Last updated on November 26th, 2025 at 02:11 pm

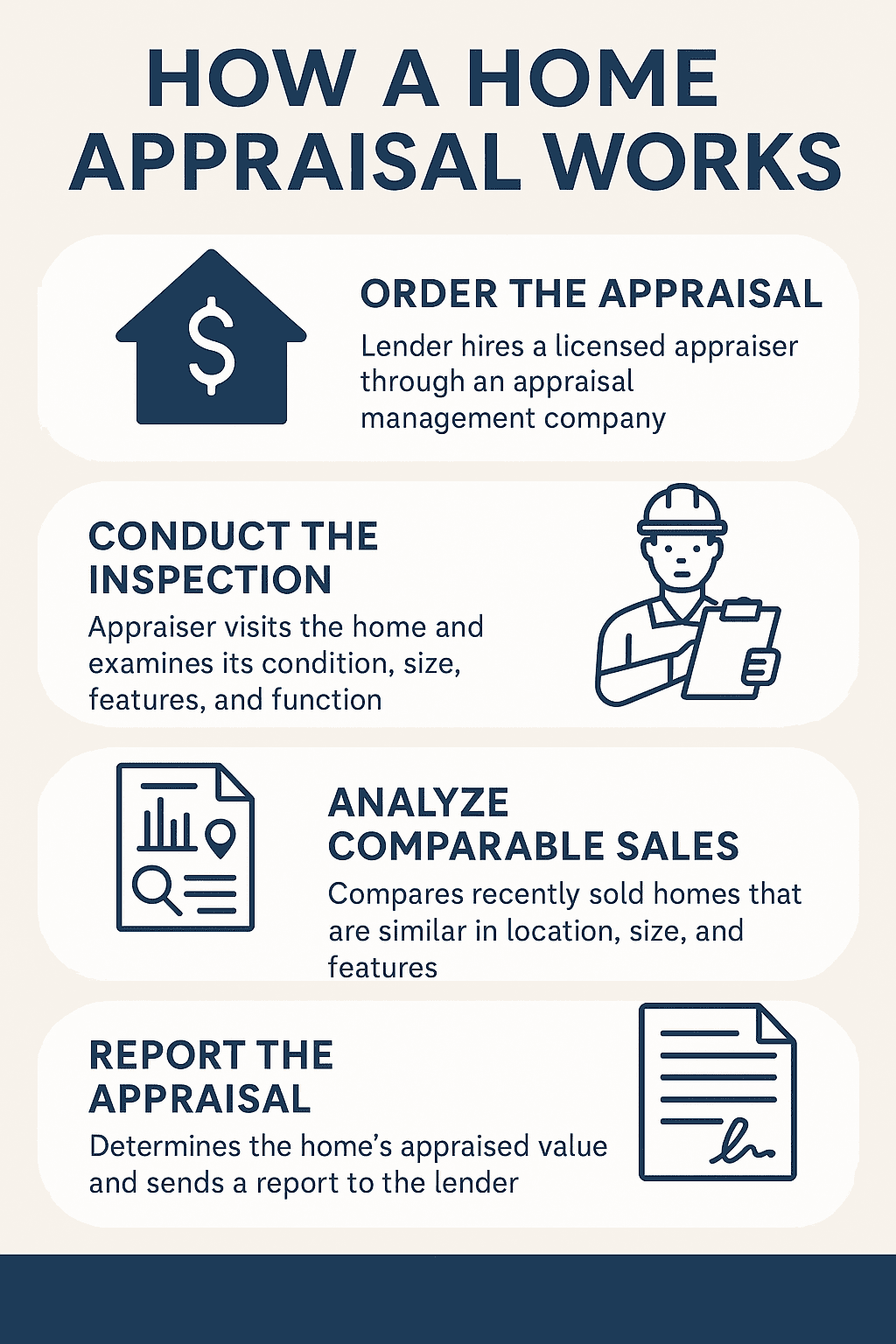

When you’re buying a home, sooner or later, you’ll be told that the home appraisal process must be completed—and that you will be paying for it. Many buyers don’t fully understand how a home appraisal works. Even some experienced homeowners and real estate agents aren’t completely familiar with the details. Here’s a clear, practical explanation of the process and what to expect.

How the Home Appraisal Process Begins

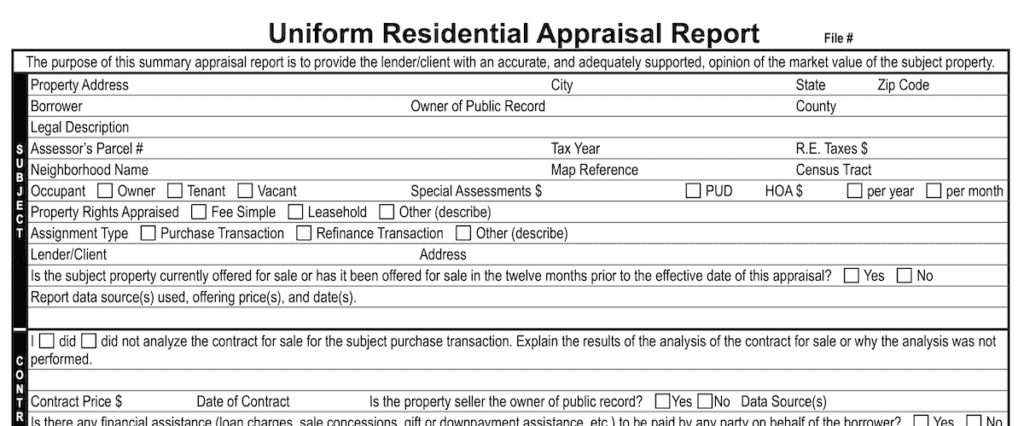

Once your contract is signed, the lender orders the appraisal through an appraisal management company (AMC). Lenders generally do not allow their own staff to choose the appraiser because the home appraisal process must remain independent and unbiased.

The appraiser receives essential information about the property: the address, details about the home, and the agreed-upon selling price.

Appraiser Licensing and Experience

There are several levels of certification for property appraisers:

- Entry-level licenses allow appraising most one-to-four–unit residential properties

- Higher certifications are required for homes over $1 million

- Commercial properties require the highest levels of licensing

Becoming a residential appraiser requires:

- State-approved education

- Hundreds of hours of supervised training

- Passing a state licensing exam

Standardized forms limit subjective judgment, helping ensure consistency across the home appraisal process.

What Happens During the Appraisal Inspection

While buyers sometimes want to accompany the appraiser, it’s best to let them work uninterrupted. Only a portion of the home appraisal process occurs at the property. Long before arriving, the appraiser has:

- Pulled recent comparable sales

- Studied neighborhood characteristics

- Identified likely comps to be used in the report

- Driven by some homes that may serve as comparables

After measuring, inspecting, and photographing the property, the appraiser returns to compile the report, apply formulas, and calculate adjustments.

How Appraisers Adjust Property Values

Appraisers typically use three to four comparable sales (comps).

Market Trend Adjustments

- In a rising market, upward adjustments may be applied

- In a declining market, downward adjustments are standard

Property Adjustments

Adjustments are made for differences in:

- Square footage

- Lot size

- Bedrooms and bathrooms

- Age, condition, and upgrades

- Location within the neighborhood

Appraisers must compare “like-kind” homes. A tract home will not be compared to custom or luxury homes, even nearby.

If few comps exist, the search radius expands until enough data points appear to support the appraisal.

When the Appraisal Comes in Low

Low appraisals don’t happen often, but they can. I once experienced this personally. The first valuation came in below the contract price, which jeopardized the financing. After requesting a review and providing additional sales data, the appraiser revisited the numbers and issued a corrected value that supported the purchase.

Although the home appraisal process is standardized, appraisers can miss a comp or misinterpret zoning. Reviews exist for this reason, though successful challenges are rare.

Your Options When the Appraisal Is Low

If the value comes in under contract price, buyers and sellers have a few choices:

- Buyer covers the difference in cash

- Seller lowers the selling price

- Both parties split the gap

- Cancel the contract (least desirable)

Most buyers and sellers are emotionally and financially invested by this point, so compromise is common.

Selling Price vs. Appraised Value

Agents use comps to help clients choose a selling price. Appraisers use comps to find the home’s value. These are related concepts, but not the same.

A good example is a home I listed where two nearby distressed sales closed at extremely low prices. Even though our offer was strong, the appraiser used those recent comps and valued the property significantly lower than the contract price. Because the buyer was financing, the lender would not approve a higher amount.

What happens when you price your home too high? It doesn’t sell—and even worse, it stays on the market longer, causing potential buyers to wonder what’s wrong with it.

Buyers I work with look at the days-on-market statistics and immediately ask why the property didn’t sell. Even if you remove the listing from the MLS and relist it later, the old price history often remains visible, and informed buyers will notice it.

How Sellers Can Prepare for the Appraisal

Sellers should ask their agent for:

- Three to four recent comparable sales

- Data showing market appreciation over recent months

- Square footage, bedroom count, and bathroom comparison

- A realistic range of value supported by comps

If comps support $200,000, and the market is appreciating at 6% every six months, a slightly higher listing price may be reasonable.

But if you want $250,000 and comps only support $210,000, expect problems—unless you receive a cash offer.

Cash Offers Avoid the Appraisal Requirement

Cash buyers rarely require an appraisal because no lender is involved. This can make overpriced homes more likely to close with a cash buyer, though still not guaranteed.

Real estate appraisals coming in too low are a major cause of sales failing to close. Read this article to learn more.

Why Overpricing Creates Problems

A seller can list at any price, but buyers and lenders rely on the home appraisal process to stay within a realistic market value. Homes that sit unsold create suspicion:

- Buyers think something is wrong

- Agents hesitate to show the home

- The listing becomes stale

In the end, the market—not the seller—determines value.

Pricing correctly from day one leads to faster sales and fewer appraisal-related surprises.

Final Thoughts and Disclaimer

William Anderson, the author, is a licensed real estate broker along the Mississippi Gulf Coast and a partner in Logan-Anderson LLC, Gulf Coastal Realtors.

Mississippi licensees cannot provide legal advice. This article is for general information only. If you are considering moving from a high-cost state to an affordable area with excellent climate and lifestyle benefits, contact William Anderson at 228-215-3234 or visit the Logan-Anderson website for more real estate resources.

You may want to reach out to the Consumer Financial Protection Bureau for more information. Another source is the Federal Housing Finance Agency for even more good information.

Buyers should read this article to help find the best real estate agent. Another article about real estate rules is a must-read.

FAQs

What is the purpose of the home appraisal process?

The home appraisal process ensures the lender is not financing more than the property is worth based on comparable sales and market data.

Who pays for the home appraisal?

Typically, the buyer pays for the appraisal, and the fee is collected early in the loan process.

Can a seller challenge a low appraisal?

Yes. Sellers can request a review and supply additional comparable sales, although changes are not guaranteed.

Do cash buyers need a home appraisal?

Not usually. Cash buyers can choose to skip the appraisal because no lender is involved.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.