The Form 1040-SR 2025 Tax Forecast Tool was created specifically for seniors and retirees who want a clearer picture of their federal tax situation before filing — and before surprises show up during tax season.

If you are retired or nearing retirement and receive income from Social Security, IRAs, 401(k)s, pensions, or part-time work, this tool is designed to help you understand how those income sources interact under the IRS Form 1040-SR rules.

Many retirees don’t realize how changes in withdrawals, required minimum distributions, or supplemental income can affect taxes owed until filing time. This forecast tool was built to give retirees and seniors more clarity — before submitting a return or making an IRS payment.

How to use this calculator

How to Use This Calculator

Our Form 1040 SR 2026 tax forecast tool is based on the IRS draft version of the 2025 Form 1040-SR. While major changes are unlikely, the IRS sometimes updates line numbers or instructions when the final forms are released each January. Please download the newest version after mid-January to ensure no line items or amounts have been revised.

What This Calculator Helps You Do

The primary purpose of this calculator is to help you determine how much money you can withdraw from tax-advantaged retirement accounts (IRA, 401(k), 403(b), TSP, etc.) before you trigger any federal income tax liability.

Even if you do owe some tax, the first two tax brackets remain relatively low thanks to the 2017 Tax Cuts and Jobs Act and the later “Big Beautiful Bill” that extended those benefits.

Includes Social Security Taxation

Up to 85% of your Social Security benefits may be taxable depending on your total income. This calculator includes the official worksheet— Social Security Taxable Benefits Calculation—to determine how much of your benefits are taxable.

- Form 1040 or 1040-SR

- Schedule 1 (adjustments and additional income)

- Your SSA-1099 (Social Security benefits)

- Pension or annuity income

- IRA distributions

- Interest, dividends, capital gains, and other income

If You’re Over 65

You may also qualify for a large additional deduction from Schedule 1-A, one of the biggest senior benefits preserved in the Big Beautiful Bill.

– The amount from Schedule 1-A, line 38 goes into

Form 1040-SR, line 13b.

– Your main standard deduction appears on line 12e.

How to Use This Calculator

- Enter your estimated income numbers into each field.

- The calculator will automatically compute:

- Total income

- Adjusted gross income (AGI)

- Total deductions

- Taxable income

- Credits and payments

- Refund or amount owed

- Taxable portion of Social Security benefits

- Adjust your planned retirement withdrawals and see how the tax result changes.

- Use this to determine how much you can take from tax-deferred accounts without triggering unnecessary tax.

Federal 1040-SR Style Summary (Estimate)

Social Security Taxable Benefits Workout

Worksheet 1. Figuring Your Taxable Social Security Benefits

| Line | Description | Amount |

|---|---|---|

| 1. | Enter the total amount from box 5 of all your Forms SSA-1099 and RRB-1099. | |

| 2. | Multiply line 1 by 50% (0.50). | |

| 3. | Combine the amounts from Form 1040 or 1040-SR, income lines (wages, interest, dividends, etc.). | |

| 4. | Enter the amount, if any, from Form 1040 or 1040-SR, line 2a (tax-exempt interest). | |

| 5. | Enter the total of any exclusions/adjustments (for example, adoption benefits, foreign earned income, or income of bona fide residents of certain U.S. territories). | |

| 6. | Combine lines 2, 3, 4, and 5. | |

| 7. | Enter the total of the amounts from Schedule 1 (Form 1040), lines 11 through 20, and 23 and 25. | |

| 8. | Is the amount on line 7 less than the amount on line 6? If Yes, subtract line 7 from line 6 and enter the result here. If No, none of your social security benefits are taxable. | |

| 9. | Threshold amount based on your filing status (generally $32,000 for married filing jointly, or $25,000 for the other statuses shown above). | |

| 10. | Is the amount on line 9 less than the amount on line 8? If Yes, subtract line 9 from line 8 and enter the result here. If No, none of your benefits are taxable. | |

| 11. | Threshold #2 based on your filing status (generally $12,000 if married filing jointly, or $9,000 for the other statuses shown above). | |

| 12. | Subtract line 11 from line 10. If zero or less, enter 0. | |

| 13. | Enter the smaller of line 10 or line 11. | |

| 14. | Multiply line 13 by 50% (0.50). | |

| 15. | Enter the smaller of line 2 or line 14. | |

| 16. | Multiply line 12 by 85% (0.85). If line 12 is zero, enter 0. | |

| 17. | Add lines 15 and 16. | |

| 18. | Multiply line 1 by 85% (0.85). | |

| 19. | Taxable benefits. Enter the smaller of line 17 or line 18. |

Enter the amount on line 19 above on line 6A in the 1040 SR worksheet at the top of the page

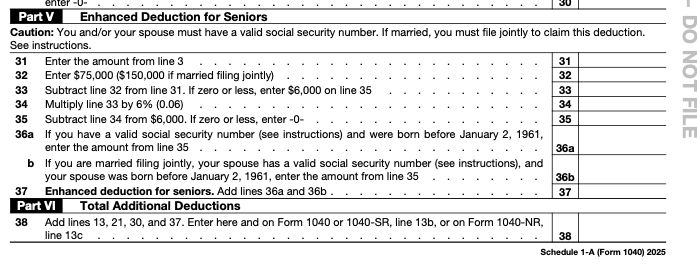

Schedule 1A for form 1040 2026

Complete this part of Schedule 1-A above to determine if you qualify for the new Enhanced Deduction just for Seniors. Most seniors do not need to complete more than this part of the form. Attached is a draft of the entire form. If you do, copy the amount in box 38 and paste it into box 6a in the 1040 SR above.

If you want to see the entire Schedule 1-A form you can download it below by clicking the button.

IRS Form 1040 SR 2025 Draft

Click on this button to download the full form 1040 SR to compare with the data entry version above.

IRS Form Schedule A

Click on the button below to see the full IRS Schedule A form for 2025.

This calculator and all related tools provided on RetireCoast are for informational and educational purposes only. They are not intended to replace professional tax, legal, or financial advice.

While we make every effort to provide accurate and up-to-date calculations, RetireCoast does not guarantee the accuracy, completeness, or timeliness of any results, estimates, or tax projections shown above. Tax laws, IRS forms, and instructions can change without notice, and mistakes can happen.

Users are fully responsible for verifying all numbers and results before filing any federal or state tax returns. You should confirm your entries using the official IRS forms and instructions, or by working with a qualified tax professional, CPA, or financial advisor.

By using this tool, you acknowledge and agree that RetireCoast is not responsible for any errors, omissions, penalties, interest, additional tax, financial loss, or other consequences arising from the use of this calculator or reliance on its output.

You further agree that you accept full responsibility for how you use these tools and the data they generate, including any tax filings, financial planning decisions, or withdrawal strategies based on the results.

This is not official IRS software and does not file or transmit your tax return.

By using this calculator and any related tools on RetireCoast, you agree to the following Terms of Use. Continued use of this website indicates your acceptance of these terms.

-

Informational & Educational Use Only:

All calculators and tools on RetireCoast are intended solely for general educational purposes. -

No Professional Advice:

Nothing on this website constitutes tax, legal, investment, or financial advice. Consult a qualified professional for personal guidance. -

User Responsibility:

You are solely responsible for entering accurate information. RetireCoast is not responsible for incorrect results due to user input or omitted information. -

No Guarantee of Accuracy:

While we strive to maintain accuracy, RetireCoast does not guarantee that calculations or tax estimates are current, complete, or error-free. -

Limitation of Liability:

RetireCoast shall not be liable for any losses, penalties, IRS letters, misfilings, financial decisions, or damages arising from the use of this tool. -

User Acceptance of Risk:

By using this tool, you accept full responsibility for all decisions and outcomes resulting from its use. -

No IRS Affiliation:

RetireCoast is not affiliated with the IRS. This calculator is not official IRS software and does not file your tax return. -

Privacy & Data:

RetireCoast does not store any information entered into this calculator. You are responsible for protecting your device and any sensitive data you input. -

Right to Modify:

RetireCoast may modify or discontinue this calculator or its terms at any time without notice.

If you do not agree to these Terms of Use, you must stop using this tool immediately.