Prefer to listen? Here’s a short audio version with key takeaways and practical next steps you can do today.

If the audio controls don’t appear after publishing, keep this as a standalone Custom HTML block (not inside a Group block).

If budgeting feels impossible, credit is holding you back, or you’re living paycheck-to-paycheck, this is where you start. These guides and tools are built to help you gain control fast—without guilt, hype, or complicated “finance bro” advice.

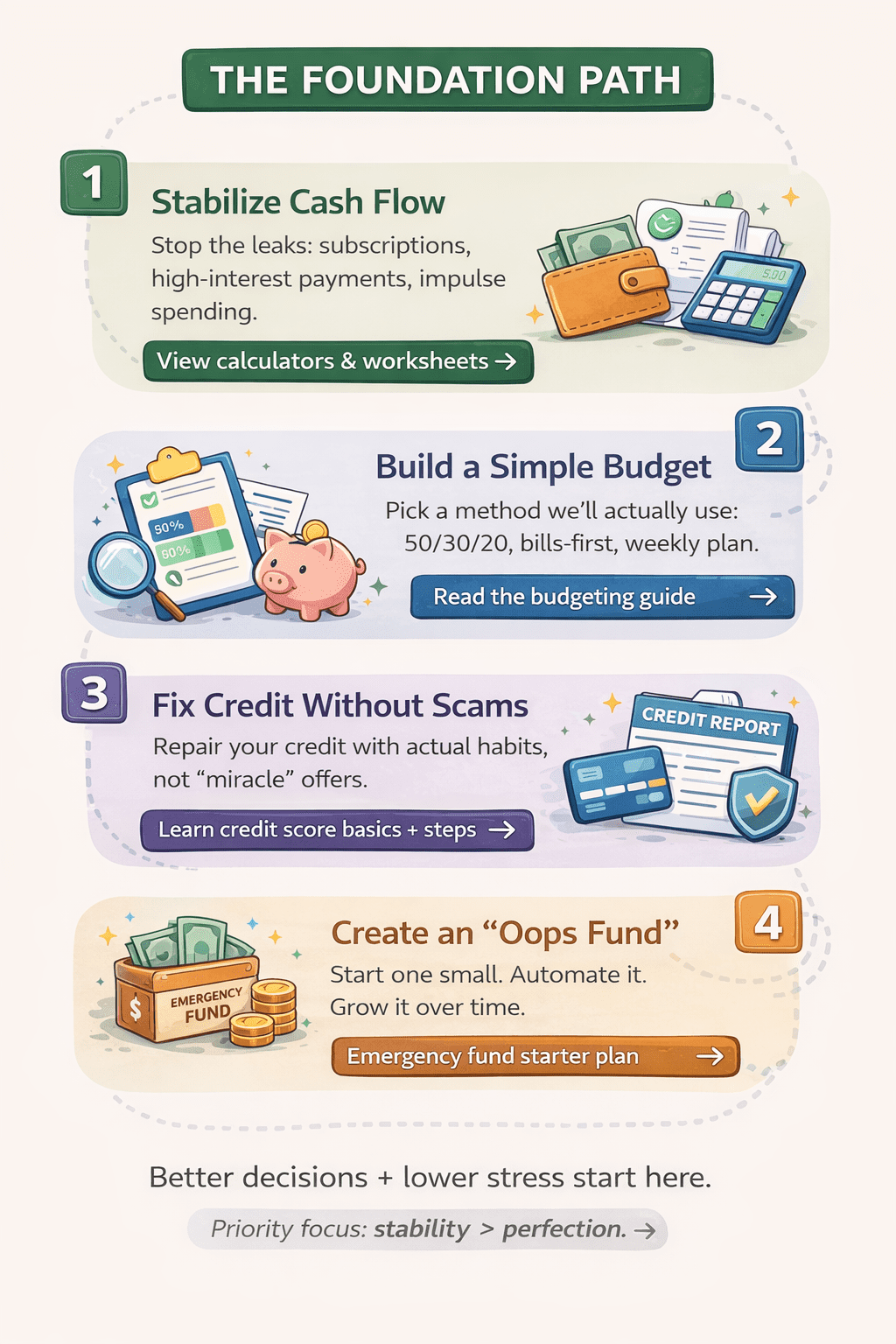

Start here: Foundations = cash flow + a simple budget + fewer bad decisions + better credit. Once those are stable, everything else gets easier.

Write down (1) what you bring in each month, (2) your top 10 bills, (3) your subscriptions. That list becomes your “money dashboard.” You can’t improve what you can’t see.

Most Millennials don’t need more motivation—they need a simple system that works in real life. Use these steps in order.

Get clear on what comes in vs. what goes out. Stop the leaks first (subscriptions, high-interest payments, impulse spending).

Suggested tools: budget planning worksheet, bill tracker, “true cost” calculator.

Budgeting shouldn’t feel like punishment. Pick a simple method (50/30/20, “bills-first,” or weekly spending plan) and keep it easy to maintain.

Credit improves when your system improves: fewer late payments, lower utilization, fewer new accounts, and time. Avoid “miracle” offers and focus on the basics.

Even $500 changes your stress level. Start small, automate it, and grow it over time.

Taking personal responsibility for your financial life makes everything else easier—career choices, relationships, home buying, even stress and sleep. Start with a simple system and keep it going.