Planning for medical expenses later in life is no longer optional—it’s essential. Rising medicare premiums and retirement healthcare planning challenges mean today’s retirees must understand not only what Medicare covers, but also where the major gaps and long-term risks exist.

This comprehensive Medicare Costs, Coverage Gaps & Long-Term Care: Retirement Healthcare Guide unpacks the real costs of aging, from Medicare premiums and prescription drug tiers to long-term care needs that can devastate an unprepared budget.

You’ll learn how to evaluate coverage options, anticipate out-of-pocket expenses, compare Medicare Advantage and Medigap, plan for long-term care, and build a personalized healthcare strategy that protects both your health and your financial security throughout retirement.

1. Medicare Premiums: What Retirees Really Pay Each Year

Medicare is often misunderstood as “free healthcare at 65,” but the reality is more complicated. While it offers solid protection compared to private insurance, retirees must budget for multiple monthly premiums, many of which increase annually. Understanding these costs upfront can prevent unexpected financial stress as you settle into retirement.

Medicare includes several parts—A, B, D, and Medicare Advantage (C). Each comes with its own premium rules, coverage limits, and income-based pricing.

Medicare Part A Premiums

For most retirees, Medicare Part A (hospital insurance) carries no monthly premium because they or their spouse paid into Medicare long enough (at least 40 quarters). But not everyone qualifies.

- $0 premium for most retirees

- Up to $505 per month (2024) for those with insufficient work credits

- Reduced premiums for those with 30–39 quarters

Official source:

https://www.medicare.gov/basics/costs/part-a-costs

Even though the premium is often free, retirees still face a large deductible and inpatient coinsurance under Part A—an important consideration if hospitalization becomes necessary.

Medicare Part B Premiums

Part B covers doctor visits, outpatient care, and preventive services. These premiums increase more consistently than any other part of Medicare.

- Standard premium: $174.70/month (2024)

- IRMAA surcharges: Higher-income retirees pay significantly more, based on IRS data from two years prior

More information:

https://www.medicare.gov/basics/costs/part-b-costs

Since the Part B premium is deducted from Social Security, many retirees feel the impact directly in their monthly income.

Medicare Part D Premiums

Part D covers prescription drugs, and premiums vary widely by plan. Costs depend on:

- Formulary design

- Pharmacy network

- Deductibles

- Tiered drug pricing

Average national premium (2024): $55.50/month

Real premiums range anywhere from $8 to $200+.

Details:

https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage

Plans change formularies annually, so reviewing your plan every year is essential.

Medicare Advantage (Part C) Premiums

Medicare Advantage plans combine Parts A, B, and often D. Many advertise $0 premiums, but retirees must look carefully at cost-sharing rules, provider networks, and travel limitations.

Compare plans here:

https://www.medicare.gov/plan-compare

A $0 premium plan may shift expenses to copays, coinsurance, or restricted access to specialists.

The Hidden Hassle: Enrollment Season = More Nuisance Calls

Every year from October 15 to December 7, Medicare’s Annual Enrollment Period (AEP) triggers an aggressive wave of calls, texts, and emails from insurance companies and brokers.

Expect:

- Spoofed calls using local exchanges

- Random city names on caller ID

- Persistent voicemails

- Unsolicited texts and emails

These solicitations are legal under Medicare’s marketing rules but confusing for many retirees.

If you have concerns about your plan, contact your broker or Medicare directly.

You are not required to engage with unsolicited callers. Consulting your broker—or going straight to Medicare—ensures you receive accurate information about all plans approved in your area.

HMO vs. PPO: A Critical Choice for Retirees

Before selecting a Medicare Advantage plan, make sure you fully understand how HMO and PPO networks work. This decision affects where—and how—you can receive care.

HMO Plans

- Lower premiums

- Local network restrictions

- No out-of-network coverage except emergencies

- Referrals typically required

If you leave your region, most HMOs will not cover routine care.

PPO Plans

- Higher premiums

- Flexibility to see providers in or out of network

- No referrals required

- Better for retirees who travel or split time between states

For retirees who travel often or have specialist needs, a PPO may offer far more long-term value than its monthly price difference suggests.

Why All of This Matters

Medicare premiums and plan structures shape your long-term retirement budget. With rising healthcare inflation, IRMAA surcharges, and annual plan changes, understanding these details is essential to making confident, well-informed decisions.

2. Understanding Medicare Gaps: What Isn’t Covered and Why It Matters

Even with Medicare, retirees still face significant out-of-pocket costs. Traditional Medicare (Parts A and B) was never intended to be a complete health insurance policy—it was designed to provide a solid foundation. But that means retirees must understand the gaps and prepare for them, either through careful budgeting, Medigap, or a thoughtfully selected Medicare Advantage plan.

Many retirees are caught off guard by what Medicare does not cover, and those gaps can become expensive if you don’t plan ahead.

Hospital & Medical Cost Gaps (Parts A and B)

Traditional Medicare has very specific coverage limits and out-of-pocket requirements.

Part A Gaps

Even though Part A often has no premium, it includes:

- A significant hospital deductible

- Daily coinsurance beginning on extended hospital stays

- Higher coinsurance costs for long-term skilled nursing care after the initial coverage window

This means that a single hospitalization can cost retirees thousands of dollars, especially if complications extend the length of stay.

Part B Gaps

Part B covers outpatient care, but retirees must pay:

- The annual deductible

- 20% coinsurance on nearly all services

- No out-of-pocket maximum (which surprises many new retirees)

Even basic imaging tests—X-rays, CT scans, MRIs—can result in meaningful coinsurance costs because Part B covers them at 80% and you cover the rest.

No Coverage for Dental, Vision, or Hearing: What That Really Means

Original Medicare does not cover:

- Routine dental cleanings

- Fillings, crowns, or dentures

- Routine vision exams or eyeglasses

- Annual hearing tests or hearing aids

A typical year of dental care alone can cost several hundred dollars, and major work (crowns, implants, root canals) can run into the thousands.

Before You Buy Medigap or Dental Insurance: Review What You Already Have

Before making the decision to purchase Medigap or a standalone dental/vision/hearing plan, review your current coverage carefully—or better yet, call your plan provider and have a conversation about your benefits.

Many retirees are surprised to learn that their existing plan already includes:

- Routine dental cleanings and exams at no cost or with minimal copays

- Basic X-rays or twice-a-year cleanings

- Annual wellness visits

- Comprehensive blood panels at no charge

- No deductible for primary care visits in some HMO plans

In many regions, certain Medicare Advantage plans include robust preventive coverage that reduces or eliminates the need for additional insurance.

It’s also wise to speak with your dentist directly. Many dentists will tell you candidly whether dental insurance makes financial sense based on your oral health. Some recommend paying cash for cleanings and routine work instead of purchasing insurance that you may not fully use.

Bottom line:

Don’t purchase extra coverage until you understand your current benefits fully. Medigap is invaluable when it fills actual gaps—but unnecessary when it duplicates coverage you already have.

Skilled Nursing vs. Long-Term Care: One of the Biggest Misunderstandings

Medicare covers short-term skilled nursing care, but with strict limitations. Coverage typically applies only after:

- A qualifying three-day inpatient hospital stay

- A need for skilled services like physical therapy, wound care, or IV treatments

- Placement in a Medicare-approved facility

Even then, coverage is temporary. Once skilled care is no longer required, Medicare coverage ends.

Medicare does not cover:

- Long-term nursing home stays

- Assisted living

- Memory care

- In-home custodial care

These services can cost anywhere from $4,000 to over $9,000 per month, depending on location. For retirees who haven’t planned ahead, these costs can quickly deplete savings.

This is why some retirees explore long-term care insurance or hybrid life-and-LTC policies, while others choose to self-insure or plan for Medicaid eligibility later in life.

Medigap Policies: How They Help—and What They Don’t Cover

Medigap (Medicare Supplement) plans are designed to cover many of the out-of-pocket costs that Original Medicare leaves behind. Plans are standardized by letter (A, B, G, N, etc.), but their coverage levels vary.

Most Medigap plans help cover:

- Part A deductible

- Part B coinsurance

- Skilled nursing coinsurance

- Foreign travel emergency care

However, it’s critical to know what Medigap does not cover:

- Prescription drugs (these require a Part D plan)

- Routine dental, vision, or hearing

- Long-term care

- Over-the-counter items

- Most preventive dental/vision benefits included in some Medicare Advantage plans

Medigap comparison tool (official):

https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies

Also note that Medigap rules vary by state. Some states have continuous open enrollment or birthday rules, while others restrict switching between plans.

Why Understanding These Gaps Matters

For many retirees, healthcare becomes one of the most significant expenses of the retirement years. The gaps in Medicare are predictable, but only if you know they exist. Good planning—whether through Medigap, Medicare Advantage, or a combination of supplemental tools—helps you control costs and avoid financial surprises.

The Real Cost of Prescription Drugs Under Medicare Part D

Prescription drugs are one of the most unpredictable healthcare expenses retirees face. Even with Medicare Part D, out-of-pocket costs can vary dramatically from year to year based on formularies, deductibles, tier changes, and whether your medications fall into higher-priced categories like specialty or GLP-1 weight-loss drugs. Understanding how Medicare drug coverage works—and how your costs are calculated—is essential to building an accurate retirement healthcare budget.

Part D Plans Are Not All the Same

Unlike Original Medicare, which is standardized, Part D plans differ widely. Your costs depend on:

- The medications you take

- Your plan’s formulary (its list of covered drugs)

- Whether your pharmacy is preferred or standard

- Whether you use brand-name, generic, or specialty drugs

- Whether you meet your deductible early in the year

- Whether your medications push you into the coverage gap (“donut hole”)

This means you must compare plans every year, because Part D formularies change annually.

Official information:

https://www.medicare.gov/drug-coverage-part-d/costs-for-medicare-drug-coverage

Deductibles: The First Big Cost Your Plan Doesn’t Pay

Most Part D plans include an annual deductible—up to $545 in 2024. Some plans waive the deductible for lower-tier generics, but nearly all apply the full deductible to expensive brand-name or specialty drugs.

This deductible resets every January, which is why many retirees are hit with unexpectedly high pharmacy bills early in the year.

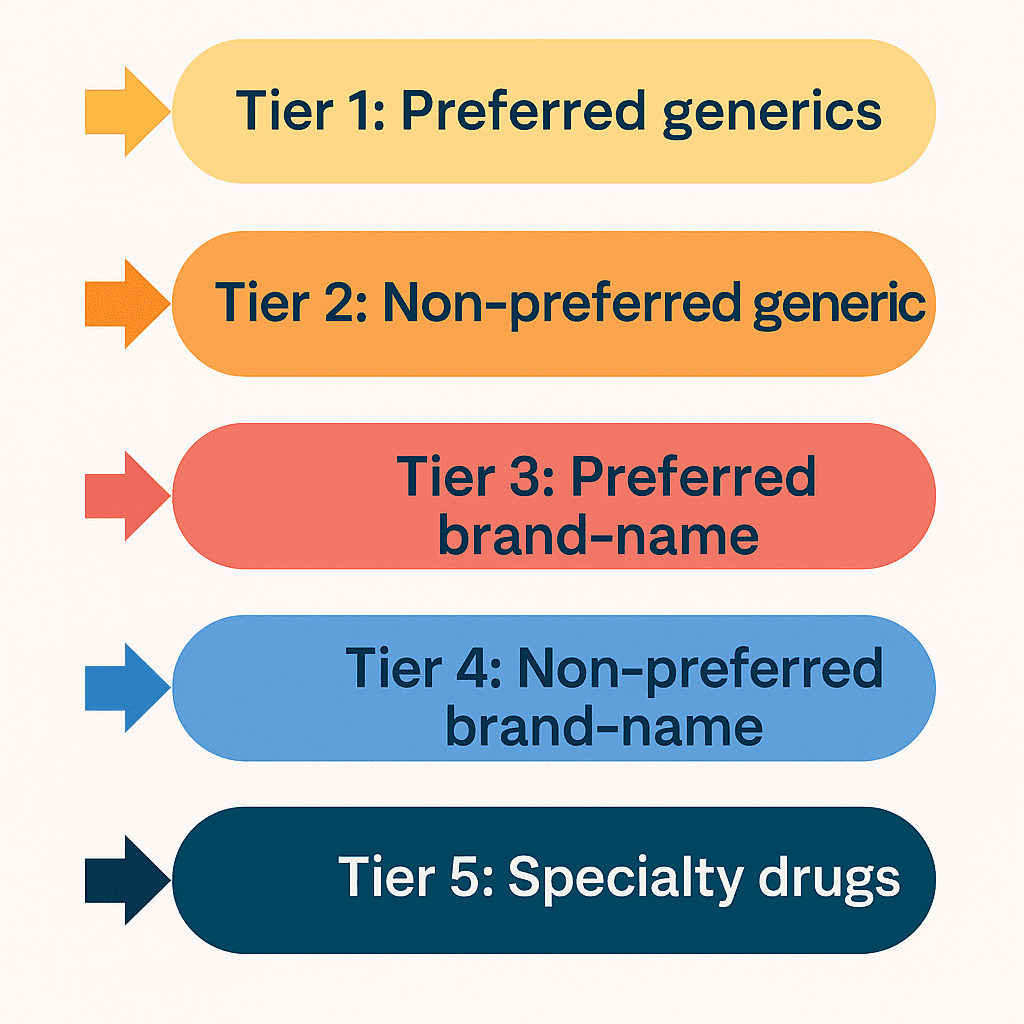

Drug Tiers Determine Your Price

Every drug in a Part D plan is assigned a tier:

- Tier 1: Preferred generics

- Tier 2: Non-preferred generics

- Tier 3: Preferred brand-name

- Tier 4: Non-preferred brand-name

- Tier 5: Specialty drugs

Higher tiers = higher costs.

Your medication can move tiers each year even if you stay in the same plan.

The Coverage Gap (“Donut Hole”) Still Matters

Although the donut hole has been reduced, it still causes real cost increases for many retirees.

- Initial Coverage Stage: You pay the plan’s copay or coinsurance.

- Coverage Gap: Once total drug spending reaches a certain amount, you pay 25% of the cost for both brand-name and generic drugs.

- Catastrophic Coverage: After you reach the out-of-pocket threshold, costs drop substantially for the remainder of the year.

If you take expensive medications, especially brand-name drugs, you may enter the gap sooner than expected.

The Rising Cost of GLP-1 Weight-Loss Drugs: A Real-World Example

GLP-1 medications—such as Ozempic, Wegovy, and Mounjaro—are increasingly prescribed to retirees for weight loss, blood sugar regulation, and diabetes prevention. These drugs usually come in a 90-day supply and are often placed in higher-cost tiers, which can significantly drive up annual healthcare expenses.

Here is a realistic example of what many retirees experience:

Peter visited his doctor and asked about receiving a GLP-1 prescription.

After reviewing his bloodwork, the doctor agreed—Peter was overweight and at risk for diabetes. But when Peter went to pick up the medication, he was surprised:

- His Medicare drug plan required a $500 deductible before any coverage applied.

- After paying the deductible, the 90-day supply cost $140.

He wasn’t prepared for the deductible and assumed the medication would be more affordable. What he learned is important for anyone considering higher-tier drugs:

- Once the deductible is met, the drug becomes much cheaper for the rest of the year.

- Every January, the deductible resets—so the first refill of the year is always the most expensive.

- GLP-1 drugs almost always trigger the deductible unless your plan specifically exempts them (rare).

For retirees exploring GLP-1 medications, the key is to understand your plan’s deductible, drug tier, and annual refill pattern before filling the prescription.

What to Ask Before Filling a GLP-1 Prescription

If you’re considering a weight-loss injection like Ozempic, Wegovy, or Mounjaro, ask these questions before you fill your prescription:

- What tier is this drug on in my Part D or Medicare Advantage plan?

- Does my plan require the **full deductible** before coverage begins?

- What will the medication cost **after** I meet the deductible?

- Is a 90-day supply cheaper than monthly refills?

- Is prior authorization needed to receive coverage?

- Are there lower-cost alternatives or therapeutic equivalents?

- Does the pharmacy I use count as a **preferred pharmacy** for this plan?

Asking these questions upfront can prevent surprises—especially with expensive drugs that reset to full cost each year when the deductible renews.

Why Pharmacy Choice Matters

Prescription prices vary widely between pharmacies. To reduce costs:

- Use preferred pharmacies for the lowest copays

- Consider mail-order options, which often offer better 90-day pricing

- Verify whether your drug is cheaper at big-box retailers vs. local pharmacies

- Ask your pharmacist about therapeutic alternatives or tier exceptions

A retiree may pay $5 at one pharmacy and $20 at another—for the exact same medication.

When to Ask for Help

If your medication becomes too expensive, take action immediately:

- Talk to your pharmacist about generics, lower-tier drugs, and alternatives

- Ask your doctor whether a prior authorization, dose change, or therapeutic equivalent can reduce cost

- Review your plan using the Medicare.gov comparison tool

- Contact your insurer if a sudden tier change has affected your cost

Never assume you’re stuck with a high price—drug tiers and coverage rules change often.

The Bottom Line

Medicare Part D can work extremely well for retirees—but only if you actively manage it. Review your medications every year, understand your deductible, take time to compare plans, and be especially cautious with specialty or high-cost drugs like GLP-1s.

Prescription costs are one of the fastest-growing expenses in retirement, and smart planning can prevent unnecessary financial strain with medicare premiums and retirement healthcare planning.

4. Long-Term Care: The High Cost of Not Planning Ahead

Long-term care is one of the most expensive and misunderstood parts of retirement healthcare. Many retirees assume Medicare will pay for assistance in a nursing home, in-home caregiving, or an assisted living facility. Unfortunately, Medicare does not pay for long-term custodial care, and failing to plan for this reality can be financially catastrophic.

Understanding what Medicare covers—and what it does not—will help you build a realistic plan that protects both your savings and your family.

What Medicare Actually Covers: Short-Term Skilled Care Only

Medicare will pay for short-term skilled nursing care under very specific conditions, typically after:

- A qualifying three-day inpatient hospital stay

- A medically necessary need for skilled care such as physical therapy, wound care, or IV management

- Placement in a Medicare-certified facility

Coverage is limited:

- Days 1–20: $0 coinsurance

- Days 21–100: Daily coinsurance applies (a significant out-of-pocket cost)

- After day 100: You pay 100% of the cost

This coverage is intended for recovery—not long-term residence.

What Medicare Does NOT Cover

Medicare does not pay for custodial or long-term care, including:

- Assisted living

- Memory care

- Long-term nursing home stays

- In-home personal care (bathing, dressing, meals, supervision)

- Adult day care

- Most home health when it is custodial rather than skilled

These are out-of-pocket expenses unless covered by long-term care insurance or Medicaid.

The High Cost of Not Planning for Long-Term Care

A lack of preparation can drain your savings quickly. Here’s why:

- Assisted living: $4,000–$6,000 per month

- Memory care: $5,000–$9,000 per month

- Nursing home care: $8,000+ per month

- In-home care: $25–$35 per hour

At these prices, a retiree needing care for just three years could easily spend $200,000 to $300,000—sometimes more.

This is why failing to plan for long-term care is one of the most financially devastating mistakes retirees make. It forces families into emergency decisions, strains relationships, and often leads to selling assets under pressure.

Planning with Family: A Practical, Sometimes Better Alternative

If you have adult children who are willing and able to assist with caregiving, this can be a far more affordable—and emotionally supportive—option than paying $5,000 to $10,000 per month for facility-based care.

In many situations:

- Staying in a family home is the most comfortable and least disruptive option

- Providing financial support to family caregivers is more cost-effective than paying outside facilities

- In-home care supplemented by family involvement offers a high quality of life

But even family-driven care requires planning. You must document:

- Who will help

- How care will be coordinated

- How finances will be handled

- What resources family caregivers will need

A Family Care Agreement is an excellent tool for clarifying these expectations.

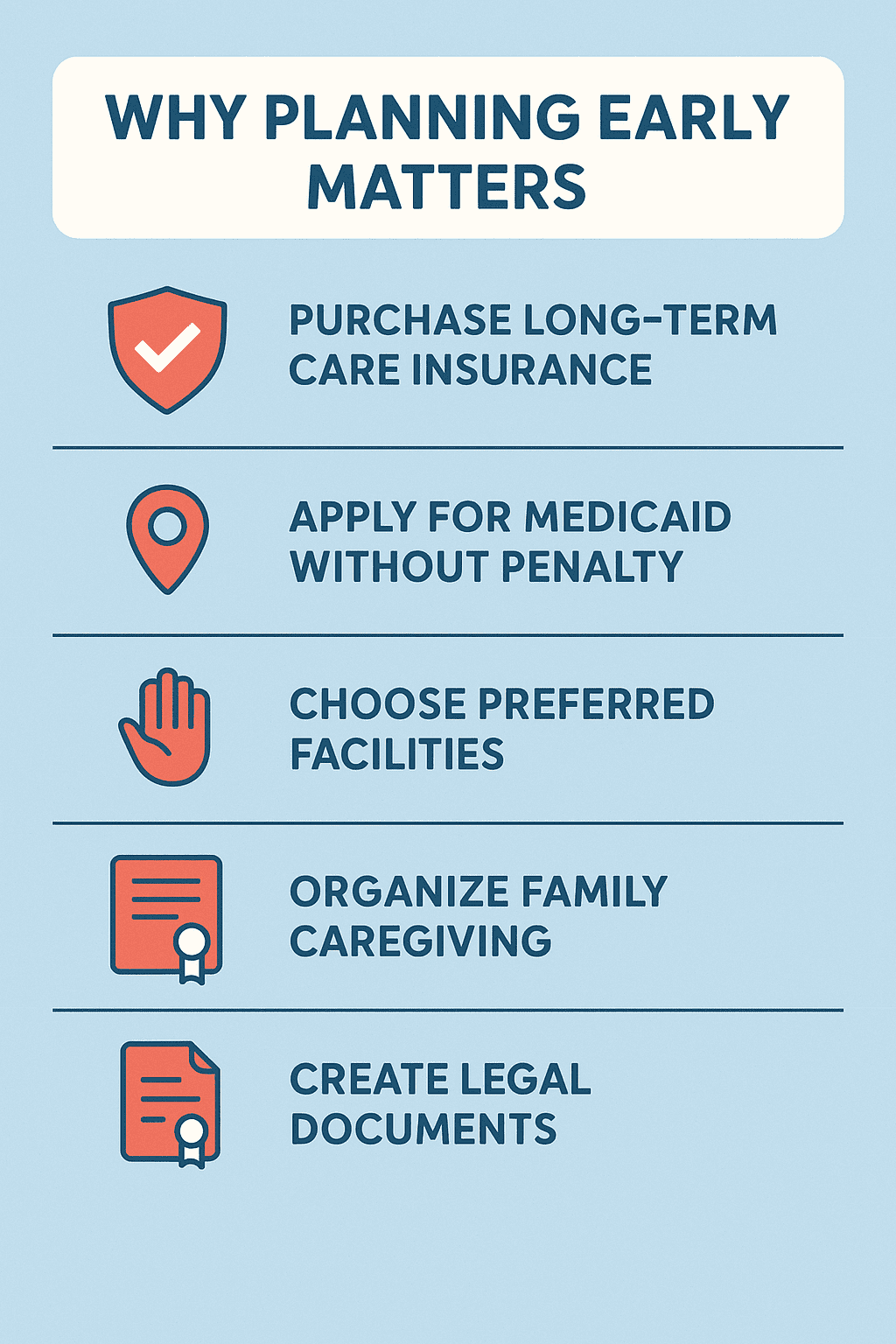

Why Planning Early Matters

Long-term care needs often emerge suddenly—after a fall, stroke, accident, or cognitive decline. At that moment, it may be too late to:

- Purchase long-term care insurance

- Reposition assets

- Apply for Medicaid without penalty

- Choose preferred facilities

- Organize family caregiving

- Create legal documents

Planning early preserves your options, reduces stress on your family, and ensures your care aligns with your preferences—not whatever is available in an emergency.

The True Cost of Long-Term Care

Long-term care is one of the most expensive and overlooked parts of retirement planning. These are the real-world costs retirees face when care is needed for an extended time:

- Assisted Living: $4,000–$6,000 per month

- Memory Care: $5,000–$9,000 per month

- Nursing Home (semi-private room): $8,000+ per month

- In-Home Care: $25–$35 per hour

- Private Duty Care: Often $10,000+ per month for full-time support

Just three years of care can cost $200,000 to $300,000 or more— and Medicare does not cover long-term custodial care. Planning ahead protects your savings, your home, and your family from financial strain during a medical crisis.

How Retirees Pay for Long-Term Care

Most retirees fund long-term care through a combination of:

1. Long-Term Care Insurance

Helps cover assisted living, nursing homes, memory care, and in-home support. Policies must be purchased while you are still relatively healthy.

2. Hybrid Life/LTC Policies

Combine life insurance with long-term care benefits. If you never need care, the death benefit passes to your heirs.

3. Self-Funding

Using savings, investments, or home equity. This requires realistic budgeting and contingency planning.

4. Medicaid

Provides long-term nursing home care, but only after meeting strict financial requirements. Asset protection strategies must comply with state look-back periods.

5. Veterans Benefits

Programs like Aid & Attendance may help veterans pay for certain types of in-home or assisted living services.

The Bottom Line

Long-term care is expensive, and Medicare will not cover most of it. Failing to plan leaves retirees vulnerable to financial loss, emotional strain, and limited care options. Planning early—whether through insurance, family arrangements, savings, or legal preparation—ensures that you receive care in a setting you prefer without overwhelming your family or jeopardizing your financial stability. And medicare premiums and retirement healthcare planning.

5. Legal Planning: Protecting Yourself Before a Health Crisis Happens

Long-term care planning isn’t only about money—it’s also about making sure the right people can make decisions for you if you become unable to speak or act for yourself. Too many families face overwhelming stress because the legal documents weren’t prepared early enough. Without proper planning, critical decisions may be delayed or disputed, and assets may be exposed to unnecessary risk.

Putting these documents in place now ensures that your wishes are honored and that your care can be managed smoothly and help plan for medicare premiums and retirement healthcare planning.

Durable Power of Attorney (POA)

A Durable Power of Attorney allows a trusted family member or friend to handle your financial affairs if you become unable to do so. This includes paying bills, managing investments, filing taxes, overseeing insurance claims, and handling long-term care arrangements.

Key points:

- It must be durable to remain valid after incapacity.

- Choose someone highly trustworthy and financially responsible.

- Without a POA, your family may need to seek court-appointed guardianship, which is expensive and slow.

This document is essential for seniors who want their finances and care decisions handled smoothly without legal obstacles.

Healthcare Power of Attorney / Medical Proxy

A Healthcare POA (also called a Medical Power of Attorney or Healthcare Proxy) designates the person who will make medical decisions if you cannot.

This person will work with doctors, approve treatments, and choose care settings based on your stated preferences. Without this document, medical providers may have limited ability to involve family in critical decisions.

It’s crucial to choose someone who:

- Understands your medical wishes

- Can handle pressure during emergencies

- Will advocate for you

Advance Health Care Directive / Living Will

An Advance Directive spells out your wishes regarding life-sustaining treatments, such as:

- Ventilation

- Artificial feeding

- Pain management preferences

- End-of-life care decisions

- Hospital vs. at-home preferences

This ensures your family never has to guess—or disagree—about your wishes during difficult times.

HIPAA Authorization

HIPAA laws prevent healthcare providers from sharing your medical information without your permission. A HIPAA authorization allows doctors and hospitals to communicate with the individuals you choose.

Without it, even your spouse or children may be blocked from receiving updates.

Estate Planning: Wills and Trusts

While estate planning is not strictly medical, it plays a major role in how your care is paid for and how assets are protected during late-life transitions.

Important tools include:

- Last Will and Testament – Directs how assets are distributed after death

- Revocable Living Trust – Helps manage assets if you become incapacitated and can avoid probate

- Irrevocable Trust – In some cases, used for Medicaid planning

- Beneficiary designations – Must be kept current on bank accounts, investments, and life insurance

A properly structured estate plan can also help protect assets from long-term care expenses, depending on state rules and timing.

Family Care Agreements

If you expect adult children to care for you, a Family Care Agreement or Caregiver Contract outlines:

- The responsibilities of the caregiver

- How they will be compensated

- How long-term care decisions will be made

- Which funds will be used for in-home support

This protects both the caregiver and the person receiving care and can be important for Medicaid eligibility later.

Essential Legal Documents Every Senior Needs

These legal documents ensure your wishes are honored and your family is protected during medical, financial, or end-of-life situations. Every senior should review and implement the items below with a trusted family member, friend, or attorney.

- Durable Power of Attorney (POA): Allows a trusted person to manage your finances if you become unable to do so.

- Healthcare Power of Attorney / Medical Proxy: Appoints someone to make medical decisions on your behalf.

- Advance Health Care Directive / Living Will: Outlines your wishes for life-sustaining treatments and end-of-life care.

- HIPAA Authorization: Permits doctors to share your medical information with designated individuals.

- Last Will and Testament: Directs how your assets are distributed after death.

- Revocable or Irrevocable Trust (when appropriate): Helps manage assets during incapacity and may protect assets depending on structure.

- Beneficiary Designations: Must be updated on bank accounts, investments, retirement plans, and life insurance.

- Family Care Agreement: Defines responsibilities and compensation if a family member will assist with long-term care.

- Funeral & Final Arrangement Instructions: Clarifies whether you prefer cremation, burial, VA cemetery placement, and how expenses will be funded.

Putting these documents in place now prevents confusion, reduces stress on your family, and ensures your medical and financial choices are carried out exactly as you intended.

Why These Legal Documents Matter

You will need some—if not all—of the legal documents listed below for several important reasons:

- End-of-life guidance:

Do not leave your family wondering what you would have wanted. Be specific about funeral arrangements—cremation, burial, interment in a VA cemetery, or another plan that reflects your wishes. Include instructions for funding your funeral expenses so your family isn’t forced to guess or make financial decisions during a difficult time. - Decision-making during incapacity:

If you become incapacitated and unable to make medical decisions, who will make them for you? This must be decided and documented well before a crisis occurs. Without legal authorization, your family may face confusion, conflict, or delays in getting you the care you need. - Financial management:

Who will manage your money, pay your bills, protect your assets, and handle your property if you cannot? Failing to answer these questions in advance can lead to expensive legal proceedings, frozen accounts, or financial mismanagement. - Preventing unnecessary burden on your family:

Caregiving, financial oversight, and emergency decision-making are stressful enough. Don’t place additional strain on your family because of a lack of planning. By implementing the documents below—with the help of a trusted family member, friend, or attorney—you create a solid, clear plan that ensures your wishes are respected and your family is protected.

This foundation helps everything that follows—medical care, financial decisions, long-term care planning—run more smoothly and with far less emotional or legal turmoil.

Why Legal Planning Is Essential

Legal planning addresses the “who” and “how” of your care:

- Who will make decisions

- Who will manage your finances

- How your care will be organized

- How your assets will be protected

By putting these documents in place long before care is needed, you eliminate confusion, reduce stress on your family, and ensure that your future care aligns with your personal preferences.

6. Building a Comprehensive Healthcare Budget for Retirement

Healthcare is one of the largest and most unpredictable expenses retirees face. Even with Medicare, supplemental plans, and preventive care, costs can rise quickly due to inflation, new medications, unexpected medical events, and long-term care needs. Creating a comprehensive healthcare budget empowers retirees to stay financially secure while accessing the care they need.

A good healthcare budget doesn’t rely on guesswork—it is built on real numbers, predictable premiums, and reasonable estimates of out-of-pocket costs. Plus medicare premiums and retirement healthcare planning.

Start With Known, Fixed Monthly Costs

Some healthcare expenses are predictable and recur every month. These should form the foundation of your budget.

Medicare Premiums

Include:

- Part B premiums

- Part D premiums

- Medicare Advantage or Medigap premiums

- IRMAA surcharges (if applicable)

Because Medicare premiums can change annually, build a small cushion into your budget to account for future increases.

Supplemental Plan Premiums

If you have a Medigap or Medicare Advantage plan, incorporate those monthly premiums. Don’t forget dental, vision, or hearing plans if purchased separately.

Estimate Prescription Drug Costs

Prescription expenses vary widely, but retirees can plan more effectively by looking at:

- Current Part D copays, deductibles, and coinsurance

- Whether they expect to reach the “donut hole”

- Brand-name vs. generic use

- Annual deductible resets

- Special medications such as GLP-1 weight-loss drugs

- Mail-order vs. retail pharmacy pricing

If medications change frequently, consider using the highest annual cost as your benchmark rather than your current total.

Plan for Out-of-Pocket Medical Expenses

Even with excellent coverage, retirees face out-of-pocket costs for:

- Office visit copays

- Specialist visits

- Urgent care or emergency services

- Imaging and diagnostics (X-rays, MRIs, CT scans)

- Physical therapy

- Dental procedures (fillings, crowns, root canals, implants)

- New eyeglasses or hearing aids

- Routine bloodwork and screenings

- Medical equipment (walkers, braces, CPAP supplies)

A realistic rule of thumb is to set aside $50–$150 per month for variable medical expenses, depending on your health history.

Include Preventive and Lifestyle Health Costs

Retirees often overlook the costs associated with maintaining wellness, such as:

- Gym memberships

- Physical therapy maintenance sessions

- Nutritional counseling

- Supplements

- Weight-loss programs

- Chiropractic or acupuncture services

- Mobility upgrades (grab bars, ramps, railings)

- Home safety devices and fall-prevention tools

These are not strictly medical, but they influence health and safety—and they cost money.

Prepare for Long-Term Care—Even If You May Never Need It

Long-term care is expensive, and the best time to plan for it is long before you need it.

Include projections for:

- In-home care services

- Assisted living

- Memory care

- Adult daycare

- Respite care

- Potential family caregiving costs

If you prefer home-based care, your budget should include funds to compensate family members or pay for part-time professional caregivers.

You don’t need to assume the worst-case scenario, but you do need a plan that considers your preferences and possible future needs.

Create a Healthcare Emergency Fund

Unexpected health events happen, even with great insurance. Set aside a dedicated emergency fund for:

- Sudden hospitalizations

- Surgeries

- Out-of-network care while traveling

- Expensive new medications

- High deductibles or coinsurance spikes

- Dental emergencies

- Medical travel or second opinions

Many retirees keep $2,000–$5,000 in a healthcare-specific reserve to avoid dipping into long-term savings.

Review and Adjust Your Budget Every Year

Healthcare spending changes dramatically from year to year. Reviewing your budget annually—preferably during Medicare’s Annual Enrollment Period (Oct. 15–Dec. 7)—helps keep your plan accurate.

Update your budget when:

- Premiums increase

- New medications are prescribed

- A deductible resets

- You develop a new chronic condition

- Plan benefits change

- A spouse or partner has new medical needs

The goal is not perfection—it’s preparedness.

Why a Healthcare Budget Matters

A well-built healthcare budget does more than list expenses. It provides:

- Peace of mind

- Protection against financial surprises

- A clearer understanding of your Medicare choices

- Insight into whether you need supplemental insurance

- A realistic picture of long-term affordability

- Confidence that you can age with dignity and control

Healthcare is one of the few retirement expenses that almost always rises with age. By creating a detailed budget, retirees stay in control and avoid the stress of guesswork or crisis spending.

Use the RetireCoast Retirement Budget Tool

To make the budgeting process easier, you can use the RetireCoast Retirement Budget Tool, which includes a dedicated section for healthcare planning and long-term cost projections. This tool helps you organize:

- Medicare premiums

- Supplemental insurance costs

- Prescription drug expenses

- Out-of-pocket medical spending

- Preventive health costs

- Long-term care estimates

Access the tool here:

Using the tool ensures you don’t overlook critical expenses and provides a structured way to create a personalized, realistic healthcare budget for your retirement years.

7. Putting It All Together: Creating Your Personalized Healthcare Plan

By now, you’ve learned that retirement healthcare planning is not one decision—it’s a series of decisions that work together. Medicare choices, prescription drug costs, long-term care preparation, and legal planning all intersect. The goal of this section is to help you combine everything into a single, easy-to-follow roadmap that fits your lifestyle, health history, financial resources, and long-term goals.

A personalized healthcare plan gives you clarity, reduces stress, and ensures you stay in control of your care as you age. Medicare premiums and retirement healthcare planning below will help with your well being.

Step 1: Identify Your Healthcare Priorities

Start with the fundamentals:

- Your current health status (conditions, medications, future risks)

- Your doctor and specialist preferences

- Your travel habits (important when choosing HMO vs. PPO)

- Your comfort level with out-of-pocket costs

- Your desire for flexibility vs. lower premiums

Write these down. They form the foundation for every decision that follows.

Step 2: Choose the Right Medicare Structure

Use what you learned in Sections 1–3 to decide between:

- Original Medicare + Medigap + Part D, or

- Medicare Advantage (HMO or PPO)

Ask yourself:

- Do I want nationwide flexibility (PPO/Original Medicare)?

- Do I prefer predictable copays (Advantage plans)?

- Do I travel often or split time between states?

- Do I have specific doctors I want to keep?

- Will I realistically need extensive medical care?

A single wrong assumption here—especially about networks or travel—can cost thousands later.

Step 3: Build Your Prescription Drug Strategy

Using the steps from Section 3:

- List all your medications

- Check their tiers on your plan

- Confirm whether deductibles apply

- Compare retail vs. mail-order pharmacy pricing

- Review your plan every year during open enrollment

- Ask your doctor or pharmacist when drugs change tiers

- Evaluate high-cost medications like GLP-1s proactively

Retirees routinely overpay for prescriptions simply by staying in the wrong plan. Avoid this trap.

Step 4: Start Planning Early for Long-Term Care

Section 4 makes this clear: long-term care is not covered by Medicare, and failing to prepare can be financially devastating.

Your plan should include:

- Whether you want in-home care or a residential facility

- Whether family members can provide care

- How care will be funded

- Whether long-term care insurance or a hybrid policy makes sense

- A plan for memory care or assisted living if needed

- Annual cost projections for your region

Add a long-term care line or category to your healthcare budget. Even a modest estimate helps prevent unexpected strain on your savings.

Step 5: Complete Your Legal Documents Early

Section 5 outlined the critical legal documents every senior should have. Incorporate them into your plan by:

- Naming your healthcare proxy

- Naming your financial POA

- Completing your Advance Directive / Living Will

- Updating your Will and Trust

- Updating beneficiaries

- Documenting funeral and end-of-life preferences

- Creating a family care agreement if appropriate

Store these documents somewhere safe, and ensure your family knows where they are.

Step 6: Build a Monthly and Annual Healthcare Budget

Use the RetireCoast Retirement Budget Tool to organize:

- Medicare premiums

- Supplement plans

- Prescription drugs

- Dental, vision, and hearing

- Co-pays and coinsurance

- Preventive and lifestyle health expenses

- Long-term care projections

- Emergency fund contributions

Healthcare inflation means your budget must be updated annually—especially during Medicare’s open enrollment period.

Step 7: Communicate Your Plan with Your Family

A healthcare plan is only effective if the people around you know about it.

Communicate:

- Your medical wishes

- Who your decision-makers are

- Your long-term care preferences

- Where your key documents are stored

- Your financial approach to care

- Who to call during emergencies

This prevents confusion, conflict, and last-minute decisions during medical events.

Step 8: Review Your Plan Every Year

Just like your financial retirement plan, your healthcare plan must evolve. Review it annually when:

- Medicare premiums change

- Prescription drug tiers shift

- New medications are added

- Your health condition changes

- Your travel habits shift

- A spouse passes away

- Long-term care needs become more likely

This annual review ensures your plan stays aligned with your life and goals.

The Value of a Personalized Healthcare Plan

A strong healthcare plan provides:

- Financial security

- Predictability in a changing healthcare system

- Clarity for you and your family

- Confidence that you can age with dignity

- Control over the care you receive

Retirement is better when healthcare worries don’t dominate your life. A personalized plan replaces uncertainty with structure and helps ensure that your healthcare decisions match your values, preferences, and financial reality.

8. Selecting Health Care Professionals: Building the Right Team for Your Retirement Years

Choosing the right doctors and specialists is one of the most important—and most overlooked—parts of Medicare planning. Your Medicare Advantage or Medigap + Part D decisions determine which providers you can see and how much you will pay. Planning ahead ensures that you can keep the doctors you trust and avoid unpleasant surprises after you enroll.

Use Your Medicare Plan’s Provider Directory

Your Medicare insurance provider should give you access to their website or online portal where you can:

- Search for in-network doctors (HMO)

- Find local providers who accept Medicare reimbursement (PPO or Original Medicare)

- View ratings, specialties, office locations, and availability

- Confirm which hospitals and clinics your plan works with

These directories are updated regularly and are essential for avoiding unexpected out-of-network charges.

Check Whether Your Current Doctors Accept Your New Coverage

If you are preparing to enroll in Medicare at age 65, or switching plans during the Annual Enrollment Period, take time to confirm whether your current doctors accept the plan you’re considering.

Here’s why this matters:

- Not all doctors accept Medicare, and some stop accepting new Medicare patients.

- Some specialists refuse both Medicare and Medicaid due to reimbursement rates.

- Certain doctors accept Original Medicare but not Medicare Advantage HMOs.

- In highly populated areas, networks may be narrower and more restrictive.

Before enrolling, make a list of your preferred doctors, including primary care physicians and specialists. Then verify whether they are:

- In-network for the Medicare Advantage plan you’re considering

- Accepting Medicare patients if you choose PPO or Original Medicare

- Contracted with nearby clinics or hospitals covered by your plan

This step alone can prevent major disruption to your care.

Selecting a Primary Care Physician (PCP)

When you enroll in most Medicare Advantage plans—especially HMOs—you must choose a Primary Care Physician(PCP). This doctor becomes your central point of contact and typically manages:

- Referrals to specialists

- Routine wellness visits

- Chronic condition follow-up

- Medication management

If you have existing medical conditions, this choice becomes even more important.

HMO vs. PPO: Specialist Access Matters

If you see specialists such as:

- Ophthalmologists

- Cardiologists

- Orthopedists

- Podiatrists

- Endocrinologists

- Dermatologists

…you may want the flexibility of a PPO. PPO plans allow you to schedule appointments directly with in-network specialists, without requiring a referral from your primary care doctor.

By contrast, HMOs generally require referrals, which may limit your ability to see the specialist you prefer—or delay care while waiting for approval.

If maintaining access to a specific doctor or specialty clinic is important to you, PPO coverage may be the better fit.

If You Are Planning to Relocate, Prepare Early

Many retirees move after age 65—to be closer to family, reduce housing costs, or enjoy a new lifestyle. However, moving can completely change your healthcare provider options.

Before relocating:

- Ask your current doctors for referrals in the new area.

- Create a list of recommended specialists and primary care physicians.

- Verify that the recommended providers:

- Accept Medicare or your specific Medicare Advantage plan

- Are taking new patients

- Are in-network (for HMO or PPO plans)

- Research the local hospital networks to confirm they align with your plan.

Knowing this information ahead of time helps you transition smoothly, especially if you have chronic conditions that require continuous care.

The Bottom Line

Selecting the right healthcare professionals is just as important as choosing the right Medicare coverage. Plan ahead, make your list, confirm provider participation, and think carefully about whether an HMO or PPO best fits your medical needs. Doing this before you enroll—or before you move—prevents gaps in care and ensures you maintain access to the doctors and specialists you trust.

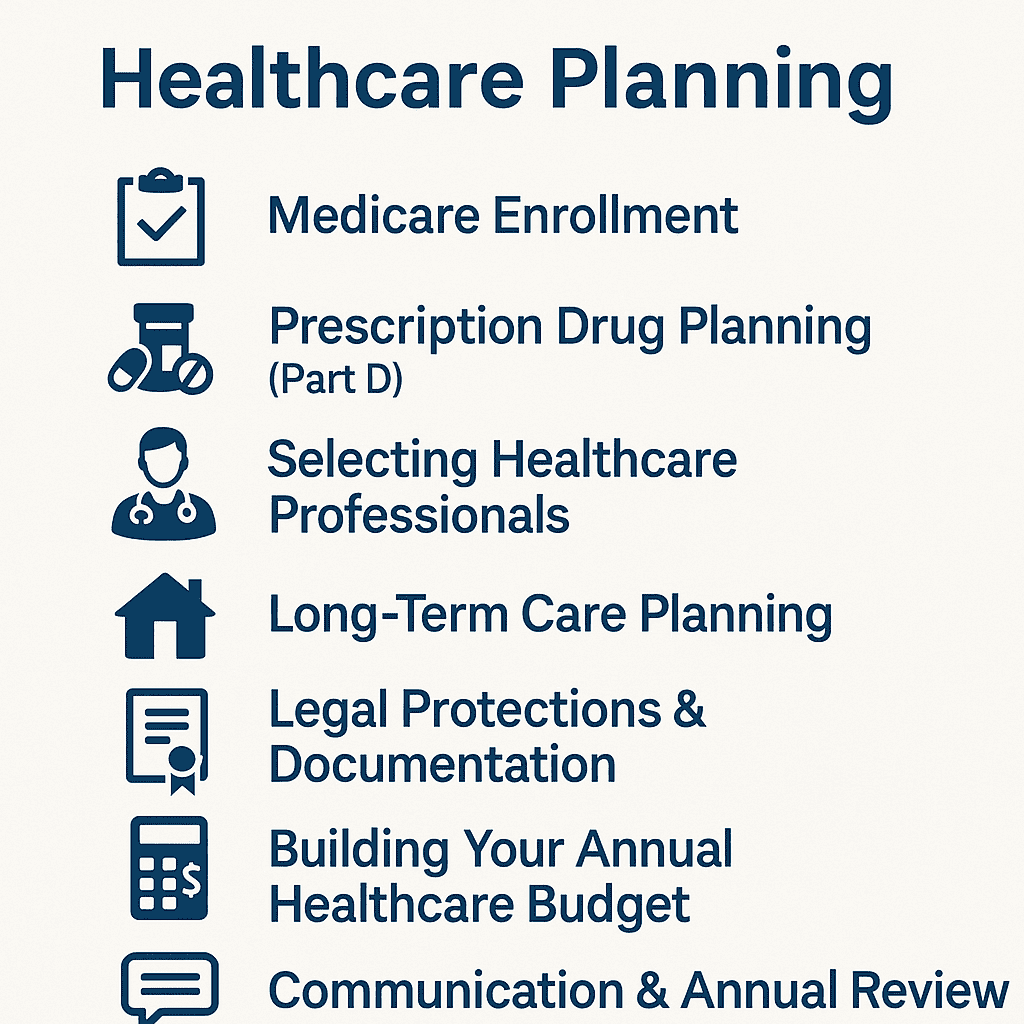

9. Your Complete Medicare & Healthcare Planning Checklist

Healthcare planning in retirement requires multiple decisions made across different categories—insurance, prescription drugs, doctor selection, long-term care, budgeting, and legal protections. This checklist brings every major step together so you can easily track your progress and ensure nothing important is overlooked.

Use it as a working document, share it with your family, and revisit it each year when your healthcare needs or Medicare options change.

✓ Medicare Enrollment & Plan Selection

Before enrolling or switching plans, confirm that you have:

- ☐ Reviewed the difference between Original Medicare + Medigap vs. Medicare Advantage

- ☐ Compared HMO vs. PPO coverage based on travel, doctor access, and specialist needs

- ☐ Checked whether your preferred doctors accept your selected plan

- ☐ Researched network hospitals and local clinics

- ☐ Evaluated whether a Medigap plan offers better predictability

- ☐ Reviewed Medicare.gov plan comparisons

- ☐ Verified premiums, deductibles, and coinsurance for each part of Medicare

- ☐ Understood IRMAA surcharges if you are above certain income thresholds

✔️Prescription Drug Planning (Part D)

- ☐ Created a list of all medications you take

- ☐ Checked each medication’s drug tier

- ☐ Reviewed your deductible and whether it applies to brand-name drugs

- ☐ Compared retail vs. mail-order pharmacy prices

- ☐ Verified preferred pharmacies for your plan

- ☐ Understood how the donut hole (coverage gap) might impact costs

- ☐ Investigated costs for GLP-1 or other specialty medications

- ☐ Reviewed your Part D plan annually during open enrollment

✓ Selecting Healthcare Professionals

- ☐ Confirmed which doctors are in-network (HMO)

- ☐ Verified which providers accept Medicare reimbursement (PPO)

- ☐ Made a list of doctors you want to keep

- ☐ Checked availability and whether they accept new Medicare patients

- ☐ Selected a primary care physician

- ☐ Identified specialists you may need (cardiology, ophthalmology, podiatry, etc.)

- ☐ If planning a move, requested referrals and checked Medicare acceptance in your new area

✔️Long-Term Care Planning

- ☐ Identified your preferences (in-home care, assisted living, nursing home, memory care)

- ☐ Discussed potential family caregiving roles

- ☐ Considered compensating family caregivers

- ☐ Reviewed long-term care insurance or hybrid policies

- ☐ Added long-term care expenses to your healthcare budget

- ☐ Evaluated whether Medicaid planning is appropriate

- ☐ Discussed your long-term care wishes with family members

✔️Legal Protections & Documentation

Ensure the following documents are updated, accessible, and legally valid:

- ☐ Durable Power of Attorney

- ☐ Healthcare Power of Attorney / Medical Proxy

- ☐ Advance Directive / Living Will

- ☐ HIPAA Authorization

- ☐ Last Will and Testament

- ☐ Revocable or Irrevocable Trust (as needed)

- ☐ Beneficiary designations on all financial accounts

- ☐ Family Care Agreement if children will help with caregiving

- ☐ Funeral and final arrangement instructions (cremation, burial, VA cemetery, etc.)

Store these documents in a safe place and tell trusted family members how to access them.

✓ Building Your Annual Healthcare Budget

- ☐ Entered premiums into your monthly budget

- ☐ Estimated prescription costs

- ☐ Reviewed out-of-pocket medical expenses

- ☐ Added dental, vision, and hearing expenses

- ☐ Included preventive care and wellness costs

- ☐ Added long-term care projections

- ☐ Created a healthcare emergency fund

- ☐ Updated your budget using the RetireCoast Retirement Budget Tool:

Budget Spreadsheet - ☐ Reviewed your budget during Medicare’s Annual Enrollment Period

✓ Communication & Annual Review

- ☐ Shared your healthcare plan and wishes with family

- ☐ Reviewed your plan every year (premiums, networks, medications, providers)

- ☐ Updated legal documents when family circumstances change

- ☐ Updated your long-term care preferences and budget

The Purpose of This Checklist

This checklist is more than a summary—it’s a roadmap. Retirement healthcare planning isn’t a one-time event; it’s a process that evolves as your medical needs and life circumstances change.

By completing and revisiting this checklist regularly, you gain:

- Control over your healthcare choices

- Financial predictability

- Peace of mind for yourself and your family

- A clear plan that supports healthy, dignified aging

Conclusion: A Smarter, Stronger Approach to Healthcare in Retirement

Healthcare planning is one of the most important steps you can take to protect your financial security, independence, and peace of mind as you age. While Medicare provides a strong foundation, it’s not a complete system—and the decisions you make at 65 and beyond will shape your healthcare experience for the rest of your life. Medicare premiums and retirement healthcare planning are discussed below.

The retirees who enjoy the best outcomes aren’t the ones with the most expensive plans. They’re the ones who:

- Understand how Medicare works

- Review their prescription coverage every year

- Choose doctors and specialists carefully

- Plan early for long-term care

- Complete their legal documents long before they’re needed

- Build realistic budgets that reflect real healthcare costs

- Communicate openly with their families

Your future healthcare is too important to leave to guesswork. By using the steps, tools, and checklists in this guide—including the RetireCoast Retirement Budget Tool—you can create a personalized healthcare plan that supports your lifestyle, protects your assets, and ensures that your wishes are respected every step of the way.

Remember: good planning isn’t about anticipating every medical event—it’s about being ready for whatever your retirement years bring. When you combine clear information, thoughtful preparation, and proactive decision-making, you give yourself the best chance at a healthier, more secure, and more enjoyable retirement.

If you’d like help reviewing your Medicare choices, building a budget, or creating a long-term care strategy, RetireCoast is here to help you make those decisions with confidence.

Healthcare & Medicare Planning FAQ

1. Why is healthcare planning so important in retirement?

Healthcare is often one of the largest and fastest-growing expenses in retirement. Planning ahead for Medicare premiums, coverage gaps, prescriptions, and long-term care helps you avoid surprise bills and protects your retirement savings.

2. What is the difference between Original Medicare and Medicare Advantage?

Original Medicare includes Part A (hospital) and Part B (medical), and you can add a Part D drug plan and an optional Medigap policy. Medicare Advantage (Part C) bundles hospital, medical, and often drug coverage into one HMO or PPO plan with its own network, rules, and out-of-pocket limits.

3. How do HMO and PPO Medicare Advantage plans differ?

HMO plans typically require you to use in-network doctors and get referrals from a primary care physician. Care outside your region is often not covered. PPO plans usually cost more but allow more flexibility to see out-of-network providers, which can be helpful if you travel or see multiple specialists.

4. Do I still need a Medigap plan if I am healthy today?

Medigap plans help pay the deductibles, coinsurance, and copays that Original Medicare does not cover. Even if you are healthy now, a Medigap plan can provide predictable costs as you age and may be harder or more expensive to obtain later if your health declines.

5. How can I control my prescription drug costs in retirement?

Review your Part D or Medicare Advantage drug coverage every year, make a complete list of your medications, use preferred or mail-order pharmacies when available, and ask your doctor about generics or lower-cost alternatives. Be especially careful with high-cost drugs like GLP-1 weight loss medications and understand deductibles before you fill a prescription.

6. Are dental, vision, and hearing covered by Medicare?

Original Medicare does not generally cover routine dental, vision, or hearing care. Some Medicare Advantage plans include limited benefits for checkups, cleanings, eyeglasses, or hearing aids. Before buying separate insurance, talk with your dentist and other providers to see whether it truly saves you money.

7. What is long-term care and does Medicare pay for it?

Long-term care includes help with daily activities such as bathing, dressing, and eating, either at home or in a facility. Medicare may cover short-term skilled nursing after a hospital stay, but it does not pay for extended custodial care. Without a plan, costs for assisted living or nursing homes can quickly drain your savings. Medicare premiums and retirement healthcare planning can help.

8. Which legal documents should I have in place for healthcare decisions?

Most retirees should have a healthcare power of attorney, a durable financial power of attorney, an advance directive or living will, a HIPAA authorization, and an updated will or trust. These documents clarify who can speak for you, how your care should be handled, and how your money will be managed if you cannot decide for yourself.

9. How do I choose doctors and specialists under my Medicare plan?

Use your plan’s online directory to search for in-network doctors, hospitals, and specialists. Make a list of the doctors you want to keep and confirm they accept your Medicare plan. If you prefer to choose your own specialists without referrals, a PPO may fit better than an HMO, but usually at a higher premium.

10. How often should I review my Medicare and healthcare plan?

At least once a year, during the Medicare Annual Enrollment Period, review your premiums, drug coverage, out-of-pocket costs, and network providers. Update your healthcare budget, revisit long-term care plans, and confirm that your legal documents still reflect your wishes.