Last updated on December 11th, 2025 at 06:09 am

Buying a home is exciting, but the financial side can feel overwhelming. That’s why we created The Complete Guide to Home Buying Costs, Tax Benefits, and Mortgage Readiness. This guide covers everything from closing costs and down payments to mortgage credit scores and long-term tax benefits, giving first-time buyers and repeat homeowners a clear roadmap for 2025.

📌 Related Articles in This Series

This pillar article connects directly to the rest of our home-buying series on RetireCoast.com. If you want to dig deeper into specific areas, start here:

Together with this complete guide, these resources will equip you with expert advice, practical tools, and insights to help you make smart financial decisions as a first-time homebuyer or seasoned homeowner.

Why Preparation Matters

The home-buying process involves many moving parts: budgeting, securing financing, working with mortgage lenders, negotiating with sellers, and ultimately closing the deal. Each step carries costs, legal requirements, and potential pitfalls. Being financially prepared is not just a good idea—it’s essential.

Without planning, buyers often face unexpected expenses, stressful delays, or worse, loan denials just before closing. By contrast, buyers who take the important steps early—checking their credit, saving for down payments and closing costs, and seeking expert advice—put themselves in a position for favorable terms, competitive rates, and a smooth path to homeownership.

Step 1: Determine If You’re Ready to Buy

Before you start browsing open houses or clicking through home listings, ask yourself: Am I financially and personally ready to buy my first home?

Here are the key factors:

Savings Beyond the Down Payment

Your down payment is only one part of the upfront costs. You’ll also need to plan for:

- Closing costs (3–6% of the loan amount)

- Moving expenses

- Initial repairs or upgrades

- Homeowners insurance premiums

- Property taxes

- Emergency funds for unexpected expenses

Closing costs usually run between 3% and 6% of the home’s purchase price. They include appraisal fees, title searches, and lender fees. The Consumer Financial Protection Bureau explains closing costs in detail here: What are closing costs?

👉 We explore closing costs in detail here: Closing Costs in Home Buying 2025.

Budget, Income, and Expenses

Your monthly mortgage payment is just the beginning. Add in property taxes, utilities, maintenance costs, and possibly condo fees or homeowners association (HOA) dues. A good rule of thumb: Your total monthly housing expenses should not exceed 28% of your gross monthly income.

Use our calculator below to determine your debt-to-income (DTI) ratio. This is a critical measure for mortgage lenders, who want to be sure you can truly afford the property you’re buying. Simply enter your monthly expenses and income, and the calculator will show your result.

If the ratio falls outside lender requirements, it’s a signal that you need to reduce your obligations as reported to the credit bureaus. You can also use the calculator to test “what if” scenarios—for example: “If I pay off this Visa card with a $5,000 balance, how will it change my ratio?”

Debt-to-Income (DTI) Ratio Calculator

Enter your gross monthly income and monthly debts. We’ll estimate your front-end (housing only) and back-end (total) DTI. Adjust the “What-If Payoff” to see how paying down a balance might change your DTI.

Other Monthly Debts

Add debts that appear on your credit report (auto loans, student loans, credit card minimums, personal loans, alimony/child support).

What-If Payoff (Optional)

Results

| Metric | Value | Status |

|---|---|---|

| Front-End DTI (Housing ÷ Income) | — | — |

| Back-End DTI (Housing + Debts ÷ Income) | — | — |

| Back-End DTI (What-If) | — | — |

Note: This tool is an estimate. Lender guidelines vary by loan type (Conventional, FHA, VA, USDA) and by underwriter.

Creating your budget

We have provided a comprehensive budget tool here for you to use. Enter the expense and income data required. If you prefer, you can print this budget, save it as a PDF, or even as a CSV file for export to Excel or Google spreadsheet.

New Homebuyer Budget Tool

Estimate your monthly housing costs, living expenses, and income. Totals update automatically. (Tip: divide annual bills by 12 before entering.)

| Item | Monthly ($) |

|---|---|

| Mortgage (Principal & Interest) | |

| 2nd Mortgage (P&I) | |

| PMI / MIP Insurance | |

| Homeowners Insurance | |

| Flood / Other Insurance | |

| Property Taxes | |

| Electricity | |

| Water | |

| Gas (Natural / Propane) | |

| Trash | |

| Sewer | |

| House Cleaning Service | |

| Cable / Internet | |

| Streaming (Netflix, Amazon, …) | |

| HOA Dues | |

| Gardener / Lawn Service | |

| Pest Control / Termite | |

| Lawn & Weed Service | |

| Replace Plants / Vegetation | |

| Home Security | |

| Home Maintenance (Repairs / Upkeep) | |

| Total Housing | $0.00 |

| Item | Monthly ($) |

|---|---|

| Car One Payment | |

| Car Two Payment | |

| Car Three Payment | |

| Boat / Jet Ski Payment | |

| Golf Cart Payment | |

| Motor Home / RV Payment | |

| Trailer Payment | |

| Storage for RV | |

| Storage for Boat | |

| Car Washes / Detailing | |

| Total Transportation | $0.00 |

| Item | Monthly ($) |

|---|---|

| Credit Cards (Monthly Minimums) | |

| Student Loans | |

| Personal Loans | |

| Other Obligation(s) | |

| Other Obligation(s) | |

| Total Debt | $0.00 |

| Item | Monthly ($) |

|---|---|

| Health (premiums, copays, rx) | |

| Food / Groceries | |

| Clothing | |

| Off-Site Storage | |

| Fuel (Car) | |

| Fuel (RV / Boat) | |

| Mobile Phone(s) | |

| Household Cleaners / Paper Goods | |

| Gifts / “Stuff” / Holidays | |

| Golf / Club Membership | |

| Warehouse Club (Costco, Sam’s) | |

| Health Club / Gym | |

| Church Donation | |

| Other Donation | |

| College / Classes / Tuition | |

| Hobby Costs | |

| Personal Grooming | |

| Pet Expenses | |

| Vacation Costs (incl. fuel) | |

| Subscriptions (magazines, apps) | |

| Hunting / Fishing License | |

| School / Kids’ Activities | |

| Entertainment | |

| Travel (Airfare) | |

| Laundry / Dry Cleaning | |

| Gambling | |

| Life Insurance | |

| Collectibles / Art / Supplies | |

| Total Living | $0.00 |

| Source | Monthly ($) |

|---|---|

| Wages / Salary (You) | |

| Wages / Salary (Spouse/Partner) | |

| Investment Properties / Business (Net) | |

| Investments – Stocks / Bonds | |

| Other Income | |

| Total Monthly Income | $0.00 |

Notes: Front-end DTI uses housing costs only. Back-end DTI uses housing + debt. Lender limits vary by loan type. For closing costs, see: Closing Costs in Home Buying (2025).

Credit Score Readiness

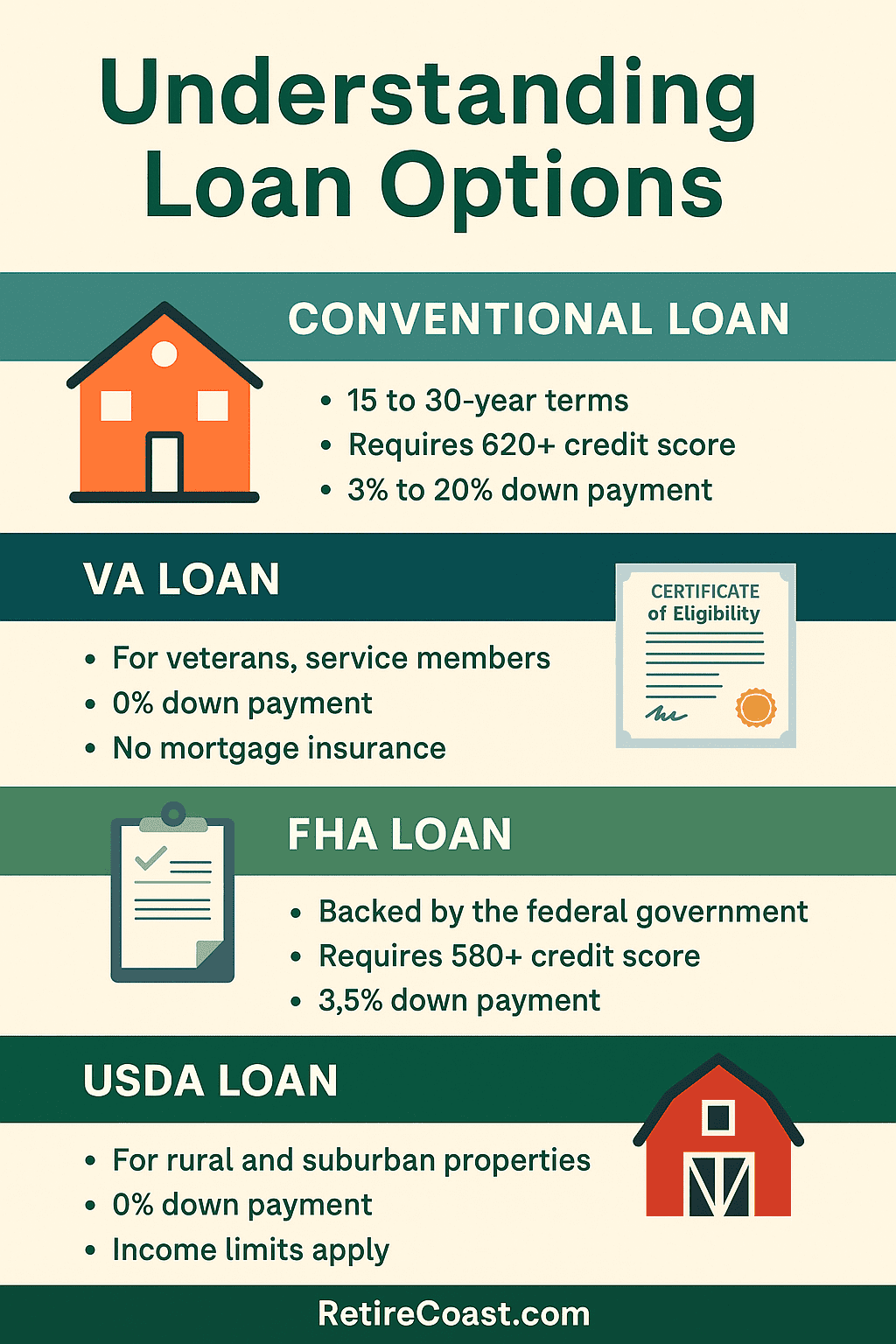

Mortgage lenders typically require:

- Conventional loans: 620 minimum

- FHA loans: 580 (or 500 with 10% down)

- VA loans: 620 (although VA itself does not require a score)

- USDA loans: 640

The best rates go to borrowers with scores above 720. A higher credit score not only lowers your interest rate but also gives you a better chance of qualifying for more favorable loan terms.

Military: VA Loans and Service Member Advantages

Service members have a unique advantage when buying a home: access to the VA loan program, which allows eligible buyers to purchase with no down payment and competitive rates. With good credit, lenders often view active-duty service members as having stable employment and reliable income.

It’s important to understand that any licensed loan broker can initiate a VA loan. Don’t be misled by ads from companies suggesting they’re the only option for VA borrowers. What truly matters is choosing a lender who communicates clearly and keeps the process moving smoothly.

One key difference with VA loans is the property appraisal. VA appraisers are more thorough than those for conventional loans because they are accountable to the Department of Veterans Affairs. They are required to flag safety and livability issues, which means even relatively minor items such as broken windows, missing handrails, or damaged screens can hold up approval.

👉 Tip: Talk to your real estate agent early about potential VA appraisal issues. Addressing small repairs before the inspection can save time and prevent surprises.

Job Stability: What Lenders Want to See

For civilian buyers, job stability is one of the most important factors in getting approved for a mortgage. Lenders want confidence that you’ll be able to repay your loan for the life of the mortgage. Ideally, they prefer borrowers who have been in the same job — or at least the same field — for two years or more.

That doesn’t mean you’ll be automatically disqualified if you recently changed jobs. As long as you don’t have a long history of short-term positions, lenders may still view you as a stable candidate. The key is demonstrating consistent income and steady career progress.

⚠️ Warning: Don’t change jobs in the middle of the mortgage process. Even if you secure a better salary, switching employers before closing can derail your loan approval. Lenders will always verify employment directly with your employer before finalizing the loan.

👉 Tip: Inform your employer that you’re applying for a mortgage so they’re prepared to confirm your status when the lender calls. Learn more about preparing in advance in our guide on improving your credit score for a mortgage. Time Horizon

If you plan to stay in your new home at least 3–5 years, you’re more likely to build equity and offset transaction costs.

This complete guide to home buying costs wouldn’t be complete without discussing credit scores and mortgage readiness.

Step 2: Figure Out What You Can Afford

Affordability is more than just the home’s purchase price. It’s about the complete cost of homeownership.

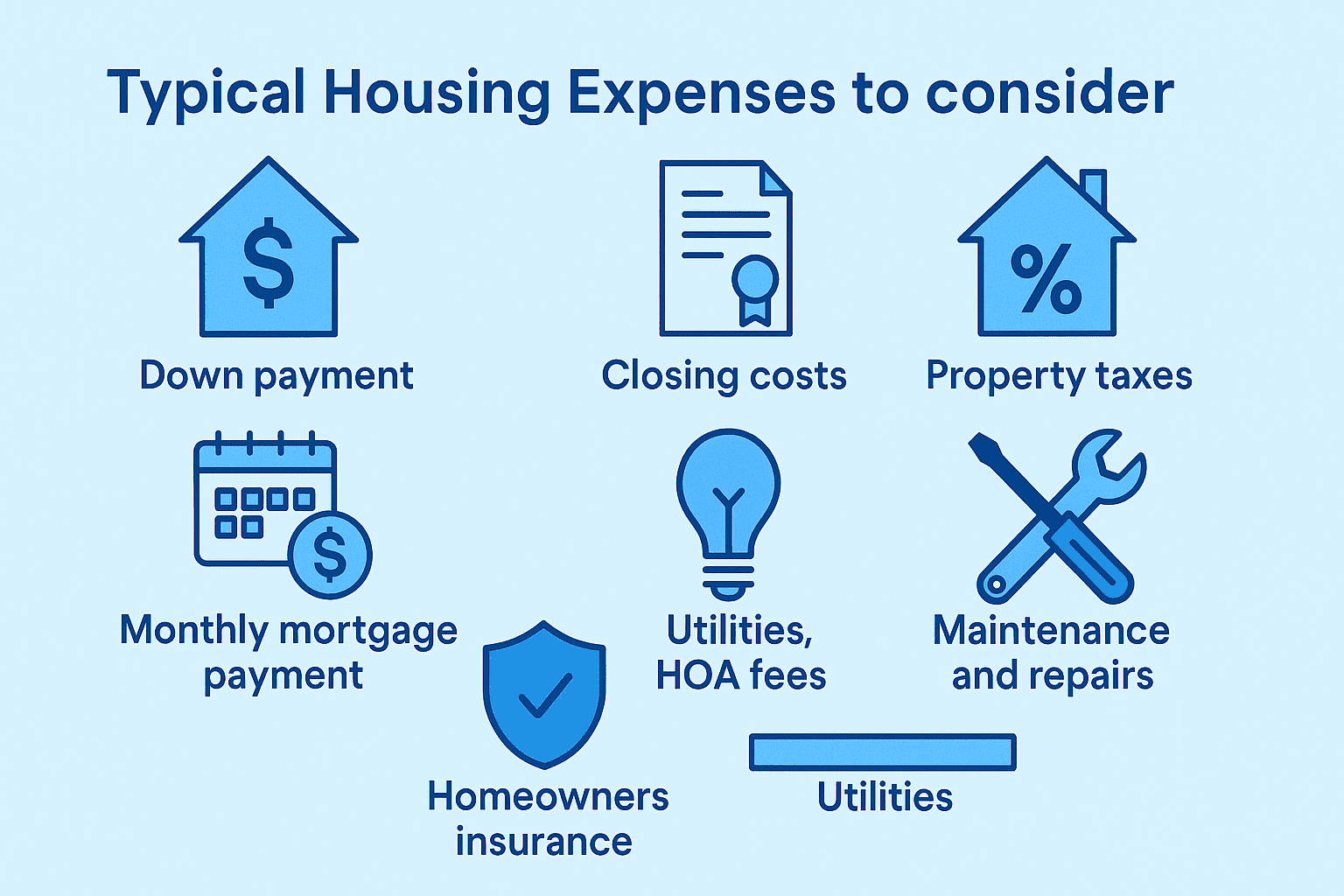

Typical Housing Expenses to Consider:

- Down payment (3%–20% depending on loan type)

- Closing costs

- Private mortgage insurance (PMI) or mortgage insurance premiums (MIP) for FHA loans

- Homeowners insurance

- Property taxes (local property tax rates vary widely)

- Utilities and maintenance costs (budget 1–4% of home value per year)

- Unexpected expenses like water damage repairs or appliance replacements

By factoring these in, you’ll set a realistic home search budget and avoid financial surprises. In this complete guide to home buying costs, we also cover how tax benefits can offset your expenses over time.

🌍 Trusted Home Buying Resources

This guide connects to reliable outside experts too. Visit the Consumer Financial Protection Bureau for mortgage details, explore national housing stats from the National Association of Realtors, and check Investopedia’s Home Buying Guide for practical financial planning tips.

Step 3: Tax Benefits of Owning a Home

Before the 2017 tax changes, many people bought homes primarily for the tax benefits. Those days are largely gone, since the standard deduction is now much higher than the average mortgage interest and property taxes paid by many households. Still, there are important tax advantages to owning a home:

- Mortgage interest and property taxes are deductible if your itemized deductions exceed the standard deduction.

- Capital gains exclusion: Homeowners can exclude up to $250,000 (individual) or $500,000 (married couple) in profit from the sale of their primary residence if they’ve lived there for two of the last five years. This is a huge advantage compared to investors, who must pay taxes on net gains.

- Estate planning advantages: Trusts can be used to pass property to family without triggering immediate tax liability (consult a financial advisor or attorney).

Homeowners may be able to deduct mortgage interest, property taxes, and in some cases, mortgage insurance. The IRS offers official guidance on homeowner deductions here: Tax Information for Homeowners.

👉 Learn more about tax benefits in this article in our series: Tax Benefits of Owning a Home 2025.

Step 4: Improve Your Credit Before Applying

Your credit score is one of the most important factors in getting approved for a mortgage. Here are the essentials:

- Always pay bills on time. Even one late payment can drop your score.

- Reduce credit card balances to lower your credit utilization ratio. Aim for under 30%, ideally under 10%.

- Avoid opening new credit accounts right before applying for a mortgage.

- Keep old accounts open to lengthen your credit history.

- Dispute errors on your Equifax, Experian, and TransUnion credit reports.

💡 Case Study: One of my clients ignored this advice and bought a new car right before closing on a house. The new auto loan pushed their debt-to-income ratio too high. The lender withdrew the mortgage approval, and the deal fell apart.

Step 5: Understand Loan Options

Different loan types fit different buyers:

- Conventional loans: Best for borrowers with higher credit scores; PMI required under 20% down.

- FHA loans: Designed for first-time buyers or those with lower scores; require MIP throughout the life of the loan.

- VA loans: For veterans and servicemembers; no down payment and no PMI; one-time VA funding fee (waived for service-connected disabled veterans).

- USDA loans: No down payment, but limited to rural areas and specific circumstances.

Each loan type has its pros and cons. Comparing them with a mortgage calculator is a crucial step in your home-buying journey.

Step 6: Mortgage Readiness Timeline

Financial advisors recommend starting at least six months before you apply:

- 6 months out: Pull your credit reports, pay down balances, fix errors, and save aggressively.

- 3 months out: Stop buying large items, avoid new credit, and maintain stable credit card balances.

- 2 months out: Keep bank accounts stable; avoid large transfers or “gifts” showing up suddenly.

- At application: Be ready with recent pay stubs, tax returns, and bank statements.

Getting pre-approved means understanding how lenders view your income, credit, and debt-to-income ratio. For more detail, Fannie Mae provides a clear breakdown of the mortgage process: Understanding the Mortgage Process

Step 7: Work With Professionals

Buying your first home is complex. Consider the professionals who can make the process smoother:

- Real estate agent or buyer’s agent: Guides your home search, negotiates, and handles paperwork.

- Mortgage lenders: Offer loan terms and competitive rates.

- Financial advisors: Help evaluate affordability and long-term financial impact.

- Attorneys: Provide legal advice and review purchase agreements.

Mortgage Lenders and Where to Start

Mortgage lenders come in many forms—from banks and credit unions to independent mortgage brokers and private lenders. Each option has its own advantages and drawbacks. If you have a high credit score (over 700), a steady source of income, and meet the debt-to-income ratio without additional issues such as collections, you can likely choose any type of lender with confidence.

However, if you are “credit challenged,” your best bet is to work with an independent mortgage broker. Brokers have access to multiple funding sources, each with unique underwriting requirements. Often, people who have been turned down by banks for a loan are still able to secure financing through a mortgage broker.

Step 8: From Offer to Closing

Once you’ve found your new home and are ready to make an offer:

- Earnest money deposit: Typically 1–3% of the home’s purchase price, held in escrow.

- Home inspection: Identifies issues like roof condition, HVAC efficiency, or water damage.

- Appraisal: Ensures the home value matches the loan amount.

- Disclosures: Sellers must disclose known defects.

- Closing date: You’ll review and sign the purchase agreement, pay closing costs, and receive your keys.

Closing Timelines and Preparation

Wondering how long it takes from signing the contract to closing? Your real estate agent will enter a closing date on the offer you make when buying your new home. This date is typically about 30 days in advance, though in practice, most closings happen within 45 days.

You should be prepared to close around the time you sign the offer. Avoid moving money around in your accounts once the offer has been submitted to the lender. Instead, have your down payment funds set up and ready before the offer is made, which helps the process move faster. In some cases, closing can even take place earlier than the contract date if all parties agree.

👉 For more details, explore our in-depth guide: Closing Costs in Home Buying (2025)

Frequently Asked Questions

1) What is the minimum credit score I need to buy my first home?

2) How much should I save for a down payment?

3) What are closing costs, and how much should I expect to pay?

4) Do I need private mortgage insurance (PMI)?

5) How does debt-to-income ratio (DTI) affect mortgage approval?

6) What’s the difference between FHA, VA, and conventional loans?

7) Should I choose a fixed-rate or adjustable-rate mortgage (ARM)?

8) What documents do I need for preapproval?

9) Can I buy a house with student loans or other debt?

10) What is an earnest money deposit and when do I get it back?

11) How long does the home-buying process usually take?

12) Is buying always better than renting?

13) Can family members gift my down payment?

14) How do property tax rates and insurance affect my monthly payment?

15) What happens if the appraisal comes in below the purchase price?

16) Where can I learn about homeowner tax benefits?

17) How can I quickly improve my credit for a mortgage?

Glossary of Key Terms

- Closing costs: Fees due at closing, including lender charges, title insurance, and appraisals.

- Earnest money: A Deposit made to show good faith when making an offer.

- DTI (Debt-to-Income Ratio): The percentage of your gross monthly income that goes toward debts.

- Home inspection: Professional assessment of a home’s condition.

- WDIR inspection: Wood-Destroying Insect Report, often required in some states.

- FHA loan: Federal Housing Administration loan for first-time buyers with smaller down payments.

- VA loan: A Loan guaranteed by the Department of Veterans Affairs with no down payment required.

- Conventional loan: Standard mortgage not insured by the government.

- Capital gains: Profit from selling a home; exclusions apply for primary residences.

- PMI (Private Mortgage Insurance): Required for conventional loans with less than 20% down.

- MIP (Mortgage Insurance Premiums): Insurance for FHA loans.

- First-time buyer (finance): Borrower purchasing their first home, often eligible for special programs.

Conclusion

Buying a home is one of life’s most important steps—and one of the most complex financial transactions you’ll undertake. By preparing early, understanding loan options, and working with trusted professionals, you can reduce stress, avoid costly mistakes, and secure favorable terms for your loan.

Remember, homeownership isn’t just about buying property—it’s about building financial stability and creating a foundation for your future. With the right planning and expert advice, you’ll be ready to enjoy not just your new home, but also the long-term benefits it brings.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.