Last updated on September 20th, 2025 at 07:10 pm

Every year, retirees anticipate the Social Security Cost of Living Adjustment (COLA). Announced in the fall and applied on January 1, the COLA is intended to help beneficiaries keep pace with inflation. At first glance, it feels like good news — more money in your monthly check. But the reality is more complicated. This is where the issue of Social Security vs Medicare comes in. Medicare premiums, especially Part B, are deducted from Social Security benefits and often rise even faster than the COLA. For many retirees, the “raise” evaporates before it ever arrives.

Why Your Raise Doesn’t Feel Like a Raise

- COLA is not a bonus — it’s inflation protection. It’s meant to maintain, not increase, buying power.

- Medicare Part B premiums rise most years. Because they’re deducted first, they reduce the COLA benefit immediately.

- Lower-benefit retirees are hit hardest. Flat Medicare premiums consume a higher percentage of smaller Social Security checks.

👉 To view your personal benefit estimates, visit the Social Security Administration my Social Security portal.

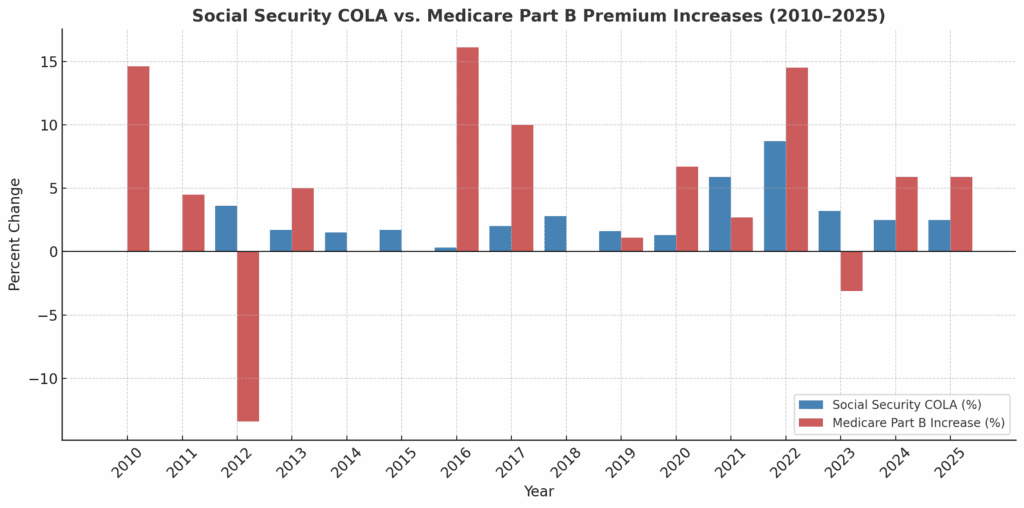

| Year | Social Security COLA (Cost-of-Living Adjustment) | Medicare Part B Premium* | % Change in Premium from Previous Year |

|---|---|---|---|

| 2010 | 0.0% | $110.50 | ~ +14.6% from 2009 |

| 2011 | 0.0% | $115.40 | ~ +4.5% from 2010 |

| 2012 | 3.6% | $99.90 | ~ −13.4% (premium dropped from 2011) |

| 2013 | 1.7% | $104.90 | ~ +5.0% from 2012 |

| 2014 | 1.5% | $104.90 | 0% change (same as previous year) |

| 2015 | 1.7% | $104.90 | 0% change |

| 2016 | 0.3% | $121.80 | ~ +16.1% from 2015 |

| 2017 | 2.0% | $134.00 | ~ +10.0% from 2016 |

| 2018 | 2.8% | $134.00 | 0% change from 2017 |

| 2019 | 1.6% | $135.50 | ~ +1.1% from 2018 |

| 2020 | 1.3% | $144.60 | ~ +6.7% from 2019 |

| 2021 | 5.9% | $148.50 | ~ +2.7% from 2020 |

| 2022 | 8.7% | $170.10 | ~ +14.5% from 2021 |

| 2023 | 3.2% | $164.90 | ~ −3.1% from 2022 (premium dropped) |

| 2024 | 2.5% | $174.70 | ~ +5.9% from 2023 |

| 2025 | 2.5% | $185.00 | ~ +5.9% from 2024 |

Historical Perspective: 2010–2025

The pattern is clear when you look at the numbers:

- COLAs are modest and inconsistent. Some years (2010, 2011) saw no increase. Other years offered 1–2%. Only in rare cases, such as 2022, did the COLA spike significantly.

- Medicare premiums nearly always rise. Exceptions (2012 and 2023) are rare. The long-term trend is upward.

- Medicare increases frequently outpace COLA.

- 2016: COLA was just 0.3%, Medicare Part B premiums surged 16%.

- 2022: COLA was 8.7%, Medicare premiums jumped 14.5%.

Chart: Social Security COLA vs. Medicare Part B premium increases, 2010–2025

2026 Forecast

Projections show the imbalance continuing:

- Social Security COLA: ~2.7% (SSA COLA page)

- Medicare Part B Premium: Projected to rise from $185 to about $206.50 — a jump of 11.6% (CMS Fact Sheet)

- Not retired yet: Learn how to maximize your future benefits, read this

This means Medicare could consume nearly 40% of the COLA increase, before taxes or other deductions are factored in.

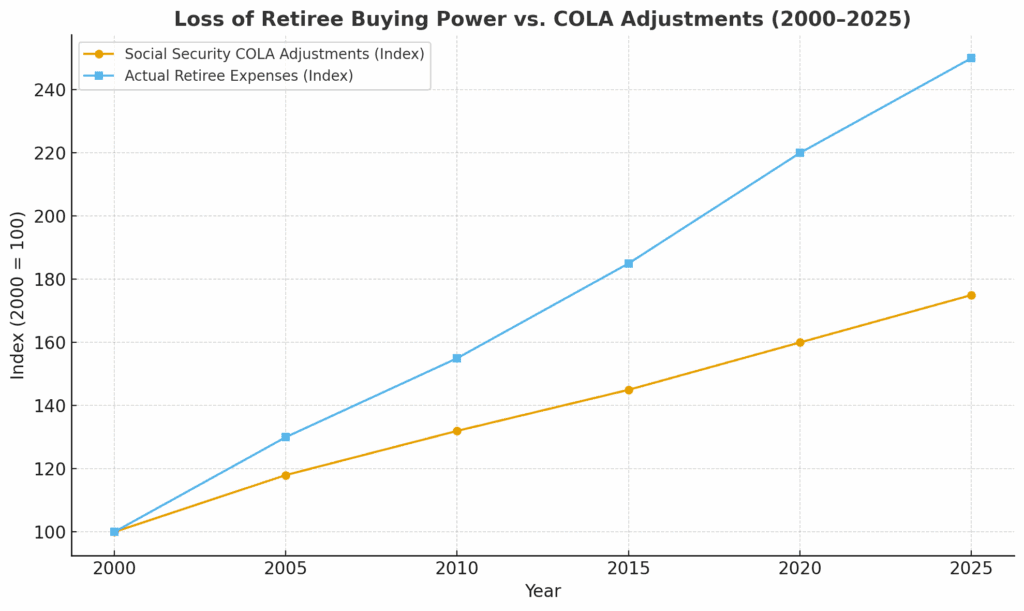

Social Security Benefits and Inflation

Statistics show that Social Security benefits have not kept up with real inflation, even with COLA adjustments.

The COLA formula is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While useful, it doesn’t reflect the spending habits of retirees, who face higher costs for healthcare, housing, and food — all categories that rise faster than the general economy.

- A retiree who started benefits 20 years ago has lost significant purchasing power.

- Healthcare costs often rise at double the rate of general inflation.

- Studies by the Senior Citizens League show retirees have lost over 30% of buying power since 2000.

The Complete Analysis

The long-term data shows:

- COLA increases are modest and inconsistent. While they protect against inflation, they rarely provide meaningful extra income.

- Medicare premiums almost always go up. Even in years with no COLA, retirees often face higher healthcare costs.

- Medicare increases outpace COLA more often than not. In percentage terms, Medicare hikes are frequently larger, reducing or canceling out COLA gains.

- Flat or declining Medicare premiums are rare exceptions. The downward adjustments in 2012 and 2023 offered temporary relief but didn’t change the upward trend.

- Net effect: Retirees often feel poorer, not richer, after annual adjustments — especially lower-income beneficiaries.

The Bottom Line

While Social Security adjustments grab headlines, the reality is that Medicare premiums quietly eat into those increases. For many retirees, the much-anticipated COLA doesn’t feel like a raise at all.

What retirees should do:

- Don’t budget on the COLA announcement alone. Wait until Medicare premiums are finalized to see the real net increase.

- Plan conservatively. Social Security is a safety net, not a retirement plan.

- Diversify income sources. Relying solely on Social Security will not protect you against long-term healthcare inflation.

- Want to know when its best to apply for Social Security Benefits, read this

For personalized details:

Social Security COLA and Benefits

Frequently Asked Questions

1. When is the Social Security COLA announced?

Usually in October, with changes taking effect on January 1. See SSA’s COLA page.

2. Are Social Security benefits keeping up with inflation?

No. While COLA provides adjustments, healthcare and housing costs rise faster, eroding buying power.

3. How does Medicare affect my Social Security check?

Part B premiums are deducted directly, reducing your net payment.

4. What is the Medicare Part B premium?

The monthly charge for outpatient coverage. Check current rates.

5. Does everyone pay the same Medicare premium?

Most pay the standard rate, but higher-income retirees may pay more under IRMAA rules.

6. Are Social Security benefits taxable?

Yes. Up to 85% of benefits may be taxable depending on your income.

7. What happens if there is no COLA?

Your check amount stays flat, but Medicare may still increase. The “hold harmless” rule may help.

8. What is the “hold harmless” rule?

It prevents most recipients from having their checks reduced if Medicare premiums rise more than COLA.

9. How can I see my exact benefit?

Log into your my Social Security account for details.

10. Where can I get official Medicare information?

Visit Medicare.gov for up-to-date details.

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.