Last updated on December 5th, 2025 at 08:27 am

Selling your business after retirement is often the final chapter in an entrepreneur’s journey. Many baby boomers and Gen Xers built second-act small businesses after leaving their careers, enjoying the purpose, cash flow, and independence that come with being your own boss.

But eventually, the sale of your business becomes more than just a financial move — it’s a way to secure financial security, protect your family business legacy, and make sure the transition is a smooth one for family members, key employees, and the new owner.

Unlike selling mid-career, this may be your last major business venture, and the decisions you make now will have a significant impact on your retirement goals and financial future. That’s why careful planning, the right advisory services, and a clear exit plan matter so much.

This article is part of a series of articles about starting a business after retirement. Several of the articles have information that can supplement what you read here: 👉 https://retirecoast.com/starting-a-business-after-retirement/

👉 In this article, we’ll walk through:

- How to recognize the right time to sell your business after retirement.

- Key steps for creating a timeline and exit plan (from five years out to the final handover).

- Strategies for increasing the value of your business and attracting potential buyers.

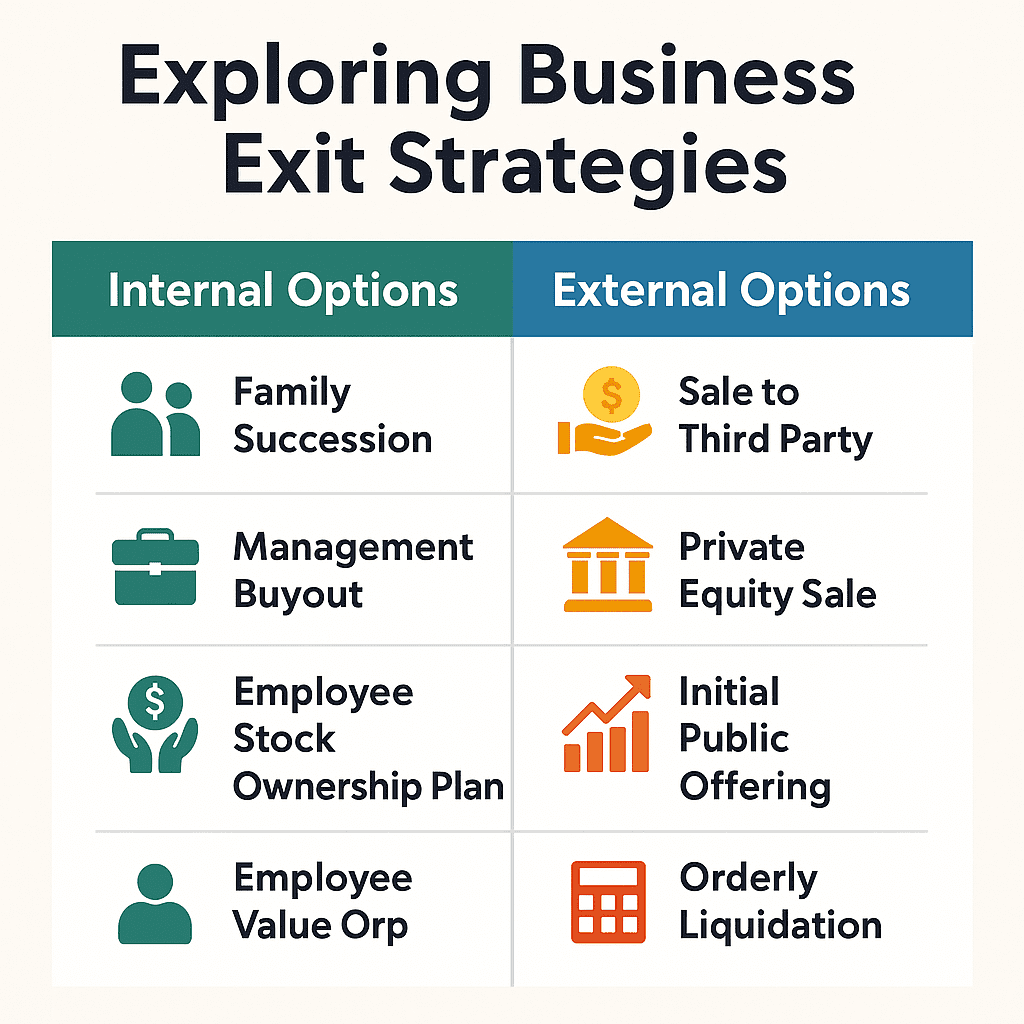

- The different business exit strategies (family transfer, management buyout, third party, ESOP, and even IPO).

- Legal, tax, and financial planning issues, including capital gains, estate planning, and deal structure.

- How to manage the transition period and ensure a smooth transfer to a new owner.

- What to expect from life after the sale, including financial planning, asset allocation, and personal goals.

By the end, you’ll have a clear view of the important considerations, the best options for your situation, and the easiest way to achieve a successful sale of the business while protecting your financial security and legacy.

Who This Article Is For

This guide is written for:

- Baby boomers who already retired once, then built a second-act business, and now face the sale of a business as their final major exit.

- Gen X small business owners who may not see themselves as “retired” yet, but who want a clear exit strategy for the future.

- Family business owners who want to weigh whether the best option is passing the company to family members, key employees, or selling to a third party.

- Small business owners are looking for practical advice on the tax implications of the sale, succession planning, and how to secure a successful transition.

If that sounds like you, you’re in the right place — this article will help you create the right plan, find the right buyer, and take the next step toward financial independence and peace of mind.

My Personal Story: Selling the Same Business Twice

I’ve been fortunate to create several businesses during my long career, and at various points, I sold each of them. But two of those sales stand out because they involved selling to Fortune 500 companies — and they both centered around the same business. My journey may mirror yours if you’re considering selling your business after retirement, so I’ll share the lessons I learned along the way.

The business was one I started from scratch: a company that collected hazardous waste from homes. At the time, no other business had succeeded in this niche — and within the first year, I knew my ultimate goal was to sell it to a larger corporation. From day one, I structured it as a C corporation to make that eventual sale easier.

The first opportunity came about two years later when the largest hazardous waste company in the country expressed interest. They acquired 49% with an agreement to purchase the remaining balance over time. I

t was a dream scenario until the company filed for Chapter 11 bankruptcy, and two of its executives were convicted of crimes. That collapse killed the deal. Fortunately, I was able to buy back their 49% and move to my backup plan — finding another buyer with strong synergies.

It took nearly three more years, but I eventually sold the entire business to another Fortune 500 company. They not only bought it outright but also retained me to manage it for several years, giving me both financial security and a smooth transition.

Throughout this article, I’ll sprinkle in details from that experience — how I approached the selling price, how I managed the timeline, and the important considerations that came up along the way. If you’re a baby boomer or Gen Xer preparing for the sale of your business after retirement, my story may sound familiar — and hopefully it will help guide you toward your own successful sale.

Would you like me to weave mini-anecdotes into each section of your existing article (e.g., in the “Knowing When to Sell” section, you share how you knew it was time when the Fortune 500 showed interest; in the “Timeline” section, how you structured as a C corp early; in “Transition,” how you stayed on with the buyer)? That way, the article feels like both a guide and a lived experience.

1. Knowing When It’s the Right Time to Sell

Many owners ask themselves, “Is now the right time to sell?” The answer often depends on both market conditions and your personal finances.

Signs it may be time to sell include:

- The business is profitable, and the company’s value is at or near its peak.

- You’ve received interest from potential buyers or private equity firms.

- Personal factors like burnout, health issues, or changing family needs are pulling you away.

- Family members aren’t interested in continuing the family business.

- Market conditions suggest the best option is to sell before the economy shifts.

- You have already included an approximate time to sell as part of your exit strategy.

💡 Pro tip: Review your wealth gap — the difference between what you have and what you need to retire securely. If the gap is wide, you may need to pursue a third-party buyer to maximize the sale price.

Personal Experience:

The bullet points above about timing are appropriate, considering the difficulty when selling most businesses. If you are working on an exit strategy, then the signs to sell are supplemental — they can help you start the process or accelerate it.

In my case, I knew from the beginning that it would take a while to sell the business. For the first sale attempt, I needed to find the best buyer — the one who would see the highest, best use of my company within their larger operation.

This took time. I researched who would find the business most valuable and, eventually, through friends, I found a great fit. After their first round of due diligence, the company agreed to a phased plan: they purchased 49% of my company upfront and would acquire the remaining 51% by year five.

It was a comfortable arrangement that gave me financial security while keeping me involved. (I’ll share more details about the financial side later in the Transition and Contingency Planning section.)

3. Building a Timeline Roadmap (Five Years to the Sale)

One of the best ways to ensure a successful business sale is to give yourself enough time. A five-year timeline is ideal, but even two to three years can help you prepare.

- Five Years Out – First Step:

- Decide on your business exit strategy: internal succession (management buyout, employee stock ownership plan, family transfer) or external sale (third party, private equity firms, initial public offering).

- Review your wealth gap and personal finances to determine your best option.

- Three Years Out – Financial Statements:

- Buyers will scrutinize three years of past performance during due diligence.

- Hire tax professionals to clean up books and standardize reporting.

- Make sure your business value reflects the company’s true strength.

- Two Years Out – Build the Advisory Team:

- Engage advisory services: financial advisors, investment bankers, estate planning attorneys, and tax advisors.

- Involve family members and key employees in succession planning conversations.

- One Year Out – Market Preparation:

- Work with a professional business broker or M&A advisor to present your business as a successful business with growth potential.

- Prepare pitch decks, financial statements, and highlight your company’s value and cash flow.

- Begin identifying prospective buyers and negotiating terms.

4. Closing the Value, Profit, and Wealth Gaps

Three gaps can make or break the sale of the business:

- Value Gap: Your company’s current valuation vs. what the best-in-class competitors achieve.

- Profit Gap: The difference between your business’s profitability and that of competitors.

- Wealth Gap: The shortfall between your financial goals and what your business can realistically sell for.

Good idea: Close these gaps early by improving systems, empowering your management team, and boosting recurring cash flow. These steps raise the perceived value of the business and attract the right buyer.

One of the most difficult parts of the sales process is establishing a value for your company that the prospective buyer agrees with. You can’t just throw a dart at the wall. Educated buyers often employ valuation experts or the best financial minds on their payroll to compare your business against competitors and evaluate how it fits into their existing operations.

For example, you might believe your company is worth one million dollars because you have sales, accounting, manufacturing, distribution, and every other function in place. The buyer, however, may argue that since they already have a stronger distribution network, that part of your business has little or no value to them.

Personal Experience:

In my case, we had a small marketing department that the buyer initially dismissed as redundant. They believed their own marketing team was more than sufficient. I had to explain that our marketers deeply understood our niche, while theirs did not. Eventually, they acknowledged the value and decided to integrate the two groups later.

During due diligence, your company will also be compared against competitors in areas like revenue, market share, operations, and risk. For me, this was straightforward — my company was the only one in the country succeeding in the hazardous waste collection space, so the evaluation proved that out.

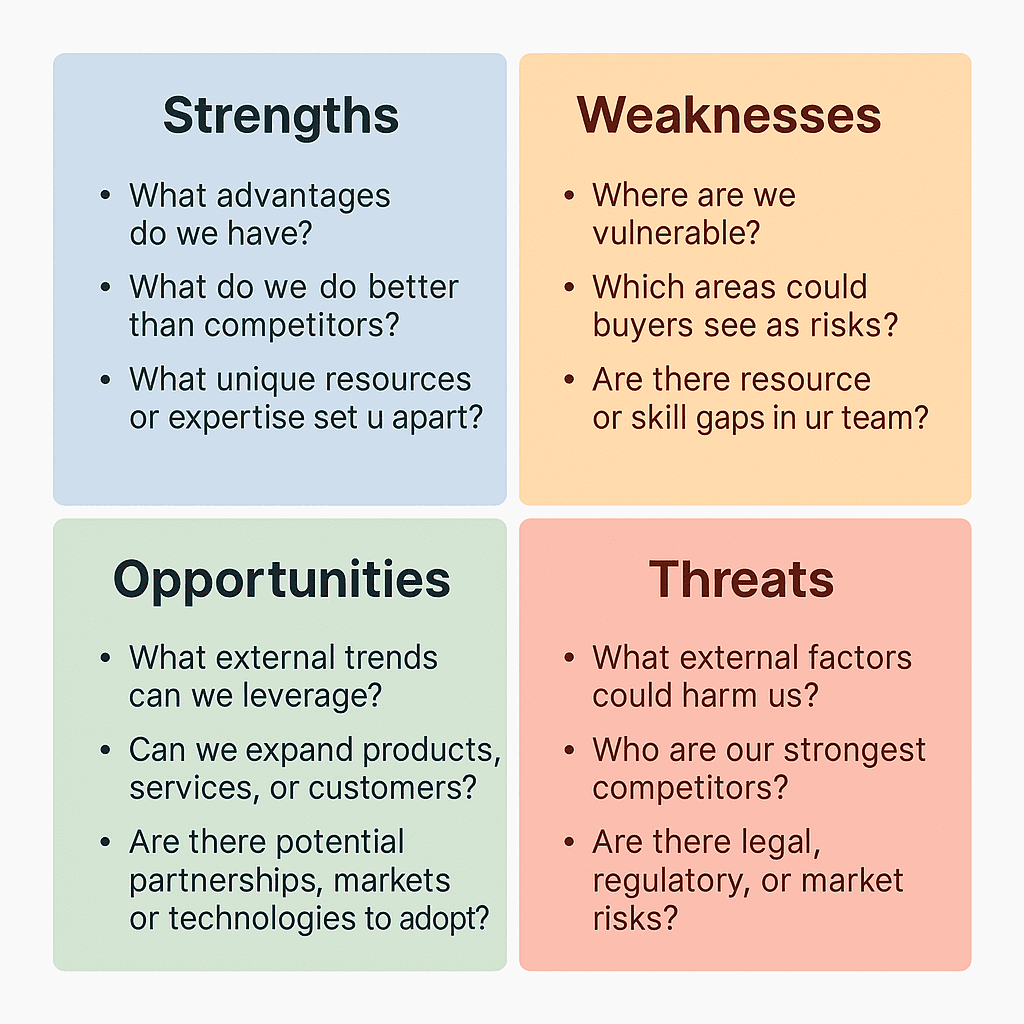

💡 Pro tip: Before you ever approach a potential buyer, run a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats see below) on your business. View it the way outsiders will. Be prepared to answer tough questions about operations, employees, policies, debt, judgments, and more. The better prepared you are, the more confident you’ll be in defending the value of your business.

📌 Lessons Learned: Valuation and Due Diligence

- Buyers value different things — what’s important to you may not be important to them.

- Defend your strengths — explain why certain departments, employees, or assets add value.

- Be prepared for comparisons — buyers will measure your performance against competitors.

- Run a SWOT analysis early — know your strengths, weaknesses, opportunities, and threats before the buyer points them out.

What Is a SWOT Analysis—and Why It Matters Before You Sell

SWOT = Strengths, Weaknesses, Opportunities, Threats. It’s a simple, structured way to view your business the same way a buyer will during due diligence.

Strengths (Internal +)

- Loyal customers / strong brand

- Proprietary processes or IP

- Experienced management & key employees

- Healthy margins & reliable cash flow

Weaknesses (Internal −)

- Owner dependence / single points of failure

- Incomplete policies & procedures

- Concentration risk (customer, vendor, product)

- Outdated systems or limited working capital

Opportunities (External +)

- New markets, services, or partnerships

- Favorable regulations or incentives

- Technology that reduces costs or scales delivery

- Buyers with strong synergy fit

Threats (External −)

- New competitors or price pressure

- Regulatory changes / compliance costs

- Economic slowdown or supply disruptions

- Loss of key staff or major accounts

How to Create Your SWOT (Step-by-Step)

- Gather facts: last 3 years of financial statements, customer and product mix, top accounts, churn, staffing, systems, contracts.

- Brainstorm honestly: 3–5 bullets per quadrant. Think like a buyer: transferability, risk, and fit.

- Prioritize: rank each list by impact on sale price, multiple, and close probability.

- Assign actions: for each Weakness/Threat, decide: fix, mitigate, or prepare to defend in negotiations.

- Tie to your exit plan: convert top items into 30/60/90-day tasks (e.g., finalize SOPs, diversify customers, elevate key employees).

Common Mistakes to Avoid

- Listing aspirations as Strengths (keep it evidence-based).

- Ignoring owner-dependence—buyers discount heavily for this risk.

- Overlooking tax and regulatory Threats that can change net proceeds.

- Failing to convert findings into action items before going to market.

5. Enhancing Business Value Before the Sale

Buyers don’t just purchase financial statements — they buy stability, leadership, and opportunity.

Ways to enhance business value include:

- Strengthen your management team and support key employees.

- Develop processes that ensure a smooth transition to a new owner.

- Reduce dependence on you as the owner so the business can stand alone.

- Diversify customers and revenue streams to reduce risk.

Personal Experience:

As this article starts, buyers want stability, leadership, and opportunity. It’s common for very large companies to acquire only the assets of a business — not the corporate structure. This allows them to avoid potential legal issues tied to the original company. They’ll either fold the assets into an existing division or create a new company entirely.

Three years before selling my business, my team and I worked hard to prepare for exactly that. As a small company, we’d always been hands-on, but we knew a Fortune 500 buyer would expect polished systems and documentation. So we created:

- Comprehensive policies and procedures manuals.

- A restructured 401(k) plan, medical insurance, and employee benefits guide.

- Operations manuals for our vehicles and the recycling process.

By the time due diligence began, everything they asked for was up to date and ready to hand over.

We also expanded beyond our initial niche. While government agencies were our core customers, we added medical waste collection from businesses and even built a recycling plant for latex paint. This diversification made the company far more attractive — not all our eggs were in one basket.

Another key element was people. I was the driving force behind the business, but I deliberately elevated key employees so they became indispensable. Buyers want to know they’re purchasing a real company, not just one person’s reputation.

💡 Lesson learned: If you want to sell someday, structure your company from the start with the buyer in mind. Avoid naming it after yourself (e.g., “Sam Jones Hardware”) so the brand stands on its own. Consider a partnership or C corporation early — it signals professionalism and makes the sale easier. Buyers need to feel confident that the business will thrive even if you’re not there.

📌 Lessons Learned: Preparing for a Big Buyer

- Document everything — manuals, policies, and procedures reduce buyer risk.

- Diversify revenue — don’t rely on a single customer or market.

- Invest in people — elevate key employees so the company isn’t dependent only on you.

- Structure matters — from the start, set up as a C corporation or partnership if you plan to sell.

- Don’t brand around yourself — buyers want a business, not “Sam Jones Hardware.”

6. Exploring Business Exit Strategies

Not all business exit strategies are the same. Choosing the best option depends on your personal finances, family situation, and retirement planning.

Internal Options:

- Transfer to family members to keep the family business legacy alive.

- Management buyout by key employees who know the company well.

- Employee stock ownership plan (ESOP) to reward employees and create a smooth transition.

- Sale to existing partners if a buy-sell agreement is in place.

External Options:

- Sale to a third party, competitor, or strategic buyer.

- Partnership with private equity firms for growth capital.

- Initial public offering (rare but possible).

- Orderly liquidation if assets exceed ongoing income.

Personal Experience:

I considered many of the routes listed above. Ultimately, though, I knew I wanted to cash out — but not at the expense of my employees. Their stability was just as important to me as my own financial future. For that reason, I structured the deal so that I sold the business but was retained to manage it for several years. This gave my employees continuity, reassured the buyer, and allowed me to exit on my own terms.

Of course, your path may look different. You might want to transfer the company to your children, or you may sell your shares to a business partner. In my case, my exit strategy was twofold:

- First, sell the business outright for a fair price.

- Second, create a situation where I could either fully retire or continue working in another field.

This took careful planning and honest communication. In fact, I gave the buyer three years’ notice that I would eventually step aside, leaving the business in good hands. That’s exactly what happened, and it made the sale a successful transition for everyone involved.

More information is available here: U.S. Small Business Administration – Selling Your Business

👉 https://www.sba.gov/

Trusted government guide covering steps, valuation, and transition planning for small business owners.

📌 Lessons Learned: Choosing the Right Exit Strategy

- Think beyond the sale price — consider employees, family members, and legacy.

- Flexibility matters — structure the sale so you can retire fully or move on to a new venture.

- Communication builds trust — giving buyers advance notice of your plans can increase confidence and stability.

- Plan early — whether it’s a management buyout, family transfer, or third-party sale, start shaping your business years in advance for the smoothest outcome.

7. Legal, Tax, and Financial Structuring

The way you structure the sale of your business can have a significant impact on your financial future.

- Deal structure matters: Asset sale vs. stock sale, each with different tax liabilities and implications for capital gains.

- Capital gains and state taxes: Work with tax advisors and tax professionals to minimize exposure.

- Estate planning: Protect family members and heirs through trusts, succession planning, and estate strategies.

- Professional guidance: Consider working with a certified financial planner, private wealth advisors, or an IRS-licensed agent license holder to get the right legal advice and clarity on financial matters.

Personal Experience – Tax Shock:

Just when you thought that your one-million-dollar sale was going to help you buy your new retirement home on the beach, it hits you: taxes. What will your tax liability be? That moment hit me as well — but fortunately, our CPA came up with a brilliant idea.

Here’s what happened:

- My company was based in a high-tax state, so both federal and state taxes would have taken a significant bite.

- When I sold the company the second time, the payout was structured over several years.

- Those payouts were going to the corporation, which was still owned by me and a few minority shareholders.

- Before the checks started arriving, we moved the corporate headquarters to a state with no corporate taxes. Since the company at that point was only a shell (the assets had already been sold), future payouts weren’t subject to state tax.

- Federal taxes were also reduced because we could apply invested equity in the business against the liability.

📌 Lessons Learned: Structuring for Tax Efficiency

Plan early — once checks start arriving, it’s too late to restructure.

Taxes can derail your plans — calculate liabilities before you sign.

Consider location — moving your headquarters to a lower-tax state may save millions.

Spread out payments — structuring payouts over time can reduce your tax bracket.

Work with professionals — CPAs, tax advisors, and estate planners can uncover strategies you may miss.

Additional information can be found by clicking this link: IRS – Closing a Business Checklist

👉 https://www.irs.gov/businesses/small-businesses-self-employed/closing-a-business-checklist

Authoritative resource on tax obligations, final returns, and compliance when selling or shutting down a business.

📌 Top Tax Questions to Ask Before Selling Your Business

Before signing anything, sit down with your tax advisor or CPA and ask:

- Will the sale be structured as an asset sale or a stock sale, and how will that affect my taxes?

- What are the capital gains tax implications at both the federal and state levels?

- Should I consider relocating my company headquarters before payouts begin to reduce state tax exposure?

- Can my basis (invested equity) reduce taxable gains, and how is that calculated?

- What options exist to spread payments out over several years to avoid being pushed into a higher tax bracket?

8. Negotiating With Potential Buyers

Negotiation is where preparation and patience pay off.

Important considerations:

- Buyers will conduct extensive due diligence on financial statements, legal matters, and past performance.

- A higher sale price isn’t always the best way forward — look at deal structure and cash flow post-sale.

- Professional business brokers and investment bankers can help present offers, manage prospective buyers, and secure the right plan.

Personal Experience:

When I negotiated my first major deal with a Fortune 500 company, it seemed like everything had lined up perfectly. They agreed to buy 49% of my company immediately and the rest by year five. But just before the full acquisition was to take place, the company filed for Chapter 11 bankruptcy, and two of its executives were later convicted of crimes. Overnight, the deal collapsed.

Fortunately, because I had structured the company properly and kept alternative plans in motion, I was able to buy back the 49% and continue searching for another buyer. A few years later, another Fortune 500 company saw the value in my business and purchased it outright, even retaining me to manage operations during the transition.

The lesson? Always have a backup plan. Even the best-looking deal can fail due to factors outside your control. A clear exit strategy, clean financial statements, and patience will put you in a position to recover and ultimately secure the right buyer.

📌 Lessons Learned: Negotiating and Backup Plans

- Have a Plan B — even great deals can collapse through no fault of your own.

- Stay flexible — if one buyer falls through, keep building the business so another will be interested.

- Understand buyer risks — their financial health and legal troubles can affect your deal.

- Don’t overcommit — structure deals so you can recover if things go wrong.

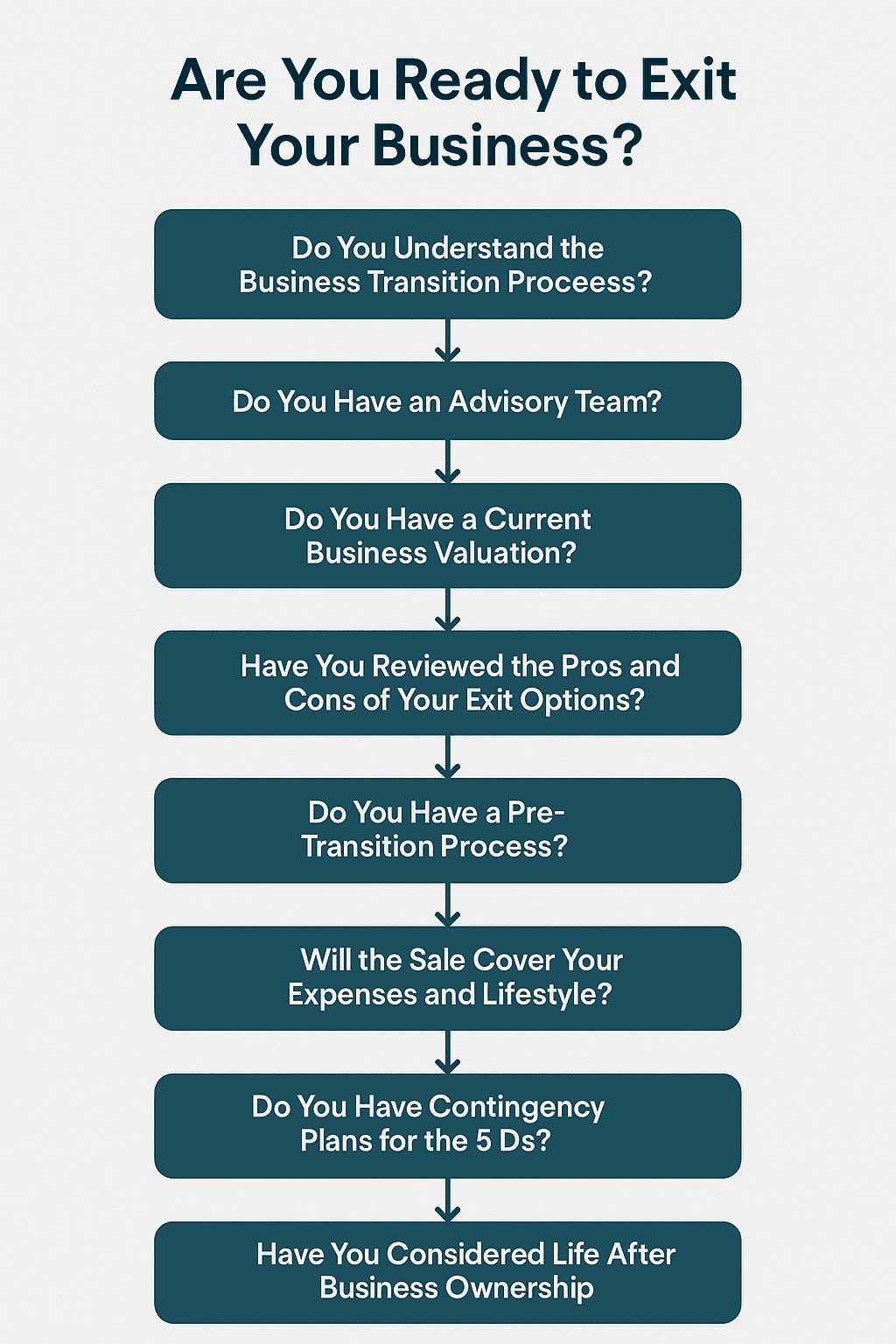

9. Transition and Contingency Planning

Even after signing the deal, most owners won’t hand over the keys and walk away the same day. Buyers — especially large corporations — want to know that operations, employees, and customers will not suffer during the handover.

Key considerations for transition include:

- Smooth transition: Create a clear exit strategy for employees, customers, and vendors.

- Transition period: Expect to stay involved during a handover or earnout period, especially for service-based businesses.

- Contingency planning: Prepare for the “5 Ds” — death, disability, divorce, disagreement, and distress.

- Protect business interests: Legal advice and advisory services help minimize risks and disruptions.

Personal Experience:

When I finally sold my hazardous waste company to the second Fortune 500 corporation, part of the deal structure required me to stay on and manage the business for several years. At first, I wasn’t sure I wanted to remain in day-to-day operations after the sale. But in practice, it turned out to be one of the best decisions.

Here’s why:

- It reassured the buyer that the company would have continuity of leadership.

- It gave my employees confidence that their jobs and benefits were secure.

- It allowed me to mentor the new management team and ensure nothing fell through the cracks.

- It gave me additional financial security through a stable salary during the transition period.

By the time I fully stepped away, the new owner had integrated my company’s assets, systems, and people seamlessly into their operations. The transition was not only smooth but also strengthened the perceived value of the business.

📌 Lessons Learned: Transitioning Out of the Business

Plan for the “5 Ds” — death, disability, divorce, disagreement, and distress can all derail operations if not addressed.

Expect to stay on — most buyers want you to help during the transition period.

Stability builds confidence — employees and clients feel more secure if you remain temporarily.

Set a timeline — define how long you’ll stay before fully retiring.

10. Life After the Sale

Once the sale of the business is complete, the focus shifts to your financial future and personal goals.

Key steps for a successful transition:

- Work with financial planners, private wealth advisors, and estate planning experts on asset allocation.

- Plan for retirement goals, charitable giving, or support for family members.

- Explore new ventures, hobbies, or simply enjoy the freedom of retirement.

- Ensure the proceeds of the business sale provide long-term financial security.

Personal Experience:

Don’t wait until you complete the sale to begin planning for the next chapter. Your personal goals and financial future are deeply intertwined with the business itself. At the same time I was preparing my company for sale, I was also planning my life after the sale. That parallel planning made a world of difference.

I asked myself:

- What happens if the sale doesn’t go through?

- What happens if the proceeds, after taxes, aren’t enough to complete my plans?

- Where will I live?

- What’s my contingency plan if things take longer than expected?

Because I started planning well in advance — and had contingency plans in place — everything worked out smoothly. I knew what I wanted the next step to look like, and I didn’t leave my financial future to chance.

If you’re selling your business after retirement, remember: this may be the business you created after leaving your lifelong career. That makes it even more important to map out what comes next.

There are many great resources, including articles on RetireCoast, that dive into retirement planning, lifestyle choices, and relocation options. Becoming familiar with these topics now will give you confidence that the sale of your business is not the end of your story — it’s the beginning of your next chapter.

📌 Lessons Learned: Transitioning Out of the Business

- Expect to stay on — most buyers want you to help during the transition period.

- Stability builds confidence — employees and clients feel more secure if you remain temporarily.

- Set a timeline — define how long you’ll stay before fully retiring.

- Plan for the “5 Ds” — death, disability, divorce, disagreement, and distress can all derail operations if not addressed.

Consider checking this link for more information about your retirement plan: https://retirecoast.com/new-retirecoast-website/

Financial planning insights tailored to business owners who are transitioning into retirement.

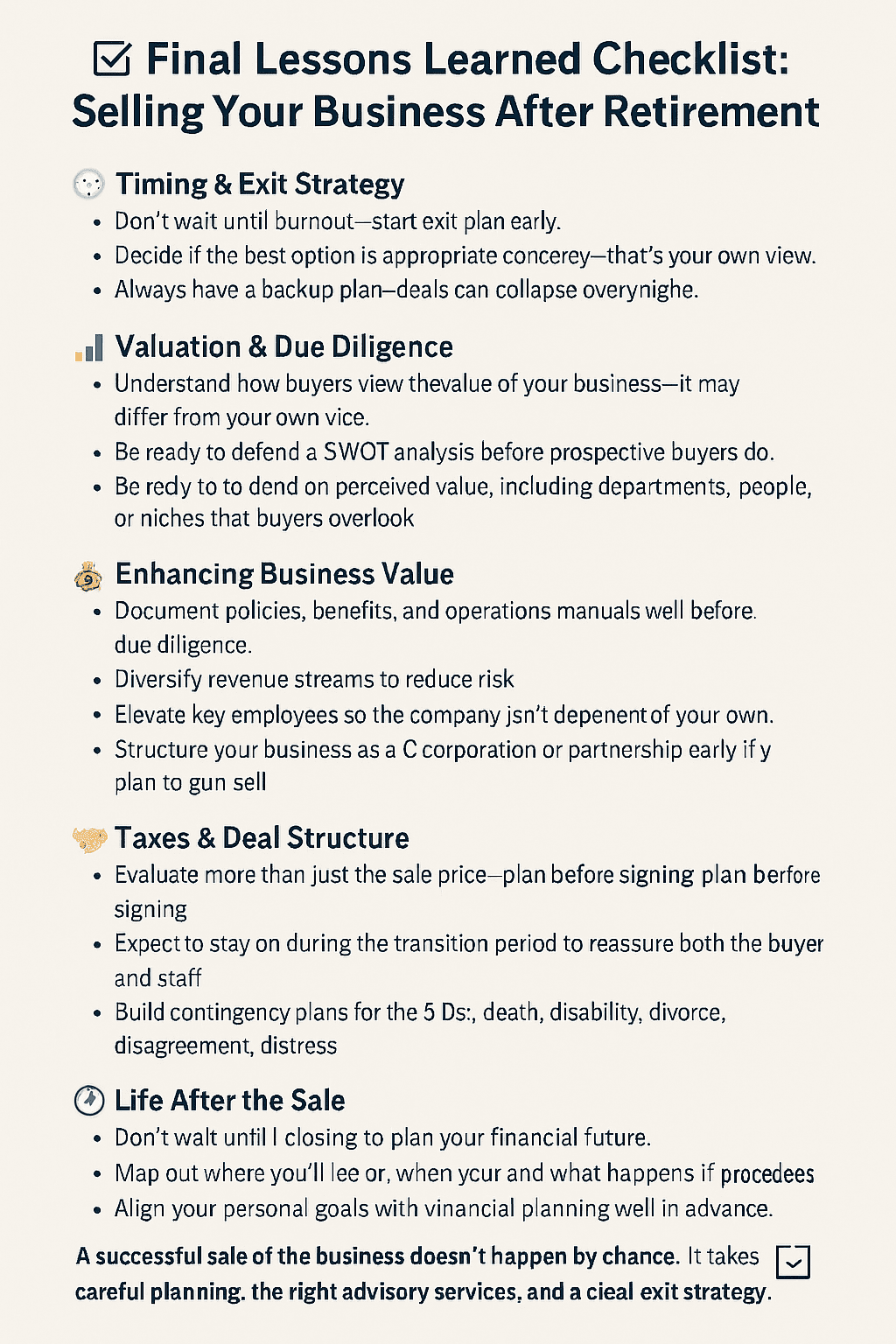

✅ Final Lessons Learned Checklist: Selling Your Business After Retirement

Selling your business after retirement is often your last major entrepreneurial move. Here’s a one-page cheat sheet of key takeaways from my journey that can guide yours:

🕰️ Timing & Exit Strategy

- Don’t wait until burnout — start exit planning early.

- Decide if the best option is family succession, management buyout, or a third-party sale.

- Always have a backup plan — deals can collapse overnight.

📊 Valuation & Due Diligence

- Understand how buyers view the value of your business — it may differ from your own view.

- Run a SWOT analysis before prospective buyers do.

- Be ready to defend the perceived value of the business, including departments, people, or niches that buyers overlook.

📚 Enhancing Business Value

- Document policies, benefits, and operations manuals well before due diligence.

- Diversify revenue streams to reduce risk.

- Elevate key employees so the company isn’t dependent only on you.

- Structure your business as a C corporation or partnership early if you plan to sell.

💰 Taxes & Deal Structure

- The tax implications of the sale can have a significant impact — plan before signing.

- Explore ways to reduce state taxes, including relocation of headquarters.

- Consider spreading payments over time to reduce your tax bracket.

- Work with CPAs, tax advisors, and estate planning professionals before the first check arrives.

🤝 Negotiation & Transition

- Evaluate more than just the sale price — look at deal structure, future cash flow, and security for employees.

- Expect to stay on during the transition period — it reassures both the buyer and your staff.

- Build contingency plans for the 5 Ds: death, disability, divorce, disagreement, distress.

🧭 Life After the Sale

- Don’t wait until closing to plan your financial future.

- Map out where you’ll live, how you’ll spend your time, and what happens if proceeds fall short.

- Align your personal goals with your financial planning well in advance.

- Selling your business may close one chapter — but with the right plan, it opens the door to a new venture, lifestyle, or true retirement.

👉 Bottom line: A successful sale of the business doesn’t happen by chance. It takes careful planning, the right advisory services, and a clear exit strategy. Start early, involve the right financial professionals, and think beyond the transaction — your financial security and peace of mind in retirement depend on it.

Frequently Asked Questions: Selling Your Business After Retirement

Below are answers to common questions small business owners ask when planning the sale of a business after retirement. From exit strategies to tax implications, these FAQs highlight important considerations that can help you prepare for a smooth transition and a successful sale.

1. How do I know if it’s the right time to sell my business after retirement?

Look at market conditions, cash flow, and your personal goals. If prospective buyers see strong financial statements and a clear exit strategy, it may be the right time.

2. What’s the first step in creating an exit plan?

The first step is a business valuation to determine the perceived value of the business. From there, work with financial advisors and tax professionals to design the right plan.

3. Should I sell to family members or a third party?

Both can work. Family business transfers require careful planning to ensure a smooth transition, while selling to a third party or private equity firms may deliver a higher sale price.

4. How do I calculate the value of my business?

Buyers often use EBITDA multiples and compare your company’s value against competitors. A professional business broker or certified financial planner can guide you through this process.

5. What role does due diligence play in the sale of a business?

Due diligence is when prospective buyers review your financial statements, key employees, policies, and past performance. Being prepared with clean records shows professionalism and builds trust.

6. What are the tax implications of the sale?

Capital gains, state taxes, and tax liabilities can have a significant impact on your proceeds. Always consult a tax advisor or IRS enrolled agent license holder to minimize taxes.

7. What are the main business exit strategies available?

Options include management buyout, employee stock ownership plan (ESOP), initial public offering (IPO), sale to partners, or orderly liquidation. The best option depends on your goals and financial situation.

8. How long does the transition period usually last?

It varies. Some buyers want you involved for 6–12 months; others may require a multi-year earnout. Planning ahead helps create a successful transition for both you and the new owner.

9. Should I hire financial professionals or handle the sale myself?

Hiring financial planners, private wealth advisors, and a professional business broker is usually the easiest way to achieve a successful sale. Advisory services reduce risks and ensure legal matters are handled properly.

10. What should I focus on for life after the sale?

Think beyond the deal structure. Work on estate planning, asset allocation, and retirement planning. Selling a business is a financial move, but planning your financial future and new ventures is just as important.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.