🧭 Planning First, Buying Second

Buying a home is not a single event. It’s a process that rewards preparation. This pre-purchase home buying checklist is designed to help you get financially, emotionally, and practically ready before you apply for a mortgage or start shopping seriously.

Think of this like a project at work or a college course: the more you plan and organize up front, the smoother and less stressful the whole experience becomes.

I strongly suggest that you read some of our articles and use the calculators linked throughout this guide.

There is no doubt in my mind that knowledge is everything. Avoiding problems others have encountered by learning from their experiences — and by using planning tools — will help you through the process.

Look at buying your home as a project: similar to completing a course in college or tackling an important assignment at work. Apply the same diligence and organization, and you can be successful while keeping the experience mostly enjoyable.

Remember, we have extensive resources on RetireCoast to help you every step of the way.

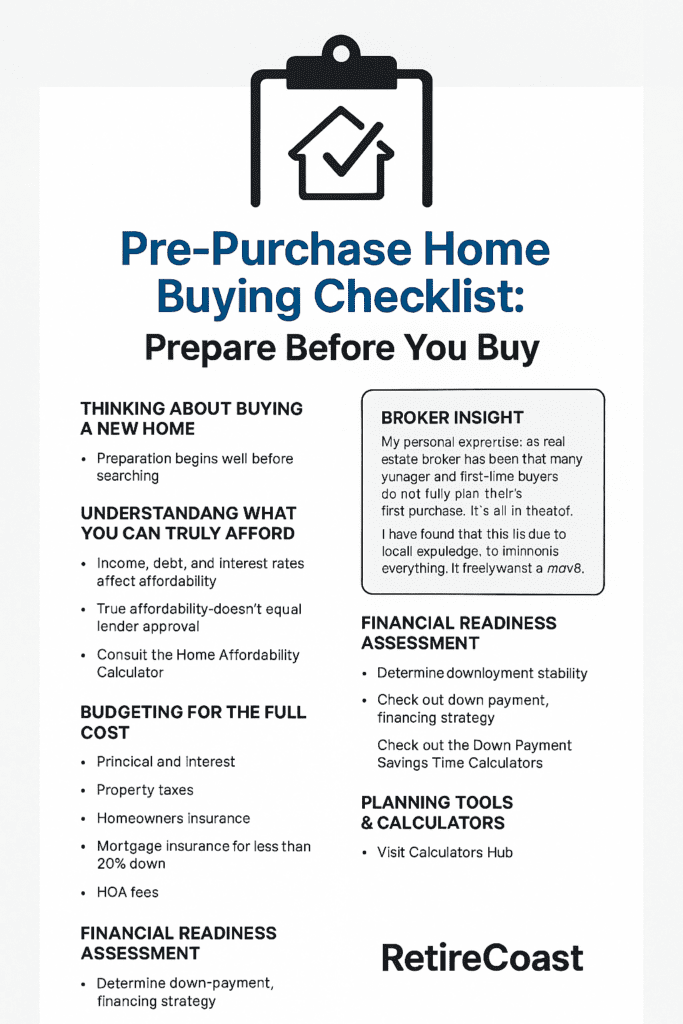

Thinking About Buying a New Home

Buying a home begins long before looking at listings or touring properties. Whether this is your first home, a relocation, or a long-term lifestyle decision, preparation determines outcomes.

For many readers, this guide functions as a first-time home buyer checklist—clarifying what needs to happen and in what order. Home buying is a sequence-based process. Skipping steps or rushing early decisions often leads to delays, higher costs, or unnecessary stress.

Understanding What You Can Truly Afford

Affordability is not the same as lender approval. True affordability reflects what fits comfortably into your monthly budget and overall financial life.

Income, existing debts, property taxes, insurance costs, and interest rates all affect what you can realistically manage. This is a critical part of preparing to buy a home and should be done before speaking with lenders.

Planning Tool:

Use the Home Affordability Calculator to estimate a realistic price range.

👉 https://retirecoast.com/home-affordability-calculator/

👀 Broker Insight: What I See All the Time

My personal experience as a real estate broker has been that many younger and first time buyers do not fully plan their first purchase. I have found that this is due primarily to the lack of knowledge. To boil this down, there are correct moves and incorrect moves and timing is everything.

The idea of buying a home is like threading a maze. Remember one thing, this process is computer based and computers are not emotional. If you are diligent in following the suggestions listed here your chances of completing a purchase are much enhanced.

Budgeting for the Full Cost of Homeownership

This home buying preparation checklist goes well beyond the purchase price. Monthly housing costs typically include:

- Mortgage principal and interest

- Property taxes

- Homeowners insurance (and flood insurance where required)

- Mortgage insurance when the down payment is less than 20%

- HOA or condo fees

- Utilities

- Maintenance and repairs

Failing to account for the full picture often results in payment shock after closing.

💡 Mortgage Insurance in Plain Language

PMI and MIP are terms used by lenders that simply mean mortgage insurance. This protects the lender—not you—and it’s usually required when your down payment is less than 20%.

PMI applies to most conventional loans and can often be removed once you build enough equity. MIP applies to FHA loans and can remain for the life of the loan unless you refinance or pay it off. An important exception is the VA loan, which allows qualified buyers to purchase a home with no down payment and no monthly mortgage insurance.

Because mortgage insurance affects both your monthly payment and long-term cost, it’s smart to model it in advance.

Try our Full Mortgage Calculator to compare scenarios with and without

mortgage insurance so you can see how different down payments and loan types

affect your monthly payment:

Full Mortgage Calculator »

Because mortgage insurance directly affects monthly payment and total cost, it should be modeled in advance.

Planning Tool:

Compare scenarios using the Full Mortgage Calculator.

👉 https://retirecoast.com/full-mortgage-calculator/

Financial Readiness Assessment

Income & Employment Stability

Lenders value consistency. Changes in employment, commission income, or self-employment can require additional documentation. Understanding this early allows you to plan instead of react.

Savings & Cash Position

Proper planning includes funds for:

- Down payment

- Closing costs

- Prepaid items

- Emergency reserves after closing

Closing costs are often underestimated. They can include lender fees, title charges, insurance, escrows, and prepaid items.

Learn what to expect here:

👉 https://retirecoast.com/how-much-are-closing-costs/

Planning Tool:

Estimate how long it may take to reach your down-payment goal with the Down Payment Savings Time Calculator.

👉 https://retirecoast.com/down-payment-savings-time-calculator/

Loan Preparation & Pre-Approval Readiness

Think of this stage as your personal mortgage readiness checklist. Preparation includes understanding loan options, gathering documentation early, and avoiding unnecessary financial changes.

Understanding Your Financing Options & Down-Payment Strategy

There are several ways to finance a home, and the loan program you choose determines how much cash you need at closing:

- VA loans offer 0% down for qualified buyers with no monthly mortgage insurance.

- FHA loans typically require about 3.5% down.

- USDA loans offer 0% down but are geographically and income-restricted.

- Conventional loans offer multiple down-payment options, though 20% down is commonly used to avoid mortgage insurance.

Once you identify the loan program you’re targeting, you can align your savings strategy accordingly.

Planning Tool:

Use the Down Payment Savings Time Calculator to match your savings timeline to the loan you plan to qualify for.

Credit Profile & Score Preparation

Credit planning is a core part of financial preparation for buying a home. Credit scores influence approval, interest rates, and total borrowing cost.

Even modest improvements can save tens of thousands of dollars over the life of a loan.

Planning Tool:

See how different credit score ranges affect your payment and long-term cost with the Mortgage Credit Score Impact Calculator.

👉 https://retirecoast.com/mortgage-score-impact-calculator/

Credit Monitoring Recommendation

I recommend subscribing to myFICO.com to monitor not only the new FICO 10T score, but also FICO 8 and 9, with access to all three credit bureaus in one place. While a free report is available once per year, buyers planning months or years ahead benefit from ongoing monitoring—especially when working to improve their score. The small monthly fee is a worthwhile investment when preparing for a major purchase.

📘 A Real-World Example: Joseph & Christie

Joseph and Christie wanted to buy their first home but didn’t know where to start. Their real estate agent told them to get pre-qualified and referred them to a loan broker. When the broker explained he would need to run their credit, Christie asked if that was premature since they were just starting the process.

The broker agreed and suggested they learn more about the process before pulling credit. Had he run it immediately, he would have found a score around 625 due to heavy credit card balances—something that would take months to improve.

Instead of rushing, Joseph and Christie chose to plan first and apply later, once they had a better handle on their credit and finances.

✅ Do This / ❌ Don’t Do This

- Learn the process before applying.

- Review and improve credit first.

- Use calculators to model payments.

- Target savings to a specific loan type.

- Apply when you are truly ready.

- Don’t apply on day one “just to see.”

- Don’t allow unnecessary credit pulls.

- Don’t guess at affordability or rates.

- Don’t ignore high credit card balances.

- Don’t hope approval will “work itself out.”

To see how much a better credit score might save you, try our

Mortgage Credit Score Impact Calculator:

Mortgage Credit Score Impact Calculator »

Planning vs. Rushing

| ✅ Do This | ❌ Don’t Do This |

|---|---|

| Learn the process first | Apply immediately “just to see” |

| Improve credit before applying | Allow unnecessary credit pulls |

| Use calculators to model outcomes | Guess at affordability |

| Target savings to a loan type | Save without a defined plan |

| Apply when truly ready | Hope approval works out |

This scenario illustrates why planning first and buying second leads to better outcomes.

🧮 Use Our Calculators to Plan with Confidence

This checklist is just the starting point. To really understand your options, run the numbers with our free tools:

- Home Affordability Calculator – Estimate a realistic price range.

- Full Mortgage Calculator – See payments with taxes, insurance, and PMI.

- Mortgage Credit Score Impact Calculator – Compare payment by score tier.

- Down Payment Savings Time Calculator – See how long it may take to reach your goal.

Explore all of these and more in our RetireCoast Calculators Hub »

Planning Tools & Calculators

This article functions as a complete home buying planning guide, supported by tools designed to work together. You can find them all in the RetireCoast Calculators Hub.

Downloadable Pre-Purchase Checklist (PDF)

At the end of this article, download the fillable Pre-Purchase Home Buying Checklist. Use it as a living document as your plans evolve—not a one-time worksheet.

Consumer Protection & Homebuyer Resources

If you encounter issues with a lender or mortgage servicer, file a complaint with the Consumer Financial Protection Bureau:

👉 https://www.consumerfinance.gov/complaint/

For education, counseling, and fair-housing information, visit HUD’s Buying a Home portal:

👉 https://www.hud.gov/topics/buying_a_home

✅ Ready to Take the Next Step?

Assuming you are ready to move forward with buying a home, the next step is to contact a mortgage broker and get pre-qualified. Once you have that pre-qualification, you can then formally contract with a real estate agent to represent you.

This is the point where the buying process truly begins. Before taking those steps, make sure you understand how to select the right professionals and how recent changes in real estate commissions may affect you.

- How to Choose the Best Real Estate Buyer’s Agent

- Understanding Real Estate Commission Changes for Buyers and Sellers

- Should I Refinance My Mortgage in 2025–2026?

Move forward confidently by applying the same preparation and diligence you’ve used so far.

Approach this stage with the same preparation you’ve applied so far, and the buying process will begin on solid ground.

Final Thought

Buying a home is not a single decision — it is a project. With preparation, structure, and the right tools, the process becomes clearer, more predictable, and far more rewarding.

Fillable PDF • Includes planning checklist + QR resources

📬 Stay Informed with RetireCoast

Get notified when we publish new buying guides, calculators, and updates designed to help you make smart home-buying decisions.

No spam. Educational updates only. Unsubscribe anytime.