Introduction: Why Stabilizing Cash Flow Comes First

Before you can invest, save aggressively, buy a home, or even feel confident about your finances, you must stabilize cash flow. That means getting clear on a simple but often overlooked question: what actually comes in each month, and where does it all go?

Many millennials feel stuck financially not because they earn too little, but because their cash flow is unstable. Income may fluctuate, expenses creep up quietly, and subscriptions or high-interest payments drain money in the background. When cash flow isn’t stable, every unexpected expense feels like a crisis—even if your income looks decent on paper.

- Introduction: Why Stabilizing Cash Flow Comes First

- How to breakdown and stabilize cash flow

- Section 1: Get Clear on What Comes In vs. What Goes Out

- Section 2: Stop the Leaks First

- Section 3: Savings Is an Expense—Not What’s Left Over

- Section 4: Use Monthly Clarity to Stabilize Cash Flow Long Term

- Section 5: Revisit, Adjust, and Build Momentum

- Section 6: Learn From Proven Cash Flow Principles

To stabilize cash flow, you don’t need complex spreadsheets or extreme lifestyle changes. You need visibility. Once you clearly see your income, fixed bills, variable spending, and financial “leaks,” you can take back control quickly. This is the foundation of financial stability—and it’s the step too many people skip.

How to breakdown and stabilize cash flow

In this guide, we’ll break down how to stabilize cash flow in a practical, realistic way. You’ll learn how to track what comes in versus what goes out, identify spending that quietly sabotages your progress, and use simple tools to create breathing room in your monthly finances. Everything else—saving, investing, reducing stress—gets easier once your cash flow is under control.

Section 1: Get Clear on What Comes In vs. What Goes Out

The first step to stabilize cash flow is visibility. You cannot fix what you cannot clearly see. Many millennials feel broke without actually knowing why, because income and expenses are scattered across multiple accounts, apps, and payment methods.

Start by listing everything that comes in each month. This includes:

- Paychecks (after taxes)

- Side hustle or gig income

- Freelance or contract work

- Any regular transfers or support

If your income varies month to month, use a conservative average based on the last 3–6 months. When your income fluctuates, stabilizing cash flow means planning for the lower months, not the best ones.

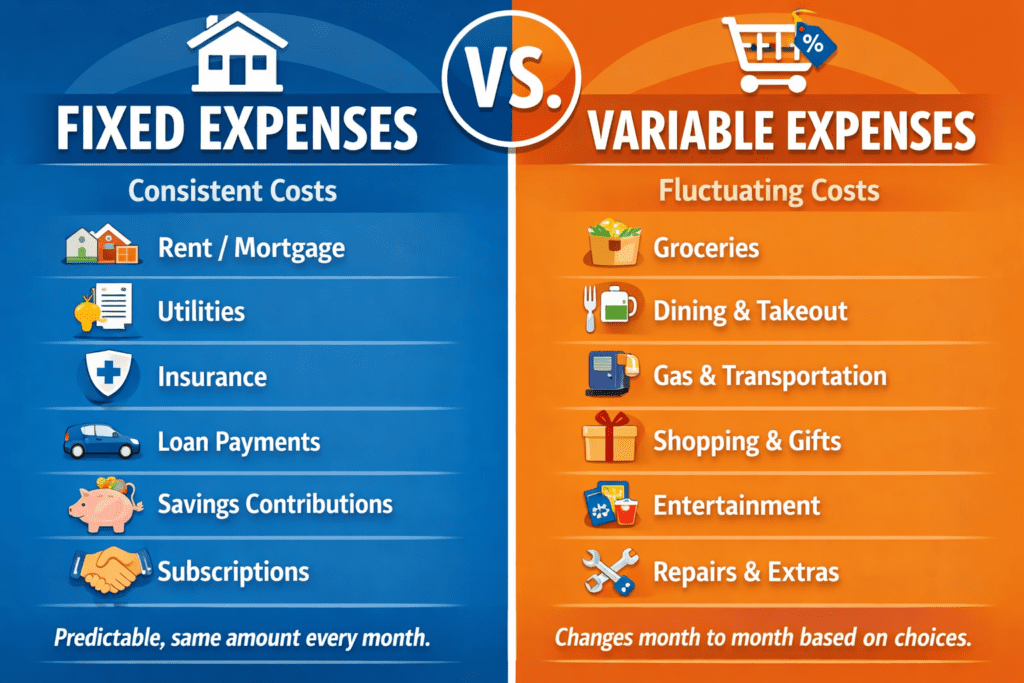

Next, list everything that goes out. Break expenses into two categories:

Fixed Expenses (Predictable)

These are bills that rarely change:

- Rent or mortgage

- Utilities

- Insurance

- Minimum debt payments

- Phone and internet

Variable Expenses (Flexible but Dangerous)

These change month to month and are often underestimated:

- Groceries

- Dining out

- Subscriptions

- Transportation

- Entertainment

- Impulse spending

This is where most cash flow problems hide. Small, frequent expenses feel harmless, but together they quietly destabilize cash flow and create stress.

Once you see both sides—income versus expenses—you may notice something important: the issue is often not income alone. It’s the gap between what you earn and what leaks out unnoticed.

At this stage, do not judge or panic. The goal is awareness, not perfection. Stabilizing cash flow starts with honesty, not restriction. You are building a clear picture so you can make smart, intentional adjustments in the next steps.

If you want to go deeper or keep things organized month to month, these tools work well together:

- Budget Planning Calculator – Track income, expenses, savings rate, and debt in one place. Open calculator

- Bill Tracker – Keep recurring bills, due dates, and payment habits visible so nothing slips through. Open bill tracker

In the next section, we’ll focus on how to stop the leaks first, so your money starts working for you instead of disappearing quietly each month.

Section 2: Stop the Leaks First

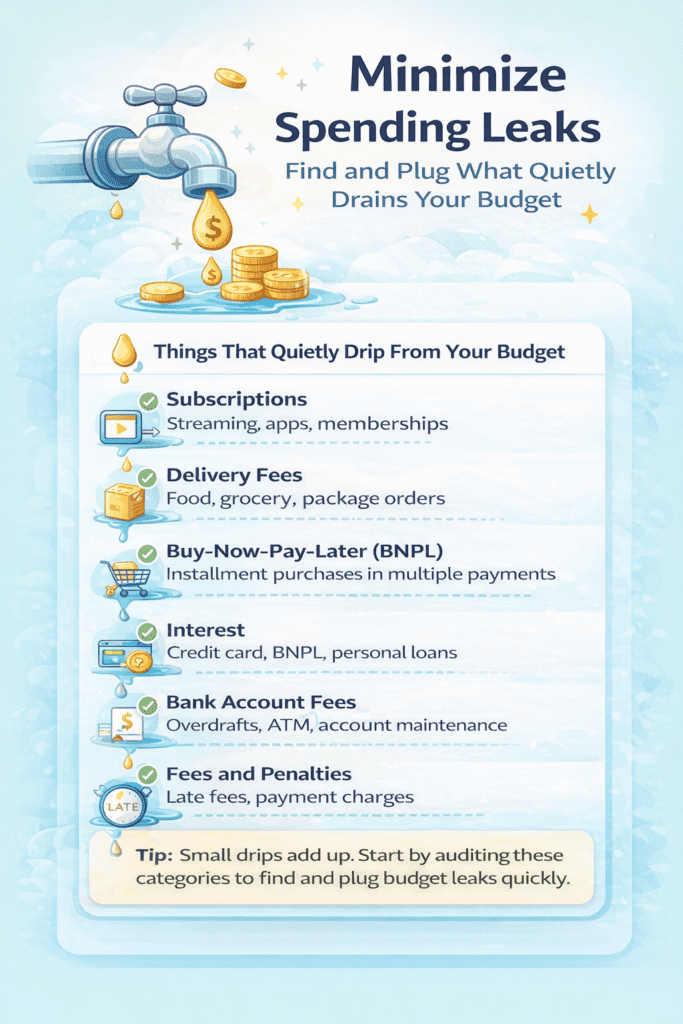

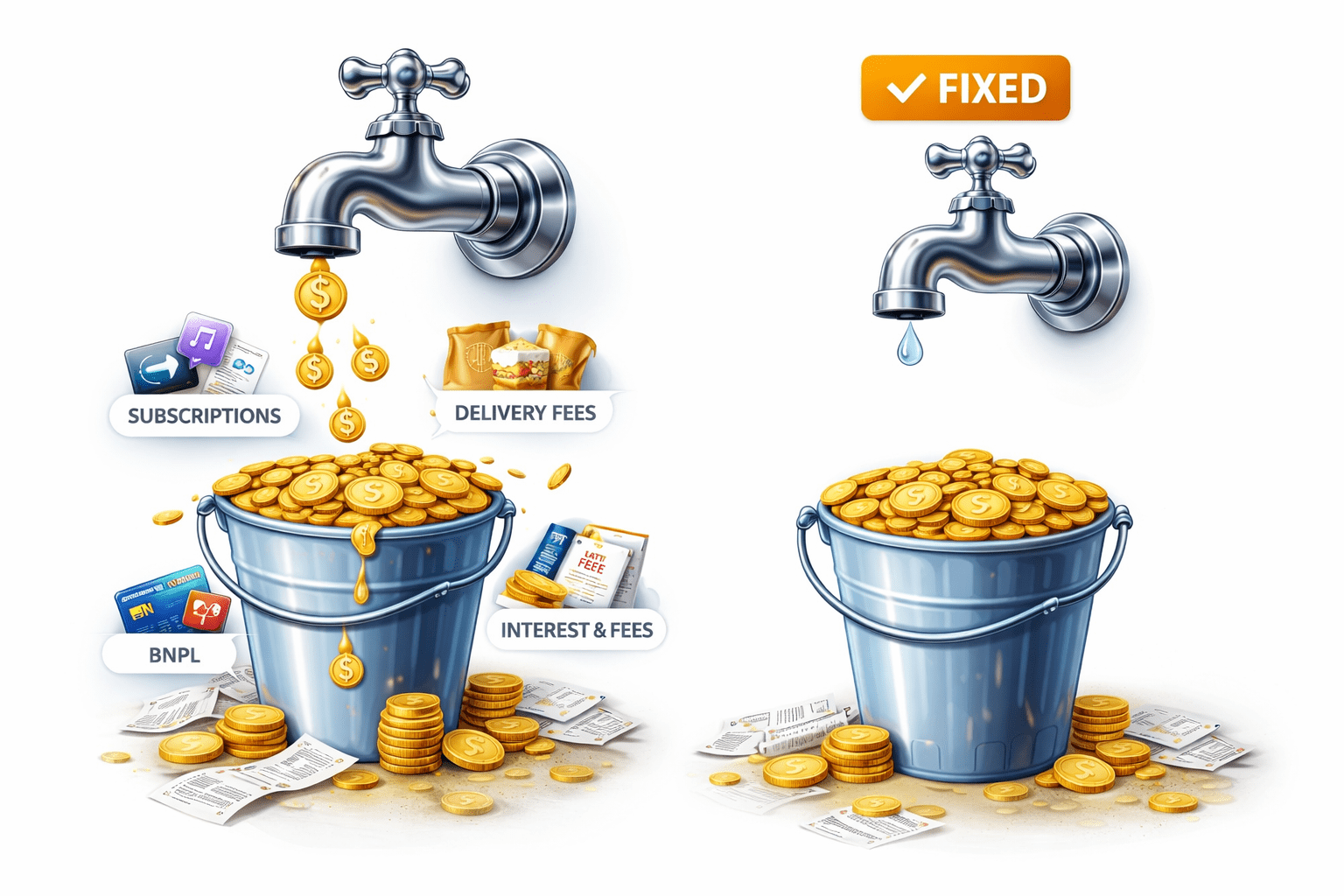

When cash flow feels tight, the problem is often not one big expense—it’s a collection of small, recurring leaks that quietly drain income month after month. These are the costs that don’t always feel significant on their own, but add up quickly when combined.

Common cash-flow leaks include:

- Subscriptions and app memberships you no longer use

- Food delivery fees, service charges, and tips

- Buy-Now-Pay-Later (BNPL) payments spread across multiple purchases

- Interest charges, late fees, and bank fees

- Convenience spending that bypasses your normal budget awareness

These expenses tend to sit in the variable category, which is why they’re the fastest place to regain control. Unlike rent or insurance, they can often be reduced or paused without renegotiating contracts or making major lifestyle changes.

Free Calculator will surface leaks

The calculator below is designed to surface these leaks by converting everything into a monthly equivalent. A $12 subscription doesn’t feel like much—until you see ten of them totaling over $100 a month. Delivery fees can quietly rival a utility bill. BNPL payments can function like invisible debt if they’re not tracked together.

- Cancel or pause subscriptions you don’t actively use

- Review food delivery fees, service charges, and tips

- List all Buy-Now-Pay-Later (BNPL) payments in one place

- Identify interest charges, late fees, and bank fees

- Decide which conveniences are worth keeping—and which aren’t

The goal here isn’t to eliminate all convenience or enjoyment. It’s to make leaks visible so you can decide which ones are worth keeping and which ones are quietly working against your cash flow.

Once leaks are identified and addressed, even modest income can feel more stable. That stability creates room for savings, debt reduction, and better long-term decisions—without relying on unrealistic cuts or extreme budgeting.

Section 3: Savings Is an Expense—Not What’s Left Over

One of the fastest ways to stabilize cash flow is to treat savings like a real monthly bill—not something you “try to do” if money is left over. Savings comes out of income the same way rent, utilities, or insurance do, so it belongs in the expense list.

In the calculator, you’ll see a category called “Savings (as an expense)” with line items like Emergency fund, 401(k) contribution, Roth IRA contribution, and Sinking funds. That category is intentional. When savings is visible as a monthly number, your budget becomes more honest and your cash flow becomes more predictable.

Savings must be part of the budget

This is similar to a mortgage payment: even though part of the payment builds equity, the full payment still leaves your account each month. Savings works the same way. It improves your future position, but it still reduces available cash today—so it should be tracked right alongside your other expenses.

If cash flow feels tight, you don’t need a perfect savings number to start. Add a small amount under Savings (as an expense)—even $25–$100—and let the calculator show the impact. Over time, as you stop spending leaks and reduce fees, you can increase savings gradually. That’s a sustainable way to stabilize cash flow without making your budget feel impossible.

A simple rule that helps: if you’re saving monthly, you’re building stability monthly. And that stability makes everything else easier—debt payoff, major purchases, and less financial stress.

Section 4: Use Monthly Clarity to Stabilize Cash Flow Long Term

Once you’ve identified fixed expenses, reduced variable leaks, and treated savings as a real expense, the next step is consistency. The goal isn’t a perfect month—it’s creating a system that helps stabilize cash flow over time, even when income or expenses change.

Stabilizing cash flow means your monthly obligations are predictable, your savings are intentional, and surprises don’t immediately create stress. That stability comes from seeing everything in one place and revisiting it regularly—not from extreme cuts or rigid rules.

The calculator above helps stabilize cash flow by converting irregular costs into monthly numbers. Annual insurance premiums, weekly spending, and one-time purchases stop being surprises once they’re normalized. When everything is expressed monthly, decisions become clearer and tradeoffs become easier to manage.

As cash flow stabilizes, priorities tend to shift naturally:

- Emergency savings becomes easier to maintain

- Debt payments feel more manageable

- Discretionary spending becomes intentional instead of reactive

- Financial decisions feel less urgent and more deliberate

This is also where automation helps. Automatic savings transfers, scheduled bill payments, and periodic check-ins with your numbers reduce the mental load of managing money. The system does more of the work for you.

Stabilizing cash flow = Control

Stabilizing cash flow isn’t about restriction—it’s about control. When you know what’s coming in, what’s going out, and what’s being set aside, you gain flexibility. That flexibility is what allows progress, even in months that don’t go exactly as planned.

Section 5: Revisit, Adjust, and Build Momentum

Stabilizing cash flow isn’t a one-time exercise—it’s an ongoing process. Income changes, expenses shift, and life rarely stays static. The goal isn’t to lock in a perfect budget, but to build a habit of checking in and making small adjustments before problems compound.

Revisiting your numbers every few months—or after major changes like a new job, move, raise, or new debt—helps you stabilize cash flow before stress sets in. What once felt manageable can quietly drift out of balance if it’s not reviewed periodically.

Expenses should be clear

This is where the system you’ve built starts working for you. When fixed expenses are clear, variable spending is visible, savings is treated as an expense, and leaks are addressed early, decisions become easier. You’re no longer reacting—you’re choosing.

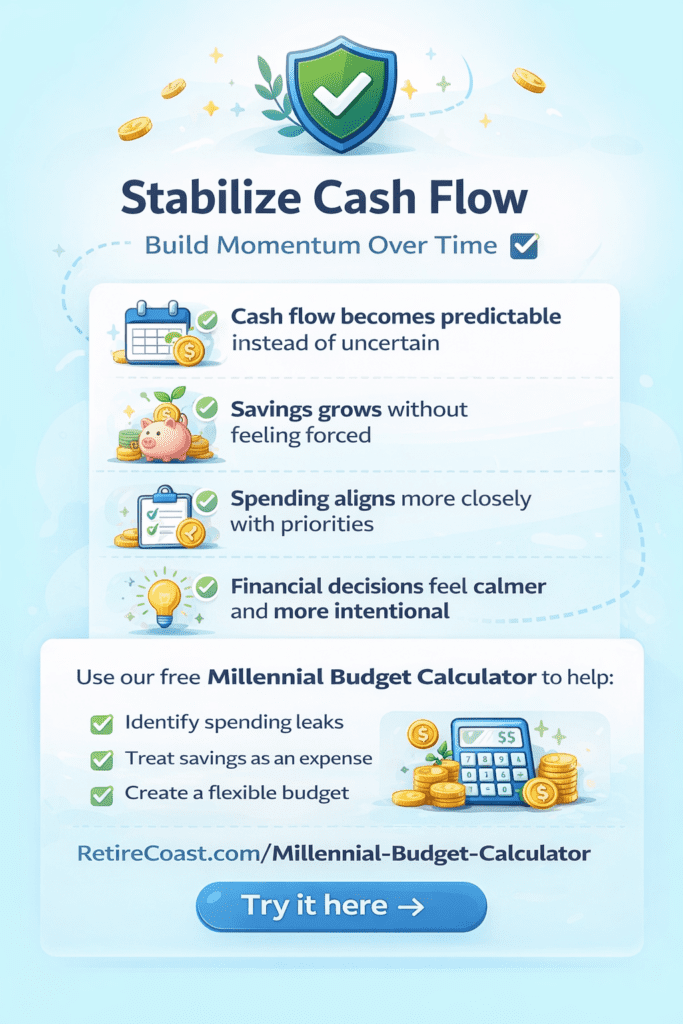

Over time, this creates momentum:

- Cash flow becomes predictable instead of uncertain

- Savings grows without feeling forced

- Spending aligns more closely with priorities

- Financial decisions feel calmer and more intentional

Most importantly, stabilizing cash flow gives you flexibility. Flexibility to handle surprises, to take advantage of opportunities, and to make long-term plans without constant financial pressure.

The calculator and companion articles in the Millennial Hub are designed to support this process. Used together, they help you build financial literacy step by step—turning clarity into confidence and consistency into progress.

Stabilize cash flow first. Everything else builds on that foundation.

Section 6: Learn From Proven Cash Flow Principles

While tools and calculators help organize your numbers, improving cash flow also benefits from understanding broader financial principles. Many of the challenges Millennials face today—irregular income, rising costs, and competing priorities—are not new. What is new is the number of small decisions that quietly impact cash flow every month.

A helpful external resource that reinforces many of the ideas in this series is Investopedia’s guide on

practical ways to improve cash flow.

It outlines common strategies such as reducing recurring expenses, prioritizing high-interest debt, and planning for irregular costs—concepts that align closely with how this calculator is designed to work.

Improving cash flow is not a single tactic

What’s important to note is that improving cash flow rarely depends on a single tactic. It’s usually the result of:

- Making expenses visible

- Reducing friction and unnecessary fees

- Planning for irregular and annual costs in advance

- Treating savings as part of the system, not an afterthought

External perspectives like this are useful because they reinforce that cash flow stability is a process, not a personality trait or income level. The same principles apply whether you’re just starting out, managing variable income, or adjusting to new financial responsibilities.

Use outside resources to deepen your understanding—but rely on your own numbers to guide decisions. When education and visibility work together, cash flow becomes easier to manage and far less stressful.

- Consumer Financial Protection Bureau (CFPB) — Plain-language guidance on budgeting, debt, and everyday money decisions.

- FDIC Money Smart Program — Free financial education covering cash flow, saving, and credit basics.

- USA.gov – Managing Your Money — Government-backed overviews of budgeting, saving, and financial planning.

- MyMoney.gov — A federal financial literacy initiative with practical explanations and tools.

- Federal Reserve – Consumer Education — How habits, behavior, and decision-making affect financial outcomes.

- IRS Taxpayer Education — Guidance on withholding, estimated taxes, and long-term tax awareness.

How do I stabilize cash flow if my income changes month to month?

What’s the difference between fixed expenses and variable expenses?

Why does the calculator treat savings as an expense?

What are “spending leaks” and why do they matter for cash flow?

How do I find which subscriptions are actually hurting my budget?

Are food delivery and convenience spending really that impactful?

How should I use Buy-Now-Pay-Later (BNPL) if I want stable cash flow?

What if my expenses are higher than my income right now?

How often should I rerun the stabilize cash flow calculator?

Where can I find more tools like this for budgeting and financial literacy?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.