Last updated on December 28th, 2025 at 04:54 pm

Section 1: Why Social Security Decisions Matter for Gen-X

For Generation X, Social Security is not a stand-alone retirement solution—it is a foundational income stream that must work in coordination with pensions, retirement accounts, and personal savings. The challenge is that Social Security decisions are permanent, and mistakes made early can’t be undone later.

Social Security benefits are calculated using your highest 35 years of earnings, adjusted for inflation. This means every working year still ahead of you matters. For Gen-Xers in their 40s and 50s, the next 15–20 years will largely determine how strong—or fragile—your Social Security benefit will be.

- Section 1: Why Social Security Decisions Matter for Gen-X

- Chart: Social Security Wage Cap vs. Typical Gen-X Earnings (Actual Numbers)

- What This Means (One-Line Interpretation)

- Lifetime Impact Snapshot

- Section 2: The Three Social Security Claiming Ages That Shape Gen-X Outcomes

- Case Study Example (Section 1): Patrick — Claiming at 62 While Still Working

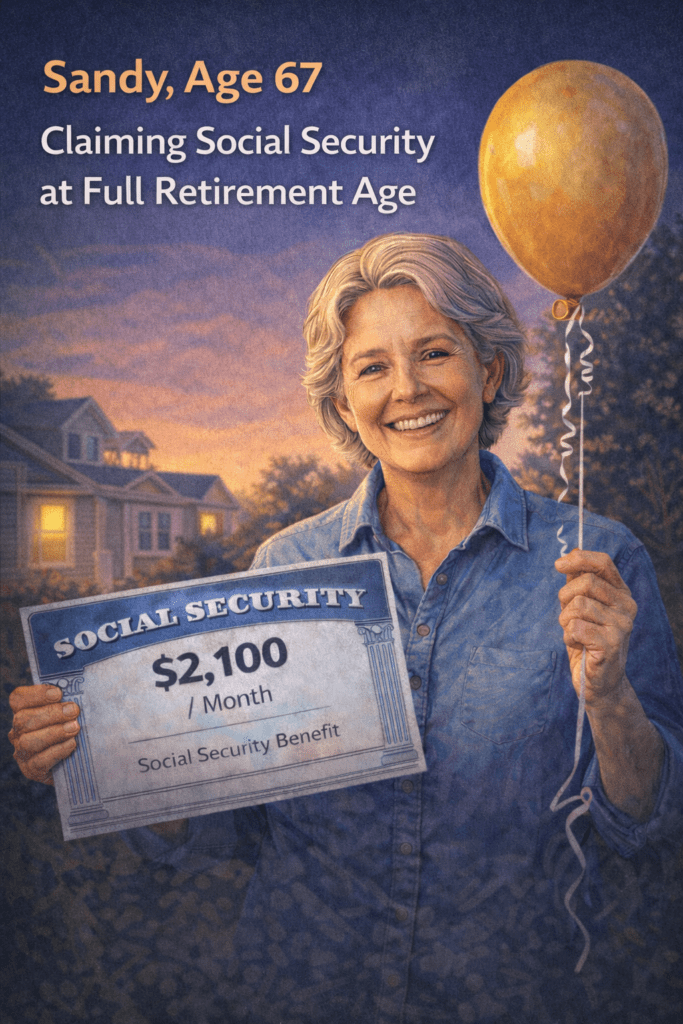

- Case Study 2: Sandy — Claiming Social Security at 67 While Still Working

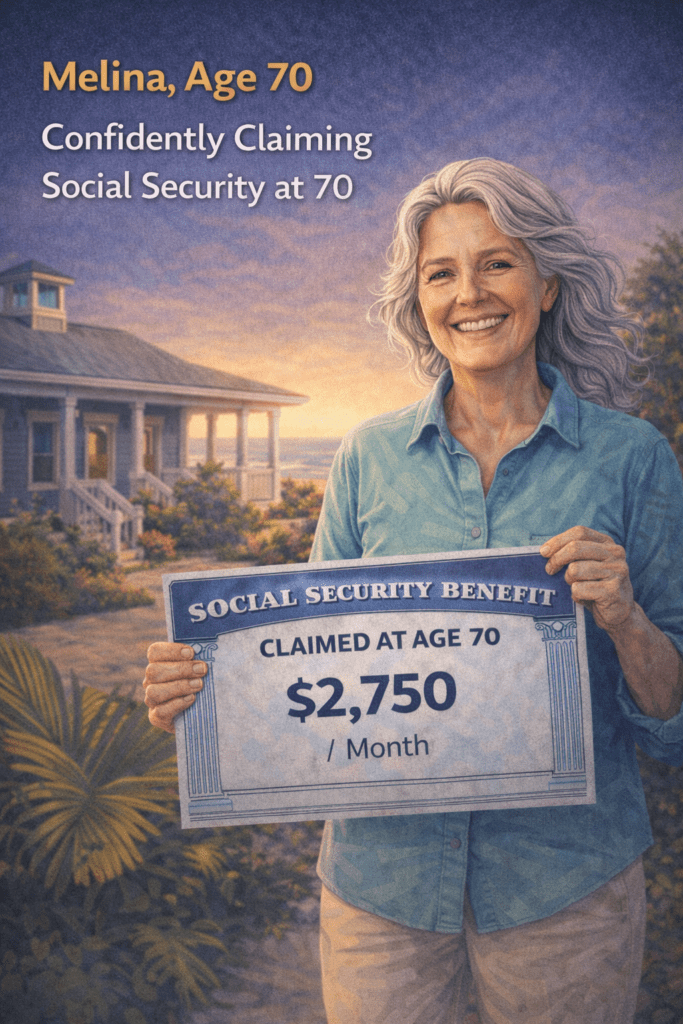

- Case Study 3: Melina — Claiming Social Security at Age 70 After Long-Term Planning

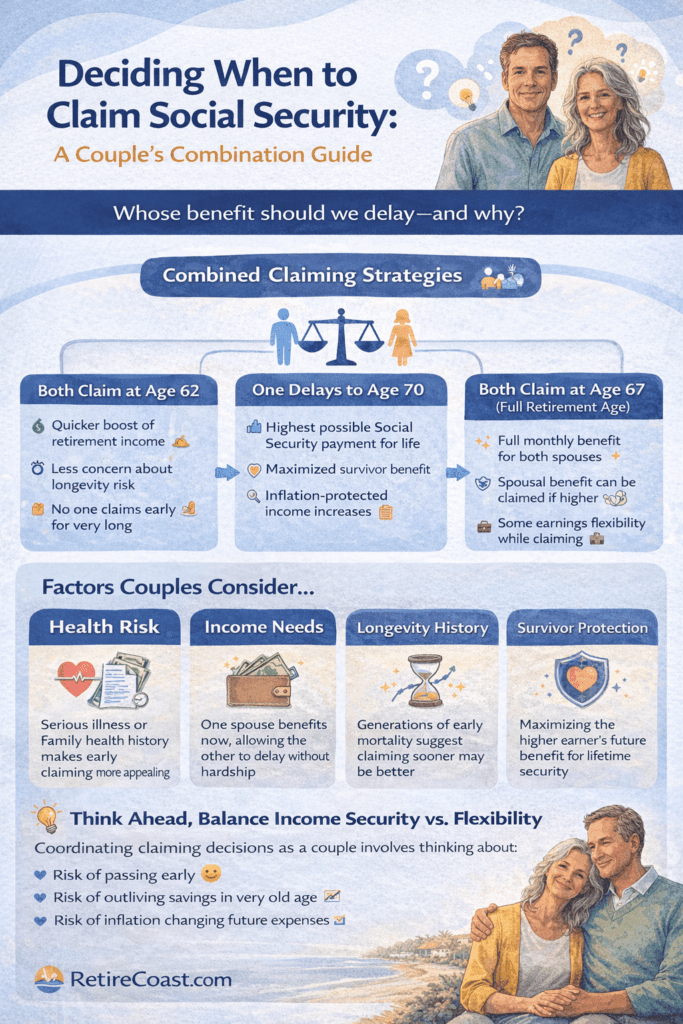

- Section 4: Coordinating Social Security Benefits With a Spouse

- Section 5: Test Your Decisions Before You Make Them

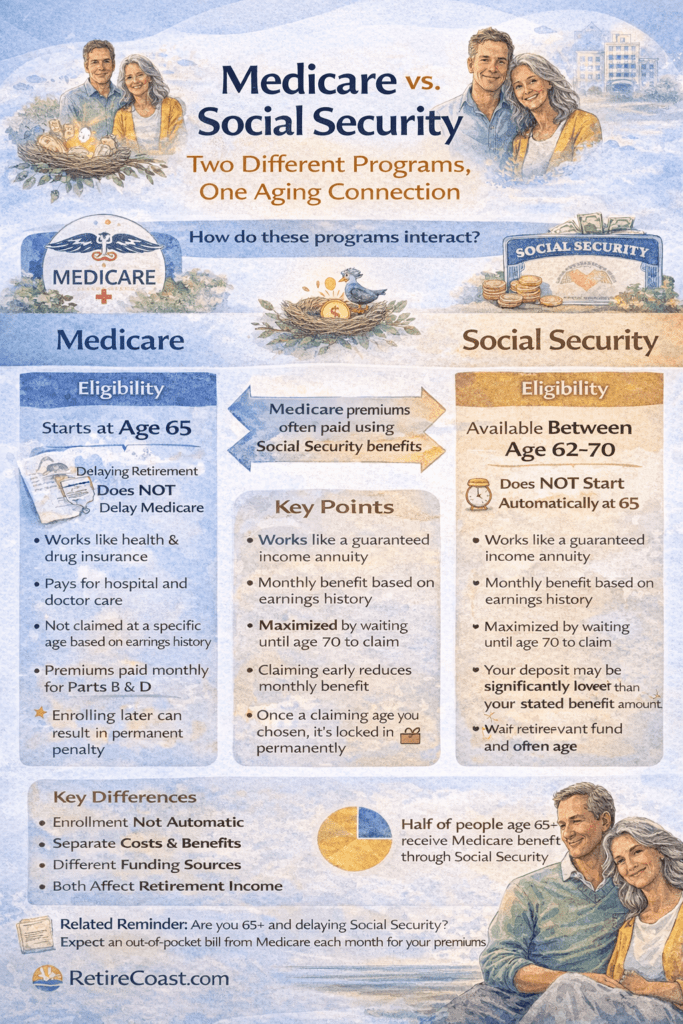

- Section 6: Medicare and Social Security — Separate Programs, Connected Outcomes

- Final Section: What Gen-X Should Do Now — While Time Is Still on Your Side

- FAQ: Gen-X Social Security Benefits (10 Questions)

The Three Irreversible Decision Points

Gen-X faces three critical claiming ages:

- Age 62 – the earliest possible claiming age

- Age 66–67 – full retirement age (FRA) for Gen-X

- Age 70 – the maximum benefit age after delayed credits

Once you claim, your base benefit is set for life. Cost-of-living adjustments apply, but the percentage reduction or increase tied to your claiming age never changes.

That’s why these decisions must be understood years before retirement, not months before filing.

Why This Is Harder for Gen-X Than Prior Generations

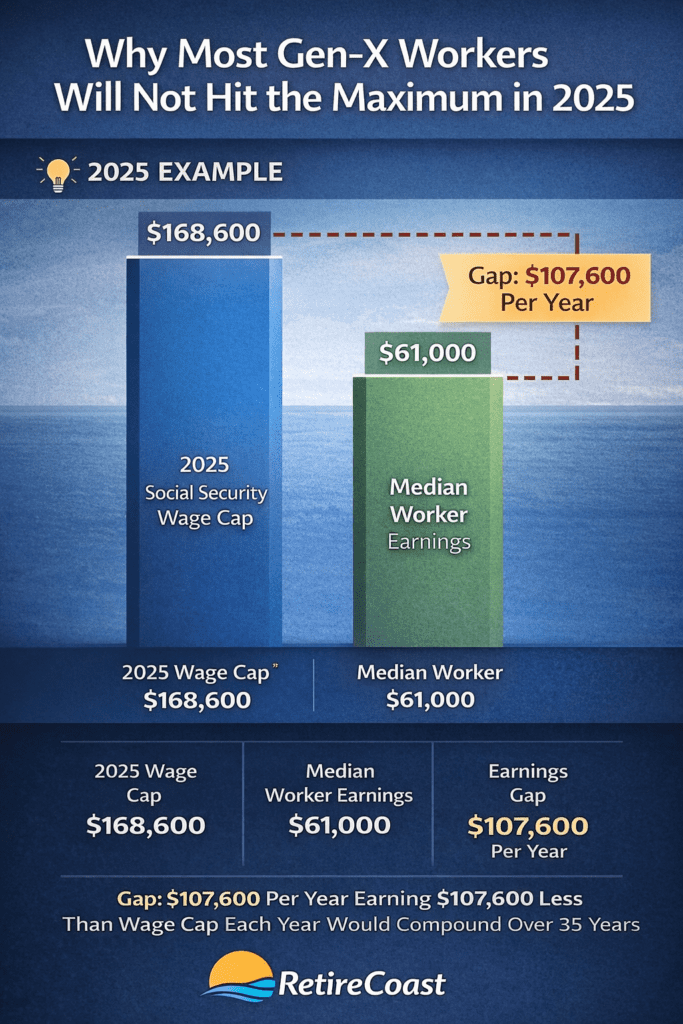

Only about 6% of wage earners pay the maximum amount into Social Security each year. In theory, that means only a small fraction of workers can ever qualify for the maximum benefit.

For Gen-X, this is even harder than it was for Baby Boomers:

- The Social Security wage cap rises almost every year

- Wages for many workers have not kept pace with that cap

- Career interruptions, recessions, and job changes reduced peak earning years

- More workers spent time in non-covered or gig employment

The result: most Gen-Xers will not receive the maximum Social Security benefit, making claiming strategy and coordination with other income sources far more important.

Planning Early Changes Outcomes

Understanding how Social Security works now—while you are still earning—gives you leverage:

- You can increase high-earning years that replace lower ones

- You can plan whether continued work past FRA makes sense

- You can coordinate benefits with a spouse to protect survivor income

- You can calculate how much income must come from savings instead

This article does not assume one “correct” choice. Instead, it sets the groundwork for understanding what each decision costs or provides—so you can build the rest of your retirement plan around realistic expectations.

Chart: Social Security Wage Cap vs. Typical Gen-X Earnings (Actual Numbers)

To earn the maximum Social Security benefit, a worker must earn at or above the wage cap for most of their highest 35 years.

The table below shows how the cap has outpaced typical wages.

📊 Social Security Maximum Taxable Earnings vs. Typical Wages

| Year | Social Security Wage Cap | Median U.S. Wage* | % of Cap Earned by Median Worker |

|---|---|---|---|

| 1990 | $51,300 | ~$21,000 | 41% |

| 2000 | $76,200 | ~$32,000 | 42% |

| 2010 | $106,800 | ~$39,000 | 37% |

| 2020 | $137,700 | ~$55,500 | 40% |

| 2023 | $160,200 | ~$59,500 | 37% |

| 2025 | ~$168,600 | ~$61,000 | 36% |

| 2026 (proj.) | ~$174,000 | ~$63,000 | 36% |

*Median wage figures rounded, inflation-adjusted where applicable.

What This Means (One-Line Interpretation)

A median Gen-X worker has consistently earned only ~35–42% of the income required to qualify for the maximum Social Security benefit.

Lifetime Impact Snapshot

To qualify for the maximum benefit, a worker generally needs:

- 30–35 years at or near the wage cap

- Earnings consistently in the top ~6% of all workers

Typical Gen-X earnings trajectory:

- Hits the cap: few or zero years

- Earnings fall below cap by $90,000+ annually in recent years

Section 2: The Three Social Security Claiming Ages That Shape Gen-X Outcomes

For Generation X, Social Security does not present a single retirement decision—it presents three distinct claiming windows, each with permanent consequences. These windows occur at age 62, full retirement age (66–67), and age 70.

What matters most is not which age is “best,” but how each choice reshapes lifetime income, survivor protection, and reliance on savings. Once a benefit is claimed, the underlying percentage adjustment is locked in for life.

This section explains what changes at each age, using baseline rules and numbers—without telling you which path to choose.

Claiming Social Security at Age 62 (Earliest Eligibility)

Age 62 is the earliest possible claiming age. Benefits claimed at this point are permanently reduced to account for the longer expected payout period.

Key characteristics:

- Monthly benefit reduced by roughly 25–30% compared to full retirement age

- Reduction applies for life

- Survivor benefits tied to this lower amount

- Benefits may be temporarily withheld if earnings exceed annual limits before FRA

Claiming at 62 increases early cash flow, but it lowers guaranteed income for every year that follows.

Claiming at Full Retirement Age (66–67 for Gen-X)

Full retirement age (FRA) is the point at which no early-claiming penalties apply. For most Gen-Xers, FRA is 67.

Key characteristics:

- Receives 100% of your calculated benefit

- No earnings penalty if you continue working

- Full spousal and survivor benefit coordination available

- Benefit can still increase if higher earnings replace lower years

Claiming at FRA represents the baseline benefit against which all other claiming decisions are measured.

Claiming at Age 70 (Maximum Benefit Age)

Delaying beyond full retirement age earns delayed retirement credits, increasing benefits by approximately 8% per year until age 70.

Key characteristics:

- Monthly benefit roughly 24–32% higher than FRA

- Highest possible survivor benefit for a spouse

- No benefit increase for delaying past 70

- Often shifts pressure away from retirement savings later in life

Claiming at 70 produces the largest guaranteed, inflation-adjusted monthly income, but requires other income sources in the years before benefits begin.

Why These Ages Matter More Than the Maximum Benefit

Most Gen-X workers will not reach the maximum Social Security benefit. However, claiming age decisions still materially affect outcomes, even at average or below-average earnings levels.

For many households:

- The difference between claiming at 62 and 70 can exceed $1,000 per month

- Survivor income can differ by tens of thousands of dollars over retirement

- Savings withdrawal rates change dramatically based on claiming age

These effects compound over time, especially in long retirements.

Tools to Compare These Outcomes

Before moving into real-world case studies, the following calculators allow you to compare claiming ages using your own estimates, not generic assumptions:

- Social Security Break-Even Calculator

- Social Security Claiming Age Optimizer

- Retirement Income From Savings Calculator

Used together, they show how claiming age decisions interact with longevity, work plans, and savings.

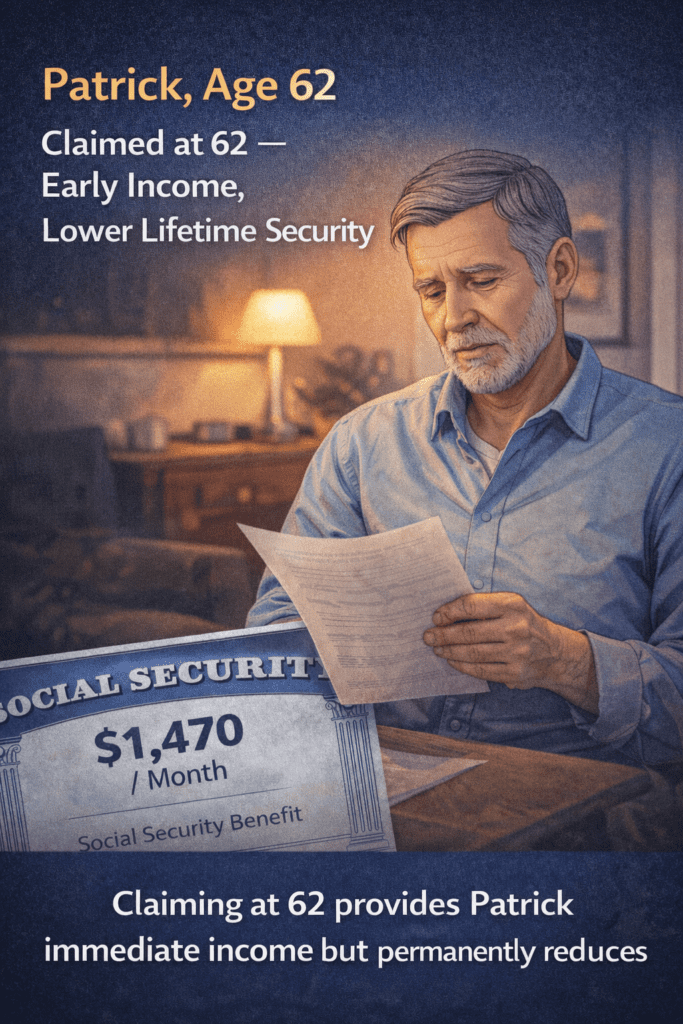

Case Study Example (Section 1): Patrick — Claiming at 62 While Still Working

Patrick decided to claim Social Security at age 62 while continuing to work full time. Like many Gen-Xers, he had heard repeated advice to “claim as soon as you can,” often framed around the fear of dying early and missing benefits.

Patrick signed up shortly after his 62nd birthday.

Patrick’s Situation at Claiming

- Age when claimed: 62

- Full Retirement Age (FRA): 67

- Estimated FRA benefit: $2,100 per month

- Claimed early benefit (approx. 30% reduction): ~$1,470 per month

- Annual earned income (full-time): $70,000

How Working Affected Patrick’s Benefits (The Math)

Because Patrick was under full retirement age for the entire year, the Social Security earnings test applied.

2025 SSA earnings limit (under FRA):

- $23,400 per year

SSA reduction rule (before FRA):

- Benefits are reduced by $1 for every $2 earned over the limit

Patrick’s Earnings Test Calculation

- Patrick’s earnings: $70,000

- Earnings limit: $23,400

- Amount over the limit: $46,600

SSA withholding calculation:

- $46,600 ÷ 2 = $23,300 withheld

Patrick’s annual Social Security benefit at 62:

- $1,470 × 12 = $17,640

Result:

Because Patrick’s withheld amount exceeded his annual benefit, the SSA withheld all of his Social Security checks for much of the year. While he had technically “claimed,” his actual cash received from Social Security was minimal until enough months passed for benefits to resume.

What Was Temporary — and What Was Permanent

It’s important to separate temporary withholding from permanent reductions:

Temporary (Earnings Test)

- The benefits withheld due to working were not lost

- When Patrick reaches full retirement age (67), SSA will:

- Recalculate his benefit

- Credit back withheld months

- Increase his monthly payment modestly

Permanent (Early Claiming)

- Patrick permanently locked in the early-claiming reduction

- Even after recalculation at FRA:

- His benefit will always be lower than if he had waited to claim

- His survivor benefit for a spouse is also permanently reduced

- Delayed retirement credits (8% per year after FRA) are no longer available

Why This Matters for Gen-X

Patrick did not make a careless decision. He followed common advice without understanding how working while claiming early interacts with the earnings test and permanent benefit reductions.

Had Patrick understood:

- The earnings limit math

- That benefits withheld are temporary

- That early claiming permanently lowers lifetime and survivor income

…it’s likely he would have delayed claiming until at least full retirement age, and possibly longer.

Section 1 Takeaway

This example illustrates why Social Security decisions should be evaluated years in advance, not at age 62:

- Early claiming + continued work often produces little immediate cash

- The earnings test confuses many workers

- Permanent reductions matter more than temporary withholding

- Understanding the math changes outcomes

Case Study 2: Sandy — Claiming Social Security at 67 While Still Working

Sandy approached her 62nd birthday with the same questions many Gen-Xers face. Friends encouraged her to claim Social Security as soon as she was eligible, warning that waiting meant “leaving money on the table.” The idea was tempting—especially while she was still working full time.

Instead of claiming immediately, Sandy paused.

While researching the long-term impact of claiming early, she came across an article on RetireCoast that clearly explained how early claiming permanently reduces lifetime income and can affect future financial flexibility. Seeing the numbers laid out changed her perspective. Sandy realized that taking Social Security at 62 would reduce her benefit for the rest of her life, even though she was still earning a strong income.

She decided to wait.

Sandy’s Financial Position at Claiming

- Age at claim: 67 (Full Retirement Age)

- Employment status: Working full time

- Claimed benefit: Full, unreduced Social Security benefit

- Earnings test: None (no penalty after FRA)

Because Sandy claimed at full retirement age, she was able to receive 100% of her calculated benefit without any reduction—even while continuing to work. Unlike early claiming, there was no earnings limit and no temporary withholding.

Her Social Security benefit became a predictable monthly income stream, separate from her paycheck.

How Sandy Used Her Social Security Income Strategically

Rather than treating Social Security as spending money, Sandy viewed it as a planning tool.

While still working in California, she purchased her retirement home on the Mississippi Gulf Coast. The monthly Social Security benefit was applied directly toward the mortgage payment on that home.

This created several financial advantages:

- The Social Security benefit covered the mortgage while she continued earning wages

- The property began building equity immediately

- Housing costs in retirement were partially solved before she stopped working

- Her wages and retirement savings remained intact

By the time Sandy retired, she owned a home that had already appreciated in value, and her monthly housing costs were significantly reduced.

The Consequence of Waiting

Sandy didn’t maximize Social Security by chasing the highest possible benefit. Instead, she optimized timing and use of her income:

- She avoided permanent early-claiming reductions

- She created a second income stream while still working

- She converted Social Security into a long-term asset rather than short-term cash flow

Had Sandy claimed at 62, her benefit would have been permanently lower, and she likely would have delayed purchasing her retirement home—or financed it entirely from savings.

Case Study Takeaway

This case illustrates that claiming at full retirement age can offer flexibility, not just income:

- No earnings penalty

- Full monthly benefit

- Ability to deploy Social Security strategically while still employed

Sandy’s outcome wasn’t driven by luck—it was driven by understanding the consequences of claiming decisions early enough to act.

Case Study 3: Melina — Claiming Social Security at Age 70 After Long-Term Planning

Melina’s outcome looked very different from Sandy’s and Patrick’s—not because of luck, but because of early, deliberate planning.

Years before retirement, Melina and her husband made a conscious decision to work until age 70. They understood that delaying Social Security would permanently increase Melina’s benefit and strengthen the household’s long-term income base.

When Melina finally claimed Social Security at age 70, her benefit reflected delayed retirement credits, resulting in the highest possible monthly payment available to her.

Melina’s Financial Picture at Retirement

By the time Melina claimed her benefit, her retirement income came from multiple sources:

- Social Security at age 70 (maximum monthly benefit for her earnings history)

- 401(k) and other retirement savings

- Rental property income

- Spousal income coordination

Melina felt confident that her income streams—combined—would support her lifestyle for the rest of her life, even in the face of inflation or market fluctuations.

Coordinating Benefits as a Married Couple

Melina is married, and her husband took a different—but coordinated—approach.

- Her husband claimed Social Security at age 67

- He directed his benefit toward investing in rental real estate

- Their claiming decisions were made together, with long-term household income in mind

This coordination mattered. By delaying Melina’s benefit to age 70, they also maximized the survivor benefit, ensuring that the higher Social Security payment would remain in place if one spouse passed away first.

Retirement Didn’t Mean Stopping

After leaving their careers—Melina as a registered nurse and her husband as a physician assistant—they didn’t stop working entirely.

With their income stable and funds in the bank, they decided to start a new chapter:

- They formed their own rental property LLC

- Retirement income covered living expenses

- Business income focused on growth, not survival

This separation between income security and business risk allowed them to pursue entrepreneurship without financial pressure.

The Consequence of Early Planning

Melina often reflects that the most important decisions were made decades earlier, not at retirement:

“It was the planning we did in our late 40s that made all the difference.”

By understanding how Social Security, retirement accounts, spousal benefits, and investment income fit together—well before claiming—Melina and her husband created flexibility that simply wasn’t available to those who waited too long to plan.

Case Study Takeaway

Melina’s case shows what becomes possible when Social Security is treated as one component of a coordinated retirement plan:

- Delayed claiming increased guaranteed income for life

- Spousal coordination strengthened survivor protection

- Retirement savings and real estate provided diversification

- Early planning created freedom, not just income

This outcome wasn’t about maximizing a single benefit—it was about aligning decisions over time.

Section 4: Coordinating Social Security Benefits With a Spouse

One of the most misunderstood—and most important—features of Social Security involves spousal and survivor benefits.

The Survivor Benefit Rule Many Couples Don’t Know

If one spouse passes away, the surviving spouse does not receive both Social Security benefits. Instead, the survivor may elect to receive the higher of the two benefits.

This rule alone causes many couples to think about Social Security decisions as a household strategy, not just an individual one.

A Survivor Benefit Example: Melina and Spencer

Melina was receiving $2,750 per month from Social Security after claiming at age 70. Her husband, Spencer, was receiving $2,600 per month, having claimed earlier.

At age 80, Melina unexpectedly passed away in an automobile accident.

Under Social Security rules, Spencer was allowed to step up to Melina’s higher benefit. His own $2,600 benefit stopped, and he began receiving $2,750 per month instead for the rest of his life.

This is why many couples decide—well in advance—who should delay benefits and who should not.

Common Claiming Combinations Couples Consider

There is no single correct strategy. Below are common approaches couples evaluate, based on their circumstances:

- Both spouses claim at age 62

- One spouse claims at 62, the other at full retirement age (67)

- Both spouses claim at full retirement age (67)

- One spouse claims at 67, the other delays to age 70

- Lower earner claims earlier, higher earner delays to age 70

Each approach produces different outcomes for:

- Monthly income while both are alive

- Survivor income after one spouse passes

- Dependence on savings and investments

Why Couples Choose Different Claiming Ages

Couples often decide to take benefits at different times for a variety of reasons, including:

A. Health considerations

If one spouse has a serious illness that may significantly shorten life expectancy, claiming earlier can feel more appropriate to some households.

B. Family longevity history

A strong family history of early mortality (for example, passing before age 80) may influence decisions toward earlier claiming.

C. Protecting the surviving spouse

Many couples choose to have the higher earner delay benefits until age 70, knowing that the larger benefit will pass to the surviving spouse if that higher earner dies first.

D. Cash flow needs while working or transitioning

Some couples use one benefit early to cover expenses while the other benefit is delayed for long-term security.

A Caution About Health Assumptions

One important consideration deserves emphasis: health outcomes change.

Medical advances occur frequently, and conditions that once shortened lifespans may not do so in the future. Family history is informative—but it is not destiny.

Planning based solely on the assumption of a shorter life can produce unintended long-term consequences if circumstances change.

Section Takeaway

Spousal Social Security decisions are not about predicting the future—they are about managing risk:

- Risk of living longer than expected

- Risk of losing a spouse early

- Risk of insufficient guaranteed income later in life

Understanding how survivor benefits work allows couples to plan intentionally, rather than defaulting to timing decisions based on fear or incomplete information.

Next section preview:

In the next section, we’ll tie these strategies back to the calculators and show how to test spousal scenarios using realistic assumptions—before any claiming decision is made.

Section 5: Test Your Decisions Before You Make Them

At this point, you’ve seen how claiming age, continued work, spousal coordination, survivor benefits, and Medicare deductions all interact. What’s left is the most important step: testing how these variables work together in your own situation.

Social Security decisions are permanent once made. But the modeling can—and should—be done years in advance.

Why Scenario Testing Matters for Gen-X

Gen-Xers still have time to influence outcomes:

- Higher earning years can replace lower ones

- Claiming ages can be coordinated between spouses

- Retirement savings withdrawals can be reduced or delayed

- Survivor income can be protected intentionally

Small changes in assumptions—retirement age, life expectancy, or work plans—can produce materially different outcomes over a 20–30 year retirement.

Use These Tools Together (Not in Isolation)

To see the full picture, use the calculators below as a set, not individually:

- Social Security Claiming Age Optimizer

Compare benefits at 62, 67, and 70 based on your assumptions. - Social Security Break-Even Calculator

Understand how long you must live for delaying benefits to pay off. - Retirement Income From Savings Calculator

See how claiming decisions affect how long your savings must last.

Run multiple scenarios:

- One where both spouses claim early

- One where benefits are staggered

- One where the higher earner delays

The goal is not to find a perfect answer—but to understand trade-offs.

Planning Is About Reducing Regret, Not Predicting the Future

No one knows:

- How long they will live

- When health may change

- What markets will do

- How laws may evolve

What you can control is whether your decisions are made with clarity instead of pressure.

The people who feel most confident in retirement are rarely those who “maximized” one benefit. They are the ones who understood the consequences early and adjusted while they still had time.

Section Takeaway

Social Security works best when it is:

- Coordinated with savings

- Coordinated between spouses

- Planned years—not months—before claiming

The next section ties everything together and outlines what Gen-Xers should focus on in their 40s and 50s, while meaningful adjustments are still possible.

Section 6: Medicare and Social Security — Separate Programs, Connected Outcomes

Medicare and Social Security are two different programs, created under different laws and funded in different ways. However, for retirees, they are closely connected—primarily because Medicare premiums are often paid through Social Security.

Understanding how these two systems interact is critical, because many people are surprised by how Medicare affects their net Social Security income.

Medicare Eligibility Is Based on Age, Not Social Security

You become eligible for Medicare at age 65, regardless of whether you are taking Social Security.

This point is often misunderstood.

- You do not have to claim Social Security to enroll in Medicare

- Delaying Social Security does not delay Medicare eligibility

- Failing to enroll in Medicare on time can result in permanent penalties

Medicare enrollment decisions must be made even if you plan to delay Social Security until age 67 or 70.

What Happens If You Don’t Take Social Security at 65

If you are eligible for Medicare but have not yet claimed Social Security, Medicare will still expect payment for your coverage.

In this case:

- Medicare will bill you directly

- You will receive a monthly or quarterly bill

- You must pay it out of pocket

This catches many people off guard. They assume Medicare premiums are only handled through Social Security, only to discover they must actively budget and pay these costs themselves until Social Security begins.

What Happens Once You Take Social Security

Once you begin receiving Social Security benefits, Medicare premiums are typically deducted automatically from your monthly Social Security payment.

- You receive your Social Security benefit net of Medicare premiums

- The deduction happens before the money reaches your bank account

- Your deposit may be significantly lower than your stated benefit amount

Many retirees plan around their gross Social Security benefit and are surprised when the actual deposit is smaller due to Medicare deductions.

Why This Planning Gap Matters

Failing to plan for Medicare costs can lead to:

- Overestimating monthly retirement income

- Drawing more heavily from savings than expected

- Confusion about why Social Security payments seem “lower than promised”

This issue is especially common among people who delay Social Security beyond age 65 and are unprepared for out-of-pocket Medicare bills during the gap years.

Working, Medicare, and Social Security: Proceed Carefully

There are additional complexities when:

- You continue working past age 65

- You have employer-provided health insurance

- You claim Social Security while still employed

These situations can affect:

- When and how you enroll in Medicare

- Whether penalties apply

- How benefits coordinate with employer coverage

These details are important—but they are beyond the scope of this article and require individual investigation.

Learn More About Medicare

This article focuses on Social Security decisions and how they fit into a broader retirement plan. Medicare deserves its own dedicated research.

To learn more about eligibility, enrollment, premiums, and coverage options, visit the official Medicare website:

Section Takeaway

- Medicare and Social Security are separate—but financially connected

- Medicare starts at 65, even if Social Security does not

- Premiums will either be billed to you or deducted from your benefit

- Planning for Medicare avoids unpleasant surprises later

Understanding this connection helps ensure that the Social Security income you planned for aligns with the actual cash flow you will receive in retirement.

Final Section: What Gen-X Should Do Now — While Time Is Still on Your Side

If there is one consistent theme across every example in this article, it’s this:

The best Social Security decisions are rarely made at age 62, 67, or 70.

They are made years earlier.

Generation X still has something extremely valuable—time. Time to influence earnings, coordinate benefits with a spouse, plan for Medicare, and align Social Security with savings, investments, and lifestyle goals.

The people who struggle most in retirement are not those who made the “wrong” claiming choice. They are the ones who never understood the consequences until the decision was irreversible.

What the Case Studies Really Show

Patrick, Sandy, and Melina did not just choose different claiming ages—they followed different planning paths:

- Patrick claimed early without understanding how work and early reductions interacted

- Sandy waited, avoided penalties, and used Social Security strategically while still working

- Melina planned decades ahead and used delayed benefits to strengthen household security and survivor protection

None of these outcomes were accidental. Each was the result of what was understood—or misunderstood—before claiming.

Social Security Is One Piece of the Plan

Social Security was never designed to carry retirement on its own. It works best when it is coordinated with:

- 401(k)s and IRAs

- Roth accounts and tax planning

- Real estate and rental income

- Spousal and survivor strategies

- Medicare timing and costs

When viewed in isolation, Social Security feels confusing and controversial. When viewed as part of a system, it becomes predictable and manageable.

The Most Important Takeaway for Gen-X

You do not need to:

- Chase the maximum benefit

- Predict how long you will live

- Guess what Congress might do

You do need to:

- Understand the rules

- Test scenarios early

- Coordinate decisions as a household

- Plan for net income, not gross benefits

That is how regret is reduced—and confidence is built.

Continue the Series

This article is one of several in our “Gen-X: 20 Years to Retirement” series. Each article is designed to give you clarity early enough to act.

Be sure to:

- Explore the calculators referenced throughout this article

- Read the other Gen-X planning guides in the series

- Revisit your assumptions every few years as your life and finances evolve

Retirement is not a single decision. It’s a sequence of decisions made over time.

And for Gen-X, the most important ones are happening right now.

Use our calculators to test Social Security claiming ages, retirement income, and long-term planning scenarios before making irreversible decisions.

FAQ: Gen-X Social Security Benefits (10 Questions)

- What are Gen-X Social Security benefits, and why do claiming ages matter?

Gen-X Social Security benefits are based on your earnings history and the age you claim. Claiming at 62 reduces benefits, claiming at full retirement age (66–67) pays your standard benefit, and delaying to 70 increases benefits through delayed retirement credits. - What is full retirement age (FRA) for Gen-X?

For most Gen-Xers (born 1960 or later), full retirement age is 67. Some older Gen-Xers have an FRA slightly below 67 depending on birth year. - How much do Gen-X Social Security benefits increase if you wait from 67 to 70?

After full retirement age, benefits typically increase by about 8% per year (delayed retirement credits) until age 70. That can raise the monthly benefit by roughly 24% compared to claiming at 67. - Can I claim Social Security at 62 and still work full time?

Yes, but if you claim before full retirement age, the Social Security earnings test may temporarily reduce benefits when earnings exceed the annual limit. This is one reason Gen-X Social Security benefits can look smaller than expected when claiming early while still working. - Are benefits withheld due to working “lost forever”?

No. Amounts withheld because of the earnings test are not “lost.” Social Security recalculates your benefit at full retirement age to credit back withheld months, which can increase your monthly payment later. - How do survivor benefits work for married couples?

If one spouse dies, the surviving spouse generally can receive the higher of the two benefits (not both). This is why many couples coordinate claiming decisions, especially when one spouse is the higher earner. - Should the higher earner delay benefits to protect the surviving spouse?

Many households consider delaying the higher earner’s benefit because the larger benefit may become the survivor benefit. This can increase the surviving spouse’s guaranteed monthly income, but it depends on health, savings, and household cash-flow needs. - How is my benefit calculated (why do my last working years matter)?

Social Security uses your 35 highest-earning years (wage-indexed) to calculate your benefit. If you keep working and earn more than earlier years, higher earnings can replace lower years and potentially increase Gen-X Social Security benefits. - What does Medicare have to do with Social Security payments?

Medicare and Social Security are separate programs, but Medicare premiums are often paid through Social Security. If you are receiving Social Security, Medicare premiums are commonly deducted from your monthly check. If you delay Social Security, you may be billed directly for Medicare premiums. - What’s the best way to compare claiming at 62, 67, and 70 for Gen-X Social Security benefits?

Use scenario tools before deciding. Start with a claiming-age optimizer and break-even calculator, then test how savings income fills the gap if you delay. This approach helps you understand consequences rather than relying on generic advice.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.