Last updated on January 20th, 2026 at 10:02 pm

1. Why Credit Repair Scams Exist (and Why They Work)

Many people searching for ways to fix their credit without getting scammed aren’t looking for shortcuts — they’re looking for relief.

Bad credit creates emotional pressure, not just financial friction. For millennials, that pressure often comes from real situations:

- Student loans that don’t move the needle

- Medical bills that hit without warning

- Missed payments during layoffs, moves, or career changes

That emotional stress makes certainty feel valuable. And that’s exactly why credit repair scams exist.

- 1. Why Credit Repair Scams Exist (and Why They Work)

- 2. The Reality Check: How Credit Actually Improves

- 3. The Red Flags: How to Spot a Credit Repair Scam Before It Costs You Money

- Red Flag #1: Promises to Remove Accurate Information

- Red Flag #2: Upfront Fees or “Setup” Charges

- Red Flag #3: Pressure to Act Immediately

- Red Flag #4: Instructions to Avoid the Credit Bureaus

- Red Flag #5: Requests for Sensitive Personal Information Too Early

- Red Flag #6: Payment Requests via Gift Cards or Unusual Methods

- Red Flag #7: Claims of “Secret” Methods or Insider Access

- Red Flag #8: Guarantees of Specific Results

- Red Flag #9: Confusing Education With “Management”

- Why This Matters for Millennials

- What Comes Next

- 4. What Legitimate Credit Improvement Actually Looks Like

- 5. What You Can Do Yourself (Free, Safe, and Actually Useful)

- Start with your free credit report (this is the first step)

- Understand the difference between reports and scores

- Not all credit scores are the same

- Why changes matter more than the number itself

- Automate the behaviors that protect your credit

- Reduce balances steadily — not emotionally

- Keep older accounts open unless there’s a clear reason not to

- Tie credit actions to real financial systems

- Why this approach works

- 6. When Outside Help Makes Sense (and When It Doesn’t)

- 7. The 15-Point Reality Check Before You Spend a Dollar

- 8. Why a Credit Decision Tool Matters Before You Contact Anyone

- The Four Legitimate Sources of Credit Help

- Trusted Sources for Credit Information (Start Here)

- Why this matters

- 9. Progress Is Measured in Direction, Not Speed

- 10. What “Good Credit” Really Means for Millennials (and Why Targets Matter)

- What Counts as “Good” Credit for Major Purchases (2026)

- 11. Protecting Your Credit and Personal Information While You Improve It

- Why credit improvement attracts scams

- Personal information you should guard carefully

- Credit monitoring and identity protection services: do you really need them?

- What you can (and should) do yourself first

- When a paid service might make sense

- Credit monitoring vs. credit fixing

- Why protection supports long-term progress

- Where this fits in the bigger picture

- 12. Staying Consistent (and What to Do When Progress Slows)

- 13. Credit Improvement Is a Skill — Not a One-Time Event

- 14. What Actually Works (and Why Most “Fixes” Don’t)

- 15. Case Study: Charlotte and Henry — What It Looks Like When the System Works

- We can get your debt reduced

- Conclusion: You Don’t Have to Do This Alone — But You Do Need the Right Tools

The fears scammers exploit

Scams don’t usually begin with obvious lies. They begin with thoughts like:

- “I’ll never qualify for anything again.”

- “One mistake ruined my future.”

- “I just need someone to fix this.”

When you’re under pressure, speed sounds reasonable — even when it isn’t.

Anyone promising a fast or guaranteed way to fix credit without getting scammed is usually selling reassurance, not results.

Case Study: When “Credit Fix-It” Went Too Far

In August 2023, a federal district court ruled against Lexington Law, CreditRepair.com, and their parent company PGX Holdings in a major enforcement action brought by the Consumer Financial Protection Bureau (CFPB).

The violation: The companies were found to have violated the Telemarketing Sales Rule, which prohibits credit repair firms from charging advance fees before proving results with a credit report issued at least six months after services are provided.

The deceptive practice: According to the CFPB, consumers were often drawn in through ads offering help with home loans, rent-to-own programs, or general financial assistance, then funneled into costly monthly credit repair subscriptions without clear disclosure of what could realistically be changed.

The outcome:

- Chapter 11 bankruptcy filings

- Roughly 80% of operations shut down

- $1.8 billion distributed to over 4 million consumers

- The largest victim-relief distribution in CFPB history

Why this matters: Credit systems respond to behavior and consistency — not subscriptions. You can’t sell speed where time is required.

The truth most people don’t want to hear

Real credit improvement is:

- Boring

- Slow

- Mechanical

It’s built on systems:

- On-time payments

- Lower credit utilization

- Fewer new accounts

- Time without new negative events

There is no dramatic reset. That reality doesn’t market well, which is why so many companies sell “fixes” instead.

Where confusion comes from

Some credit repair companies do offer recommendations and suggestions. On the surface, this can feel like a legitimate way to fix credit without getting scammed.

The problem is that:

- The advice often mirrors basic credit fundamentals

- Paying for it does not speed up results

- The same guidance is available at no cost

When education is packaged as urgency, people mistake activity for progress.

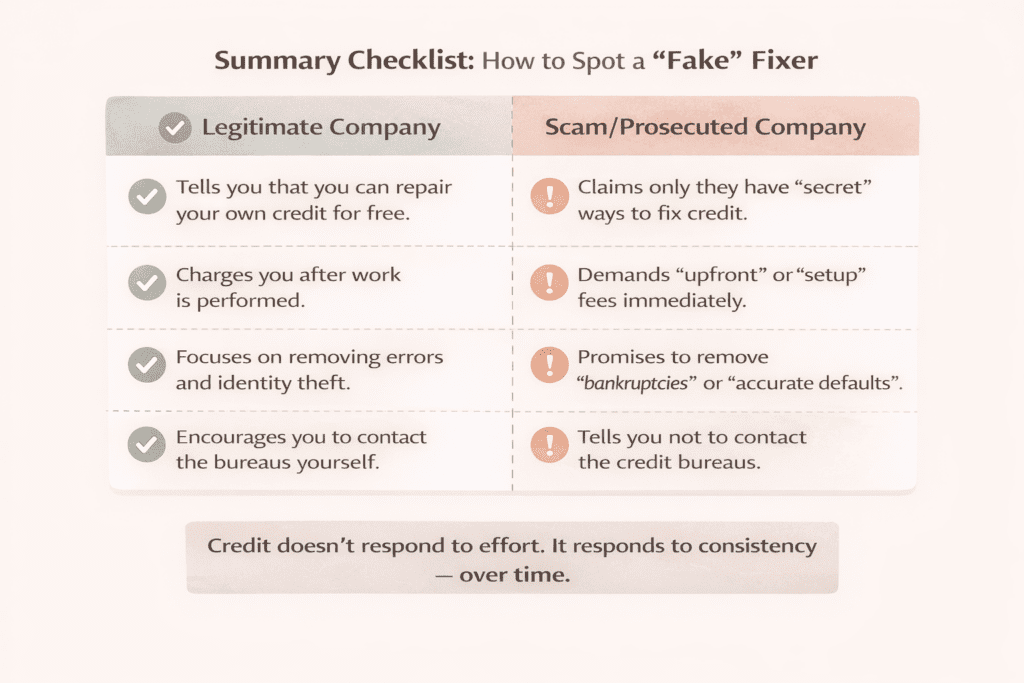

⚠️ The “Red Flag” Test (From the Author)

A legitimate company will never ask for payment before services are performed, and they will never promise to remove accurate information from your credit report. This distinction is critical.

If the information on file is accurate, regardless of what someone promises, it is unlikely that the reporting company will remove it. Any claim to the contrary should immediately raise concerns.

That’s why we’ve included a section in this article showing you how to potentially mitigate negative items yourself — with no guarantees, no shortcuts, and no promises. Just realistic options, explained clearly.

2. The Reality Check: How Credit Actually Improves

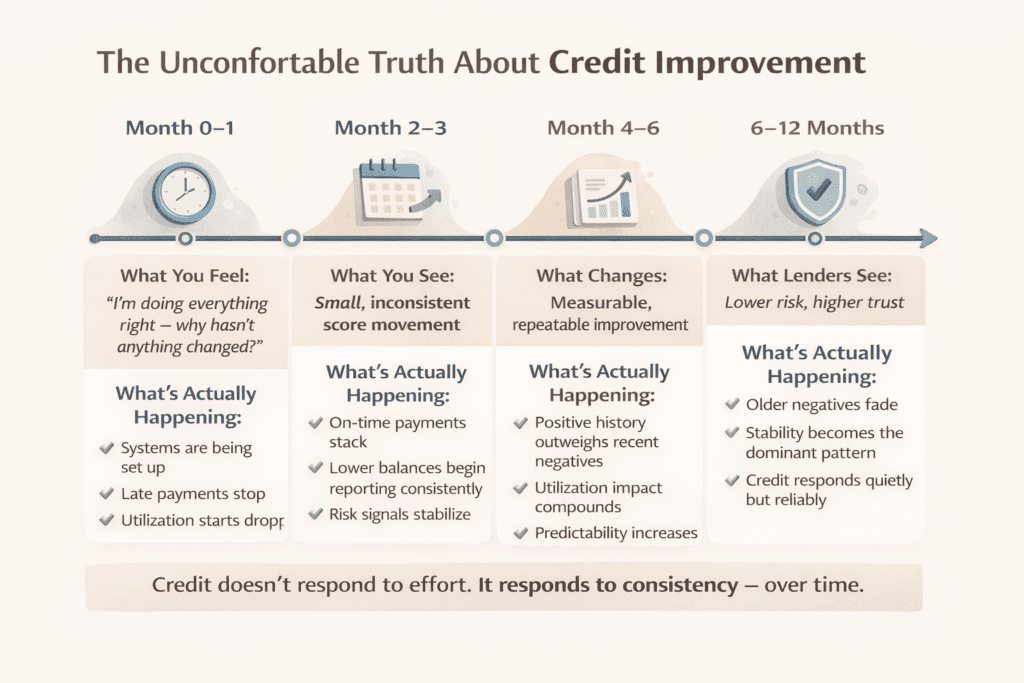

If you want to fix your credit without getting scammed, you need to understand one uncomfortable truth:

Credit does not respond to effort.

It responds to patterns.

Credit scores don’t care how hard you’re trying or how motivated you feel. They quietly track behavior over time and update only when those patterns change.

Credit scores are measurements, not judgments

A credit score is not a verdict on your intelligence, responsibility, or worth. It’s a snapshot of how predictable you look to lenders based on a few inputs.

Credit improves when:

- Payments are made on time, consistently

- Balances stay low relative to limits

- New credit slows down

- Older accounts remain open

- Time passes without negative events

There is no paid service that can override those mechanics.

That’s why learning how to fix credit without getting scammed starts with understanding how limited the system actually is.

Why “fixes” feel real — but don’t fix anything

Many services promise to optimize or accelerate credit improvement. What they usually provide instead is structure:

- Reminders

- Checklists

- Dispute templates

- Encouragement

Those tools can be useful — but they don’t change how credit scores are calculated.

You can follow the same steps yourself, for free, and fix your credit without getting scammed at the same pace.

The part no one likes: time is not optional

Even when you do everything right:

- Late payments fade slowly

- Utilization only helps once it stays low for multiple cycles

- Positive history must outweigh older negatives

That delay doesn’t mean nothing is happening. It means the system is waiting for consistency.

Why this matters for millennials

Millennials are often balancing:

- Career transitions

- Side hustles or new businesses

- Relocations

- Family responsibilities

- Uneven income

That makes shortcuts especially tempting — and especially risky.

The safest way to fix your credit without getting scammed isn’t to move faster.

It’s to build stability and let the system recognize it.

Quietly. Mechanically. Reliably.

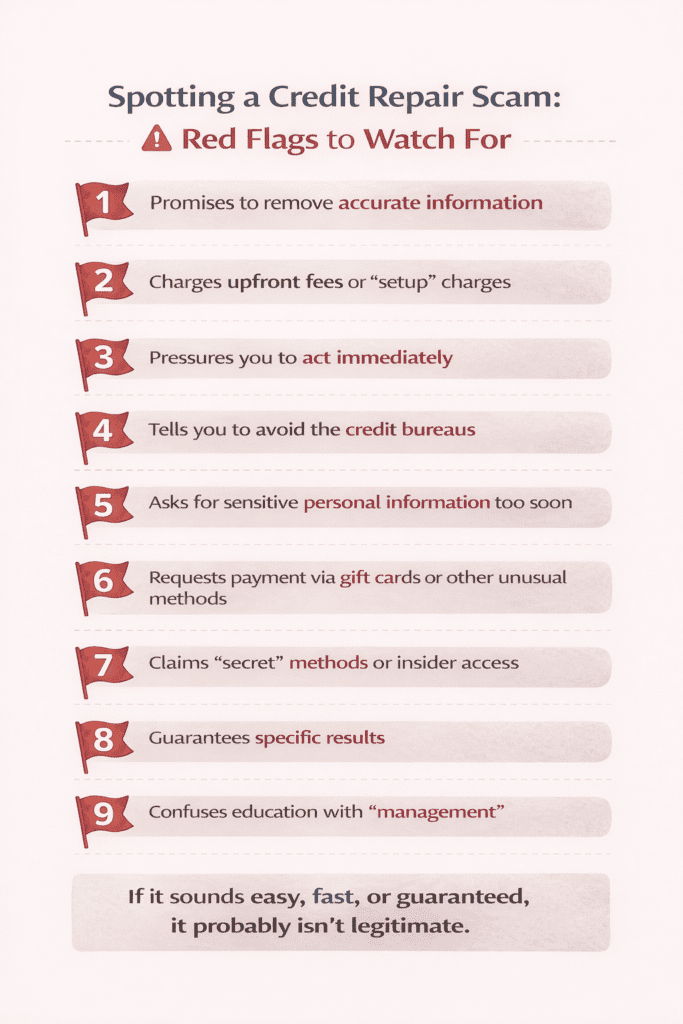

3. The Red Flags: How to Spot a Credit Repair Scam Before It Costs You Money

Once you understand how credit actually works (Sections 1 and 2), the warning signs become much easier to see.

Most credit repair scams don’t rely on complex tricks — they rely on urgency, confusion, and incomplete information. These are the patterns young people, Gen Zers, and young adults should watch for.

Red Flag #1: Promises to Remove Accurate Information

A legitimate provider will never promise to remove:

- Accurate late payments

- Valid charge-offs

- Legitimate collections

- Verified negative information

If the item is accurate, it generally stays until it expires under the Fair Credit Reporting Act. Any claim otherwise is a major red flag.

This is where many credit repair companies cross the line from education into deception.

Red Flag #2: Upfront Fees or “Setup” Charges

Under the Credit Repair Organizations Act, credit repair services cannot legally charge you before work is performed.

Common scam language includes:

- “Enrollment fee”

- “Processing fee”

- “First month required today.”

If payment is demanded before results, walk away.

Red Flag #3: Pressure to Act Immediately

Scammers often rely on urgency:

- “This offer expires today.”

- “Your credit file will get worse if you wait.”

- “One phone call can fix this.”

Real credit improvement does not hinge on a single phone call or fast decision. Pressure tactics are a classic hallmark of common scams.

Red Flag #4: Instructions to Avoid the Credit Bureaus

No legitimate service provider will tell you:

- Not to contact the major credit bureaus

- Not to pull your own free credit report

- Not to review your own credit history

If they discourage transparency, it’s usually because they don’t want you to see what’s actually happening.

Red Flag #5: Requests for Sensitive Personal Information Too Early

Be cautious if you’re asked for:

- Your Social Security number before any written agreement

- Bank account numbers without a detailed contract

- Unique passwords or login credentials

This opens the door to identity theft, online fraud, and credit card fraud — especially when combined with social media outreach.

Red Flag #6: Payment Requests via Gift Cards or Unusual Methods

No legitimate credit repair company will ask you to pay via:

- Gift cards

- Wire transfers

- Untraceable payment apps

These methods are commonly associated with online scams, romance scams, and fraudulent service providers.

Red Flag #7: Claims of “Secret” Methods or Insider Access

There are no hidden systems, secret portals, or special relationships with:

- The major credit bureaus

- Law enforcement

- The Federal Trade Commission

- The Better Business Bureau

Anyone claiming insider influence is misrepresenting how the system works.

Red Flag #8: Guarantees of Specific Results

Promises like:

- “We’ll raise your score 100 points.”

- “Guaranteed approval”

- “Fastest way to a good credit score”

…are incompatible with how credit scoring works. Scores are affected by various factors, including payment history, credit utilization ratio, and account age — none of which can be guaranteed.

Red Flag #9: Confusing Education With “Management”

Some services repackage basic personal finance education and present it as active repair:

- Budget tips

- Automatic payments

- Spending habit reminders

These are helpful ideas — but they’re things you can do yourself, for free, using tools like your own bank’s online portal or a budgeting guide.

Why This Matters for Millennials

Young people often face:

- Student loans

- Medical bills

- First credit card bills

- Lower starting incomes

- Pressure from social media success stories

That combination makes quick fixes tempting — and scams profitable.

The best protection is knowing that:

If it sounds easy, fast, or guaranteed, it probably isn’t legitimate.

What Comes Next

Now that you know what to avoid, the next sections focus on:

- What legitimate credit improvement looks like

- What you can do yourself at no cost

- When outside help actually makes sense

No hype. No shortcuts. Just clear the next steps.

Legitimate, Non-Profit Credit Assistance (Education & Support)

The organizations below are not credit repair services. They do not remove accurate negative information or promise score increases. Instead, they provide education, counseling, and—when appropriate—help developing realistic repayment plans you can afford.

-

National Foundation for Credit Counseling (NFCC)

https://www.nfcc.org/

A long-standing non-profit network that connects consumers with certified credit counselors. In some cases, they can help you set up a Debt Management Plan (DMP) that works with creditors to reduce interest rates and establish affordable monthly payments over time. -

Federal Trade Commission (FTC)

https://consumer.ftc.gov/

The FTC enforces consumer protection laws and provides guidance on credit reports, disputes, identity theft, and how to avoid credit repair scams. Their resources explain your rights and what legitimate assistance looks like.

In some situations, non-profit counselors can help you work out a structured repayment plan with creditors based on timelines and amounts you can realistically afford. These plans focus on stability and follow-through—not shortcuts or guarantees.

4. What Legitimate Credit Improvement Actually Looks Like

Once you know how credit works and how scams operate, the next question is obvious:

If shortcuts don’t work, what does?

Legitimate credit improvement isn’t flashy, fast, or outsourced. It’s a combination of accuracy, stability, and consistency, applied long enough for the system to recognize the change.

Legitimate improvement starts with accuracy

The first goal is not a higher score — it’s a clean credit file.

That means:

- Your personal information is correct

- Accounts listed actually belong to you

- Balances and statuses reflect reality

- Negative items are accurate and current

Fixing errors doesn’t “game” the system. It ensures the system is judging you on the right information.

This is especially important for young adults, Gen Zers, and younger people whose credit history is still forming and is more sensitive to mistakes.

Disputes are about correctness, not erasing the past

Disputing inaccurate information is a legal right, but it’s not a magic wand.

Legitimate disputes focus on:

- Identity theft or credit card fraud

- Incorrect balances or duplicate accounts

- Accounts marked late when payments were on time

- Negative items that should have aged off

They do not focus on:

- Removing accurate late payments

- Rewriting legitimate defaults

- Promising a specific score increase

If the information is accurate, it usually stays until time does its job.

Stability matters more than speed

Credit systems reward predictability, not urgency.

Legitimate improvement looks like:

- On-time payments month after month

- Credit card bill payments that reduce balances gradually

- A stable credit utilization ratio

- Fewer new applications

- Older accounts staying open

This is why automatic payments, realistic monthly payments, and controlled spending habits are far more effective than chasing a “fastest way” solution.

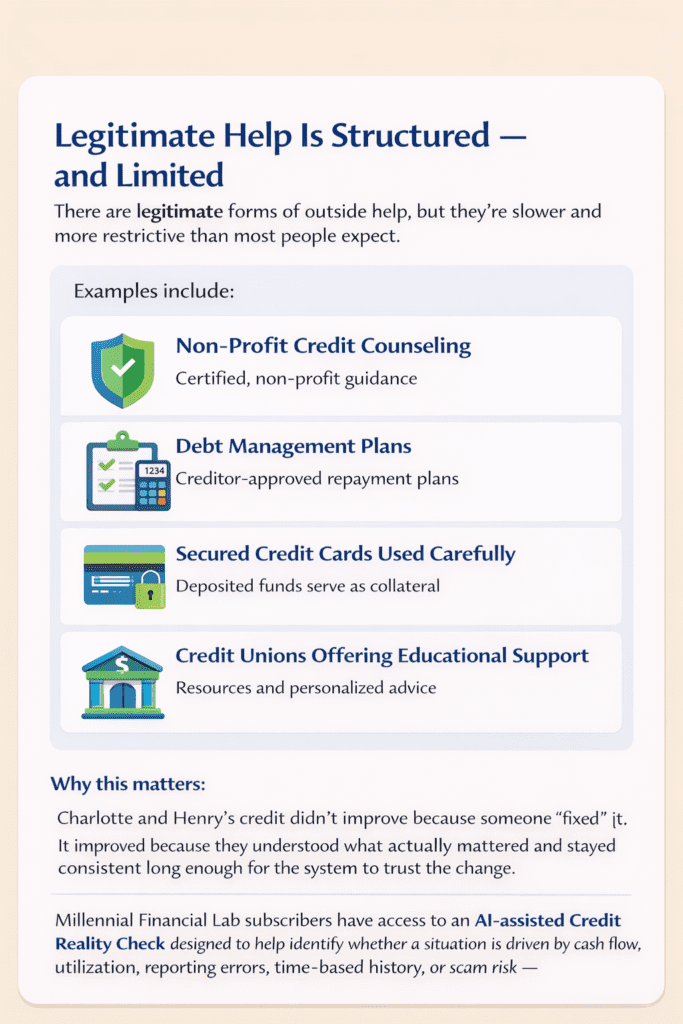

Legitimate help is structured — and limited

There are legitimate forms of outside help, but they’re slower and more restrictive than most people expect.

Examples include:

- Non-profit credit counseling

- Debt management plans

- Secured credit cards are used carefully

- Credit unions offering educational support

These options don’t promise speed or guaranteed results. They focus on rebuilding habits and reducing risk — which is exactly why they’re credible.

Why this approach works for millennials

Many millennials are juggling:

- Student loans

- Medical bills

- Irregular income

- Credit card debt

- First-time financial responsibilities

Legitimate credit improvement fits into real life. It doesn’t require perfect behavior — just consistent, boring progress.

And while it may not feel dramatic, this approach is the best way to build a good credit score that actually lasts.

What comes next

Now that you know what legitimate improvement looks like, the next section focuses on:

- What you can safely do yourself

- What costs nothing

- And where most people should start

No scripts. No sales calls. Just practical next steps.

Source note:

Based on consumer credit guidance from ConsolidatedCredit.org, the Consumer Financial Protection Bureau(https://www.consumerfinance.gov), and the Federal Trade Commission (https://www.ftc.gov). Educational use only.

5. What You Can Do Yourself (Free, Safe, and Actually Useful)

If you’re trying to fix credit without getting scammed, this is where most progress really happens — quietly, consistently, and at no cost.

You don’t need a credit repair company to start improving your situation. In fact, the safest and most effective steps are the ones you control directly.

Start with your free credit report (this is the first step)

Before changing anything, you need to see what’s actually on file.

By law, you can access your credit reports from all three major credit bureaus at:

https://www.annualcreditreport.com

Your credit report shows:

- Accounts you have open

- Payment history (including late payments)

- Balances and account status

- Negative items you may need to plan around

- Errors or outdated information

This report is about accuracy, not judgment. It tells you what exists, not how good or bad you are with money.

Understand the difference between reports and scores

Many people confuse credit reports and credit scores — and that confusion is where scams thrive.

Here’s the distinction:

- Credit reports show the raw data (accounts, balances, history)

- Credit scores summarize that data into a number

Most credit cards and banks now offer free access to a credit report and a credit score through their online portals. That’s a great tool — but there’s an important caveat.

Tracking Progress: Credit Scores vs. Credit Reports

You can sign up with myFICO.com to view your FICO credit scores. They offer a free option that lets you monitor score changes, along with paid subscription plans that provide full reporting whenever you log in.

If you are diligently working to improve your credit, the free score option is often enough. It works well alongside your free annual credit report:

- The credit report shows what’s on file — including errors or negative items you must plan around.

- The credit score shows whether your efforts are actually improving your standing over time.

If you prefer frequent visibility and access to multiple score types, you may consider a paid subscription. As of this writing, plans are offered around $29.95 per month for expanded access.

This option makes the most sense for people who want to check progress often — not because it fixes credit, but because it provides clearer feedback while you follow a long-term improvement plan.

Not all credit scores are the same

The “free score” you see through a credit card or credit report:

- Is useful for tracking trends

- Is often educational

- May not be the score your lender actually uses

There are many different credit scores used for different purposes:

- Auto loans

- Mortgage loans

- Credit cards

- Personal loans

That’s why, if you want to see the types of scores creditors actually use, it’s best to visit https://www.myFICO.com.

myFICO provides access to FICO scores commonly used by lenders, along with optional paid plans for people who want frequent, detailed visibility.

Why changes matter more than the number itself

For millennials working to improve credit, the direction of change is often more important than the exact score.

For example:

- If your score shows 600, and over time it moves to 640, that’s real progress

- Even if that score isn’t the exact version a lender uses, the upward movement matters

Credit improvement is about trends:

- Fewer late payments

- Lower balances

- Better utilization

- More consistency

Tracking those changes helps you stay motivated and confirms that your systems are working.

Automate the behaviors that protect your credit

Two actions prevent more damage than almost anything else:

- On-time payments, every month

- Avoiding new negative entries

Setting up automatic payments — even just for the minimum — protects your payment history while you work on the bigger picture.

If cash flow is tight, improving credit without getting scammed often means stabilizing income and expenses first.

🔗 https://retirecoast.com/stabilize-cash-flow-2/

Reduce balances steadily — not emotionally

High balances relative to limits (your credit utilization ratio) are a major reason scores stay low.

You don’t need to eliminate debt overnight.

You do need consistency.

Seeing how payments and balances interact is more powerful than any promise.

🔗 https://retirecoast.com/calculators-hub/

Keep older accounts open unless there’s a clear reason not to

Closing old accounts can shorten your credit history and raise utilization. For many young adults, keeping older accounts open — even unused — helps more than it hurts.

This is a common mistake among people trying to “clean up” their credit too quickly.

Tie credit actions to real financial systems

Credit reflects how well your overall financial life is working.

That’s why budgeting, planning, and long-term thinking matter just as much as disputes or payments.

If you’re still building that foundation:

🔗 https://retirecoast.com/millennial-budget-guide/

And remember — credit is a tool, not the goal. It supports larger plans like investing and housing, not the other way around.

🔗 https://retirecoast.com/investing-basics-for-millennials/

Why this approach works

People who successfully fix credit without getting scammed usually stop looking for shortcuts and start tracking progress.

It’s not flashy.

It’s not instant.

And it works.

6. When Outside Help Makes Sense (and When It Doesn’t)

If you’re trying to fix your credit without getting scammed, knowing when to seek outside help is just as important as knowing who to trust.

Outside help is not automatically bad — but it’s often misunderstood, misused, or sought too early.

When outside help can make sense

Outside assistance is most appropriate when your situation involves structural problems, not just habits.

Examples include:

- Multiple missed payments or defaults you can’t realistically catch up on alone

- Credit card debt with interest rates that prevent balances from declining

- Medical bills or life events that disrupted your finances

- A need for a structured repayment timeline you can actually afford

In these cases, help isn’t about fixing credit — it’s about stopping further damage and creating breathing room.

That’s why legitimate help usually comes from:

- Non-profit credit counseling organizations

- Credit unions offering financial education

- Structured debt management plans

These options focus on sustainability, not shortcuts.

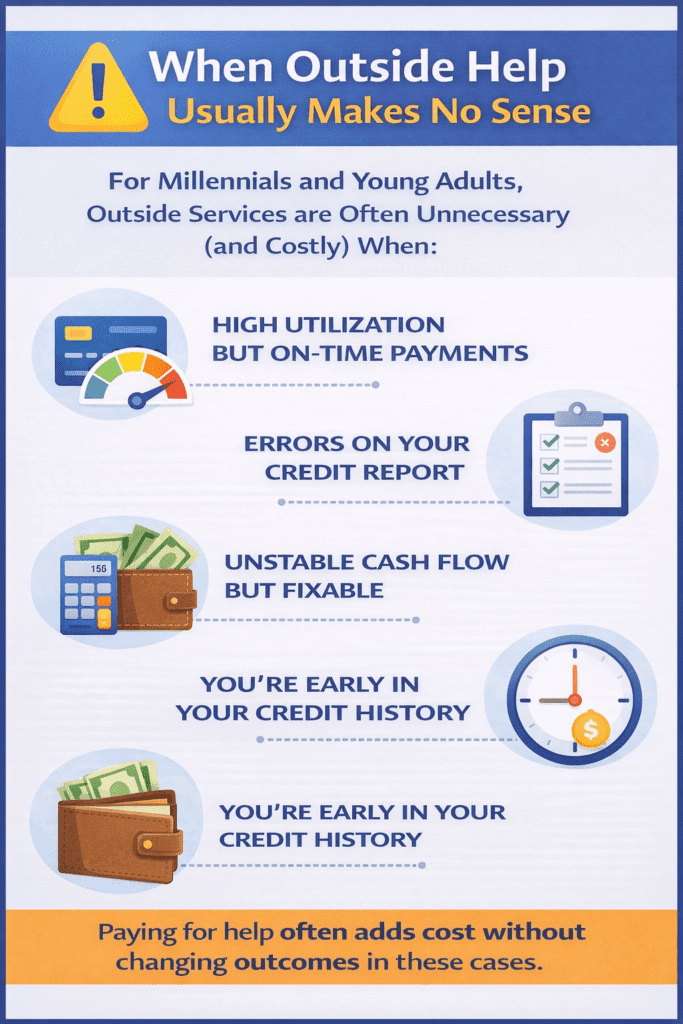

When outside help usually does not make sense

For many millennials and young adults, outside services are unnecessary — and sometimes harmful — when:

- Your main issue is high utilization, but on-time payments

- Errors on your credit report are straightforward to dispute

- Cash flow is unstable, but fixable with budgeting

- You’re early in your credit history, and time is the main factor

In these cases, paying someone else often adds cost without changing outcomes.

If a service promises speed, certainty, or score guarantees, that’s a signal to pause.

Red flags to watch for (revisited briefly)

At this stage, red flags should be familiar — but they’re worth reinforcing:

- Upfront fees before work is performed

- Promises to remove accurate negative information

- Pressure to act quickly

- Requests to stop communicating with creditors or bureaus

- Vague explanations paired with frequent reassurance emails

If you’re unsure, that uncertainty itself is information.

Outside help should reduce stress — not add to it

Legitimate assistance:

- Explains limits clearly

- Sets realistic expectations

- Focuses on education and follow-through

- Encourages you to stay involved

Scams rely on urgency and confusion. Real help relies on transparency.

A better question to ask

Instead of asking:

“Can someone fix this for me?”

A better question is:

“What problem am I actually trying to solve right now?”

That distinction often determines whether outside help is useful — or a distraction.

What’s next

Now that you know:

- What you can do yourself

- When outside help makes sense

- How scams operate

The next section brings it all together with a clear checklist you can use to protect yourself before taking any next step.

Authors Note: Systems, master them for a successful life

Author’s Note: Credit Is a System — and Systems Can Be Learned

We’ve talked about systems in other RetireCoast articles. A system is a structure created to fulfill a specific purpose in society. Credit is one of those systems.

A credit system rewards certain behaviors and penalizes others. As with any system, you have choices: you can ignore it, fight it, or learn how it works and use it to your advantage. The best course is almost always to understand the rules.

For example, keeping your credit utilization below about 15% sends a strong signal of control and stability. If you have a $5,000 credit limit, that means avoiding balances above roughly $750 at any point — including previous balances. Consistently exceeding that level signals higher risk, and scores often respond accordingly.

Knowing how the system works allows you to plan. And planning means you are taking control — instead of reacting to outcomes after the fact.

7. The 15-Point Reality Check Before You Spend a Dollar

If you remember nothing else from this guide, remember this:

You can fix credit without getting scammed — but only if you slow down long enough to ask the right questions.

Before you pay anyone, sign anything, or hand over personal information, use this checklist.

The Credit Reality Checklist (Millennial Edition)

- Have I pulled my own free credit report first?

If not, stop here. You can’t fix what you haven’t reviewed. - Do I understand why my credit score is low?

High utilization, late payments, short history, or errors all require different responses. - Is my main issue behavior, timing, or accuracy?

Most credit problems are not “repair” problems — they’re system problems. - Have I stabilized cash flow enough to avoid new damage?

Fixing credit while missing payments is like bailing water without fixing the leak. - Am I being promised fast or guaranteed results?

That’s your cue to walk away. - Is anyone asking for upfront fees before work is done?

Legitimate help doesn’t work that way. - Has anyone claimed they can remove accurate negative information?

They can’t — and saying so is a major red flag. - Am I being pressured to act quickly or “lock in” an offer?

Urgency is a common scam tactic. - Am I being told not to contact credit bureaus or creditors myself?

Transparency is essential. Isolation is not. - Am I being asked for sensitive personal information too early?

Social Security numbers and IDs should never come before trust and clarity. - Does this service explain what it cannot do?

Legitimate providers are clear about limits. - Have I considered non-profit or educational options first?

They won’t promise miracles — but they won’t make things worse either. - Am I confusing score monitoring with score improvement?

Watching numbers change is helpful; it doesn’t replace good habits. - Would this still make sense if progress took a year instead of a month?

If not, the plan is probably flawed. - Am I making this decision from pressure — or from understanding?

Credit decisions made calmly almost always outperform reactive ones.

Why this checklist matters

People who successfully fix credit without getting scammed don’t rely on luck or secret methods.

They rely on:

- Information

- Systems

- Patience

- And informed choices

This checklist isn’t about perfection — it’s about protection.

What comes next

In the final section, we’ll step back and answer the big question:

What does “good credit” actually mean for millennials — and how does it fit into long-term financial goals like housing, investing, and stability?

No hype. No fear. Just perspective.

Illustration for educational purposes only

8. Why a Credit Decision Tool Matters Before You Contact Anyone

One of the biggest reasons people get scammed when trying to fix credit isn’t desperation — it’s taking action before understanding the problem.

Most credit mistakes happen in this order:

- Stress rises

- Urgency takes over

- A third party is contacted too quickly

- Money or personal information is handed over

- Nothing meaningful changes

If you want to fix credit without getting scammed, the most important step is not who you contact — it’s knowing where you actually belong before contacting anyone at all.

That’s why we’re building an AI-assisted Credit Support Tool inside the Millennial Financial Lab.

Not to fix credit.

Not to dispute accounts.

But to help you make the right decision first.

What the AI-assisted Credit Support Tool does

The tool is designed to guide you to the right type of help — or confirm that you don’t need outside help at all.

It asks a small number of key questions to understand:

- What’s actually happening in your credit file

- Whether the issue is accuracy, behavior, timing, or fraud

- Whether outside assistance would help — or make things worse

Based on your answers, the tool points you to one of four legitimate paths.

The Four Legitimate Sources of Credit Help

1. Self-Help (DIY)

For many millennials, this is where credit improvement should start — and often where it should stay.

Self-help is appropriate when:

- You have high utilization but are making on-time payments

- Errors on your report are minor and correctable

- Your credit history is short and time is the main factor

- Cash flow issues are fixable with budgeting

Basic self-help actions include:

- Pulling your free credit reports

- Reviewing accounts for accuracy

- Monitoring score trends over time

- Contacting credit bureaus to correct real errors

Examples of correctable errors:

- Misspelled name

- Incorrect address

- Duplicate accounts

- Outdated status

It’s also important to understand that:

- If you’ve ever applied for joint credit, another person’s name or address may appear

- This doesn’t automatically mean fraud

- It often reflects shared financial history

2. Non-Profit or Government-Supported Help

Non-profit credit counseling and government-supported agencies focus on education and stability, not score manipulation.

This path makes sense when:

- You’re behind on payments

- Balances aren’t declining due to interest

- You need a structured repayment plan you can afford

These organizations may:

- Help negotiate lower interest rates

- Create debt management plans

- Provide counseling and budgeting guidance

They do not:

- Remove accurate negative information

- Guarantee score increases

- Charge upfront “repair” fees

3. Your Lender or Financial Institution

Sometimes the best help is the one you already have a relationship with.

Contacting your lender makes sense when:

- A hardship caused missed payments

- A fee or reporting issue may be reversible

- You need clarification on account status

Many lenders and credit unions:

- Offer payment flexibility programs

- Provide financial education

- Give free access to credit monitoring tools

This option is often overlooked — and often free.

4. An Attorney

Legal help is not for routine credit improvement — but it is critical in specific situations.

An attorney may be appropriate when:

- You are a victim of identity theft

- Fraud caused funds to be taken from a bank account

- A lender refuses to correct documented errors

- Significant financial harm occurred and reimbursement was denied

Attorneys can:

- Help enforce consumer protection laws

- Assist with identity theft recovery

- Work when financial institutions fail to act

This is not the first stop — but it’s the right stop when legal rights are involved.

Trusted Sources for Credit Information (Start Here)

Before using any tool or contacting any third party, rely on primary sources:

Credit Reports (Official)

- Annual Credit Report

https://www.annualcreditreport.com

This is the federally authorized site for free credit reports from all three bureaus:

- Experian

- Equifax

- TransUnion

Credit Scores (FICO)

- myFICO

https://www.myfico.com

This site shows the types of FICO scores many lenders actually use for:

- Credit cards

- Auto loans

- Mortgages

Credit Card Monitoring Tools

Many credit card companies provide free access to:

- Credit Karma or similar tools

- Educational credit scores

- Ongoing report monitoring

While these scores may not be the exact version a lender uses, they are useful for tracking directional progress.

Why this matters

The goal isn’t to do everything.

The goal is to do the right thing first.

The AI-assisted Credit Support Tool exists to slow the process down — so you don’t make expensive decisions under pressure.

That’s how people actually fix credit without getting scammed.

9. Progress Is Measured in Direction, Not Speed

One of the biggest mistakes people make when trying to fix credit is assuming that fast change equals real change.

In reality, credit improvement is almost always incremental. And that’s not a flaw in the system — it’s how the system is designed to work.

Why slow progress is often the right progress

Credit systems are built to measure risk over time, not short bursts of good behavior.

That means:

- One good month doesn’t erase a bad year

- One dispute doesn’t outweigh repeated late payments

- One payoff doesn’t undo years of high utilization

But it also means the opposite is true:

- A series of on-time payments matters

- Gradually lower balances matter

- Stability matters

If you’re seeing steady improvement — even modest improvement — you’re moving in the right direction.

What real progress usually looks like

For many millennials and young adults, progress looks like:

- Fewer late payments (or none at all)

- Credit card balances trending downward

- Utilization moving below key thresholds

- Scores improving in steps, not leaps

For example:

- A score moving from 590 to 620

- Then to 650

- Then holding steady while habits solidify

That’s not slow — that’s normal.

Important Warning: Temporary Removal Is Not a Fix

Many “credit fix-it” businesses rely on a tactic that can be misleading if you don’t understand how credit reporting investigations work.

These companies often send letters to credit reporting agencies claiming that a late payment or negative item is incorrect — for example, saying a payment was mailed on time or processed late. This forces the credit bureau to open an investigation.

During the investigation, the reporting agency may temporarily remove the item. If your credit is checked during this short window, it can appear that the problem was “fixed.”

What they often fail to explain is that once the creditor reviews the request, they will usually verify the information if it is accurate. When that happens, the negative item is added back to your report.

This process can take a few weeks — or even a couple of months — depending on how frequently the creditor reports data. When the item reappears, customers are left confused and frustrated.

A temporary disappearance during an investigation is not a fix. Real credit improvement comes from accuracy, consistency, and time — not short-lived paperwork tactics.

Why scams focus on speed

Credit repair scams succeed by exploiting impatience.

They imply:

- Immediate results are normal

- Slow improvement means failure

- Paying someone accelerates outcomes

None of that is true.

If someone tells you your credit should “skyrocket” quickly, they’re either misunderstanding the system — or misrepresenting it.

Direction matters more than the exact number

Especially early on, the trend is more important than the score itself.

If your score is:

- Going up over time

- Holding steady while debt declines

- Recovering after a setback

That indicates progress — even if the number isn’t where you want it yet.

This is why tracking changes (not chasing perfection) is one of the most reliable ways to fix credit without getting scammed.

Credit progress should reduce stress, not increase it

If a plan makes you:

- Check scores obsessively

- Panic over small dips

- Feel like you’re “failing”

That plan isn’t sustainable.

Healthy credit improvement feels boring. Predictable. Uneventful.

And that’s exactly what lenders want to see.

What comes next

Now that expectations are reset, the next section focuses on a critical mindset shift:

How to think about “good credit” without letting it dominate your financial life.

That’s where long-term stability really begins.

10. What “Good Credit” Really Means for Millennials (and Why Targets Matter)

For many millennials, “good credit” gets framed as a single number — and that misunderstanding creates anxiety, poor financial decisions, and vulnerability to scams.

In reality, good credit is not a destination. It’s a tool that supports real-life goals.

Understanding this distinction is one of the most practical ways to fix credit without getting scammed.

Good credit is about access, not perfection

Lenders are not looking for flawless behavior. They’re looking for predictability over time.

Good credit generally means:

- You make on-time payments

- You manage balances responsibly

- You don’t rely on credit to survive

- Your behavior is consistent, not reactive

A perfect score is not required to:

- Buy a home

- Finance a car

- Obtain insurance

- Access mainstream financial products

Chasing “perfect” credit often leads people to overpay for services that don’t meaningfully change outcomes.

Why setting realistic credit targets matters

If you’re in the process of improving your credit, setting reasonable goals is a smart move.

Instead of aiming for “the best” or “exceptional,” focus on reaching good first.

In the world of credit:

- “Good” usually means you’re eligible for loans — but not at the lowest advertised rates

- “Great” or “Exceptional” credit unlocks the best pricing

Once you reach “good,” you can reassess and decide whether pushing further is worth the effort for your situation.

What Counts as “Good” Credit for Major Purchases (2026)

Below are practical benchmarks for what lenders typically consider good — not perfect — credit for common financial decisions.

These ranges are especially useful for millennials who have struggled with low credit scores in the past and want clear, achievable targets.

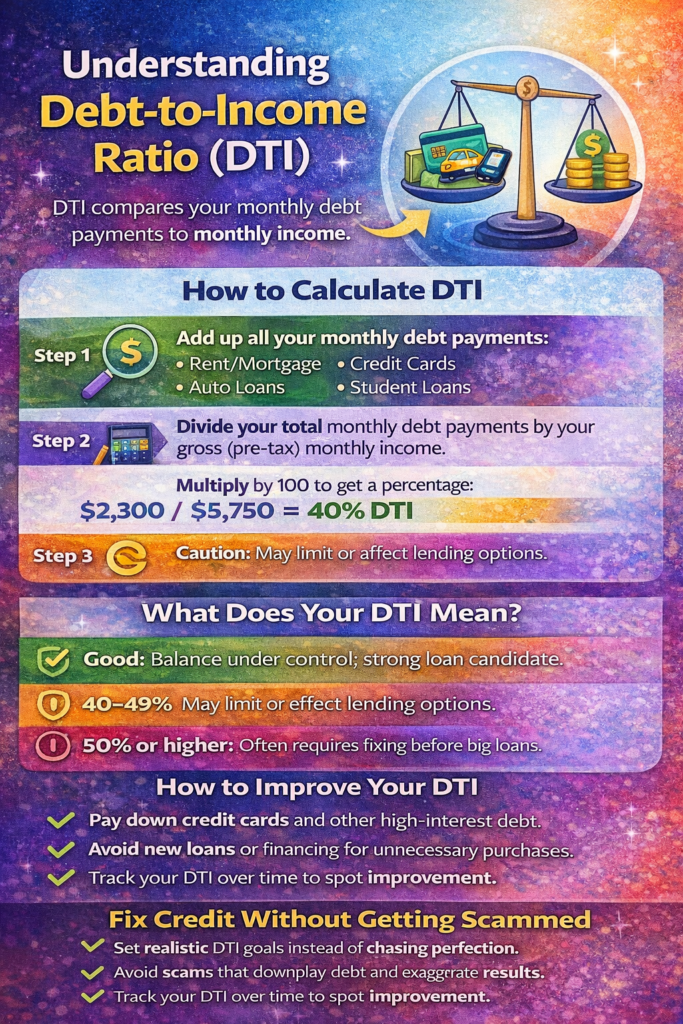

Credit Score Isn’t the Whole Picture: Debt-to-Income Matters

In addition to your credit score, creditors closely evaluate your debt-to-income ratio (DTI) — the percentage of your monthly income that goes toward debt payments.

DTI is an absolute requirement when buying a home. Even with a decent credit score, a high DTI can prevent mortgage approval or force higher rates. This is one of the strongest reasons to reduce credit card balances and pay down certain loans that appear on your credit report.

For car purchases and insurance, DTI usually matters less — but keeping your total DTI around 40% or lower is considered good financial practice and improves overall borrowing flexibility.

Want to see where you stand? Try our Debt-to-Income (DTI) Calculator to understand how your current debts impact future borrowing decisions.

1. Buying a House (Mortgage)

For mortgages, 620 is often the minimum threshold to escape subprime territory.

Good Score Range: 660–719

The trade-off:

You’ll likely qualify for a conventional loan, but your interest rate may be 0.5%–1.0% higher than someone with a 760+ score. Over 30 years, that difference can add up to six figures in additional interest.

Alternative:

If your score is closer to 580, an FHA loan may be an option. These loans are designed for “good-ish” credit but require ongoing mortgage insurance (MIP).

Author’s Perspective: Time Is the Most Underrated Credit Tool

I’ve worked with many people trying to buy a home who had less-than-stellar credit records. My advice is almost always the same: first, fix everything you reasonably can on your credit report while, at the same time, bringing credit card balances below about 15% of available credit — or paying them off entirely.

This process takes time, particularly when you are challenging information on a credit report that is inaccurate. Disputes don’t resolve overnight, and balances don’t drop instantly without planning.

I strongly recommend starting this process at least six months before you plan to submit an application for a mortgage or other major credit decision. That window gives you room to correct errors, lower utilization, and allow positive behavior to be reflected in your score.

Before you apply, check the credit score thresholds for the type of loan you want and use our tools in the Calculators Hub to see whether you qualify — and how much home you can realistically afford.

Time heals in the credit system. The more you plan ahead, the better your outcomes — and higher credit scores almost always mean lower interest payments over the life of a loan.

2. Buying a Car (Auto Loan)

Auto lenders are generally more flexible because:

- Loan terms are shorter

- Vehicles are easier to repossess

Good Score Range: 661–720

The trade-off:

A “great” score might secure a 5–6% APR, while a “good” score often lands in the 7–9% APR range.

Important note:

Below 600, borrowers are usually considered subprime, where rates can jump to 15% or higher.

3. Buying an RV (Recreational Vehicle)

RVs are considered luxury purchases, so lenders are often stricter than with auto loans.

Good Score Range: 680–739

The trade-off:

Many RV lenders won’t consider applicants below 660. With a “good” score, approval is possible — but you may need a larger down payment (15–20%) compared to someone with elite credit.

4. Insurance (Auto & Home)

In most states, insurers use a credit-based insurance score to estimate claim risk.

Good Score Range: 670–739

The impact:

Moving from “poor” to “good” credit can reduce premiums by up to 50%. “Great” credit (750+) may offer a smaller additional discount.

State exceptions:

California, Hawaii, and Massachusetts prohibit insurers from using credit scores to set auto insurance rates.

Why this protects you from scams

When you understand what “good” actually means:

- You stop chasing unrealistic promises

- You recognize when an offer sounds exaggerated

- You can measure progress without panic

That clarity makes it much easier to fix credit without getting scammed.

What comes next

In the next section, we’ll look at how to protect your credit and personal information while you’re improving it — and why security matters just as much as score movement.

11. Protecting Your Credit and Personal Information While You Improve It

Improving your credit doesn’t just require better habits — it also requires strong protection.

The moment you start paying attention to your credit, you become more visible to:

- Online scams

- Aggressive marketing

- Fake “credit fix” services

- Data-harvesting websites

Learning how to protect your personal information is a core part of learning how to fix credit without getting scammed.

Why credit improvement attracts scams

When people are actively working on their credit, they tend to:

- Search online for solutions

- Click ads promising fast results

- Share personal information more freely

Scammers know this. That’s why credit repair scams and online fraud schemes are often targeted at:

- Millennials and young adults

- People with low credit scores

- Anyone preparing to buy a house, car, or refinance

Urgency is the common thread — and urgency is where mistakes happen.

Personal information you should guard carefully

You should slow down anytime someone asks for:

- Your Social Security number

- Full bank account or debit card details

- Driver’s license images

- Credit card numbers

- One-time passcodes

Legitimate organizations may eventually need some of this information — but never all at once, never immediately, and never before trust is established.

If a service asks for extensive personal data early in the process, that’s a major red flag.

Credit monitoring and identity protection services: do you really need them?

Many companies offer to monitor your credit and promise to “fix” identity theft issues — or your money back.

Some of these companies are legitimate. But it’s important to understand what you’re paying for.

In most cases, you are paying for convenience, not access to special powers.

The Federal Trade Commission (FTC) and consumer advocates consistently point out that most identity-protection steps can be done on your own, for free.

What you can (and should) do yourself first

1. Freeze your credit (Free and highly effective)

Freezing your credit is the single most effective way to prevent new accounts from being opened in your name.

It is:

- Free

- Reversible

- Available directly from all three major credit bureaus

You can place and lift freezes through:

- Experian

- Equifax

- TransUnion

For many people, this step alone prevents the majority of credit-related identity theft.

2. Use IdentityTheft.gov (Free and official)

IdentityTheft.gov is the U.S. government’s official identity theft recovery site.

It provides:

- A personalized step-by-step recovery plan

- Pre-filled letters and forms

- Guidance for dealing with creditors and credit bureaus

For most consumers, this resource is more than sufficient — and costs nothing.

When a paid service might make sense

There are situations where paying for credit monitoring or identity recovery assistance can be reasonable.

It may be worth considering if:

- You are extremely busy

- You’ve experienced complex or ongoing identity theft

- You want a “white-glove” service to handle hours of phone calls and paperwork

In those cases, paying $15–$30 per month may be worth the peace of mind — as long as you understand the limits and are not being promised fast credit improvement.

Credit monitoring vs. credit fixing

Monitoring your credit is a defensive tool, not a repair strategy.

Monitoring helps you:

- Detect fraud early

- Spot new or unauthorized accounts

- Catch reporting errors quickly

But monitoring alone does not improve credit unless it’s paired with:

- On-time payments

- Lower balances

- Stable cash flow

Understanding this distinction prevents wasted spending and unrealistic expectations.

Why protection supports long-term progress

The goal of improving credit isn’t just a higher score — it’s financial stability.

Protecting your credit file ensures:

- Progress isn’t undone by fraud

- Errors are caught early

- Stress stays manageable

When protection and improvement work together, credit becomes a tool — not a source of anxiety.

Where this fits in the bigger picture

People who successfully fix credit without getting scammed:

- Move slowly with personal information

- Rely on official sources first

- Use paid services only when convenience — not desperation — is the reason

That mindset is one of the strongest protections you can build.

Don’t Close Credit Card Accounts (Unless You Truly Have To)

Closing credit card accounts can hurt your credit more than many people realize. One reason is that open cards give you credit for the length of time you’ve had the account — a key factor in your overall credit profile.

If you absolutely cannot control your spending, closing some or all cards may be necessary in the short term. But when possible, keeping accounts open is usually the better long-term move.

A practical strategy is to rotate card usage. For example, use Card A one month and Card B the next, keeping balances under about 15% of available credit and paying them off if you can.

People who close cards often reopen new ones later — taking hits for new accounts while losing the valuable aging on their older cards. When managed carefully, older accounts can be a quiet advantage in rebuilding credit.

12. Staying Consistent (and What to Do When Progress Slows)

At some point in every credit journey, progress slows.

Balances decline more slowly.

Scores stall.

Nothing looks “wrong,” but nothing seems to be improving either.

This is where many people abandon good habits — or worse, become vulnerable again to promises of a quick fix.

Understanding this phase is critical if you truly want to fix credit without getting scammed.

Why plateaus are normal

Credit systems reward patterns, not bursts of activity.

Once you’ve:

- Corrected obvious errors

- Brought accounts current

- Reduced utilization significantly

Further improvement often depends on:

- Time

- Aging of accounts

- Continued on-time payments

None of those can be rushed — and no service can shortcut them.

What not to do when progress stalls

This is the danger zone.

Avoid:

- Opening unnecessary new accounts

- Closing older accounts out of frustration

- Paying for “advanced” repair services

- Re-disputing accurate information repeatedly

These actions often reset progress instead of advancing it.

What actually helps during plateaus

When improvement slows, focus on maintenance and protection:

- Keep balances low and predictable

- Use automatic payments to prevent slips

- Monitor reports for accuracy, not obsession

- Protect personal information aggressively

- Let older accounts age naturally

This phase is about preserving momentum, not forcing results.

Credit Reports Include More Than Credit Cards

Items that appear on your credit report aren’t limited to late payments on credit cards. For example, you may have moved out of an apartment years ago and left behind damage or unpaid charges. If the property owner obtained a judgment, that judgment can appear on your credit report.

Judgments are a major red flag for future landlords and lenders and can significantly lower your credit score. These issues are often difficult to remove — and the longer you wait, the harder it becomes. Property management staff change, records disappear, and documentation becomes harder to obtain.

If you discover an old judgment or similar item, address it as soon as possible. In some cases, you may be able to negotiate a settlement where you pay an agreed amount in exchange for a written letter sent to the credit reporting agencies confirming the debt has been satisfied.

Always get any agreement in writing before you pay. Verbal promises don’t protect you — written confirmation does.

Mini Checklist: What to Do When You Find a Judgment

- Confirm the details. Verify the amount, creditor, and date by reviewing your credit report and any available court records.

- Determine if it’s accurate. If the judgment is incorrect or outdated, gather documentation before taking any next steps.

- Contact the creditor or property owner. Ask who currently holds the debt and what documentation exists.

- Negotiate before paying. If possible, agree on a settlement amount that includes written confirmation the debt will be reported as satisfied.

- Get everything in writing. Never rely on verbal promises. Written agreements protect you.

- Keep records. Save emails, letters, receipts, and confirmations in one place.

- Follow up with credit bureaus. After payment or settlement, confirm the update appears correctly on your credit report.

13. Credit Improvement Is a Skill — Not a One-Time Event

One of the biggest mindset shifts millennials can make is understanding that credit management is a learned skill.

Just like:

- Budgeting

- Investing

- Career growth

Credit improves as knowledge compounds.

Once you understand:

- Utilization thresholds

- Reporting cycles

- Score ranges that actually matter

- How lenders evaluate risk

You stop reacting — and start planning.

That’s when credit becomes boring. And boring is good.

Why this protects you long-term

People who treat credit as a skill:

- Spot scams immediately

- Ignore unrealistic promises

- Make calm financial decisions

- Recover faster from setbacks

They don’t need luck. They don’t need secrets. They don’t need expensive services.

They understand the system.

14. What Actually Works (and Why Most “Fixes” Don’t)

By this point in the article, a pattern should be clear.

People who successfully fix credit without getting scammed don’t rely on tricks, shortcuts, or secret systems. They rely on a small number of fundamentals — applied consistently.

Most “credit fixes” fail not because people don’t care, but because they focus on the wrong leverage points.

What actually works, over time

Real credit improvement almost always comes from a combination of:

- Accurate credit reports

Errors are corrected, not ignored — and only when they are real errors. - Controlled credit utilization

Balances stay low relative to available credit, signaling stability. - On-time payments

Payment history is protected at all costs, often with automation. - Aging of accounts

Older accounts are preserved when possible, allowing time to work in your favor. - Stable cash flow

Budgets, income planning, and realistic monthly obligations support consistency.

None of these are exciting. All of them are effective.

Why most “fixes” fail

Credit repair schemes tend to fail for predictable reasons:

- They promise speed in a system designed to measure time

- They focus on paperwork instead of behavior

- They create temporary changes that don’t hold

- They distract from the actions that actually matter

Worse, they often leave people:

- More frustrated

- Out of pocket

- And no closer to their goals

A temporary disappearance of a negative item, a short-lived score bump, or a vague reassurance email is not progress.

Understanding the difference between activity and results

One of the most expensive mistakes people make is confusing activity with progress.

Sending letters.

Signing up for monitoring.

Paying monthly fees.

None of these improve credit on their own.

Progress shows up as:

- Fewer negative events

- Lower balances

- Better ratios

- More time since the last mistake

That’s how lenders evaluate risk — not by how busy you are.

Why knowledge is the real advantage

Once you understand:

- How scores are calculated

- What thresholds matter

- What lenders actually look for

- What cannot be “fixed” quickly

You become extremely difficult to scam.

Knowledge slows you down in the right way. It replaces urgency with planning.

And planning is what produces lasting results.

The quiet truth about credit improvement

Credit improvement isn’t dramatic.

It’s steady.

Predictable.

Sometimes boring.

And that’s exactly why it works.

What comes next

In the final section, we’ll step back and put everything in perspective:

How to think about credit as part of a larger financial life — not a constant project or source of stress.

That’s where confidence replaces vigilance.

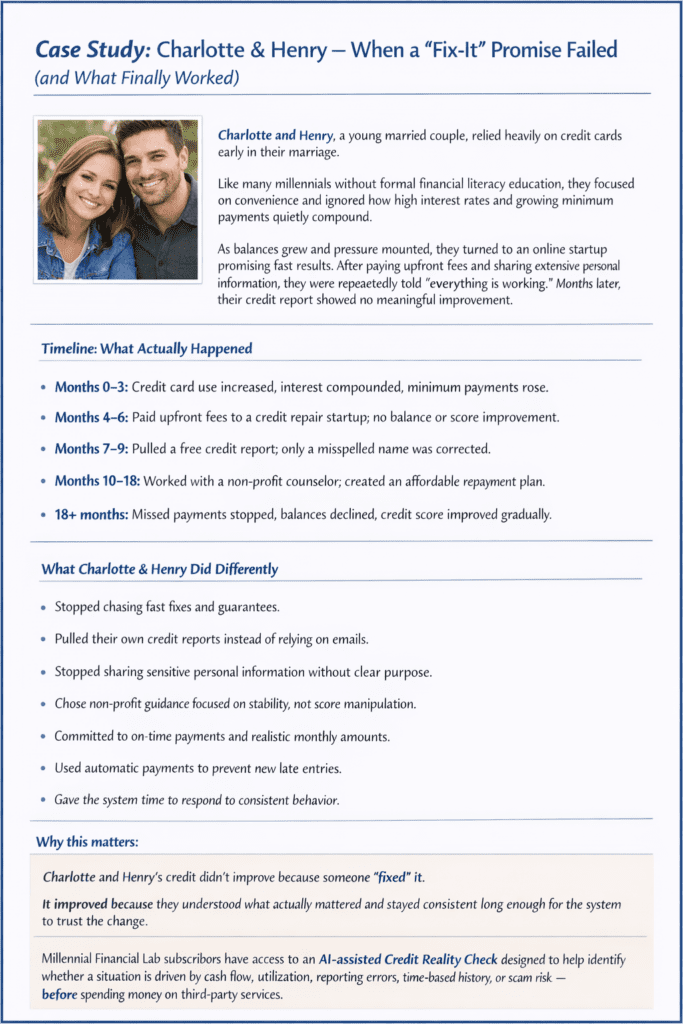

15. Case Study: Charlotte and Henry — What It Looks Like When the System Works

Charlotte and Henry didn’t fix their credit overnight.

They didn’t hire a “fix-it” company.

They didn’t chase shortcuts.

They made a plan — and they stuck to it.

The goal

Charlotte and Henry set a clear, realistic target before applying for a mortgage:

reach a credit score of at least 720.

That number wasn’t arbitrary.

They understood that:

- A higher credit score would qualify them for better interest rates

- Lower interest rates would reduce their monthly payment

- A lower monthly payment would improve their debt-to-income ratio

- A healthier DTI would allow them to shop for a higher-priced home

- Better terms meant access to the neighborhood they actually wanted

Credit wasn’t the goal — options were.

What they actually did

Their approach wasn’t complicated, but it required discipline.

- They made every payment on time, without exception

- They scheduled payments using:

- Bill pay through their bank

- Auto-pay with several vendors to prevent mistakes

- They paid off some credit cards entirely

- They paid down others they used regularly to under 15% utilization

- They kept spending under control

As balances dropped and payments stabilized, their debt-to-income ratio fell below 40% — a key threshold for mortgage approval.

Letting time do its job

Once the fundamentals were in place, time became their ally.

- Older late payments carried less weight

- Some negative items naturally dropped off their reports

- Remaining issues mattered less as positive behavior accumulated

Years earlier, they had discovered a judgment related to a car repossession.

Instead of ignoring it, they:

- Negotiated a repayment agreement

- Documented everything in writing

- Followed through

Eventually, that judgment was resolved and fell off their reports.

The outcome

Charlotte and Henry reached their target score.

Not because someone “fixed” their credit —

but because they understood the system and worked within it.

They did the work themselves by:

- Reading credible articles

- Using calculators to understand thresholds

- Planning months ahead instead of reacting under pressure

- Mastering how credit actually works

It took effort.

It took patience.

And it worked.

Why this matters

Charlotte and Henry’s story isn’t unique — and that’s the point.

Their success came from:

- Knowledge, not promises

- Planning, not urgency

- Systems, not shortcuts

That’s how people really fix credit without getting scammed.

Final thought

Credit isn’t something you “repair.”

It’s something you learn to manage.

Once you do, it stops being a barrier — and starts becoming a tool.

That’s the difference between chasing fixes and building a future.

We can get your debt reduced

Private companies that offer to reduce your credit card debt—often called debt settlement companies—operate in a legal but highly risky “gray area.” While some are legitimate businesses, the industry is also filled with predatory actors and outright scams.+1

Even with a legitimate company, the process is aggressive and can have severe consequences for your financial future.

How it Works (The Catch)

To “reduce” your debt, these companies typically instruct you to stop paying your creditors entirely. Instead, you pay that money into a separate savings account they control. The goal is to make you look so delinquent that the credit card company eventually agrees to accept a smaller “lump sum” rather than nothing at all.+2

The Risks of “Legitimate” Debt Settlement

Private companies advertise that they can get your debt reduced if you hire them. This is an extremely risky proposition. We added this at the end because it is something that you should probably avoid unless you go with a recognized, industry supported not-for profit.

Even if the company is not a scam, you should be aware of these high-stakes downsides:

- Severe Credit Damage: Intentionally skipping payments will tank your credit score for years.

- Lawsuits and Garnishments: Since you aren’t paying your bills, your creditors can (and often do) sue you or garnish your wages while the settlement company is “waiting” to negotiate.

- High Fees: Legitimate companies charge 15% to 25% of the total debt they settle.

- Tax Consequences: The IRS usually treats “forgiven” debt as taxable income. If a company settles $10,000 of your debt for $5,000, you may owe taxes on that $5,000 “gain.”+1

- No Guarantees: Creditors are not legally required to negotiate with these companies and some major banks refuse to work with them entirely.

Red Flags: How to Spot a Scam

If you encounter a company with these traits, it is likely a scam:

- Upfront Fees: It is illegal under federal law for a debt settlement company to charge you a fee before they have successfully settled at least one of your debts.

- Guarantees: No one can “guarantee” they will wipe out your debt or stop lawsuits.

- “Government” Claims: Beware of companies claiming they are part of a “new government program” to help with credit card debt.

- Pressure to Stop Communication: If they tell you to stop talking to your bank entirely without explaining the legal risks, be cautious.

Safer Alternatives

Before signing a contract with a private settlement firm, consider these options:

- Non-Profit Credit Counseling: Organizations like the National Foundation for Credit Counseling (NFCC) or Money Management International (MMI) offer Debt Management Plans (DMPs). They can often lower your interest rates without the massive credit damage of settlement.

- Direct Negotiation: You can call your credit card’s “hardship department” yourself. Many banks have internal programs to lower interest or settle for less if you can prove financial hardship.+1

- Debt Consolidation Loan: If your credit is still decent, a personal loan with a lower interest rate can simplify your payments without the “delinquency” risk.

Conclusion: You Don’t Have to Do This Alone — But You Do Need the Right Tools

Fixing credit takes time, planning, and consistency — but that doesn’t mean you have to figure everything out by yourself.

If you want help moving faster without risking scams or shortcuts, our Millennial Credit Coach, located inside the Millennial Financial Lab, is designed to support exactly that kind of progress:

👉 Millennial Financial Lab

https://retirecoast.com/millennial-financial-lab/

The focus isn’t on “repairing” credit for you — it’s on helping you understand the system, make better decisions, and avoid costly mistakes while you work toward your goals.

Use calculators to turn knowledge into action

Many readers get stuck knowing what to do, but not how to apply it to their own situation.

That’s where our calculators help.

Visit the Calculators Hub and click the Millennial Hub button to access tools built specifically for:

- Credit score improvement planning

- Debt-to-income analysis

- Affordability and borrowing decisions

- Cash flow and budgeting trade-offs

👉 Calculators Hub

https://retirecoast.com/calculators-hub/

These tools help you test scenarios, set realistic targets, and see progress — without guessing.

Keep learning, keep connecting the dots

This article is part of a larger collection designed to work together.

If you want deeper context and related guidance that dovetails directly into what you’ve learned here, explore the Millennial Hub, where you’ll find additional articles on:

- Credit fundamentals

- Budgeting and cash flow

- Investing basics

- Housing affordability

- Long-term financial planning

👉 Millennial Hub

https://retirecoast.com/millennial-hub/

The takeaway

You don’t need secret systems.

You don’t need fast fixes.

And you don’t need to hand over control to anyone else.

With the right information, tools, and support, you can:

- Set realistic credit goals

- Avoid scams and bad actors

- Improve steadily and confidently

- Use credit as a tool — not a stress point

That’s how people really fix credit without getting scammed.

FAQ: Fix Credit Without Getting Scammed (15 Questions)

1) What does “credit repair” actually mean?

2) Can credit repair companies really fix my credit faster than I can?

3) Is credit repair legal?

4) Will disputing items hurt my credit score?

5) What are the biggest red flags of a credit repair scam?

6) Why do some people think their credit was “fixed” temporarily?

7) What’s the first step I should take if my credit is bad?

8) How important is credit utilization compared to late payments?

9) Should I close credit cards to fix my credit?

10) Do free credit scores from apps or cards really matter?

11) When does outside help actually make sense?

12) What’s the difference between “good” and “great” credit?

13) How long does it realistically take to improve credit?

14) Can identity theft be fixed through credit repair companies?

15) What’s the safest way to avoid getting scammed while fixing credit?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.