Retirement is far more than stepping away from work—it’s the beginning of a retirement lifestyle planning journey that shapes how you live, travel, relax, and stay connected. Today’s retirees want a lifestyle filled with flexibility, meaning, and joy. Because of that, planning ahead ensures your retirement years align with what matters most: freedom, relationships, purpose, and the experiences you choose to build into your life.

This guide explores five major lifestyle pillars—travel, hobbies, grandkids, entertainment, and personal choices—and shows how each contributes to a fulfilling retirement lifestyle. Throughout, you’ll see why the Mississippi Gulf Coast has become one of the nation’s most appealing lifestyle destinations for retirees seeking sunshine, affordability, and coastal living.

Travel: The Foundation of a Flexible Lifestyle

Travel is often the first area people consider when beginning retirement lifestyle planning. With your schedule finally your own, you can design a lifestyle centered around exploration, relaxation, and experiences you once postponed.

Travel Lifestyles That Fit Retirees

Because retirement allows you to travel outside peak season, you can enjoy:

- Snowbird living — A popular option that supports a warm-weather lifestyle for several months each year. The Mississippi Gulf Coast offers mild winters, affordable beachfront rentals, and easy access to dining, arts, and events.

- RV lifestyle — Retirees increasingly adopt RV travel as a full or partial lifestyle. Highway 90 along the Gulf Coast provides scenic drives, coastal views, and convenient RV parks.

- Cruise-centered lifestyle — With cruise terminals in New Orleans and Mobile, retirees can incorporate regular cruises into their annual plans.

- Short “micro-adventures” — Weekend trips to Ocean Springs, Bay St. Louis, or Biloxi help maintain an active lifestyle without extensive planning.

Why the Mississippi Gulf Coast Fits a Travel Lifestyle

The Coast supports a relaxed but engaging lifestyle with:

- Uncrowded beaches

- Outdoor recreation

- Historic attractions

- Festivals like Mardi Gras and Cruisin’ the Coast

- Affordable accommodations

As a result, many retirees discover that what starts as a vacation quickly becomes part of their long-term lifestyle.

Hobbies: Rediscovering Passions and Purpose

A key part of retirement lifestyle planning is deciding how you want to spend your days. Hobbies help create structure, purpose, and enjoyment, ultimately shaping the rhythm of your retirement lifestyle.

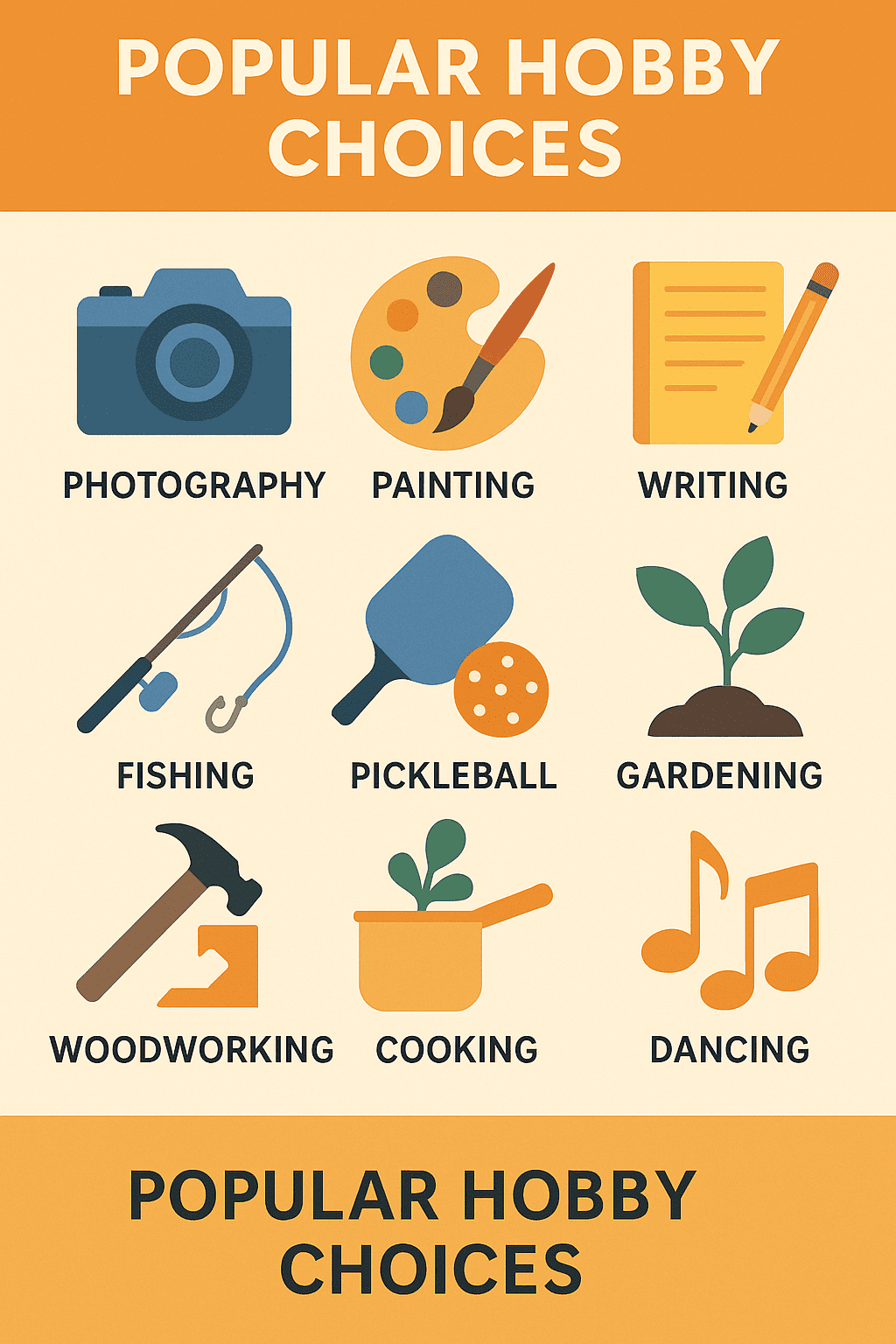

Lifestyle Hobbies That Inspire Retirees

Popular choices include:

- Photography, painting, or writing

- Fishing, boating, kayaking, or birdwatching

- Pickleball, golf, or walking groups

- Gardening, woodworking, or crafting

- Cooking, dancing, or attending art classes

Because of its mild weather and year-round outdoor access, the Mississippi Gulf Coast is ideal for hobbies that support an active lifestyle. In addition, the thriving arts communities in Ocean Springs, Gulfport, and Bay St. Louis offer classes, workshops, galleries, and festivals that bring creativity into daily life.

Turn Your Hobby Into a Business After Retirement

Many retirees discover that their hobbies are not only enjoyable but also offer surprising income potential. Turning a hobby into a business can become an important part of retirement lifestyle planning, especially for those who want purpose, structure, or supplemental income.

For example, some close friends of mine retired without a solid plan for how they would spend their time. They were in their early 60s, healthy, and capable of doing almost anything—or nothing. As they reflected on the hobbies they had always wanted to explore, they decided to start making handcrafted items out of wood.

Naturally, they bought every woodworking tool and machine they could find. At first, the hobby was simply fun. They made gifts for friends and relatives, enjoying the creativity and the satisfaction of learning something new. Eventually, people began asking them to create special pieces—this time for payment. Before long, their hobby had quietly transformed into a small, enjoyable business generating real income.

Stories like theirs inspired me to write an entire series on starting a business after retirement. That series, available here:

https://retirecoast.com/stareting-a-business-after-retirement-full-series-indez/

will take you through every stage of launching a retirement business—from idea to growth.

When Hobbies Become Lifestyle Anchors

For many retirees, hobbies ultimately:

- Become rewarding volunteer opportunities

- Grow into part-time or seasonal income

- Strengthen social connections

- Support a healthy, active lifestyle

Planning time for hobbies ensures your retirement lifestyle remains vibrant, meaningful, and personally fulfilling.

Grandkids: Nurturing a Family-Centered Lifestyle

Family often plays a central role in retirement lifestyle planning. Whether your grandkids live nearby or across the country, retirement gives you the freedom to invest time and energy into creating meaningful relationships.

Lifestyle Traditions That Strengthen Bonds

You can design family traditions that become part of your retirement lifestyle, such as:

- Annual beach trips to the Mississippi Gulf Coast

- Holiday baking days or summer “grandparent camp”

- Shared hobbies like gardening, fishing, or crafting

- Exploring coastal museums, parks, and attractions together

Since the Coast offers aquariums, waterparks, kid-friendly beaches, and family-oriented events, it’s an ideal destination for multigenerational travel.

Balancing Time With Grandkids and Your Own Lifestyle

Your grandkids may be so enjoyable to be around that your adult children will naturally ask you to babysit. I did the same with my parents when my wife was working and I was attending college at night. Of course, there were also parties and special events when additional help was appreciated. My parents were wonderful about stepping in during those times, and it created lasting memories for all of us.

However, this is exactly why good communication becomes an important part of retirement lifestyle planning. You and your adult children must talk openly about balancing their childcare needs with your desire to travel, relax, or pursue hobbies.

After all, you waited decades to finally have this freedom together—and while helping with grandkids is rewarding, it should not prevent you from achieving your own retirement goals.

As long as everyone agrees that you have already raised your children and now deserve time to experience life on your terms, the arrangement can work beautifully. I loved the time I had with my grandchildren, and our family found a balance that supported everyone’s lifestyle and needs.

Building Connection from a Distance

If grandkids live far away, lifestyle planning still helps maintain strong ties. For example:

- Weekly video calls

- Mailing postcards from your travels

- Reading books together online

- Sharing digital photo albums

A family-centered lifestyle enriches both your retirement years and theirs.

Entertainment: Staying Social, Active, and Engaged

Entertainment is often overlooked in retirement lifestyle planning, yet it’s essential for staying mentally sharp and socially connected. A strong entertainment lifestyle includes both quiet experiences and lively activities.

Entertainment Options That Support a Balanced Lifestyle

Retirees often enjoy:

- Live music and community theater

- Art festivals and cultural events

- Casino shows and concerts (a major part of Gulf Coast entertainment)

- Dining out and exploring new restaurants

- Parades, markets, and seasonal celebrations

- Volunteering or joining hobby groups

The Mississippi Gulf Coast excels at providing diverse entertainment options. As a result, it supports a lifestyle that blends excitement with relaxation—something retirees value greatly.

Casino Play and Mental Sharpness

Some entertainment options also support cognitive health. For example, I have found that playing craps at the casino keeps my mind sharp. Each bet includes its own payout structure—especially the proposition bets—so you must think quickly and clearly. My personal style is to increase bets using house money, and to do it effectively, you must calculate payouts, press bets correctly, and evaluate risk in real time.

This becomes a lot of math in a short period of time, which is excellent mental stimulation. In fact, sometimes at home when I’m relaxing, I play craps in my head—placing imaginary bets, pressing them, and tracking winnings. It’s a surprisingly effective mental exercise that keeps the brain active.

Volunteering as Entertainment and Purpose

Entertainment can also take the form of giving back. For example, my brother volunteers with the USO and gets tremendous satisfaction from working with young military families. Occasionally, I go with him to help cook hamburgers or assist at events. We both enjoy contributing our time to something meaningful, and the experience adds a sense of community and purpose to our retirement lifestyle.

Personal Choices: Designing a Lifestyle That Fits You

Ultimately, retirement lifestyle planning is about making choices that shape your daily life. These decisions influence your happiness, security, and long-term satisfaction.

Lifestyle Decisions Many Retirees Consider

Common choices include:

- Downsizing or relocating

- Moving to a coastal lifestyle destination like the Mississippi Gulf Coast

- Simplifying finances

- Prioritizing health and fitness

- Starting a small business or passion project

- Creating a lifestyle that balances travel, hobbies, and family time

Why Many Retirees Choose the Gulf Coast Lifestyle

The Coast offers:

- A low cost of living

- Friendly, walkable communities

- Excellent healthcare access

- Cultural and recreational activities

- Affordable beachfront living

These elements combine to create a retirement lifestyle that is comfortable, enjoyable, and financially smart.

Final Thoughts: Crafting Your Ideal Retirement Lifestyle

Retirement is not an ending—it’s the beginning of a carefully designed lifestyle. By focusing on retirement lifestyle planning, you can create a future filled with meaning, connection, travel, hobbies, entertainment, and family. Moreover, choosing the right place to live or travel—like the Mississippi Gulf Coast—can enhance every pillar of that lifestyle.

Your retirement lifestyle is yours to shape. With thoughtful planning and the right environment, the years ahead can be your most fulfilling chapter yet.

Retirement Lifestyle FAQ

1. How do I start planning my retirement lifestyle?

Begin by listing what matters most: travel, hobbies, time with grandkids, and community life. Estimate the cost of each, then match those choices with your retirement income and savings. Adjust until the lifestyle you want feels both exciting and sustainable.

2. How much travel can I realistically afford in retirement?

Total your fixed expenses first (housing, healthcare, insurance, food). Whatever remains can be used for “lifestyle spending” such as travel. Many retirees stretch their budget by taking off-season trips, driving instead of flying, and choosing affordable destinations like the Mississippi Gulf Coast for longer stays.

3. Why is the Mississippi Gulf Coast a good retirement travel destination?

The Mississippi Gulf Coast offers warm weather, beaches, casinos, golf, fishing, and historic towns at a much lower cost than many coastal areas. It’s easy to reach by car, has a relaxed small-town feel, and plenty of restaurants and entertainment, making it ideal for repeat visits or snowbird stays.

4. How can hobbies improve my lifestyle after retirement?

Hobbies add structure, social connection, and a sense of purpose to your days. Whether it’s woodworking, gardening, travel photography, or pickleball, regular hobbies keep your mind and body active and help you build a new identity beyond your former career.

5. Can I turn a hobby into a small business after retirement?

Yes. Many retirees turn hobbies into income by selling handmade items, teaching others, or offering services part-time. Start small, track your costs, and read up on starting a business after retirement so your hobby-business supports your lifestyle instead of becoming stressful.

6. How do I balance time with grandkids and my own lifestyle goals?

Talk openly with your adult children about expectations. Let them know you love your grandchildren, but also plan to travel, pursue hobbies, or spend part of the year away—maybe on the Mississippi Gulf Coast. Agree on a schedule that respects everyone’s needs and prevents resentment.

7. What are some low-cost entertainment ideas for retirees?

Look for free concerts, community festivals, library events, local parks, and church or civic group activities. On the Mississippi Gulf Coast, for example, you can enjoy strolls on the beach, car shows, parades, and live music in casino lounges without spending a fortune.

8. How can I keep my mind sharp in retirement?

Regularly challenge your brain with reading, puzzles, learning new skills, volunteering, or even strategy-based games. Tracking odds at a casino game, learning a new card game, or planning complex trips all require mental math and problem-solving that help keep you sharp.

9. What if my spouse and I have different lifestyle ideas for retirement?

Create two separate “ideal week in retirement” lists, then compare. Look for overlap and trade-offs: maybe you split time between travel and home-based hobbies, or alternate trips to see grandkids with getaways to places like the Mississippi Gulf Coast. Revisit the plan each year as interests change.

10. How often should I review my retirement lifestyle plan?

Review it at least once a year or after any major life change. Check whether your spending still matches your priorities, whether you’re getting enough social time, and whether travel, hobbies, and family time feel balanced. Adjust as needed so your retirement lifestyle stays fun, flexible, and affordable.