Deciding rent vs buy for millennials isn’t just about home prices or interest rates—it’s about how your housing choice fits your budget, job flexibility, and life timeline right now. For many Millennials, the pressure to “buy before it’s too late” can lead to rushed decisions that create stress instead of stability. This guide is designed to slow that process down and help you evaluate rent vs buy for millennials using practical checkpoints, not outdated rules or outside expectations.

Our calculators can help you decide a direction without pushing you toward a specific outcome. You’ll find them in the Millennial Calculators Hub , where tools like the Rent vs. Buy Calculator let you compare real-world costs, flexibility, and cash flow side by side.

If you want to go deeper, the Millennial Financial Hub helps you work through scenarios using decision tools that connect housing choices to your broader financial picture—so you’re not making this decision in isolation.

The goal isn’t to rush you into renting or buying. It’s to help you choose the option that supports your life, your finances, and your future—on your terms.

- 1. Start With Your Timeline (This Matters More Than Price)

- 2. Budget Reality Check (Not the Bank’s Version)

- 3. Job Flexibility & Income Stability

- 4. Lifestyle Fit (The Part Calculators Can’t Measure)

- 5. Cash Position & Opportunity Cost (Short-Term vs. Long-Term)

- 6. Market Reality (Without Trying to Time It)

- 7. Emotional Pressure & External Noise

- Case Study: Brenda & Julian — A Rent vs. Buy Decision at a Turning Point

- 8. Decision Snapshots (Quick Self-Assessment)

- 9. Your Next Smart Step (No Pressure)

- Short Quiz

- FAQ

1. Start With Your Timeline (This Matters More Than Price)

When weighing rent vs buy for millennials, timeline often matters more than home price, interest rates, or even rent increases. How long you realistically expect to stay in one place affects whether buying builds stability—or creates unnecessary risk.

Buying a home comes with upfront costs, ongoing responsibilities, and less flexibility. Those trade-offs can make sense if you plan to stay put long enough to benefit from them. If your timeline is uncertain, renting can be a strategic choice—not a setback.

Checklist: How long do you expect to stay in this location?

- Less than 2 years — Renting usually makes more sense. Transaction costs and market swings can outweigh any ownership benefits.

- 2–5 years — This is a gray zone. Buying may work only if your budget is solid and your income is stable.

- 5+ years — Buying becomes more viable, assuming the rest of your finances support it.

For many Millennials, timelines shift due to job changes, remote work flexibility, relationship changes, or plans to relocate for affordability. That’s why rent vs buy for millennials should start with an honest look at where your life may move next—not where you feel pressured to land today.

Why timeline changes the math

- Closing costs, moving costs, and commissions take time to recover

- Short stays increase exposure to market downturns

- Flexibility often has real financial value

If your timeline feels uncertain because of finances, it may be worth addressing those first. Improving your credit can expand housing options and lower future borrowing costs—but only if it’s done safely. If that’s part of your picture, review our guide on fixing credit without getting scammed before making any long-term housing commitments.

Likewise, clarity around your monthly cash flow can help you determine whether buying aligns with your timeline or stretches it too far. Our Millennial Budget Guide walks through how to assess housing costs in the context of real life—not just what a lender says you can afford.

The takeaway: choosing between renting and buying isn’t about predicting the market. It’s about choosing the option that gives you the most stability and flexibility for the timeline you’re actually living.

2. Budget Reality Check (Not the Bank’s Version)

When comparing rent vs buy for millennials, one of the biggest mistakes is letting a lender—or an online headline—define what you can afford. Banks qualify you based on risk to them. Your budget needs to work for your actual life.

A realistic housing decision should leave room for savings, flexibility, and the unexpected. If buying a home only works when everything goes perfectly, it’s a fragile plan—even if the numbers technically “approve.”

Checklist: Can your budget handle ownership comfortably?

- Your total monthly housing cost fits comfortably within your take-home pay

- You still have an emergency fund after closing

- Housing doesn’t crowd out other priorities (travel, investing, career moves)

- You can absorb higher costs without relying on future raises

This is where tools—not opinions—make the decision clearer. The Rent vs. Buy Millennial Calculator compares renting and buying using real monthly costs, not just a mortgage payment. It factors in items that are easy to overlook, like maintenance, taxes, insurance, and the cash you tie up upfront.

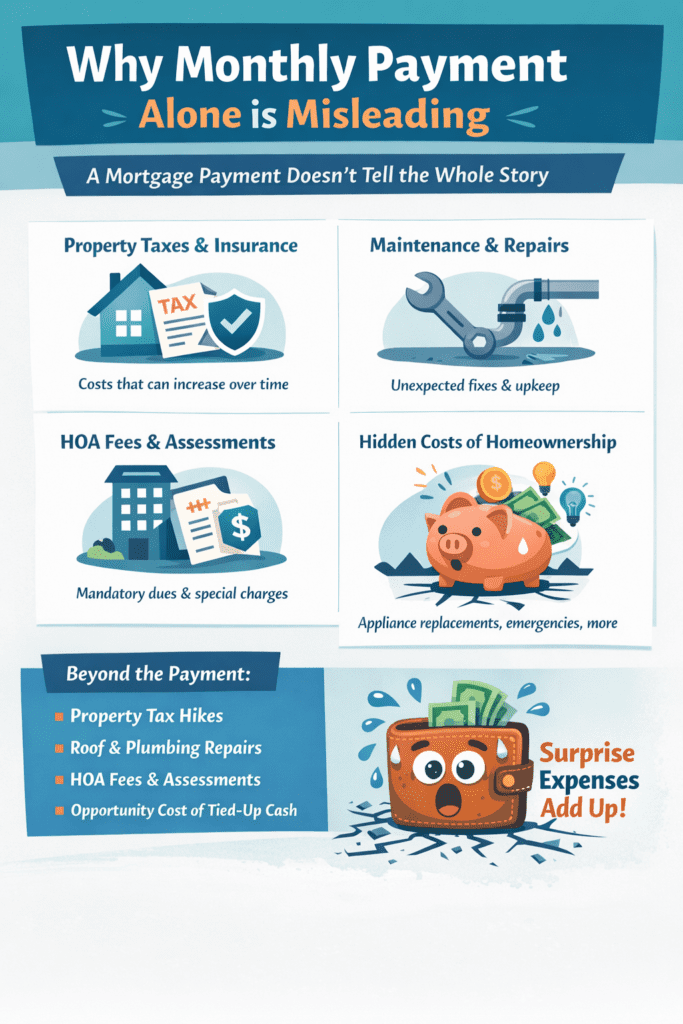

Why monthly payment alone is misleading

A mortgage payment can look manageable on paper while the total cost of ownership quietly strains your budget. Buying often adds expenses that don’t exist—or are capped—when renting.

- Property taxes and insurance that can increase

- Maintenance, repairs, and replacements

- HOA fees or special assessments

- Opportunity cost of your down payment

The calculator helps surface these trade-offs so you can see whether buying improves your financial position—or simply locks you into higher fixed costs with less flexibility.

Stress-testing your decision

As you use the calculator, ask yourself a few grounding questions:

- What happens if my income dips for a few months?

- Can I still save and invest consistently?

- Would this payment feel tight if other costs rise?

If the numbers only work under ideal conditions, renting may be the smarter short-term move—even if buying feels like the “grown-up” choice. In the rent vs buy for millennials decision, sustainability matters more than symbolism.

The goal isn’t to minimize your housing cost at all costs. It’s to choose the option that supports your financial stability and gives you breathing room as your life evolves.

3. Job Flexibility & Income Stability

When evaluating rent vs buy for millennials, job flexibility and income stability often matter just as much as price or interest rates. A housing decision that works today can become stressful quickly if your income changes or your job requires you to relocate.

Millennials are more likely to change roles, switch industries, freelance, or run small businesses. While this flexibility can increase opportunity, it also affects how safe—or restrictive—homeownership feels compared to renting.

Regular income from a job or business is critical when applying for a loan to buy a house—or even to rent an apartment. Your income-to-debt ratio may be reviewed by a landlord and is always evaluated by a lender. Both want to understand what you earn now and whether that income is likely to continue over the next six months.

How income type affects housing choices

The way you earn income can influence whether renting or buying feels more supportive—or more restrictive.

- Salaried income — Typically easier to document and predict, which may support buying if other factors align.

- Commission or variable income — Often requires longer documentation history and adds risk to fixed housing costs.

- Self-employed or freelance income — Can be strong and growing, but lenders usually look for consistency over time.

This doesn’t mean homeownership is off the table if your income isn’t traditional. It simply means the rent vs buy for millennials decision should account for how resilient your budget feels if income fluctuates.

Job flexibility vs. housing flexibility

If your career allows—or requires—you to move quickly, renting can preserve options. Buying ties you more tightly to a location and adds friction if an unexpected opportunity arises.

- Remote work policies can change

- Promotions or layoffs can shift timelines

- Career pivots may require relocation

Renting can function as a form of career insurance during periods of transition. Buying tends to work best when your income and location are both relatively stable.

Stress-testing your income

Before committing to a long-term housing cost, consider these questions:

- Could you manage your housing costs if income dipped temporarily?

- Do you have reserves to cover slow periods?

- Would selling or moving quickly be difficult?

In the context of rent vs buy for millennials, the safer choice is often the one that gives you the most flexibility if life doesn’t follow a straight line.

4. Lifestyle Fit (The Part Calculators Can’t Measure)

When thinking through rent vs buy for millennials, spreadsheets and calculators are essential—but they don’t capture everything. Your housing choice also affects how you live day to day, how much mental space you have, and how easily you can adapt when life changes.

A decision that looks good financially can still feel wrong if it doesn’t match your current lifestyle. That mismatch is often where regret creeps in—not because the math was wrong, but because the fit wasn’t.

Checklist: What does your current lifestyle actually need?

- Flexibility to relocate for work or personal reasons

- Predictable monthly costs with fewer surprises

- Minimal responsibility for repairs and maintenance

- Freedom to travel or spend time away from home

- Control over your space and ability to customize

Neither renting nor buying is automatically better—it depends on which of these matter most to you right now.

Renting may fit better if:

- You value flexibility or expect life changes in the next few years

- You prefer calling a landlord instead of managing repairs

- You want predictable housing costs month to month

- You don’t want housing to limit travel, career moves, or side projects

Buying may fit better if:

- You plan to stay in one place long enough to benefit from stability

- You want control over your living space

- You’re comfortable managing maintenance and unexpected issues

- Your budget has room for higher and less predictable costs

The mental load factor

Housing decisions don’t just affect your bank account—they affect your time and energy. Owning a home often means making decisions about repairs, contractors, insurance, and long-term upkeep. Renting shifts much of that responsibility elsewhere.

In the rent vs buy for millennials conversation, mental load is a real cost. If housing stress crowds out focus on career growth, relationships, or health, that trade-off deserves weight in the decision.

The right choice is the one that supports how you want to live today while still leaving room for tomorrow. Lifestyle fit isn’t permanent—it can change as your priorities change, and that’s okay.

- Compare renting vs. buying based on your timeline

- See how cash flow, savings, and flexibility are affected

- Built for Millennial realities—not outdated rules

5. Cash Position & Opportunity Cost (Short-Term vs. Long-Term)

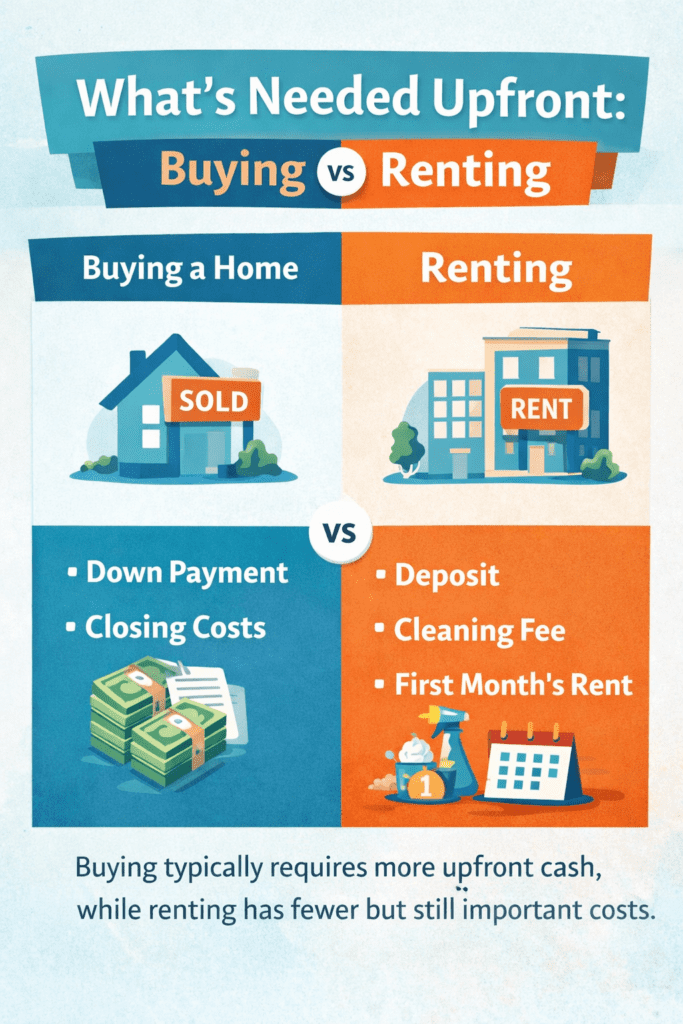

In the rent vs buy for millennials decision, cash is often the tightest constraint—and the most misunderstood. Buying a home usually requires a large upfront commitment, while renting preserves liquidity. Neither is automatically better; the right choice depends on how that cash supports both your present needs and your future goals.

Opportunity cost is the trade-off you make when money goes one direction instead of another. A down payment tied up in a home can’t be used for investing, career moves, or flexibility. At the same time, not owning a home means missing out on long-term equity growth that has historically played a major role in financial stability later in life.

Owning a home is a long-term decision. People who own homes when they enter retirement tend to do far better financially than those who do not. Home equity built over decades is difficult to replace and can provide stability, flexibility, and options later in life. When you reach the point where buying makes sense, consider not just today’s numbers, but the long-term wealth a home can help build to support your future retirement. Avoid making a decision based solely on short-term conditions—think long term as well.

Short-term flexibility vs. long-term payoff

Renting often wins in the short term because it requires less upfront cash and offers more mobility. This can be valuable early in your career or during periods of transition.

Buying, on the other hand, shifts money into an asset that can grow over time. While it reduces liquidity, it also creates forced savings through principal payments and potential appreciation—especially when held long term.

Questions to ask yourself

- Would buying leave me cash-poor or financially stretched?

- Am I sacrificing important near-term goals to buy?

- Am I delaying ownership indefinitely without a plan?

- Does this decision support both my current life and my future self?

In the context of rent vs buy for millennials, the strongest decisions usually balance flexibility today with intentional planning for tomorrow. Renting can be the right step now, while buying can be the right move later—when it aligns with both your finances and your long-term vision.

The key isn’t choosing one forever. It’s choosing the option that fits your stage of life, while keeping future wealth-building firmly in view.

6. Market Reality (Without Trying to Time It)

One of the most common traps in the rent vs buy for millennials decision is waiting for the “perfect” market. Headlines focus on interest rates, price swings, and predictions—but housing decisions rarely benefit from trying to outguess the market.

Markets move in cycles, and by the time conditions feel ideal, competition often increases or affordability shifts in a different way. The result is hesitation that delays progress without meaningfully improving outcomes.

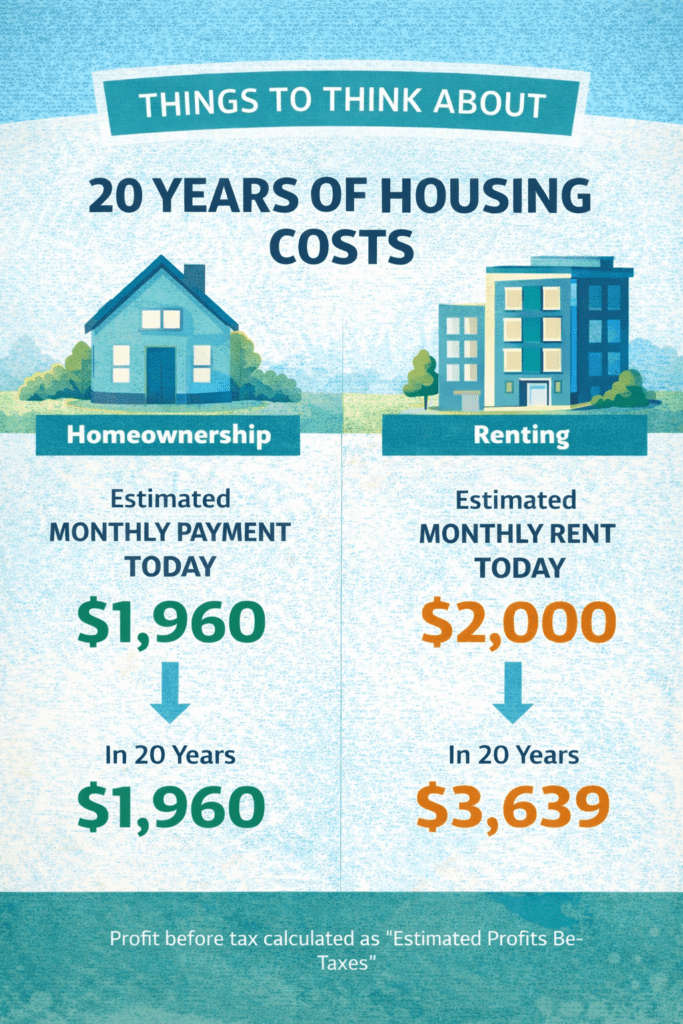

It’s almost impossible to chase interest rates successfully. If you wait for rates to drop, remember that home prices often rise alongside inflation. While rates fluctuate, prices tend to move upward over time. The good news is that you can often refinance if rates drop significantly—many homeowners do.

Why timing the market is so difficult

- Interest rates and home prices rarely move in opposite directions for long

- Inflation affects construction costs, rents, and sale prices

- Competition increases quickly when conditions “improve”

Waiting can feel safe, but it often carries its own cost—higher prices, rising rents, or missed opportunities to build stability over time.

A better way to think about market conditions

Instead of asking whether the market is perfect, ask whether the decision works under reasonable assumptions. Can your budget handle the payment? Does the timeline make sense? Would the decision still feel manageable if conditions shift slightly?

In the context of rent vs buy for millennials, the most successful decisions usually come from personal readiness—not market timing. When buying fits your finances, your lifestyle, and your long-term plan, short-term market fluctuations matter less than consistency and sustainability.

Renting can be the right choice while you prepare. Buying can be the right move when the fundamentals line up. The key is avoiding paralysis based on predictions that even experts struggle to get right.

Housing choices like rent vs. buy rarely exist in isolation. They affect cash flow, flexibility, long-term wealth, and future opportunities. That’s why we created the Millennial Financial Lab—a subscription platform built specifically to help Millennials work through these kinds of real-life financial decisions.

Inside the Lab, you’ll find decision tools and expanded calculators designed to guide—not pressure—you. The goal isn’t telling you what to do. It’s helping you understand your options clearly so you can choose the path that fits your life and timeline.

Explore the Millennial Financial Lab7. Emotional Pressure & External Noise

In the rent vs buy for millennials decision, emotional pressure often plays a bigger role than most people realize. Family opinions, social media timelines, and well-meaning advice can quietly push you toward decisions that don’t actually fit your life.

Buying a home is frequently treated as a milestone or a signal of success. Renting, by comparison, is sometimes framed as temporary or “falling behind.” Those narratives can create urgency where none is needed.

Common sources of pressure

- Friends posting home purchases online

- Family members who bought in a very different market

- Articles predicting you’ll be “priced out forever”

- Advice based on someone else’s timeline, not yours

None of these voices carry your full financial picture. They don’t see your budget, your career flexibility, or your long-term goals. That’s why outside noise should inform your thinking—but never drive your decision.

Grounding questions that cut through the noise

- Would I make the same choice if no one else knew about it?

- Does this decision reduce stress—or add more?

- Am I reacting to fear, or responding to readiness?

In the context of rent vs buy for millennials, confidence comes from clarity, not comparison. Renting can be a smart, intentional choice. Buying can be the right move—when it aligns with your finances and your future.

There is no universal schedule for housing decisions. The right timing is the one that supports your stability, your growth, and your ability to adapt as life changes.

Case Study: Brenda & Julian — A Rent vs. Buy Decision at a Turning Point

Brenda and Julian were at a familiar crossroads for many Millennials. They were preparing to get married, planning to leave their separate apartments, and deciding whether their next step should be renting together or buying their first home.

Both had stable careers. Brenda was a marketing manager at a mid-sized company with the flexibility to work from home most days. She valued having a dedicated home office and wanted a space that felt permanent enough to grow into. Julian was a manager at a large auto dealership with a predictable schedule and strong income. Neither expected to relocate anytime soon.

Their financial position

- Stable, full-time income from established employers

- Met lender debt-to-income requirements comfortably

- Solid credit profiles and consistent earnings history

- Able to qualify for a mortgage without stretching their budget

On paper, Brenda and Julian looked like ideal first-time buyers. Their timeline was stable, their income was reliable, and their combined budget could support ownership without major strain.

The hesitation: waiting on interest rates

Despite being financially prepared, Brenda and Julian hesitated. Interest rates were higher than they hoped, and they wondered whether waiting for rates to drop would improve affordability. Like many couples weighing rent vs buy for millennials, they worried about locking in a decision at the wrong time.

They also recognized that delaying too long could mean higher home prices or rising rents—especially in the areas they preferred. The challenge wasn’t qualification; it was confidence.

How they reframed the decision

Instead of asking, “Should we buy right now?” Brenda and Julian focused on a more useful question: “Which option supports our next phase of life best?”

- Buying would give Brenda a dedicated office and long-term stability

- Renting would preserve flexibility if rates dropped significantly

- Either option needed to work comfortably within their budget

They also learned that interest rates don’t have to be permanent. Refinancing later—if rates dropped meaningfully—was a realistic option. That realization helped shift the decision from fear-based timing to long-term planning.

The takeaway

Brenda and Julian’s situation highlights an important truth: being “ready” to buy doesn’t always mean buying immediately. For Millennials, the best housing decision balances stability, lifestyle needs, and long-term goals—without waiting indefinitely for perfect conditions.

Whether renting for another year or buying sooner, their decision became intentional rather than reactive. And that clarity mattered more than predicting the market.

How Brenda & Julian Used the Rent vs. Buy Calculator

Brenda and Julian realized that “waiting for rates” wasn’t a plan by itself. They needed to see what the numbers looked like in their situation—cash flow, upfront costs, and how long they expected to stay in the home.

They ran their scenario in the Rent vs. Buy Millennial Calculator and focused on three practical outputs:

- Upfront cash needed — down payment and closing costs vs. rent deposit and first month’s rent

- True monthly ownership cost — mortgage plus taxes, insurance, maintenance, and any HOA fees (not just the payment)

- Timeline sensitivity — how long they’d need to stay for buying to make sense versus renting

The calculator helped them replace “market guessing” with clarity. If buying worked comfortably within their budget and they planned to stay put, they could move forward knowing they weren’t stretching. If it didn’t, renting for another year became a confident, intentional choice—not a delay.

Run your own numbers to compare renting vs. buying based on your budget, timeline, and monthly cost reality.

Open the Rent vs. Buy Calculator8. Decision Snapshots (Quick Self-Assessment)

If you’re still weighing rent vs buy for millennials, these snapshots can help you sanity-check your thinking. They aren’t rules—just patterns that tend to show up when one option fits better than the other.

You may be better off renting right now if:

- Your timeline is uncertain or likely to change within a few years

- Your income is variable, commission-based, or still stabilizing

- You value flexibility more than permanence right now

- Buying would drain savings or leave little margin for surprises

- You’re waiting on clarity—career, location, or life changes

Renting in this phase isn’t a delay—it’s a strategy. It can give you time to strengthen cash flow, improve flexibility, and prepare for ownership on your own terms.

You may be ready to buy if:

- You plan to stay in one place long enough to benefit from stability

- Your income is reliable and comfortably supports the full cost of ownership

- You have reserves left after closing—not just enough to qualify

- You want control over your space and are comfortable with responsibility

- You’re thinking beyond the next year and toward long-term wealth building

Buying doesn’t need to be perfect to be practical—but it should feel sustainable. If ownership supports your lifestyle, budget, and long-term goals, it may be the right move even if conditions aren’t ideal.

The most important snapshot

In the rent vs buy for millennials decision, the strongest indicator isn’t the market—it’s alignment. When your finances, lifestyle, and timeline point in the same direction, the choice becomes clearer.

If they don’t align yet, that’s useful information—not failure. The right decision is the one that reduces stress today while keeping future options open.

Estimate vary, maintenance not included. Equity bill up also not reflected in owning.

9. Your Next Smart Step (No Pressure)

If you’ve worked through this guide, you’ve already done something important: you slowed the rent vs buy for millennials decision down enough to think clearly. That alone puts you ahead of most people making housing choices under pressure.

The next step doesn’t have to be buying or signing another lease. It can simply be understanding your numbers, your timeline, and your priorities with more clarity.

A simple way to move forward

- Run your scenario through the Rent vs. Buy Calculator

- Review your full budget to see what feels sustainable—not just what qualifies

- Revisit this decision as your life, career, or goals change

If you want deeper guidance, the Millennial Financial Lab was built for exactly this purpose. It brings together decision tools and expanded calculators designed to help you think through big financial choices step by step—without sales pressure or one-size-fits-all advice.

Renting can be the right choice right now. Buying can be the right move later. Or buying may make sense today because your finances, lifestyle, and long-term plans align.

There’s no universal timeline and no finish line you’re racing toward. The right decision is the one that supports your stability today while keeping future options open.

Short Quiz

- More “Rent” answers: Renting may fit better right now—flexibility and stability matter more than ownership today.

- More “Buy” answers: You may be closer to being ready—your timeline, savings, and stability support ownership.

- Mostly “Neutral”: You’re in the gray zone. Run the numbers and focus on timeline + budget comfort.

FAQ

- More “Rent” answers: Renting may fit better right now—flexibility and stability matter more than ownership today.

- More “Buy” answers: You may be closer to being ready—your timeline, savings, and stability support ownership.

- Mostly “Neutral”: You’re in the gray zone. Run the numbers and focus on timeline + budget comfort.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.

![Biloxi Mississippi is a great place to live/visit [2025]](https://retirecoast.com/wp-content/uploads/2022/06/Biloxi-light-house-440x264.jpeg)

Trackbacks/Pingbacks