401(k) Contribution Impact on Your Paycheck

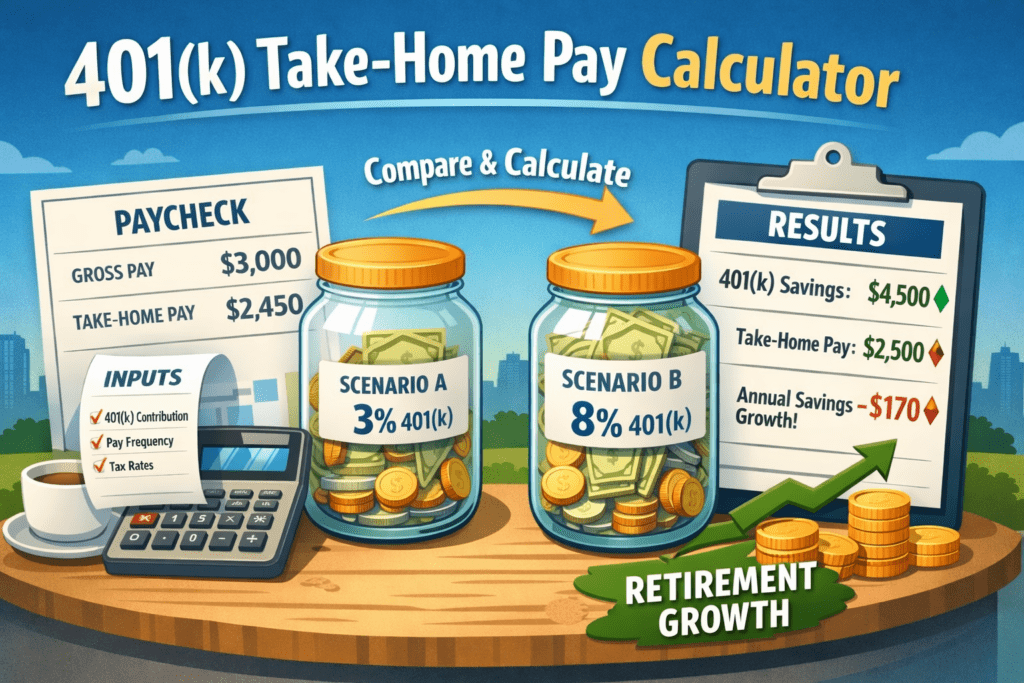

This calculator shows how changing your traditional 401(k) contribution percentage can reduce your take-home pay while increasing retirement savings. It also estimates the tax savings effect using your selected tax rates. (This is an educational estimate, not a tax filing tool.) Update ResultsPrintReset

Tip: compare two contribution rates side-by-side.

1) Paycheck Inputs

Pay Frequency Biweekly (26) Semi-monthly (24) Weekly (52) Monthly (12) Gross Pay per Paycheck ($)Other Pre-Tax Deductions ($)

Health insurance, HSA, etc. (optional)State + Local Tax Rate (%)Federal Withholding Rate (%)

Approximate effective rate per paycheckRoth 401(k)? No (Traditional, pre-tax) Yes (Roth, after-tax)

Roth won’t reduce taxable wages in this model

2) 401(k) Contribution Rates to Compare

Scenario A: 401(k) Contribution (%)Scenario B: 401(k) Contribution (%)

For simplicity, this calculator assumes contributions are within IRS limits and does not model caps or catch-up limits.

Results: Take-Home Pay vs Retirement Savings

401(k) Contribution Impact on Take-Home Pay

Change your 401(k) percentage and see the estimated effect on your paycheck and annual retirement savings. This is a simplified educational estimator (withholding varies by W-4, benefits, and state rules).

Inputs

Continue Your Planning

Explore more tools on the RetireCoast Calculator Hub. For broader context, see the companion article: Financial Strategies for Everyday Life .

More about your 401(k) plan

Choose from several articles about tax-advantaged plans, including your 401(k) plan, such as this article: About recent tax reforms affecting your 401(k) plan. Or this one about tax-advantaged plans, including ROTH and HSA.

Disclaimer: This calculator provides simplified educational estimates and does not provide tax, legal, or financial advice. Actual withholding depends on your W-4, income, deductions, benefits, and state rules. Consult a qualified professional for decisions affecting your taxes or retirement strategy.

The IRS has more information about your 401(k) plan here: https://www.irs.gov/retirement-plans/401k-plans