Vacation Rental ROI Calculator: Compare Three Properties

Use this calculator to estimate the one-year return on investment (ROI) for up to three vacation rental properties. For each property, enter your cash invested, annual net cash flow (after mortgage and expenses), and an expected appreciation rate. ROI is calculated as: (Annual Net Cash Flow + Appreciation Gain) ÷ Total Cash Invested.

📊 Compare Vacation Rentals with Confidence

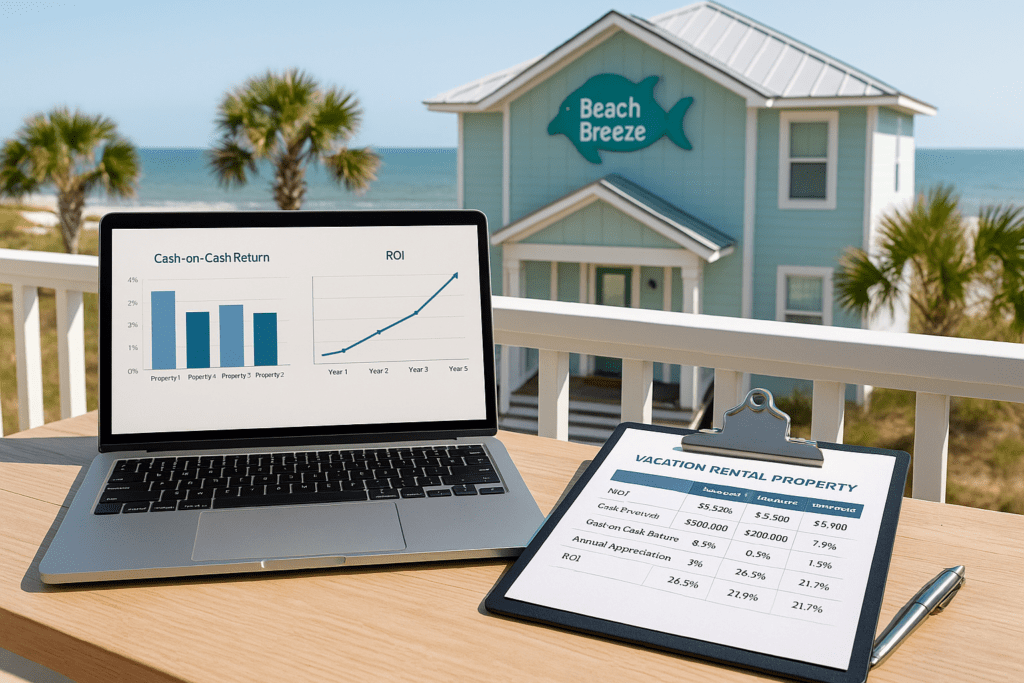

This Vacation Rental ROI Calculator allows you to compare up to three properties side by side using key investment metrics such as cash-on-cash return, Net Operating Income (NOI), appreciation assumptions, and overall return on investment (ROI). Side-by-side analysis makes it easier to identify which property best fits your financial goals and risk tolerance.

-

RetireCoast Calculators Hub

Access our full suite of real estate, retirement, and financial calculators — including income analysis tools, ROI models, mortgage calculators, and planning resources designed to work together. -

Vacation Rental Income & NOI Calculator

Start by estimating gross rental income, operating expenses, and Net Operating Income. Accurate NOI figures feed directly into more reliable cash-on-cash and ROI comparisons. -

Buying & Operating a Vacation Rental

Learn how experienced investors evaluate vacation rentals — including location selection, seasonality, management decisions, financing considerations, and long-term exit strategies. -

Senior Finance & Investment Articles

Explore how rental real estate can support retirement income, diversification, and long-term financial stability through cash flow and appreciation.

Want to review real vacation rentals before comparing ROI? Visit ChristiesGulfBeachRentals.com to browse active vacation rentals and see real-world pricing and rental patterns you can model in this calculator.

When you’re ready to explore purchasing a vacation rental, visit our Real Estate & Homeownership Hub or go directly to GulfCoastalRealtors.com to view available properties and work with experienced Gulf Coast real estate professionals.

Tip: Use NOI to confirm a property’s operating strength, then compare cash-on-cash return and total ROI across multiple properties to identify the best overall investment — not just the highest income.