RetireCoast Net Worth Calculator: A Clear Snapshot of Where You Stand

Most people think they know their net worth — until they actually calculate it.

Balances are scattered across bank accounts, retirement plans, real estate, vehicles, loans, and credit cards. Some assets feel solid but aren’t easily usable. Some debts fade into the background because they’re “normal.” Over time, it becomes surprisingly easy to lose sight of the full picture.

- Why net worth matters more than income

- What the RetireCoast Net Worth Calculator does differently

- Net Worth → Next Step Decision Flow

- Evaluating Your Assets Realistically

- How to Use the Net Worth Calculator

- A living snapshot — not a one-time exercise

- Taxes: What Happens When You Start Divesting Assets

- How this fits the RetireCoast approach

- SHORT QUIZ

- FAQ

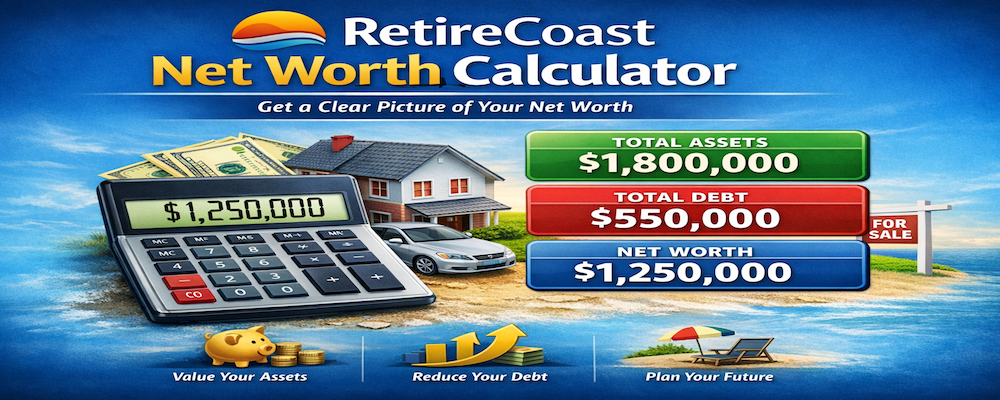

That’s why we built the RetireCoast Net Worth Calculator.

Use the RetireCoast Net Worth CalculatorThis tool isn’t about perfection or comparison. It’s about clarity — giving you a realistic snapshot of where you stand today so future decisions are based on facts instead of assumptions.

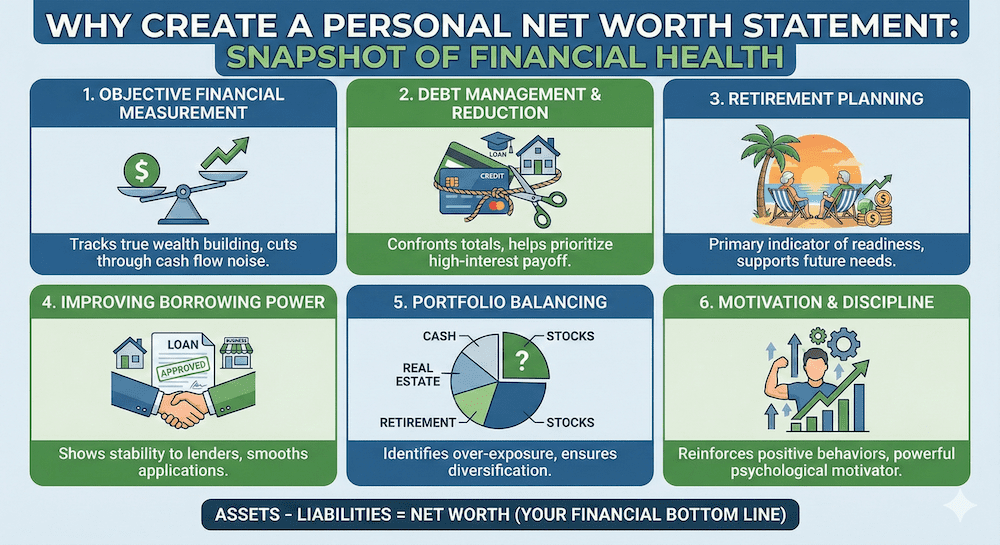

Budgeting tracks your spending, but a Net Worth Statement tracks your progress. From balancing your portfolio to preparing for retirement, seeing your assets minus your liabilities gives you the objective truth about your financial health. It’s not just a number—it’s the roadmap to your financial freedom. #FinancialLiteracy #NetWorth #WealthBuilding #RetirementPlanning

Why net worth matters more than income

Income shows motion. Net worth shows position.

Two households earning the same income can be in dramatically different situations depending on:

- Assets they’ve accumulated

- The debt they’re carrying

- Liquidity versus locked-up wealth

- How dependent they are on continued income

Net worth connects today’s decisions to tomorrow’s options. It influences flexibility, resilience, and the ability to absorb change — whether that’s a job shift, market volatility, health costs, or retirement timing.

Without understanding net worth, planning becomes guesswork.

What the RetireCoast Net Worth Calculator does differently

Many online calculators fall into one of two traps:

- They’re too simple and ignore real-world assets and liabilities

- They’re too complex and require information most people don’t have

The RetireCoast Net Worth Calculator is designed to sit in the middle — practical, realistic, and repeatable.

It helps you:

- Organize assets and liabilities in one place

- See totals clearly without financial noise

- Understand why your number looks the way it does

- Revisit and adjust over time as life changes

It’s not a one-time tool. It’s a baseline you can return to.

Net Worth → Next Step Decision Flow

What to do after you see your number

Your net worth number isn’t a verdict. It’s a starting point.

This decision flow translates your result into one clear priority, not ten competing ones.

Step 1: Is your net worth positive or negative?

Net worth is negative

You owe more than you own.

This is common — and fixable. The priority here isn’t investing harder. It’s stabilizing the foundation.

Focus next on:

- Identifying high-interest or fragile debt

- Improving cash flow before chasing returns

- Building a basic liquidity buffer

You’re ready to move on when:

You’re no longer adding new debt just to cover routine expenses.

Net worth is positive, but mostly illiquid

You technically have wealth — but it’s locked up.

Common scenarios include:

- Heavy home equity with little cash

- Retirement accounts with limited access

- Assets are growing while flexibility shrinks

Focus next on:

- Liquidity and optionality

- Stress-testing income disruptions

You’re ready to move on when:

You could handle a 6–12 month disruption without selling assets under pressure.

Net worth is positive and balanced

You have assets, manageable debt, and flexibility.

At this stage, discipline matters less than direction.

Focus next on:

- Optimization and alignment

- Tax efficiency

- Purposeful allocation

You’re ready to move on when:

Decisions feel intentional rather than reactive.

Step 2: How concentrated is your net worth?

If one asset dominates — such as a primary residence, a single rental, or one retirement account — concentration risk matters.

Ask yourself:

“If this asset underperforms, what breaks?”

If assets are diversified but unmanaged, the issue is often inefficiency rather than risk.

Ask instead:

“Do these assets work together — or just coexist?”

Step 3: What phase are you actually in?

Your phase matters more than your age.

- Building phase: income-driven growth, long runway

- Priority: consistency and protection

- Transition phase: peak earnings, shifting priorities

- Priority: flexibility and downside control

- Preservation phase: fewer inputs, greater reliance on assets

- Priority: stability and predictability

Step 4: Choose ONE next move

Most people stall by trying to fix everything at once.

This flow narrows your focus to one dominant lever:

- Cash flow improvement

- Debt reduction

- Liquidity building

- Risk rebalancing

- Tax efficiency

- Timeline clarity

Execute one move. Then reassess.

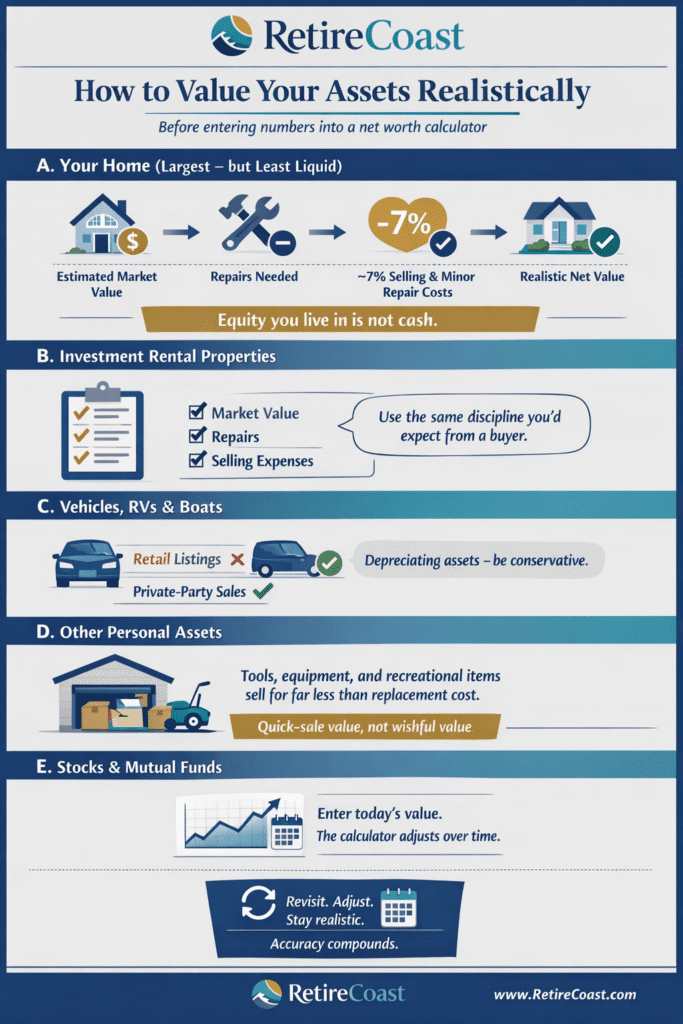

Evaluating Your Assets Realistically

Why conservative inputs create better decisions

A net worth calculator is only as useful as the numbers entered. The goal isn’t optimism — it’s usability.

Here’s how to value each major asset category realistically.

A. Your home

Your home is an asset — but you live in it. That makes it illiquid.

For most households, home equity is the single largest asset, so realism matters.

How to estimate value:

- Check online estimates using free tools such as Realtor.com and Zillow.

These aren’t perfect, but they’re usually in the ballpark. - Evaluate your home honestly.

Would it sell as-is, or would repairs be required? - Deduct the cost of needed repairs.

- Deduct approximately 7% for selling and minor repair costs.

Use the remaining figure as your current realistic value, not the headline estimate.

Return periodically and adjust for major maintenance items like roof replacement or deferred repairs.

B. Investment rental properties

Use the same discipline for rental properties:

- Estimate market value

- Deduct known or expected repairs

- Deduct selling expenses before entering the value

Rental properties often feel more liquid than they are. Conservative inputs provide clearer insight into risk and flexibility.

C. Cars, trucks, RVs, and boats

These are depreciating assets.

Be conservative.

Instead of retail pricing, look at:

- Private-party listings

- Facebook Marketplace and similar platforms

Few owners receive what they expect when selling or trading vehicles. Understating this category slightly is usually safer than overstating it.

D. Other personal assets

This includes items stored in garages or storage units — tools, equipment, and recreational items.

Heavily discount these values.

Even larger items like lawn tractors or golf carts rarely sell for anything close to replacement cost. Use quick-sale pricing, not ideal pricing.

E. Stocks and mutual funds

For investments:

- Enter the current value on the day you use the tool

- No forecasting required

The calculator adjusts over time using inflation assumptions. Accuracy starts with today’s number.

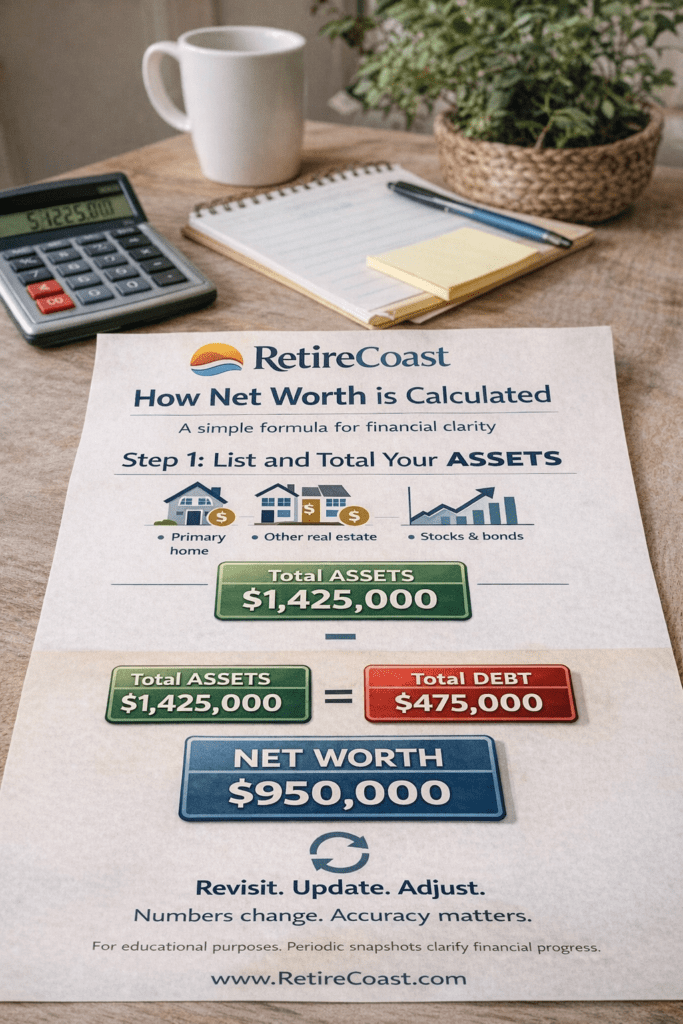

How to Use the Net Worth Calculator

Think of the RetireCoast Net Worth Calculator as your central list of assets and liabilities. There’s no need to write everything down or build a spreadsheet. The calculator does that work for you.

The goal is simple: enter the current value of everything you own, then enter everything you owe.

Step 1: Enter your assets

Start by listing the current value of each asset. Enter values as they exist today, not what you paid for them and not what you hope they’ll be worth.

Examples include:

- Cash and checking accounts

- Savings accounts (listed individually)

- Investment accounts

- Retirement accounts

- Real estate

- Vehicles and other major property

Some assets have no debt attached — such as cash, savings, or paid-off property. These only need to be entered in the asset section.

Step 2: Enter your liabilities (debts)

Next, list everything you owe.

Common liabilities include:

- Mortgages

- Auto loans

- Personal loans

- Student loans

- Credit cards

- Business or personal notes

Understanding assets that also have debt

Many items appear twice — once as an asset and once as a liability. This is correct and intentional.

For example:

- Your home

- Listed as an asset (its current value)

- Listed again as a liability (the remaining mortgage balance)

- A financed vehicle

- Listed as an asset (what it’s worth today)

- Listed again as a liability (what you still owe)

This is how net worth works: value minus debt.

Special cases to handle correctly

- Borrowed money sitting in the bank

- List the cash you still have as an asset

- List the loan balance as a liability

- Multiple bank or savings accounts

- List each account separately

- This improves clarity and is especially useful for planning and documentation later

What you can use the results for

Your net worth calculation isn’t just a number — it’s a working document.

You can use it for:

- Ongoing financial planning

- Evaluating major decisions

- Tracking progress over time

- Estate planning

When creating a will or trust, an asset list is required. The results from this calculator provide an excellent starting point for that process.

If you decide to start a business or apply for financing, lenders will often ask for a personal financial statement, which typically includes a net worth statement. Your calculator results help prepare you for that request.

A practical reminder

This calculator is a living tool. Return to it periodically:

- Update values

- Add or remove assets

- Adjust debts as they’re paid down or added

Accuracy improves clarity — and clarity supports better decisions.

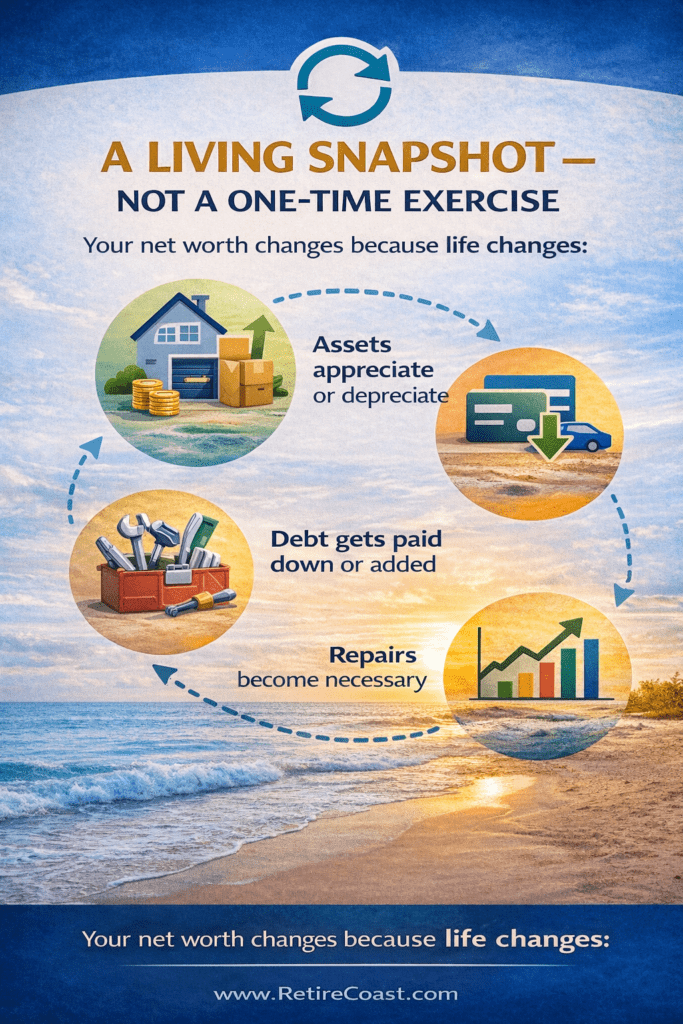

A living snapshot — not a one-time exercise

Your net worth changes because life changes:

- Assets appreciate or depreciate

- Debt gets paid down or added

- Repairs become necessary

- Markets move

Return periodically. Update values. Adjust as needed.

Accuracy compounds — just like interest.

Taxes: What Happens When You Start Divesting Assets

When you begin selling assets, taxes matter — and they can meaningfully change what your net worth is actually worth to you.

A common mistake is treating asset values as if every dollar is spendable. In reality, some portion of those dollars may belong to the IRS once an asset is sold.

Asset sales and taxable income

In general, profits from selling assets are taxable, regardless of the dollar amount.

A “profit” is the difference between:

- What you originally paid for an asset (your cost basis), and

- What do you sell it for

If you sell something for more than you paid, the gain is usually reportable — even for items most people think of as casual or informal.

For example:

- Someone selling a riding lawn mower for $2,500 might simply pocket the cash

- But if multiple assets are sold — such as during an estate sale — those gains can become reportable income

The key issue isn’t how you sell something. It’s whether you sold it for more than your cost basis.

Your primary home

Home equity receives special tax treatment — up to a point.

Under current IRS rules (which can change), many homeowners may exclude:

- Up to $250,000 of gain if filing individually

- Up to $500,000 of gain if filing jointly

Any gain above the exclusion limit may be subject to capital gains tax.

When valuing your home for net worth purposes:

- Identify how much of your equity may exceed the exclusion

- Estimate the potential tax on that excess

- Reduce the asset value by the expected tax

This gives you a more realistic picture of what that equity is actually worth to you.

Investment properties

Investment and rental properties are more likely to generate taxable gains.

Taxes may include:

- Capital gains tax (depending on how long the property was held)

- Recapture of depreciation taken over time

Because of this, the headline market value of an investment property is rarely the amount you’ll walk away with after a sale.

When entering values:

- Estimate the taxable portion of the gain

- Reduce the asset value by the taxes you may owe

Conservative estimates create clearer planning decisions.

Apply this logic across all assets

The same principle applies broadly:

- Vehicles

- Equipment

- Recreational assets

- Collectibles

- Business property

If selling an asset would likely trigger a tax bill, discount the value accordingly when calculating net worth.

Why this matters

Net worth is about usable wealth, not paper value.

Ignoring taxes can:

- Overstate flexibility

- Create false confidence

- Lead to poor timing decisions

Adjusting values for potential taxes doesn’t make your situation worse — it makes it clearer.

A realistic net worth reflects what you keep, not just what you sell.

As always, tax rules change, and individual situations vary. This section is meant to support planning clarity, not provide tax advice. When large transactions are involved, consulting a qualified tax professional is a smart next step.

How this fits the RetireCoast approach

At RetireCoast, the goal isn’t financial hype. It’s decision clarity.

The Net Worth Calculator answers:

“Where am I?”

The decision flow answers:

“What should I focus on next?”

Together, they reduce noise, prevent overreaction, and support better long-term decisions.

Understanding your numbers doesn’t create problems.

It creates options. Want to read more from other sources about why you should prepare a Net Worth Statement? Click on these:

Charles Schwab: Your Personal Net Worth

- Note: Schwab’s resource is titled “Your Personal Net Worth” on their Moneywise site, which covers the definition and calculation steps described.

Kiplinger: How to Create Your Personal Net Worth Statement

SHORT QUIZ

1) What is net worth, in plain English?

2) Why does net worth matter more than income?

3) How do I value my home realistically?

4) Should I include my home if I live in it?

5) How should I value rental or investment properties?

6) Do cars, boats, and RVs count as assets?

7) What about “stuff” in my garage or storage unit?

8) Are taxes part of net worth?

9) How often should I update my net worth?

10) What should I do after I calculate my net worth?

FAQ

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.