INTRODUCTION: REAL ESTATE IS A BUSINESS—WHETHER YOU MEAN IT TO BE OR NOT

Generation X is entering a defining financial phase. Many Gen X households are balancing mortgages, college expenses, aging parents, rising insurance costs, and the growing realization that retirement is no longer theoretical—it is approaching on a real and measurable timeline.

That reality is exactly why real estate investing resonates so strongly with Gen X.

Should you decide to invest in rental real estate, you are not simply buying property—you are creating a business. Some people approach rental property as a hobby or a side project, but the moment you rent a property and collect income, the IRS considers you to be in business for yourself.

Rental income is taxable income. Whether you intended it or not, you have effectively created a sole proprietorship the moment rent is collected. That legal and tax reality exists even if you never form an LLC, never open a business bank account, and never think of yourself as an entrepreneur.

This article is built around a different assumption:

You are going to create a real, legal business—intentionally.

That means thinking seriously about:

- Legal structure

- Tax exposure

- Liability protection

- Sustainable income

- Long-term exit options

This approach mirrors the same principles used by people who start businesses after retirement. The difference for Gen X is critical: you still have time to build the business before you need it. (Real estate investing for Gen X.)

WHY REAL ESTATE INVESTING WORKS FOR GEN X

Real estate aligns particularly well with Gen X because it sits at the intersection of income, control, and long-term optionality. (Real estate investing for Gen X.)

Steady Cash Flow

Rental income can supplement earned income now and gradually replace it later, without requiring an abrupt career exit.

Hedge Against Inflation

Rents and property values tend to rise over time, helping protect purchasing power as living costs increase.

Long-Term Appreciation

Mortgage amortization combined with appreciation quietly builds net worth year after year.

Tax Advantages

Depreciation, expense deductions, and tools like 1031 exchanges allow investors to keep more capital working instead of losing it to taxes.

Flexible Management

You can manage properties yourself early, then transition to professional management as income stabilizes and priorities shift.

FULL-TIME OR PART-TIME INCOME: SETTING REALISTIC EXPECTATIONS

Before quitting a day job, it is critical to understand how long it takes for real estate income to become truly sustainable. (Real estate investing for Gen X.)

Many new investors confuse:

- Gross rent

- Monthly deposits

- True spendable income

If your goal is $5,000 per month that you can actually spend on your own living costs, that translates to $60,000 per year in net income—after:

- Mortgage debt service

- Property taxes

- Insurance

- Property management

- Maintenance and repairs

- Vacancy reserves

- Capital reserves for roofs, HVAC, and major systems

Assume a realistic scenario:

- Net cash flow per property (after reserves): $500 per month

To reach $5,000 per month, you would need 10 properties producing consistent net cash flow. That portfolio might reasonably look like:

- Two four-plexes

- One duplex

This is achievable—but it takes time, discipline, and reinvestment.

Cash flow must be defined clearly. True cash flow exists after reserving for vacancies and future repairs. Many investors spend early income and later fund repairs from personal savings. That is not passive income—it is deferred risk.

Before turning in a resignation letter, treat your rental business like a startup and self-fund it through the growth phase.

Scaling by Retaining Cash, Not Spending It

I purchased a single-family home with cash, furnished it, and converted it into a vacation rental. The property performed substantially better than projected during its first year.

Instead of taking the income personally, I retained the cash inside the business. I did not need the income immediately and wanted strong reserves for future opportunities and protection against market shifts.

By the end of the year, the property had produced enough documented income to qualify for a DSCR refinance. Using the loan proceeds—along with excess income retained in the business—I purchased two additional homes, furnished them, and converted them into vacation rentals.

I continued this discipline across all three properties. When market conditions softened, having six months of surplus operating income allowed the portfolio to absorb slower periods and operate smoothly until the next high-earning season.

This approach transformed one successful property into a small but resilient portfolio—without relying on personal funds or rushing into full-time income dependence.

STEP 2: CHOOSE THE RIGHT BUSINESS STRUCTURE

Choosing the right business structure is one of the most important early decisions you will make. While structures can be changed later, doing so is often complex, expensive, and disruptive. (Real estate investing for Gen X.)

Sole Proprietorship

This is the default structure created when you collect rent in your own name. There is no liability separation between personal and business assets. For real estate investors, this is the riskiest structure and rarely appropriate long-term.

Limited Liability Company (LLC)

Most Gen X real estate investors start with an LLC, and for good reason.

An LLC:

- Separates personal and business liability

- Allows income and losses to flow through to your personal tax return

- Requires less administrative overhead than corporations

- Works well for single investors and small partnerships

For most investors, an LLC offers the best balance of protection, simplicity, and flexibility.

S-Corporation (S-Corp)

An S-Corp is often considered when income becomes consistent and significant.

It can provide tax efficiencies in certain situations but introduces:

- Payroll requirements

- Increased accounting complexity

- Eligibility restrictions

Importantly, it is generally easier to convert an LLC into an S-Corp later than the other way around.

C-Corporation (C-Corp)

C-Corps are typically used in larger, more complex real estate ventures, especially those involving:

- Multiple investors

- Stock ownership

- Retained earnings

- Formal governance

C-Corps allow stock issuance and easier capital aggregation but come with:

- Corporate taxation

- Potential double taxation

- Higher compliance costs

For most rental portfolios, C-Corps are unnecessary—but they can be appropriate in multi-investor or development scenarios.

The key takeaway for Gen X:

Start simple. Preserve flexibility. Avoid unnecessary complexity early.

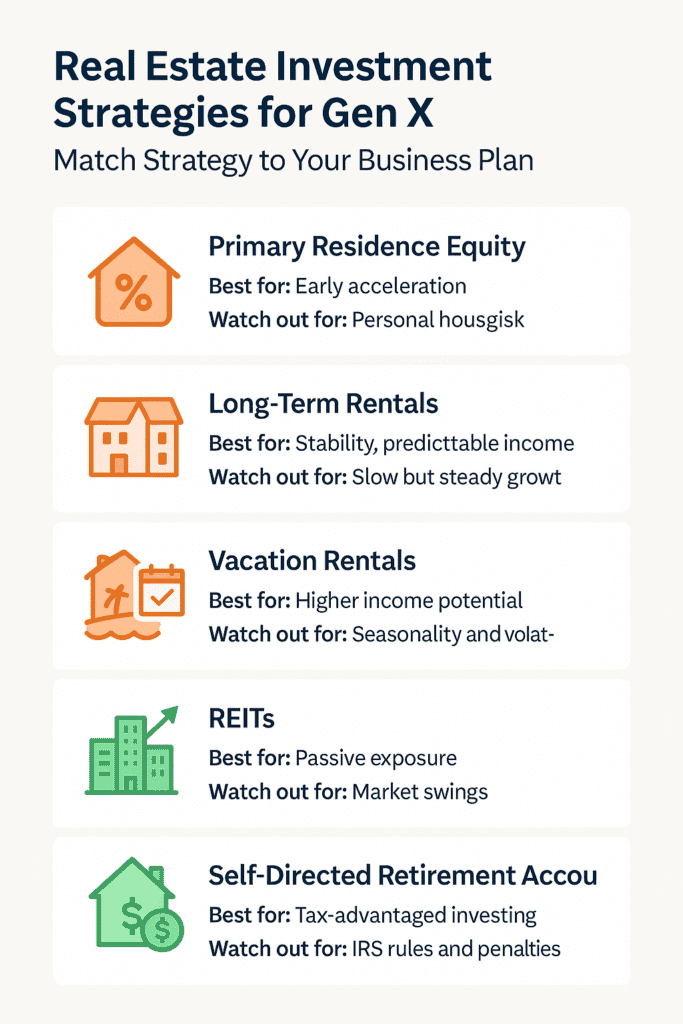

STEP 3: SELECT YOUR INVESTMENT STRATEGY

Once your goals, risk tolerance, and business structure are defined, the next decision is how you will invest. This is where many Gen X investors go wrong by chasing trends instead of matching strategy to lifestyle, time, and financial reality. (Real estate investing for Gen X.)

There is no single “best” strategy—only the one that fits your business plan.

🏠 Leveraging Equity in a Primary Residence

For many Gen X households, the home they already own is their largest asset. Equity can sometimes be used strategically to fund an investment property through a cash-out refinance or home equity line of credit (HELOC).

This approach can accelerate entry into real estate, but it must be handled conservatively. You are effectively placing your primary residence into the capital stack of your investment business. If rents soften or expenses rise, you must still protect your personal housing stability. Used carefully, home equity can be a powerful tool; used aggressively, it can increase stress at the worst possible time.

🏘️ Long-Term Single-Family & Small Multifamily Rentals

Buy-and-hold rental properties remain the backbone of most Gen X real estate portfolios. Single-family homes and small multifamily properties (duplexes to four-plexes) tend to attract stable tenants and are easier to finance, insure, and manage.

These properties rarely deliver explosive short-term returns—but they excel at predictability. Over time, tenants pay down mortgages, rents increase gradually, and equity builds quietly. For Gen X investors focused on stability rather than speculation, this strategy often forms the core of a sustainable portfolio.

🌴 Vacation Rentals & Short-Term Rentals

Vacation rentals can generate higher gross income than long-term rentals in the right markets, but they operate more like hospitality businesses than traditional rentals. Income is seasonal, expenses are higher, and management is more involved.

This strategy works best for investors who are comfortable with fluctuating income and who model conservatively. Strong markets can produce exceptional returns, but success depends on pricing discipline, reserves, and realistic occupancy assumptions—not optimistic projections.

📊 REITs & Passive Real Estate Investments

Real Estate Investment Trusts (REITs) allow investors to gain exposure to real estate without owning or managing physical property. They can provide dividends and diversification and are often used as a complement to direct ownership.

However, REITs behave more like market-traded securities than owned property. They fluctuate with interest rates and broader market sentiment. For Gen X investors who value liquidity and passivity, REITs can play a role—but they do not provide the same level of control as owning real estate directly.

🧾 Self-Directed Retirement Accounts

Self-directed IRAs and Solo 401(k)s allow retirement funds to be invested in real estate rather than stocks and bonds. This can be attractive for investors who want to diversify retirement savings while maintaining tax advantages.

These structures come with strict IRS rules around prohibited transactions, personal use, and disqualified persons. Mistakes can be costly. Used correctly and with professional guidance, self-directed accounts can be effective; used casually, they can create serious tax problems.

⚖️ Strategy Selection Reality Check

Each strategy requires different levels of:

- Time involvement

- Capital reserves

- Risk tolerance

- Income stability

The right strategy is the one that fits your business plan and life stage, not the one producing the loudest headlines.

STEP 4: SECURE FINANCING (GEN X REALITY)

For many Gen X investors, financing is the point where real estate investing starts to feel complicated. This is not because deals are inherently risky, but because Gen X income profiles often no longer fit the clean W-2 mold lenders prefer. (Real estate investing for Gen X.)

By midlife, many Gen X households are:

- Self-employed or partially self-employed

- Consulting or working contract roles

- Running small businesses

- Earning mixed income from wages, rentals, and side ventures

None of this disqualifies you from borrowing—but it does change how lenders evaluate risk. Understanding that reality before you shop for properties or loan programs will save time, frustration, and costly missteps.

Broker Insight: How Lenders Really Look at Gen X Income

Self-employed individuals are typically required to provide tax returns and detailed financial statements to demonstrate that there is sufficient income to support mortgage obligations. Lenders are less concerned with how hard you work and more concerned with what can be documented, repeated, and supported on paper.

When personal income is harder to document, fluctuates year to year, or is partially offset by business deductions, lenders often rely on DSCR (Debt Service Coverage Ratio) loans. These loans shift the focus away from the borrower’s personal income and instead evaluate whether the property itself generates enough cash flow to support the loan.

In simple terms, DSCR loans ask one primary question:

Does the rental income cover the mortgage payment, taxes, and insurance—with a margin of safety?

This structure is particularly useful for Gen X investors who:

- Are self-employed

- Are transitioning careers

- Are building rental income alongside earned income

- Want to scale without being constrained by W-2 history

At the same time, many Gen X investors are surprised to learn that being self-employed does not automatically eliminate access to conventional loans.

Gen X investors who are self-employed but also have W-2 income—from a spouse, consulting arrangement, part-time employment, or remembered side work—may still qualify for standard conventional financing. In these cases, lenders evaluate combined income sources, not just rental cash flow.

Regardless of whether the loan is DSCR-based or conventional, lenders increasingly expect a forward-looking financial forecast. They are not only evaluating today’s income, but whether projected income appears sufficient and sustainable.

As a general rule, most lenders will not approve loans that exceed approximately 75% of verified or supported income, whether that income comes from wages, business activity, or rental cash flow. This buffer exists to protect both the lender and the borrower from market shifts, vacancies, or unexpected expenses.

Bottom line:

Strong documentation, conservative assumptions, and realistic projections materially improve approval odds. Aggressive assumptions do the opposite.

Before contacting a lender, it is wise to run the numbers yourself. Small changes in rent, interest rates, insurance costs, management fees, or vacancy assumptions can turn a deal that looks profitable on paper into one that fails underwriting—or worse, survives underwriting but struggles in reality.

This is why Gen X investors should treat financing analysis as part of the business-planning process, not a formality handled after a property is chosen.

TIMING: START NOW OR WAIT UNTIL RETIREMENT?

This is where Gen X has a unique advantage that many investors before them did not.

Many people wait until retirement to start a business. They assume the transition happens all at once—work ends, investing begins. Gen X does not have to follow that model.

Starting Now (20 Years Before Retirement)

If you begin investing in your 40s or early 50s, time becomes a strategic asset.

Starting earlier allows:

- Rental income to grow gradually rather than needing to replace a paycheck immediately

- Mortgages to be paid down by tenants instead of personal savings

- Systems, processes, and teams to be built before time becomes scarce

- Properties to be refinanced, exchanged, or sold strategically over multiple cycles

Just as important, starting now allows mistakes to be absorbed, corrected, and learned from while you still have earned income and flexibility.

By the time you reach retirement age, the business you started years earlier may already be:

- Producing steady, predictable income

- Professionally managed rather than owner-operated

- Positioned for sale, consolidation, or estate planning

At that point, real estate is no longer a “new venture.” It is an operating business.

Starting After Retirement

Other investors choose to start later, often with more capital and fewer daily obligations. The same principles apply—but the runway is shorter.

Mistakes take longer to recover from. Financing options may be more limited. Income interruptions feel more significant when there is no external paycheck supporting the business during early growth.

That does not make starting later wrong—but it does make planning and conservatism even more important.

Key Insight

Starting earlier allows real estate to become both a retirement income stream and a sellable business asset. Instead of relying on properties simply to produce cash flow, Gen X investors can build something with transferable value—an asset that can be refinanced, consolidated, or sold to support the balance of their golden years.

This is where Gen X bridges both worlds:

working today while intentionally building tomorrow.

STEP 5: BUILD YOUR INVESTMENT TEAM

Real estate investing is rarely a solo activity—especially when it is treated as a real business rather than a side project. The right team does more than execute transactions; these professionals help you build, protect, and scale your business over time.

These experts can help you build your business, and working with experienced professionals materially improves your ability to achieve your goals. Just as important, the relationships you form at this stage often become long-term strategic partnerships, not one-off engagements.

Gen X investors should take the time to interview loan brokers, real estate agents, and other professionals who may become trusted associates for years to come. The goal is not to assemble the largest team possible—but the right one.

Investor-Savvy Real Estate Agent

Not all real estate agents understand investing. You want an agent who thinks in terms of cash flow, risk, financing, and exit strategies, not just purchase price and curb appeal.

A strong investor-focused agent can:

- Identify properties with income potential

- Provide realistic rent and vacancy expectations

- Spot deal risks early

- Connect you with reliable property managers and contractors

Because agents are typically paid by the seller at closing, this expertise often comes at no additional cost to you—making it one of the most leveraged relationships in your business.

Property Manager

A property manager is often the difference between owning a rental property and owning a scalable business.

Good property managers:

- Place and screen tenants

- Handle rent collection and day-to-day operations

- Coordinate maintenance and repairs

- Provide insight into local rental demand and pricing

Just as important, experienced property managers often know which owners are preparing to sell, giving you access to opportunities before they reach the open market.

Certified Public Accountant (CPA)

A CPA is not just a tax preparer—they are a strategic advisor.

An experienced CPA helps you:

- Choose and manage the right entity structure

- Stay compliant with IRS rules

- Plan for depreciation, reserves, and tax exposure

- Evaluate financing and growth decisions

As your portfolio grows, your CPA becomes a critical part of maintaining profitability and avoiding costly mistakes.

Loan Broker

Rather than relying on a single bank, many successful investors work with an independent loan broker who has access to multiple lending sources. The right broker understands your goals, learns your portfolio, and helps structure financing that supports growth—not just approval.

A strong loan broker can:

- Introduce DSCR and other investor-friendly loan programs

- Help you compare conventional, portfolio, and commercial options

- Structure refinancing strategies that unlock capital responsibly

- Help you avoid overleveraging

Over time, a trusted loan broker becomes a strategic asset—someone who understands your business as it evolves.

Why This Matters for Gen X

Treating real estate like a business means building relationships, not just closing deals. Investors who surround themselves with capable professionals make better decisions, recover faster from mistakes, and scale with fewer disruptions.

The right team allows you to focus on strategy while experienced professionals handle execution.

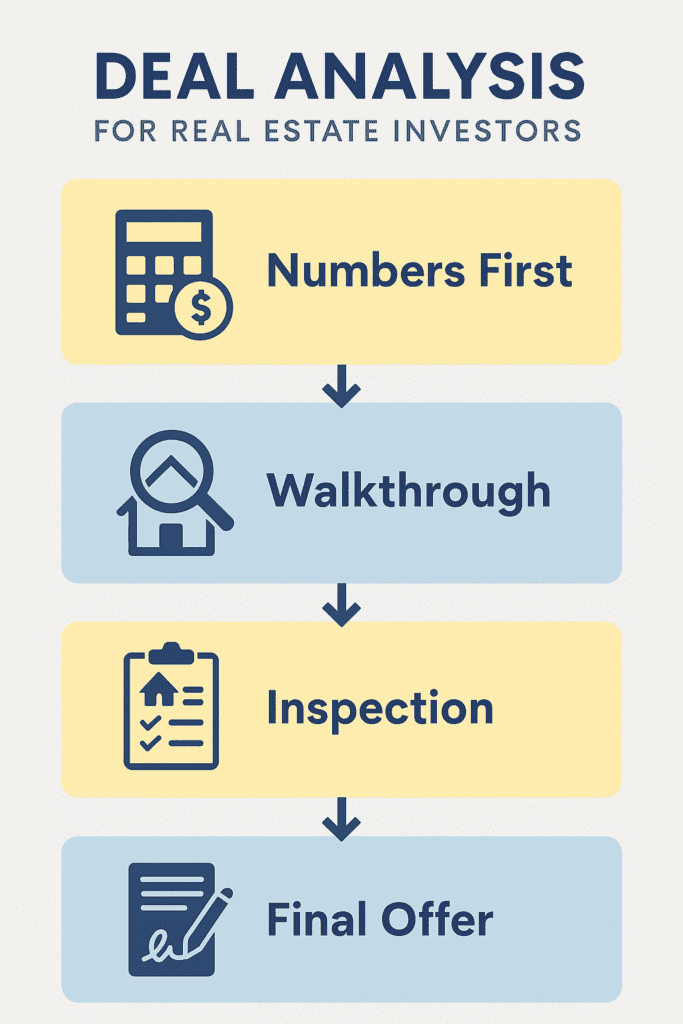

STEP 6: ANALYZE EVERY DEAL (DISPASSIONATELY)

Do not even look at a house without first running the numbers.

That may sound harsh, but it is one of the most profitable habits an investor can develop. In real estate investing, you are not buying a home—you are buying a business asset. You will not be living there, and you cannot allow curb appeal, staging, or emotional reactions to override your financial requirements.

Start the process dispassionately:

If the property does not meet your minimum financial expectations based on:

- Condition

- Location

- Rent potential

- Financing terms

- True operating expenses

- Vacancy risk

- Insurance and tax reality

…then it is not a deal. It is a distraction.

But there is an equally important second truth:

Running the numbers is necessary, but it is not sufficient.

A property can “work” on paper and still be a terrible investment once you understand what is physically wrong with it—or what is going on in that neighborhood, that block, or that structure.

If you want a faster way to model deals (rent assumptions, expenses, financing, and cash flow), take a look at DealCheck . Use it to “stress test” assumptions before you ever schedule a showing.

The Real Point: Numbers First, Then Reality Testing

Yes, you must run the numbers first—but you must also verify that the deal is real.

After your initial financial screen, do a second level of analysis that includes:

- Physical condition: hidden damage, deferred maintenance, pests, moisture issues

- Repair scope and cost realism: not guesses—real contractor inputs when possible

- Neighborhood and tenant demand: not just comps, but street-level reality

- Insurance availability and cost: especially in storm, flood, or high-claim areas

- Rent durability: will the rent still hold if the market softens?

- Exit strategy: can you sell, refinance, or convert the use if needed?

A good property is not the one that feels exciting. It is the one that remains profitable when you apply conservative assumptions and real-world inspection.

Investor Rule:

Run the numbers first. Then inspect the reality.

If either step fails, walk away.

STEP 7: TAKE ACTION (TURN KNOWLEDGE INTO YOUR FIRST OR NEXT INVESTMENT)

At some point, learning has to turn into doing. Use a disciplined checklist to move from thinking about buying a property to actually doing it—step by step, with clear decision points along the way. (Real estate investing for Gen X.)

Broker / Investor Tip:

Become an expert on the entire process—from planning and goal setting, to research, acquisition, financing, and ultimately the management of both your properties and your business.

Make yourself a PhD in Real Estate Investment. Read, analyze, model deals, talk to professionals, and learn from both successes and mistakes. Knowledge truly is power, and the more you understand the process, the better your decisions will be—and the wealthier you are likely to become over time.

Pre-Tour Real Estate Investment Checklist (Print-Friendly)

Check items as you go, then print this page from your browser when you’re done. (Real estate investing for Gen X.)

Reminder: Walking away early isn’t failure—it’s professional investing.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.