Retirement doesn’t have to mean slowing down. In fact, it can be the perfect time to start something new — especially a business after retirement that fits your lifestyle, skills, and financial goals.

If you’ve ever wondered, “I’m retired — what kind of business should I start?” this guide is for you.

💡 For a complete roadmap on forming and running a post-retirement business, visit our Ultimate Guide to Starting a Business After Retirement.

Frequently Asked Questions

1. What’s the best type of business for a retiree?

The best business is one that matches your experience, personality, and lifestyle. Many retirees succeed by turning professional skills or hobbies into ventures like consulting, real estate, or online commerce.

2. Can I really start a business on a retirement income?

Absolutely. Many retirees launch part-time or home-based ventures with minimal costs. You can:

- Form an LLC for liability protection

- Start lean with low-overhead digital tools

- Scale gradually using profits rather than savings

(Full setup steps are in the Ultimate Guide to Starting a Business After Retirement.)

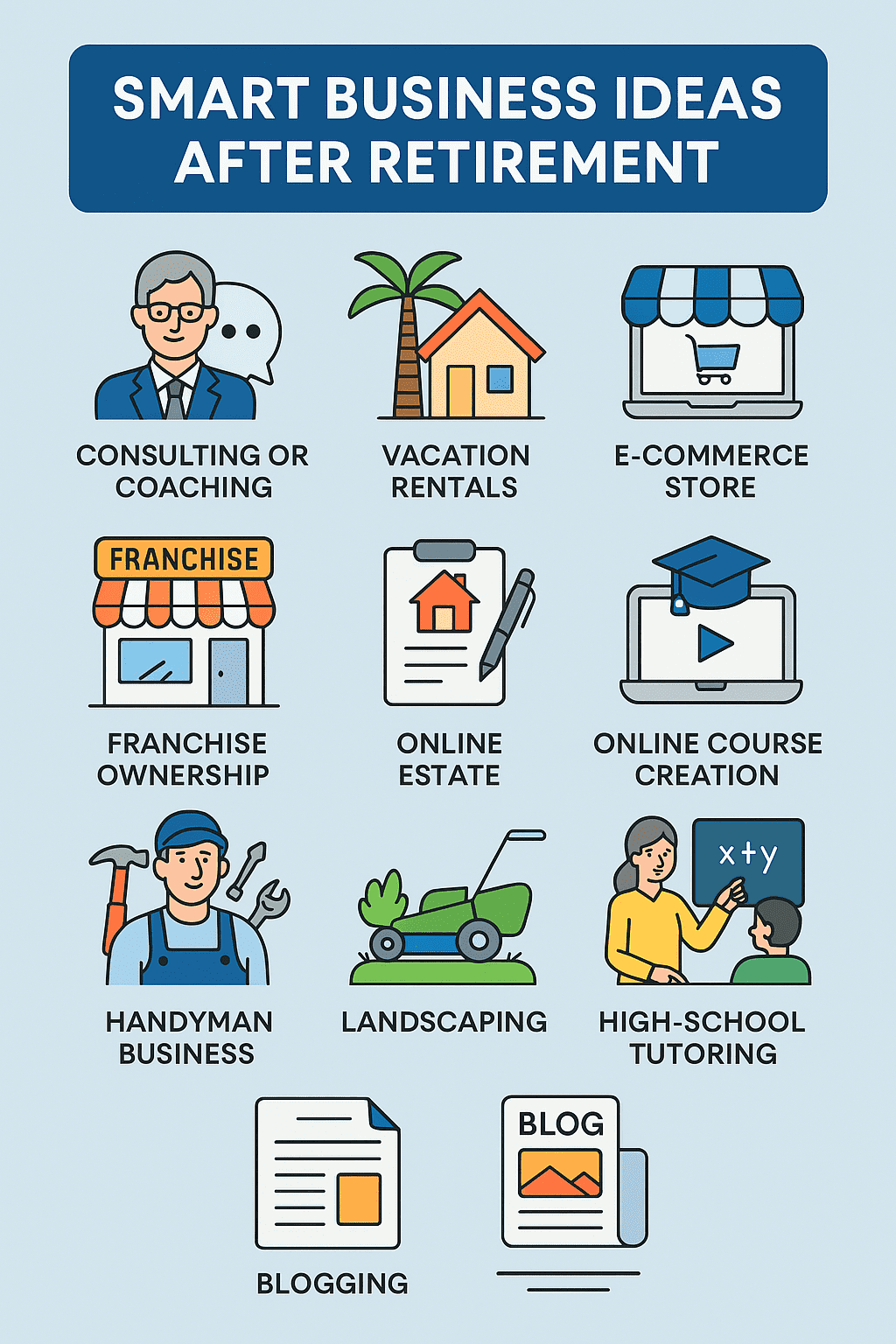

3. What are some smart business ideas for retirees?

Below are 11 proven options suitable for retirees with different interests, skills, and budgets.

1. Consulting or Coaching

Use your career experience to help businesses or individuals.

Startup cost: Minimal — just marketing and communication tools.

Why it works: You already have expertise people value.

2. Vacation or Long-Term Rentals

Turn a property into an income stream.

Startup cost: Moderate (prep, listings, insurance).

Why it works: Delivers passive income and long-term equity.

(Cross-link to your real-estate investment and rental-management guides.)

3. E-Commerce Store

Sell physical or digital products online through Shopify, Etsy, or Amazon.

Startup cost: Low to medium.

Why it works: Flexible hours and location independence.

(Cross-link to your “How to Build a Website for Your Business After Retirement” article.)

4. Franchise Ownership

Buy into a proven business model — cleaning, coffee, home services, senior care.

Startup cost: Higher (franchise fees and setup).

Why it works: Built-in training and branding make it ideal for structured retirees.

See Small Business Administration articles

5. Real-Estate Brokerage or Referral Business

Stay active in real estate part-time.

Startup cost: Licensing, MLS fees, and marketing.

Why it works: Leverages community ties with flexible income potential.

Want to sell real estate on the beach.

6. Online Education or Course Creation

Teach what you know — from bookkeeping to coastal cooking.

Startup cost: Minimal (camera and hosting).

Why it works: Scalable and perfect for knowledge sharing.

7. Home-Based Services

Offer pet sitting, bookkeeping, or errand services.

Startup cost: Very low.

Why it works: Keeps you engaged and social while earning steady income.

8. Handyman Business

Perfect for retirees with practical or trade skills — plumbing, carpentry, or general repairs.

Startup cost: Tools, vehicle, and insurance.

Why it works: Always in demand; flexible schedule and strong local word-of-mouth.

Why Seniors need a handyman

9. Landscaping or Lawn-Mowing Business

Provide regular yard care for homeowners or rental properties.

Startup cost: Equipment and transport.

Why it works: Recurring income, light exercise, and outdoor work you can control seasonally.

Lawns are important. Landscaping can be Cathartic.

10. High-School Tutoring

Use your academic strengths to tutor students in math, English, or science.

Startup cost: Almost none — advertise locally or online.

Why it works: Meaningful, flexible, and pays hourly.

Check out this article about volunteering with Southern Mississippi University

11. Blogging or Content Creation

Start a blog on travel, retirement life, or hobbies — and monetize with ads, affiliate marketing, or digital products.

Startup cost: Low (domain, hosting, design).

Why it works: Lets you share wisdom and earn passive income over time.

start a business after retirement

4. How do I decide which business is right for me?

Ask yourself:

- What do I enjoy doing every day?

- How much time and capital can I invest?

- Do I prefer structure or flexibility?

- Do I want to work alone or with people?

The sweet spot is where your skills, passion, and lifestyle intersect.

5. Are there tax benefits to running a small business in retirement?

Yes. Many retirees deduct legitimate expenses — office supplies, mileage, and partial home utilities.

Always consult a tax professional to ensure compliance.

Tax strategies for a business after retirement

6. What if I am a Veteran?

If you’re a veteran, you have access to valuable programs designed to help you start or grow a business after retirement. The U.S. Small Business Administration (SBA) operates several programs tailored for veterans and their families, including:

- Veteran-Owned Small Business (VOSB) certification, which can help you qualify for government contracts.

- SBA Veterans Business Outreach Centers (VBOCs) offering free business training, mentoring, and counseling.

- Patriot Express Loan Program and SBA 7(a) loans, which often feature favorable terms for veteran entrepreneurs.

You can also explore state and local resources. For example, Mississippi and Gulf Coast regional organizations often provide grants or mentorship for veteran-owned businesses.

(Outbound link suggestion: SBA Veteran-Owned Business Resources)

If you’re drawing on skills from your military career — leadership, discipline, or technical expertise — you already have what it takes to build a successful business. Many veteran retirees thrive in consulting, logistics, construction, or franchise ownership, where teamwork and structure translate naturally.

🇺🇸 Resources for Veteran Entrepreneurs

Veterans bring leadership, teamwork, and discipline to every business venture. Take advantage of programs created just for you — from startup funding to mentoring and federal contracting opportunities.

7. What if I want to keep my business small and part-time?

That’s ideal. “Lifestyle businesses” are designed to supplement income without stress.

Consulting, rentals, tutoring, and blogging all fit this model perfectly.

8. Where can I learn more before starting?

Get full checklists, calculators, and business-planning tools in our:

👉 Ultimate Guide to Starting a Business After Retirement

Final Thoughts

Starting a business after retirement is less about risk and more about freedom — choosing what you enjoy and building it your way.

Whether you fix things, teach others, write, or invest in property, each step keeps you active, purposeful, and connected.

💼 Still Exploring Business Ideas?

You’ve seen 11 great ways to start a business after retirement — but if you’re ready to go further, don’t miss our in-depth guide. Learn how to choose the right structure, get your LLC, and turn your idea into a profitable, low-stress business.

➜ Read the Ultimate Guide to Starting a Business After Retirement

Frequently Asked Questions

What’s the best type of business to start after retirement?

The best business for retirees is one that fits your lifestyle and experience. Many start small with consulting, e-commerce, real estate, or local services like handyman or tutoring work. These options have low overhead and flexible schedules.

Can I start a business on my retirement income?

Yes. Many retirees begin part-time businesses using existing savings or Social Security income. Start lean—form an LLC for protection, use online tools, and grow gradually. Visit our Ultimate Guide to Starting a Business After Retirement for a full step-by-step plan.

What are low-stress businesses for retirees?

Low-stress businesses include consulting, blogging, property rentals, or online courses—ventures you can manage at your own pace. They keep you active, social, and financially independent without requiring full-time hours.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.