Last updated on May 6th, 2025 at 03:48 pm

Introduction

I’ve thought about this a lot over the years — especially after raising my own family. You might wonder: What’s the best gift kids can give their parents? A hint: it’s not money, and it’s not things.

It’s something much more meaningful — their financial independence.

Parents never really stop worrying about their children, no matter how old they get. The greatest peace of mind kids can give their parents is showing them they’re self-supporting, capable, and on the right path.

And honestly, the best gift parents can give their kids? Teaching them how to stand on their own two feet. Teaching skills that will support them and their families long after we’re gone. If we do that right, we can let go of the worry — and trust that they’ll be just fine without our constant help.

Parents’ Worry Never Ends

No matter how old our children become, that little flicker of concern never fully disappears.

Will they be okay? Are they managing? What happens if life throws them a curveball?

The greatest relief — and the greatest joy — parents can experience is the knowledge that their grown children are strong, self-reliant, and capable. Not just surviving, but thriving.

When kids build a life where they don’t need financial help, it frees their parents to truly enjoy their own later years without fear or guilt.

Personal Story: My Parents’ Lessons in Responsibility

My parents would have, as they often said, “sold the shirts off their backs” for their kids.

That never changed, even when we were well into our 50s.

They worked hard, and early on, they taught us the importance of working for what we wanted.

Later in life, as we became adults, we shifted the dynamic. We refused to let them pay for meals when we went out. We pitched in for family gatherings like Thanksgiving. We began taking care of them the way they had taken care of us — not because they demanded it, but because it felt right.

Those early lessons in independence weren’t just about money. They were about respect, gratitude, and love.

Growing Up in a Big Family: Learning Independence Early

I’m part of the Baby Boomer generation, and like many families back then, ours was large — five kids, two parents, and not a lot of extra money floating around.

We didn’t have luxuries, but we had the essentials — a roof over our heads, food on the table, and strong family values.

As we got older, we quickly realized that if we wanted anything extra — a new bike, spending money, or nicer clothes — we had to earn it ourselves.

All five of us worked at something:

- Delivering newspapers

- Mowing lawns

- Pulling weeds

- Washing cars

- Helping neighbors clean garages

One of my personal favorite ways to earn extra cash was helping moving van drivers unload furniture. Later, I got a job at a local drugstore that paid very well for a teenager.

We found time to go to school, do chores around the house, and work to earn our own money.

By the time we were older teenagers, we all had real jobs, and that took a large burden off our parents’ shoulders.

As adults, we turned the tables. We refused to let our parents pay for meals or outings. Even for family events like Thanksgiving, we all brought food and contributed. We had all learned an important lesson early: you work for what you get — and you take pride in being able to give back.

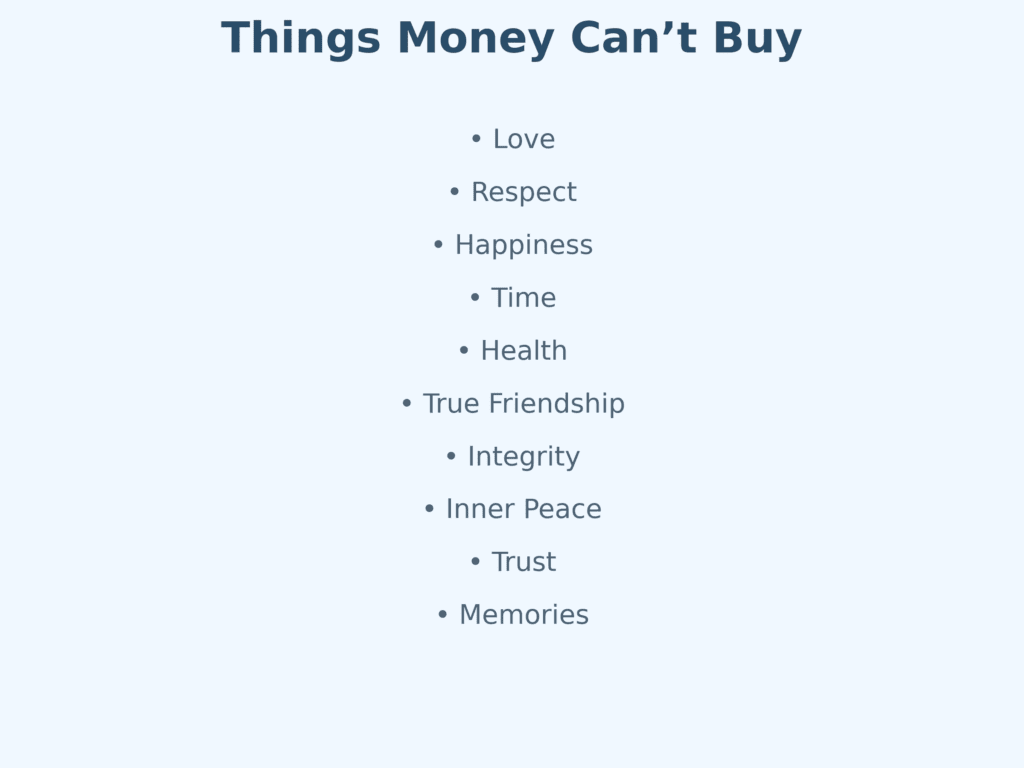

We Had What Money Couldn’t Buy

Years later, our mother would sometimes express regret that we never went to Disneyland growing up — even though we lived just a few miles away.

She wished she could have given us more.

But we always reassured her:

We didn’t miss what we never had.

We had a great childhood — filled with love, security, family, and friends.

Our parents also worried that because they both worked full-time (and sometimes more than one job), we had to be latchkey kids, doing a lot for ourselves.

But honestly? We loved it.

We learned independence naturally, and it helped us become confident adults.

Ultimately, because we became financially independent young, our parents were spared one of the greatest stressors older parents face: worrying about whether their adult children would need constant financial help.

In our view, that independence — along with the grandchildren we gave them — was the best gift we could ever have given them.

Why Financial Independence Matters: Emotional Freedom for Parents and Kids

When children grow up to manage their own finances responsibly, it lifts an invisible but heavy burden from their parents’ shoulders.

It gives parents emotional freedom — the ability to focus on their own health, happiness, and retirement without the background noise of constant worry.

Financial dependence changes family relationships. It creates guilt, stress, and resentment.

Financial independence builds confidence, pride, and peace.

For children, managing their own money builds real-world self-esteem.

You’re not only surviving — you’re thriving.

You’re not a burden — you’re a source of pride.

Financial independence isn’t just a number in a bank account. It’s a reflection of love, trust, and strength across generations. Teach your kids to be financially literate. Read this article.

The Hidden Costs of Enabling Adult Children

It’s only natural for parents to want to protect their children at every stage.

But sometimes, that instinct to help turns into enabling — and enabling carries heavy hidden costs.

Helping empowers someone to stand.

Enabling keeps them dependent.

Emotional Costs of Enabling

Financial dependence often damages the emotional bond between parents and adult children.

What starts as generosity can grow into resentment.

Parents begin to feel trapped, exhausted, or taken for granted.

Adult children can begin to feel ashamed, helpless, or resentful themselves.

Healthy relationships are built on pride, respect, and independence — not guilt and obligation.

Financial Costs of Enabling

Beyond emotions, the financial toll is severe.

Every loan, every bailout, every co-signed obligation can quietly drain retirement savings that took decades to build.

Small loans add up. Retirement dreams shrink.

In some cases, parents are forced to delay retirement or re-enter the workforce just to continue supporting adult children who should have been self-sufficient long ago.

The Federal Reserve reports that over 30% of young adults now receive ongoing financial support from their families, often covering essentials like housing and medical care.

The longer parents enable, the harder it is to recover — and the more devastating the long-term impact.

Real-World Stories: How Enabling Quietly Derails Good Intentions

Sometimes, the path to enabling starts with the best intentions — a parent trying to help during a rough patch. But small acts of rescue can quietly turn into long-term patterns of dependence.

Here are a few real-world examples:

1. The Permanent “Temporary Loan”

Mark and Susan started by paying their son’s rent for a few months after graduation. Five years later, they’re still subsidizing his lifestyle.

2. Co-Signing Catastrophe

Patricia co-signed a car loan for her daughter. When payments stopped, Patricia’s credit score plummeted — jeopardizing her retirement plans.

3. Inheritance Gone Too Soon

An adult son burned through his inheritance within two years and became financially dependent again, having never built true independence.

A Little Personal History

My parents had us when they were in their 20s, long before they reached their financial peak. We learned fast that if we wanted money, we had to earn it.

Chores turned into odd jobs like mowing lawns, and before long, we were making our own spending money. We moved out early, found jobs, and built lives.

Sure, sometimes they helped us out with small loans — but we always paid them back, even when they told us it wasn’t necessary. Paying them back wasn’t just about the money — it was about respect.

Today, it’s harder. Retirement savings compete with the costs of raising kids. Many parents are putting their kids through high school while approaching their 60s. But that makes it even more important to raise kids who are ready to face the world head-on.

A Growing Trend: Parents Supporting Adult Children Longer

In 1970, only about 11% of adult children received financial support from their parents.

That rate stayed relatively stable through the 2000s.

Today, over 30–50% of young adults receive ongoing financial support from their parents (Federal Reserve; Pew Research Center).

This is not sustainable.

Too many young adults enroll in expensive degrees without clear job prospects, saddling families with debts that sometimes last into retirement.

Without better career planning, stronger boundaries, and personal responsibility, these patterns will continue — and the consequences will only deepen.

The Larger Cost of Enabling: Damage to Society and the Next Generation

The consequences go beyond individual families.

They ripple out into our society.

For generations, America rewarded hard work and personal responsibility.

But today, many adult children live at home well into their 30s without steady work — and many parents accept it.

This does real harm.

Children who aren’t taught personal responsibility may squander inheritances, struggle financially, and suffer emotionally after their parents are gone.

Tough love — a term once reserved for addiction — now applies to a broader generation.

It means loving enough to set firm boundaries.

It means helping children stand strong — not holding them up indefinitely.

According to Pew Research Center, over 50% of young adults aged 18–29 now live with their parents — a level not seen since the Great Depression.

Teaching Responsibility from a Young Age: A Practical Approach

Teaching responsibility doesn’t happen overnight — it starts young.

- Talk openly about responsibility.

- Say no when appropriate.

- Tie work to rewards.

- Encourage decision-making and living with the consequences.

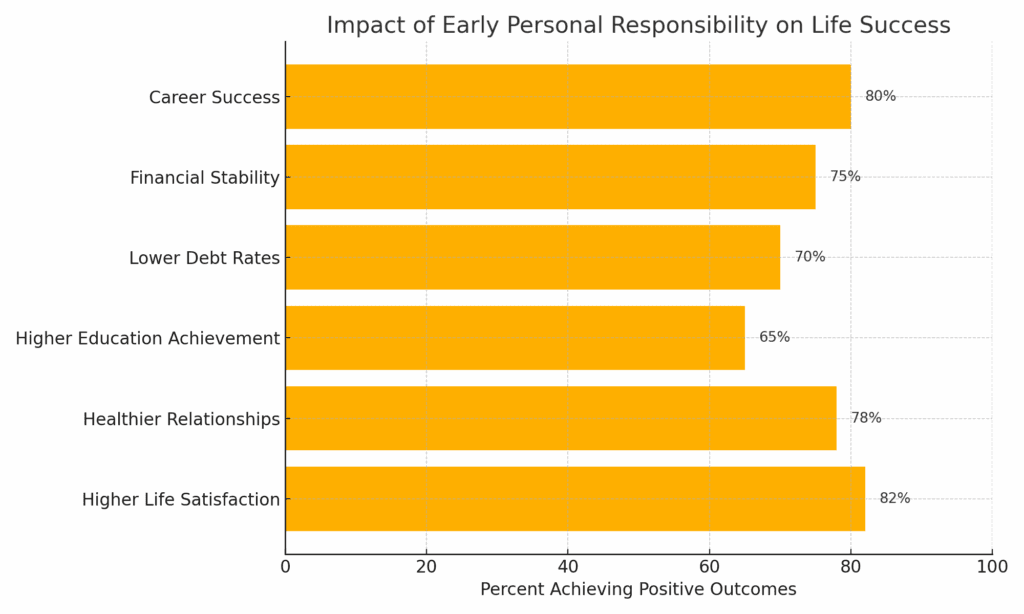

The National Endowment for Financial Education emphasizes that beginning financial literacy education by middle school significantly improves young adults’ future financial outcomes.

Personal Story: Earning Responsibility Through Driving and Work

When I was young, turning 15 and a half was a milestone we all looked forward to — it was the age when you could finally get your driver’s learner’s permit.

At 16, you could earn your full driver’s license.

I got my learner’s permit at the first opportunity, but my parents — wisely — insisted I wait a little longer before getting my full license. They wanted to be sure I could handle the responsibility.

I didn’t get my license until I was 17.

Around that time, something unexpected happened.

My father bought a car he didn’t really need — a 1952 Chevy four-door.

We all wondered why he bought it, since he already had his own car.

It turns out he had a plan.

Just after I obtained my driver’s license and was hired for my first real job — working at a local drug store that paid union wages — my father handed me the keys to that Chevy.

But it wasn’t a gift with no strings attached.

He told me:

“It’s yours — but you have to buy it from me. You’ll also pay your own insurance, gas, and maintenance.”

That day, for the first time, I truly understood what real responsibility meant.

I had to show up for work on time.

I had bills to pay.

I was responsible not just for the car, but for the freedom it represented.

A year later, after saving diligently, my father took me to a dealership and helped me pick out a newer, better car — one I could afford because I had learned how to work, save, and manage my own money.

That experience shaped me deeply.

It taught me that independence wasn’t just about being free — it was about earning and managing that freedom.

I loved my parents even more for giving me the chance to stand on my own — and not protecting me from the challenges that helped me grow.

Tips for Parents Raising Kids Later in Life

Today, more parents are having children later — often after reaching a stage in their careers where they can afford a very comfortable lifestyle.

While this success is something to be proud of, it also brings a hidden danger: the ability to give your children almost everything they want financially.

If you’re raising children later in life, you must be especially intentional about teaching them the value of money — and the discipline to manage it.

Here are some tips:

🎯 Put Your Kids on a Budget Early

- Don’t wait until they’re teenagers.

- Even at 8–10 years old, start teaching them how to manage an allowance or chore-based earnings.

- Help them use budgeting apps or digital tools that fit their lifestyle — for example, Quicken, YNAB (You Need A Budget), or Greenlight for teens.

Have your kids use this budget worksheet. It can be printed. A great first step before you invest in software.

Kid Budget Worksheet

Income Sources

| Source | Estimated ($) | Actual ($) |

|---|---|---|

| Allowance | ||

| Chores | ||

| Birthday/Gifts | ||

| Other | ||

| Total Income |

Spending Plan (Expenses)

| Category | Planned ($) | Spent ($) |

|---|---|---|

| Custodial Roth IRA Deposit | ||

| Toys or Games | ||

| Snacks or Treats | ||

| Saving for Big Goal | ||

| Giving/Donations | ||

| Other | ||

| Total Expenses |

Summary

Money Left Over (Actual Income – Spent):

My Monthly Goal

🎯 Share Your Household Budget

- Let them see where the money actually goes — mortgage, insurance, food, utilities, car payments, retirement savings.

- Help them understand that even a comfortable income must be managed wisely.

- Teach percentages — what part of the total income covers each major expense?

🎯 Define “Wants” vs. “Needs”

- Make it clear when it’s appropriate to ask for help and when it isn’t.

- Explain the difference between necessities (food, shelter, clothing) and luxuries (video games, brand-name shoes, designer bags).

🎯 Talk About Retirement Early

- Explain that you are saving for your retirement — not just living paycheck to paycheck.

- Emphasize that saving is not selfish — it ensures you will not burden your children financially later.

- Let them know that financial independence is a family value — not just a personal goal.

If you must give money to a child or an adult child, have them sign a “Parent-to-Child Loan Agreement”. Hold them to it. Take a look at the sample provided below:

Parent-to-Child Loan Agreement

Loan Agreement

(Between Parent and Child)

This Loan Agreement (“Agreement”) is entered into this ____ day of ____________, 20__, by and between:

Lender: ___________________________________

(Parent’s Full Name)

Residing at: ___________________________________

(Parent’s Address)

Borrower: ___________________________________

(Child’s Full Name)

Residing at: ___________________________________

(Child’s Address)

1. Loan Amount

The Lender agrees to loan the Borrower the principal sum of $__________.

2. Purpose of Loan

The Borrower acknowledges that the loan will be used for the following purpose:

__________________________________________________________________

3. Repayment Terms

- Total Amount Due: $__________

- Interest Rate (if any): __________% per annum / No Interest (circle one)

- Repayment Schedule: ___________________________________

- Final Payment Due Date: ___________________

Payments will be made by (circle one): Check / Electronic Transfer / Other: _______________

4. Prepayment

The Borrower may prepay the loan in full or in part at any time without penalty.

5. Default

If the Borrower fails to make any scheduled payment within _____ days after it becomes due, the Lender may declare the entire remaining balance immediately due and payable.

6. No Obligation to Forgive

The Borrower understands that this loan is not a gift. The Lender has no obligation to forgive any portion of the amount owed.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ____________________.

8. Entire Agreement

This Agreement constitutes the entire agreement between the parties regarding this loan and supersedes all prior agreements, understandings, and representations.

Signatures:

Lender Signature: ___________________________

(Parent’s Full Name)

Date: ___________________________

Borrower Signature: ___________________________

(Child’s Full Name)

Date: ___________________________

Personal Story: Teaching High Finance to My Grandson

A few years ago, my 11-year-old grandson was spending a few days at my house.

One day, I brought him to work with me and introduced him to everyone in the office.

I asked him if he wanted to earn some money, and he immediately said yes.

One of the tasks available was folding large plastic bags and inserting them into envelopes for mailing.

But there was a catch — if he wanted to make money, he had to negotiate with the office manager for a payment plan.

He did — successfully — and started folding bags enthusiastically.

At lunch, I asked him how it was going. He was so excited that he wanted to come back the next day and keep working.

By the end of the second day, he had a tally sheet prepared by the office manager showing what he had earned.

When we got home

When we got home, I sat him down at the kitchen table for a lesson in high finance.

First, we calculated his gross income.

Then, I explained that he couldn’t keep all of it.

He was surprised.

“What costs?” he asked.

I walked him through federal income taxes, state taxes, Social Security deductions, and a 401(k) contribution.

We even deducted the cost of the lunches we had during his workdays.

As his “take-home pay” dwindled, he was stunned.

He looked at me and said,

“Is this what happens when my dad and mom work? The government takes all of this money out of their pay?”

I smiled and said, “Yes — that’s exactly how it works.”

Then, I explained the 401(k) retirement plan.

I told him he could choose how much to contribute — and that the “company” (me) would match 100% up to 5% of his earnings.

We worked out the match, and I paid him the difference in cash.

To his shock, I kept only the amount for his 401(k) (which we set up as a Roth IRA contribution) and gave him the rest of the money back as a reward.

That lesson stuck.

Today, he’s in college — working part-time, attending a two-year school, and taking on zero debt.

His parents — who are now older — don’t have to financially support him through college.

He remembers that lesson about taxes, retirement, and financial reality to this day.

And he’s careful with money in a way few young adults are.

A Broader Solution: Resetting Family, Education, and Government Priorities

The problem isn’t just in homes — it’s systemic.

Parents must fund education tied to viable career paths.

Government must reform student loan policies and stop encouraging tuition inflation.

Schools must reintroduce vocational training and financial literacy education starting in middle school — and regularly involve parents in the process.

Research from the Brookings Institution shows that government-backed student loans have enabled colleges to consistently raise tuition, fueling unsustainable student debt levels.

Real solutions mean resetting expectations across society.

Success is not measured by degrees earned — but by independent lives built.

According to the National Center for Education Statistics, college tuition has outpaced general inflation for decades, even as many degrees fail to guarantee strong employment outcomes.

According to the U.S. Department of Labor, the American economy faces significant skilled trade shortages, making it critical for schools to reintroduce vocational education pathways.

🎯 Schools Must Bring Back Skilled Trades and Career Readiness

At the same time, our K-12 education system needs to be retooled to reflect reality.

For decades, schools removed programs like auto mechanics, electrical work, woodworking, and metal trades — sending the message that college was the only respectable path.

This was a mistake.

Today, skilled trades are not only respectable — they are in high demand and often pay better than many traditional college-degree careers.

According to the U.S. Department of Labor, the American economy faces significant skilled trade shortages, making it critical for schools to reintroduce vocational education pathways.

(U.S. Department of Labor Source)

Schools must:

- Reintroduce manual arts, shop classes, and vocational training.

- Promote the trades as equally valuable options for students, not fallback plans.

- Work with local industries to create apprenticeship pipelines for young workers.

Not every student needs a four-year degree to succeed.

But every student needs a skill that the economy actually demands.

✅ Solutions Summary: How to Reverse the Trend of Financial Dependence

Parents:

- Invest wisely in education — Only support degrees tied to viable career paths.

- Set financial boundaries early — Funding is conditional, not automatic.

Government:

- Reform college funding — Tie grants and subsidies to real career outcomes.

- Control college costs — End unchecked tuition inflation fueled by easy loans.

Schools:

- Bring back vocational training — Manual arts and skilled trades matter.

- Teach financial literacy early — Begin in 7th grade and continue through high school.

- Involve parents in financial education — Host meetings to help parents learn too.

Society:

- Value responsibility over credentials.

- Reset cultural expectations — College is one path, not the only path.

Building a Legacy of Strength

At the end of the day, the greatest legacy parents can leave isn’t a trust fund — it’s capable, resilient, independent children.

Financial independence is a reflection of much more than money.

It shows that lessons were learned, values were passed down, and strength was built from the inside out.

📋 Final Version of Your Story:

Personal Story: A Legacy of Independence and Gratitude

Our parents sometimes talked about leaving us money after they passed away.

By the time these conversations started, all of us — their children — were already doing better financially than they had at our ages.

To a person, we rejected the idea that they needed to save anything for us.

We told them what really mattered:

“Your responsibility was to introduce us to the world — to raise us, teach us, and prepare us. You did that. And you spent years of your lives and much of your hard-earned money to give us that foundation.”

Now that we had made it on our own, we wanted them to enjoy life.

We urged them to use the fruits of their labor to travel, to relax, to make their golden years truly golden.

When our father passed away first, everything naturally went to support our mother.

Even after that, she continued to insist she needed to leave us something — to somehow “make up” for what she believed she couldn’t give us when we were young.

I thought we had convinced her otherwise.

She had worked so hard; she deserved to spend her money on herself.

But when she passed away, each of us received a small gift — just a few thousand dollars.

It wasn’t the amount that mattered. It was her way of still trying to care for us.

In honoring her legacy, I chose to open accounts for my grandchildren with that money.

I wanted to pass forward the spirit of independence and gratitude that she had instilled in us.

We were never a financial burden to our parents — and that’s exactly how it should be.

That was their real gift to us. And it’s the gift we are determined to pass on to the next generation.

When children stand on their own, they honor the sacrifices their parents made.

When parents enjoy their later years without financial worry, they are free to live life to the fullest.

True love isn’t about providing forever — it’s about preparing the next generation to thrive.

Note: Don’t forget to create a will, check this article.

Podcast below

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.