Last updated on January 12th, 2026 at 06:42 am

How to Fund a Child’s Education Without Crushing Your Finances

In this short audio, the author explains why education funding is one of the most important financial decisions a family will ever make—and how to approach it with a plan, a process, and realistic trade-offs.

Author Audio Introduction

Related Pillar: Financial Strategies for Everyday Life →/financial-strategies-for-everyday-life/

Financing Education for Children — Financial Strategies in Action

Few financial decisions test a family’s financial literacy more than how to pay for college and manage the long-term consequences of that choice.

Education funding sits at the intersection of emotion, identity, and money. Parents want to provide opportunities. Children want independence, experiences, and status. Schools market aspiration far more aggressively than affordability. Student loans make almost any choice seem possible—at least in the short term.

For Gen X families, especially, how to pay for college is one of the most consequential financial strategies they will ever use. The costs are high, the commitments are long, and the margin for error is much smaller than it once was. A single decision can affect household stability, emergency savings, and retirement readiness for decades.

Financial literacy does not remove emotion from this process—but it does insist that emotion follow structure, not replace it.

- How to Fund a Child’s Education Without Crushing Your Finances

- Financing Education for Children — Financial Strategies in Action

- Education Funding Is a Financial Decision, Not a Moral Obligation

- Start With the Goal, Not the School

- Student Loans: The Illusion That Makes Bad Financial Strategies Look Affordable

- Case Study: When Good Intentions Become Financial Risk

- They acted like loving parents—but not like financial stewards. This is precisely where financial strategies are meant to intervene.

- What Would You Do?

- The Education Funding Decision Tool — Financial Strategies Made Practical

- Sean & Janet — Alternative Outcomes (and What Path You’re On)

- Average Annual Costs for One Year of Postsecondary Education (2025-2026 Academic Year, U.S. Averages)

- Parents Are in Charge — and That Matters

- Education Is an Investment — Not a Gift Without Limits

- What the Data Shows — and Why It Matters

- Maturity, Responsibility, and Real-World Consequences

- The Financially Literate Path Forward

- Note to Readers

Education Funding Is a Financial Decision, Not a Moral Obligation

There is a powerful cultural belief that “good parents pay for college.”

While well-intentioned, this belief often leads families into financial commitments they are not prepared to sustain.

Education is valuable, but it is not exempt from financial reality. When parents pay for education, they are allocating capital just as they would for a home, a business investment, or a retirement plan. That capital has limits, opportunity costs, and risk—especially when families have not clearly defined how to pay for college without sacrificing their own financial stability.

Financial strategies require acknowledging those limits before commitments are made.

That means asking difficult but necessary questions:

- What is the total cost of this education, not just tuition?

- How much borrowing will be required—and who is responsible for it?

- What income does this degree realistically produce?

- What happens if life does not go according to plan?

Avoiding these questions does not protect the family. It only delays the consequences.

Start With the Goal, Not the School

A financially literate education decision begins with a single grounding question:

What is the career goal?

Too many families reverse this order. They start with the school, the campus, or where friends are going, and only later consider outcomes. Financial strategies work best when the desired result is defined first—especially when deciding how to pay for college responsibly.

Once the career goal is clear, families can evaluate:

- What credentials are required to enter the field

- Whether multiple education paths lead to the same outcome

- Whether higher-cost schools meaningfully improve income or placement

In many professions, the “ticket to entry” is simply a bachelor’s degree. When expected income is similar across institutions, dramatically higher costs require extraordinary justification. If the return is the same, paying more is not generosity—it is inefficiency.

This is where financial literacy becomes practical.

The Education ROI & Career Decision Calculator helps families step back from emotion and evaluate education choices using real numbers. It compares the total cost of college, available funds, borrowing needs, and expected career income—then stress-tests the decision against real-life risks like job loss, elder care, or medical expenses.

Run the calculator first for the preferred school, then rerun it for lower-cost alternatives such as in-state schools, community college transfer paths, trade programs, or military options. Seeing the comparison side-by-side often changes the conversation.

Compare college cost, student loans, career income, and alternatives before making a decision.

Use this calculator as a family. It is designed to support productive conversations, not to eliminate goals, by ensuring education decisions fit within sustainable financial strategies.

Before finalizing your college decision, it often helps to get everyone on the same page.

The Family Meeting Education Funding Decision Summary (PDF) provides a structured guide for discussing goals, costs, return on investment, risk, and how a decision affects savings and retirement. Pair it with the Education ROI & Career Decision Calculator for a complete family planning process.

A one-page guide to help families discuss education costs, ROI, and debt decisions calmly and clearly.

Student Loans: The Illusion That Makes Bad Financial Strategies Look Affordable

Student loans are often what turn an unaffordable decision into a signed commitment.

Loans delay pain, but they do not reduce cost. In fact, they often magnify it. Families routinely underestimate how long education debt lingers and how much flexibility it removes from future decisions.

Commonly overlooked risks include:

- Interest accumulating for decades

- Parent co-signers assuming long-term liability

- Reduced ability to save for retirement

- Increased vulnerability to job loss or illness

- Default consequences that follow families, not just students

Federal and private student loans are not interchangeable, and neither should be treated casually. Misunderstanding repayment rules, deferment options, and default consequences can permanently destabilize household finances.

Student loans can follow borrowers and families for decades. Before agreeing to any borrowing— especially parent-backed or private loans—it is critical to understand repayment rules, default consequences, and how different loan types affect long-term financial stability.

- Avoiding Student Loan Default: StudentAid.gov — Default Risk & Consequences

- Choosing the Right Loan Type: StudentAid.gov — Federal vs. Private Student Loans

RetireCoast Insight: Federal loans generally offer more borrower protections than private loans. Understanding these differences before signing can prevent irreversible mistakes.

They acted like loving parents—but not like financial stewards. This is precisely where financial strategies are meant to intervene.

What Would You Do?

Sean and Janet’s situation raises difficult—but very common—questions for Gen X families. Take a moment to consider how you would respond.

- Would you agree to co-sign a student loan that exceeds your current savings?

- Have you clearly defined how much you can afford to help your children—without harming your own future?

- Do you treat emergency savings as untouchable, or as a backup funding source?

- Have you planned for the possibility of supporting aging parents while still helping your children?

- If life changed suddenly, how much financial flexibility would you really have?

Financial literacy is not about denying opportunities—it is about understanding tradeoffs before emotion makes the decision for you.

Parents are in charge of the funding decision. Use this self-score to separate emotion from math and identify whether your plan is a sound adult decision—or a debt-driven gamble.

The Education Funding Decision Tool — Financial Strategies Made Practical

This is where financial literacy becomes action.

The Education Funding Decision Tool is designed to force clarity before commitments are made. Used as a family, it removes emotion from the first pass and replaces it with math, tradeoffs, and transparency.

The tool helps families:

- Calculate total education cost

- Compare available funds versus required borrowing

- Evaluate the degree of ROI

- Explore alternative education paths

- Stress-test the plan for real-world disruptions

- Produce a printable summary for family alignment

Feelings still matter—but they should follow the numbers, not replace them.

Sean & Janet — Alternative Outcomes (and What Path You’re On)

Same family. Same goal. Very different long-term financial outcomes. Use the self-score below to see which direction your household is leaning.

| Category | Emotion-Led Path | Financial Literacy Path |

|---|---|---|

| 🎓 School Choice | “Best name / friends are going” drives the decision | School matches goal + cost + realistic outcomes |

| 💳 Funding Strategy | Parent-backed loans fill the gap | Clear cap on parent contribution + student contribution plan |

| 🛟 Emergency Fund | Emergency savings becomes “college funding” | 3–6 months of expenses preserved as untouchable |

| 📈 ROI Reality | Assumes expensive school = higher lifetime income | Compares expected income vs total cost (break-even + debt-to-income) |

| 👵 Life Happens Test | No margin if a parent needs care or income drops | Plan remains stable even if an unexpected event occurs |

| 😰 Stress Level | High: ongoing financial anxiety | Lower: decisions aligned with capacity |

✅ Quick Self-Score: Which Path Are You On?

Give yourself 1 point for each statement that’s true today. Total your score at the end.

- 🧾 We know the full 4-year cost (tuition, room/board, fees, travel) before committing.

- 🛟 We will keep at least 3–6 months of expenses in emergency savings after paying for school.

- 💰 We’ve set a clear cap on what parents will contribute (total or annual).

- 👷 The student has a written contribution plan (work, loans, scholarships, or all three).

- 📊 We compared expected income in the chosen field against total cost and debt payments (ROI).

- 🔁 We seriously compared alternatives (community college transfer, in-state, trade school, military).

- 🧯 We tested a “life happens” scenario (job loss, illness, elder care) to see if the plan collapses.

🧭 Use the Education Decision Tool Before You Commit

This decision tool turns emotion into a plan by comparing total cost, funds available, student contribution, degree ROI, and lower-cost alternatives—plus a “life happens” stress test.

Go to the RetireCoast Calculator Hub →Tip: If you don’t see the tool yet, bookmark the Calculator Hub—new tools are added regularly.

Average Annual Costs for One Year of Postsecondary Education (2025-2026 Academic Year, U.S. Averages)

Costs vary by institution type, program, residency, and living arrangements. Community colleges and trade schools are primarily commuter-based (most students live off-campus or at home), so the full cost of attendance excludes on-campus room & board. In contrast, state and private colleges typically include on-campus living in their averages. Data from College Board Trends in College Pricing 2025, Education Data Initiative, and vocational reports.

| Category | Community College (Public 2-Year, In-District, Commuter) | Trade School (Vocational/Technical, Commuter) | State College (Public 4-Year, In-State, On-Campus) | Private College (Nonprofit 4-Year, On-Campus) |

|---|---|---|---|---|

| Tuition & Fees Only | ~$4,000–$4,100 | ~$10,000–$16,000 (public ~$8,000–$10,000; private higher) | ~$11,950 | ~$45,000 |

| Full Cost of Attendance (Sticker Price) (Tuition/fees + books/supplies + off-campus living/food + transportation + personal expenses) | ~$19,000–$21,000 (many live at home, lowering effective costs) | ~$20,000–$25,000 (most commute; limited housing) | ~$30,000–$31,000 | ~$63,000–$65,000 |

| Average Net Price (After grants/scholarships) | ~$14,000–$16,000 | ~$12,000–$18,000 (strong aid for many programs) | ~$20,000–$21,000 | ~$35,000–$37,000 |

Key Notes:

- Community College (Commuter): Lowest overall costs due to low tuition and no on-campus housing requirement. Many students live at home (reducing living expenses to ~$10,000–$15,000/year) or off-campus. Grants often cover tuition entirely for eligible students.

- Trade School (Commuter): Costs vary widely by program length (often 6–24 months) and type (public is cheaper than private for-profit). Focus on skills like HVAC, welding, or cosmetology; most students commute, keeping living costs similar to community college.

- State College (Public 4-Year): Affordable in-state tuition, but includes on-campus room & board (~$12,000–$13,000). Out-of-state sticker price is much higher (~$50,000+ total).

- Private College: Highest sticker prices, but significant institutional aid reduces net costs for many. Includes on-campus living.

- Military Enlistment: An option that can lead to learning a skill that can carry through to a career in or outside of the military. There is no cost for this option. Programs are available to help a student become an officer with part of college paid by the military.

- These are national averages; costs vary by state, program, and aid eligibility. Trade and community options often result in faster entry to the workforce with lower debt.

- Costs rise ~3–4% annually. For accurate estimates, use school net price calculators or FAFSA tools.

Smarter Alternatives Are Not Failures

Financial literacy expands options—it does not limit them.

Community college transfer paths, in-state public universities, trade and technical programs, grants, and service-based education options often preserve capital, reduce risk, and increase long-term flexibility.

Lower cost does not mean lower success. In many cases, it means better financial strategies that survive real life.

Parents Are in Charge — and That Matters

When it comes to financing education, one principle needs to be stated plainly:

Parents are in charge because parents earned the money.

College-age children can — and should — have opinions. They can express interests, goals, and preferences. But they are not the ones who built the savings, managed the household budget, or absorbed decades of financial risk. That responsibility rests with the parents, and so does the final decision about how to pay for college.

This is not about control. It is about accountability.

Teenagers and young adults are still developing the cognitive and emotional skills required to make high-stakes financial decisions. Neuroscience is clear on this point: full adult-level emotional regulation and risk assessment typically does not mature until the mid-20s. Even then, wisdom is built through experience, not enthusiasm.

That matters because college decisions are often driven by emotion:

- Where friends are going

- Campus lifestyle

- Prestige or brand perception

- Fear of missing out

Those are understandable feelings — but they are not sound financial criteria.

Education Is an Investment — Not a Gift Without Limits

If parents are paying for education, they are making an investment, whether they label it that way or not.

And like any investment, it deserves an honest question:

What is the expected return?

This does not mean reducing a child’s future to a dollar figure. It means recognizing that spending $150,000–$250,000 on education has consequences that can last decades — for both the student and the parents.

Parents are allowed to want:

- A reasonable return on their investment

- A degree path that supports financial independence

- A plan that does not jeopardize retirement or emergency savings

Encouraging a child to pursue a low-earning degree at a very high cost is not generosity — it is often financial negligence, even when intentions are good.

That is why education funding should be approached the same way an adult would evaluate a stock or business investment:

- Without emotion

- With realistic assumptions

- With downside risk fully considered

The question is not “Do you love this school?”

The question is “What will this realistically return — and at what risk?”

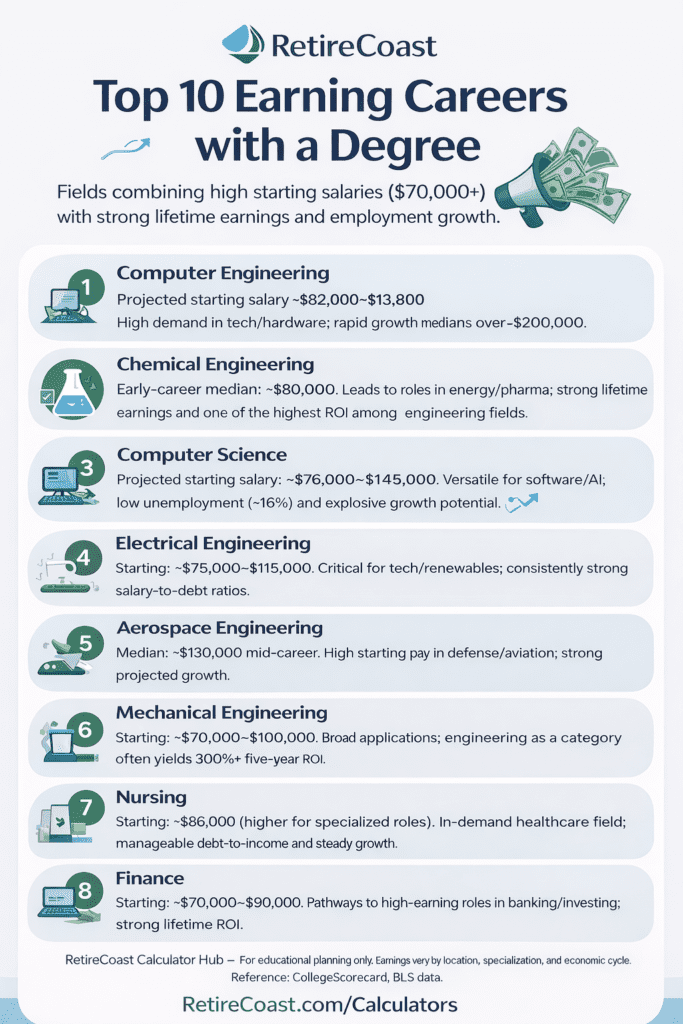

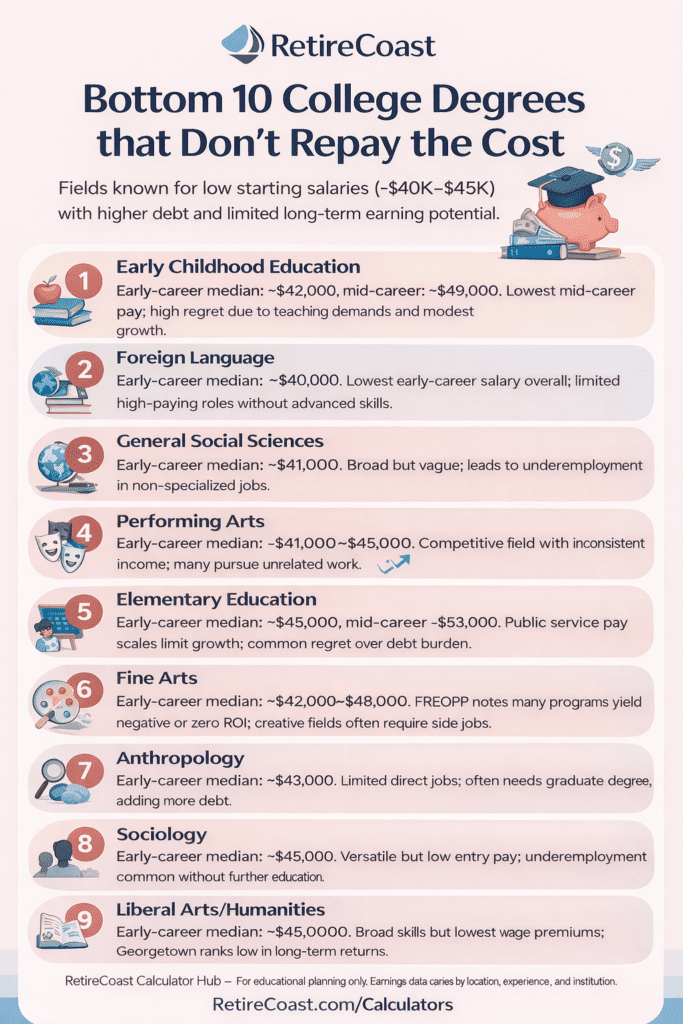

What the Data Shows — and Why It Matters

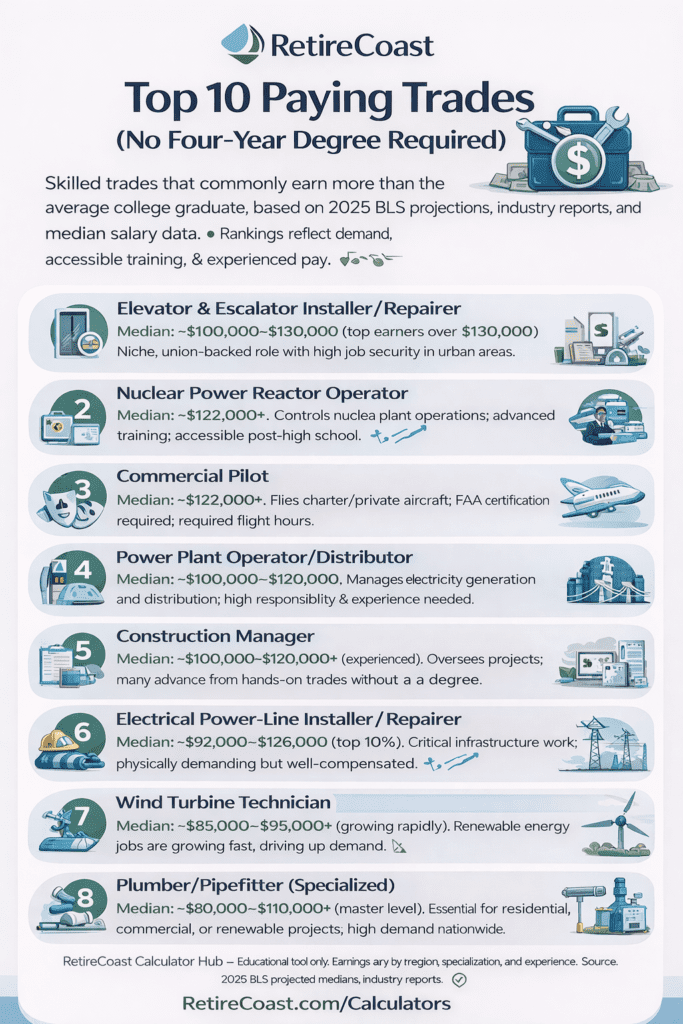

The infographics above exist to remove emotion from the discussion.

They show three important realities:

- Not all degrees repay their cost

Some fields consistently produce low earnings relative to the debt required to obtain them, even decades into a career. - Some degrees offer a strong ROI — even at public institutions

Fields tied to engineering, healthcare, finance, and applied sciences often provide strong earnings with manageable debt. - Many non-college trades outperform the average college graduate

Skilled trades and technical careers — often accessible through apprenticeships and certifications — can generate six-figure incomes without four years of tuition and debt.

None of this means certain paths are “bad” or “wrong.”

It means the cost must match the outcome.

Maturity, Responsibility, and Real-World Consequences

Children and teens are not emotionally mature in the adult sense — and that is not an insult. It is biology.

Their brains are still developing:

- Impulse control

- Long-term risk evaluation

- Emotional regulation under stress

Expecting them to fully grasp the lifetime implications of student debt is unrealistic. That is precisely why parents must act as the financial adults in the room.

A child may passionately argue for an expensive school to pursue a broad liberal arts degree. That passion does not make the decision financially sound — especially when parents are expected to absorb the cost. Its also about how to pay for college.

Saying “no” or “not at that price” is not crushing a dream.

It is modeling adult decision-making.

The Financially Literate Path Forward

A financially literate approach does not eliminate opportunity — it channels it responsibly.

That means:

- Matching degree cost to realistic earnings

- Considering lower-cost schools for the same credential

- Evaluating trade and technical paths with strong income potential

- Protecting emergency savings and retirement plans

- Using tools and data — not emotion — to decide

Education can open doors.

Debt can quietly close them.

The goal is not prestige.

The goal is independence, stability, and a future that works — for the child and the parents who funded the journey.

A four-year college is one path—not the only path. Community college transfers, in-state public universities, trade and technical programs, military and service-based education, apprenticeships, and employer-sponsored training can all lead to stable, well-paying careers.

Financial literacy expands opportunity by preserving flexibility. Choosing a lower-cost path early does not close doors—it often keeps them open longer by protecting savings, reducing debt, and allowing course corrections as interests and abilities evolve.

Parents are not limiting ambition when they insist on affordability. They are modeling adult financial strategies that prioritize long-term stability over short-term emotion.

Closing: Financial Strategies That Survive Reality

Paying for education should not require sacrificing emergency savings, retirement security, or family stability. Parents are not obligated to fund every dream at any cost—but they are obligated to protect the household’s long-term financial health.

Financial strategies do not say “no” to education.

They say “yes—within a plan that survives reality.”

The next section returns to the daily financial strategies that make decisions like this possible in the first place: budgeting income, protecting savings, and planning for the future while still supporting the people you love.

Note to Readers

We are currently exploring the development of an 8-hour, video-based course designed for parents and their child or student to thoughtfully evaluate the full range of education and career pathways—university, community college, trade school, and related options—using many of the concepts introduced in this article.

If produced, the course would be presented by the author, drawing on real-world experience across multiple paths, and supported by practical tools, calculators, and decision frameworks that families can apply to their own situation.

The intent would not be to promote any single outcome or path. Instead, the focus would be on facts, trade-offs, costs, risks, and long-term financial and family impacts, allowing families to make informed decisions without speculation, pressure, or agenda.

Readers who wish to receive future articles on this topic may choose to provide their email address. If a decision is made to move forward with the course, a brief, informational article outlining the structure, tools, and objectives of the course will be shared with those subscribers.

Two Families. Two Approaches. Two Very Different Outcomes.

Sean and Janet moved forward emotionally, hoping they could “figure it out later.” Marlyn and Peter slowed the process down, held a family meeting, researched majors, income potential, alternatives, and return on investment before committing.

Both families cared deeply about their children. The difference was not love or support—it was process. Understanding how to pay for college requires more than reacting to acceptance letters or peer pressure. It requires placing education decisions inside a broader financial plan.

If you’re trying to decide how to pay for college without damaging retirement, cash flow, or long-term security, the right tools and frameworks can change the outcome.

These resources help connect education planning to the bigger picture—so today’s decisions support your family’s future instead of limiting it.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.