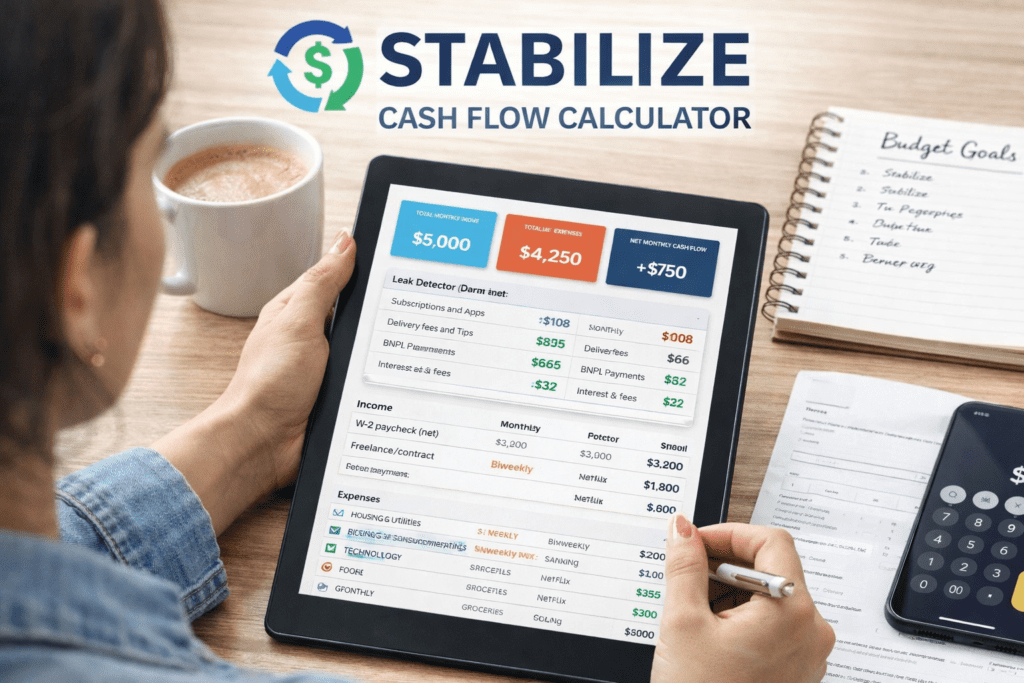

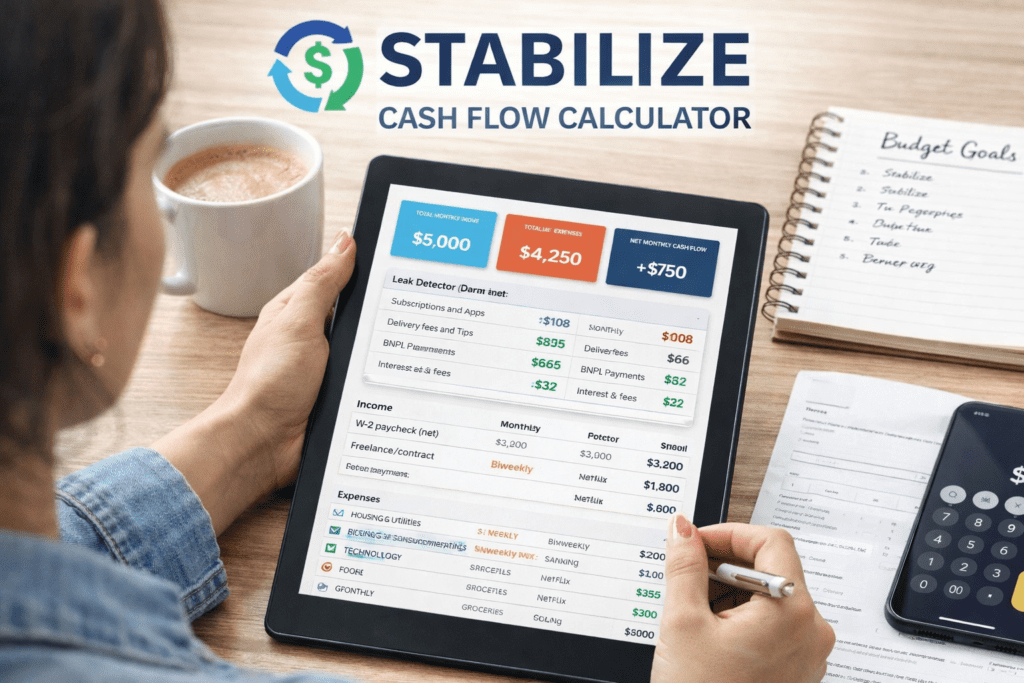

Return to the landing page that includes this calculator: Stabilize Cash Flow.

Air Force veteran, real estate broker, investor, and founder of RetireCoast. I write about retirement planning, relocation, real estate, and launching second-act businesses.

The RetireCoast Podcast is listened to in 64 countries and more than 1,200 cities — and growing.

Try our most popular retirement & real estate calculators

Local experts helping retirees, investors, and relocating families.

We provide cost-of-living breakdowns, local insights, and access to new listings.

Planning a trip to the Mississippi Gulf Coast? Enjoy clean, comfortable homes just steps from the sand with Christie’s Gulf Beach Rentals. Ideal for families, couples, and long-term visitors.

View Available Rentals

Browse the complete archive of RetireCoast articles, guides, and resources.

RetireCoast is independently operated for readers who love retirement, coastal living, and real estate.

Explore our growing collection of articles about life in 1776, the people of the Revolution, weapons, camp followers, women of the war, and how America changed over 250 years. Many of our 250th Anniversary articles are among the most-read and highly rated history features on RetireCoast.

Visit the 250th Anniversary Hub →Not sure how to spend 2–5 days on the Mississippi Gulf Coast? Our AI itinerary builder plans each day for you.

Plan My Visit