Big life expenses rarely arrive all at once. More often, they sneak in quietly — a car upgrade here, a wedding deposit there, a move that costs more than expected, or a series of “small” lifestyle upgrades that slowly reshape your monthly budget.

Most people don’t struggle with whether these expenses are worth it. The real challenge is figuring out how to pay for them without breaking cash flow, draining savings, or adding long-term stress.

This guide is about planning major life costs realistically — without guilt, judgment, or spreadsheets that assume perfect discipline.

She felt she couldn’t say no. But quietly, those repeated commitments kept her from building financial security for two or three full years. It wasn’t one bad decision—it was a pattern of small, well-intentioned ones.

Planning for your wedding or life event matters. But so does planning for everyone else’s. Sometimes the most financially responsible decision isn’t about money at all—it’s about knowing when it’s okay to say no.

Why big expenses feel harder than they used to

Millennials aren’t imagining it. Big expenses are harder to manage today because:

- Housing, vehicles, childcare, and education costs have risen faster than wages

- Many households rely on variable income or dual earners

- Debt is more common earlier in life

- Lifestyle expectations are higher — often unintentionally

At the same time, financial advice often treats big expenses as isolated decisions instead of ongoing monthly commitments. That disconnect is where stress creeps in.

- Monthly impact estimate

- Savings timeline

- Save vs finance comparison

- Risk flags & next steps

The most common big life expenses

While every situation is unique, most major costs fall into a few familiar categories.

🚗 Cars and transportation

A vehicle purchase is rarely “just the payment.” Insurance, maintenance, registration, fuel, and repairs all stack onto monthly expenses — and often increase over time.

The trap isn’t buying a car. It’s buying too much car for your cash flow.

💍 Weddings and major celebrations

Weddings are emotional, time-sensitive, and socially charged. Costs often escalate quickly, and deposits lock decisions in early.

Without a plan, couples may:

- Rely heavily on credit

- Delay other goals

- Carry the financial impact long after the event is over

👶 Kids and family changes

Children bring joy — and recurring costs that evolve every year:

- Childcare

- Healthcare

- Education

- Housing adjustments

The challenge isn’t just affordability today, but how costs change over time.

📦 Moves and relocations

Moving costs are easy to underestimate:

- Deposits

- Temporary housing

- Storage

- Furniture

- Utility setup

- Commute changes

Even “positive” moves can quietly strain monthly budgets.

🧠 Lifestyle creep (the sneakiest one)

Lifestyle creep isn’t about irresponsibility. It’s about convenience.

Better internet, nicer groceries, upgraded phones, subscription stacking, dining out more often — individually manageable, collectively powerful.

Left unchecked, lifestyle creep reduces flexibility and makes big expenses feel overwhelming.

The real problem most people miss: monthly impact

The biggest planning mistake is focusing only on the total cost.

What matters more is:

- How much this expense adds to monthly obligations

- How long those costs last

- Whether your cash flow can absorb them without stress

A one-time $12,000 expense may feel manageable — until it requires:

- $500/month in savings

- A new loan payment

- Higher insurance

- Less emergency flexibility

That’s when regret shows up.

Planning without judgment (and without panic)

Good planning doesn’t mean saying “no” to life. It means answering three honest questions:

- What is the true cost — including buffer?

- How will this affect my monthly cash flow?

- Is the timing realistic based on my current finances?

When those answers are clear, decisions become calmer and more confident.

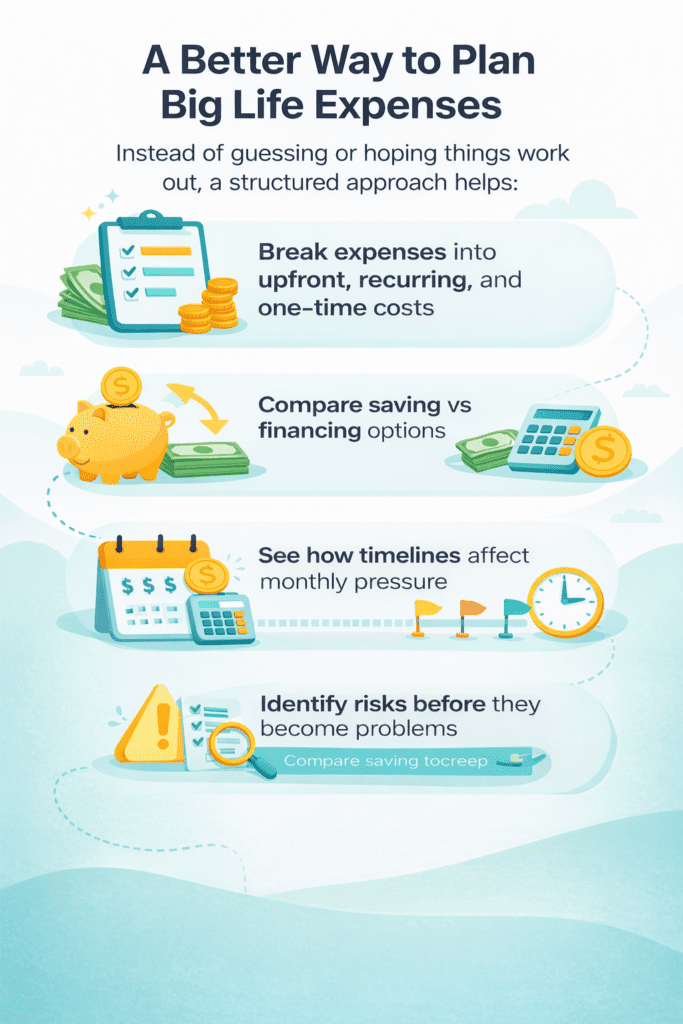

A better way to plan big life expenses

Instead of guessing or hoping things work out, a structured approach helps:

- Break expenses into upfront, recurring, and one-time costs

- Compare saving vs financing options

- See how timelines affect monthly pressure

- Identify risks before they become problems

This isn’t about perfection. It’s about visibility.

Plan before you commit

If you’re facing a big expense — or expect one in the next year or two — the Big Life Expense Planner helps you:

- Estimate the true monthly impact

- Build a realistic savings or financing plan

- Spot cash-flow risks early

- Decide whether to move forward, adjust timing, or reduce scope

You can start with a free preview and see how one decision fits into your real financial life.

👉 Try the Big Life Expense Planner

https://retirecoast.com/big-life-expense-planner/

One last thought

Big life expenses don’t mean you’re “bad with money.”

They mean you’re living.

The goal isn’t to avoid these moments — it’s to enter them prepared, confident, and in control.

Planning ahead turns big decisions into manageable ones — and gives you room to enjoy the life you’re building.

Short Quiz

☐ I’d manage, but I’d need to adjust spending or savings

☐ It would likely create ongoing financial pressure

☐ I have a rough idea, but it fluctuates

☐ I’m not really sure—it changes too often

☐ I do some planning, but decisions feel rushed

☐ I usually figure it out after committing

☐ Sometimes, but it’s hard to prioritize

☐ Rarely—today’s needs usually win

☐ I feel mostly okay, but a big expense could change that

☐ I feel uncertain about what comes next

FAQ

1) What counts as a “big life expense”?

2) Why do big expenses feel stressful even when I can “afford” them?

3) What is a sinking fund, and why does it help?

4) Should I save or finance a major purchase?

5) How much buffer should I add to a big expense?

6) How do I know if the timing is realistic?

7) What if my income changes month to month?

8) How does lifestyle creep affect big life expenses?

9) Should I pause big plans until my emergency fund is larger?

10) What’s the fastest way to create a realistic plan?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.