Last updated on November 29th, 2025 at 02:57 pm

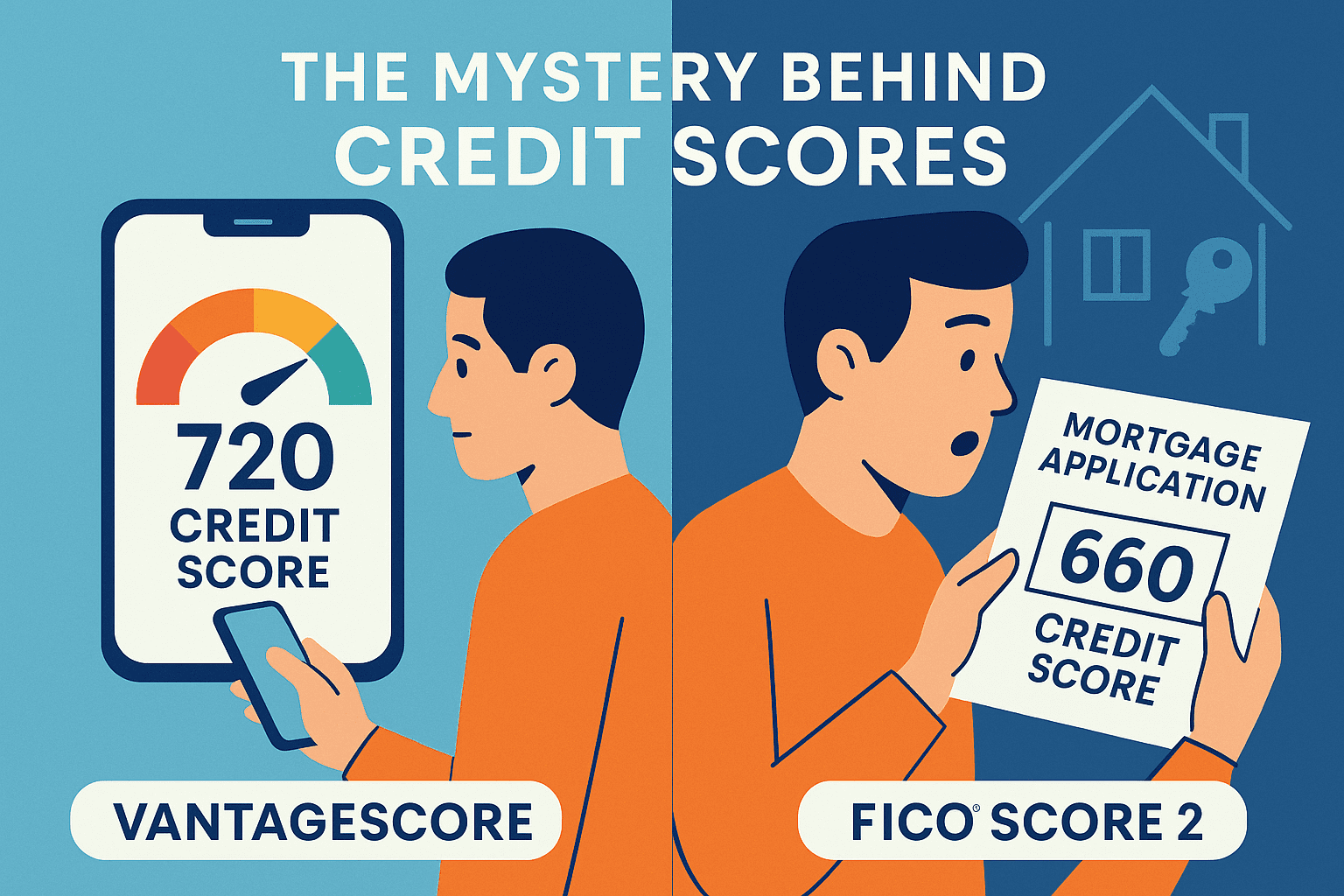

Credit scores for mortgages can feel like a puzzle. Many buyers check their numbers on apps like Credit Karma or their bank’s dashboard, see a solid score, and assume that’s the figure a mortgage lender will rely on. Unfortunately, that’s rarely true. Mortgage lenders still use the older FICO mortgage models (FICO 2, 4, and 5)—versions that often generate lower results than modern consumer scores such as VantageScore 3.0 or 4.0, or even the newly released FICO 10T, which uses a 24-month “look-back” model that tracks your debt trends over time.

Understanding these differences is critical if you’re preparing to buy a home. The score you see online may not be anywhere close to the score a lender calculates, and the gap can directly affect your approval, interest rate, and long-term affordability. Learning how credit scores for mortgages are built—and why they vary so widely—can save you thousands of dollars over the life of your loan. Our article about mortgage discount points can help you before applying to buy a home.

📊 FICO 10T: The New 24-Month “Look-Back” Credit Score

The newly released FICO 10T score introduces a powerful change: it uses a 24-month look-back model that tracks your credit trends over time — not just today’s numbers.

- Examines rising or falling balances

- Analyzes 2 years of payment patterns

- Penalizes long-term high utilization

- Rewards consistent debt reduction

- Provides lenders a more accurate risk picture

For consumers, this means your habits over time matter more than ever — steady improvement helps, and persistent high balances hurt.

1. What a Credit Score Really Is

A credit score is a three-digit number that represents your likelihood to repay borrowed money. It’s based on information collected in your credit reports by the three major credit bureaus: Experian, Equifax, and TransUnion.

These private companies compete with each other. They record debts, payments, and even court actions based on information supplied by member businesses. In return, they provide credit histories back to lenders to help decide whether or not to extend credit.

Separate from the bureaus is the Fair Isaac Corporation (FICO). FICO doesn’t collect the data — instead, it creates scoring models that translate raw credit report information into a number. Different versions of FICO exist for different lending needs.

Types of Credit Scores and Their Uses (Updated for FICO 10, 10T & VantageScore 4.0)

👉 Takeaway: You don’t have one credit score — you may have dozens. While new models like FICO 10T and VantageScore 4.0 offer more advanced scoring, mortgage lenders still rely only on the older FICO 2/4/5 models, which is why your mortgage score is often lower than the one you see online.

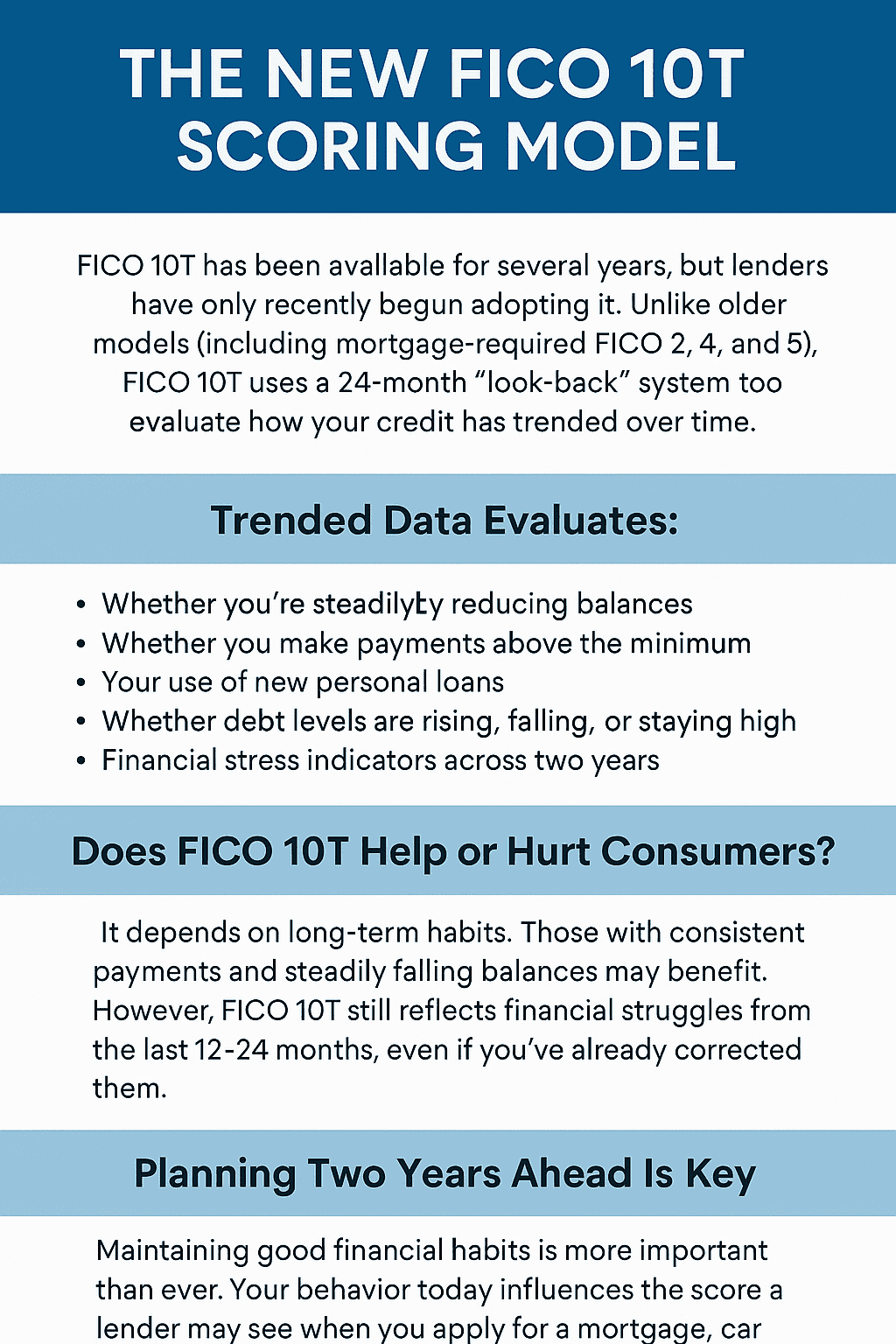

1A. The New FICO 10T Scoring Model

The FICO 10T scoring model has been available for several years, but lenders have only begun adopting it recently. Unlike older scoring models—such as the mortgage-required FICO 2, 4, and 5— which rely on a single snapshot of your credit, the new FICO 10T uses a 24-month “look-back” system to evaluate how your credit has trended over time [1].

This means the score doesn’t just ask, “What do your balances look like today?” Instead, it evaluates whether your debt has been rising, falling, or remaining consistently high; whether your payments exceed the minimum; how often you take on new personal loans; and how your overall financial behavior evolves across two full years. FICO claims that this trending approach increases lender predictive accuracy by up to 10% compared to earlier models [2].

Does FICO 10T help consumers—or hurt them?

The answer depends on your long-term behavior. Consumers who steadily reduce balances, make consistent on-time payments, and avoid sudden spikes in debt tend to benefit under FICO 10T. But if you’ve had financial struggles in the last two years—even if you’ve recently corrected them—the model will still reflect that trend. This is why the jury is still out on whether FICO 10T ultimately helps or harms consumers.

Why you should think two years ahead

Because FICO 10T looks back 24 months, your financial habits today directly influence the score you’ll have when you apply for a mortgage, auto loan, HELOC, or credit card in the future. If you think you may want to make a large purchase within two years, you should start strengthening your financial habits immediately—lowering balances, avoiding unnecessary debt, and making all payments on time.

Although mortgage lenders still use the older FICO 2/4/5 models for now, the industry is gradually moving toward more predictive scoring systems like FICO 10T. This makes consistent, long-term credit management more important today than ever.

Sources

- FICO Official. “Introducing FICO® Score 10 Suite.” FICO.com.

- FICO Whitepaper. “How FICO Score 10 Improves Predictive Power.” FICO Research, 2020.

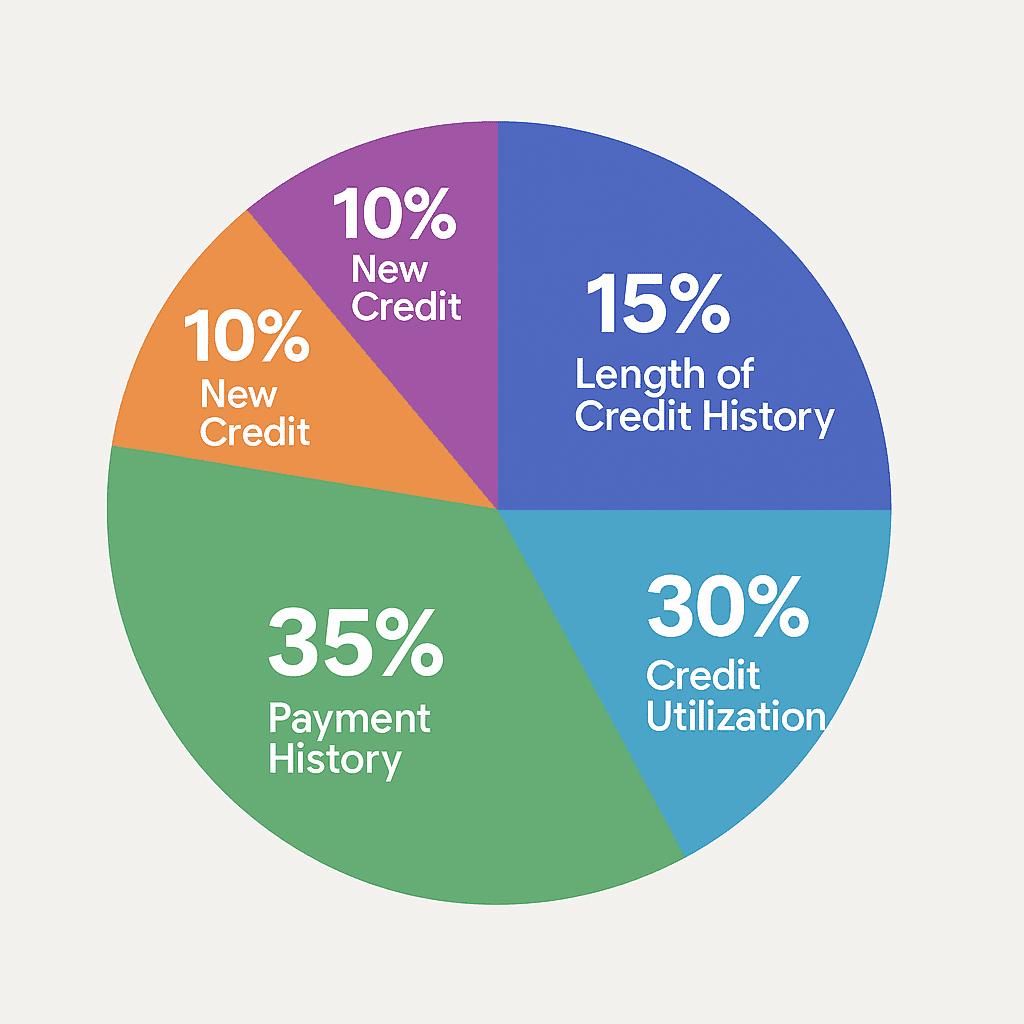

2. The Five Factors That Make Up a Credit Score

All FICO scores are based on the same five factors, weighted differently.

| Factor | Weight | Meaning |

|---|---|---|

| Payment History | 35% | On-time vs. late payments; bankruptcies and collections weigh heavily. |

| Credit Utilization | 30% | How much of your available credit you’re using. Lower is better. |

| Length of Credit History | 15% | Age of accounts and average credit history. Older is better. |

| Credit Mix | 10% | Variety of accounts (cards, loans, mortgage). |

| New Credit | 10% | Recent inquiries and newly opened accounts. |

Why It Matters: Payment history and utilization together make up 65% of your score. Improving just these two areas can yield quick results.

2a. Key Terms to Know About Credit

- Hard Inquiry – A lender pulls your credit for a new account (may lower your score slightly).

- Soft Inquiry – A credit check for insurance, utilities, or existing accounts. Does not affect your score.

- Credit Utilization – Your balance divided by your total available credit. Keep it under 20% for best results.

- Credit Bureau – Experian, Equifax, and TransUnion.

- FICO Score – Credit scores created by the Fair Isaac Corporation.

- VantageScore – A competing model created by the three bureaus, often shown in apps.

- CFPB – The Consumer Financial Protection Bureau, which regulates credit reporting practices.

- Collections – Unpaid accounts sent to collection agencies. Mortgage FICO scores penalize these heavily.

- Delinquency – Payments 30+ days late.

- Credit Mix – The balance of account types in your profile.

📌 Your Rights: You’re entitled to one free report from each bureau every year at AnnualCreditReport.com.

3. FICO vs. VantageScore: Why You See Different Numbers

Apps like Credit Karma typically show VantageScores, while mortgage lenders rely on older FICO 2/4/5 scores. That explains why the number you see at home may be higher than the one your lender uses.

Example: Same Borrower, Different Models

Credit Score Differences Across Bureaus (Including FICO 10T & VantageScore 4.0)

| Bureau | FICO Mortgage Score (2 / 4 / 5) |

FICO 10T | VantageScore 3.0 / 4.0 | Why Different |

|---|---|---|---|---|

| Experian | 662 | 675 | 690 | FICO 10T uses trended 24-month data; Vantage ignores paid collections and rewards recent improvement. |

| TransUnion | 678 | 700 | 705 | 10T heavily weighs patterns of rising/falling balances; Vantage rewards consistent on-time behavior. |

| Equifax | 650 | 668 | 685 | FICO mortgage scores weigh utilization heavily; 10T penalizes persistent high balances over time. |

As a real estate broker, I often meet buyers who proudly show me their Credit Karma score, expecting it to match their mortgage score. It almost never does. I explain that while free apps are useful for tracking, they don’t show the real FICO scores lenders use. To see those, you need a paid service like MyFICO.com or wait until your lender pulls them.

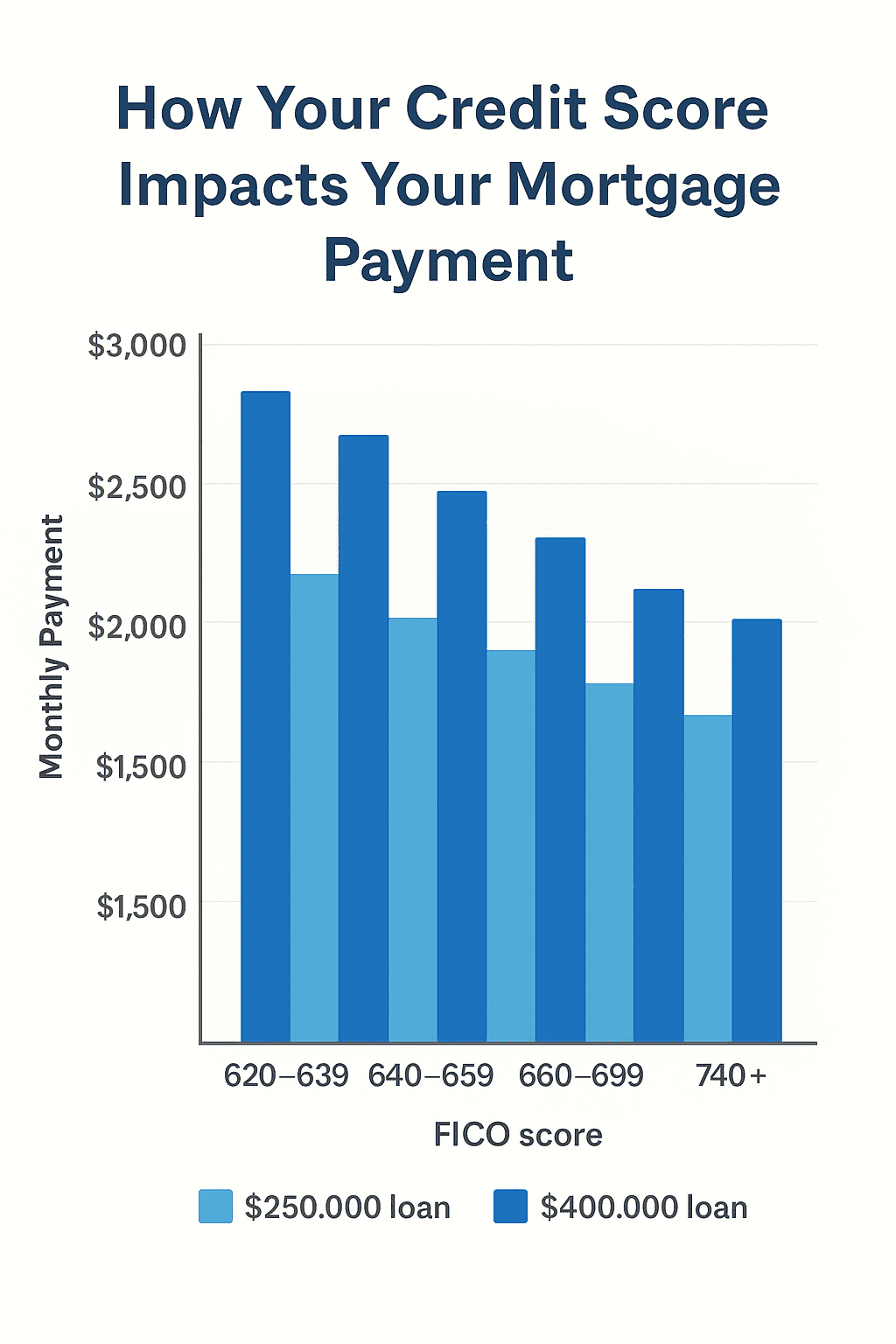

4. The Real Cost of a Lower Score

Your score doesn’t just affect approval — it directly determines your interest rate.

| FICO Range | Approx. Rate | Monthly Payment ($250k Loan) | Monthly Payment ($400k Loan) |

|---|---|---|---|

| 620–639 | ~7.75% | $1,791 | $2,866 |

| 640–659 | ~7.25% | $1,705 | $2,729 |

| 660–679 | ~7.00% | $1,663 | $2,661 |

| 680–699 | ~6.75% | $1,621 | $2,594 |

| 700–719 | ~6.50% | $1,580 | $2,528 |

| 720–739 | ~6.25% | $1,539 | $2,463 |

| 740+ | ~6.00% | $1,499 | $2,398 |

📊 Impact: A borrower with a 650 score could pay $200–$500 more per month than someone at 740+, adding up to $70,000–$180,000 over 30 years.

And this doesn’t just apply to mortgages. Insurance companies, credit card issuers, and auto lenders all use your score to set costs. Better credit = lower borrowing and insurance costs.

5. Why Scores Differ by Bureau

Your score may not match across Experian, Equifax, and TransUnion because:

- Not all lenders report to all three bureaus.

- Data updates happen on different days.

- Errors appear in one bureau but not others.

- Each bureau structures data slightly differently.

For mortgages, lenders use your middle score — or if two borrowers apply, the lower of their middle scores.

6. How to Check the Right Score Before a Mortgage

- MyFICO.com – Paid, but shows your true FICO mortgage scores.

- Through your lender – They’ll pull FICO 2/4/5 during pre-approval.

- Credit counseling services – Some nonprofits share FICO mortgage scores.

Free apps like Credit Karma are useful for trends but don’t show the actual scores used in mortgage lending.

7. What You Can Do to Improve Your Score

Even small improvements make a big difference. Poor credit scores can terminate a real estate sale as this article explains

Quick Wins

- Pay down balances – Lower utilization boosts scores fast.

- Always pay on time – Set autopay to avoid slips.

- Be strategic about new accounts – Don’t open too many at once, but gradually increasing your total available credit helps keep utilization under 20%. Apply for new cards every 6+ months if needed.

- Dispute errors – Incorrect items drag your score down.

- Keep old accounts open – Age of credit matters.

Long-Term Thinking

A better score doesn’t just lower your mortgage costs — it reduces interest rates on credit cards, auto loans, and even insurance.

👉 For a step-by-step action plan, read my guide: How to Improve Your Credit Score for a Mortgage.

👉 For everyday strategies, see my RetireCoast article: 17 Best Ways to Use My Credit Cards Now.

8. Key Takeaways and Next Steps

- Mortgage lenders use FICO 2/4/5 and FICO 10T not VantageScores.

- A small score difference can cost tens of thousands in extra interest.

- Always check your real FICO mortgage scores before applying.

- You’re entitled to free credit reports each year at AnnualCreditReport.com.

If you’re planning to buy a home, don’t rely on the score in your favorite app. Check the real numbers, take action to improve them, and save yourself serious money.

9. Credit scores affect more than mortgages

Did you know that the price you pay for auto insurance, RV insurance and homeowners insurance is based in part on your credit score? True, your score can cost you big if you permit it to drop. While you may not be buying a home anytime soon, you may be in the market to rent another apartment. Property managers run credit and make determinations on your score.

My property management company will usually not rent to anyone with less than a 680 credit score. Believe it or not there is a correlation between credit scores and how well tenants keep their properties and pay their rent. Lower scores mean potential damage, non-payment, evictions etc.

Try buying a car with a low credit score and you will pay far more for the vehicle. The moral of this section is to pay on time, keep your score high and all of the time. Millennials, read this guide to financial literacy which can help you when you are about to apply for credit.

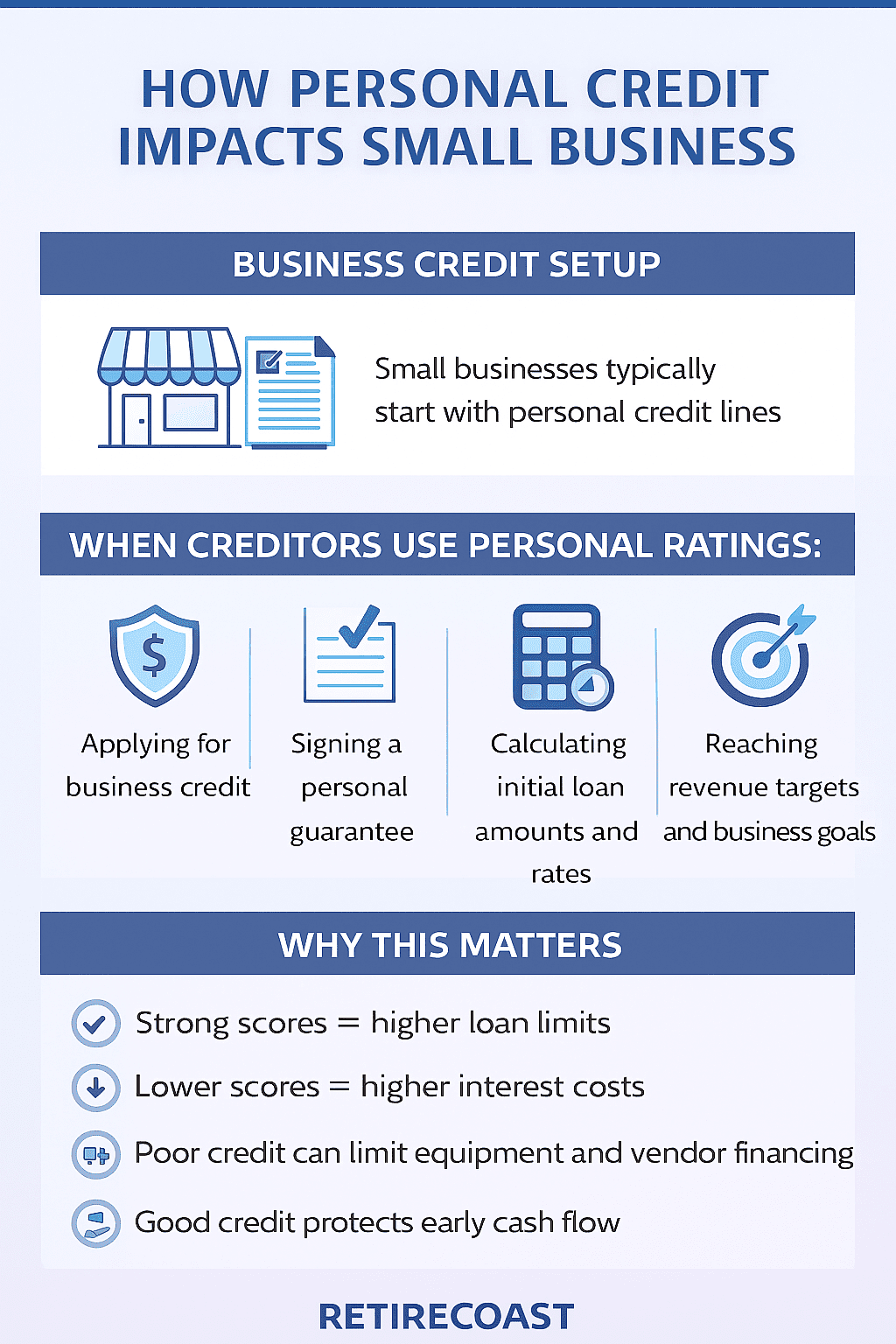

10. Credit Scores and Business Credit

When it comes to business financing, many people are surprised to learn that consumer credit agencies do not report true business credit activity. This is good news for small-business owners and retirees launching a second career. For example:

- Your American Express business credit card will not appear on your personal credit report.

- A DSCR (Debt Service Coverage Ratio) mortgage loan also does not show up on your consumer credit file.

- Corporate accounts, vendor lines, and business auto loans typically stay off personal credit reports as long as they are structured properly.

However, there is an important caveat for new or small businesses — especially for those Starting a Business After Retirement.

(Series link: https://retirecoast.com/starting-a-business-after-retirement-full-series-index/)

Most business credit still relies on your personal credit

Unless your business is:

- Several years old,

- Has strong revenues,

- Shows consistent cash flow, and

- Is properly incorporated with its own EIN and business credit profile,

creditors will almost always require a personal guarantee (PG).

That means your personal credit score — including your mortgage FICO 2/4/5, your newer FICO models, and even FICO 10T trended data — will still determine:

- Whether you get approved

- Your interest rate

- Your credit limit

- Your repayment terms

This is why many retirees launching new ventures are surprised when a “business” credit card application still pulls their personal credit file.

Why business credit matters for retirees starting a business

Many small-business owners (especially first-time entrepreneurs) start their companies using:

- Personal credit cards

- Personal lines of credit

- HELOCs

- Short-term financing options

- Cash-out refinances

- DSCR loans on rental property

This means that the same rules, strategies, and pitfalls discussed in earlier sections of this guide apply directly to new business owners.

For example:

- High utilization on personal cards can reduce your credit score and limit your borrowing power — even if the spending was for your business.

- Missed payments on a personal card used for business purchases can affect your FICO mortgage score.

- Your FICO 10T trend (two-year look-back) can impact your ability to get future business financing.

- A poor personal score may force you into high-interest or predatory business loan products.

Why this section matters

We include this section because business credit and personal credit are deeply connected for most people — particularly those launching a venture later in life. The same strategies that strengthen your mortgage score also strengthen your credibility as a business borrower.

Strong credit makes it easier to:

- Open vendor credit lines

- Secure business cards with higher limits

- Lease equipment

- Finance commercial vehicles

- Purchase investment property

- Build long-term business credit profiles

- Protect cash flow during the early years of your business

Want to learn more?

For a full breakdown of how to launch a business, structure it properly, set up business credit, and protect your personal credit while doing so, visit our complete series:

👉 Starting a Business After Retirement

https://retirecoast.com/starting-a-business-after-retirement-full-series-index/ and https://retirecoast.com/starting-a-business-after-retirement-part-3-business-plan/

Frequently Asked Questions About Credit Scores and Mortgages

Click each question below to expand the answer.

Why do I have so many different credit scores, and which ones matter for mortgages?

You don’t have one score — you may have dozens. Lenders and apps use different scoring models, including older FICO 2/4/5 mortgage scores, the new FICO 10T, and consumer-focused models like VantageScore 3.0 and 4.0.

For credit scores for mortgages, lenders still rely only on the older FICO 2, 4, and 5 versions required by Fannie Mae and Freddie Mac. These scores often differ from the higher VantageScores you see in free apps, and also differ from the new trended-data FICO 10T model.

How far back does FICO 10T go?

FICO 10T uses a 24-month “look-back” period. It studies two full years of your past balances, payments, and spending trends — not just today’s numbers.

With the new FICO 10T, how long before I apply for credit should I start working on my finances?

Ideally, begin improving your finances two years before applying. Since FICO 10T looks back 24 months, your long-term habits matter more than ever.

But even 6–12 months of on-time payments and reducing balances can improve both FICO 10T and your traditional mortgage scores.

How can I get my FICO 10T score?

The most reliable source is myFICO.com, where you can purchase your FICO 10T score directly. Most free apps show VantageScore, not FICO 10T or the older mortgage scores.

What credit score do mortgage lenders use?

What is the minimum credit score needed to buy a house?

Why is my Credit Karma score higher than my lender’s score?

How much does a low credit score increase mortgage costs?

How often should I check my credit reports?

Do soft inquiries affect my score?

What is credit utilization?

Do mortgage lenders use the same score as auto or credit card companies?

How long does it take to improve my credit score?

Can paying off collections improve my mortgage score?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.