| Feature | Free | Membership |

|---|---|---|

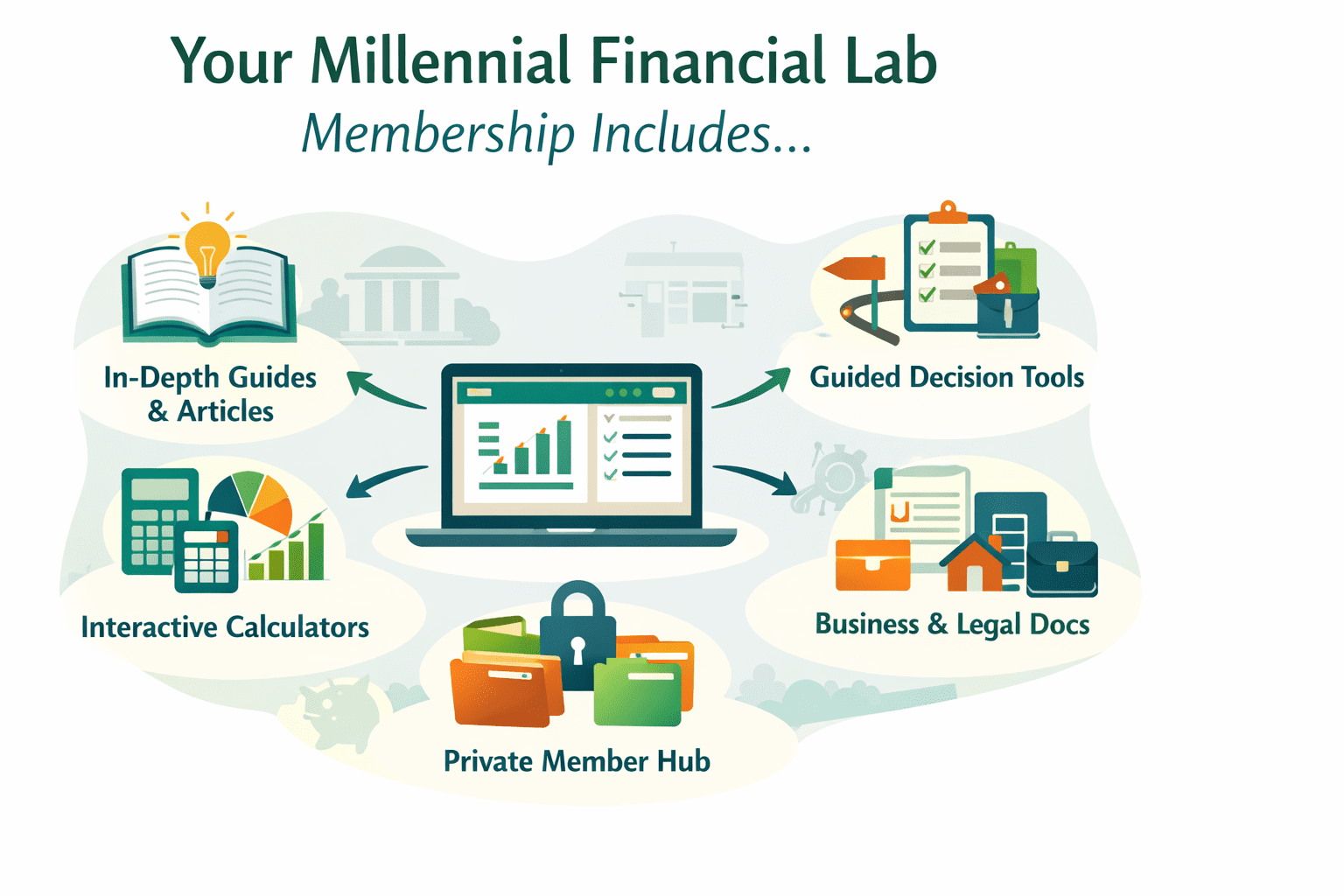

| Public Articles & Guides | ✓ Limited | ✓ Full library |

| In-Depth System Explanations | — | ✓ Included |

| Interactive Calculators | Basic only | ✓ Full access |

| Guided Decision Tools | — | ✓ Included |

| Business Startup & Planning Tools | — | ✓ Included |

| Legal Document Preparation Tools | — | ✓ Included |

| Downloadable Templates & Checklists | — | ✓ Included |

| Member Hub Access | — | ✓ Included |

| New Tools & Updates | — | ✓ Automatically added |

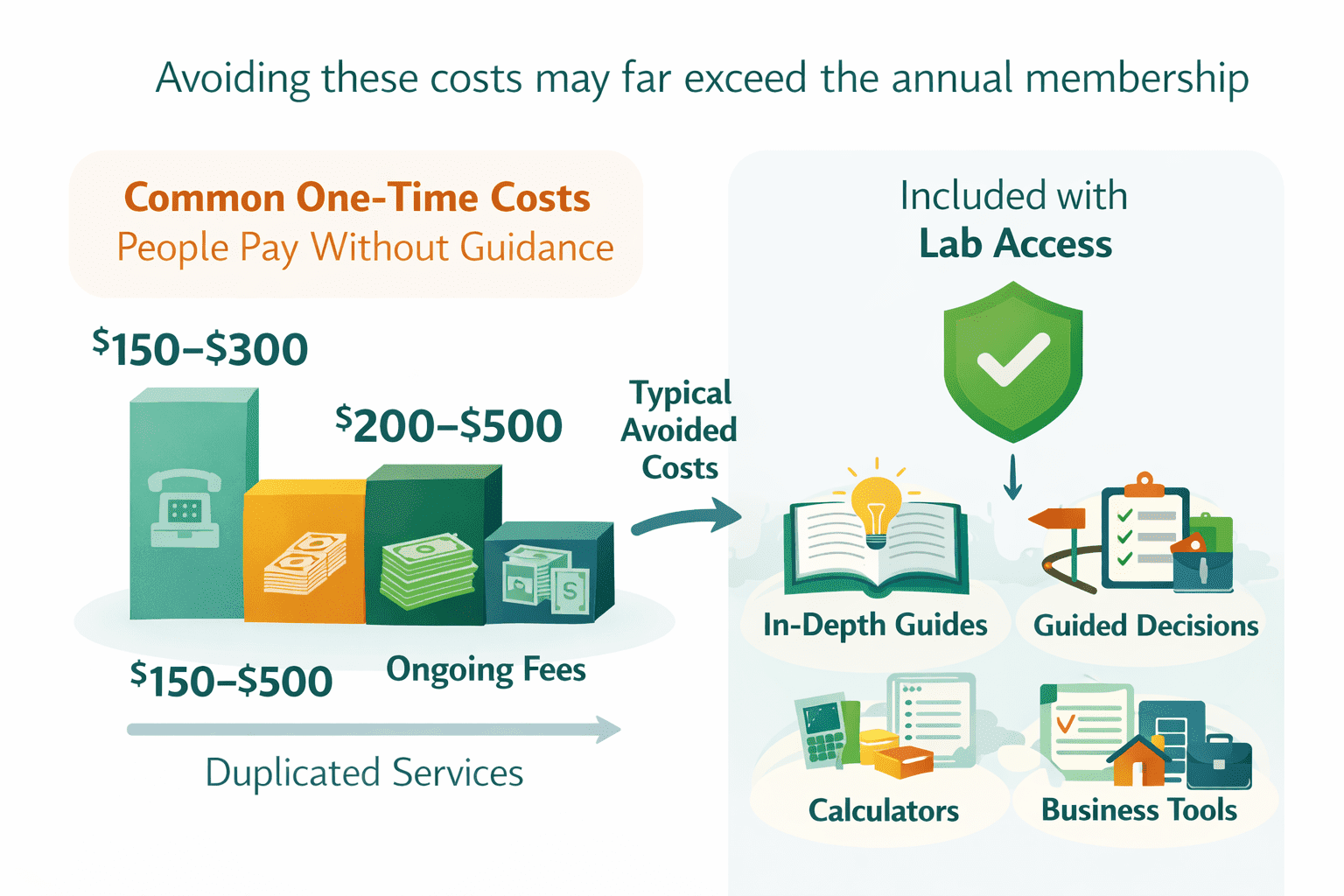

| Tool | Typical Standalone Cost | Included |

|---|---|---|

| Quit Claim Deed Creator | ~$200 | ✓ |

| Warranty Deed Creator | ~$200 | ✓ |

| LLC Startup Checklist & Filing Guide | $100+ | ✓ |

| LLC Operating Agreement Template | $150+ | ✓ |

- How systems work (credit, banking, housing, debt, taxes)

- Cash-flow stabilization and “Oops Fund” planning

- Realistic credit improvement paths (no hype)

- Plain-language explanations that connect decisions to outcomes

- Tools linked to articles so you can act while you read

- Scenario testing before you commit to decisions

- Budget and cash-flow tools built for real constraints

- Payoff and utilization tools to show tradeoffs clearly

- Planning calculators tied to specific guides

- Ongoing updates as best practices evolve

- Decision routing for common credit, cash-flow, and debt scenarios

- Guidance that emphasizes “right next step” over “expensive step”

- Clear warnings about red flags and unnecessary paid services

- Action prompts that point you to the best starting point

- LLC startup checklists and planning templates

- Reference guides you can reuse as your situation changes

- Organizers tied to calculators and guides

- Updates and improvements added over time

- Practical tools + clear explanations

- System-focused guidance built for real constraints

- Designed to reduce confusion and prevent bad next steps

- Continuously improved as systems and tools evolve

- Legal advice

- Investment advice

- A guarantee of savings or outcomes

- A replacement for licensed professional help when needed

- Subscribe and receive immediate access to the private Member Hub.

- Included tools and resources unlock automatically.

- New tools and updates appear inside the hub as they’re released.