Last updated on September 1st, 2024 at 06:16 pm

The combination of a higher interest rate and higher sales price for your next home may disqualify you from a typical mortgage loan. Seller-owner financing may be an option compared to conventional financing. If your debt-to-income ratio makes it difficult for you to obtain the type of financing that you were looking for, consider the terms of the loan offered by a seller. The owner of the property can dictate the financing process and provide a viable option for many.

The idea for this article came from my son who called on behalf of another family member. The family member owns a property and his real estate agent was approached by another agent with an offer to buy if the owner financed the deal. I wrote the original article in 2021, much has changed since then, and edits bring this article up to date.

What makes this article timely now is the state of our economy. Many people are struggling to buy a home because the restrictions on borrowing make it impossible for many reasons not the least of which are down payment, low credit score, and others. Seller-owner financing provides an avenue for many that do not exist with conventional financing. This recession has opened opportunities for both sellers and buyers. Seller-owner financing can generate inflation-beating interest rates for the seller-owner.

High Inflation and Recession make seller-owner financing an option

The buyer sees this as an opportunity to get into a property now while their credit is repaired over time. Yes, the interest rate is higher but the down payment and closing cost reduction may be the key to making it work. Seller-owner financing can work at any time but with high inflation and a recession, this is the time to consider the opportunities that this concept brings to the sale.

Not a common method of financing, Seller-Owner financing can be a lifesaver for a person who does not qualify for a traditional government-backed loan. Seller-owner financing is a great solution for both parties assuming that the owner/seller holds clear title to the property without a mortgage.

My son asked lots of questions because it was clear that the real estate agent did not know how to get the mechanics of the process going, the seller knew even less and my son knew that I probably had the answer. This is where I put in a plug for my many, many decades of buying and selling real estate.

What are your goals as a seller?

As a real estate broker, it is assumed that I have all of the answers. Fortunately, in addition to book learning, I have had real-world experience, and very recently with the concept of seller-owner financing mortgages. My son came to the right place and the following is what I told him.

First, the owner/seller must decide if they need the funds from the sale for any project or life need such as medical, etc. Assuming that the funds are not immediately required, how long a term would they permit the loan for, and what would be a reasonable interest rate to expect? Part of this mix is the selling price as well.

In this case, the seller is getting well above the market for his property which makes a big difference in the interest rate. In fact, the buyer offered not only a 20% down payment but also signed a note due and payable in 10 years amortized over 10 years.

The real estate agent suggested an interest rate of 4%. This is written in June 2021 when interest rates for this type of loan would likely be about 3% for a 720 credit score with 20% down (possibly slightly lower). This property is worth less than $100,000 so interest rates are higher for loan balances of less than $100,000 from most lenders. I would have suggested 7% as an interest rate if the person would have wanted a 30-year amortization on the loan with a note due in 10 years. In fact, I would have suggested a note due in 5 years.

Small down payment, higher interest rate

What makes this deal different is the large down payment which is unusual for seller-owner financing sales. Often, the reason that the buyer can not obtain a good loan is that they are short funds to make a larger down payment. I recently completed a similar deal with a 5-year balloon payment but allowed the buyer to amortize the loan over 30 years to keep their mortgage payment low. The interest on that deal was 10% because the down payment was very small. Lending is all about risk, the higher the risk, the higher the cost.

So back to the deal that my son called about. The seller agreed to a 4% interest rate because the buyer put down over 20% and the buyer only wanted a 10-year amortization on the loan. The seller determined that having that extra income for the next 10 years was a nice thing for him. There were some strange things with the transaction which I will omit here but suffice to say, some decisions were made for the buyer by the selling agent which was well-intended but inappropriate.

Your agent can help you understand the process

A good, experienced real estate agent should be in a position to help a buyer understand the entire process of financing including seller financing. Often lenders are out of the area so a sit down with a mortgage broker may not be possible. Your talented real estate agent can help you understand the entire process. Real estate agents understand the documents.

Your real estate agent is not an attorney so they can not give legal advice but they can discuss how homes are financed, the closing process, the funds that will be required, etc. Some real estate agents may not be experienced with finance issues so do not expect expert-level assistance from all agents.

Every state has its own methods of managing real estate transactions including finance, insurance, etc. In my state, Mississippi, lawyers or a title company are used to prepare documents, collect deposits, disburse funds, and file documents. I suggested had I come into this earlier that the law office could have explained this process for both parties more particularly the buyer. They are used to sell financing and understand the documents that are required.

Seller financing requires skill

YOur real estate agent is an excellent resource, have them direct you to a title/escrow company who can help you with documents. Investor Agents-Brokers have more skills in this area and can discuss terms and conditions you may want to consider. Some are listed in this article.

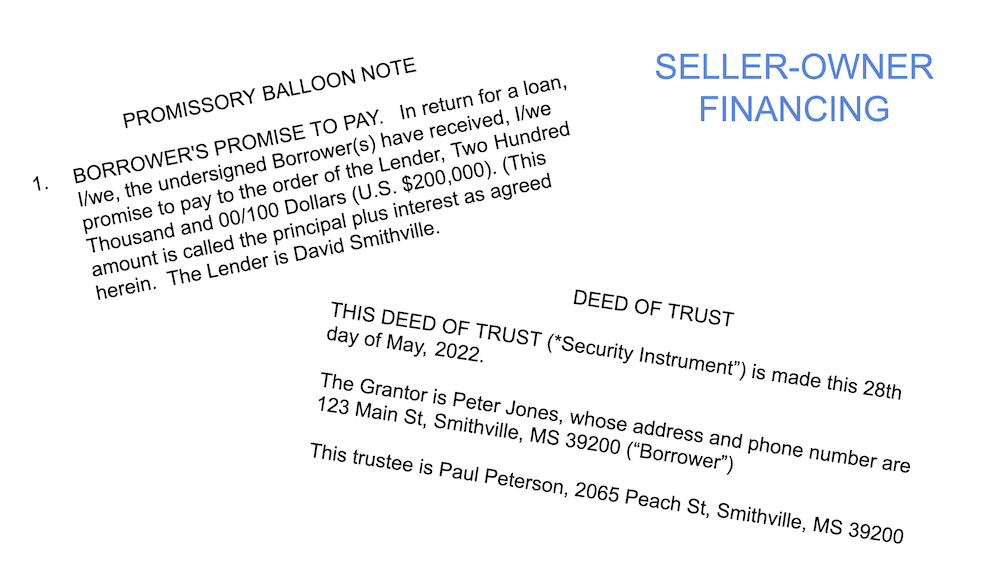

Consider the terms

My son contracted a local escrow office(in California) and they agreed to prepare the note and the deed of trust as part of the closing. The terms are inserted into the real estate contract which is a satisfactory place for them but not actually necessary. All that would have been necessary is to state that the owner agrees to finance the seller based on the terms and conditions that will appear in the documents prepared by the escrow office. The reason for keeping the deal language to a minimum is to reduce risk on the part of all parties.

About those documents, the note in particular. Consider a due-on-sale clause to ensure the buyers do not sell the property with the existing mortgage without your approval. There is a concept called a wraparound mortgage that some may try to apply to mean that the owners move out and let someone else come in and make payments. This may be ok with the seller but the seller should approve or disapprove. The standard notes are usually inclusive of this type of language but it’s good to have a real estate attorney or CPA look over the documents.

It’s important to not convolute the deal which is two parts. First, there is a clean purchase contract that contains the only language about the sale itself. The loan is a separate arrangement and the escrow office can produce the documents necessary to fully advise both parties of their obligations and requirements.

Normally mortgages are issued by institutions that are licensed to originate mortgages. These firms must comply with HUD requirements that include disclosures and notifications all of which must be done in a timely manner.

Seller-owner financing requires a credit check just to identify the buyers

A seller-owner financed mortgage requires none of the HUD documents. That said, it’s good to use some of the documents which may help both parties. For the seller, it’s vital that the “Note” be accurate with the terms and conditions of the loan. The Trust Deed is filed along with the note at the county recorder or justice court as public record. The filing protects the seller.

Back to the process. As a seller, you should require a credit check from the buyer. Many buyers who accept seller financing have less than stellar scores and this is to be expected. The seller understands the risks and the rewards of the deal.

The credit check is not used so much as a determining factor for the loan but it is a way to ensure you know the borrower/buyer. Should the seller ever have to foreclose on the buyer, the seller must have a way to locate the buyer if they leave the property when served for not making payments.

You can use any number of online sources to check credit. You can ask the escrow office to do it for you and charge the buyer. Because you are not working with a loan broker, as the seller, it will be your responsibility to verify the information that you receive. Call the buyer’s employer for example to verify employment. When you are satisfied that they are who they say they are and you can move forward with the loan, be sure that your agent removes the credit check as a contingency.

Make it simple, “sold as is where is”

It is not very common for a buyer using owner financing to ask for a home inspection. If they do and you agree, be prepared to use some of that deposit money to fix things that may be discovered during the inspection. You can always insert language in the contract that this property is being “sold as is and where is”. The buyer is then responsible for all repairs and maintenance of the property.

I also suggest that language be inserted in some closing documents even if you have to create a separate document that indicates the buyer will maintain the property in good condition as long as you hold the note on the property. The last thing you want to do is to have the buyers walk away and leave you with a poorly maintained property.

The escrow agency should already know this but you will require the buyer to have an impound account for the payment of property taxes and insurance. This is essential. If you receive the payments each month, have the discipline to retain the escrow funds in a savings account so that you can pay the taxes and insurance payments when they are due.

Regarding insurance, you can stipulate the minimum coverage e.g. rebuild cost of x$ per foot, wind/hail, and flood coverages. Be sure that the insurance company mails the bills to your home or to any firm you hire to receive the loan funds. I can tell you horror stories about terminated insurance policies.

Set up electronic deposits to your account, no mail

Be sure that the taxing authority has your address as the address to mail the annual tax bills. This is such a simple almost “no-brainer” thing but bad addresses have caused property owners to lose their properties to tax sales. If you are going to hold the escrow funds, consult with the escrow office about typical amounts to be impounded from the closing funds.

Insurance is paid for at the time of closing for 12 months and an amount will also be held in impound for about 3 months of insurance payments. You the seller must credit the buyer for property taxes from the beginning of the tax year up to the closing date.

The buyer must provide funding to finish the year. For example, you close on July 1. As the seller, you owe the buyer 6 months of taxes. The buyer will pay the balance of the year with monthly payments but you also need to escrow at least three months of property taxes for your security.

About the payments. I strongly recommend that you require the buyer to make payments electronically directly to your bank or the bank of your property manager or escrow company. The U.S. Mail that has served us for many years has taken a hit in performance. It seems that not much gets to its destination without a delay. Give the buyer no reason to blame it on the U.S. Mail.

Keep an eye on the property while you hold the note

They can deposit the funds into your bank or they can do electronic funds transfer through their bill pay. Set your terms for repayment that include a late fee after e.g. 10 days. Have the escrow office explain clearly to the buyer that the funds are due on the 1st of the month and not the 10th. Any foreclosure will follow state laws.

Pretend that you are renting the property to the buyer because the actions you need to take are similar to those of a landlord. This includes a periodic drive-by to ensure that the property is not losing value through bad decisions made by the buyer e.g. not watering the yard. If you have to repossess the property, you do not want to spend thousands fixing it for resale. Send the buyer an annual report and 1099-Misc (or have your loan servicer do it for you).

I mention using a loan servicer to collect the monthly payments and pay the taxes and insurance. This is a great idea, try to be as isolated from the deal as possible. this way when the buyer runs into issues with payments etc., they can call the loan servicer.

Many people do not want to be landlords because they get calls from tenants about problems e.g. the washing machine is broken or their funds are short this month and ……… You do not need to deal with this. In the transaction that I have described above, the escrow agency agreed to manage the funds for a few dollars each month and a once-a-year payment of about $100. This allows you to relax and not worry about the issues.

Keep accurate records of escrow funds and income

If you use a third party to collect, do not expect to receive your money on the first day of the month. It is common practice for disbursements to be made on or about the 25th of the month. The servicer needs time to ensure checks clear the bank before they issue funds to you. This brings me to the issue of taxes. As a side note, some servicers report to credit agencies which is a plus for the buyer that their mortgage payments can show current on their credit report.

If you collect the mortgage payment each month, you should separate the escrow funds from the total payment and tuck them away in a savings account. Go to your amortization table and determine for that month how much of the money you have received is from the principal and how much is from interest. You will be liable for income taxes on the interest portion of the payment.

Keep track of the (your servicer will provide a report but it may not separate the funds for tax purposes) interest portion for your tax return. Remember, you are not permitted to deduct the property taxes that the seller is paying each month, that is their deduction to make.

Closing costs

Closing costs for both parties are lower for owner-financed homes. One thing to keep in mind for sellers is that real estate agents don’t work for free. You will owe commissions for one or two agents. If you are not asking the buyer for a large enough down payment, you may have to pay these commissions out of pocket. There are new rules now that include negotiating commissions.

Connect with your CPA about the interest income

The way your books will look is this; Total payment received: $100. Insurance impounds $10, Tax impounds $10. The remainder is principal and interest. For example, the $80 remaining consists of $65 in interest and $35 in principal. The $65 amount is the only amount subject to taxes (depending upon your situation). The principal belongs to you and the $20 for the impounds belongs to the buyer.

Regarding the sale of the property that you are financing for the buyer. Each person is permitted to accept tax-free up to $250,000 in income earned from the sale of their primary residence if they lived in it for two or five years (ask a tax advisor about the details here). In the case I have described above, the sellers’ income from the property was well below that amount so there is no income tax liability from the sale, only the interest earned on the mortgage.

This process of being the seller and the lender is not complicated. Use the expertise of your professionals to help you through the process. I work with a loan officer on a regular basis helping my clients obtain loans. On the rare occasion that there is a seller financing sale, he agrees to, for a fee, create the loan documents that are usually created by the finance company and run the credit.

He interacts with the buyer which makes the process easy for the seller. I always recommend the use of third-party experts as there are bodies of law in all of these transactions and the best people to understand the process are professionals.

Pros-Cons of Seller-Owner Financing

There are many benefits available for an owner-seller financing contract for both the buyer and the seller, the following are just a few:

SELLER

- Home sale price at or above market

- Higher rates earned on an owner-financed transaction

- Period of time based upon your goals e.g. 5-year balloon

- Lump sum payment at the end of the loan term

- Lower taxes, you only pay taxes on the interest earned until you sell the property

- You own the home loan in the event the buyer defaults, and you repossess the property

- Faster close

BUYER

- Lower cost than a traditional lender with a traditional mortgage

- No origination fees, big savings

- Faster closing process

- Poor credit may not be a major factor

- Seller finance means lower closing costs

- Connection with the seller in case something goes wrong, they may have knowledge e.g. warranty on roof

- Help improve your financial situation to obtain a long-term fixed mortgage when the balloon comes up

- Good news for some who could not make their debt-to-income ratio work

Consider selling your note if you need funds

As a home seller, you have the opportunity to sell your mortgage at any time to a third party. If for example, you later determine you would like to have a shorter term, you may obtain a cash offer from a buyer of investment properties or another investor. Your mortgage may be for example $200,000 with the new owner of the home.

You sold the house for $220,000 and received $20,000 upfront. You paid $150,000 for the house so you still have $50,000 in profit. Considering that the final payment is for example four years down the road, you may want to give up $25,000 or half of the remaining profit to sell the mortgage.

If you sell the mortgage, there is no impact on the buyers. The buyers will be in search of a conventional lender within a year or so before the balloon is due. This gives them time to look for the best interest on a traditional loan. If their credit is poor, the few years it takes to increase their credit score will permit them to work with a financial institution to obtain traditional financing at a lower interest rate. It would seem that if the payments are made on time every month, both parties would benefit from the arrangement.

Terms and Conditions – Mortage Loan

Consider these items for your note:

- How long will the mortgage be amortized: e.g 30 years

- When is the balance of the mortgage due: e.g 5 years

- Interest rate, fixed for the amortized term: e.g. 12% (you could charge interest only)

- Down payment % or $: E.g 10% of the selling price (inflation rate + 4%)

- Who pays closing costs including termite and property inspection?

- Escrow terms: e.g. 3 months of insurance and 3 months of property taxes upfront at closing (HOA fees etc.)

- When late: e.g. 14 days after the monthly due date

- Late fees: e.g. $50

- Due-on-Sale clause: If they sell the house, they must pay off the mortgage at closing unless the Mortgagee agrees to remortgage the house to the new buyers.

- If a 3rd party is managing the mortgage who pays the fees: e.g. 1/2 each party

- Any personal property that goes with the property e.g hoses etc. that the seller will allow the buyer to use but not keep

- Alarm contract: e.g. new buyer takes over

- Solar contract: e.g. new owner takes over

- Insurance requirements: e.g. list minimum requirements for homeowners insurance and hazard insurance e.g. flood

- Early payoff: e.g. no penalties if paid off more than 180 days after closing

Most typical clauses are included in a standard note supplied by the closing company. It’s important that you review it and make adjustments after deciding on the items above. You will be an expert by the time the loan closes. Consult the escrow/title company and their real estate attorney if you need more help with this part. You may want to read this article about creating a will to include this note.

Resources

Owner-Seller Profit and amortization table – This table allows you to enter the information about the loan you are considering and determine the results. Print the page to retain for your records.

Please read our other articles about this and other topics on this website. If you are interested in becoming an investor in residential rental real estate, check out this article about a great course you can take.

Subscribe to our blog articles.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.