Last updated on December 28th, 2025 at 04:49 pm

A New Era in Coastal Retirement Investing

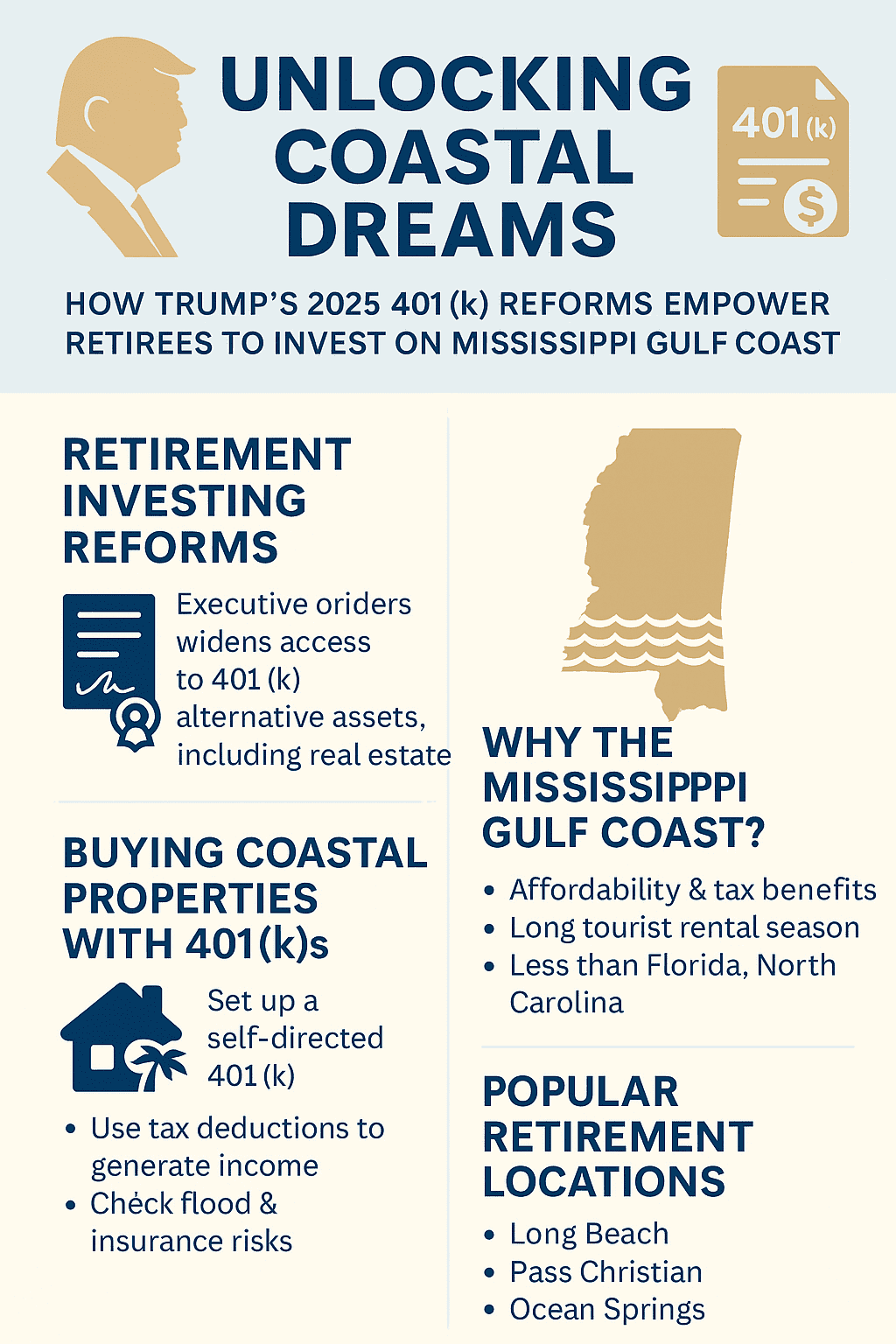

The Trump 2025 401(k) reforms have quietly unlocked a new opportunity: using your 401(k) to invest directly in real estate — even beachfront property. For retirees dreaming of coastal life but wary of inflated Florida or Carolina prices, the Mississippi Gulf Coast now stands out as a hidden gem for coastal retirement investing. With lower taxes, affordable homes, and the freedom to own income-generating property through self-directed plans, Mississippi’s shoreline is emerging as one of the smartest and most scenic ways to diversify your retirement portfolio.

Low taxes, affordable homes, walkable beach towns, and a relaxed pace make Mississippi one of the most retirement-friendly states in America. As the recent article Why I Retired in Ocean Springs, MS explains, the region delivers Gulf views without Gulf prices. Combine that with the Trump 2025 401k reforms, and retirees now have an entirely new path to achieve their beachfront dreams. Trump 2025 401k reforms.

- A New Era in Coastal Retirement Investing

- Before You Start Making Plans — Understand What Has Happened

- II. What Trump’s 2025 401(k) Reforms Actually Change

- III. Why the Mississippi Gulf Coast is the Smartest 401(k) Play for Retirees

- IV. Regional Comparison: Florida and North Carolina vs. Mississippi

- V. How to Use Your 401(k) to Buy Coastal Property

- VI. Understanding Risks on the Coast

- VII. Tax Savings and Year-End 2026 Planning

- VIII. Real-Life Examples of Retirees Building Beach Equity

- IX. Mapping Your Next Move

- X. Conclusion — The New Coastal Opportunity

- Frequently Asked Questions

Before You Start Making Plans — Understand What Has Happened

The 2025 executive order doesn’t immediately rewrite the 401(k) rulebook, but it opens the door to something new — the potential for Americans to direct part of their retirement savings into real estate and other alternative assets.

Here’s what that really means:

Opens the Door to a New Possibility

The order directs federal agencies to review and adjust regulations that currently block access to alternative investments within 401(k)s.

It specifically mentions “direct and indirect interests in real estate” as an asset class that should be considered for inclusion in future plans.

Requires Regulatory Review

The Department of Labor (DOL), Securities and Exchange Commission (SEC), and Treasury Department are tasked with reevaluating rules that make it difficult for plan participants to invest in nontraditional assets.

This could lead to updated frameworks for 401(k) providers to offer real estate options safely and transparently.

Doesn’t Guarantee Immediate Change

This isn’t a switch flipped overnight. The executive order is a directive for regulatory action, not an automatic policy change.

Actual implementation will depend on new guidance and rulemaking, which may take months or even years before participants see the full impact.

Fiduciary Responsibility Remains Key

Even after new rules are issued, whether real estate becomes an available 401(k) investment option will depend on each plan’s fiduciary — the employer or plan administrator.

They must still determine if the option is in the best interest of plan participants and consistent with fiduciary duties under ERISA.

“The 2025 executive order doesn’t instantly change your 401(k), but it opens the door for real estate to become part of your retirement plan.”

II. What Trump’s 2025 401(k) Reforms Actually Change

The Trump executive order on retirement (August 2025) directs the Department of Labor and Treasury to make alternative assets — like real estate and private equity — more accessible to 401(k) participants.

In practical terms, retirees can now use self-directed 401(k) accounts to invest in tangible assets, not just mutual funds. That means your retirement portfolio can include a beach house in Long Beach or a rental condo in Ocean Springsalongside your traditional holdings.

For context:

- Florida retirees have long looked at 401(k) real-estate rollovers, but high insurance costs and competition often limit returns.

- North Carolina retirees enjoy charming coastal havens like Arapahoe and Beaufort, but home values there have soared.

- Mississippi Gulf Coast retirees find comparable beauty — for half the price.

To understand Mississippi’s overall tax edge, see Tax Benefits of Retiring in Mississippi.

🌴 Mississippi’s Coastal Advantage

The Mississippi Gulf Coast offers the best balance of affordability and beauty for 401(k) investors. With new Trump 2025 401(k) reforms, retirees can now invest in Long Beach, Ocean Springs, and other Gulf communities through self-directed plans—earning income and enjoying coastal living.

👉 Explore listings and guidance from Logan Anderson Gulf Coastal Realtors or read more at RetireCoast.com.

III. Why the Mississippi Gulf Coast is the Smartest 401(k) Play for Retirees

1. Affordable Beachfront Living

Where else can you buy a house a block from the Gulf for under $400,000?

Long Beach, Mississippi, offers quiet beaches, wide boulevards, and elevated homes overlooking the Sound — a setting many retirees call “the Florida Panhandle 30 years ago.”

Read more: Long Beach Mississippi Community Profile.

Just east lies Ocean Springs, the coastal arts capital of Mississippi. Walkable downtown streets lined with restaurants and galleries, festivals nearly every weekend, and beach access make it perfect for those wanting lifestyle with equity. Why I Retired in Ocean Springs details how this small city draws both full-time retirees and investors. Trump 2025 401k reforms.

2. Income-Generating Beach Rentals

The Mississippi Gulf Coast enjoys a six-month rental season thanks to events like Cruisin’ the Coast and Mardi Gras. A single property can deliver both personal use and steady cash flow — perfect for a 401k rollover real estate strategy.

For tips on property management and investor relationships, see Real Estate Agents Guide to Work with Investors.

3. Tax Advantages and Policy Alignment

Mississippi exempts most retirement income from state tax, and property taxes remain low compared to Florida or North Carolina. When paired with beach property tax deductions, the result is a coastal investment that earns income and saves taxes. Trump 2025 401k reforms.

IV. Regional Comparison: Florida and North Carolina vs. Mississippi

Florida Hidden Retirement Spots — Places like Crystal River or Port St. Joe are lovely but costly; insurance and tax burdens eat returns.

North Carolina Coastal Havens — Towns such as Arapahoe and Beaufort offer small-town charm but command premium prices and higher taxes.

Mississippi Gulf Coast — From Bay St. Louis to Ocean Springs, the region delivers affordability, a growing rental market, and low property taxes — an ideal mix for coastal retirement investing.

If you’re comparing coastal states, you’ll find that Mississippi offers a far better balance of cost, tax savings and lifestyle. See Why Leaving California for Mississippi Makes Financial Sense.

V. How to Use Your 401(k) to Buy Coastal Property

Step 1 – Set Up a Self-Directed 401(k) Coastal Plan

Work with a financial advisor who understands self-directed 401(k) investments. The goal is to structure your account to own real estate as an alternative asset without triggering taxable events.

Step 2 – Identify the Right Property

Choose an investment that balances personal use and cash flow potential. Retirees are favoring Long Beach, Pass Christian, and Ocean Springs, where values are rising but still reasonable. For local expertise, contact Logan Anderson Gulf Coastal Realtors.

Step 3 – Leverage Tax Incentives

Use deductions for repairs, maintenance, and depreciation to offset rental income. Pair that with Mississippi’s retirement tax breaks and the expanded OBBBA senior deductions from the 2025 tax law.

Step 4 – Consider an Entity Structure

Some retirees form an LLC to hold the property within the 401(k) framework. For guidance on structuring and operating agreements, explore the Starting a Business After Retirement Series.

VI. Understanding Risks on the Coast

The Mississippi Gulf Coast offers a gentler risk profile than many Atlantic or Florida barrier islands, but every coastal investment carries exposure to storms and sea-level change.

Sea-Level Rise and Insurance

Concerned about hurricanes? Move to the Mississippi Gulf CoastMississippi’s coastal elevation and modern building codes help mitigate sea-level rise investment risks, but home elevation and flood insurance remain critical.

Market Volatility

Like any real estate market, rental rates and occupancy can fluctuate. Apply retiree market volatility tips by keeping some liquid reserves and viewing the beach property as a medium-term hold (5–10 years) rather than a quick flip.

Diversification

A senior real estate diversification approach balances traditional securities with physical assets like coastal real estate, providing both stability and income.

VII. Tax Savings and Year-End 2026 Planning

As the Trump 2025 401k reforms take full effect, now is the ideal time to review your plan allocations.

Combine the new OBBBA senior deductions with Mississippi’s retirement-friendly laws to maximize returns.

At year end:

- Rebalance your 401(k) to include real estate or alternative assets.

- Estimate potential tax savings on beachfront buys through depreciation and deductions.

- Discuss capital-gains timing and withdrawal plans with a CPA.

For tips on timing and deductions, read End-of-Year Tax Tips for Retirees.

VIII. Real-Life Examples of Retirees Building Beach Equity

Take Pat and Linda, a couple from Texas who rolled part of their 401(k) into a self-directed plan and bought a three-bedroom home in Long Beach. They spend summers on the Coast and rent the house for $3,000 a month in winter. Their property appreciated nearly 15 percent in two years.

Or consider David from Atlanta, who purchased a condo in Ocean Springs through his 401(k) LLC. He now earns steady short-term rental income while building long-term equity.

Their stories mirror the trend seen in Why Real Estate Sales Fail – How to Avoid Failure — patience, location and planning pay off.

These retirees’ beachfront dreams aren’t just personal goals — they’re sound investment strategies under the new rules.

IX. Mapping Your Next Move

Here’s your checklist for turning a 401(k) into a coastal asset:

- ✅ Review your 401(k) plan for alternative asset eligibility.

- ✅ Set up a self-directed 401(k) with a qualified custodian.

- ✅ Research coastal markets — Long Beach, Pass Christian, Ocean Springs.

- ✅ Consult Logan Anderson Gulf Coastal Realtors for property selection and valuation.

- ✅ Check insurance and flood zones using coastal property maps for retirees.

- ✅ Coordinate tax and entity setup with your CPA.

- ✅ Integrate everything into a year-end retirement planning 2025 session.

Mississippi’s affordability and favorable laws mean you can start smaller and grow over time — perhaps owning a second rental by 2027.

X. Conclusion — The New Coastal Opportunity

The Trump 2025 401(k) reforms quietly reshaped retirement planning. They open doors to retiree real estate investments that deliver both income and lifestyle. Nowhere is that more accessible than on the Mississippi Gulf Coast, where you can turn your retirement funds into a tangible asset you can live in, rent out, and pass on.

Whether you dream of a porch in Long Beach, an art walk in Ocean Springs, or a quiet RV-friendly spot near the Sound, the path has never been clearer. With new laws, tax advantages, and market timing on your side, it’s time to make those empowering retirees coastal dreams a reality.

For listings, investment guidance, and local market insights, visit Logan Anderson Gulf Coastal Realtors and explore more resources at RetireCoast.com.

🚀 Get Started on Your Coastal Investment

Ready to turn your 401(k) into a Gulf-front lifestyle? The Trump 2025 401(k) reforms have opened the door for retirees to invest in Mississippi Gulf Coast real estate—from Long Beach to Ocean Springs.

Explore beachfront listings, second-home options, and income-producing rentals with local experts at Logan Anderson Gulf Coastal Realtors. For more insights on affordable coastal living and retirement strategies, visit RetireCoast.com.

🌊 Your coastal future starts with one decision—see what your 401(k) can build by the beach.

Frequently Asked Questions

1. What are Trump’s 2025 401(k) reforms and why do they matter for coastal real estate?

Trump’s 2025 401(k) reforms expand access to alternative assets inside retirement plans, including real estate. That means retirees may be able to use self-directed 401(k) structures to invest in properties like Mississippi Gulf Coast beach homes and rentals, instead of being limited to mutual funds and bonds.

2. Can I really use my 401(k) to buy a home on the Mississippi Gulf Coast?

In many cases, yes—if your 401(k) is rolled into a self-directed account that allows real estate investments and is handled by a qualified custodian. The account, not you personally, typically owns the property. You must follow IRS rules carefully, so always work with a knowledgeable advisor and custodian.

3. Why focus on the Mississippi Gulf Coast instead of Florida or North Carolina?

The Mississippi Gulf Coast generally offers lower home prices, lower property taxes, and more affordable insurance than many popular parts of Florida or North Carolina. Towns like Long Beach and Ocean Springs provide walkable neighborhoods, beaches, and amenities at price points that are more accessible for retirees.

4. What makes Long Beach, Mississippi attractive for 401(k)-funded investments?

Long Beach combines quiet beaches, elevated homes, and a small-town feel close to Gulfport and the casinos. Purchase prices are often lower than similar Gulf or Atlantic coastal markets, yet demand for long-term and vacation rentals continues to grow, supporting income-generating beach rental strategies.

5. Why is Ocean Springs, Mississippi popular with retirees and investors?

Ocean Springs is known for its arts community, restaurants, festivals, and walkable downtown near the water. Retirees like the lifestyle, and investors appreciate the mix of primary residences, second homes, and short-term rentals. It can be a smart target for a self-directed 401(k) coastal strategy focused on lifestyle plus income.

6. How does a self-directed 401(k) for coastal real estate actually work?

You roll some or all of an existing 401(k) into a self-directed 401(k) that allows alternative assets. A custodian helps you purchase property inside the plan, or through a plan-owned LLC. All income and expenses flow through the plan, not your personal accounts, and you must avoid prohibited transactions, such as personally using plan-owned property without following IRS rules.

7. What are the main risks of investing 401(k) funds in beachfront property?

Key risks include storm damage, flooding, sea-level rise, insurance cost increases, local rental regulations, vacancy risk, and property-value fluctuations. Because 401(k) funds are meant for retirement, you should only commit an amount that fits your overall plan and maintain diversification into more liquid investments.

8. Are there tax advantages to owning beach rentals through my 401(k)?

Inside a qualified retirement plan, rental income and gains generally grow tax-deferred (or tax-free in a Roth), which can enhance long-term compounding. Outside a plan, you might also use depreciation and expense deductions. The best structure depends on your age, account type, and objectives, so coordinate with a tax professional.

9. How do I get started if I’m interested in Mississippi Gulf Coast real estate?

First, review your current 401(k) and talk with a financial advisor about whether a self-directed option is appropriate for you. Then, connect with a local coastal real estate expert to analyze neighborhoods, prices, and rental potential. From there, you and your custodian can coordinate a compliant purchase strategy.

10. Should I still keep traditional investments if I use my 401(k) for beach property?

Yes. Most retirees are better served by a diversified portfolio that includes traditional assets like stocks, bonds, and cash reserves alongside any coastal real estate holdings. Think of Mississippi Gulf Coast property as one piece of your retirement puzzle—not the entire picture.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.