Last updated on November 25th, 2025 at 06:16 am

Mississippi Cost of Living: One of the Best Values Now

When people talk about the “best” place to live right now, they usually mean a location where quality of life is high and everyday costs stay low. That combination is rare. However, Mississippi — especially the Mississippi Gulf Coast — still offers that balance. Housing prices are far below national levels, electricity rates remain among the lowest in the country, and even weekly grocery and gasoline bills feel manageable compared with the West Coast or Northeast.

This article takes an analytical look at how the Mississippi cost of living stacks up against several other states, including California, New York, Illinois, and Florida. We’ll focus on the big four budget items: housing, electricity, gasoline, and food. Along the way you’ll see how retirees, remote workers, and real estate investors can turn those lower costs into a long-term advantage.

1. Housing: Where Mississippi Really Shines

Housing is usually the single largest expense in a household budget. Therefore, it’s the first place to compare. Data from multiple cost-of-living studies consistently show that Mississippi’s home prices and rents sit well below the national average, while coastal states such as California and New York rank among the highest.

- Mississippi: Overall housing costs tend to be 30–40% lower than the U.S. average, with many markets still offering attractive single-family homes at prices that would barely buy a condo in Los Angeles or New York City.

- California & New York: Both states regularly appear near the top of national housing-cost rankings. Buyers face high prices, steeper property taxes in many areas, and intense competition for livable neighborhoods.

- Illinois and Florida: These fall in the middle; some metro areas are pricey while others remain affordable, but on balance both still cost more than Mississippi.

For a detailed local look at coastal communities, see your comparison work on cities such as Ocean Springs, Bay St. Louis, and Pass Christian at RetireCoast.com. Those articles show how buyers can still find reasonably priced homes that are near the beach, near shopping, and within reach of good restaurants and medical facilities.

Lower housing costs don’t just help owner-occupants. They also change the math for investors. A real estate investor purchasing in Mississippi can often acquire two modest properties for the cost of one similar property in a high-cost coastal state. That can mean more doors, more rental income streams, and better diversification inside a retirement portfolio.

Housing + Lifestyle: Why the Gulf Coast Feels Different

It’s one thing to pay less and quite another to enjoy life while you do it. The Mississippi Gulf Coast combines lower prices with an attractive lifestyle: warm weather, beaches, fishing, festivals and local culture. For people relocating from high-tax, high-cost regions, that combination often feels like a genuine upgrade rather than a sacrifice.

If you want to test the waters first, you can always rent a place on the Coast for a month or two. Stay with Christies Gulf Beach Rentals and track your actual food, gasoline and entertainment bills while you’re here. That real-world experiment usually confirms what the spreadsheets already suggest: day-to-day life simply costs less.

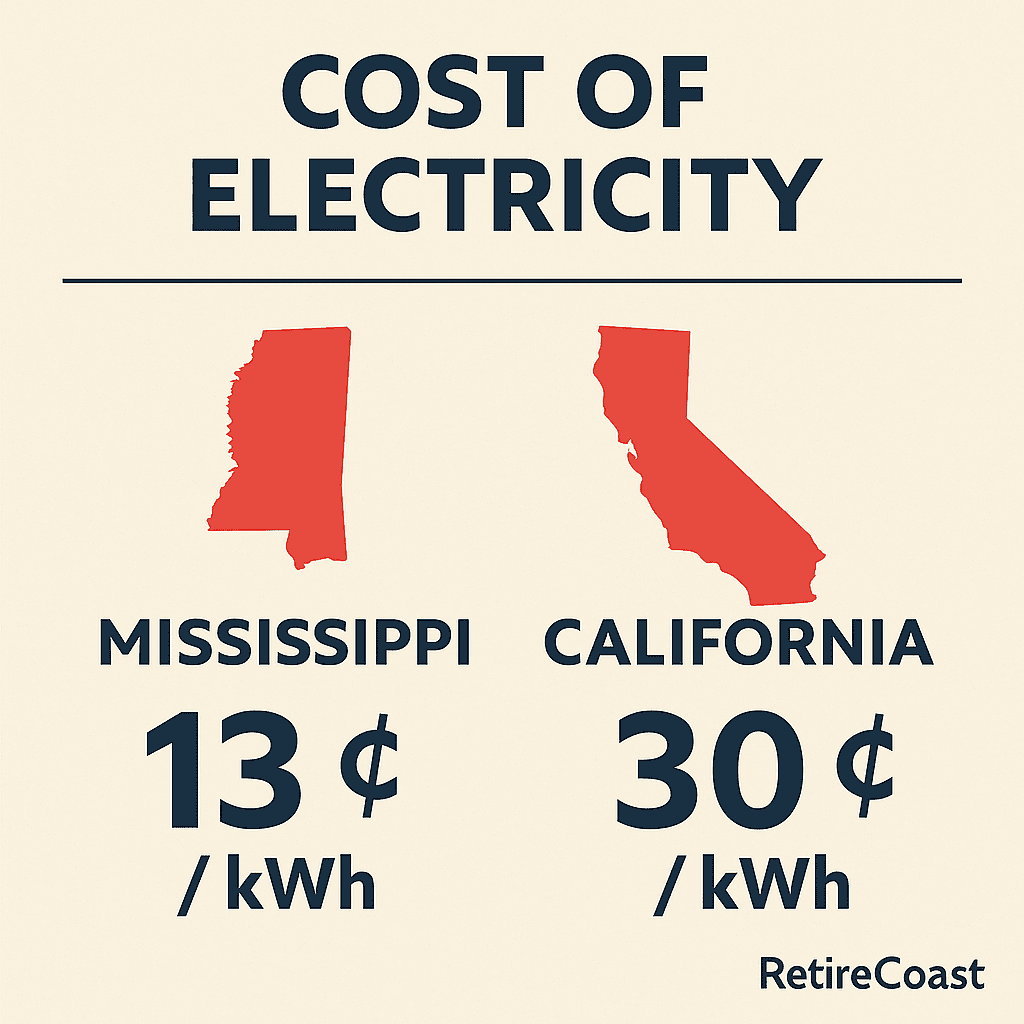

2. Electricity: Low Rates Add Up Month After Month

Next, look at electricity. Because air-conditioning runs much of the year in the South, power rates matter. Fortunately, Mississippi’s electricity prices rank among the lowest in the nation, while California sits near the top.

Industry data from sources such as the U.S. Energy Information Administration and regional utilities show that:

- Mississippi residential electricity rates are typically well below the U.S. average on a cents-per-kilowatt-hour basis.

- California residential electricity rates are often more than double Mississippi’s, driven by infrastructure, policy, and fuel-mix differences.

Those differences may not seem dramatic when you look at a single monthly bill, but they compound over time. A household that pays $150 a month for power in Mississippi might easily pay $250–$300 a month in California for similar usage. Over ten years, that gap can buy a lot of road trips, home upgrades or additional retirement savings.

Power costs also matter for anyone running a small business from home, especially retirees starting new ventures. If you plan to operate an online business, real estate investment company, or consulting practice out of a home office, lower electricity bills help keep fixed overhead low and profits higher.

3. Gasoline and Transportation: Everyday Mobility on a Budget

Transportation costs come next. Because many people in Mississippi drive personal vehicles rather than relying on large transit systems, the price of gasoline and basic car expenses has a direct impact on monthly budgets.

Over the past several years, average gasoline prices in Mississippi have consistently run below the national average and well below prices in California and New York. Taxes, environmental rules, and distribution costs all play a role in those differences. Drivers who relocate often notice the savings immediately; filling up a pickup truck or SUV no longer feels like a major financial event.

On the other hand, Illinois and Florida tend to fall somewhere in the middle. Their average fuel costs may spike along with national prices, yet they rarely match California levels. When you combine cheaper fuel, shorter commute times in many Mississippi markets, and more available parking, the total “cost of getting around” usually tilts in Mississippi’s favor.

For retirees and remote workers, transportation savings also take a different form. Many households discover they can live comfortably with one vehicle instead of two when they move to a smaller coastal community. That choice cuts insurance, maintenance and depreciation as well as gasoline.

4. Food Costs: Groceries, Dining Out and Everyday Living

Food prices have climbed everywhere, but the baseline still varies by state and region. In Mississippi, grocery costs usually sit slightly below the national average, while large metro areas in California and New York pay noticeably more.

Several national cost-of-living calculators highlight this pattern. A basket of standard supermarket items — bread, milk, eggs, fresh produce and basic proteins — often costs less in Mississippi than in West Coast or Northeast cities. While you will still feel inflation, the starting point is lower, so your total bill remains more manageable.

Dining out follows a similar pattern. A casual seafood dinner with friends in a Gulf Coast town rarely equals what you might pay for a comparable meal in San Francisco or Manhattan. This doesn’t mean there are no high-end choices in Mississippi. Instead, it means that casual, frequent dining remains realistic for many local residents, even on a fixed income.

Because food and fuel are “visible” prices that people see each week, they strongly influence how affordable a place feels. When the grocery receipt and gas-pump display are both lower, Mississippi can quickly feel like a welcome reset for people who are used to high-cost urban living.

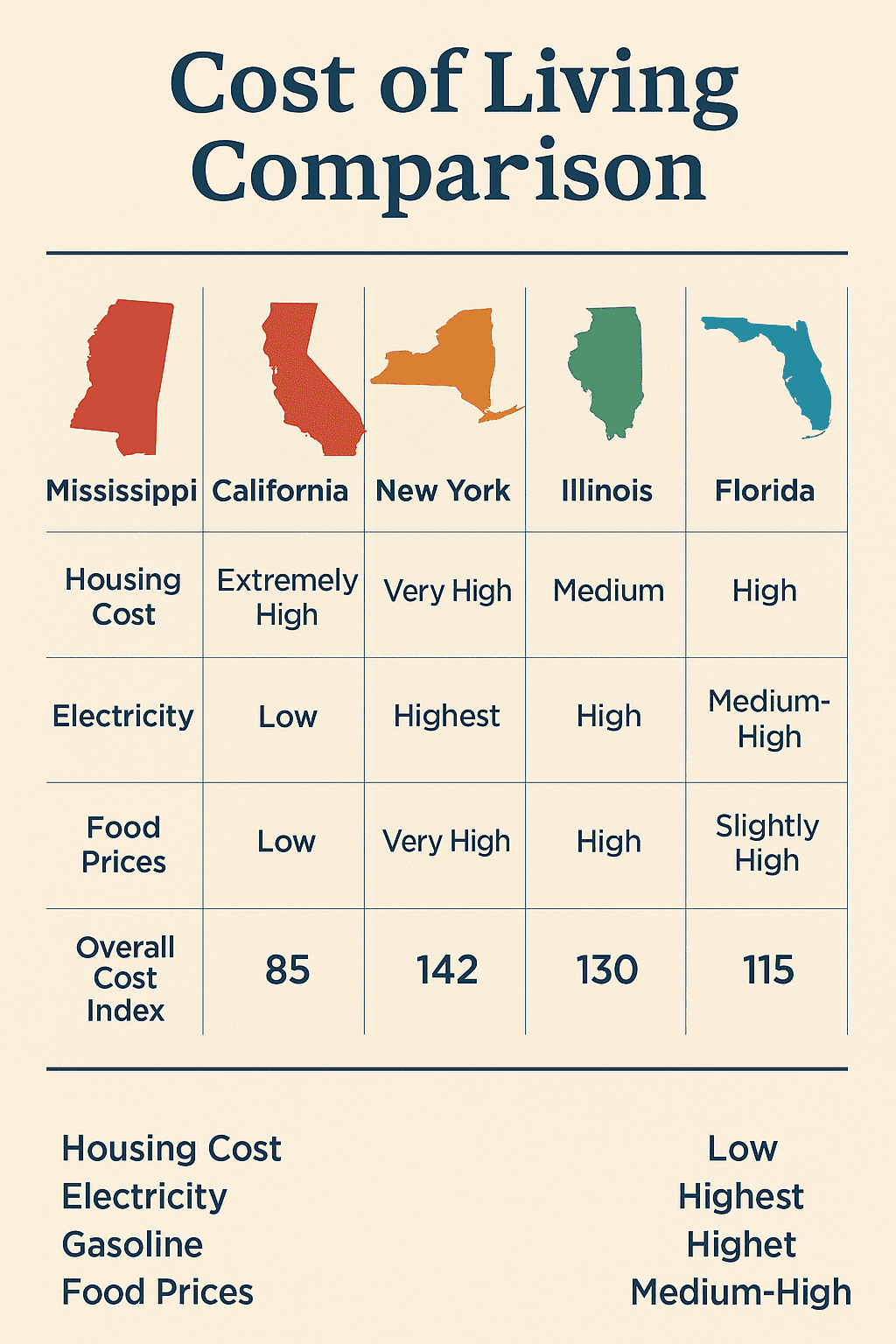

5. Five-State Cost of Living Comparison at a Glance

To see the big picture, it helps to step back and compare several states at once. The infographic below provides a simple, visual way to understand how Mississippi stacks up against California, New York, Illinois and Florida on housing cost, electricity, and food prices.

The labels are deliberately simple — “low,” “high,” “very high” and so on. They capture what most residents experience when they go about daily life in each state. Mississippi stands out with very low housing costs and relatively low prices for electricity, gasoline and food. California and New York sit at the extreme high end, Illinois lands in the medium-high range, and Florida stays somewhere in between.

This doesn’t mean Mississippi is perfect or that cost is the only consideration that matters. However, when you step back and examine the full household budget instead of any single line item, Mississippi often delivers one of the best overall values now available in the United States.

6. What Lower Costs Mean for Retirees and Remote Workers

If you are planning retirement or already retired, the Mississippi cost of living can change the math in several ways:

- Your savings last longer. When daily expenses fall, you don’t have to withdraw as much from retirement accounts to maintain the same lifestyle.

- You can upgrade your home or location. Many newcomers sell a modest home in a high-cost state and buy a larger or newer property on the Mississippi Gulf Coast, often with cash left over.

- Part-time work becomes optional. Instead of needing a second job just to cover rent or utilities, you can choose flexible part-time work or a small business that fits your interests.

Your existing articles on starting a business after retirement at RetireCoast show how lower overhead in Mississippi makes it easier for new ventures to reach breakeven. Cheaper rent, power and fuel all support that goal.

Remote workers also benefit. A programmer or designer earning a national-market salary from a Mississippi beach town can save or invest substantially more than someone with the same income paying San Diego or New York prices. That extra margin can flow into rental properties, index funds, or other long-term assets instead of disappearing into the monthly burn rate.

7. Why Real Estate Investors Watch the Mississippi Cost of Living

Real estate investors care deeply about both sides of the cash-flow equation: rental income and operating expenses. A low cost of living environment often supports both. Lower acquisition prices mean investors can buy more properties or keep leverage conservative. Meanwhile, tenants benefit from affordable rents, lower utility bills and cheaper gasoline for commuting, which can help keep occupancy high.

Investors who want a deeper dive into Mississippi properties can review resources at Logan Anderson, LLC, your coastal real estate company. That site showcases actual listings, local market commentary and tools for buyers weighing the Gulf Coast against other retirement or investment destinations.

At the same time, investors who need a place to stay while scouting neighborhoods can book a condo or beach house with Christies Gulf Beach Rentals. Living for a week or a month in the exact communities where you might later buy gives a much clearer feel for both costs and lifestyle.

8. Putting It All Together: Is Mississippi the Best Value Now?

No single state is right for everyone. Some people prioritize huge urban centers, mass transit, or specific industries that Mississippi cannot match. However, when you focus on the big household budget categories — housing, electricity, gasoline and food — Mississippi delivers a combination that is hard to beat, especially on the Gulf Coast.

For many people leaving high-cost regions, living here means:

- Owning a comfortable home instead of renting a small apartment.

- Paying substantially less for monthly utilities and fuel.

- Enjoying meals out, local events and beach time without constant financial stress.

- Having room in the budget to travel, help family or invest for the future.

If you’re exploring options, browse additional RetireCoast guides on topics such as building a website for your business after retirement or comparing Mississippi Gulf Coast cities. Then consider a scouting trip, stay with Christies Gulf Beach Rentals, and track your real-world expenses for a week or two.

When you add up those receipts and compare them with what you spend now, you’ll see why so many people conclude that the Mississippi cost of living makes it one of the best values now for retirees, remote workers and real estate investors who want more lifestyle for every dollar.

Mississippi Cost of Living: Frequently Asked Questions

1. Why is Mississippi’s cost of living so much lower than other states?

Mississippi stays affordable because housing, land, utilities, and everyday essentials cost less than the national average. This creates a strong overall value compared with high-cost states like California and New York.

2. How does Mississippi compare to California for everyday expenses?

Mississippi households pay significantly less for housing, electricity, gasoline, and groceries. California’s higher taxes, strict regulations, and premium housing markets drive up its monthly expenses.

3. Is the Mississippi Gulf Coast an affordable place to retire?

Yes. The Gulf Coast offers low housing costs, manageable utilities, and a relaxed coastal lifestyle. Retirees from high-cost regions often find they can improve their quality of life while spending less.

4. Do groceries cost less in Mississippi than in other states?

Generally, yes. Grocery prices in Mississippi trend slightly below the national average, while states like California and New York pay considerably more due to transportation and overhead costs.

5. How do electricity costs in Mississippi compare to other regions?

Electricity prices in Mississippi remain below those in California and parts of the Northeast. Even with summer cooling needs, the state’s monthly power bills stay more affordable.

6. Is gasoline cheaper in Mississippi than in the rest of the country?

Most of the time, yes. Mississippi consistently posts lower gasoline prices than California, New York, and Illinois, making commuting and travel more affordable.

7. How much less does housing cost in Mississippi compared to high-cost states?

Housing in Mississippi can be 30–60% cheaper than in national hotspots. Many relocating homeowners discover they can buy a larger or newer home—and sometimes with cash left over after selling in a high-cost state.

8. Does Mississippi offer good value for real estate investors?

Yes. Lower purchase prices, moderate utilities, and growing tourism make Mississippi an attractive market for long-term rentals and vacation rentals, especially along the Gulf Coast.

9. How does Mississippi compare to Florida as a beach retirement option?

Florida’s popular metros have higher housing, insurance, and tourism-driven living costs. Mississippi offers beaches, entertainment, and coastal amenities at a more accessible price point.

10. Is Mississippi a good place to stretch retirement savings or fixed income?

Absolutely. Lower monthly expenses—especially for housing, utilities, food, and gasoline—help retirement savings last longer while supporting a comfortable coastal lifestyle.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.