Last updated on December 16th, 2025 at 02:50 am

As you move toward retirement—or already live in it—your home becomes more than a place to live. It’s likely your largest asset, and the decision to sell or turn it into a rental can shape your cash flow, lifestyle, and legacy for decades. This article will cover selling vs renting in retirement in some detail, read on.

Selling can unlock equity, simplify your life, and wipe out debt. Renting can generate steady income and allow your property to keep appreciating. The best choice depends on your goals, your numbers, and your timeline.

This guide walks you through:

- How to decide whether to sell, rent, or blend both strategies,

- Real-world case studies (including the author’s experience),

- The role of taxes, insurance, and property management, and

- Tools from RetireCoast to help you run the numbers, not just go with your gut.

- 1. Quick Decision Framework: Should You Sell or Rent?

- 🔎 Sell vs. Rent Decision Infographic

- 2. Core Differences: What Selling vs. Renting Really Does for You

- 3. Key Factors You Must Evaluate

- 4. Selling as a Strategic Retirement Move

- 5. When Renting Makes the Most Sense

- 6. Rental Properties in Retirement: Management Matters

- 7. Real-World Case Studies

- 8. Hybrid & Sequenced Strategies

- 9. Put the Numbers to Work

- 10. FAQ: Common Questions About Selling vs. Renting

- Frequently Asked Questions About Selling vs. Renting Before and During Retirement

- Final Thought

1. Quick Decision Framework: Should You Sell or Rent?

Before we get into the details, it helps to zoom out and look at the big picture.

If you need immediate cash and want a simpler life, selling may be the better path. If you’ve got time, equity, and a strong rental market, renting can be a powerful way to build income and wealth. Many retirees ultimately use a hybrid approach—sell once, rent later, or rent through a weak market and sell when conditions improve.

Think of this as a sequence, not a single yes/no decision.

🔧 ACTION: Use the decision framework and infographic below to see which path you’re leaning toward.

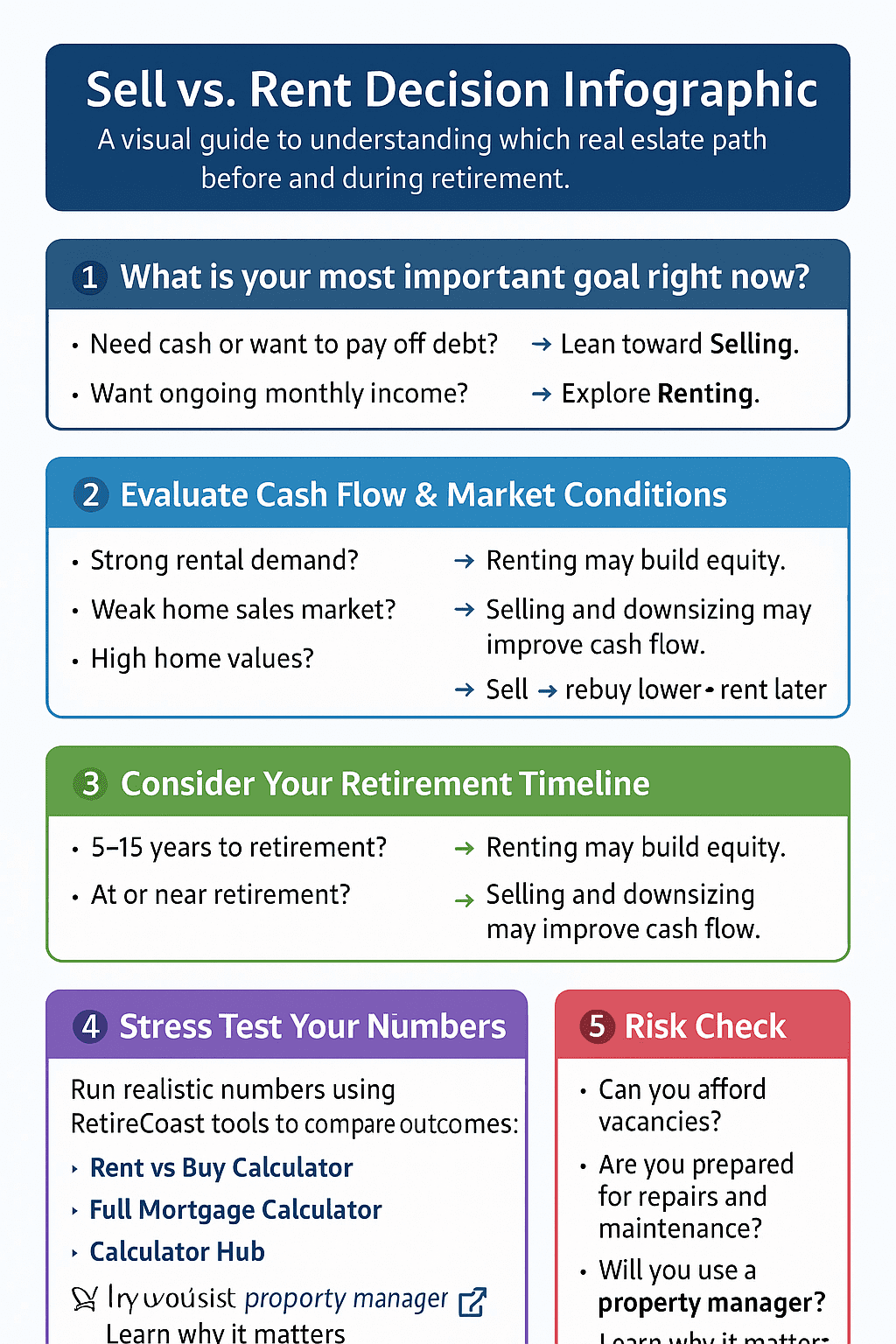

🔎 Sell vs. Rent Decision Infographic

A visual guide to understanding which real estate path works best before and during retirement.

1️⃣ What is your most important goal right now?

- Need cash or want to pay off debt? → Lean toward Selling.

- Want ongoing monthly income? → Explore Renting.

- Need flexibility while relocating? → Consider a Hybrid Approach.

2️⃣ Evaluate Cash Flow & Market Conditions

- Strong rental demand? → Renting may work well.

- Weak home sales market? → Renting may preserve equity.

- High home values? → Selling may capture gains.

3️⃣ Consider Your Retirement Timeline

- 5–15 years to retirement? → Renting may build equity.

- At or near retirement? → Selling and downsizing may improve cash flow.

- Later-life housing change expected? → Sell → rebuy lower → rent later.

4️⃣ Stress Test Your Numbers

Run realistic numbers using RetireCoast tools to compare outcomes:

5️⃣ Risk Check

- Can you afford vacancies?

- Are you prepared for repairs and maintenance?

- Will you use a property manager? Learn why it matters

- Will property taxes increase without homeowner exemptions?

- Can landlord insurance raise your monthly costs?

✨ Final Guidance

Selling or renting is rarely a one-time decision—it is a sequence of financial and lifestyle moves. The best choice aligns with your cash flow needs, market timing, debt level, and retirement lifestyle goals.

2. Core Differences: What Selling vs. Renting Really Does for You

Selling: Turning Equity Into Flexibility

When you sell, you convert your home into cash. For many retirees, that money can:

- Pay off high-interest credit cards and other debt

- Eliminate or reduce your mortgage

- Fund a move to a more affordable or desirable area

- Strengthen your emergency reserves or investment portfolio

If debt is part of your picture, read:

- How to Pay Off Credit Cards

https://retirecoast.com/how-to-pay-off-credit-cards/

If you’re heading into retirement with a mortgage balance, this is essential context:

- Retiring With Mortgage Debt

https://retirecoast.com/retiring-with-mortgage-debt/

Sometimes refinancing is part of your repositioning strategy before you sell or while you’re transitioning:

- Should I Refinance My Mortgage? (2025–2026 Guide)

https://retirecoast.com/should-i-refinance-my-mortgage-2025-2026/

Renting: Turning Your Home Into an Income Asset

Renting your home can:

- Provide monthly income

- Allow someone else to help pay down your mortgage

- Let you ride out a weak sales market rather than selling low

- Preserve your options if you might want to move back or keep the property in the family

For some retirees (and especially Gen Xers approaching retirement), a well-managed rental is effectively a small businesswrapped around a house.

More on that idea here:

- I’m Retired—What Kind of Business Should I Start?

https://retirecoast.com/im-retired-what-kind-of-business-should-i-start/

3. Key Factors You Must Evaluate

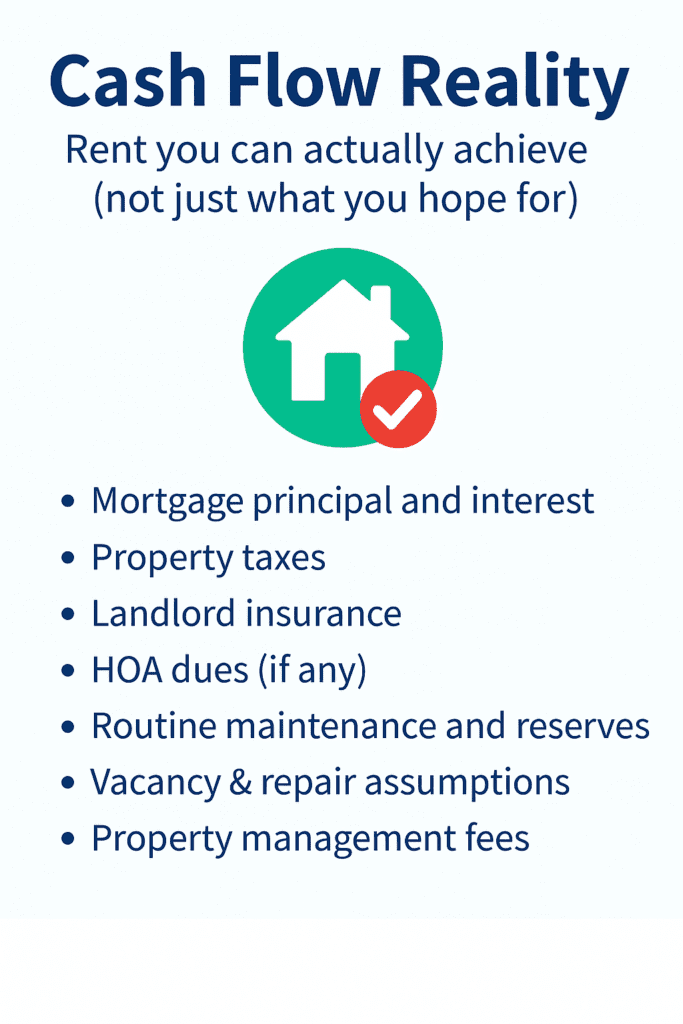

A. Cash Flow Reality

The first question is simple:

Will this property produce positive cash flow as a rental?

To answer that, you need realistic numbers for:

- Rent you can actually achieve (not just what you hope for)

- Mortgage principal and interest

- Property taxes

- Landlord insurance

- HOA dues (if any)

- Routine maintenance and reserves

- Vacancy & repair assumptions

- Property management fees

Use your RetireCoast tools to run “what if” scenarios:

- Rent vs Buy Calculator

https://retirecoast.com/rent-vs-buy-calculator-2/ - Full Mortgage Calculator

https://retirecoast.com/full-mortgage-calculator/ - Calculator Hub (all tools)

https://retirecoast.com/calculators-hub/

B. Property Condition

A tired property with a worn roof, original HVAC, or deferred maintenance can quickly turn into a cash-flow stress test. Fixing major items before renting is often necessary, but it can also make selling more attractive if you don’t want to invest in the work.

If your home is in good shape and low maintenance, it’s better suited for rental income.

C. Lifestyle and Stress Tolerance

Ask yourself:

- Do you want to be answering calls about leaky sinks and broken A/C in retirement?

- Are you comfortable chasing late rent, managing turnovers, and overseeing repairs?

- Do you plan to travel or live far from the property?

If the answer to those questions is “no,” renting is only realistic if you’re prepared to hire a property manager (we’ll get to that shortly).

D. Taxes

Taxes play a big role in whether selling or renting is smarter for you.

- Selling a primary residence may qualify you for a Section 121 capital gains exclusion, allowing you to exclude a portion of your gain (subject to IRS rules).

- Renting opens the door to depreciation and deducting legitimate operating expenses like maintenance, insurance, repairs, and management cost.

- However, if you have homeowner / homestead exemptions on the house, those usually go away when it becomes a rental, which can increase your property taxes. The increase might not be huge, but it’s a real line item in your cash-flow analysis.

Always run your situation past a qualified tax professional before making a final decision.

E. Insurance Costs

When you convert a primary residence to a rental, your insurance changes too.

You can’t keep standard homeowners insurance on a tenant-occupied property.

You need landlord insurance, which is usually more expensive.

⚠️ Rental Property Insurance Consideration

Converting a primary residence into a rental typically requires landlord insurance in place of standard homeowners insurance. Landlord policies often carry higher premiums due to increased risk exposure. Be sure to factor any increase in property insurance costs into your sell-versus-rent decision matrix.

4. Selling as a Strategic Retirement Move

Selling your house doesn’t mean you’re “done” with housing. It means you’re repositioning.

Many retirees follow a strategy like this:

- Sell a higher-value home.

- Relocate to a lower-cost area or smaller property.

- Use the excess proceeds to wipe out credit cards, car loans, and even a remaining mortgage.

- Enjoy much lower monthly expenses and more flexible cash flow.

Later in retirement, some choose a second stage:

- Sell the downsized home.

- Shift to renting and live partially on the equity they’ve built up.

This two-stage approach uses your home equity twice: Once to stabilize your early retirement, and later to fund your lifestyle when you no longer want the responsibilities of ownership.

For Gen X, who often have less guaranteed pension income than prior generations, thinking this way is critical:

- Gen X Retirement Guide

https://retirecoast.com/gen-x-retirement-guide/

5. When Renting Makes the Most Sense

You may lean toward renting if:

- Your property is in a strong rental market

- You have a low mortgage rate or own the home free and clear

- Your cash-flow analysis shows positive or manageable negative cash flow

- You want long-term appreciation and are willing to hold through market cycles

- You’re comfortable treating the rental like a business asset, not just a leftover house

In these cases, the rental can become a retirement income stream and a long-term wealth builder.

6. Rental Properties in Retirement: Management Matters

Renting in retirement isn’t “set it and forget it.”

That’s especially true for:

- Coastal and vacation rentals

- Properties in tourist or high-turnover markets

- Homes located far from where you live

Two helpful reads:

- My Coastal Vacation Rental (what it’s really like to own one)

https://retirecoast.com/my-coastal-vacation-rental/ - Best Tips for Maintenance of Your Vacation Rental Home

https://retirecoast.com/best-tips-for-maintenance-of-your-vacation-rental-home/

Both highlight that vacation rentals require systems, discipline, and often professional help.

Do You Need a Property Manager? (Short Answer: Probably)

Most retirees don’t want tenant calls at midnight or the stress of chasing late rent. That’s where a property managerbecomes non-optional.

A good property manager will:

- Screen tenants or guests

- Handle maintenance and emergency repairs

- Ensure leases and notices match local law

- Collect rent and provide reports

- Protect your time and health in retirement

Read this next if you’re thinking about renting:

- Why You Need a Property Manager for Your Rental Properties

https://gulfcoastpm.com/you-need-a-property-manager-for-your-rental-properties/

🏠 Property Management Is Not Optional for Many Retirees

Renting a home during retirement often requires more hands-on oversight than expected. In many cases—especially for vacation rentals or out-of-area properties— working with a professional property manager is essential.

Learn why property management is critical to protecting your time, income, and investment:

Why You Need a Property Manager for Your Rental Properties

7. Real-World Case Studies

Theory is useful. Real stories are better. These two cases show how renting can work out very differently—and still end well when the numbers are understood.

🏠 Case Study: Renting Through a Weak Market

Years ago, the author faced a difficult decision. He was ready to purchase a new home, but the housing market was weak. Selling his existing home at that time would have erased years of equity gains. Rather than locking in a loss, he chose to rent the home instead.

Fortunately, the rental market was strong. The property produced a small monthly profit while tenants continued to pay down the mortgage. Over time, the home quietly regained—and then exceeded—its prior value.

When the housing market eventually roared back, the author sold the rental with substantial equity and used the proceeds to purchase two additional properties, turning one strategic decision into long-term wealth growth.

🏠 Case Study: When Rental Income Doesn’t Meet Expectations

Phil and Tammy decided to buy a new home while keeping their existing house as a rental. Based on online estimates, they believed it would rent for $1,800 per month, which helped them qualify for their new mortgage.

The reality was more difficult. It took two months to find the first tenant, during which they paid two mortgages. That tenant paid one month’s rent and left. When the home was re-listed, they discovered the market would only support $1,400 per month, leaving them $200 short each month after expenses.

Despite the shortfall, they continued renting the property because the equity portion of their mortgage payment exceeded the monthly loss. After five years, they sold the home with over $35,000 in increased equity, more than covering the roughly $12,000 in cash-flow losses during that time.

Lessons Learned

- Projected rent often differs from what the market will actually support.

- Vacancies and turnover can create early financial strain.

- Double mortgage payments require strong cash reserves.

- Short-term negative cash flow can be acceptable if equity growth compensates.

- Time and market recovery can transform a weak start into long-term gains.

8. Hybrid & Sequenced Strategies

Most successful retirement housing strategies aren’t purely “sell everything” or “keep everything.”

You might:

- Rent through a weak market, then sell when prices recover.

- Sell and buy down to a smaller home now, then sell again and rent in later life.

- Keep one property as a long-term rental while selling another to pay off debt and fund your retirement move.

The key is flexibility. Don’t assume that the first decision is permanent. Instead, build a sequence that:

- Improves your monthly cash flow,

- Reduces risk and stress, and

- Gives you options later in life.

9. Put the Numbers to Work

Ultimately, your decision should be grounded in math, not just emotion. Selling vs renting in retirement?

Use these tools:

Rent vs Buy Calculator

https://retirecoast.com/rent-vs-buy-calculator-2/

Full Mortgage Calculator

https://retirecoast.com/full-mortgage-calculator/

Calculator Hub (for supporting tools like maintenance budgets, relocation budgets, etc.)

https://retirecoast.com/calculators-hub/

📌 Thinking About Selling or Renting?

Use our RetireCoast calculators to compare your options, estimate cash flow, and plan your retirement real estate strategy with confidence.

Visit the Calculator Hub10. FAQ: Common Questions About Selling vs. Renting

To wrap things up, here are answers to the questions readers ask most often about selling vs. renting before and during retirement—covering taxes, insurance, property managers, and lender rules.

Frequently Asked Questions About Selling vs. Renting Before and During Retirement

These common questions and answers can help you decide whether selling or renting your home is the better move as you approach or live in retirement.

How do I decide whether to sell or rent my home before retirement?

Start with your goals: Do you need cash now to pay off debt or fund retirement, or are you comfortable turning the property into a long-term income-producing asset? Compare your potential sale proceeds with realistic rental cash flow, property taxes, insurance, and maintenance. Our RetireCoast Calculator Hub and the Rent vs Buy Calculator can help you run side-by-side scenarios.

How can I tell if my home will generate positive cash flow as a rental?

Add up your expected monthly rent and subtract all expenses: mortgage principal and interest, property taxes, insurance (including landlord coverage), HOA dues, maintenance reserves, and property management fees. If the result is positive, you have cash flow; if it’s negative, you’re subsidizing the property. Use your numbers in the calculators on our Calculator Hub to test different rent and expense scenarios.

What tax issues should I consider when deciding to sell or rent?

If you sell a primary residence, you may qualify for the Section 121 capital gains exclusion, which can shelter a portion of your gain. If you rent instead, you may benefit from depreciation and deductible expenses, but you’ll likely lose any homeowner or homestead exemptions. Those exemptions often reduce property taxes on an owner-occupied home. When the property becomes a rental, those exemptions usually go away, and property taxes can increase. The increase may not be large enough to change your decision, but it should be part of your cash-flow analysis. Always consult a tax professional for advice on your specific situation.

Will my property taxes go up if I convert my home to a rental?

In many areas, yes. If you have a homeowner or homestead exemption on your current residence, that exemption typically applies only to owner-occupied homes. Once the home becomes a rental, the exemption is usually removed and your property tax bill can increase. The increase might be modest, but it should be included in your decision matrix when comparing selling versus renting.

Do I need different insurance if I rent my home out?

Yes. Rental property generally requires landlord insurance instead of a standard homeowners policy. Landlord coverage usually costs more because it’s designed for tenant-occupied properties and may include additional liability protection. Be sure to obtain quotes and factor any increase in insurance costs into your cash-flow projections before deciding to rent.

Do I really need a property manager, or can I manage the rental myself?

Some owners can successfully self-manage, but many retirees find that a professional property manager is worth the cost. A manager can handle tenant screening, leases, rent collection, maintenance coordination, inspections, and legal compliance—especially important if you live out of the area or want a low-stress retirement. To understand why this matters, read You Need a Property Manager for Your Rental Properties .

Is it ever okay to have slightly negative cash flow on a rental?

It can be, as long as the negative cash flow is small, affordable, and intentional. In some cases, like the Phil and Tammy example in this article, a monthly shortfall was offset by significant equity growth and market appreciation over time. However, retirees should be cautious: persistent, large negative cash flow can strain a fixed income. Make sure you have reserves and a clear plan for how long you are willing to subsidize the property.

Can I use projected rental income to qualify for a new home loan?

Many lenders will consider documented or reasonable projected rental income from your existing property when you apply for a new mortgage. However, they may discount that income (for example, using 70–75% of projected rent) to account for vacancies and expenses. The Phil and Tammy case study in this article shows the risk of relying on optimistic rent estimates—if actual rent or vacancy experience is worse than expected, your budget can become tight. Be conservative with your assumptions and maintain a financial cushion.

What if market rent is lower than online estimates or what I think I “need”?

The market doesn’t respond to what you need; it responds to what tenants are willing to pay. Online estimates can be helpful, but they are often inaccurate for a specific property. If you consistently receive little interest at your target rent, the market is telling you the price is too high. In that case, you must either lower the rent, improve the property, or reconsider whether renting is truly the right strategy.

Which tools and calculators should I use to compare selling vs. renting?

To make a data-driven decision, start with:

• The

Rent vs Buy Calculator to compare owning and renting outcomes.

• The

Full Mortgage Calculator to understand your payoff schedule and equity growth.

• The full

Calculator Hub for additional tools that support retirement and real estate decisions.

Running real numbers through these calculators will help you decide whether selling or

renting creates the best outcome for your retirement.

Final Thought

Whether you sell, rent, or use a hybrid approach, remember:

You’re not just choosing what to do with a house. You’re designing how you’ll live—and what your money will do for you—in retirement.

Use the calculators, read through the case studies, and map out a sequence of moves that fits your life, your numbers, and your version of a successful retirement.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.