Last updated on January 14th, 2026 at 02:56 pm

Tax Rates and Tax Breaks

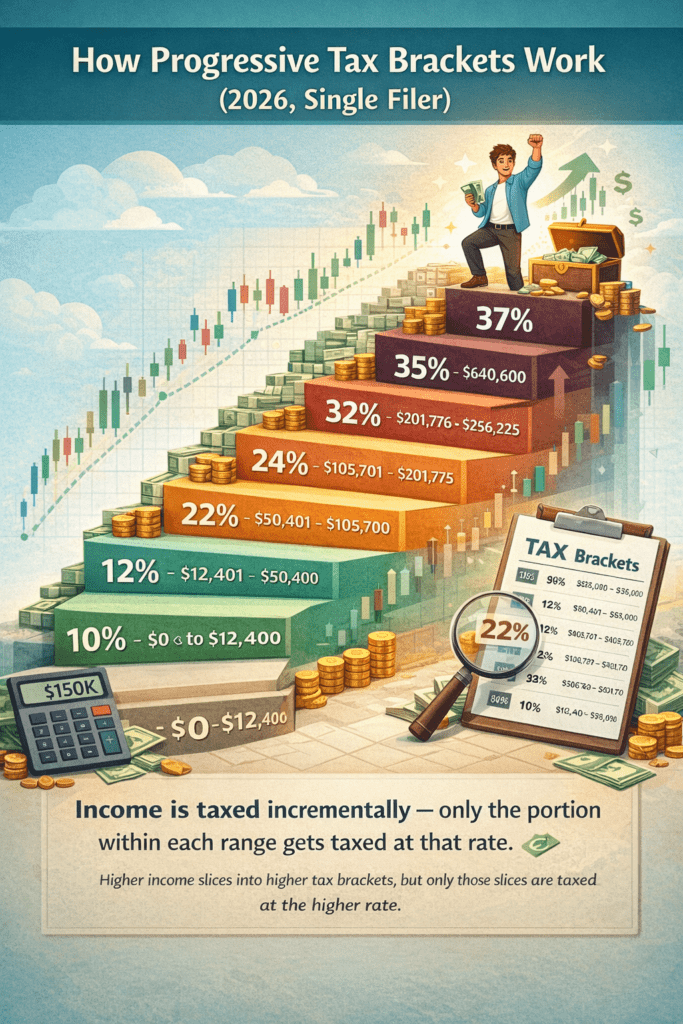

When people talk about taxes, the conversation often centers on tax brackets. Tax rates do matter, but they’re only part of the picture. What ultimately shapes how much tax is paid is the interaction between tax rates and tax breaks—and that interaction is a major reason the taxes long-term impact can feel different from one person to the next.

The U.S. income tax system is generally progressive, meaning higher levels of income are taxed at higher marginal rates. At the same time, not all income is treated the same, and not all income is taxed in the same way. This is where tax breaks—such as deductions, credits, and exclusions—come into play. These provisions can reduce taxable income or reduce taxes owed, and they can significantly change outcomes across households.

After applying the standard deduction or itemized deductions, however, the percentage of your total income that actually goes to taxes is often lower. This is known as your effective tax rate. In this example, even though the marginal rate is 22%, the effective tax rate might be closer to 12%.

This difference helps explain why tax outcomes can feel less severe than the headline tax bracket suggests—and why deductions and credits play an important role in long-term tax outcomes.

This is also why two people with very different incomes can sometimes end up with similar effective tax rates, or why someone earning more might pay a smaller percentage of their income in taxes than someone earning less. The difference often comes down to which tax breaks apply, when income is received, and how financial decisions align with the tax rules in place.

Rather than thinking of taxes as a single number or bracket, it can be more helpful to think in terms of after-tax outcomes. Over time, understanding how tax rates and tax breaks interact can bring clarity to why planning—not guessing—often plays a meaningful role in long-term financial stability.

- Tax Rates and Tax Breaks

- Section 2: Big Decisions Create Long-Term Tax Ripples

- Section 3: Income Changes Create “Spike Years” and “Dip Years”

- Section 4: Deductions and Credits — Why the Difference Matters

- Section 5: Why “Tax Loopholes” Are Often a Misunderstanding

- Section 6: Retirement Accounts and Tax Timing

- Section 7: Taxes Don’t End — They Change Over Time

- Final Section: Turning Awareness Into Clarity

Section 2: Big Decisions Create Long-Term Tax Ripples

Why Timing Often Matters More Than the Decision Itself

Many financial decisions feel isolated in the moment—changing jobs, buying a home, starting a side income, or selling an investment. In reality, these choices often interact with taxes in ways that unfold over time. This is where the taxes long-term impact becomes easier to see, especially when income or expenses change quickly.

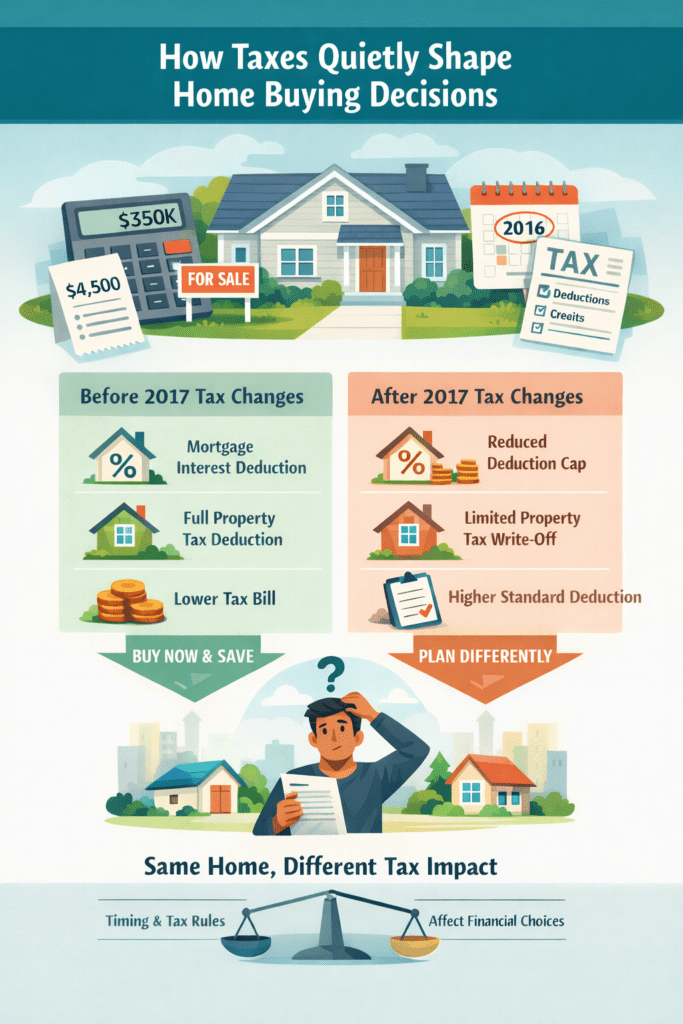

One helpful way to think about taxes is through timing. When income is earned, when deductions are taken, and when assets are bought or sold can all influence how much tax is ultimately paid. Two people making the same decision may experience very different outcomes simply because they made that decision in different years or under different circumstances.

Housing is a good example. Homeownership decisions are often discussed in terms of affordability, interest rates, or monthly payments, but taxes quietly play a role as well. Property taxes, potential deductions, and future capital gains rules can all affect long-term outcomes.

This is one reason housing affordability is often misunderstood. If you’re interested in how these factors interact beyond just purchase price, our article Exploding the Myths of Housing Affordability explores this topic in more depth:

👉 https://retirecoast.com/housing-affordability-myths/

The same timing principle applies to other decisions, such as selling investments during a high-income year, receiving a bonus while also earning side income, or making retirement contributions during a year when income temporarily spikes or dips. None of these choices are inherently good or bad—but their tax impact can change depending on when they occur.

Rather than trying to predict the “perfect” move, understanding how timing influences taxes can make it easier to anticipate outcomes and avoid surprises later.

Section 3: Income Changes Create “Spike Years” and “Dip Years”

Why Some Tax Years Feel Heavier Than Others

Income doesn’t always move in a straight line. For many Millennials, earnings fluctuate as careers evolve, side income appears, or life events temporarily change how much money comes in. These shifts often create what can be thought of as “spike years” and “dip years,” and they play a meaningful role in the taxes long-term impact.

A spike year might include a promotion, a bonus, stock compensation, freelance income, or the sale of an investment—all happening within the same tax year. A dip year might look very different: a job change, unpaid leave, returning to school, relocating, or reducing hours for personal or family reasons. Neither situation is unusual, and neither is inherently good or bad. What matters is how taxes respond to those changes.

Because income taxes are progressive, higher-income years can push more income into higher marginal brackets, while lower-income years may create opportunities for different planning choices. This is often why two years with similar life decisions can produce very different tax results. The tax system reacts to when income shows up, not just how much is earned over a lifetime.

Understanding this pattern can make taxes feel less random. Instead of seeing a higher tax bill as a surprise or a mistake, it becomes easier to recognize it as a reflection of timing. Over the long run, recognizing spike and dip years helps frame taxes as part of a broader financial rhythm rather than a single annual event.

Section 4: Deductions and Credits — Why the Difference Matters

How Tax Breaks Shape Real Outcomes

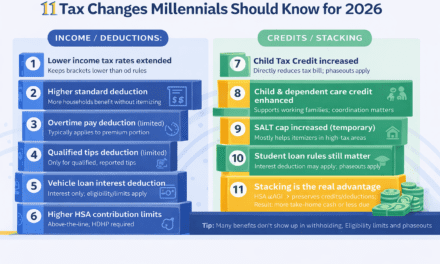

When people hear the phrase “tax breaks,” it often sounds vague or interchangeable. In practice, not all tax breaks work the same way, and understanding the difference between deductions and credits can make the taxes long-term impactmuch clearer.

Tax deductions reduce the amount of income that is subject to tax. Common examples include the standard deduction, certain retirement contributions, and some itemized expenses. Deductions are helpful because they lower taxable income, but their value depends on your tax bracket. A deduction tends to be more valuable when income is higher and less impactful when income is lower.

Tax credits, on the other hand, reduce taxes owed directly, dollar for dollar. Credits don’t depend on tax brackets in the same way deductions do. This is why credits—such as education credits or child-related credits—can have a noticeable effect on how much tax is ultimately paid, even when income levels differ.

Because tax policy is not always permanent, a benefit that exists this year may be reduced or disappear in a future year. This is one reason tax planning focuses on flexibility rather than relying on any single rule or break. When tax laws change, goals and strategies may shift as well—and understanding that reality helps reduce surprises over time.

Another layer to keep in mind is that some deductions and credits phase out as income rises. This means a tax benefit that applies one year may partially or fully disappear in a higher-income year. These phaseouts are one reason taxes can feel unpredictable unless income changes are viewed in a broader context.

Rather than focusing on any single deduction or credit, it’s often more useful to understand how these tools interact over time. When income changes, family situations evolve, or filing status shifts, the mix of deductions and credits can change as well—quietly influencing long-term outcomes.

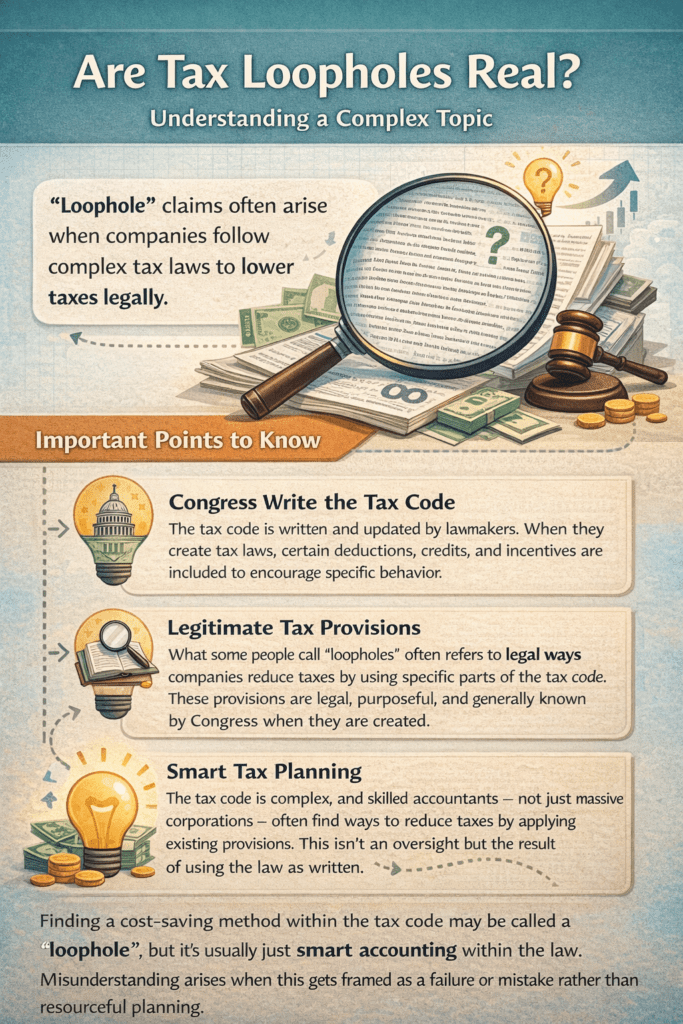

Section 5: Why “Tax Loopholes” Are Often a Misunderstanding

Complexity, Not Tricks, Drives Different Outcomes

When people see individuals or companies paying less in taxes than expected, the explanation is often reduced to the idea of “tax loopholes.” In practice, the tax code is less about hidden tricks and more about complexity, structure, and intent. This distinction matters when thinking about the taxes long-term impact.

The U.S. tax code is written by Congress and state legislatures, and most provisions are created deliberately to encourage or discourage certain behaviors—such as investing, hiring, saving for retirement, or purchasing assets. When an accountant or tax professional applies those rules as written and finds a way to reduce taxes legally, that outcome is sometimes labeled a loophole. In reality, it is usually the result of following the law as designed.

Tax code is large and detailed

Because the tax code is large and detailed, not everyone benefits from it in the same way. People and businesses with more complex financial situations often encounter more provisions that apply to them. That difference can create the impression that the system is uneven, when in many cases it is simply operating as intended under a set of detailed rules.

What are often called tax loopholes are typically legal provisions built into the tax code—illustrating how tax outcomes are shaped by complexity and policy design rather than hidden tricks.

This is also why tax planning is often less about finding something hidden and more about understanding what already exists. Provisions that may appear arbitrary from the outside are typically the result of negotiated policy decisions, economic incentives, or trade-offs made at the time the law was written. Over time, those provisions may change, expire, or be replaced—but while they exist, they are part of the legal framework.

For Millennials, the takeaway isn’t about defending or criticizing the system. It’s about recognizing that legal tax outcomes usually come from knowledge and structure, not shortcuts. Understanding this can make tax planning feel less mysterious and more grounded in how the system actually works.

Section 6: Retirement Accounts and Tax Timing

Paying Taxes Now vs. Paying Taxes Later

Retirement accounts are often discussed as savings tools, but they also play an important role in how and when taxes are paid. This timing element is a key part of the taxes long-term impact, especially as income changes over the course of a career.

Some retirement accounts allow contributions to reduce taxable income today, while others involve paying taxes upfront in exchange for tax-free withdrawals later. Neither approach is universally better. The difference comes down to timing, future income expectations, and how flexible someone wants their options to be down the road.

For many people, retirement years often come with lower taxable income, which can mean those deferred taxes are eventually paid at lower rates. While outcomes vary, this timing difference is one reason tax-advantaged accounts are often viewed as a powerful tool for building future wealth.

What makes this especially relevant for Millennials is that retirement planning often spans decades. Over that time, tax rates can change, income can rise or fall, and personal circumstances can shift. A decision that feels small early on can quietly influence how much control someone has over taxable income later in life.

Another factor to keep in mind is that retirement accounts don’t exist in isolation. Employer matching contributions, health savings accounts, and other tax-advantaged tools often interact with retirement planning in subtle ways. Together, they shape how income is taxed during working years and how withdrawals are taxed later.

Rather than viewing retirement accounts as a single choice, it can be helpful to see them as part of a broader timeline. The goal isn’t predicting the future perfectly, but understanding how today’s choices affect future flexibility.

Section 7: Taxes Don’t End — They Change Over Time

Why Long-Term Awareness Matters More Than a Single Year

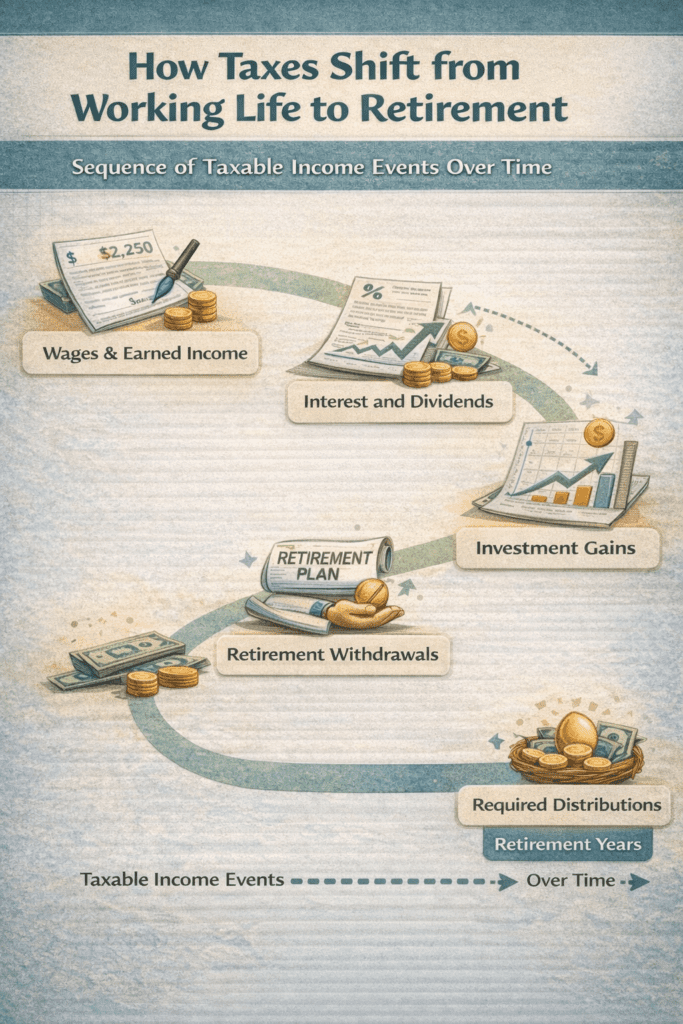

It’s easy to think of taxes as something tied only to working years, but taxes don’t disappear when income changes or when work slows down. Instead, they often change form. This shift is an important part of understanding the taxes long-term impact, especially when looking beyond the present moment.

During working years, taxes are often centered on wages and earned income. Later, they may be tied more closely to withdrawals from retirement accounts, investment income, or required distributions. The source of income changes, and with it, how taxes are calculated. This is one reason decisions made earlier—sometimes decades earlier—can continue to influence outcomes long after they’re made.

Another factor is that benefits and thresholds can interact in unexpected ways. Income levels can affect how much of certain benefits are taxed or whether additional costs apply. These interactions are rarely obvious year to year, but over time they can shape cash flow and flexibility in meaningful ways.

Rather than viewing taxes as a finish line that eventually disappears, it can be more helpful to see them as a system that evolves alongside income and life stages. Awareness of that evolution helps frame decisions as part of a longer timeline, not isolated moments.

1) Early in a career, which income source is most commonly taxed?

2) Which change often happens as income sources diversify over time?

3) True or False: Moving into a higher tax bracket means your entire income is taxed at the higher rate.

4) Which type of tax break reduces taxes owed dollar-for-dollar?

5) When full-time work slows down later in life, what often changes first?

6) Which statement best matches long-term tax reality?

7) Key concept check: What’s the main reason tax planning matters over decades?

Final Section: Turning Awareness Into Clarity

Why Tools and Resources Matter for Long-Term Tax Planning

Understanding how taxes work over time is helpful, but clarity often comes from seeing how those ideas play out with real numbers. This is where calculators and reference tools can add meaningful context to the taxes long-term impact, especially as income, benefits, and life circumstances change.

One example is our 401(k) Take-Home Pay Calculator:

👉 https://retirecoast.com/401k-take-home-pay-calculator/

This calculator helps illustrate how retirement contributions can affect take-home pay today while also influencing future tax outcomes. Seeing the difference between gross income and take-home income can make tax timing concepts—such as deferring taxes into the future—much easier to understand in practical terms.

Other calculators in our FREE Calculator Hub are designed with the same goal in mind: helping translate tax concepts into real-world scenarios. Whether it’s understanding how deductions, credits, or retirement contributions affect cash flow, these tools support informed decision-making without requiring deep tax expertise. They’re meant to encourage exploration and awareness, not provide tax advice.

In addition to tools like calculators, reliable reference sources can also be helpful. The IRS publishes guidance intended to support year-round awareness, not just filing season. Their Year-Round Tax Planning Pointers offer general insights into how life events and income changes can affect taxes over time:

👉 https://www.irs.gov/newsroom/year-round-tax-planning-pointers-for-taxpayers

For those who want to track their own tax activity—such as checking the status of a tax refund or accessing official IRS information—the IRS website provides direct access to those services:

👉 https://www.irs.gov

Taken together, tools and trusted references can help turn abstract tax concepts into something more tangible. The goal isn’t to predict every outcome, but to build enough awareness that taxes feel less reactive and more understandable over time.

Like any large system, taxation is not perfect. Waste, fraud, and abuse do exist and are frequently identified through audits, oversight, and public accountability. People may also disagree with how tax dollars are allocated. In a representative system, those disagreements are addressed through elections and civic participation.

Citizens can express concerns and perspectives through public forums, community meetings, written correspondence, and direct engagement with elected officials. Major tax legislation—such as changes enacted in 2017 and again in 2025—has had broad effects, including updated tax tables, higher standard deductions, new or revised forms, and provisions affecting seniors and working households alike.

Because tax policy evolves slowly, there is often time to stay informed and participate before changes take effect. Subscribing to official communications from elected representatives, following legislative updates, and paying attention to proposed changes can help avoid surprises later. Once tax laws are passed, options are usually limited to compliance rather than influence.

As discussed throughout this article and others on RetireCoast, one practical approach is to lean into the system as it exists—learning how it works, staying informed as it changes, and using that knowledge to make thoughtful, long-term decisions. Over time, understanding the system tends to be more productive than reacting to it.

1) What does “taxes long-term impact” mean in everyday life?

2) What’s the difference between marginal tax rate and effective tax rate?

3) Do higher tax brackets mean all income is taxed at the higher rate?

4) What’s the difference between a tax deduction and a tax credit?

5) Why can two people with different incomes pay similar tax percentages?

6) What are “spike years” and “dip years,” and why do they matter?

7) Are “tax loopholes” the same thing as illegal tax evasion?

8) Why do retirement accounts matter for taxes?

9) What does it mean when tax rules “sunset”?

10) Where can I find reliable tax information and tools?

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.