Many people assume their monthly living expenses in retirement will go down. No more commute, no work clothes, no lunches out—so the budget should shrink, right? In reality, expenses are more often swapped than eliminated. Some costs disappear, but others quietly rise and new ones appear.

This page is here to help you see the full picture before you take the leap into retirement. You’ll find:

- A downloadable Monthly Living Expenses Checklist (PDF)

- A budget spreadsheet you can use to organize all those numbers

- Real-world examples of “surprise” retirement expenses you’ll want to plan for

Use these tools together with your own numbers so you can build a retirement budget that is honest, realistic, and flexible.

Pre-Retirement vs. Post-Retirement Expenses: What Really Changes

Sometimes yes, sometimes no—but they definitely change.

When you’re working full time, you get used to a certain pattern of spending that’s built around employment. When you retire, those costs don’t simply disappear. They’re often replaced by new costs tied to your home, health, travel, and how you spend your time.

To make this simple, think in terms of pre-employment vs. post-employment spending patterns.

Major Pre-Retirement (Working Life) Expense Categories

These are the kinds of expenses that tend to be highest while you’re still working:

- Commuting and transportation to work

Fuel, tolls, parking, public transit, rideshare, extra wear and tear on the car. - Work-related clothing and grooming

Office attire, uniforms, dry cleaning, frequent haircuts. - Meals and coffee on the go

Lunches out, coffee stops, take-out when you’re too tired to cook after work. - Child- and work-schedule-related costs

Childcare, after-school programs, convenience services because you’re short on time. - Retirement contributions tied to paychecks

401(k) contributions, extra savings pulled straight from your salary. - Job-related education and licensing

Continuing education, conferences, licenses, professional memberships.

Some of these truly shrink after you retire—but the money usually flows somewhere else.

My Personal Experience Planning Monthly Living Expenses in Retirement

My personal adventure into quasi-retirement was very well planned—or so I thought.

I sold my company, stayed on for a few years to manage it for the buyer, and then moved into what I assumed would be true retirement. And I wasn’t winging it; I did serious research for many years ahead of time. I even bought my retirement home before I retired. (If you’re considering that path, take a look at this article: Buy Your Retirement Home Before You Retire.)

Even with all that planning, I still found expenses I had not specifically accounted for, especially the fact that the “new” home I purchased would age and need repairs or replacement of major items:

- Systems I took for granted when I was working (roof, HVAC, water heater) eventually demanded attention.

- Small repairs became more frequent.

- Service calls seemed to cost more every year.

The lesson: planning works, but life is never as neat as a spreadsheet. Your retirement home and lifestyle will both age right along with you—and that has a cost attached to it.

The Expenses No One Warns You About

When you’re working full time and earning good money, irregular expenses feel “annoying but manageable.” In retirement, those same surprises can throw the budget off unless you’ve planned for them.

Here are a few real-world examples:

- The $750 RV insurance deductible

My 5th wheel had an electrical fire. The good news: it was insured. The not-so-good news: I still had to write a check for the $750 deductible.

It’s hard to budget for that kind of event as a neat line item, but you can plan for an annual “Murphy’s Law” fund to cover things like this. - A cross-country funeral trip

Your best friend from college passes away 2,000 miles away. Airline tickets, hotel, rental car, and meals can easily reach or exceed $1,000. Few people build that into their monthly budget, but it’s exactly the kind of thing that happens in real life. - Aging home systems

- A water heater that’s already 10 years old when you retire has a pretty good chance of failing in the near future.

- A roof that’s 20–25 years old may “have a few more years in it,” but at some point your insurance company will start caring about its age and condition.

- Rising insurance and property taxes

- Property insurance rarely gets cheaper from year to year.

- Property taxes often go up as property values increase.

- Vehicle insurance can also creep up over time.

These are the things people don’t usually tell you about retirement. They’re ordinary when you’re working and earning steady income. In retirement, they must be planned for.

Turn ‘I Hope It Works Out’ into a Real Plan

To help you get ahead of these costs, we’ve created two simple tools you can start using today:

- Monthly Living Expenses Checklist (PDF)

- Print it or save it on your device.

- Go line by line and jot down your current expenses and realistic future estimates.

- Use it as your master list when you review bills, statements, and quotes.

- Retirement Budget Spreadsheet

- Transfer your numbers from the checklist into the spreadsheet.

- Group expenses by category: housing, utilities, healthcare, insurance & taxes, transportation, food, personal & fun, giving & family, and irregular “Murphy’s Law” costs.

- Adjust and test different scenarios so you can see how changes affect your total monthly needs.

Suggested flow:

- Download the checklist.

- Gather your bank statements, credit card statements, and recurring bills.

- Fill out the checklist carefully.

- Enter those numbers into the budget spreadsheet.

- Review the totals and update at least once a year.

The Two Big Pieces of the Puzzle

After helping a lot of people think through retirement, I keep coming back to two simple ideas:

- Plan well on the expenses side.

Don’t guess. List every realistic expense, including the “ugly” ones like roof replacements, insurance deductibles, and trips you hope you won’t need to take. Planning doesn’t create the expense—it just makes sure you’re not surprised by it. - Have sufficient income to cover most expenses.

This can come from Social Security, pensions, retirement accounts, rental income, small businesses, part-time work, or a mix of all of these. The more diverse and stable your income sources, the easier it is to handle those irregular hits.

For some retirees, starting a small business is not just a way to stay engaged—it’s also a way to build extra income and a margin of safety into the retirement plan. If that sounds interesting, you might enjoy this in-depth guide:

Keep Going – Learn More About Real-World Retirement Planning

If you’d like to hear a deeper discussion of these ideas, listen to our podcast episode on retirement budgeting and surprise expenses. We talk frankly about:

- How real retirees deal with unexpected costs

- Why “just cut expenses” is not a full plan

- How side income and flexible planning can lower your stress

(Here, embed or link to the relevant RetireCoast podcast episode.)

You may also find these articles helpful:

- Buy Your Retirement Home Before You Retire

- Best Step-by-Step Guide to Starting a Business After Retirement

Retirement can be great—and there is no need to live in fear of the future—as long as you’re willing to get in front of the unknowns by identifying them now, on paper, while you can still make adjustments to your monthly expenses in retirement.

RetireCoast’s Retirement Budget Spreadsheet is the most comprehensive planning tool you’ll find anywhere—and we’re offering it free to subscribers. Download it now and pair it with our exhaustive list of expense items to build a retirement plan that actually works. Take charge of your future and start planning today. After the FAQ section, be sure to listen to our podcast for even more real-world guidance.

Monthly Living Expenses in Retirement – FAQ

How far in advance should I start planning my retirement expenses?

Start thinking about retirement savings as early as possible, but for detailed expense planning aim for at least 5–10 years before your target retirement date. That gives you time to adjust your lifestyle, pay down debt, and test-drive a realistic budget while you’re still earning.

What’s the difference between my working budget and my retirement budget?

Your working budget includes job-related costs such as commuting, work clothes, meals out, and payroll deductions. A retirement budget replaces many of those with new items such as higher healthcare costs, more travel, hobbies, and home maintenance you used to postpone.

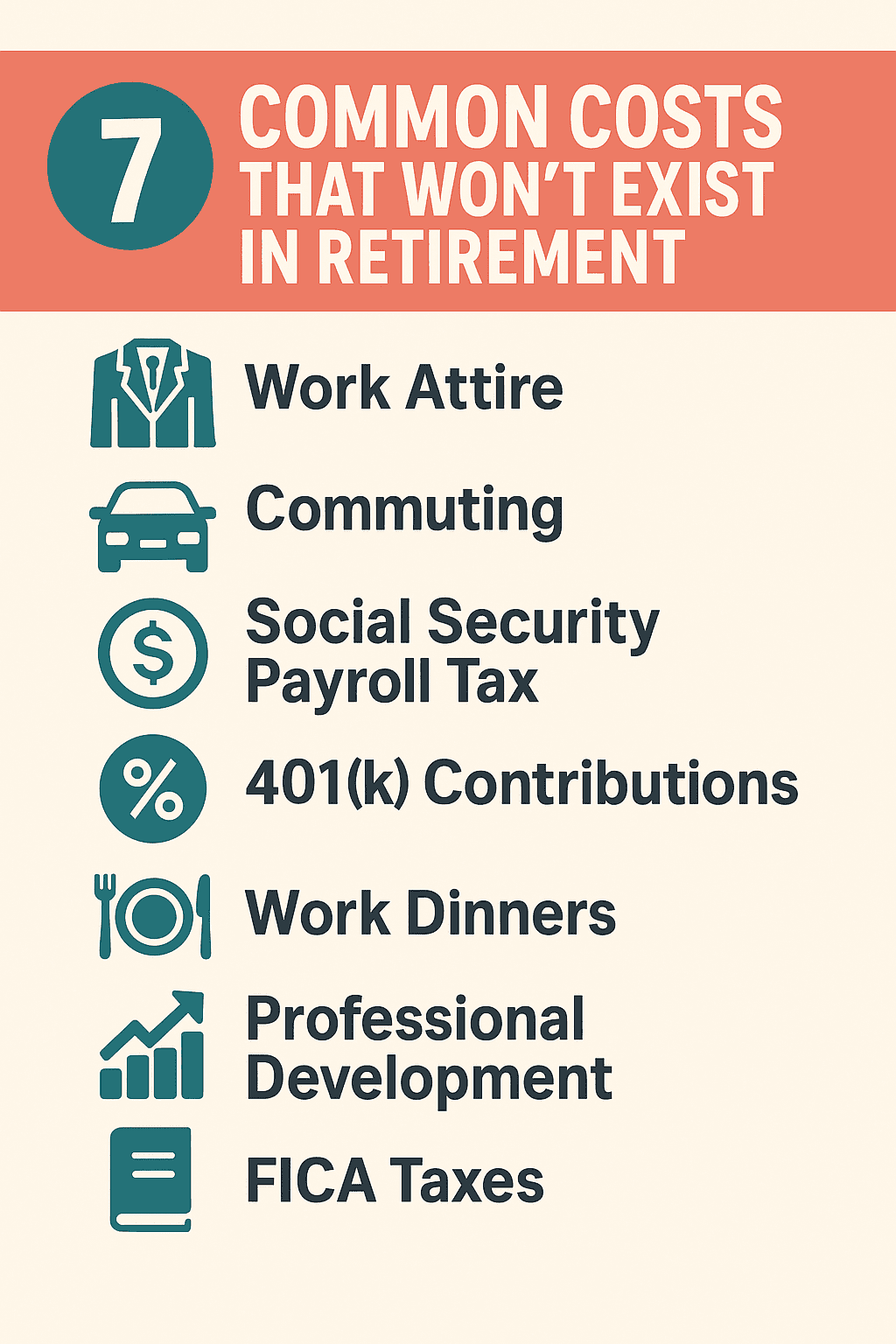

Which expenses usually go down after I retire?

Commonly reduced costs include commuting, parking, work clothing, lunches out, and some payroll deductions. You may also spend less on professional memberships or continuing education tied to your job.

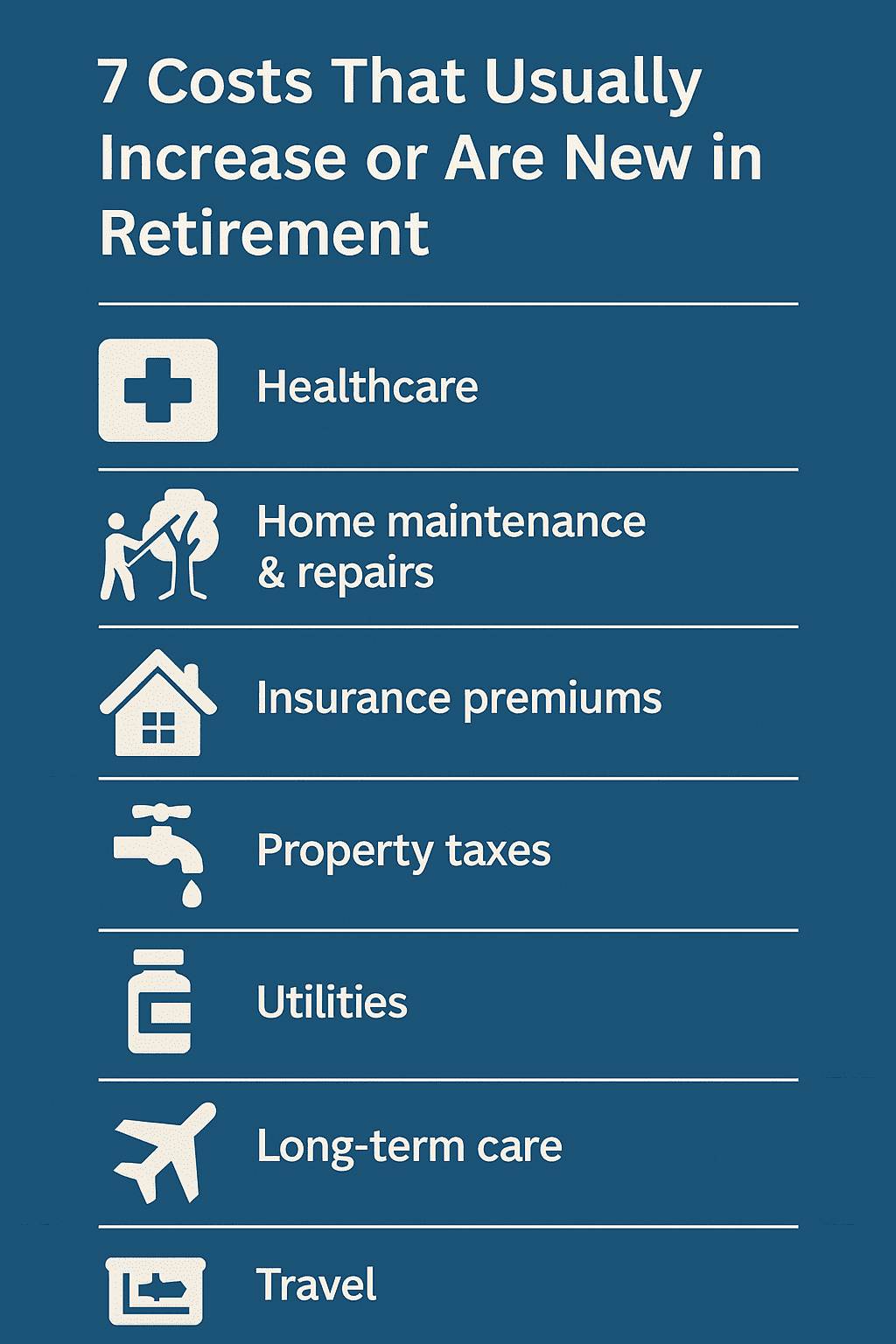

Which expenses often go up in retirement?

Healthcare and insurance, property taxes, home repairs, hobbies, travel, and gifts for children or grandchildren often increase. You may also hire help for things you once did yourself, such as yardwork or minor home maintenance.

How do I estimate healthcare and Medicare costs?

Start with your current premiums and out-of-pocket costs, then add projected Medicare premiums, supplemental insurance, and prescription expenses. Many insurers and government sites provide calculators; build in a cushion for rising premiums and unexpected medical needs.

How should I plan for big, irregular expenses like a new roof or car repairs?

List major items (roof, HVAC, appliances, vehicle replacement, RV repairs, insurance deductibles) and estimate their remaining life. Divide the total cost by the number of years left and set aside that amount each month in a dedicated “repairs & replacements” fund.

Should I try to be debt-free before I retire?

Being debt-free dramatically reduces monthly living expenses and stress. High-interest debt (credit cards, personal loans) should be paid off first. A small, affordable mortgage may be manageable, but include it carefully in your retirement budget and consider whether downsizing would improve cash flow.

How often should I review and update my retirement budget?

Review your numbers whenever something significant changes—a move, new vehicle, medical issue, or insurance increase. As a rule of thumb, revisit the budget at least every six months in the 5–10 years before retirement and monthly once you’re retired.

How do I deal with inflation in my retirement expense plan?

Assume most living expenses will rise over time. You can model this by increasing annual expenses by 2–4% per year in your spreadsheet. Review categories like insurance, property taxes, and groceries regularly and update your budget as prices change.

Can part-time work or a small business help my retirement budget?

Yes. Even modest income from part-time work or a retirement business can ease pressure on savings and give you more flexibility for travel or unexpected costs. Just remember to budget for any new expenses that come with that work, such as supplies, licensing, or self-employment taxes.