the size of your estate is through lifetime gifting.

As of the date this article was written, you may give up to $18,000 per recipient (2025) each year without paying federal gift tax or tapping into your lifetime exemption.

If you’re married, you and your spouse can combine your exclusions and give $36,000 per person per year.

⚠️ Stay current: Congress typically indexes these allowances for inflation, so the limits may increase periodically. Always confirm the latest amounts before making large gifts. A quick call to your tax professional or a visit to IRS.gov early each year can ensure you’re using the most current figures.

Example:

If you and your spouse have three children, you can jointly gift each child $36,000 in one year. That’s $108,000transferred out of your taxable estate completely tax-free — and your children receive it immediately with no filing or legal complexity.

For larger transfers, your lifetime gift and estate tax exemption (scheduled to adjust to $6.8 million per person starting in 2026) can be used strategically. Many families use this exemption to:

- Fund an irrevocable trust that protects assets from estate taxes and creditors.

- Transfer ownership of a vacation home or rental property to children over time.

- Gift non-controlling shares of a family business to the next generation while maintaining operational control.

💡 Tip: Keep written records of every significant gift — including the date, amount, and recipient.

Your CPA or estate attorney will need this documentation if the IRS ever reviews your estate or lifetime gifting totals.

Gifting is not only a financial strategy — it’s also an emotional one. It allows you to see the impact of your generosity during your lifetime, helping loved ones pay off debt, buy homes, or start businesses, while simultaneously reducing the taxable value of your estate.

2. Trusts: Controlling How and When Assets Are Used

Trusts are the cornerstone of most successful estate plans. They allow you to control how and when your wealth is distributed. Read our article about trusts here

Here are the most common types:

| Trust Type | Purpose | Key Benefit |

|---|---|---|

| Revocable Living Trust | Manages assets during life and passes them privately after death | Avoids probate and allows flexibility |

| Irrevocable Trust | Permanently removes assets from your estate | Reduces estate taxes and protects from creditors |

| Dynasty Trust | Holds assets for multiple generations | Minimizes taxes at each generational transfer |

| Charitable Remainder Trust (CRT) | Provides income to you or your heirs, remainder goes to charity | Generates a tax deduction and supports causes you care about |

| Irrevocable Life Insurance Trust (ILIT) | Owns life-insurance policies outside your estate | Keeps death benefits tax-free and provides estate liquidity |

🧭 Example:

You can transfer a rental property into a revocable living trust to bypass probate.

Your successor trustee can immediately manage it upon your passing — no court delays, no extra fees.

3. Life Insurance as a Planning Tool

Life insurance isn’t just income replacement; it’s a strategic tool for covering estate taxes, equalizing inheritances, or funding business buyouts.

Example:

Let’s say your son will inherit the family business, but your daughter won’t be involved. You can use a life insurance policy to provide her an equivalent inheritance in cash, ensuring fairness without splitting ownership of the company.

Certain life insurance policies can also fund buy-sell agreements for business partners, pay estate taxes, or create liquidity so heirs aren’t forced to sell valuable assets under pressure.

4. Business Succession Planning

If you own a business, wealth transfer gets more complicated — and more critical.

Without a written plan, your heirs could face confusion, taxes, or even legal disputes over ownership.

Common strategies include:

- Buy-Sell Agreements between co-owners to define how ownership transfers upon death, retirement, or disability.

- Family Limited Partnerships (FLPs) or LLCs that allow you to maintain control while transferring ownership interests gradually.

- Grantor Retained Annuity Trusts (GRATs) for high-growth business assets, letting you transfer appreciation to heirs with minimal tax.

Start by asking: Who should own or operate this business in ten years? Then create the paperwork to make that vision real — before circumstances make the choice for you.

Check Your Estate Planning Readiness

The Great Wealth Transfer will move more than $84 trillion from Baby Boomers to younger generations over the next two decades. Whether you’re just beginning or already have a plan in place, understanding your level of readiness is the best way to protect your family and your legacy. Take this quick assessment to see how prepared you are — and discover your next steps before meeting with your attorney, CPA, or financial advisor.

Estate Planning Readiness Calculator

Answer these quick questions to see how prepared you are for the Great Wealth Transfer and what your best next steps might be.

🧭 The Family Meeting Planner: A Practical Tool for the Great Wealth Transfer

Purpose

This planner helps Baby Boomers, Gen X, and their families structure meaningful, productive conversations about inheritance, estate planning, and financial responsibilities.

It reduces confusion, prevents conflict, and makes sure everyone understands the family’s wishes and values.

Sections & Example Fields

1️⃣ Meeting Overview

| Field | Example |

|---|---|

| Meeting Date | January 15, 2026 |

| Location | Home, Office, or Virtual |

| Organizer | “Peter Smith” |

| Facilitator (if using attorney/advisor) | “Tal Braddock – Estate Attorney” |

| Main Purpose | “Discuss creation of family trust and distribution plans” |

2️⃣ Attendees

Allow multiple entries:

- Full Name

- Relationship to You

- Role (e.g., executor, beneficiary, trustee)

- Contact Email / Phone

- Notes (“Prefers Zoom calls; CPA for the family business”)

3️⃣ Agenda Template

You can customize per family.

| Topic | Notes / Lead Person | Target Time |

|---|---|---|

| Welcome & Purpose | Organizer | 10 min |

| Review of Existing Documents (Wills, Trusts, POAs) | Estate Attorney | 20 min |

| Property & Business Assets Overview | Financial Advisor / Owner | 20 min |

| Beneficiary Discussions & Questions | All Family Members | 30 min |

| Next Steps & Follow-Ups | Organizer / CPA | 15 min |

4️⃣ Documents to Bring or Share

Checklist for attendees:

- ✅ Last Will and Testament

- ✅ Trust Agreements

- ✅ Deeds and Titles to Real Estate

- ✅ Life Insurance Policies and Annuities

- ✅ Investment and Retirement Account Statements

- ✅ List of Debts and Liabilities

- ✅ Tax Returns (Past 2 Years)

- ✅ Advance Directives & Healthcare Proxies

5️⃣ Discussion Prompts

Encourage emotional clarity as well as logistics.

- What values do you want to preserve through this transfer of wealth?

- How should real estate or business interests be handled after you’re gone?

- Do all family members understand your estate plan and roles?

- Are there charitable causes to support as part of your legacy?

- Who will act as executor or trustee, and is that person prepared?

6️⃣ Action Items & Next Steps

Let users record what to do after the meeting.

| Task | Responsible Person | Due Date | Status |

|---|---|---|---|

| Update trust documents | Attorney | 3/15/2026 | Pending |

| Schedule meeting with CPA for tax review | Organizer | 2/01/2026 | Open |

| Upload copies of deeds to secure cloud folder | Executor | 1/25/2026 | Complete |

7️⃣ Follow-Up Plan

- Schedule the next family meeting (date and format)

- Assign someone to take notes and distribute summaries

- Review progress quarterly or annually

- Revisit estate documents every 2–3 years or after major life events

💡 Pro Tip: Hold your first family meeting even if you think you’re “not ready.” The conversation itself is the most important step. Our Family Meeting Planner helps you organize the details so you can focus on what matters — communication and clarity for future generations.

Family Meeting Planner

“Download this fillable Family Meeting Planner to type your notes directly and save a digital copy with your estate documents.”

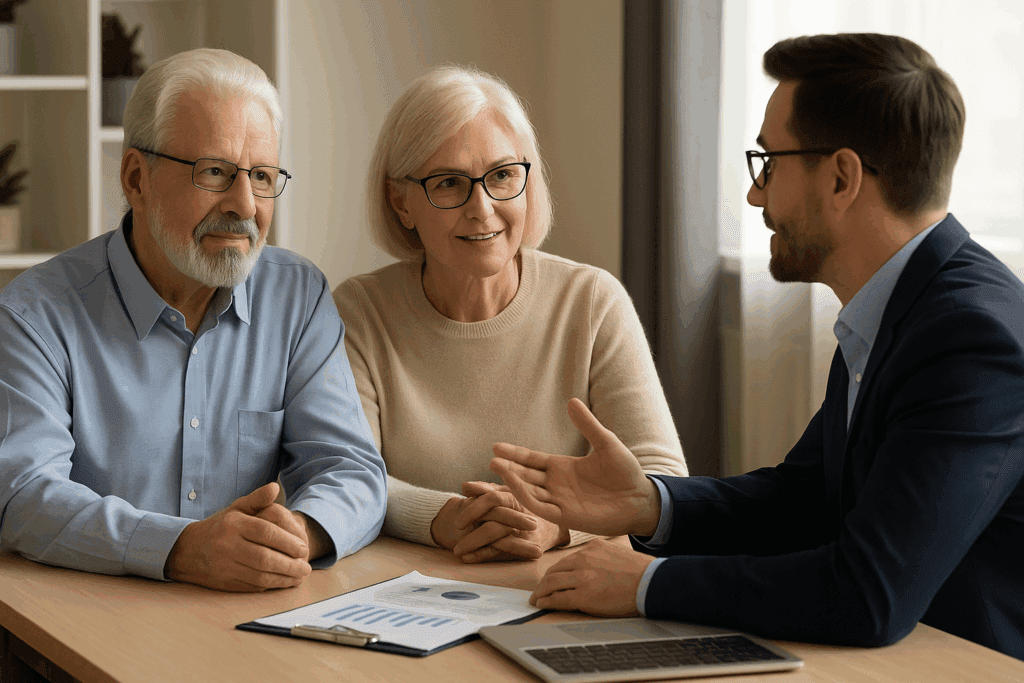

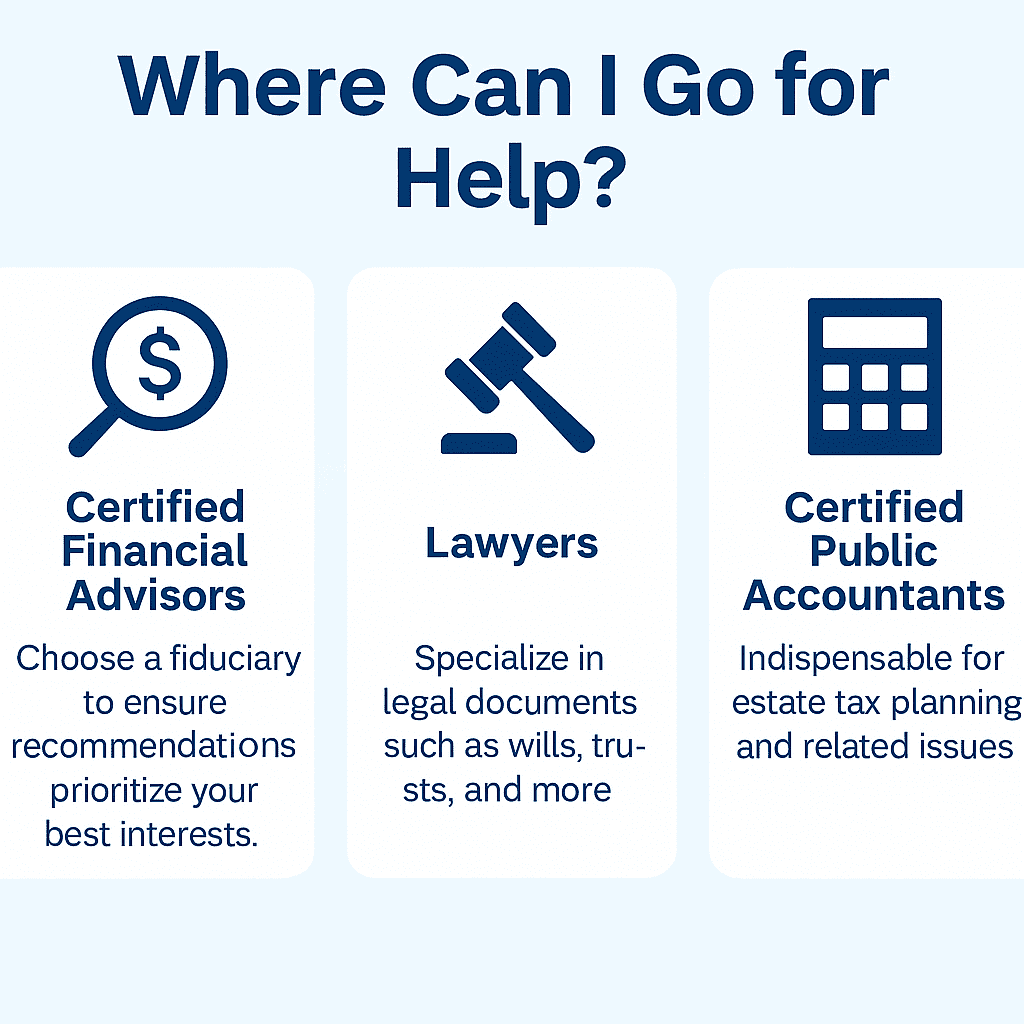

Where Can I Go for Help?

You don’t have to navigate the estate planning and wealth transfer process alone. There are three primary categories of professionals who can guide you — each with distinct roles that often overlap.

Depending on the complexity of your estate and your personal goals, you may need one, two, or even all three types of advisors to develop a complete plan. Our article about selection your professional team includes the above.

1. Certified Financial Advisors

A Certified Financial Advisor (CFA or CFP®) focuses on your overall financial planning — investments, retirement income, estate taxes, and long-term financial security for you and your family.

However, not all financial advisors are the same. The most important distinction is whether the advisor is a fiduciary or a non-fiduciary.

- A fiduciary advisor is legally obligated to act in your best interest, not theirs.

They must recommend only the products and strategies that benefit you, even if that means lower compensation for them. - A non-fiduciary advisor, often associated with commission-based firms, may recommend investment products or insurance policies that earn them higher commissions — even if better alternatives exist.

💡 Always choose a fiduciary.

Ask your advisor directly: “Are you a fiduciary, and will you act in my best interest at all times?”

The right financial planner can help you structure retirement accounts, choose investment products, and coordinate with your CPA and attorney to ensure every decision aligns with your legacy goals.

2. Lawyers

Your attorney’s primary role is to prepare and review the legal documents that form the backbone of your plan:

- Wills

- Trusts (revocable and irrevocable)

- Powers of attorney

- Healthcare directives

- Transfer-on-death deeds and beneficiary designations

An estate attorney ensures that your wishes are enforceable and that your assets are distributed according to your instructions — not the court’s.

They can also structure irrevocable trusts, charitable remainder trusts, or family limited partnerships to protect significant wealth and reduce exposure to estate taxes.

⚖️ Tip: Choose an attorney who specializes in estate planning, not just general law.

A good estate lawyer will coordinate closely with your financial advisor and CPA to integrate the legal, financial, and tax sides of your plan.

3. Certified Public Accountants (CPAs)

Since much of estate planning is also tax planning, a Certified Public Accountant (CPA) plays an essential role.

They can estimate future tax liabilities, evaluate annual gift tax exclusions, and prepare strategies to reduce the tax burden on your heirs.

CPAs also help ensure compliance with federal and state reporting rules, calculate capital gains, and guide you through charitable giving, retirement savings distributions, and business succession accounting.

📘 Remember: Your CPA is often the professional who keeps your plan current. Tax laws change regularly, and your CPA can update your strategy when new exemptions, deductions, or filing rules take effect.

For Smaller Estates

If your estate is modest or straightforward, you may not need an entire team of professionals.

Many smaller estates can be planned with reliable online resources and the guidance of a CPA for tax filings and basic legal advice.

Free or low-cost document-preparation tools can help you draft a simple will, name beneficiaries, and organize your financial assets without significant cost.

🧭 Bottom line: The sooner you assemble the right team — even if it’s just a CPA and a fiduciary financial advisor — the smoother and more affordable your planning process will be.

🧭 DIY Estate Planning vs. Professional Help

| Situation | DIY Planning May Work | When You Need Professional Help |

|---|---|---|

| Estate Size | Small estates under federal and state tax thresholds | Large or complex estates involving multiple properties, trusts, or businesses |

| Legal Documents | Simple wills or basic beneficiary designations | Complex trusts, LLCs, or blended-family situations |

| Taxes & Investments | Straightforward accounts with few assets | Estates involving investment products, retirement accounts, or estate taxes |

| Goals | Transfer property to one or two heirs | Long-term legacy planning for future generations or family businesses |

| Comfort Level | Confident using verified online templates | Want fiduciary advice, coordinated financial planning, or legal advice |

⚖️ Bottom line:

If you’re comfortable using verified online resources and your estate is simple, a DIY approach with a CPA’s tax review may be sufficient.

But for anyone with real estate, business ownership, or significant wealth, it’s worth hiring professional advisors to protect your family and your financial legacy.

Downloadable Checklist: Choosing the Right Professional Help

Before you begin working with an advisor, attorney, or accountant, it’s important to ask the right questions. The quality of your estate planning, financial advice, and tax guidance depends on the expertise and ethics of the professionals you choose. To make the process easier, we’ve created a simple, printable checklist that outlines the key questions to ask before hiring a Certified Financial Advisor, CPA, or Estate Planning Attorney. Use it as your guide during initial interviews — it will help you identify true fiduciaries, understand service fees, and select the professionals who best align with your goals and values

💬 Call-Out: Control the Outcome, Don’t Leave It to Chance

Estate planning is about control — controlling how your wealth moves, who benefits, and how much goes to taxes.

The government already has a plan for your estate if you do nothing; it’s called probate.

Your plan — using gifts, trusts, and strategic insurance — ensures your wishes are honored and your family avoids unnecessary stress, delays, and expense.

Frequently Asked Questions About the Great Wealth Transfer & Estate Planning

1. What is the Great Wealth Transfer?

The Great Wealth Transfer refers to the historic shift of wealth from the Baby Boomer generation to younger generations (Gen X, Millennials, and Gen Z). Over the next two decades, more than $84 trillion in assets is expected to move through inheritance, gifts, and estate plans.

2. Why is this wealth transfer larger than anything in the past?

Baby Boomers benefited from decades of economic growth, rising real estate values, stock market gains, and employer-sponsored retirement plans. As a result, they hold more private wealth than any previous generation. When they pass this wealth on, the total amount transferred will be larger than any prior intergenerational wealth transfer in history.

3. Who needs an estate plan?

Almost everyone. If you own a home, have retirement accounts, life insurance, a business, or savings, you need at least a basic estate plan. Without a will or trust, state law and the probate court will decide who gets what, which can be slow, expensive, and stressful for your family.

4. What’s the difference between a will and a trust?

A will is a legal document that states who should receive your assets after you die, but it normally must go through probate. A revocable living trust holds your assets during your lifetime and passes them to your beneficiaries privately, usually without probate. Many families use both: a trust to manage assets and a “pour-over” will to catch anything left outside the trust.

5. What happens if I die without a will or trust?

If you die without a will (“intestate”), state law determines who inherits your property. The court appoints an administrator, and your family may have little control over the process. This can cause delays, higher legal fees, and conflict among family members who expected different outcomes.

6. How do estate taxes work at the federal level?

The federal estate tax applies to estates above a certain exemption amount. Beginning in 2026, that exemption is scheduled to drop to roughly half of the 2025 level, meaning more estates may be taxable. Amounts above the exemption can be taxed at rates up to 40%. Tax laws change over time, so always check with a CPA or estate attorney for current rules.

7. Do all states have inheritance or estate taxes?

No. Some states impose additional estate or inheritance taxes, while others do not tax inheritances at all. Where you live—and where your property is located—can affect how much tax your heirs may pay. Before relocating or transferring property, talk with a professional about your specific state’s rules.

8. What is a fiduciary financial advisor and why does it matter?

A fiduciary financial advisor is legally required to act in your best interest when recommending investment products or strategies. Non-fiduciary advisors may be held to a lower “suitability” standard and can recommend products that pay them higher commissions. For most families, working with a fiduciary provides better alignment and transparency.

9. How do gifts help with estate planning?

Lifetime gifting allows you to move assets out of your estate while you are still alive. As of the date of this article, you can give up to the annual exclusion amount per recipient each year without paying federal gift tax. These limits are usually indexed for inflation, so confirm current amounts with your tax advisor. Gifting can reduce the size of your taxable estate and help younger family members today.

10. Why should I involve my family in estate planning discussions?

Family meetings can reduce confusion, build trust, and prevent surprises after you’re gone. Openly discussing your goals, your documents, and who will handle key roles (executor, trustee, healthcare agent) helps set expectations and preserves family harmony during a difficult time.

11. How often should I update my estate plan?

A good rule of thumb is to review your plan every 2–3 years, or sooner if you experience a major life event: marriage, divorce, death of a spouse, birth of a child or grandchild, sale of a business, significant change in wealth, or a move to another state. Laws change, and your wishes may change too.

12. What role does a CPA play in estate planning?

A Certified Public Accountant helps you understand the tax side of your estate. They can estimate future estate and income tax liabilities, advise on gifting strategies, and coordinate with your attorney and financial advisor. Because tax laws are complex and change frequently, having a CPA review your plan is often essential.

13. I don’t have a large estate. Do I still need professional help?

If your estate is relatively small and your situation is simple, you may be able to handle much of the planning with reputable online tools and templates, then have a CPA or attorney review your documents. However, if you own a business, multiple properties, or have a blended family, professional advice is strongly recommended.

14. How do I get organized before meeting with an attorney or advisor?

Start by listing your assets (homes, real estate, investments, retirement accounts, insurance policies) and debts, and gather your existing documents (wills, trusts, deeds, statements). Tools like an estate organizer workbook and a family meeting planner can save time and reduce professional fees by giving your advisors a clear picture from day one.

15. What’s the first step if I’m feeling overwhelmed?

Don’t try to solve everything at once. Begin with one simple step: create a basic inventory of what you own and who depends on you. Then, schedule an initial meeting with a fiduciary financial advisor, estate planning attorney, or CPA. From there, you can build the rest of your plan piece by piece with guidance from professionals who do this every day.

https://docs.google.com/spreadsheets/d/1YXdqeXWxGWNMZ836N9_OXRDqDY3oObOhFsKteJwKI-Q/edit#grid=0

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.