Last updated on January 7th, 2026 at 09:40 pm

Home › Selling & Investing Hub › Pricing and Preparing Your Home to Sell

Broker-backed strategies to attract serious buyers and protect your financial future

Selling a home is one of the largest financial transactions most people will ever make. Done well, it can fund your next move, reduce debt, strengthen retirement security, or open the door to new investment opportunities. Done poorly, it can lead to unnecessary stress, months on the market, and a disappointing final sale price.

- This guide is part of our Selling & Investing Hub

- Why Pricing and Preparation Are Inseparable

- Understanding What Actually Determines a Home’s Value

- Pricing Strategy: Where Homes Sell (and Where They Don’t)

- Preparation: The Cheapest Way to Create the Most Value

- Curb Appeal and First Impressions

- Photography, Marketing, and Showings

- Think Beyond the Sale: Net Proceeds Matter

- National Market Perspective (External Reference)

- Final Thought

- Gen X Seller FAQ: Pricing & Preparing Your Home to Sell

Selling & Investing Hub

This guide is part of our Selling & Investing Hub

Explore more resources to help you decide whether to sell, rent, downsize, or reinvest your equity:

• Selling vs. Renting Your Home

• Downsizing vs. Rightsizing

• Pricing Strategy & Market Conditions

• Tax & Investing Considerations After the Sale

That’s why pricing and preparing your home to sell correctly from the start matters more than ever.

This guide walks through how experienced brokers think about pricing, preparation, and presentation—so you understand what buyers see, how the market responds, and how to position your home for a successful sale in today’s housing market.

This article is part of our broader Selling & Investing Hub, where we help homeowners decide whether selling, renting, downsizing, or reinvesting equity makes the most financial sense.

👉 Learn more here: /selling-and-investing/

Why Pricing and Preparation Are Inseparable

In every local real estate market, pricing and preparation work together. A beautifully prepared home priced incorrectly will sit. A well-priced home that’s dirty, cluttered, or poorly maintained will lose buyer confidence.

Buyers compare your home to:

- Recent sales of comparable homes

- Similar properties currently on the market

- Online photos and listing descriptions

- Overall market conditions and interest rates

Their decision happens quickly—often before they step through the front door. Strong curb appeal, realistic pricing, and clean presentation shape those critical first impressions.

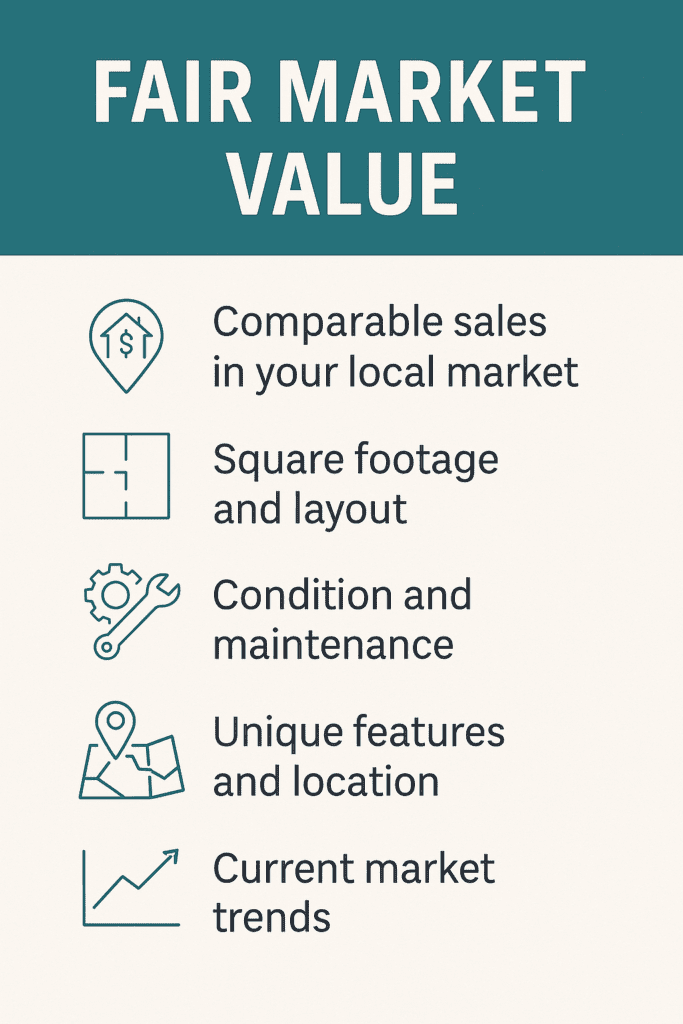

Comparable sales in your local market, square footage and layout, overall condition and maintenance, unique features and location, and current market trends.

Understanding What Actually Determines a Home’s Value

Many home sellers start with a number in mind. That’s natural—but it’s only a starting point.

What matters to buyers (and appraisers) is fair market value, which is determined by:

- Comparable sales in your local market

- Square footage and layout

- Condition and maintenance

- Unique features and location

- Current market trends

One misconception that causes problems: what you owe on the house has no bearing on what the market will pay for it. Buyers do not care about mortgage balances, outstanding debts, or personal financial goals.

A knowledgeable real estate agent uses a comparative market analysis (CMA)—supported by available data and recent comparable sales—to determine an appropriate list price. Some sellers also choose a professional appraisal as an added data point. Don’t forget the real value of your home is what someone is willing to pay for it.

Pricing Strategy: Where Homes Sell (and Where They Don’t)

The number one reason homes don’t sell quickly is price.

Overpricing rarely works. When a home sits on the market too long, buyers assume something is wrong. Months later, those same buyers often feel comfortable submitting lower offers, believing the seller is now more motivated.

A strong pricing strategy aims for the sweet spot:

- Competitive within its price range

- Attractive compared to similar homes

- Aligned with your timeline and goals

If you need a quicker sale—due to a job change, purchase contingency, or financial planning needs—pricing slightly more competitively can generate stronger interest and faster results. If you have more flexibility, pricing closer to the top of fair market value may work, but patience is required.

Your timeline matters. Your market matters. Pricing should reflect both.

For homeowners weighing alternatives, you may also want to explore whether selling is the right move at all:

📌 Broker Insight #1: Price Drives Everything

The number one reason houses don’t sell quickly is price. Overpricing a home rarely works. When a property sits on the market too long, it signals to buyers that something is wrong — and months later, those buyers often submit lower offers. Correct pricing from the start protects your negotiating power and helps you achieve a better final sale price.

Preparation: The Cheapest Way to Create the Most Value

Preparation isn’t about remodeling—it’s about removing doubt.

The best return often comes from simple, inexpensive steps:

- Deep cleaning

- Decluttering

- Fixing small but visible problems

- Neutralizing the space so buyers can picture themselves living there

A fresh coat of paint in neutral colors, removing excess furniture, and addressing minor repairs can make an average home feel far more appealing to prospective buyers.

🧼 Broker Insight #2: Cleanliness Is Not Optional

Clean your house. After price, cleanliness is the biggest issue that turns buyers away. Dirty rooms, bad smells, clutter, an unkempt yard, or even an unchanged litter box can overshadow everything else. A clean, fresh home always feels more valuable to buyers.

Buyers interpret cleanliness as a signal of overall care. If they see mess, they assume deferred maintenance.

🛠️ Broker Insight #3: Make Sure Everything Works

All major items need to work. Air conditioning, water heaters, plumbing, electrical systems, stoves, refrigerators, dishwashers, microwaves, and garage door openers must function properly. Don’t replace them—just repair them. Working systems reduce inspection issues, strengthen buyer confidence, and help keep negotiations focused on price instead of repairs.

Working systems reduce inspection issues, avoid renegotiation, and help keep the transaction on track after the home inspector’s report.

Buyers form opinions before they walk inside, and simple improvements like clean landscaping, trimmed shrubs, pressure-washed siding, a welcoming front door, and tidy entryways go a long way.

Curb Appeal and First Impressions

Buyers form opinions before they walk inside.

Simple curb appeal improvements go a long way:

- Clean landscaping

- Trimmed shrubs

- Pressure-washed siding

- A welcoming front door

- Tidy walkways and entry areas

These are some of the best ways to support a higher asking price without major investment.

Photography, Marketing, and Showings

Most buyers find homes online first. That means:

- Professional photography matters

- Clean, well-lit rooms photograph better

- Staging doesn’t have to be expensive

Strategic open houses and clear listing descriptions help buyers see your home as a great deal relative to comparable properties.

Think Beyond the Sale: Net Proceeds Matter

Before finalizing your pricing and preparation decisions, consider the full financial picture:

- Agent commissions

- Attorney fees and closing costs

- Capital gains considerations

- Down payment needs for your next home

You may want to review:

- Tax benefits of owning a home

https://retirecoast.com/tax-benefits-owning-home-2025/ - How selling fits into your long-term plan via the Selling & Investing Hub

Calculators that may help:

- https://retirecoast.com/calculators-hub/

- https://retirecoast.com/full-mortgage-calculator/

- https://retirecoast.com/mortgage-payoff-calculator/

- https://retirecoast.com/rent-vs-buy-calculator-2/

National Market Perspective (External Reference)

For broader housing trends and buyer behavior, data from the National Association of Realtors provides useful context:

👉 https://www.nar.realtor/

While national data matters, pricing decisions should always be grounded in your local real estate market, not headlines.

Selling & Investing Hub

This guide is part of our Selling & Investing Hub

Explore more resources to help you decide whether to sell, rent, downsize, or reinvest your equity:

• Selling vs. Renting Your Home

• Downsizing vs. Rightsizing

• Pricing Strategy & Market Conditions

• Tax & Investing Considerations After the Sale

Final Thought

A successful home sale is rarely about luck. It’s the result of:

- Realistic pricing

- Smart, affordable preparation

- Understanding buyer psychology

- Guidance from knowledgeable real estate professionals

When pricing and preparation align with your goals, the market responds—and your home sells with less stress, stronger offers, and a better outcome.

Gen X Seller FAQ: Pricing & Preparing Your Home to Sell

1. As a Gen X homeowner, how should I think about pricing my home?

Start by separating emotion from data. Many Gen X sellers are using this sale to fund their next home, pay off debt, or boost retirement savings. The right price comes from a comparative market analysis (CMA), recent sales of comparable properties, and current local market conditions – not from what you owe on the mortgage or what you “need to get.” A knowledgeable real estate agent can help you find a fair price that supports your long-term goals.

2. How does my retirement timeline affect my pricing strategy?

Your retirement timeline is a key factor. If you plan to retire soon and need the proceeds for a down payment on your next home or to reduce outstanding debts, a more competitive price can help you achieve a quicker sale and more predictable cash flow. If you have flexibility and don’t need to move immediately, you may choose to price closer to the top of the fair market value range, understanding it may take longer to sell.

3. Should Gen X sellers worry about capital gains when selling a home?

Yes, but don’t panic. Many Gen X homeowners qualify for the capital gains exclusion on the sale of a primary residence if they’ve lived in the home for at least two of the last five years. It’s smart to talk with a tax professional before setting your selling price, especially if your home has appreciated significantly. Understanding potential capital gains ahead of time helps you plan how to use the sale proceeds.

4. Is it a good idea to do major renovations before I sell?

Usually, no. Gen X sellers are often better off focusing on the best return, not the biggest project. Major renovations right before a sale rarely deliver dollar-for-dollar payback. Instead, concentrate on the highest-impact improvements: minor repairs, neutral paint, curb appeal, and fixing anything that makes the home feel neglected. These updates are typically the most efficient way to support a higher asking price and a successful sale.

5. How important is it for all my major systems to work?

Very important. Gen X buyers and younger buyers alike expect the air conditioner, water heater, plumbing, electrical systems, and appliances to function properly. You don’t need to replace everything, but you should have non-working items repaired before listing. Working systems reduce inspection issues and protect your final sale price by avoiding last-minute repair demands or credits.

6. What if I’m still working and can’t keep the home show-ready all the time?

Many Gen X sellers are still working full-time, juggling families, and managing busy lives. Be honest with your agent about your schedule and capacity. Together, you can plan limited showing windows, use open houses strategically, and simplify staging so it’s manageable. In some cases, pricing slightly more competitively can balance the reality that the home may not look perfect every single day.

7. How should Gen X sellers think about downsizing or rightsizing?

For many Gen X homeowners, this sale is part of a bigger conversation about downsizing or rightsizing for the next phase of life. Before you list, think through your long-term plan: Do you want a smaller home, lower maintenance, or a different location? Pricing and preparation should align with that plan. The goal isn’t just a higher price today, but a home sale that supports your lifestyle and financial goals for the next 10–20 years.

8. Is it worth hiring a local real estate agent if I’m a savvy Gen X homeowner?

Yes. Even savvy Gen X sellers benefit from a local real estate agent who understands current market trends, comparable sales, and buyer expectations in your specific area. An experienced agent can help you set a competitive price, position your home effectively, and negotiate the best overall deal – not just the highest headline number. That guidance is especially valuable when your home sale is tied to retirement planning, debt payoff, or a major relocation.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.