Last updated on January 19th, 2026 at 03:20 pm

- Budgeting shouldn’t feel like punishment.

- Why Budgeting Feels So Hard (And Why It Doesn’t Have to)

- Example of Millennial Budget Calculator

- What a Budget Is (And What It Isn’t)

- Step One: Understand Your Cash Flow Before You Set Rules

- Three Budgeting Methods That Millennials Actually Stick With

- The Rule That Matters More Than the Method

- Where Most Budgets Quietly Fail

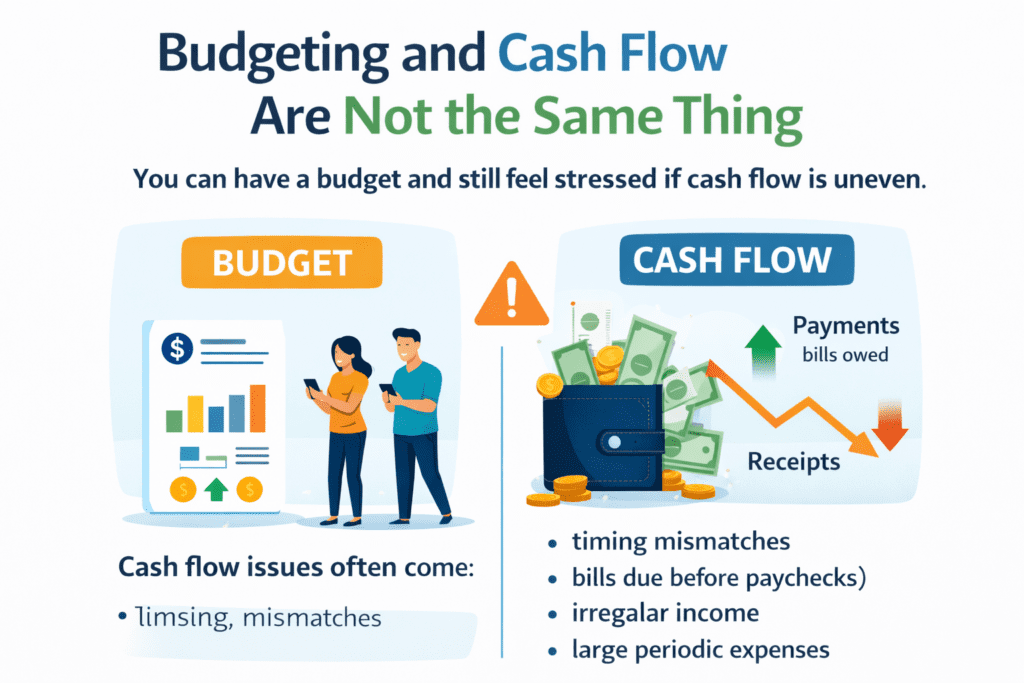

- Budgeting and Cash Flow Are Not the Same Thing

- Housing Costs and Budget Reality

- Budgeting and Taxes: The Long View

- Why Simple Budgets Outperform Perfect Ones

- Case Study #1: A Budget That Worked

- Case Study #2: A Budget That Fell Apart

- What These Two Stories Teach Us

- Where Tools Fit (Now and in the Future)

- Budgeting Is a Skill, Not a Trait

- What a Healthy Budget Feels Like

- What to Do Next

- Bottom Line

Budgeting shouldn’t feel like punishment.

If you’ve ever tried to build a budget and abandoned it a few weeks later, you’re not alone. Most budgets fail not because people lack discipline, but because the systems themselves don’t reflect real life. This Millennial Budget Guide will walk you through a great process.

For Millennials, budgeting has to work in a world of:

- changing income

- rising housing costs

- student loans or lingering debt

- subscriptions and digital spending

- competing goals like saving, investing, travel, and flexibility

This guide isn’t about strict rules or perfection.

It’s about building a simple, usable budget that supports your life — not controls it.

Instead, we streamlined the content and focused on the most important ideas, inserting key elements along the way—such as links to calculators and related guides—so you can explore specific topics in more depth without being overwhelmed.

We also realized something important: this article is just one piece of a much larger body of work. When taken together, our Millennial-focused articles form what is effectively a master-class-level exploration of Millennial finances, tradeoffs, and future planning.

If you want to go deeper, we encourage you to explore our curated collection in the Millennial Hub, created to help Millennials take a thoughtful, realistic deep dive into building a livable and sustainable financial future.

Why Budgeting Feels So Hard (And Why It Doesn’t Have to)

Many budgeting frameworks were designed decades ago, when:

- Income was more predictable

- Fewer expenses were recurring subscriptions

- housing costs took a smaller share of income

- Fewer people juggled side income or self-employment

Today, Millennials are often navigating:

- variable pay

- multiple income streams

- delayed homeownership

- Higher insurance and healthcare costs

- economic uncertainty make long-term planning harder

When budgeting advice ignores this reality, people disengage.

A budget shouldn’t make you feel like you’re failing.

It should help you see clearly, decide intentionally, and adjust without guilt.

About this article

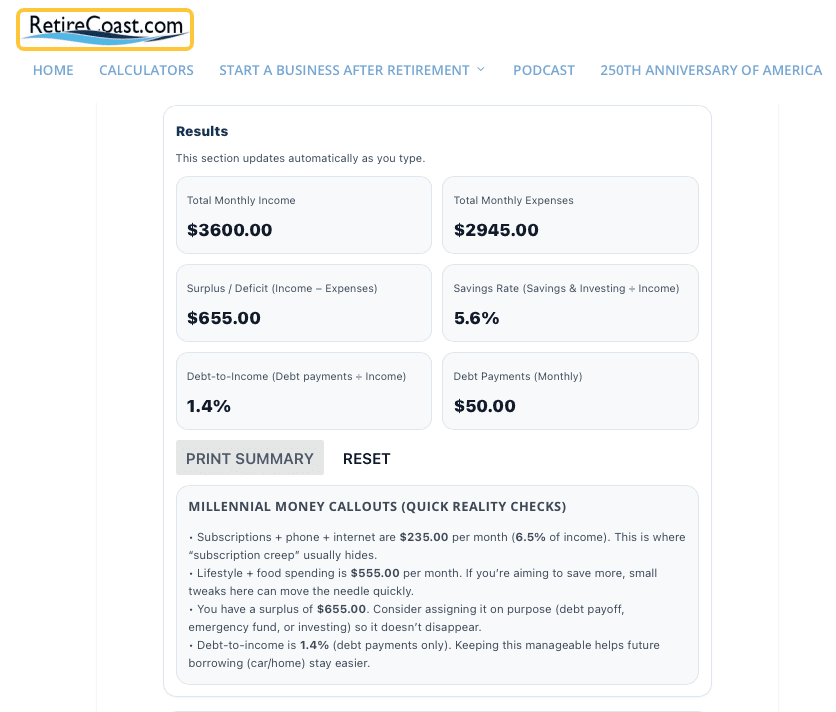

Example of Millennial Budget Calculator

These examples show the calculator and the results. There are dozens of categories to choose from. This is how to get a handle on your expenses. I originally set the income at $3,000 per month and started adding items that are typical of a millennial living alone, renting an apartment. I soon had to raise the income, or there would be no money for food. Go to the end of the article for a link to this valuable planning tool.

What a Budget Is (And What It Isn’t)

A budget is:

- a planning tool

- a decision aid

- a snapshot of priorities

A budget is not:

- a moral scorecard

- a restriction on enjoyment

- a fixed document that never changes

The best budgets evolve as your life evolves.

Step One: Understand Your Cash Flow Before You Set Rules

Before choosing a budgeting method, you need clarity on one thing:

What actually comes in — and what actually goes out?

This includes:

- salary or wages

- bonuses or irregular income

- side hustle income

- recurring expenses

- irregular but predictable expenses

- subscriptions that quietly renew

Many people underestimate spending simply because they don’t see it all in one place.

This is where a budget hub and calculators become helpful — not to judge, but to organize.

You can explore tools and guides in the broader Budget Hub to get this baseline view before committing to a method.

Three Budgeting Methods That Millennials Actually Stick With

There is no “best” budgeting method — only the one you’ll continue using.

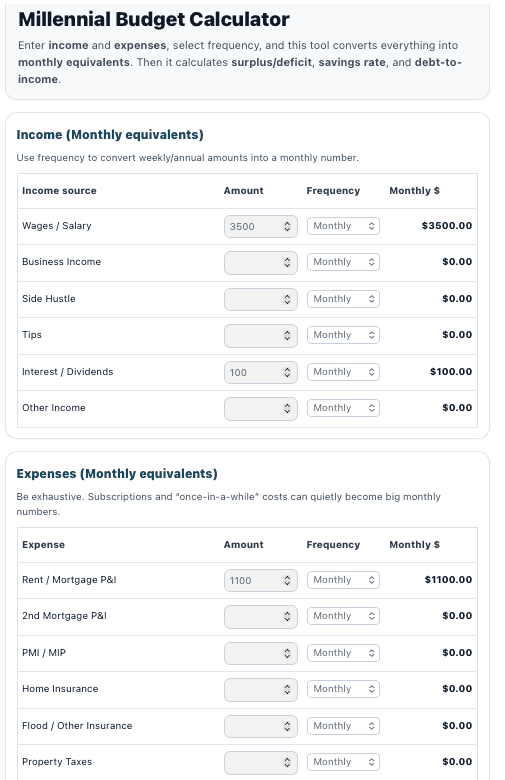

1. The 50 / 30 / 20 Method (Flexible and Balanced)

This approach divides income into broad categories:

- 50% Needs

Housing, utilities, insurance, groceries, transportation, and minimum debt payments - 30% Wants

Dining out, entertainment, travel, hobbies, discretionary spending - 20% Future You

Emergency savings, retirement, investing, and extra debt reduction

Why it works:

- It’s simple

- It allows enjoyment

- It creates room for saving without micromanaging

Why it sometimes doesn’t:

- housing costs in some areas exceed 50%

- Income variability makes fixed percentages hard

If you live in a high-cost area, this method still works — it just needs adjustment, not abandonment.

2. Bills-First Budget (Stress-Reducing and Practical)

This method prioritizes certainty.

First:

- cover fixed expenses and essentials

Then:

- decide how to allocate what’s left

This approach works especially well if:

- income fluctuates

- Financial anxiety is high

- You want to avoid overdrafts or surprises

It removes the fear of “Did I forget something?” and replaces it with clarity.

3. Weekly Spending Plan (Reality-Based)

Monthly budgets can feel abstract. Weekly budgets feel immediate.

Instead of asking:

“Can I afford this this month?”

You ask:

“Does this fit this week?”

This is especially effective for:

- food

- entertainment

- discretionary spending

- gas and transportation

Weekly planning aligns more closely with how people actually spend money.

The Rule That Matters More Than the Method

No matter which framework you choose:

Savings must be treated as a planned expense.

If saving is what happens “after everything else,” it usually doesn’t happen.

Your budget should intentionally include:

- emergency savings

- retirement contributions

- future goals

Even small, consistent contributions build momentum.

If you want to understand how budgeting fits into a broader financial picture, the article

Investing Basics for Millennials

https://retirecoast.com/investing-basics-for-millennials/

explains how saving, investing, and budgeting work together — not as competing priorities.

Where Most Budgets Quietly Fail

Budgets rarely fail loudly. They drift.

Common breakdown points include:

- subscriptions you forget about

- annual expenses that aren’t averaged monthly

- lifestyle inflation after raises

- underestimating irregular expenses

- unrealistic expectations of perfection

This is why budgeting should be iterative, not rigid.

Budgeting and Cash Flow Are Not the Same Thing

You can have a budget and still feel stressed if cash flow is uneven.

Cash flow issues often come from:

- timing mismatches (bills due before paychecks)

- irregular income

- large periodic expenses

Stabilizing cash flow makes budgeting easier — not the other way around.

If cash flow is your main struggle, the article

Stabilize Cash Flow

https://retirecoast.com/stabilize-cash-flow-2/

dives deeper into smoothing income and expense timing so budgets actually hold.

Housing Costs and Budget Reality

For many Millennials, housing is the largest budget line — and often the most frustrating.

There’s a persistent narrative that housing is “unaffordable everywhere” due solely to external forces. The reality is more nuanced.

Understanding housing costs in context helps you:

- set realistic budget expectations

- avoid comparing apples to oranges

- make better long-term decisions

For a deeper dive, read

Housing Affordability Myths

https://retirecoast.com/housing-affordability-myths/

Budgeting works best when it’s grounded in accurate information — not fear or headlines.

U.S. Bureau of Labor Statistics data on income and employment trendsBudgeting and Taxes: The Long View

Taxes don’t just affect April.

They influence:

- take-home pay

- savings rates

- investment outcomes

- long-term financial stability

A good budget accounts for taxes realistically and avoids surprises.

The article

Taxes & Long-Term Impact

https://retirecoast.com/taxes-long-term-impact/

explains why understanding taxes over time matters — especially for Millennials building wealth gradually.

IRS guidance on how taxes affect take-home pay can be found here: https://www.irs.gov/individuals/tax-withholding-estimator

Why Simple Budgets Outperform Perfect Ones

A perfect budget that you abandon does nothing.

A simple budget you revisit:

- adapts to change

- builds awareness

- reduces stress

- improves decision-making

The goal is not control — it’s alignment.

Case Study #1: A Budget That Worked

Alexa and Sam — Planning a Life Together Without Burning Out

Profile

- Ages: 31 and 33

- Household: Couple, living together

- Careers: Alexa works in healthcare administration; Sam is a project coordinator

- Housing: Renting

- Major goals:

- Get married in two years

- Pay for a modest wedding without debt

- Save for a honeymoon

- Begin building long-term financial stability together

The Situation

Alexa and Sam moved in together after dating for three years. While they were aligned emotionally, their financial habits were very different.

- Alexa liked structure and planning

- Sam preferred flexibility and didn’t enjoy spreadsheets

They knew that with a wedding and honeymoon on the horizon, “winging it” wasn’t going to work — but they also didn’t want budgeting to dominate their relationship.

Their biggest concern wasn’t income.

It was coordination.

The First Attempt (That Almost Failed)

Their initial budget tried to do too much:

- separate categories for everything

- rigid monthly limits

- detailed tracking that required constant attention

Within six weeks:

- Entries were falling behind

- Small disagreements started popping up

- Budgeting began to feel like another chore

They realized the problem wasn’t commitment — it was complexity.

The Reset: A Simpler, Shared Budget

They scrapped the complicated version and rebuilt from scratch with three rules:

- Bills-first, together

All shared expenses were listed and handled first: rent, utilities, insurance, and groceries. - Joint goals, individual flexibility

- A shared “Wedding & Honeymoon” savings line

- Separate discretionary spending allowances

- No policing each other’s personal spending

- Savings are treated as a fixed expense

Wedding savings were automated, not optional.

Instead of tracking everything daily, they checked in once a week and reviewed totals monthly.

The Results

Within the first year:

- Wedding savings stayed on track without stress

- Fewer money-related disagreements

- Clear expectations around shared vs personal spending

- Increased confidence in future planning

Most importantly, budgeting stopped being emotional.

It became supportive instead of restrictive.

The Key Lesson

A budget works better when it supports the relationship — not when it turns into a referee.

Alexa and Sam didn’t budget harder.

They budgeted together, with simplicity and shared purpose.

Case Study #2: A Budget That Fell Apart

Jordan — Skilled at His Trade, Unprepared for His Cash Flow

Profile

- Age: 28

- Household: Single

- Career: Automotive technician working toward journeyman status

- Income: Solid base pay with overtime variability

- Lifestyle: Social, active, enjoys nights out with friends

The Situation

Jordan is excellent at what he does.

He understands engines, diagnostics, and repair systems inside and out. But when it came to personal finances, he admitted something honestly:

“I know how to fix almost anything on a car — I just never learned how money really works.”

Jordan didn’t feel broke, but he also never felt ahead.

Paychecks came in.

Bills got paid.

The rest disappeared.

The Budget That Looked Good on Paper

Motivated to “get his life together,” Jordan built a detailed monthly budget:

- dozens of categories

- aggressive savings targets

- strict entertainment limits

The plan assumed:

- consistent overtime

- no surprises

- strong willpower on weekends

Reality didn’t cooperate.

Where It Fell Apart

Jordan’s weak spots weren’t obvious at first:

- spontaneous nights out

- splitting tabs with friends

- weekend spending that felt small in the moment

Within the first month:

- entertainment spending blew past limits

- Savings targets were missed

- Overtime income fluctuated

Instead of adjusting the budget, Jordan felt discouraged.

He stopped tracking.

By the third month, the budget was abandoned entirely — not because he didn’t care, but because it felt like proof he was failing.

What Was Missing

Jordan’s budget failed because:

- It didn’t account for social spending patterns

- It assumed income stability that didn’t exist

- It required daily discipline instead of periodic awareness

- It treated overspending as failure instead of feedback

The issue wasn’t irresponsibility.

It was misaligned with real behavior.

The Wake-Up Call

After a few months of drifting, Jordan realized something important:

“I don’t need to stop having fun. I need to stop being surprised by what it costs.”

When he eventually revisited budgeting, he simplified:

- fewer categories

- weekly awareness instead of monthly restriction

- realistic entertainment expectations

Progress restarted — slowly, but sustainably.

The Key Lesson

A budget that ignores how you actually live will eventually be ignored.

Jordan didn’t need more rules.

He needed visibility without judgment.

What These Two Stories Teach Us

Both case studies point to the same conclusion:

- Budgeting is behavioral, not moral

- Complexity increases friction

- Flexibility keeps people engaged

- Awareness beats perfection

The difference wasn’t income, intelligence, or effort.

It was whether the budget was designed for real life.

Where This Fits in the Bigger Picture

These stories connect directly to:

- investing consistency

- cash flow stability

- tax planning over time

- housing decisions

- long-term financial confidence

That’s why budgeting isn’t a standalone task — it’s the foundation.

Where Tools Fit (Now and in the Future)

Planning tools and calculators help you:

- see patterns

- test scenarios

- summarize complexity

They should support your thinking — not replace it.

Over time, tools that help track reality between planning sessions can add value. That’s why future tools discussed elsewhere are designed to complement, not complicate, the budgeting process.

For now, the focus is on understanding the concepts and building a habit that works.

Budgeting Is a Skill, Not a Trait

You don’t “fail” at budgeting.

You learn:

- What’s realistic

- where friction exists

- What matters most to you

Each iteration improves clarity.

What a Healthy Budget Feels Like

A healthy budget:

- allows flexibility

- supports priorities

- evolves with your life

- reduces anxiety

- helps you say yes and no intentionally

It doesn’t eliminate uncertainty — it helps you navigate it.

What to Do Next

If you’re building or rebuilding a budget:

- Start with awareness, not restriction

- Choose a method that fits your life

- Treat savings as intentional

- Adjust regularly without guilt

Explore the Budget Hub for supporting guides and calculators as needed.

Revisit related Millennial articles to understand how budgeting connects to investing, housing, cash flow, and taxes — because none of these decisions exist in isolation.

Bottom Line

Budgeting isn’t about deprivation.

It’s about:

- clarity

- confidence

- control without rigidity

Build a simple system.

Use it imperfectly.

Refine it over time.

That’s how budgets actually work — and why they stick.

- A comprehensive budgeting tool built specifically for Millennial lifestyles

- An advanced AI-driven Millennial Budget Tracker to help track real-life spending and improve day-to-day decisions

- Additional calculators, tools, and articles addressing the financial challenges Millennials face today

- Guidance and tools for those interested in starting a business, especially first-time founders

1) What’s the best budgeting method for Millennials?

2) How do I budget if my income is irregular or includes side hustle money?

3) Should I pay off debt first or save first?

4) What’s the simplest way to stop overspending on entertainment and dining out?

5) Why do my finances feel stressful even when I have a budget?

6) Do I need a separate savings account for every goal?

7) How often should I review my budget?

8) What is “subscription creep” and how do I prevent it?

9) What if housing costs are so high that 50/30/20 doesn’t work?

10) How do I start budgeting if I’m embarrassed by my current numbers?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.