Last updated on September 20th, 2025 at 06:19 pm

Updated for 2026: Yes, you can afford to retire by the beach on Social Security. The Mississippi Gulf Coast offers some of the nation’s lowest housing prices and cost of living, making it possible to rent or even buy a home using only your Social Security benefits.

Why the Mississippi Gulf Coast Works for Retirees

- Affordable housing: Rentals and home prices are far below national averages.

- Tax-friendly laws: Mississippi does not tax Social Security, pensions, or 401(k) withdrawals.

- Mild climate: Warm summers, mild winters, and year-round beach access.

- Healthcare access: Most doctors and facilities accept Medicare.

- Lifestyle perks: Beaches, marinas, golf, festivals, and small-town living.

Social Security Income Assumptions

For this analysis, we use two Social Security checks, typical for many retired couples:

- Check #1: $1,750/month (average retirement benefit)

- Check #2: $2,800/month (higher-earning spouse)

- Combined Household Income: $4,550/month

This income alone — without pensions or savings — can cover housing and living costs comfortably along the Mississippi Gulf Coast.

Use Our Budget Tool

💡 Why This Budget Tool Matters

RetireCoast’s budget spreadsheet will help you account for all income and expenses. While mortgage lenders focus only on the debt-to-income ratio based on what credit reporting agencies show, this budget gives you the real picture of your financial life.

Before you decide to buy your home, run the numbers: can you actually afford to make the payments and still cover your lifestyle choices? Use it as a “what if” tool to test scenarios:

- If you discover you can’t afford the boat — don’t buy it, or sell it.

- Adjust expenses until you’re comfortable with the results.

- Get your total debt in line with lender requirements.

Lenders use the DTI ratio because tens of thousands of loan outcomes prove a simple truth: when people take on too many obligations, they eventually lose the house. They also know that beyond what’s on a credit report, life costs — like food, insurance, memberships, and medical care — must be paid every month.

✅ Your budget tool fills in what the lender can’t see, helping you make smarter retirement choices.

Renting by the Beach in 2026

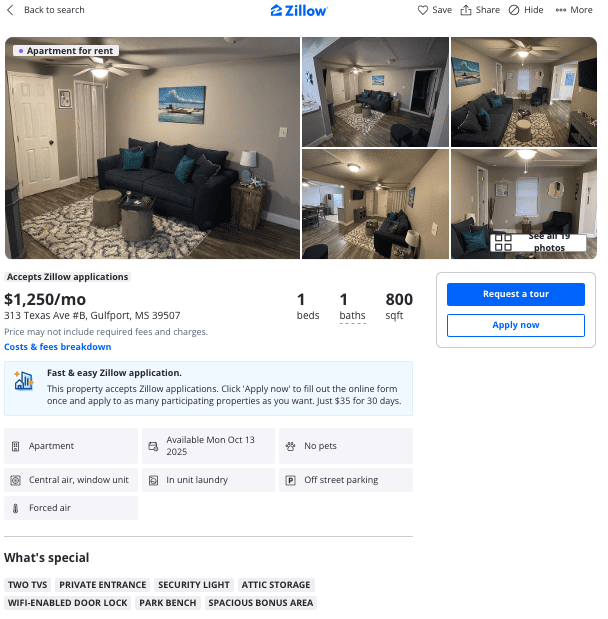

Here’s a real-world rental example from Zillow (2025/2026):

- Monthly Rent: $1,250

- Details: Fully furnished, one-bedroom with separate living room, kitchen, and bathroom

- Extras: Fenced yard and parking

- Location: Five-minute walk to the beach

Budget Impact

- Social Security household income: $4,550

- Rent: $1,250

- Remaining: ~$3,300/month for utilities, healthcare, groceries, and extras

✅ Renting provides flexibility and requires no maintenance costs.

Buying a Home on Social Security

If you’d rather own, USDA loans allow for little to no down payment.

Sample Purchase:

- Selling Price: $189,900

- Down Payment: $0 (USDA loan)

- Finance Amount: $189,900

- Interest Rate: 6.3%

- Loan Term: 30 years

- Annual Insurance: $2,500 (~$208/month)

- Mortgage Insurance: USDA premium added to monthly payment

👉 Estimated Monthly Payment (PITI + MI): $1,438

- Closing costs: ~$5,500 (not included in monthly estimate)

- Example property was listed by Logan-Anderson, Gulf Coastal Realtors in November 2024

Budget Impact

- Social Security household income: $4,550

- Mortgage payment: $1,438

- Remaining: ~$3,112/month

✅ Buying means more space (3 bedrooms vs. 1 bedroom rental) and the chance to build equity.

Rent vs. Buy Comparison

| Option | Monthly Cost | Property Type | What You Get | Leftover Income (Couple) |

|---|---|---|---|---|

| Rent | $1,250 | Fully furnished 1BR, 1BA | Fenced yard, parking, 5 min to beach | $3,300 |

| Buy | $1,438 | 3BR, 1BA single-family | Ownership, equity, more space | $3,112 |

For nearly the same monthly cost, you could own a larger home and start building equity.

Cost of Living Comparison

👉 Insert Cost of Living Comparison tool/table here

Mississippi beats most coastal states in:

- Housing

- Electricity rates (~9¢/kWh vs 18¢ in California)

- Water/sewer

- Food costs (15% lower than national averages)

- Taxes (none on retirement income)

Mortgage Pre-Check: Debt-to-Income (DTI)

👉 Insert DTI calculator here

💡 Important for Retiree Mortgages

You may have hundreds of thousands of dollars in your retirement accounts, but unless the dividends and interest income are sufficient to pass the debt-to-income ratio, you will not qualify for a loan.

Lenders need to see a steady stream of income such as Social Security or pension payments. Having large savings alone will not secure a mortgage. It certainly helps — and if there are minor issues, your savings may push you over the edge — but reliable monthly income is what determines approval.

Lenders often require a debt-to-income ratio under 55%. Our sample couple with only a $1,438 mortgage and $250 in other debts comes in below the threshold, meaning they would qualify for financing.<!– Mortgage Savings vs Income

Everyday Lifestyle Savings

- Property Taxes: Mississippi offers some of the most generous property tax exemptions in the country.

- Age 65+ Exemption: Homeowners over age 65 receive a homestead exemption that eliminates property taxes on the first $75,000 of assessed value of their primary residence. In many cases, this means seniors pay little or no property tax at all.

- 100% Disabled or Military Veterans: If you are 100% disabled or a 100% disabled military veteran, you pay zero property taxes on your primary residence, regardless of its value. This can save thousands of dollars every year and is a major benefit for retired service members.

- Example: On a $190,000 home, a senior over 65 would pay property taxes only on the portion above $75,000 assessed value. A 100% disabled veteran would pay nothing at all.

- Fishing License: Lifetime license for retirees under $8.

- Healthcare: Costs are generally below national averages, and Medicare is widely accepted.

- Food: Buy shrimp, fish, and crabs directly from local boats — fresher and cheaper than stores.

Retired Military on the Mississippi Gulf Coast

Many retired military personnel choose to live near the beach on the Mississippi Gulf Coast — and for good reason. Beyond the low cost of living and tax benefits, this area offers unique advantages for those who served:

- Military Bases & Facilities

- Keesler Air Force Base (Biloxi) and the Navy Seabee Base (Gulfport) both provide commissaries, exchanges, and year-round recreational activities, including boating, fishing, and jet skis.

- Healthcare Access

- Retirees have access to the VA hospital and the hospital at Keesler, ensuring quality healthcare within minutes.

- Property Tax Savings

- 100% disabled veterans pay zero property taxes on their primary residence — a powerful financial benefit for those who qualify.

- Everyday Discounts

- Many retail outlets, restaurants, and service providers along the Coast offer military discounts for both retired and active-duty personnel.

- Community & Lifestyle

- A strong social scene with other retirees, veterans’ groups, and military-friendly organizations means it’s easy to connect, meet friends, and enjoy life after service.

✅ These benefits, combined with affordable housing and beachfront living, make the Mississippi Gulf Coast one of the most military-friendly retirement destinations in the U.S.

Activities & Community

Retiring here isn’t just about saving money. You’ll enjoy:

- Outdoor fun: Beaches, piers, bayous, and golf courses.

- Social life: Senior centers, yacht clubs, festivals, and parades.

- Events: Mardi Gras, Cruisin’ the Coast, free concerts, farmers’ markets.

Can You Afford to Retire by the Beach in 2026?

The answer is yes. With two Social Security checks, you can:

- Rent a fully furnished home 5 minutes from the beach for $1,250/month

- Or own a 3-bedroom home for $1,438/month

Either option leaves $3,000+ per month for everything else.

👉 Challenge: Tell me where else in the U.S. you can live by the beach, on just Social Security, for this price.

Next Steps

- Use the Budget Tool to test your own numbers.

- Compare Rent vs Buy with our calculator.

- Explore Local Listings on Zillow or Logan-Anderson Realtors.

- Plan Ahead — the Gulf Coast housing market is competitive, but far more affordable than most U.S. coastlines.

Rent vs Buy — Mississippi Gulf Coast

Compare a fully furnished rental near the beach against buying a 3-bedroom home. Adjust any inputs. USDA mortgage insurance fields are included so you (or your lender) can align with current program terms.

Household Income (for leftover comparison)

Rent (Fully Furnished Example)

Buy (USDA Example)

Notes: This tool is an estimate for planning. Property taxes vary by city/county and exemptions (65+, disabled, etc.). USDA fees are inputs so you can match your lender’s terms. Closing costs are not included in monthly comparisons.

Mortgage Pre-Check: Debt-to-Income (DTI)

Quickly estimate your DTI using Social Security income and your debts. Many lenders aim for total DTI ≤ 55% (varies by program & credit profile).

Tip: If DTI is high, try lowering other debts, increasing down payment, or choosing a lower price point. Senior exemptions may reduce taxes and help.

Cost-of-Living Comparison

Edit the values to keep this chart fresh. Click a column header to sort. Export to CSV for your records.

| State/Region | Avg Rent (2BR) | Avg Home Price | Electric (kWh) | Water (monthly) | Notes | Actions |

|---|---|---|---|---|---|---|

| Mississippi Gulf Coast | 1050 | 190000 | 0.09 | 30 | No state tax on retirement income | |

| Florida | 1600 | 330000 | 0.12 | 45 | No SS tax | |

| Texas | 1500 | 290000 | 0.13 | 50 | No SS tax | |

| California | 2800 | 650000 | 0.18 | 60 | SS partially taxed | |

| New York | 2400 | 480000 | 0.19 | 55 | SS partially taxed |

Pro tip: Add a “Beach City vs Inland” row for each state to highlight the Mississippi Gulf Coast advantage.

Frequently Asked Questions

Is Mississippi a good place to retire from the military?

Yes. The Mississippi Gulf Coast is one of the most military-friendly retirement destinations in the U.S. Retired service members benefit from zero property taxes if 100% disabled, access to Keesler Air Force Base and the Navy Seabee Base with commissaries and exchanges, nearby VA and base hospitals, and strong veterans’ organizations. Many local retailers and restaurants also offer military discounts.

Can you get a mortgage on Social Security income?

Yes. Many lenders will qualify you for a mortgage using Social Security income as long as your debt-to-income (DTI) ratio meets guidelines (often 43–55%). With USDA, VA, and FHA programs, it’s possible to buy a home with little or no down payment while on Social Security.

Is there an age limit on a mortgage loan?

No. Federal law prohibits age discrimination in lending. If you meet credit, income, and DTI requirements, you can qualify for a mortgage whether you’re 55 or 85. Lenders focus on your ability to repay, not your age.

What is the cheapest city to retire on the Mississippi Gulf Coast?

Inland areas such as Waveland, Bay St. Louis, and parts of Gulfport often have lower home prices than beachfront towns like Ocean Springs or Pass Christian, while keeping you just minutes from the beach.

How much does rent cost near the beach?

Fully furnished one-bedroom rentals within walking distance of the beach can be found around $1,250/month. Inland rentals may be closer to $1,000/month depending on size and condition.

Is healthcare affordable on the Gulf Coast?

Yes. Healthcare costs in Mississippi are generally below the national average, and most providers accept Medicare. Many retirees report lower copays and better access than in large metro areas.

Do retirees pay property taxes in Mississippi?

Homeowners age 65+ receive a homestead exemption that eliminates property taxes on the first $75,000 of assessed value of their primary residence. 100% disabled or 100% disabled military veterans pay no property taxes on their primary residence.

Can I live on just one Social Security check?

Yes, but it’s tighter. A single retiree with about $1,900/month can rent modestly and cover essentials. Couples with two checks (~$4,550/month) have far more flexibility and can comfortably rent or buy.

✅ Bottom Line

The Mississippi Gulf Coast proves you can retire by the beach in 2026 — not just survive, but thrive — on Social Security alone.re a few articles below that you may be interested in, just click on them.

Resources

Why I decided to retire in Ocean Springs, Mississippi

Why you need to retire on the Mississippi Gulf Coast

The Complete Guide to Home Buying Costs, Tax Benefits, And Mortgage Readiness

Social Security “myAccount” Check your account here, to find out how much you will earn.

PODCAST

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.