- Why Coastal Properties Can’t Be Left Fully Unattended

- Year-Round Regulatory and Insurance Demands

- What Standby Services Provide

- Fee Structures in Coastal Markets

- Spotlight on the Mississippi Gulf Coast

- Pros and Cons of Standby Fees

- Real-World Case Study: A Rare Freeze on the Mississippi Gulf Coast

- Insurance Industry Standards & Guidelines

- Final Thoughts for Coastal Retirees and Owners

- Frequently Asked Questions (FAQ): Standby Fees for Coastal Vacation Rental Properties

Coastal vacation properties—from the Mississippi Gulf Coast (Ocean Springs, Biloxi, Gulfport) to Florida’s Emerald Coast and Panhandle, California’s beaches, North Carolina’s Outer Banks, and other U.S. shorelines—represent dream lifestyle investments, paying a coastal vacation rental standby fee is discussed here.

Many owners purchase these homes planning eventual full-time retirement after relocating from northern states, while using them for personal/family visits a few times a year and listing them as short-term rentals (on Airbnb, Vrbo, etc.) to generate supplemental income during peak seasons.

A key reality for these properties: they cannot safely be left completely unattended for extended periods. Harsh coastal conditions, year-round regulations, insurance requirements, and potential emergencies demand ongoing attention.

Across coastal markets, many professional property management companies offer a “standby,” “vacancy,” or “retainer” service—a modest fee (typically charged only in months with no rental bookings)—to provide that essential oversight and protection.

This guide from RetireCoast.com explains the concept, risks involved, and common fee approaches seen nationwide, with examples from various coastal areas including the Mississippi Gulf Coast.

Why Coastal Properties Can’t Be Left Fully Unattended

Coastal environments expose homes to unique, persistent threats that worsen when the property sits empty:

- Weather and Structural Risks: Hurricanes, tropical storms, high winds, storm surge, heavy rain, salt-air corrosion, and even rare winter freezes can lead to unnoticed roof leaks (causing mold/rot), burst pipes, downed trees, or wind-driven water intrusion.

- Security Threats: Empty beach houses attract vandalism, break-ins, squatters, or theft of outdoor items like grills, kayaks, and furniture.

- Plumbing/Electrical/Fire Hazards: Hidden leaks flood foundations, rodents damage wiring (sparking fires), or pool/hot water heater failures cause major damage.

- Pests and Biological Issues: High humidity fosters mold, termites, roaches, or rodent infestations when doors stay closed for weeks.

- Exterior/Landscaping Problems: Overgrown yards trigger HOA fines, city code violations, or mosquito-breeding standing water.

These issues occur regardless of whether the home generates rental income, serves mainly for personal use, or is a “pure” vacation retreat with minimal bookings.

Year-Round Regulatory and Insurance Demands

Many coastal jurisdictions require short-term rental permits, licenses, or a designated local manager/contact available 24/7—not limited to rented periods. Cities need a reliable point person for:

- Occupied issues: noise complaints, trash violations, parking disputes, neighbor concerns.

- Unoccupied emergencies: fire alarms, break-ins, squatters, storm damage reports.

HOAs frequently add stricter mandates, such as periodic wellness checks or proof of ongoing management to avoid fines or rental restrictions.

Insurance is equally critical: Many policies (homeowners or short-term rental-specific) include vacancy clauses that limit or exclude coverage after 30–60 days unoccupied—often denying claims for vandalism, water damage, theft, or storm losses if the property lacks evidence of “reasonable care” (e.g., monitoring, local oversight, prompt response).

Without a designated contact or documented attention, premiums can rise, claims get rejected, or coverage lapses—potentially costing owners tens of thousands in uncovered repairs. The coastal vacation rental standby fee is not an insurance policy but it supports your existing policy.

What Standby Services Provide

Even without active bookings, managers deliver ongoing value:

- 24/7 emergency availability and coordination with vetted vendors (e.g., plumbers, roofers, tree services).

- Remote monitoring (via cameras/sensors) and occasional drive-by checks.

- Compliance support: Filing occupancy/tax reports (required even for $0-revenue months), maintaining permits, acting as the mandated local contact.

- HOA/neighbor liaison and prep for owner personal stays (often treated like guest-level service).

This “stand-by” role safeguards high-value assets year-round—crucial for future retirees planning to move in full-time.

Fee Structures in Coastal Markets

Vacation rental management fees vary widely (often 15–40% of revenue during booked periods), but standby/vacancy options address no-income months:

- Pure commission: No fee when unoccupied (but may reduce off-season proactive care).

- Flat retainers: $150–$500+ per month year-round (seen in high-demand areas like Florida’s Panhandle or Outer Banks).

- Conditional standby/vacancy fees: Charged only in zero-income months ($50–$200 common), focusing on availability and compliance.

Examples from industry sources include flat monthly fees of $100–$500+ for oversight in slow seasons, vacancy fees of $50–$100 in Florida coastal markets, and hybrid models ensuring compensation during vacancies without full retainers.

Spotlight on the Mississippi Gulf Coast

In areas like Ocean Springs, Biloxi, and Gulfport—where cities often require permits and a 24/7 local manager/contact—companies like Christies Gulf Beach Rentals offer a notably fair approach: a modest $50 monthly fee only for months with no rental income.

This covers essential duties like freeze/storm monitoring, tax reporting, and serving as the required local point person. It’s described as “more than fair” compared to higher retainers ($200+ per month) from some other managers nationwide or in busier coastal regions.

Pros and Cons of Standby Fees

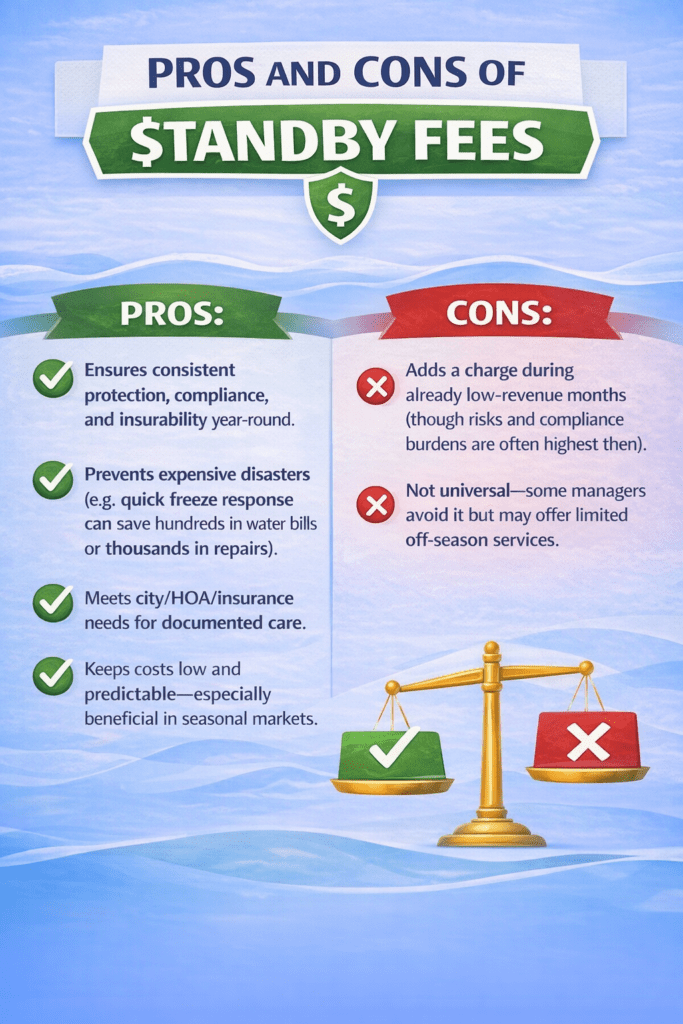

Pros:

- Ensures consistent protection, compliance, and insurability year-round.

- Prevents expensive disasters (e.g., quick freeze response can save hundreds in water bills or thousands in repairs).

- Meets city/HOA/insurance needs for documented care.

- Keeps costs low and predictable—especially beneficial in seasonal markets.

Cons:

- Adds a charge during already low-revenue months (though risks and compliance burdens are often highest then).

- Not universal—some managers avoid it but may offer limited off-season services.

For owners of pure vacation homes (minimal rentals, mostly personal use), negotiating a standalone standby agreement with a local manager is particularly wise.

Real-World Case Study: A Rare Freeze on the Mississippi Gulf Coast

Sam and Mary built their dream beach home in Gulfport, Mississippi, with breathtaking Gulf of America views from the balcony—intended as their eventual full-time retirement residence after moving from the north. They visit several times a year, while listing it as a short-term rental the rest of the time.

They contracted with a local management company for full services during bookings plus standby protection (a $50 fee only in no-income months).

In early 2026, an unusual hard freeze hit the normally mild Gulf Coast. A neighbor spotted two exterior faucets cracked and gushing water as temperatures rose—risking massive flooding, erosion, high utility bills, and damage.

The neighbor alerted Sam and Mary (away at the time), who contacted their manager. The manager arrived on-site within 15 minutes, shut off the main water, coordinated a plumber to replace the faucets, checked for hidden issues, and restored service—just in time for the next guest.

That month had no bookings, so only the $50 coastal vacation rental standby fees applied. Without the rapid response, unchecked water could have cost hundreds (or more) in bills and repairs—plus potential insurance complications from delayed discovery. The modest fee delivered outsized protection.

Insurance Industry Standards & Guidelines

To underscore the importance of ongoing oversight like standby services, consider these authoritative sources:

- International Risk Management Institute (IRMI) – Discussing “Vacancy Provisions,” standard ISO (Insurance Services Office) policy forms—which most U.S. insurers use as templates—suspend coverage for specific perils (theft, water damage, vandalism) if the property has been vacant for 60 consecutive days. This reinforces why documented monitoring or a local contact is vital to avoid gaps.

- OakTrust Insurance (Gulf Coast/Mississippi focus) – In their guidance on “Vacant Dwelling Insurance in Mississippi”, standard homeowners policies may be “completely nullified” for inadequate occupancy, with unoccupied buildings facing higher risks—especially on the Mississippi coast due to unique weather and environmental factors. They emphasize the need for specialized coverage or addendums when properties sit empty.

These standards highlight that while a professional standby service isn’t the only option, it provides reliable, documented protection that aligns with insurer expectations—potentially preventing claim denials or the need for costly separate vacant-home policies (which can cost 50–60% more than standard coverage).

Final Thoughts for Coastal Retirees and Owners

A standby fee isn’t an unnecessary expense—it’s practical insurance for your coastal dream home. Whether on the Mississippi Gulf Coast, Florida, California, or elsewhere, it ensures someone handles the unexpected, keeps everything compliant and insured, and preserves your investment for retirement or enjoyment.

Compare local options for transparent, conditional structures that match your usage. Peace of mind often costs far less than one avoided disaster.

(Insights based on industry guides, regional regulations, insurance practices, and examples as of 2026. For more on retiring to the Coast, explore RetireCoast.com resources.). We have many articles that can expand your knowledge about property management and investment at RetireCoast such as this one: https://retirecoast.com/18-most-important-tax-deductions-for-vacation-rentals-now/ and https://retirecoast.com/real-estate-investing-after-retirement/. One of our newest articles; https://retirecoast.com/trump-2025-401k-reforms-mississippi-gulf-coast-retirement/ . Other sources include Christies Gulf Beach Rentals and this article: https://christiesgulfbeachrentals.com/9-things-to-improve-your-vacation-rental-income-now-▲/

Frequently Asked Questions (FAQ): Standby Fees for Coastal Vacation Rental Properties

Here are 10 of the most common questions about standby (or vacancy) fees for coastal vacation homes, especially relevant for owners on the Mississippi Gulf Coast and similar areas.

- What exactly is a standby fee (or vacancy fee) for a vacation rental property? It’s a modest monthly charge—typically $50–$200—paid only during months when the property generates no rental income. It covers the property manager’s ongoing availability for emergencies, compliance, monitoring, and basic oversight, even when the home is unoccupied or used personally.

- Why do coastal properties need this kind of service when they’re not rented? Coastal homes face constant risks from weather (hurricanes, freezes, salt corrosion), pests, vandalism, squatters, and more. These threats don’t pause during off-season or personal-use months. Leaving the property completely unattended can lead to major damage, fines, or insurance issues.

- Is a standby fee really necessary if I have neighbors or family checking on the place? Neighbors or family can help, but they aren’t available 24/7, may not have vendor networks, or be equipped to handle emergencies (e.g., shutting off water at 2 a.m. after a storm). A professional manager provides reliable, documented “reasonable care” that insurers and cities often expect.

- What does the standby service usually include? Typical coverage includes:

- 24/7 emergency response and vendor coordination

- Remote monitoring (cameras/sensors) and occasional drive-by checks

- Filing required tax/occupancy reports (even $0 months)

- Serving as the designated local contact for city/HOA emergencies or complaints

- Preparing the home for your personal stays

- How much do standby fees typically cost on the Mississippi Gulf Coast? On the Mississippi Gulf Coast (Ocean Springs, Biloxi, Gulfport), fees are often very reasonable. For example, Christies Gulf Beach Rentals charges just $50 per month only when there is no rental income—much lower than the $150–$500+ retainers some companies charge year-round or during vacancies.

- Why do some managers charge a fee only when there’s no income, while others charge every month?Conditional standby fees (like $50 only in zero-income months) align costs with actual usage and keep things fair for owners during slow periods. Flat year-round retainers provide predictability for the manager but can feel burdensome when the property isn’t earning.

- How does a standby fee help with insurance coverage? Many homeowners and short-term rental policies have vacancy clauses that limit or exclude coverage (e.g., for vandalism, water damage, theft) after 30–60 days unoccupied. A local manager provides documented oversight and rapid response, helping demonstrate “reasonable care” to avoid claim denials. (See Insurance Information Institute and IRMI guidelines.)

- What happens if I don’t have a standby service and something goes wrong? You could face:

- Massive water bills or repair costs from undetected leaks

- Denied insurance claims due to lack of monitoring

- City/HOA fines for non-compliance (many require a 24/7 local contact)

- Mold, foundation damage, or vandalism that escalates without quick intervention

- Is a standby fee worth it for a “pure” vacation home that I rarely rent out? Yes—especially if it’s your future retirement home. The risks (weather, pests, security, regulations) are the same whether rented frequently or mostly personal. A small conditional fee ensures year-round protection without high ongoing costs.

- Can you give a real example of how a standby fee saved money? Yes: In early 2026, a rare hard freeze on the Mississippi Gulf Coast cracked two outdoor spigots on an Ocean Springs vacation home. A neighbor noticed water gushing. The standby manager arrived in 15 minutes, shut off the water, coordinated repairs, and prevented flooding. That month had no bookings, so only the $50 standby fee applied—saving hundreds in water waste and potentially $1,000+ in landscaping/erosion fixes.

If you have more questions about coastal vacation rental standby fees and services, insurance implications, or local options on the Mississippi Gulf Coast, feel free to ask!

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.