Introduction

Investing basics for millennials don’t have to be complicated or intimidating. Many in the millennial generation—and Gen Z investors just getting started—have faced student loan debt, economic uncertainty, and nonstop financial advice from social media. Compared to previous generations and older generations like baby boomers, today’s young people are often juggling more financial pressure while trying to build long-term financial confidence. The good news is that investing does not require much money, perfect timing, or expert-level knowledge to get started.

This guide focuses on financial education, not stock tips or hype. Instead of telling you what individual stocks to buy, it explains how the stock market works, the major asset classes you’re likely to encounter, and the simple steps behind building an investment portfolio that supports long-term goals. By understanding the building blocks—such as an emergency fund, employer retirement accounts, and diversified investment products—you can make better investment decisions, gain more control of your finances, and move toward financial freedom over a long period of time.

- Introduction

- Section 1: Before You Invest — The Three Non-Negotiables

- Section 2: The Core Investment Structures (The Building Blocks)

- Section 3: Where to Invest — Accounts and Access

- Section 4: Setting Goals and Choosing an Investment Strategy

- 5. Key Investment Terms

- Section 6: Putting It All Together — Simple, Consistent, and Long-Term

- Section 7: Understanding Investment Returns: Growth, Income, and How They Work Together

- 7.1 Stock Returns: Price Growth and Dividends

- 7.2 Mutual Funds: Combined Growth and Distributions

- 7.3 ETFs: Similar Structure, Different Mechanics

- 7.4 REITs: Income-Focused by Design

- 7.5 Bonds: Predictable Income with Different Risk Profiles

- 7.6 Using Returns to Support Your Investment Goals

- 7.7 Putting Asset Classes to Work Together

- Final Thoughts

- 📱 Easy-to-Use Mobile Brokerage Platforms

-

Where to Invest First – Priority Planner

See how to prioritize emergency savings, employer match, retirement accounts, and brokerage investing. -

Millennial Asset Allocation Calculator

Explore how different mixes of stocks, bonds, and cash can align with time horizon and risk tolerance. -

Investment Growth & Fee Impact Calculator

Estimate long-term portfolio growth and see how expense ratios and fund fees affect results over time.

Section 1: Before You Invest — The Three Non-Negotiables

Before choosing investments or opening accounts, there are a few important things that need to be in place. Skipping these steps doesn’t just increase financial risk — it increases the chance of making emotional decisions when markets move.

These three non-negotiables create stability, protect your progress, and make investing sustainable over the long term.

1.1 Build an Emergency Fund First

An emergency fund is money set aside for unexpected expenses such as medical bills, job interruptions, or urgent repairs. This is not investment money — it’s protection.

Most financial experts recommend keeping three to six months of essential expenses in emergency savings. That money should be easy to access and protected from market volatility.

Where an emergency fund belongs:

- A high-yield savings account

- A standard bank account

- A money market account designed for stability

Emergency funds are not meant to generate high returns. Their purpose is to prevent you from being forced to sell investments during the downs of the market. Without this buffer, even a well-designed investment portfolio can unravel at the wrong time.

1.2 Capture Employer Match — The Closest Thing to Free Money

If your employer offers a retirement plan with matching contributions, this is one of the best ways to start investing.

Employer match works like this:

- You contribute a portion of your paycheck

- Your employer contributes additional money

- That match becomes free money added to your retirement savings

This is one of the few situations in financial matters where you can receive an immediate return before market performance even matters. For many millennial investors, capturing the full employer match is the perfect time to begin building retirement accounts.

Skipping the match is one of the most common and costly mistakes young people make.

1.3 Consistency Beats Timing

Many people wait for the best time to invest, hoping to avoid market downturns or economic uncertainty. In reality, trying to time financial markets often leads to missed opportunities. This article is basically a course in investing basics for Millennials.

Investing works best when:

- Contributions happen automatically

- Small amounts are invested regularly

- The focus stays on long-term goals

This approach reduces emotional decision-making and allows the power of compound interest to work over a longer period of time. Even during periods of market volatility, consistent investing helps smooth out price swings and supports a long-term strategy.

You don’t need much money to get started. What matters most is building the habit and letting time do the heavy lifting.

When doing your research, be sure to compare a fund’s fees against other similar funds that track the same type of investments. Higher fees can reduce long-term returns, especially over a long period of time.

Mutual funds and exchange-traded funds do not charge fees directly to you as a bill. Instead, fees are deducted from the fund’s assets before returns are reported. Every fund pays a different fee, and returns can vary widely, so it’s important to compare both expense ratios and historical returns when evaluating similar funds.

Section 2: The Core Investment Structures (The Building Blocks)

Before choosing where to invest or setting an investment strategy, it helps to understand the basic investment structures you’ll encounter. These are the building blocks that show up inside retirement accounts, brokerage accounts, and employer plans. You may already own several of them without realizing it.

This section explains what each investment is, how it behaves, and why it exists—not which one is “best.”

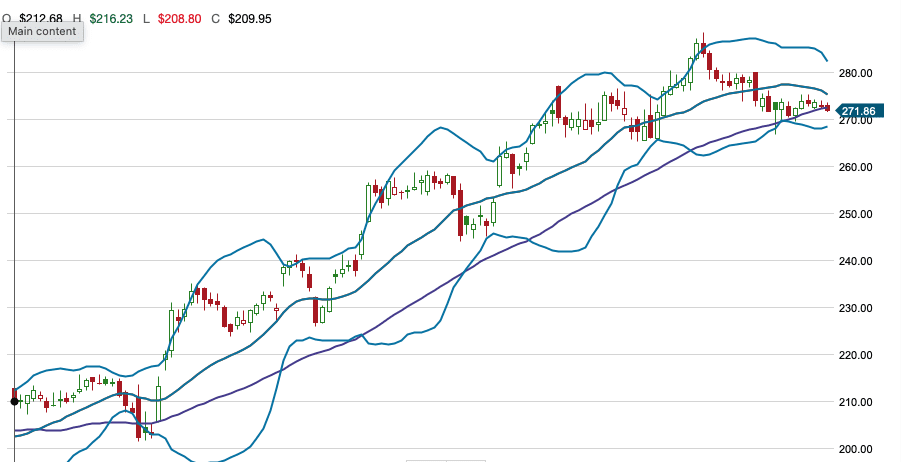

This illustrates an important concept for new investors: stock prices don’t move smoothly in one direction. In addition to long-term trends, daily trading activity introduces constant short-term fluctuations.

For long-term investors—especially millennials—these daily movements are usually less important than the overall direction of the market over months, years, and decades. Understanding this helps reduce the urge to react to short-term price changes that are a normal part of how markets function.

2.1 Stocks: Ownership in a Business

A stock represents a share of a company. When you own stock, you own a small piece of that business and participate in its success or failure.

Stocks generate value in two main ways:

- Price growth as the company becomes more valuable

- Dividends, which are cash payments that some companies distribute to shareholders

Individual stocks can offer higher returns, but they also come with more risk. Company-specific issues, market volatility, and economic uncertainty can all affect stock prices. That’s why most millennial investors own stocks indirectly through diversified funds rather than holding many individual stocks themselves.

Stocks are considered a growth-oriented investment and are typically used for long-term goals.

2.2 Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) bundle many investments together into a single product. An ETF might hold:

- Hundreds or thousands of stocks

- Bonds

- Or a mix of different asset classes

ETFs trade throughout the day like stocks, but they function more like diversified portfolios. Many ETFs are index funds, meaning they aim to match the performance of a broad market index rather than beat it.

Why ETFs are widely used:

- Built-in diversification

- Lower fees than many actively managed products

- Easy access to major asset classes

For many investors, ETFs are an easy way to gain exposure to financial markets without taking on the risk of individual stock selection.

2.3 Mutual Funds

Mutual funds are similar to ETFs in that they pool money from many investors to buy a collection of investments. The key difference is how they trade and how they’re managed.

Mutual funds:

- Trade once per day at a set price

- They are often actively managed

- May carry higher fees depending on management style

Many employer-sponsored retirement accounts rely heavily on mutual funds. While fees matter, what ultimately drives investment returns is what the fund owns, not the label on the fund itself.

Mutual funds are investment products used to access different asset classes, not investments on their own.

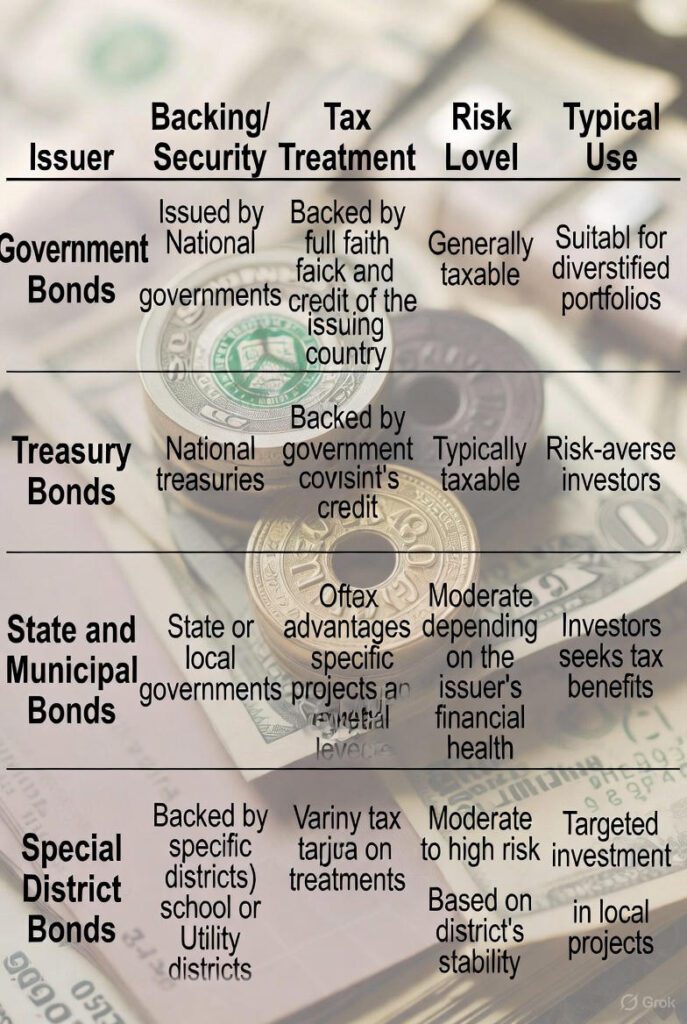

2.4 Bonds: Lending Instead of Owning

When you buy a bond, you are lending money to a company or government. In return, you receive:

- Regular interest payments

- Your original investment back at maturity

Bonds tend to be more stable than stocks but usually offer lower long-term returns. They play an important role in balancing an investment portfolio, especially during market downturns.

Bonds are often used to:

- Reduce overall portfolio risk

- Provide income

- Add stability during periods of market volatility

2.5 Treasury Bills, Notes, and Bonds

U.S. Treasury securities are bonds issued by the federal government and are considered among the lowest-risk investment products available.

They come in different time frames:

- Treasury bills (short-term)

- Treasury notes (medium-term)

- Treasury bonds (long-term)

Treasuries are commonly held through bond funds inside retirement accounts rather than purchased directly. They are often used for capital preservation and risk management, not aggressive growth.

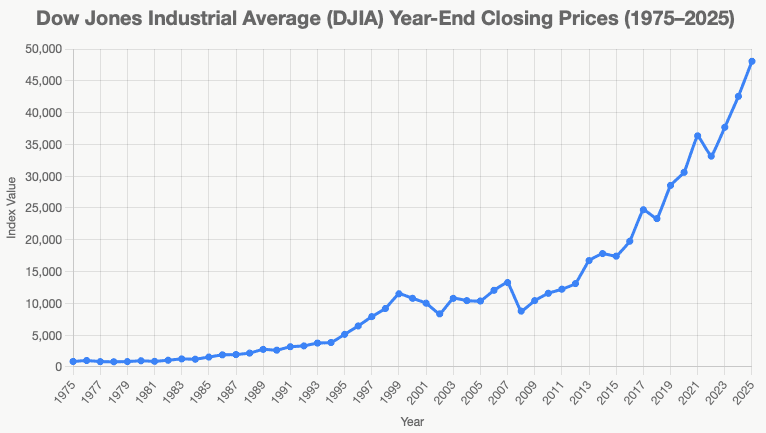

One of the longest and most stressful periods occurred between 2007 and 2013. Investors who were close to retirement during that time may have chosen to delay retirement or wait for a recovery. Eventually, the market did recover and moved on to new highs.

For Millennials, the key takeaway is time horizon. With many years—or decades—before retirement, short-term volatility is less critical than staying invested and focused on long-term goals. This long view helps explain why younger investors generally do not need to react to every market decline, as time is a powerful ally in recovery.

2.6 Money Market Funds

Money market funds are designed for stability and liquidity, not high returns. They invest in short-term, high-quality debt instruments.

Common uses include:

- Emergency savings

- Temporary holding of cash

- Reducing exposure to market swings

Money market funds are different from a bank account or high-yield savings account, but they serve a similar purpose: keeping money accessible while limiting risk.

2.7 Why Structure Matters More Than Picking

Each of these investments behaves differently during ups and downs of the market. The most important decision most investors make isn’t choosing a specific fund or stock—it’s deciding how much of their money goes into each type.

That mix is called asset allocation, and it plays a larger role in long-term results than trying to time the market or chase past performance.

Understanding these building blocks makes it easier to:

- Set realistic financial goals

- Choose appropriate retirement accounts

- Build confidence in your investment decisions

Transition line (optional, if you want it):

Now that you understand the building blocks, the next step is knowing where to use them—starting with the accounts you already have access to.

Section 3: Where to Invest — Accounts and Access

Understanding where to invest is just as important as understanding what you’re investing in. Part of this decision involves choosing the accounts you’ll use and the financial institutions that hold your money and execute your investment decisions.

Think of this step as setting up the infrastructure that allows your investment strategy to work smoothly over the long term.

3.1 Your 401(k): Investing Through Your Employer

If you have a 401(k) plan, your employer has already done some of the setup for you. Employers typically contract with a large brokerage firm to administer the plan, handle recordkeeping, and provide a menu of investment products.

How it works:

- Contributions are deducted directly from your paycheck

- Funds are deposited into your retirement account automatically

- You choose from a list of investment options selected by the plan

Most 401(k) plans offer a range of choices such as mutual funds, index funds, and target-date funds. These options are designed to cover major asset classes and support long-term retirement savings.

Some plans also allow participants to invest through a self-directed brokerage option, which gives access to a wider range of investments such as stocks, bonds, mutual funds, and exchange-traded funds. Not every plan offers this feature, but when it does, it provides more flexibility for those who want greater control of their own investments.

3.2 Opening Your Own Account: Roth IRA and Brokerage Accounts

If you’re investing outside an employer plan, you’ll need to open an account on your own. Common options include a Roth IRA, a traditional individual retirement account, or a taxable brokerage account.

Opening an account is similar to opening a bank account:

- You select a brokerage firm

- You complete an application

- The account is established in your name

Once the account is open, you fund it by transferring money from your bank account. This transfer can be done:

- Manually, when you choose

- Automatically, on a recurring schedule

- Initiated by the brokerage or your bank

Automating these transfers is an easy way to stay consistent and reduce the temptation to delay investing.

3.3 How Investments Are Chosen Inside Accounts

Whether you’re using a 401(k), a Roth IRA, or a brokerage account, the investment process follows the same basic pattern:

- Money enters the account

- You select investments from the available options

- Those investments make up your investment portfolio

In employer-sponsored retirement accounts, the investment choices are preselected by the plan sponsor. In accounts you open yourself, you typically have access to a wider range of investment products across different asset classes.

The key point is that the account itself does not determine your returns. The investments you choose inside the account — and how they are allocated — drive long-term outcomes.

3.4 Ready for the Next Step: Investing Basics for Millennials

Once your accounts are open and funded, you’re ready for what the rest of this article lays out:

- Understanding how different investments behave

- Setting financial goals

- Choosing an investment strategy that matches your time horizon and risk tolerance

With the right structure in place, investing becomes less about guesswork and more about following a clear, repeatable process.

Section 4: Setting Goals and Choosing an Investment Strategy

Once your accounts are in place, the next step is deciding why you’re investing and how your investments should work for you. This is where many people get tripped up—not because investing is complex, but because goals aren’t clearly defined.

Clear investment goals help you choose the right mix of investments, manage risk, and stay consistent during market ups and downs.

4.1 Start With Clear Financial Goals

Every investment should support a specific purpose. Common financial goals include:

- Building long-term retirement savings

- Growing wealth over a long period of time

- Saving for a down payment on a home

- Achieving financial independence

Your goals determine:

- How long your money can stay invested

- How much risk you can reasonably take

- Which accounts and investment structures make sense

Long-term goals—especially retirement—generally allow for more exposure to growth-oriented investments. Shorter-term goals require more stability and less exposure to market volatility.

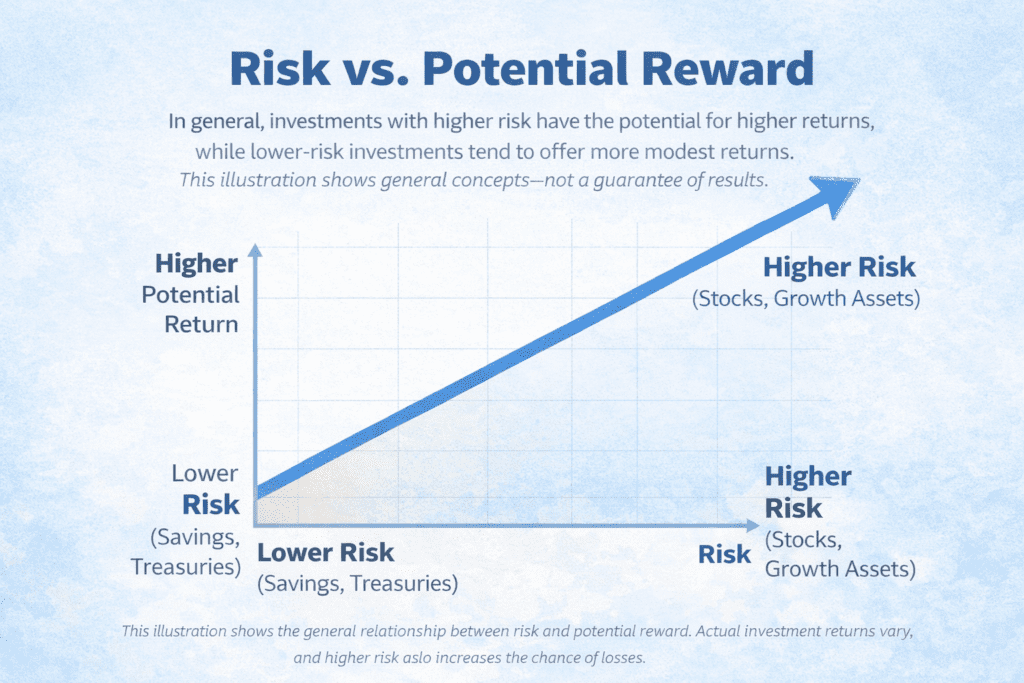

4.2 Understand Your Risk Tolerance

Risk tolerance is your ability and willingness to handle fluctuations in your investment portfolio. All investments carry some level of risk, but not all risk feels the same to every investor.

Risk tolerance is influenced by:

- Time horizon

- Income stability

- Emergency savings

- Personal comfort with market swings

Taking too much risk can lead to emotional decisions during market downturns. Taking too little risk over long periods may limit investment returns. The goal is finding a balance you can stick with through the ups and downs of the market.

As people move closer to retirement, priorities often shift toward stability and income. Investors near retirement may favor equities that are more established and generate dividends, helping reduce exposure to large market swings.

When researching an equity—such as a stock, mutual fund, or exchange-traded fund—you can usually find a published risk rating. Reviewing this information can help ensure an investment aligns with your time horizon and overall risk tolerance.

4.3 Asset Allocation: The Most Important Decision

Asset allocation refers to how your money is divided among major asset classes such as stocks, bonds, and cash equivalents.

This mix matters more to long-term results than choosing individual investments. A well-structured investing basics for Millennials allocation:

- Helps manage risk

- Smooths out market volatility

- Aligns your portfolio with your goals

As a general pattern:

- Younger investors often emphasize growth-oriented assets

- Mid-career investors blend growth and stability

- Investors closer to retirement focus more on income and preservation

Your allocation should evolve as your goals and timeline change.

A well-known example is :contentReference[oaicite:0]{index=0}. At one time, Enron produced exceptional results for shareholders, leading many employees to invest a large portion—or even all—of their 401(k) funds in company stock. With little warning, Enron declared bankruptcy, and many employees lost a significant part of their retirement savings. The impact was devastating.

The lesson is captured in the old saying: “Don’t keep all of your eggs in the same basket.” Diversifying across different industries, companies, and investment types helps hedge against unexpected events and reduces the risk that a single failure can derail long-term financial goals.

4.4 Growth vs. Income Over Time

Investment strategies often fall along a spectrum between growth and income.

- Growth-focused strategies aim to increase portfolio value over time and are common for younger investors with long horizons.

- Income-focused strategies prioritize cash flow, often through dividends or interest, and become more important as retirement approaches.

Many investors spend years in the middle—seeking both growth and some income while reinvesting earnings to support compounding.

4.5 Reinvesting for Long-Term Results

One powerful way to support a long-term strategy is automatic reinvestment. When dividends or interest are reinvested instead of taken as cash, they buy additional shares, which can generate even more returns over time.

This process:

- Supports the power of compound interest

- Requires no additional effort

- Helps small amounts grow into meaningful balances

Reinvestment is commonly available in retirement accounts, brokerage accounts, and many investment platforms by default.

Looking back, that reaction was driven by fear—not strategy. I wasn’t an investment expert, and most casual investors aren’t either. By the time market downturns become headline news, the so-called “smart money” has usually already acted. At that point, reacting often does more harm than good.

What I eventually learned is that markets move in cycles. What goes down has historically come back up with time. As a Millennial, you typically have years—sometimes decades—for corrections to play out. In the meantime, many investments continue generating dividends and interest even during volatile periods.

The better approach is to avoid panic, stay invested, and rebalance your portfolio periodically—ideally during calmer periods, not in the middle of heightened volatility.

4.6 Staying Consistent Through Market Changes

Markets move. Economic conditions change. Headlines can be unsettling. A clear investment for millennials strategy tied to your goals helps prevent short-term reactions from derailing long-term progress.

Consistency matters more than prediction. Investors who understand their goals, risk tolerance, and asset allocation are better positioned to stay invested and maintain financial confidence over time.

5. Key Investment Terms

Here’s the complete single list of essential investment terms for millennials! I’ve combined everything from before into one beginner-friendly glossary. Explanations are simple, relatable, and assume you’re starting from zero—perfect for learning while doomscrolling or setting up your first app. I’ve grouped them loosely by category for easier scanning, with visuals sprinkled in to make it less boring.

Retirement & Basics

- 401(k)

Employer-sponsored retirement account with pre-tax contributions (often with free employer matching). Millennials: Max the match—it’s basically free money for your future self. - Roth IRA

Retirement account with after-tax money; growth and withdrawals are tax-free later. Great if you expect higher taxes or income in retirement.

Core Concepts & Strategies

- Compound Interest

Earnings on your earnings—money grows exponentially over time. Why starting young is OP. - Dollar-Cost Averaging (DCA)

Investing fixed amounts regularly (e.g., $100/month) no matter the price. Smooths out market ups/downs—ideal for auto-invest apps. - Diversification

Spreading money across investments to lower risk. Classic: Don’t put all eggs in one basket. - Asset Allocation

Deciding how to split your portfolio (e.g., 80% stocks, 20% bonds). Changes with age/risk tolerance. - Risk Tolerance

How much market drama can you stomach without panic-selling? Younger = usually higher tolerance. - FOMO (Fear of Missing Out)

Impulse buying during hype (meme stocks, crypto pumps). Common trap—avoid it! - Bull/Bear Market

Bull: Prices rising (party time); Bear: Prices falling (hibernation mode). You’ve probably seen both.

Investment Types & Assets

- Equities (Stocks)

Ownership slices of companies. High potential growth (and risk). - Bonds

Loans to companies/governments that pay interest. Safer, steadier than stocks. - Index Fund

Low-cost fund tracking a market index (e.g., S&P 500). Passive investing fave. - ETF (Exchange-Traded Fund)

Like index funds but trade like stocks. Cheap, flexible, thematic options galore. - Mutual Fund

Pooled money managed by pros—buys a basket of stuff. Good diversification, but check fees. - REIT (Real Estate Investment Trust)

Invest in property (buildings, malls) without buying houses. Pays dividends from rent. - Cryptocurrency (Crypto)

Digital money like Bitcoin. Volatile AF—small allocation for “fun” money only. - Asset Classes

Big buckets: stocks, bonds, real estate, cash, etc. Mix for balance. - Dividends

Company payouts to shareholders (cash bonus). Passive income vibes. - Blue-Chip Stocks

Big, stable companies (e.g., in the Dow). Reliable, often dividend-paying.

Tools & Platforms

- Brokerage (Brokerage Account)

Your app/platform (Robinhood, Fidelity) to buy/sell investments. Many are commission-free now. - Robo-Advisor

Automated service (Betterment, Wealthfront) that builds/manages your portfolio. Hands-off for busy millennials. - Micro-Investing

Investing spare change (Acorns rounds up purchases). Low-barrier entry. - Morningstar

Site that rates funds/ETFs with stars (5 best). Like reviews for investments.

Other Key Terms

- Dow Jones Industrial Average (The Dow)

Index of 30 major U.S. companies. Quick snapshot of “the market.” - ESG Investing

Focusing on Environmental, Social, Governance factors (planet-friendly companies). - Expense Ratio

Annual fee on funds (as %). Lower = more money stays with you. - P/E Ratio (Price-to-Earnings)

Stock price divided by earnings. Helps spot if something’s overpriced or a deal.

You’re not clueless—you’re just getting started. Pick one term, Google it in an app, and invest $10 to test. Time + consistency = wins. 🚀

Section 6: Putting It All Together — Simple, Consistent, and Long-Term

By this point, you’ve covered the most important building blocks of investing basics for millennials:

how accounts work, how risk and reward relate, how diversification protects portfolios, and why time matters more than timing.

The final step is not complexity — it’s consistency.

6.1 Investing Is a System, Not a Prediction Game

One of the most important lessons in investing basics for millennials is understanding that successful investing is not about predicting what markets will do next. It’s about building a repeatable system you can follow through different market cycles.

That system typically includes:

- Using the right accounts

- Maintaining a sensible asset allocation

- Staying invested through market ups and downs

- Making adjustments deliberately, not emotionally

Markets will rise and fall. That’s normal. What matters most is having a plan rooted in investing basics for millennials, not reacting to headlines or short-term noise.

6.2 Why Consistency Matters More Than Perfect Timing

Many people struggle early on because they believe investing requires perfect timing. In reality, one of the core principles of investing basics for millennials is that consistency almost always beats timing.

Consistency helps:

- Capture long-term market growth

- Reduce emotional decision-making

- Allow dividends and interest to continue compounding

- Turn small, regular contributions into meaningful balances

For millennials, time is a major advantage. Staying invested allows that advantage to work in your favor.

6.3 Review, Rebalance, Repeat

Another key part of investing basics for millennials is understanding that investing does not require constant changes. Instead:

- Review your portfolio periodically

- Rebalance when allocations drift

- Adjust strategy only when goals or timelines change

This approach keeps risk aligned with your objectives without reacting to daily market movements.

6.4 Confidence Comes From Understanding

Financial confidence doesn’t come from picking the “right” investment at the right moment. It comes from understanding the structure behind investing basics for millennials:

- Why your investments are set up the way they are

- How risk, time, and diversification interact

- What role does each account play in your overall plan

When you understand the basics, market volatility becomes easier to tolerate, and long-term decisions become easier to stick with.

6.5 A Long Game Worth Playing

At its core, investing basics for millennials is about playing a long game. Start simple. Stay consistent. Let time do the heavy lifting.

That approach has helped generations of investors build financial stability—and it remains just as relevant today. Heavy lifting.

| Investment Type | Primary Return Type | Distribution Frequency | Common Use |

|---|---|---|---|

| Stocks | Growth + Dividends | Quarterly or variable | Long-term growth, optional income |

| Mutual Funds | Growth + Distributions | Often annually | Diversified growth and income |

| ETFs | Growth + Dividends | Usually quarterly | Low-cost diversification |

| REITs | Income-focused dividends | Quarterly (typical) | Consistent income |

| Government Bonds | Interest income | Often quarterly | Stability and income |

| Corporate Bonds | Fixed interest income | Typically fixed schedule | Predictable income |

Section 7: Understanding Investment Returns: Growth, Income, and How They Work Together

When people talk about “returns” from investments, they are usually referring to two different ways money is generated:

growth and income. Most long-term investment strategies use a combination of both.

Understanding how each asset type produces returns helps you decide what belongs in your portfolio and how those returns should be used.

7.1 Stock Returns: Price Growth and Dividends

Stocks can generate returns in two primary ways:

1. Price appreciation

If a stock increases in value over time, the investor realizes income when the stock is sold. This type of return is common in growth-oriented strategies and is often favored by investors with long time horizons.

2. Dividend income

Some companies distribute a portion of their profits to shareholders in the form of dividends. These payments may occur monthly, quarterly, or on another schedule, depending on the company.

Dividend-paying stocks offer:

- Ongoing income while holding the stock

- Potential reinvestment to acquire additional shares

- A second return source in addition to price appreciation

Companies announce dividend payments in advance, allowing prospective investors to evaluate whether the stock’s price and expected dividend income align with their goals.

It’s important to understand that dividends are not guaranteed. Companies may:

- Reduce dividends during difficult periods

- Suspend dividends entirely

- Increase dividends over time

- Occasionally, issue special or supplemental dividend payments

7.2 Mutual Funds: Combined Growth and Distributions

Mutual funds often hold dozens or hundreds of underlying securities, including dividend-paying stocks and interest-generating bonds.

Returns from mutual funds typically come from:

- Changes in the fund’s net asset value (NAV)

- Dividends generated by underlying holdings

- Capital gains distributions

Some mutual funds distribute dividends and capital gains separately—often once per year, typically near the end of the calendar year. These distributions may be paid in cash or reinvested automatically, depending on account settings.

When evaluating mutual funds, most platforms provide analytical tools that include Morningstar-style ratings, typically ranging from one to five stars. These ratings help compare funds based on historical performance, risk, and cost—but they are descriptive, not predictive.

7.3 ETFs: Similar Structure, Different Mechanics

Exchange-traded funds (ETFs) often function similarly to mutual funds but trade throughout the day like stocks.

ETFs can generate returns through:

- Price appreciation

- Dividend distributions

Dividend payments from ETFs are commonly made quarterly, though schedules can vary. Like mutual funds, ETF dividends may be reinvested automatically or taken as income.

Because ETFs often track indexes and have lower operating costs, they are frequently used for both growth and income strategies.

REITs typically invest in income-producing real estate such as:

- Residential rental properties

- Apartment complexes

- Office and commercial buildings

- Industrial and warehouse facilities

- Retail and specialized properties

Publicly traded REITs are bought and sold on stock exchanges and trade like stocks, meaning their prices can move daily based on market conditions. This allows investors to gain real estate exposure with liquidity similar to equities, rather than owning physical property directly.

7.4 REITs: Income-Focused by Design

Real estate investment trusts (REITs) are a distinct asset class with a unique income structure.

By law, REITs are required to distribute at least 90% of their taxable income to shareholders. As a result:

- REITs tend to generate consistent dividend payments

- Dividend yields are often higher than those of stocks or stock-based funds

REIT income is typically supported by:

- Residential rental properties

- Commercial and industrial buildings

- Office, retail, and specialized real estate

Because these properties generate recurring lease payments, REIT dividends are often more stable—though still subject to economic and real estate market conditions.

7.5 Bonds: Predictable Income with Different Risk Profiles

Bonds generate returns primarily through interest payments, sometimes referred to as coupon payments.

- Government bonds often distribute interest quarterly

- Payments may change over time if tied to inflation or other indexes

- Corporate bonds typically pay interest at a consistent rate

- Higher yields often reflect higher credit risk

Bond income tends to be more predictable than stock dividends, making bonds an important tool for income-focused strategies and risk management.

7.6 Using Returns to Support Your Investment Goals

How returns are used is just as important as how they are generated.

Many investors—especially those earlier in their careers—choose to:

- Reinvest dividends and interest

- Increase equity holdings automatically

- Accelerate long-term growth through compounding

Investors closer to or in retirement more often:

- Take dividends and interest as income

- Use distributions to supplement retirement savings

- Reduce reliance on selling assets

7.7 Putting Asset Classes to Work Together

A thoughtful investment plan considers:

- Risk tolerance

- Time horizon

- Need for immediate income

- Desire for long-term income and growth

Different asset classes serve different roles. Stocks, funds, REITs, and bonds each contribute differently to growth, income, and stability.

Understanding how returns work across these asset types helps you build a portfolio that supports your goals—not just today, but over time.

Final Thoughts

Understanding investing basics for millennials is not about predicting markets or chasing short-term trends. It’s about learning how investments work, how returns are generated, and how time and consistency shape long-term outcomes.

For millennials, time is a powerful advantage. Markets will rise and fall, dividends and interest will change, and economic conditions will evolve—but a diversified, disciplined approach allows those movements to work in your favor rather than against you.

By focusing on structure instead of speculation, using the right accounts, and staying consistent through market cycles, investing becomes less about reacting to uncertainty and more about building financial confidence over time.

To continue learning and applying these concepts, visit the Millennial Calculator Hub, where you’ll find investment calculators designed to be used alongside this article—helping you explore scenarios, understand tradeoffs, and reinforce smart long-term thinking.

Start simple. Stay consistent. Let time do the work.

📱 Easy-to-Use Mobile Brokerage Platforms

- Robinhood

- Very simple and intuitive app design — clean navigation makes trading stocks, ETFs, and crypto easy for beginners. StockBrokers.com+1

- Great for starting small and learning trades from a mobile interface.

🔗 https://www.robinhood.com

- Charles Schwab (Mobile App)

- Highly rated for usability and educational tools, making it easy for new investors to research and trade from a smartphone. The Motley Fool+1

- Offers fractional shares and excellent customer support accessible via mobile.

🔗 https://www.schwab.com

- Fidelity Investments (Mobile App)

- Intuitive mobile interface with access to accounts, research, and retirement plans. SmartAsset+1

- Well-rated on app stores and supports a full range of account types beyond just brokerage.

🔗 https://www.fidelity.com

- SoFi Active Investing

- Simple, easy onboarding with no minimums and $0 commissions, good for entry-level investing. Raisin

- Offers integrated tools with banking features for convenience.

🔗 https://www.sofi.com/invest/

- E*TRADE Mobile

- Easy-to-navigate app with basic trading tools, educational content, and research resources — suitable for beginners. StockBrokers.com

- Includes features for both basic trades and more advanced tools as you gain confidence.

🔗 https://www.etrade.com

📌 Notes for Millennials

- These mobile platforms make it easy to start investing with small amounts and fit a long-term investment strategy into your everyday life. Bankrate

- Most support fractional shares, commission-free trades, and retirement account access — helpful as you build your investment portfolio over time. The Motley Fool+1

- While ease of use is important, it’s also good to gradually explore tools and educational content in each app as your confidence grows. SmartAsset

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.