Good news! If you’re a senior, you may not be required to file a federal tax return for the 2025 tax year (filed in 2026). If you decide to file, you can use the 2025 IRS Form 1040-SR, the simplified return designed specifically for seniors. In this article, you’ll learn how to use this form, discover who qualifies, and see how a married couple filing jointly can legally pay zero federal income tax.

This article has been fully updated for 2026 to reflect the latest standard deductions, income brackets, and contribution limits. It also includes valuable tax planning strategies you should implement before December 31, 2026.

2025 1040 SR Tax Preparation Tool

We just completed work on the 2025 1040 SR form that is specifically for seniors to file their income tax. You can use our new tool based upon the actual IRS Form here.

Why use our tool? To help plan ahead. A good example is the tool can help you determine how much you may want to remove from a tax advantaged plan before taxes would be due. Or even, that you can withdraw an amount and pay in the lowest tax bracket. Don’t forget the new additional deduction for seniors which is good for the year 2025 thanks to actions taken in congress.

IRS form 1040-SR

this special form was created just for seniors and contains a method to obtain that “extra” senior deduction.

Countdown to filing your 2025 taxes in 2026

🧾 Important Filing Deadlines for the 2025 Tax Year

- Tax Year Covered: 2025

- Filing Year: 2026

- Tax Deadline: April 15, 2026

- Extension Filing Deadline: October 15, 2026

If your return isn’t postmarked by April 15, 2026, it’s considered late. File as soon as possible to reduce penalties and interest. The IRS charges interest on any unpaid amount starting April 15, 2026.

🧓 The 1040-SR: A Simplified Tax Form for Seniors

Congress recognized that many seniors have straightforward finances—mainly Social Security, pensions, or small investment income—and do not need complex tax forms. As a result, the IRS Form 1040-SR was created.

If you’re age 65 or older, you can use this form. It provides larger, easier-to-read print and includes the senior standard deduction automatically. Many seniors can prepare it themselves without paid preparers.

💰 2025 Standard Deduction Amounts

The IRS adjusts standard deductions each year for inflation. For tax year 2025, the projected standard deduction for seniors is approximately:

| Filing Status | Under 65 | Age 65+ | Both 65+ (Married) |

|---|---|---|---|

| Single | $14,700 | $16,650 | — |

| Married Filing Jointly | $29,400 | $31,700 | $33,950 |

| Head of Household | $21,900 | $23,850 | — |

💡 Note: Exact amounts will be confirmed by the IRS in late 2025, but these estimates are based on current inflation indexing.

For most senior couples, itemizing deductions is no longer necessary since the standard deduction exceeds typical mortgage interest and property tax deductions. Remember, there’s still a $10,000 cap on combined state and local tax (SALT) deductions.

History of Standard Deduction Increases

| Tax Year | Married Seniors | Single Seniors | Notes |

|---|---|---|---|

| 2016 | $15,100 | $7,550 | Pre-TCJA era; much lower deduction |

| 2017 | $15,700 | $7,850 | Minor inflation bump |

| 2018 | $26,600 | $13,300 | Big jump under Tax Cuts and Jobs Act |

| 2019 | $27,000 | $13,500 | Inflation adjustment |

| 2020 | $27,400 | $13,700 | Slight increase |

| 2021 | $28,100 | $14,050 | Inflation |

| 2022 | $28,700 | $14,350 | Inflation |

| 2023 | $29,200 | $14,600 | Inflation |

| 2024 | $30,750 | $15,700 | Inflation, higher senior add-on |

| 2025 | $33,950 | $16,650 | Projected under the Big Beautiful Bill |

🚫 Why Many Seniors Pay No Federal Income Tax

A significant number of retirees—especially those relying mostly on Social Security income—owe zero federal income tax. Here’s why:

- Social Security is only partially taxable if total income exceeds $32,000 (married) or $25,000 (single).

- The higher senior deduction often offsets other income.

- Charitable deductions are no longer advantageous for most individuals because the standard deduction is so high.

If your income is primarily Social Security and modest pension or IRA distributions, you may owe nothing in federal income taxes.

⚖️ 2025 Federal Income Tax Brackets

| Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| 10% | Up to $11,600 | Up to $23,200 | Up to $16,500 |

| 12% | $11,601–$47,150 | $23,201–$94,300 | $16,501–$63,100 |

| 22% | $47,151–$100,525 | $94,301–$201,050 | $63,101–$100,500 |

| 24% | $100,526–$191,950 | $201,051–$383,900 | $100,501–$191,950 |

| 32% | $191,951–$243,725 | $383,901–$487,450 | $191,951–$243,700 |

| 35% | $243,726–$609,350 | $487,451–$731,200 | $243,701–$609,350 |

| 37% | Over $609,350 | Over $731,200 | Over $609,350 |

🏦 Required Minimum Distributions (RMDs) for Seniors 73+

If you’re age 73 or older, you must take a Required Minimum Distribution (RMD) from your traditional IRA or 401(k). Your plan custodian should notify you of the minimum amount each year.

RMD Example:

If you’re age 74, your IRS life expectancy factor is 25.5 years.

If your IRA balance on December 31, 2025, is $200,000, divide by 25.5 to find your RMD:

$200,000 ÷ 25.5 = $7,843.

You must withdraw this amount by April 15, 2026, or face a 25% penalty (reduced to 10% if corrected promptly).

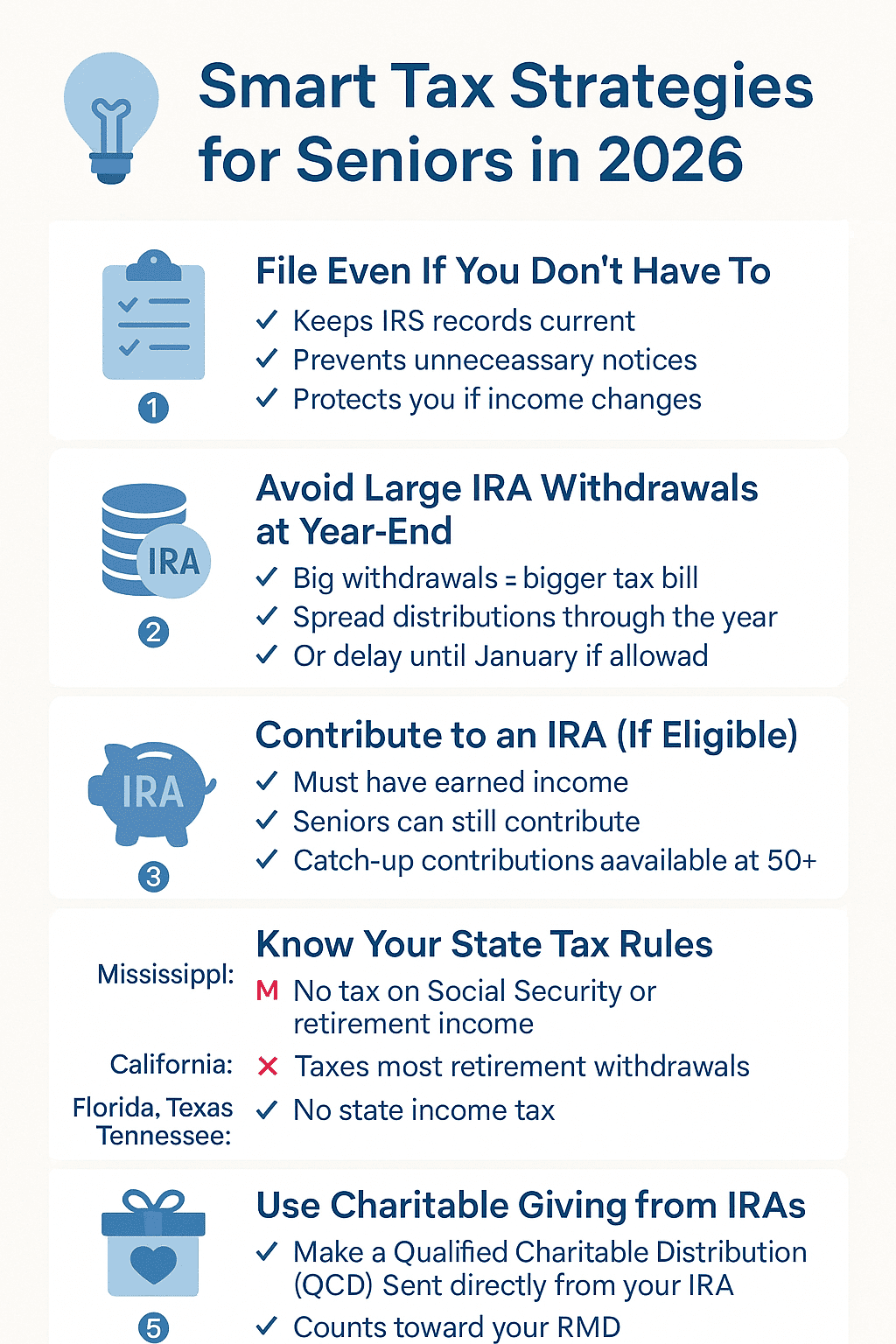

💡 Smart Tax Strategies for Seniors in 2026

- File Even If You Don’t Have To.

Filing keeps your IRS record current and avoids unnecessary notices, especially if your income changes. - Avoid Large IRA Withdrawals at Year-End.

Large distributions increase taxable income. If you can, delay until the following year or spread withdrawals. - Contribute to an IRA (If Eligible).

Seniors with earned income can still contribute and receive tax benefits. Catch-up contributions are allowed after 50. - Check State Tax Rules.

- Mississippi: No tax on Social Security or retirement income.

- California: Taxes nearly all retirement withdrawals.

- Florida, Texas, Tennessee: No state income tax.

- Charitable Giving from IRAs.

Qualified Charitable Distributions (QCDs) made directly from your IRA to a charity count toward your RMD without increasing taxable income.

🗓️ Extension Filing (Form 4868)

If you need more time to file your 2025 return (in 2026):

- File IRS Form 4868 by April 15, 2026.

- This gives you until October 15, 2026, to file.

- Remember: It extends time to file, not time to pay.

📈 Example: Sally and Paul Jones (Married Filing Jointly)

Sally and Paul, both over 65, receive:

- $28,000 in Social Security benefits

- $6,000 in pension income

- $2,000 in dividends

Their total income is $36,000, well below the taxable threshold. After applying their $33,950 standard deduction, their taxable income = $0.

✅ Result: No federal income tax owed for 2025.

🧮 Checking Your Refund or Return Status

You can check your refund status anytime at:

🔗 IRS.gov/Refunds

If you qualify, you may also file for free through IRS Free File or local senior tax programs (such as AARP Tax-Aide).

🎥 Watch the 2026 Seniors Tax Filing Guide on YouTube

👉 Watch the video here

This walkthrough covers completing Form 1040-SR and updates for 2025 income limits and 2026 filing procedures.

📘 Final Thoughts

Most seniors will continue to enjoy low or zero federal tax liability in 2025, especially those whose primary income source is Social Security. Still, thoughtful planning—like managing IRA withdrawals, using Roth conversions strategically, and checking state rules—can save you even more.

Tax avoidance is legal and smart. Tax evasion is not. Always pay what you owe—but not a penny more.

🔍 Related Articles

- Seniors’ Income Tax Strategies for 2026

- Retiring in Mississippi: A Hidden Gem for Tax Savings

- How to Avoid Paying Taxes on Your IRA Withdrawals

Disclaimer:

This article is for educational purposes only and not financial or tax advice. Consult the IRS website or a qualified CPA for your specific situation.

Senior Income Tax 2026 — FAQ (Tax Year 2025)

1) Who can use Form 1040-SR in 2026?

Taxpayers age 65 or older may file using the simplified Form 1040-SR; it uses the same schedules as Form 1040 but features larger print and a built-in standard-deduction table. :contentReference[oaicite:0]{index=0}

2) What are the key filing deadlines for 2025 income (filed in 2026)?

The federal filing deadline is April 15, 2026. If you request an extension with Form 4868 by that date, you’ll have until October 15, 2026 to file (an extension gives more time to file, not to pay). :contentReference[oaicite:1]{index=1}

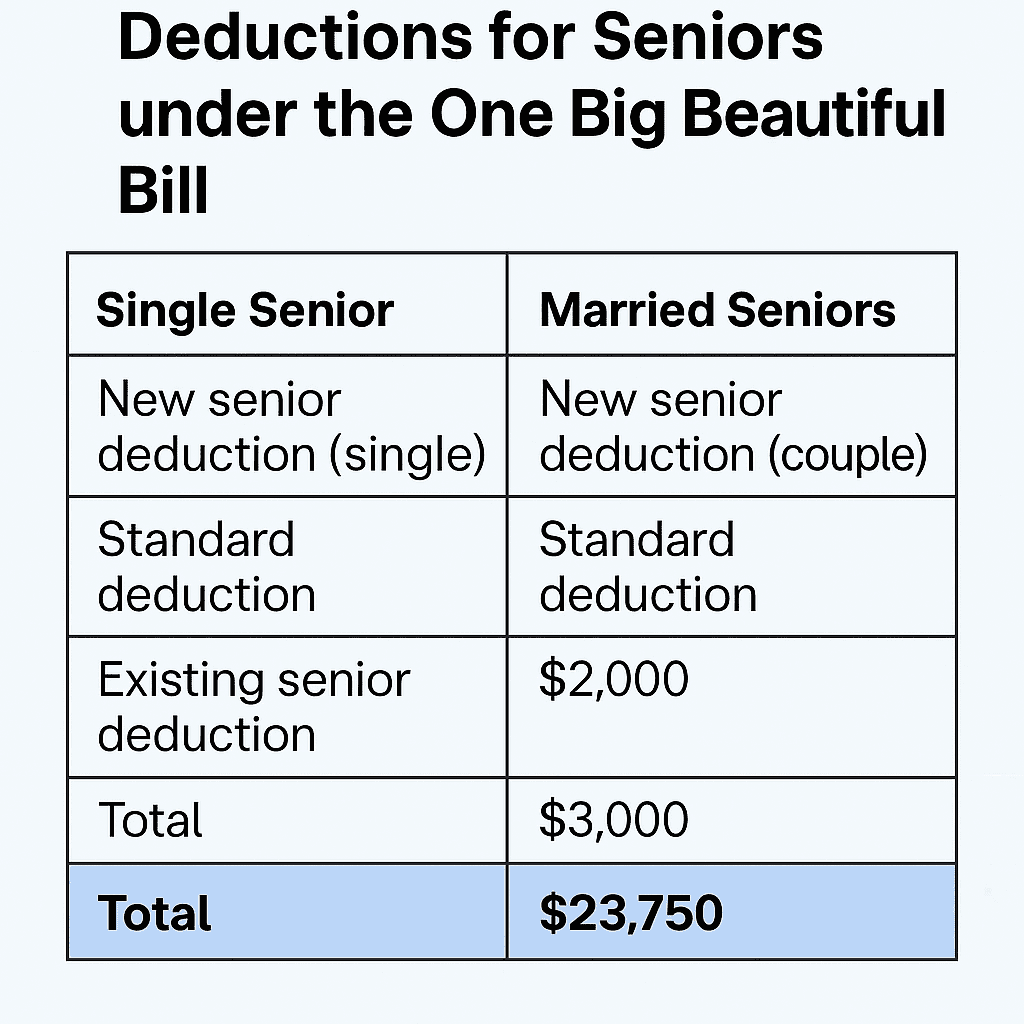

3) How much did the standard deduction go up in 2026 due to the “Big Beautiful Bill”?

Under the One Big Beautiful Bill (OBBB) and 2026 inflation adjustments, the basic standard deduction rose approximately to $16,100 (Single), $32,200 (Married Filing Jointly), and $24,150 (Head of Household). That’s an increase of about $350, $700, and $525, respectively, over 2025 OBBB amounts. :contentReference[oaicite:2]{index=2}

4) Is there a new extra deduction for seniors?

Yes. Beginning with tax year 2025 and currently running through 2028, OBBB created a new $6,000 deduction per qualifying senior (65+), on top of the regular standard deduction and the existing “age 65+ / blindness” add-on; phase-outs may apply at higher incomes. :contentReference[oaicite:3]{index=3}

5) Are Social Security benefits taxable for seniors?

Possibly. Depending on “combined income,” up to 50% or 85% of benefits can be taxable; thresholds commonly referenced are $25,000 (single) / $32,000 (married filing jointly) for partial taxation and $34,000 / $44,000 for up to 85%. See IRS Pub. 915 for details. :contentReference[oaicite:4]{index=4}

6) Where can I find the worksheet to calculate my taxable Social Security?

Use the worksheets in IRS Publication 915 to determine how much (if any) of your Social Security benefits are taxable. :contentReference[oaicite:5]{index=5}

7) What’s the difference between Form 1040 and 1040-SR?

Substantively they’re the same return and use the same schedules; 1040-SR is an easier-to-read version intended for seniors (age 65+), with a standard-deduction box that highlights senior add-ons. :contentReference[oaicite:6]{index=6}

8) How do I check the status of my 2025 refund filed in 2026?

Use the IRS Where’s My Refund? tool or the IRS2Go app. You’ll need your SSN/ITIN, filing status, and exact refund amount. :contentReference[oaicite:7]{index=7}

9) If my only income is Social Security, do I have to file?

Many seniors whose only income is Social Security do not have to file, but requirements depend on total income, filing status, and other factors. Check IRS Pub. 554 and Pub. 915 for current rules before deciding. :contentReference[oaicite:8]{index=8}

10) How do I get more time to file without penalties for late filing?

Submit Form 4868 by April 15, 2026 to receive an automatic extension to October 15, 2026. Remember, the extension is time to file; any taxes owed are still due April 15 to avoid interest and penalties. :contentReference[oaicite:9]{index=9}

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.