How to Make Better Decisions Without Stress, Shame, or False Urgency, Financial Tradeoffs for Millennials

- 1. Why Tradeoffs Matter More Than “Right Answers”

- 2. What a Tradeoff Really Is (and Why We Miss Them)

- 3. Common Tradeoffs Millennials Face (and Why None of Them Are Simple)

- 4. The Hidden Cost of “Doing Nothing”

- 5. How to Evaluate Tradeoffs Without Panic

- 6. Tools That Make Tradeoffs Visible

- 7. Why “Good Enough” Is Often the Best Choice

- Ready to Explore Your Options—Without Pressure?

- Quiz

- FAQ

1. Why Tradeoffs Matter More Than “Right Answers”

Most financial decisions aren’t about choosing something right or wrong. They’re about choosing one outcome over another — now versus later, flexibility versus certainty, or simplicity versus growth.

If you’ve ever felt overwhelmed by options, you’re not behind. You’re not doing anything wrong. You’re simply at a stage of life where decisions start to stack on top of each other: housing, career direction, saving, investing, relationships, family planning, and lifestyle choices. Each decision interacts with the next, which can make everything feel heavier than it needs to be.

What often creates stress isn’t the decision itself — it’s not being able to see the tradeoff clearly.

When tradeoffs stay invisible, choices feel permanent, risky, or emotionally loaded. When tradeoffs are visible, decisions become calmer. You stop asking, “What’s the perfect move?” and start asking, “What am I gaining, and what am I giving up — for now?”

This shift matters. Most long-term financial pressure doesn’t come from one bad decision. It comes from a series of unexamined defaults — renting longer than intended, delaying savings without realizing the impact, or avoiding decisions because they feel too complex.

Understanding tradeoffs doesn’t force you to act faster. It gives you permission to act more intentionally.

As you move through this guide, the goal isn’t to push you toward a specific choice. It’s to help you see how today’s decisions shape future outcomes — so you can choose a path that fits your life, your values, and your tolerance for pressure.

2. What a Tradeoff Really Is (and Why We Miss Them)

A tradeoff isn’t a mistake or a failure to optimize. It’s simply the result of choosing one outcome instead of another.

Every decision carries two sides: what you gain now, and what you postpone—or give up—for later. The challenge is that the benefits are usually immediate and visible, while the costs tend to be delayed, subtle, or abstract. That imbalance makes tradeoffs easy to overlook, even when they matter.

This is why many decisions feel heavier than they should. When tradeoffs aren’t clearly defined, choices can feel permanent or risky, even when they’re not. Renting longer than planned may feel “safe,” but it quietly trades long-term stability for short-term flexibility. Delaying savings might relieve cash flow today, while reducing options years down the road.

Another reason tradeoffs are easy to miss is that many of them arrive disguised as defaults. Automatic payments, minimum balances, standard advice, and social expectations all encourage decisions that don’t require active choice. Over time, those defaults can shape outcomes just as strongly as intentional plans.

It’s also common to mistake complexity for danger. When a decision involves unfamiliar numbers or long timelines, avoiding it can feel like the responsible move. In reality, avoidance is still a choice—it just leaves the tradeoff unexamined.

Understanding what a tradeoff really is doesn’t force you to act. It gives you clarity. Once you can name what you’re gaining and what you’re delaying, decisions become less emotional and more manageable. You stop reacting to pressure and start responding with intention.

The goal isn’t to eliminate tradeoffs. That isn’t possible. The goal is to see them clearly enough to choose the ones you can live with—today and in the future.

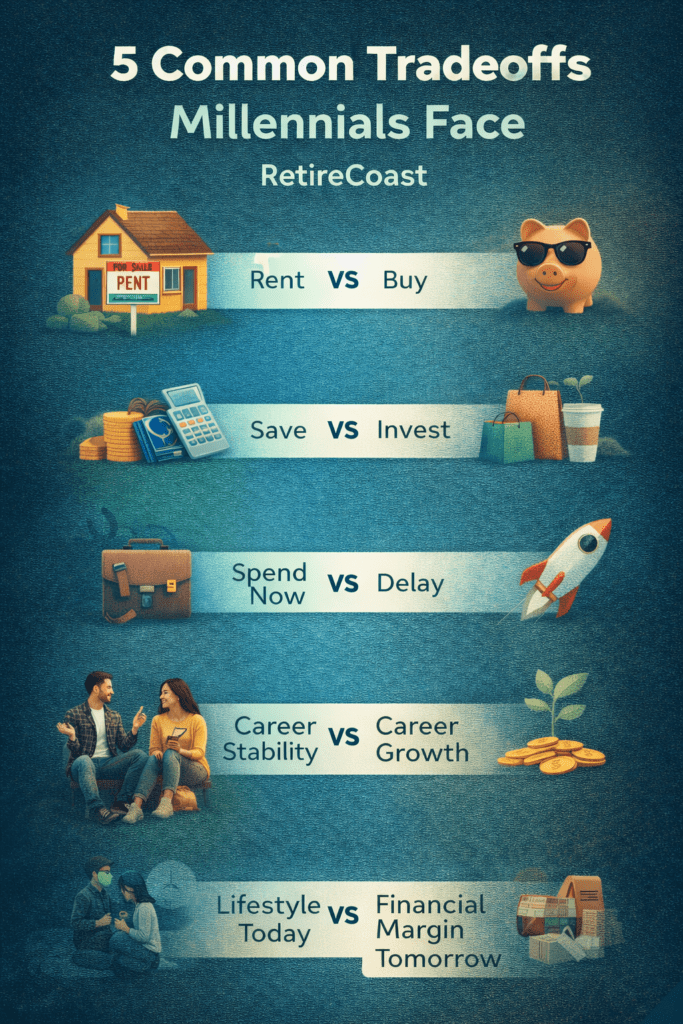

3. Common Tradeoffs Millennials Face (and Why None of Them Are Simple)

Most tradeoffs don’t appear as single, dramatic moments. They show up as everyday decisions that quietly influence future outcomes. What makes them difficult isn’t a lack of information—it’s that the “right” choice often depends on timing, priorities, and how much flexibility you want to preserve.

Below are some of the most common tradeoffs millennials face, along with why they’re rarely as straightforward as they seem.

Rent vs Buy

This decision is often framed as a milestone, but in reality it’s a tradeoff between flexibility and long-term stability.

Renting can offer mobility and predictable monthly costs. Buying can build equity and provide longer-term housing security, but often with higher upfront and ongoing responsibilities. Neither option is automatically better—what matters is understanding what you’re trading.

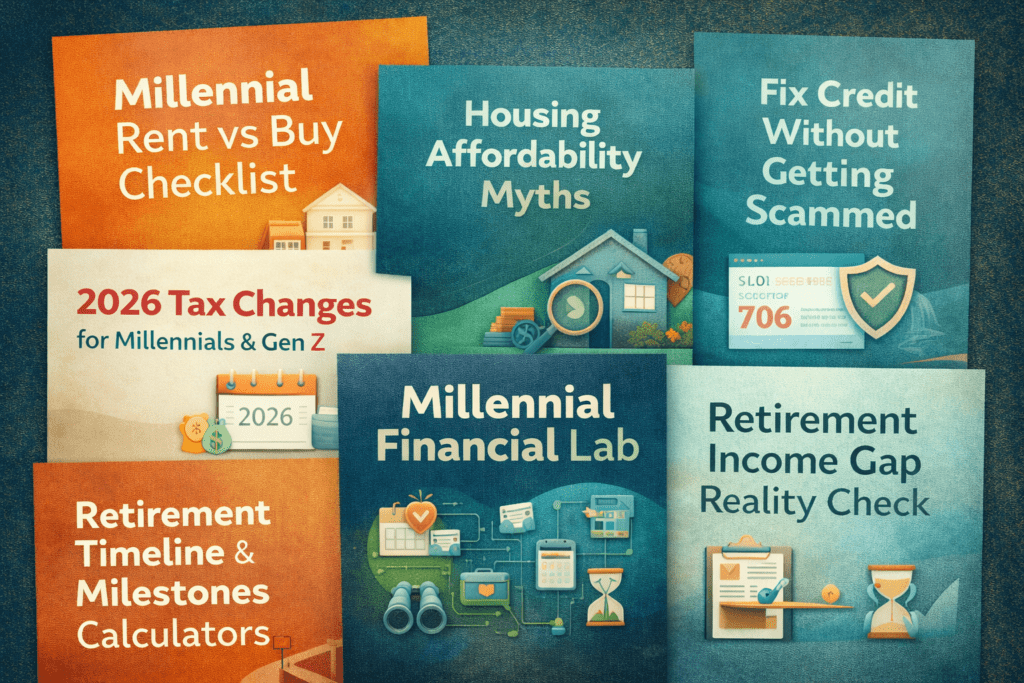

If you’re weighing this decision, the Millennial Rent vs Buy Checklist helps break the choice down without pressure, and the housing affordability myths many people assume to be true are worth rethinking before committing either way.

Save vs Invest

This tradeoff is about certainty versus growth.

Saving prioritizes accessibility and peace of mind. Investing prioritizes long-term potential, but comes with uncertainty and time horizons that can be hard to visualize. For many millennials, this decision is further complicated by changing tax rules, which is why understanding 2026 tax changes affecting millennials and Gen Z can make a real difference in how savings and investments perform over time.

Choosing between saving and investing isn’t about discipline—it’s about deciding which type of pressure you want to reduce first.

Spend Now vs Delay

Spending decisions often feel emotional because they touch enjoyment, identity, and lifestyle.

Spending now can improve quality of life and reduce burnout. Delaying spending preserves options and creates margin for future choices. This tradeoff becomes easier to navigate once cash flow and priorities are clearer, which is where the broader planning tools inside the Millennial Financial Lab are designed to help—without judgment or urgency.

Career Stability vs Career Growth

Career decisions often involve choosing between predictability and potential.

Stability can lower stress and provide consistent income. Growth can increase earning power and future options, but usually involves risk. Many millennials move back and forth between these priorities throughout their careers, and that’s not inconsistency—it’s normal adaptation.

Clear financial footing, including healthy credit, makes these transitions easier. If credit concerns are part of the equation, learning how to fix credit without getting scammed can remove unnecessary friction from career-related decisions.

Lifestyle Today vs Financial Margin Tomorrow

Lifestyle choices don’t always feel like financial decisions, but they often carry the longest-lasting tradeoffs.

Upgrading housing, travel, subscriptions, or daily conveniences can improve life today. Preserving financial margin creates resilience when life changes unexpectedly. This tradeoff often happens quietly, through habits rather than big decisions—which is why clarity matters more than restriction.

These examples aren’t meant to push you toward a specific choice. They’re meant to show that tradeoffs are everywhere, and that understanding them reduces stress, removes guilt, and makes decisions feel less permanent.

In the next section, we’ll look at what happens when tradeoffs stay invisible—and why “doing nothing” can quietly become the most influential choice of all.s remain invisible—and why “doing nothing” can quietly become the most influential choice of all.

4. The Hidden Cost of “Doing Nothing”

Doing nothing often feels like the safest choice. When options are unclear or overwhelming, waiting can feel responsible—even wise. In reality, “doing nothing” isn’t neutral. It’s simply a decision that allows existing patterns to continue.

Most financial pressure doesn’t come from one dramatic mistake. It comes from unexamined defaults that quietly shape outcomes over time. Rent increases continue. Savings opportunities pass. Career paths narrow or widen on their own. None of this happens because of a bad choice—it happens because no choice was made at all.

A great reference: https://www.federalreserve.gov/consumerscommunities/shed.htm

The challenge is that the cost of inaction is rarely immediate. It doesn’t announce itself with a bill or a deadline. Instead, it shows up gradually as fewer options, tighter timelines, or increased stress later on. By the time the impact becomes visible, the original decision point is often long gone.

Avoidance can also create a false sense of control. Waiting may reduce short-term anxiety, but it often increases long-term pressure. When decisions are postponed without clarity, they tend to resurface later—usually with less flexibility than before.

This doesn’t mean you need to act quickly or decisively. It means that awareness matters. Even choosing to delay intentionally—knowing what you’re trading—puts you back in control. You’re no longer reacting to circumstances; you’re acknowledging them.

Understanding the hidden cost of doing nothing isn’t about creating urgency. It’s about restoring agency. When you recognize that inaction carries its own tradeoffs, you can decide whether they’re acceptable—or whether a small, thoughtful adjustment today could make tomorrow feel easier.

In the next section, we’ll look at how to evaluate tradeoffs calmly, without pressure, and without needing to predict the future perfectly.

5. How to Evaluate Tradeoffs Without Panic

When decisions feel heavy, the instinct is often to either rush toward relief or avoid the choice altogether. Neither approach helps with financial tradeoffs for millennials, especially when those choices affect years—not weeks—of future outcomes.

A calmer approach starts by reframing what you’re actually deciding.

Most choices aren’t permanent. They’re long-term financial decisions that unfold in stages, not single moments. Evaluating tradeoffs doesn’t require certainty about the future—it requires clarity about what you’re choosing right now.

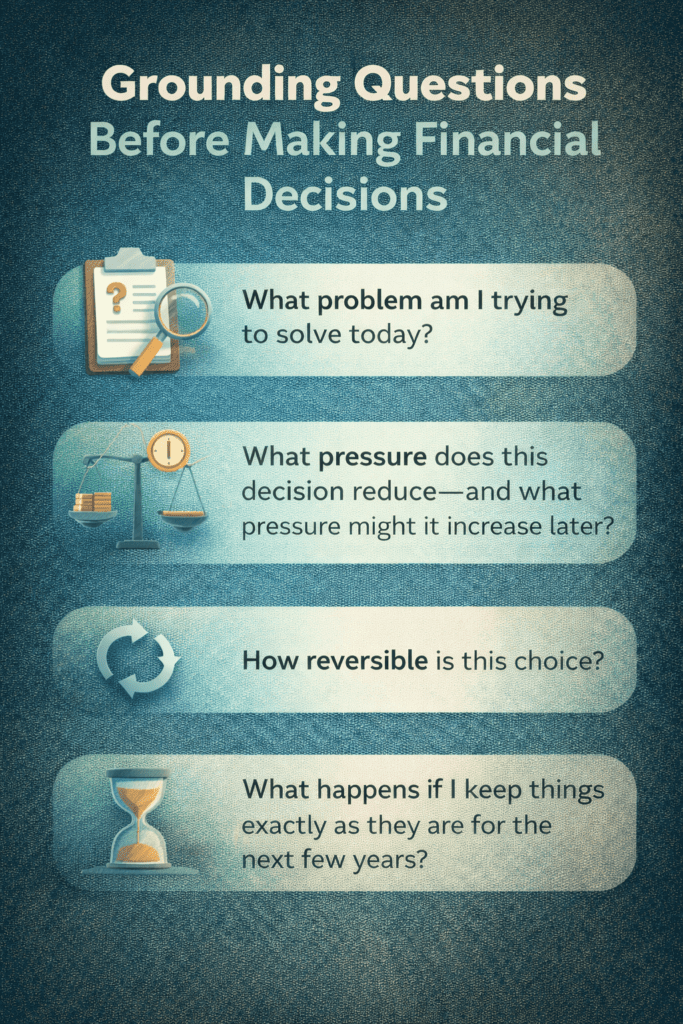

A helpful way to slow the process down is to ask a few grounding questions:

- What problem am I trying to solve today?

- What pressure does this decision reduce—and what pressure might it increase later?

- How reversible is this choice?

- What happens if I keep things exactly as they are for the next few years?

These questions work because they shift your focus away from outcomes you can’t control and back toward choices you can.

For example, rent vs buy decisions often feel overwhelming because they’re framed as lifetime commitments. In reality, they’re tradeoffs between flexibility and stability at a specific point in time. The same is true for save vs invest tradeoffs, which are less about doing the “right” thing and more about deciding which form of uncertainty you’re most comfortable carrying for now.

Panic usually comes from feeling boxed in. Clarity restores space.

You don’t need to map out your entire future to move forward. You only need enough understanding to choose the tradeoff that fits your current priorities—and the confidence to revisit that choice as life changes.

The goal isn’t to eliminate risk or guarantee results. It’s to make decisions that feel intentional instead of reactive, allowing progress without pressure.

6. Tools That Make Tradeoffs Visible

Some decisions feel overwhelming not because they’re complicated, but because too much is happening at once. Housing affects cash flow. Cash flow affects saving. Saving affects flexibility. When choices overlap, it becomes difficult to see which tradeoff actually matters most.

This is where tools help—not by giving answers, but by making financial tradeoffs for millennials visible.

Seeing numbers, timelines, and scenarios side by side reduces emotional pressure. It turns vague concern into something you can evaluate calmly. Instead of guessing how a decision might affect you, tools allow you to explore how different paths shape long-term financial decisions over time.

An excellent resource: 👉 https://www.consumerfinance.gov/consumer-tools/

For example, housing choices often feel permanent when they don’t need to be. Tools like the Millennial Rent vs Buy Checklist help break that decision into manageable pieces, while unpacking common assumptions highlighted in housing affordability myths that quietly push people toward choices that may not fit their situation.

Other tradeoffs are harder to see because they happen in the background. Tax changes, take-home pay, and timing can quietly influence how much flexibility you actually have. Understanding 2026 tax changes affecting millennials and Gen Z helps connect income decisions today with real outcomes later—without focusing on filing or deadlines.

Credit is another hidden constraint. It often limits options long before a decision is made, affecting housing, career moves, and borrowing costs. Learning how to fix credit without getting scammed removes uncertainty so credit stops being an invisible barrier and becomes a tool you control.

When decisions stretch further into the future—especially around saving and retirement—visibility matters even more. Tools like retirement timelines and income gap calculators don’t require you to commit to a plan. They simply show what changes if you adjust direction now versus later, making future outcomes feel less abstract and more manageable.

All of these tools come together inside the Millennial Financial Lab, where housing, cash flow, credit, taxes, and timelines connect. The goal isn’t optimization. It’s understanding how one choice affects another—so decisions feel intentional instead of reactive.

Used this way, tools don’t create urgency. They restore agency.

In the next section, we’ll explore why choosing “good enough” is often more powerful than waiting for the perfect answer—and how that mindset reduces pressure over time.

7. Why “Good Enough” Is Often the Best Choice

One of the most common reasons decisions stall is the belief that there’s a perfect answer waiting to be found. In practice, most financial tradeoffs for millennials don’t resolve into a single correct outcome—they exist within a range of choices that are all workable in different ways.

Waiting for certainty can quietly increase pressure. When decisions are delayed in search of the ideal outcome, options often narrow rather than improve. Choosing something that is good enough allows movement without locking you into a rigid path, which is especially important for long-term financial decisions that naturally evolve over time.

This is easy to see in familiar situations. Rent vs buy decisions, for example, are often framed as permanent commitments, when they’re really temporary tradeoffs between flexibility and stability at a specific stage of life. The same is true for save vs invest tradeoffs, which don’t require perfect timing to be effective—only reasonable alignment with your current priorities and tolerance for uncertainty.

Choosing “good enough” doesn’t mean settling or lowering standards. It means recognizing that progress comes from intentional action, not optimization. Small, thoughtful steps tend to create more clarity than waiting for conditions that may never feel perfect.

Good decisions aren’t defined by flawless execution. They’re defined by awareness, adaptability, and the confidence to revisit choices as circumstances change. When you allow yourself to move forward without pressure, decisions feel lighter—and far more sustainable.

Ready to Explore Your Options—Without Pressure?

You don’t need to decide everything today. You just need enough clarity to take the next thoughtful step.

If you want to see how different choices play out over time—without judgment, urgency, or “one right answer”—the Millennial Financial Lab brings these tools together in one place. Explore scenarios, compare tradeoffs, and move forward at your own pace.

Explore the Millennial Financial Lab →

Quiz

Quick Quiz: How Do You Usually Make Financial Decisions?

There are no right or wrong answers. Choose the option that feels most like you right now.

FAQ

Frequently Asked Questions

These answers are designed to reduce pressure and increase clarity—without pushing you toward a single “right” choice.

1) What does “tradeoff” mean in personal finance?

2) Why do financial decisions feel so stressful sometimes?

3) Is avoiding a decision the same as making one?

4) How do I decide between rent and buy without pressure?

5) Should I focus on saving or investing first?

6) What does “good enough” mean for a financial choice?

7) How do I know if a decision is reversible?

8) Why do small choices matter more than big “milestones”?

9) Do tools and calculators actually help, or do they create more stress?

10) What’s one small step that can reduce pressure this week?

Tip: If you want these FAQs to be more SEO-focused, add 1–2 internal links inside the answers (sparingly) and keep each answer under ~70–90 words.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.