Last updated on December 17th, 2025 at 02:25 pm

Gen X Retirement Fears: The Real Reason Money Anxiety Runs Deep

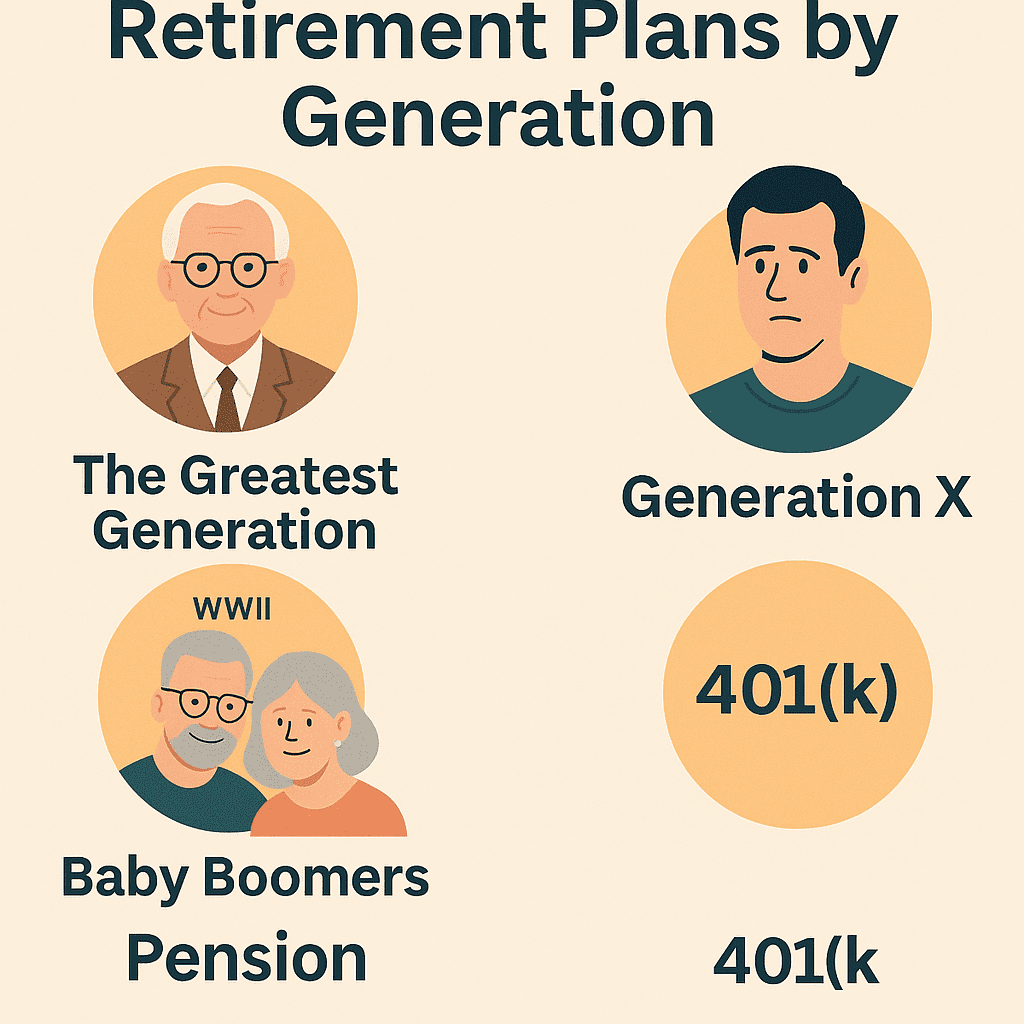

As a Baby Boomer, I grew up in a world where retirement planning wasn’t a dinner table topic. My parents both earned defined benefit pensions—steady checks that guaranteed them a comfortable life after work. My parents didn’t worry about investment returns or contribution limits, and frankly, neither did I (not like our children with their Gen X retirement fears).

When I entered the private sector in my 20s and 30s, my first employer offered a pension plan, and my second job provided an even better retirement benefit plus a 401(k). With those safety nets in place, I never felt an urgency to plan for retirement on my own. But then things changed.

When I started my own business

When I struck out to start my own business, the pension safety net disappeared. Suddenly, I had to take responsibility for my retirement future—just as many Baby Boomers did when companies began phasing out defined benefit pensions in favor of 401(k) plans. For the first time, we had to actively plan, save, and manage our retirement money.

Gen X inherited this new reality, but without the example of parents who had ever discussed the financial side of retirement. Unlike Boomers, who could fall back on pensions during their early working years, Gen X became the first generation to face retirement entirely without that safety net. Today, many are discovering the consequences: more than 70% of Gen Xers say they fear running out of money in retirement more than death itself.

This article explores why that fear has become so widespread, the unique pressures Gen X faces compared to other generations, and—most importantly—the practical solutions that can turn uncertainty into security. Read our pillar post article, Ultimate Guide for Gen X.

Section 2: The Retirement Savings Gap

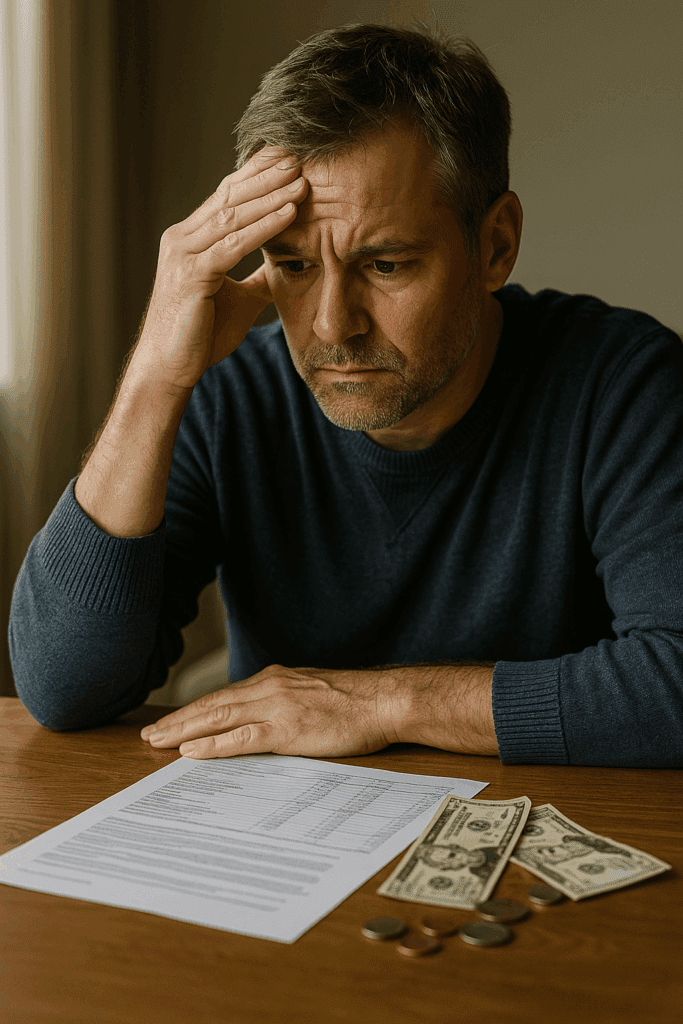

For David and Maria, both in their late 40s, life has been a balancing act. They’ve managed to pay the mortgage, help their oldest child through college, and keep up with everyday expenses. But when they finally sat down to review their retirement accounts, the reality hit them: after 20 years of working, they had less than $150,000 saved.

With retirement creeping closer, they began to wonder how they could ever bridge the gap between what they had and what they would need.

They’re not alone. Surveys show that Gen Xers estimate they’ll need around $1.5 million to retire comfortably, but have saved only about $108,600 on average. That leaves a shortfall of more than a million dollars — a staggering gap to close with just a decade or two left in the workforce. Unlike Baby Boomers, who often had pensions to supplement their savings, Gen Xers are navigating retirement almost entirely on their own. This leads to Gen X retirement fears.

The timing of family life

For many, the timing of family life has made things even more difficult. A large portion of Gen Xers started their families later than their parents, often not until their mid-30s. This put them at a disadvantage, particularly as the cost of college tuition skyrocketed.

Too many Gen X parents co-signed on student loans that now stretch far into their retirement years. To make matters worse, a sizable number of their children have little ability — or willingness — to repay those debts, leaving their parents burdened at a time when they should be catching up on retirement savings.

This mismatch between expectations and reality feeds directly into the fear of running out of money. Many Gen X households find themselves stuck: too young to retire, but old enough to realize they don’t have as much time left to recover from missed opportunities. Every new expense — a roof replacement, an aging parent’s medical bill, or another tuition payment — chips away at savings that were already behind schedule.

The retirement savings gap isn’t just a financial issue; it’s an emotional one. For Gen X, seeing that gap in black and white reinforces the anxiety that retirement could be defined by scarcity rather than security.

Section 3: The “Fragile Decade”

Karen, age 61, has been counting down the years until she can step away from her corporate job. Her retirement account looks healthy at first glance — just over $600,000 — but every time she checks the stock market, she feels a wave of panic.

What if a downturn wipes out a quarter of her savings just as she plans to retire? She remembers watching her parents lose value during the 2008 crash, and she fears she won’t have enough time to recover if it happens again.

Financial experts call this period the “fragile decade” — the five years before and after retirement. It’s fragile because withdrawals begin at the very moment retirement portfolios are most vulnerable to market swings. For Gen Xers entering their late 50s and early 60s, this reality can be terrifying.

One ill-timed recession could mean the difference between a stable retirement and running out of money too soon. More reasons why Gen X has retirement fears.

Unlike Boomers, who often had pensions to cushion the blow, Gen Xers are exposed almost entirely to the ups and downs of their 401(k)s and IRAs. Sequence-of-returns risk — the danger of experiencing market losses early in retirement while drawing down savings — is one of the least understood but most dangerous financial threats they face.

For Gen X, the fragile decade amplifies the fear that already looms large: that even decades of work and saving won’t be enough. The uncertainty of when to retire, how much to withdraw, and whether the market will cooperate only deepens the anxiety that 70% of this generation already reports.

You’re Not Alone

By this point in the article, it may feel like everything we’re presenting is negative. Bear with us — solutions are coming.

The purpose of sharing these challenges is to help you recognize that you are not alone in your fears and anxieties about retirement. Many Gen Xers feel exactly the same way.

👉 The good news? The solution is to create a clear plan — and in the next sections we’ll show you practical steps to take control.

Section 4: Lifestyle Shifts — Why Senior Living Is Changing for Gen X

Mike, age 56, recently toured a new retirement community near his hometown. Instead of the quiet halls he remembered from visiting his grandparents’ facility, this place had a coffee bar, a pickleball court, a coworking space, and even an outdoor firepit for evening gatherings.

It felt more like a resort than a nursing home. Mike loved the idea of staying socially active, but when he saw the monthly costs, his excitement quickly turned to concern. Would his savings be enough to afford the kind of lifestyle he wanted in retirement?

Gen Xers are approaching retirement with different expectations than Boomers. They want communities that offer connection, activity, and independence, not just medical support. Developers are responding by adding amenities like gyms, craft studios, and event programming designed to appeal to a generation that values both convenience and quality of life.

The problem, of course, is cost. Premium senior living options come with premium price tags — and that collides directly with Gen X’s financial insecurity. Many in this generation fear being forced to settle for less, not because they don’t want more, but because their budgets won’t allow it. This disconnect between desired lifestyle and financial readiness feeds into the broader anxiety about retirement.

What makes the situation more complex is timing. Gen Xers aren’t fully retired yet, so they are peering into the future with uncertainty: trying to imagine what kind of community they’ll afford, whether they’ll need to keep working, or if they’ll have to scale back expectations entirely. The fear isn’t just about running out of money — it’s about running out of options for the life they want to live.

Section 5: The Confidence Crisis

Sharon, age 59, thought she’d be ready to retire by 62. She has a solid career behind her, a home that’s nearly paid off, and children who are financially independent. Yet every time she sits down with her retirement statements, she hesitates. What if her savings won’t last? Healthcare costs may spiral. What if the market takes a dive just as she stops working? The uncertainty has left her frozen. Instead of setting a retirement date, she keeps saying, “Maybe I’ll work just a few more years.”

Her story is echoed across the Gen X generation. Surveys reveal that nearly half of Gen Xers lack confidence in their ability to retire on their own terms. That lack of confidence often leads to indecision: delaying retirement, working longer than planned, or avoiding the topic altogether.

Unlike Boomers, who could lean on pensions, or Millennials, who still have decades to adjust, Gen Xers are stuck in a tight window. They know they should have more saved by now, but life expenses, caregiving responsibilities, and market uncertainty have chipped away at their confidence. Even those with respectable balances in their 401(k)s wonder if it’s enough more Gen X retirement fears.

Crisis is psychological, too!

This crisis of confidence is as much psychological as it is financial. The constant barrage of headlines about retirement shortfalls and Social Security’s uncertain future only adds to the sense that Gen X is on shaky ground.

It does not help anyone when all you see on TV, the internet, or in many podcasts is doom and gloom, such as predictions that the Social Security system will collapse and not be there for you. It’s truly unfortunate that negative reinforcement seems to be all you can get from the media.

Read further, because there is light at the end of the tunnel. The solutions are real, and Gen X still has the time and tools to take control — but it starts with separating fact from fear and building confidence through planning.

Section 6: Hidden Pressures on Gen X

Anthony and Michelle, both in their mid-50s, thought this stage of life would finally be about preparing for retirement. Instead, they find themselves squeezed from both sides. Michelle’s mother recently moved in after a health scare, adding new medical bills and daily care responsibilities.

At the same time, their youngest daughter is still living at home after college, unable to afford rent while paying off her student loans. Anthony and Michelle aren’t just planning for retirement — they’re supporting two generations while trying to save for their own future.

This is the reality for millions of Gen Xers caught in the “sandwich generation.” They are caring for aging parents who need support while simultaneously helping adult children who aren’t yet financially independent. That means more bills, less savings, and a constant sense of being stretched thin.

The Weight of Healthcare Costs

Healthcare is a major burden, and it’s only growing heavier. Premiums, deductibles, and out-of-pocket costs continue to climb, and Gen X knows Medicare won’t cover everything. Long-term care, whether for parents now or for themselves later, is an especially daunting concern — with nursing home costs often exceeding $90,000 a year.

Possible Solutions:

- Health Savings Accounts (HSAs): For those still working, maxing out HSA contributions provides triple tax benefits — contributions are deductible, growth is tax-free, and withdrawals for medical expenses are tax-free.

- Long-Term Care Insurance or Hybrid Policies: Buying coverage in your 50s can protect against the steep costs of future care. Some life insurance policies also include long-term care riders.

- Preventive Health Focus: Investing in fitness, nutrition, and wellness today can reduce the likelihood of costly chronic conditions later.

Student Loan and Family Debt Pressures

Many Gen Xers started families later than their parents, often in their mid-30s. This delayed timeline collided with skyrocketing college tuition. Too many Gen Xers co-signed student loans that now stretch into their retirement years. When adult children struggle to repay, parents end up shouldering the debt well into their 50s and 60s.

Possible Solutions:

- Refinancing Student Loans: Parents and children together can explore refinancing at lower interest rates to reduce the burden.

- Family Repayment Plans: Establishing a clear repayment agreement with children helps avoid resentment and keeps retirement planning on track.

- Limit Ongoing Support: Offering adult children financial help may feel generous, but setting firm boundaries ensures parents don’t compromise their retirement security.

The Cost of Caring for Aging Parents

From groceries to in-home care aides, many Gen Xers are covering expenses their parents didn’t plan for. This can drain retirement accounts if not carefully managed.

Possible Solutions:

- Pooling Family Resources: Sharing caregiving duties and costs with siblings spreads the load.

- Government and Community Programs: Medicaid planning, veterans’ benefits, and local senior assistance programs can offset costs.

- Legal Preparation: Helping parents establish wills, healthcare directives, and power of attorney documents reduces future stress and potential financial chaos.

The Bigger Picture: Balancing Support and Self-Preservation

The hidden pressures Gen X faces are real, but the critical step is recognizing that saving yourself must come first. It’s often said, “You can’t pour from an empty cup.” Providing unlimited financial support to parents or children at the expense of your own retirement security only ensures that the cycle of financial strain continues. Again, more Gen X retirement fears.

Setting boundaries, planning for healthcare, and making intentional choices about debt repayment are not selfish acts — they are necessary steps to secure both your future and your family’s stability.

Section 7: Real Solutions — How Gen X Can Take Control

After months of avoiding the conversation, Lisa, age 54, finally sat down with a financial advisor. She had been carrying the same fears as so many in her generation: too little saved, too many bills, and too much uncertainty. But instead of dwelling on what she couldn’t change, her advisor focused on what she could control. That shift — from fear to action — was the turning point.

The good news is that Gen X still has time. Retirement may be closer than it once felt, but there are powerful strategies that can help bridge the gap and reduce anxiety. The key is creating a plan that balances reality with opportunity. Read more about planning here.

Want to compare retirement accounts that can help reduce taxes now or later? Use this guide to understand the most common tax-advantaged options and how they typically work.

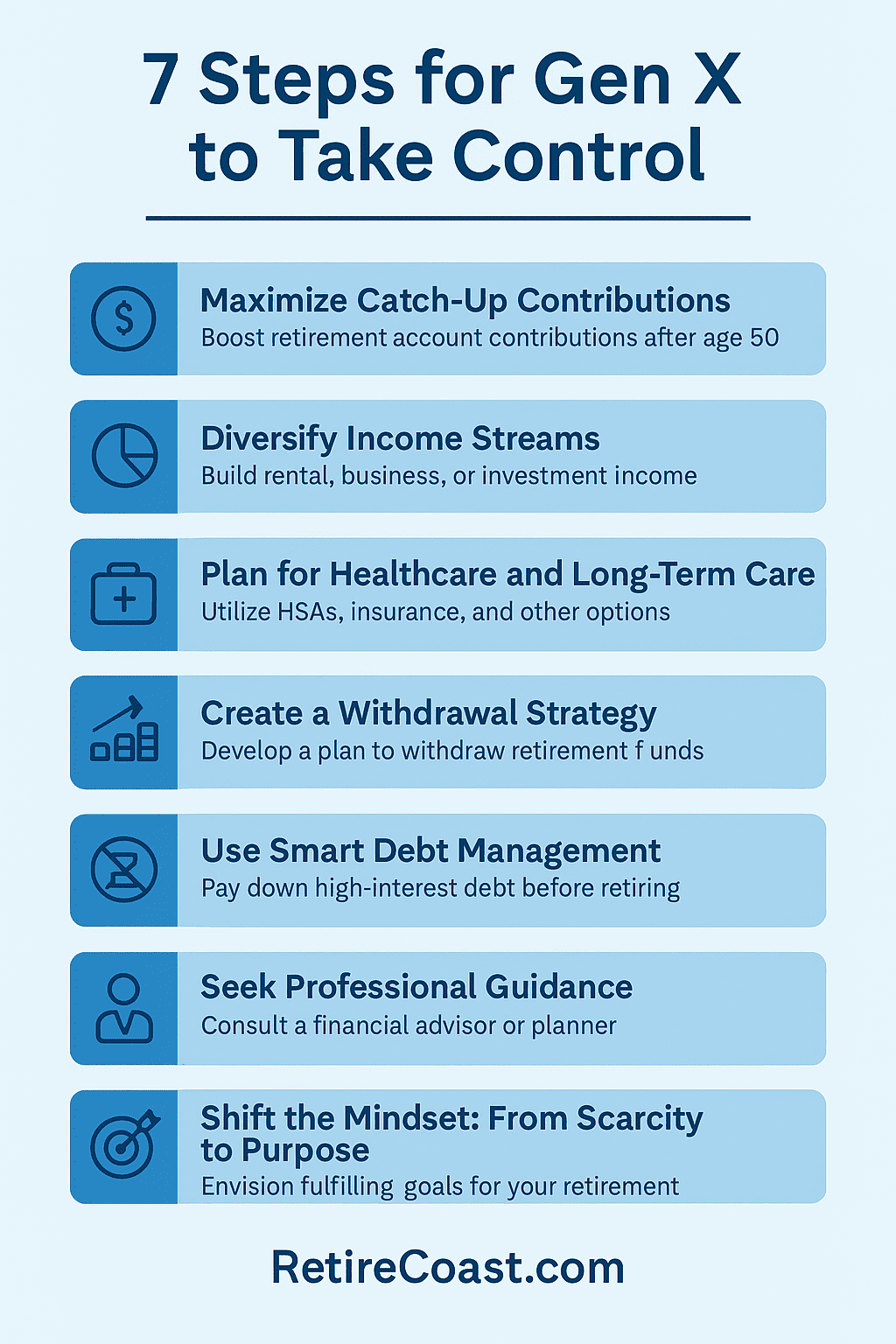

Read the guide →1. Maximize Catch-Up Contributions

Once you hit age 50, the IRS allows extra contributions to retirement accounts:

- 401(k): an additional $7,500 in 2025 (on top of the $23,000 standard).

- IRA: an additional $1,000 in 2025.

Example: If a 52-year-old contributes the max 401(k) plus catch-up ($30,500 annually) and earns 6% returns, they could add over $400,000 to their nest egg by age 67.

Action Step: Increase contributions by 1–2% every year until you reach the catch-up max. Many payroll systems allow automatic increases. Check out our entire article about Gen X and 401(k) here.

2. Diversify Income Streams

Relying solely on a 401(k) is risky. Gen X can create resilience by building multiple sources of retirement income:

- Real Estate: Rental properties, REITs, or house hacking. Build wealth through home ownership.

- Side Businesses: Consulting, coaching, or leveraging existing skills.

- Dividend Stocks or Annuities: Provide steady cash flow to cover baseline expenses.

Action Step: Identify one new income source you can begin testing in the next 12 months, even if it starts small.

3. Plan for Healthcare and Long-Term Care

Medical costs are one of the biggest unknowns. Without planning, they can drain savings.

- HSAs: Triple-tax advantage (deductible contributions, tax-free growth, tax-free withdrawals).

- Supplemental Insurance: Protects against gaps in Medicare.

- Long-Term Care (LTC) Insurance: Consider hybrid life/LTC policies to protect assets.

Action Step: Run a projection of your healthcare costs using a retirement planning tool — then earmark funds or insurance to cover them.

4. Create a Withdrawal Strategy

The classic “4% rule” isn’t enough anymore. Gen X needs flexibility:

- Bucket Strategy: Divide savings into short-term (cash), medium-term (bonds), and long-term (stocks).

- Guardrail Approach: Adjust withdrawals up or down depending on portfolio performance.

- Bridging Strategy: Use part-time work or rental income in the first years of retirement to let investments grow.

Action Step: Draft a withdrawal plan that covers at least the first 10 years of retirement, then revisit annually.

5. Use Smart Debt Management

Carrying debt into retirement magnifies fear. Paying down high-interest debt now can free up future cash flow.

- Prioritize credit cards and personal loans first.

- Consider downsizing a home to eliminate mortgage payments.

- Refinance or consolidate student loans where possible.

Action Step: Make a “debt-free by retirement” plan with milestones and dates.

6. Seek Professional Guidance — Without Losing Control

Many Gen Xers prefer DIY investing, but fear often stems from uncertainty. A professional advisor can help stress-test your plan and uncover blind spots. Look for fee-only fiduciaries who are required to put your interests first.

Action Step: Schedule at least one consultation with a fiduciary advisor to validate your current plan.

7. Shift the Mindset: From Scarcity to Purpose

Fear thrives in the unknown. When you have a clear vision of what you want retirement to look like — whether it’s part-time work, travel, volunteering, or starting a second-act business — the financial planning becomes a tool, not a burden.

Action Step: Write a one-page “retirement vision statement” describing your goals, lifestyle, and priorities. Use this as your compass for every financial decision.

For Lisa, the plan didn’t erase every worry, but it gave her a roadmap. Instead of lying awake at night fearing the unknown, she had specific actions to take and milestones to hit. That’s the real solution for Gen X: replace fear with a plan, and turn uncertainty into empowerment.

8. Budgeting

Planning ahead requires more than saving and investing — it requires the discipline of a solid budget. A budget is not just about tracking spending; it is an integral part of your overall retirement plan and one of the most important tools for ensuring long-term success.

The best solution is to use our free budget planning tool, which walks you step-by-step through the process of building a realistic financial picture. By entering your expected expenses and income sources — including retirement income streams — you can fine-tune your plan and see how everything works together.

The tool also allows you to make assumptions on return on investment, giving you a way to stress-test your future against different scenarios.

Budgeting may not sound exciting, but it is the foundation for confidence. When you can see exactly where your money will come from and how it will be spent, fear starts to fade. Our detailed article and tool will help you build, refine, and adjust your budget — ensuring it becomes a living roadmap for your retirement journey.

📌 Try it here: Free Gen X Retirement Budget Planning Tool

8. Social Security Strategies

For Gen X, one of the most powerful levers in retirement planning is how and when you claim Social Security. The difference between taking benefits at age 67 versus waiting until age 70 can mean hundreds of dollars more per month for the rest of your life.

Example:

If your full retirement age benefit (at 67) is $2,200 per month, delaying until age 70 could increase your benefit by roughly 8% per year — giving you about $2,728 per month. That’s an additional $528 per month, or more than $6,300 per year. Over a 20-year retirement, waiting those extra three years could add well over $120,000 in lifetime income.

Another key strategy is to ensure your earnings history is solid. Only work for employers who deduct Social Security taxes and match your contributions. Every qualifying paycheck builds toward your future benefit, and gaps in contributions can lower your final monthly payout.

How can I maximize earnings for Gen-X Social Security📌 Want a deeper dive? Read our full article on Gen X Social Security strategy to learn how timing, earnings, and work choices can maximize your benefit.

Section 8: Redefining Retirement — Purpose Beyond Finances

When Paul, a 58-year-old IT manager, thinks about retirement, he doesn’t picture sitting in a rocking chair. Instead, he imagines launching a small woodworking business he’s dreamed about since college, traveling with his wife to places they’ve always wanted to see, and volunteering with local youth programs. For him, retirement isn’t an ending — it’s a chance to finally shape life on his own terms.

This is the opportunity Gen X has before them: to redefine retirement not as a stage of decline, but as a third act of purpose and fulfillment. Yes, the financial fears are real — but money is only one part of the equation. What you do with your time, your skills, and your passions can be just as important as how much is in your retirement account.

Finding Purpose in the “Third Quarter of Life”

Experts sometimes call the years between ages 50 and 75 the third quarter of life. It’s a stage filled with unique opportunities:

- Pursuing passion projects or second-act careers, such as starting a business (read more here)

- Spending more time with family and building deeper connections.

- Exploring lifestyle changes like downsizing, relocating, or traveling.

- Giving back through mentoring, volunteering, or community work.

Why Purpose Matters as Much as Money

Studies show that retirees who stay engaged — mentally, physically, and socially — enjoy longer, healthier, and more fulfilling lives. For Gen X, that means planning for both finances and lifestyle choices. Building a retirement vision that includes hobbies, side ventures, or social engagement can make the numbers on a savings statement feel less intimidating.

Balancing Practicality and Dreams

It’s important to acknowledge that financial security and purpose go hand in hand. A plan that combines steady income with meaningful activities is more sustainable — and more satisfying — than one that focuses only on dollars and cents.

For Gen X, the challenge is real, but so is the opportunity. Retirement doesn’t have to be defined by fear of running out of money. With the right plan and a clear sense of purpose, it can become the most rewarding chapter yet.

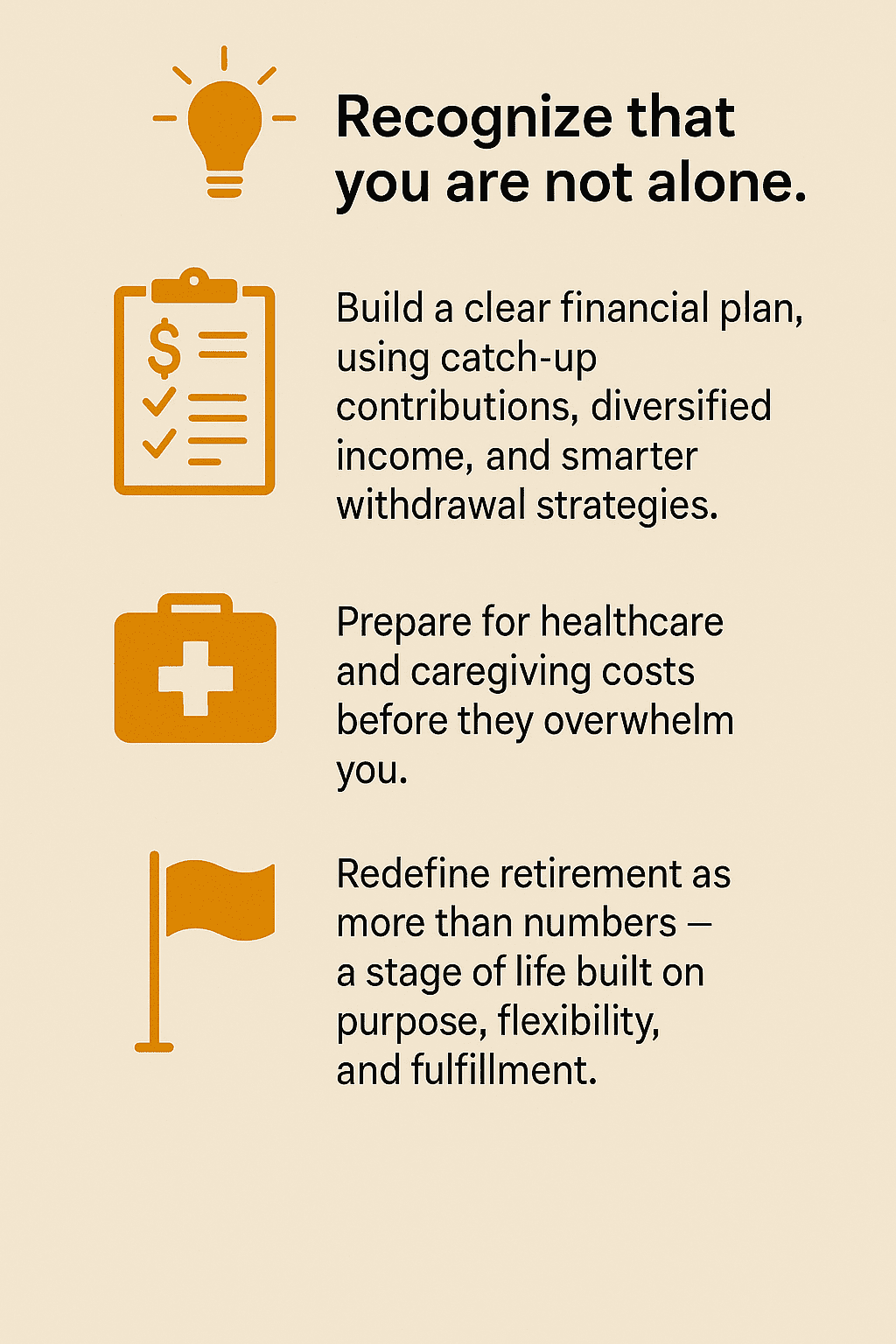

Section 9: Conclusion — From Fear to Action

For Gen X, the fear of running out of money in retirement is both widespread and deeply personal. Surveys confirm that more than 70% of this generation worries about financial security more than death itself. And after reviewing the savings gap, the fragile decade, lifestyle pressures, and hidden burdens, it’s easy to see why.

But fear alone doesn’t define Gen X. What sets this generation apart is resilience. Gen Xers have navigated recessions, housing crashes, job changes, rising healthcare costs, and the demands of caring for both children and parents. Each of these challenges has built the toughness needed to face retirement head-on.

The key is to move from fear to action:

- Recognize that you are not alone.

- Build a clear financial plan, using catch-up contributions, diversified income, and smarter withdrawal strategies.

- Prepare for healthcare and caregiving costs before they overwhelm you.

- Redefine retirement as more than numbers — a stage of life built on purpose, flexibility, and fulfillment.

There is no one-size-fits-all answer. But there is a universal truth: retirement doesn’t have to be defined by fear. With the right strategies and mindset, Gen X can transform anxiety into empowerment and create a future where financial stability and personal meaning go hand in hand.

Resources

We have written over a dozen articles on most areas that Gen X will need information about. Check out our Free Gen X Retirement Budget Planning tool by clicking on this line. Read about what you need to know about your dream home here. If you go to our Directory of articles, you can choose to get into more depth on a topic you are interested in. Click here.

👉 Your next step is simple: start planning. Begin with a written strategy, revisit it often, and don’t be afraid to seek professional advice. Fear fades when clarity grows — and for Gen X, clarity is the most powerful tool of all. Have your children participate wth you, as you learn, teach them.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![Biloxi Mississippi is a great place to live/visit [2025]](https://retirecoast.com/wp-content/uploads/2022/06/Biloxi-light-house-440x264.jpeg)