Last updated on January 30th, 2026 at 08:02 pm

1. Introduction: The Changing Face of Tipping in America

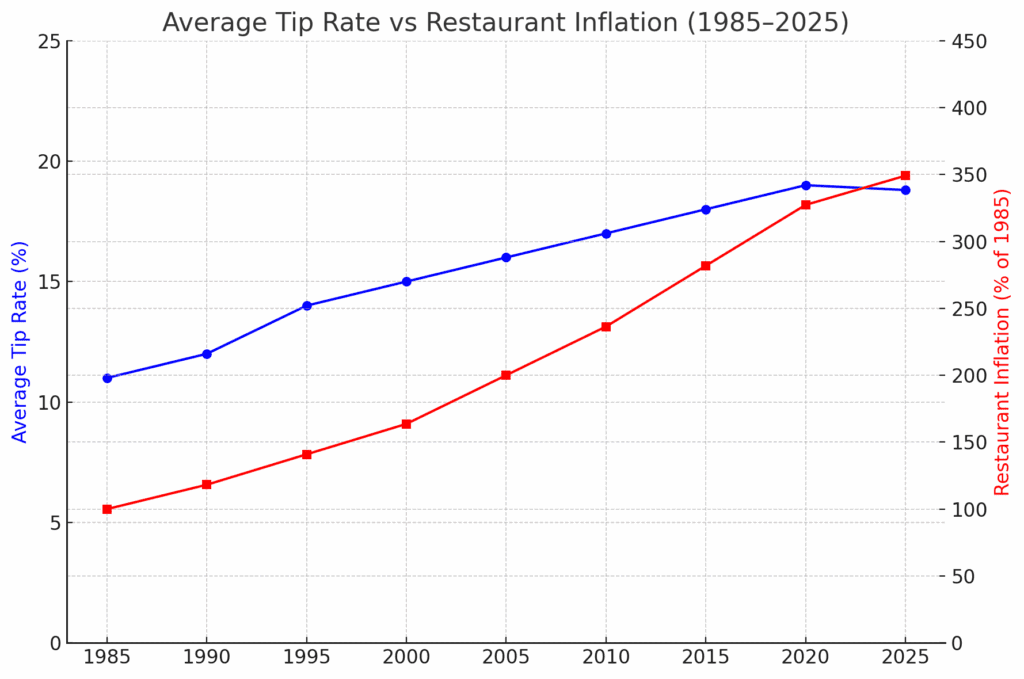

Over the past four decades, dining out in America has changed in more ways than just what’s on the plate. In 1985, leaving a 10–12% tip was considered polite, even generous. By 2000, 15% had become the standard. Today, diners are routinely faced with digital point-of-sale (POS) machines suggesting 20%, 25%, or even 30% — a shift that has fueled what many now call tipflation in restaurants, all while the cost of meals has more than tripled over the same period.

Personal Note: When I met my wife, she was a server at a five-star restaurant. She was terrific at her job and became their highest tip earner. Often she brought home more in a week than I made in a month. This article is not about great servers or even poor ones — it’s about the system as it was and as it is. If you are a server, please understand this article is not written to criticize your profession.

- 1. Introduction: The Changing Face of Tipping in America

- Rising tip expectations

- Understanding Tipflation in Restaurants: Why It Matters

- 2. A Brief History of Tipping

- 3. The Rise of POS Machines and Tip Prompts

- 4. Server Wages vs. the General Public

- 5. Tax Policy Tilt: The “No Tax on Tips” Deduction

- 6. Credit Card Fees and the Hidden Tip Inflation

- 7. Managing Tip Fatigue as a Consumer

- 8. Corporate and Expense Account Policies

- 9. Millennials, where does your generation fall on the tipping question?

- 9.1 Quiz about your tipping habits

- 10. Conclusion: Taking Back Control of Tipping

- FAQ: What Should I Do If…

- PODCAST

When I met my wife, she was a server at a five-star restaurant. She was terrific at her job and became their highest tip earner. Often, she brought home more in a week than I made in a month. This article is not about great servers or even poor ones — it’s about the system as it was and as it is. If you are a server, please understand this article is not written to criticize your profession.</p> </div>

Rising tip expectations

This collision of restaurant inflation, rising tip expectations, and new tax rules for service workers has created the modern reality of tipflation in restaurants. What once was a small token of appreciation has become a significant — and often unavoidable — part of the dining bill.

Recent data confirms this shift. A Fox Business report citing Toast’s payment data showed that average tips at full-service restaurants, once as high as 19.8% in 2021, slipped to 18.8% by the third quarter of 2024 — evidence of growing “tip fatigue” as diners resist constant prompts to give more, even in places where no service was really provided.

At the same time, servers are benefiting from a perfect storm: higher base wages, larger tips in raw dollars thanks to inflated menu prices, and new federal tax breaks that allow them to keep more of their income.

Restaurant owners, meanwhile, are leaning on technology to shift wage pressure onto customers, using POS systems that quietly normalize higher tip percentages and reinforce tipflation in restaurants as the new norm.

And to top it off, many restaurants now tack on credit-card fees or service charges, inflating the bill — and the tip — even further.

This article takes a hard look at where tipping has been, where it’s going, and what diners can do to take back control of their wallets without shortchanging good service. We’ll examine the data behind tipflation in restaurants, the role of POS machines, the impact of tax law, and strategies to combat guilt tipping — all while placing today’s tipping culture in the broader historical context.

Understanding Tipflation in Restaurants: Why It Matters

2. A Brief History of Tipping

To understand today’s frustrations with tipping, it helps to look back at how the practice began and how far it has drifted from its origins.

🇺🇸 Imported from Europe, Reinvented in America

Tipping in the U.S. traces its roots to European customs in the 19th century, where wealthy travelers would leave small coins as a token of gratitude for special service. When the practice crossed the Atlantic, it was initially resisted — many Americans saw it as undemocratic, a way of buying favor or reinforcing class differences. But by the early 20th century, tipping had spread widely in restaurants, hotels, and rail travel.

🪙 From Pocket Change to Policy

Originally, tips were meant to be spare change for exceptional service — a way to say “thank you” for going above and beyond. In the 1950s and 60s, 10% was common. By the 1980s, the standard had shifted to 12–15%.

Large companies even set official policies for employees on expense accounts: no more than 15%, and often closer to 10%. Many travelers from that era still remember being told by their employer to keep gratuities modest.

🍽️ The 21st-Century Shift

In recent decades, tipping culture exploded:

- POS prompts normalized 18–25% as “default.”

- Self-service tipping became common — coffee shops, takeout counters, and even drive-thrus now flash tip requests.

- Social pressure intensified as digital screens made tipping decisions visible to staff and other customers.

✂️ Narrowing the Definition of Service

Historically, tips went to those who provided a direct, physical service: waiters carrying plates, bartenders mixing drinks, shoe shiners, taxi drivers, or attendants pumping gas. Today, the expectation has broadened so far that customers are asked to tip even when they did most of the work themselves, such as picking up a coffee at the counter.

📉 From Generosity to Obligation

What was once an optional gesture of generosity has become, in many cases, an expectation — or worse, a demand. This cultural drift explains why many Americans now resent tip prompts, especially when combined with inflated menu prices and new fees.

✅ Bottom Line: Tipping in the U.S. began as a voluntary way to thank someone for special service. Over time, it has morphed into a quasi-mandatory surcharge that follows consumers everywhere — even where no real service has been performed.

3. The Rise of POS Machines and Tip Prompts

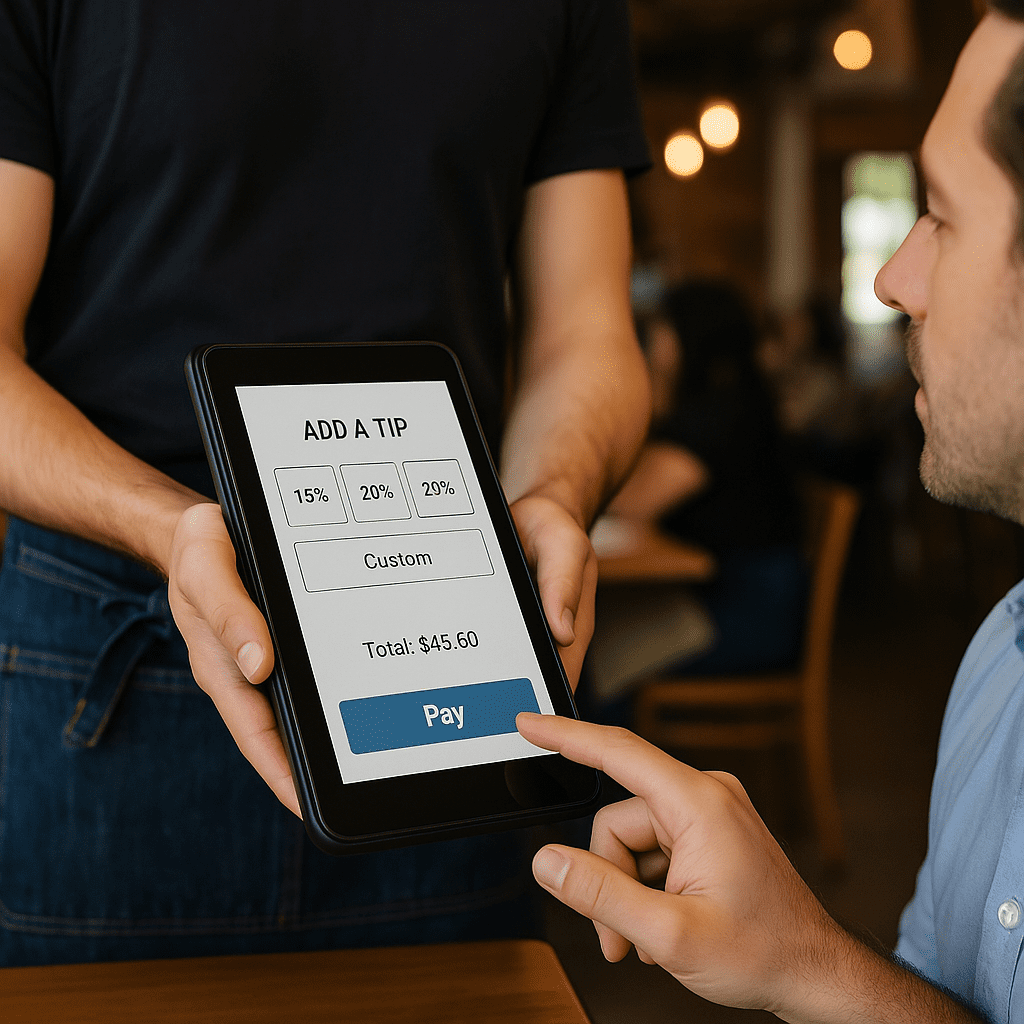

If you’ve dined out recently, you’ve probably seen it: the glowing tablet or handheld payment screen spun toward you at the end of a meal, offering “suggested” tip buttons that start at 20% and climb from there. These point-of-sale (POS) systems have become the new normal in American restaurants, cafés, and even coffee shops. But why are they pushing such high tip percentages, and who really benefits?

💻 Why POS Systems Push Higher Tips

Modern POS platforms (like Toast, Square, and Clover) are designed with built-in prompts that steer customers toward higher tip amounts. Industry research shows that when diners are presented with three options — say 20%, 25%, and 30% — most will select the middle button. By structuring the prompts this way, POS manufacturers engineer higher average tips without the customer even realizing they’ve been nudged.

🍽️ Who Benefits: Restaurants vs. POS Companies

For restaurant owners, higher tip rates mean happier servers — without raising payroll costs. Instead of increasing wages, owners can point to “strong tips” as proof that their staff are well-compensated. POS companies benefit too: they market these results as a selling point, claiming restaurants using their systems see measurable increases in employee satisfaction and retention.

In some cases, POS providers also profit indirectly by collecting processing fees on the larger bill totals that include inflated tips.

😒 Why Customers Hate It

From the diner’s perspective, it feels manipulative. Being asked to tip 20–30% — sometimes before food has even arrived — creates guilt pressure. And when a server hovers over the table while the screen waits for input, the social pressure intensifies.

Consumers call this “guilt tipping,” and surveys show many are tired of being forced to pay more than they believe the service was worth. The resentment grows when POS screens appear in self-service settings, like coffee counters or fast-casual spots, where little or no personal service is provided.

📝 A Personal Example

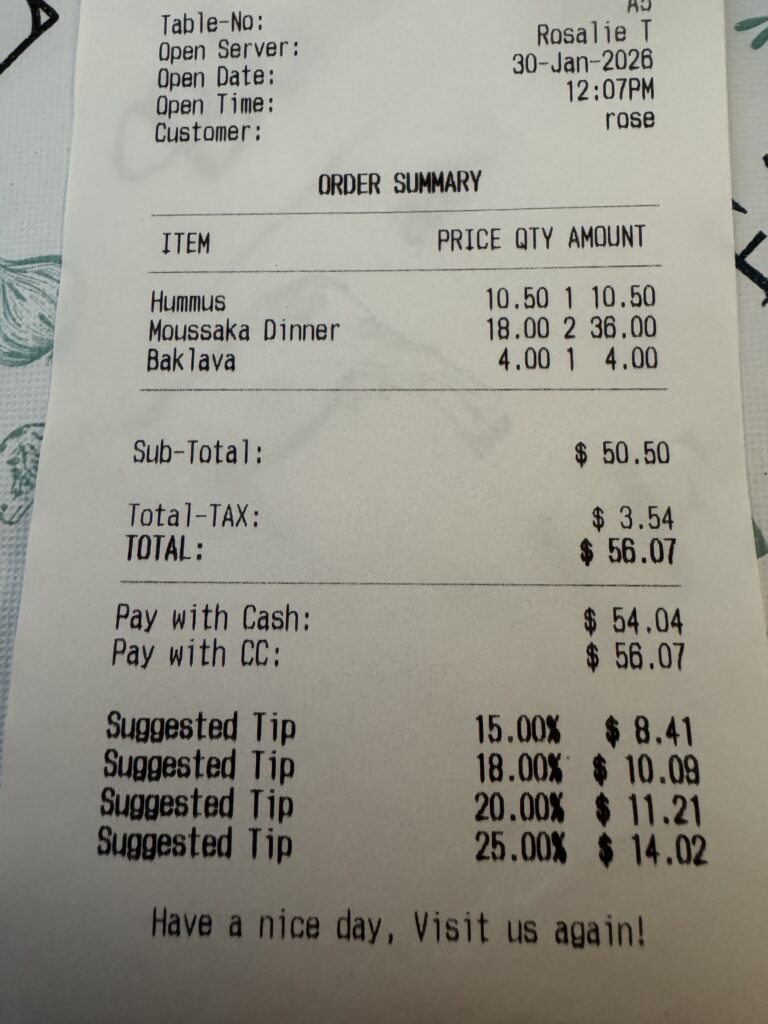

I recently went to a restaurant I frequent with my wife. The POS ticket offered several tip choices starting at 18% and going up to 30%. The amounts were pre-calculated with the tax included — all I had to do was check a box and sign. Just a month earlier, the lowest option had been 15%. Proof that the POS companies are pushing the envelope upward.

For years, I used to check the box, even though I knew I was paying a tip calculated on taxes. This time, I pulled out my phone, calculated my usual 15% on the pre-tax subtotal, and entered the custom amount instead.

My wife and I just returned from a trip across the country, racking up over 4,000 miles in our truck towing a 5th wheel. Needless to say, we stopped at many restaurants. All but two restaurants presented the bill asking for a minimum of 18% which was calculated by adding in taxes and fees. Two restaurants still have 15% as the first choice, but both of those added the tax and fees to the total.

What we discuss here is not an exception but the actual rule, which is that POS manufacturers have programmed their systems to drag the highest tip possible out of guests. Please read on and learn more about this practice and other practices used to benefit restaurant owners and POS makers.

✅ Bottom Line: POS prompts are less about giving customers a choice and more about normalizing higher tips. For owners, it’s a no-cost wage substitute. For servers, it can mean extra dollars. But for customers, it often feels like a high-tech shakedown.

4. Server Wages vs. the General Public

One of the strongest arguments for “tip fatigue” is that servers’ incomes have grown faster than those of many other workers in the U.S. economy. A combination of rising menu prices, higher tipping percentages, and wage increases has pushed total compensation for restaurant staff well above the trend line for other occupations.

📈 Wage Growth Outpacing the Average

According to Bureau of Labor Statistics data, wages in the food service sector have climbed more than 35% over the past five years, compared to roughly 20% for the overall workforce. While much of that was driven by labor shortages and mandated minimum wage hikes, it’s the tipping system that amplifies those gains.

When menu prices rise due to inflation, a 15–20% tip automatically rises with them — delivering servers a built-in raise without any change in the percentage.

For example:

- In 2005, a $50 meal with a 15% tip produced $7.50 for the server.

- In 2025, that same meal costs closer to $90 due to restaurant inflation. Even with no change in tip rate, the server receives $13.50. And if the POS system nudges the customer to 20%, the tip climbs to $18.00.

🧾 The Tax Advantage

Servers are also benefiting from new federal tax rules. Under the “One Big Beautiful Bill Act,” up to $25,000 in tips is exempt from federal income tax (2025–2028). While other workers pay income tax on every dollar earned, tipped workers now get a substantial portion of their wages tax-free.

Employers and employees still owe Social Security and Medicare contributions on tips, but the income tax break directly boosts take-home pay.

⚖️ A Growing Divide

The result is a widening gap between service workers and the general public. While many Americans are struggling with wages that barely keep pace with inflation, servers are enjoying:

- Higher hourly wages are driven by labor shortages and minimum wage hikes.

- Bigger tip checks thanks to menu price inflation and POS nudging.

- Lower effective tax rates on their income.

This combination explains why diners are pushing back. They see servers’ pay growing faster than their own and feel resentful when asked to tip 20–30% on inflated restaurant bills.

✅ Bottom Line: The American tipping system has evolved into a mechanism where servers consistently outpace the average worker in wage growth — not just because of hard work, but because the system itself guarantees raises tied to inflation, and now tax policy tilts even further in their favor.

5. Tax Policy Tilt: The “No Tax on Tips” Deduction

In July 2025, a new federal law reshaped the economics of tipping: the One Big Beautiful Bill Act. At its core is a simple but powerful change — tipped workers can now exclude up to $25,000 in tips from federal income tax each year (effective 2025 through 2028).

🧾 How It Works

For most servers, bartenders, and other tipped employees, this means the bulk of their tip income is now completely tax-free at the federal level. Only amounts above $25,000 count as taxable income. Employers and employees still owe Social Security and Medicare contributions on tips, but those payroll taxes were always required. The income tax exemption, however, delivers an immediate boost in take-home pay.

💵 Real-Life Impact

Consider a server earning $30,000 in reported tips annually:

- Before 2025: Entire $30,000 taxed as income → roughly $3,600 owed in federal income tax (assuming 12% rate).

- After 2025: Only $5,000 taxable → just $600 in federal tax.

- Net result: About $3,000 extra in take-home pay each year.

For servers who earn less than $25,000 in tips annually, their federal income tax bill on tip income is now effectively zero.

⚖️ Tilt Compared to Other Workers

This tax change creates a striking contrast with the general public:

- A retail clerk or office assistant earning $30,000 must still pay full federal income tax on every dollar.

- A restaurant server earning the same amount in tips may now owe little or nothing on that portion of income.

Years ago, people tipped generously out of sympathy. Servers were seen as underpaid, working long shifts for low wages. But that reality has shifted. Many servers today work part-time or shorter hours, yet their overall compensation is growing faster than that of the customers who leave the tips.

In effect, continuing to tip at ever-higher percentages can feel like giving money to a person with a handout — so they can put gas in their $100,000 sports car.

📊 Why It Matters

This policy was promoted as a way to reward service workers and ease reporting burdens. But combined with higher menu prices, nudged tip percentages, and rising base wages, it has further tilted the playing field. Servers already benefiting from inflation-adjusted tip growth now enjoy a tax structure that lets them keep significantly more of their income compared to other workers.

✅ Bottom Line: The “No Tax on Tips” deduction is not just a perk — it’s a structural shift that boosts servers’ financial advantage. For many, it eliminates their federal income tax burden on tips altogether, widening the gap between tipped workers and the rest of the labor force.

6. Credit Card Fees and the Hidden Tip Inflation

Another layer of frustration for diners is how restaurants are increasingly passing credit card processing fees onto customers. These fees — often 2–4% of the bill — are added on top of sales tax, then rolled into the total before the tip is calculated. The result? Diners not only pay more in fees but also end up tipping on those fees, compounding the cost.

💳 How It Works

Let’s take a $100 meal as an example:

- Sales tax (8%): +$8

- Credit card fee (3%): +$3

- Subtotal before tip: $111

Now apply the tip:

- 20% tip on $111 = $22.20

- 20% tip on $100 subtotal = $20.00

That simple shift inflates the tip by $2.20 — money that goes to the server, even though it’s calculated on fees and taxes that provided no additional service.

🍽️ Why Restaurants Do It

From the owner’s perspective, passing along the credit card fee protects razor-thin margins. Instead of absorbing 2–4% in processing costs, they shift the expense to customers. But when combined with tipping prompts, the outcome is a double hit: customers cover the fee and pay a larger tip on the inflated base.

Call-Out: Restaurant owners operating on slim margins would do better by raising their prices instead of adding credit card fees. It’s a psychological issue for consumers. The same reason Amazon does well with “free” shipping — we all know it’s baked into the cost of goods, but the perception matters.

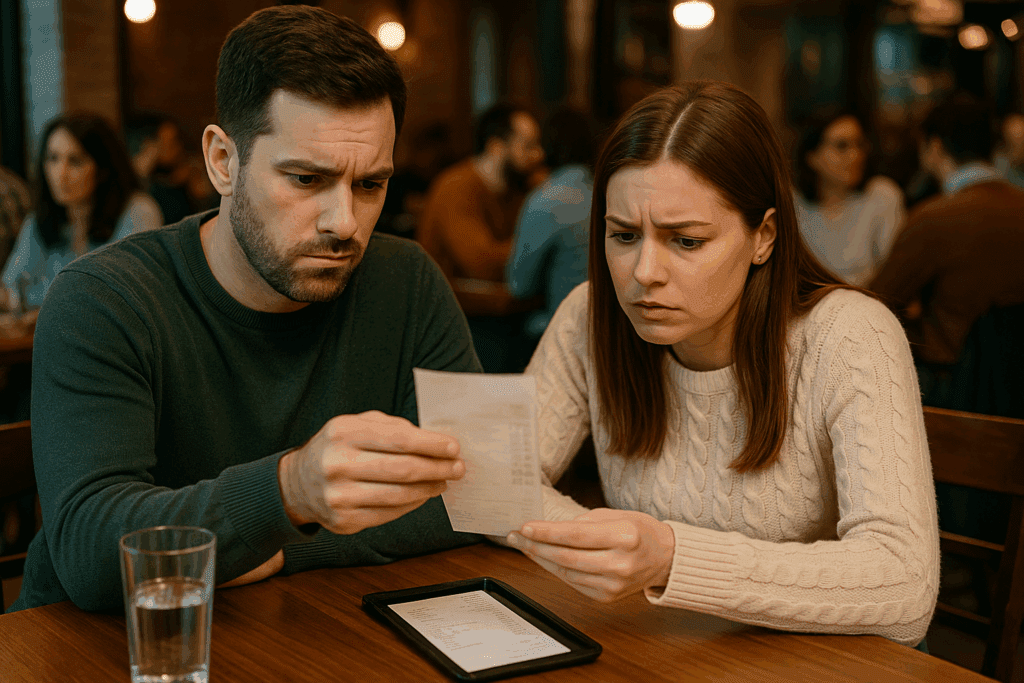

👎 Why Customers Feel Cheated

Most diners don’t realize that tips are being calculated on fees and taxes. They assume they’re rewarding service, not subsidizing financial charges. When they notice, it can feel like a bait-and-switch. For many, this is the tipping point — literally — where they start pulling out their phone calculators to enter a custom tip based only on the pretax subtotal.

✅ Bottom Line: Passing card fees onto the bill might make sense for restaurants, but when tips are layered on top, it inflates servers’ pay even further while frustrating customers. It’s one of the clearest examples of how tipflation is being driven by structural tricks in the system, not just customer generosity.

7. Managing Tip Fatigue as a Consumer

By now, most diners have felt the frustration of tipflation. What used to be a quick mental calculation at the end of a meal has turned into a confusing dance with POS prompts, added fees, and social pressure. The good news is, you’re not powerless. With a few simple strategies, you can reward good service fairly while keeping control of your own spending.

🧮 Do the Math Yourself

Don’t let the POS machine do the thinking. Calculate your tip on the meal subtotal before taxes and fees:

- Excellent service: 15–18%

- Average service: 10–12%

- Poor service: 0–5%

This ensures you’re tipping on the food and service alone — not subsidizing government taxes or credit card charges.

🔢 Use the “Custom Tip” Option

When a tablet flashes only 20%, 25%, or 30% choices, look for the custom button. Enter your own number based on your calculation. It takes a few seconds longer but keeps the decision in your hands, not the software designer’s.

💪 Don’t Be Intimidated

Servers may stand nearby as you tip, and sometimes other customers can see the screen. Don’t let that pressure sway you. It’s your money and your decision. A good server will be pleased with a fair tip, especially if it’s higher than average for excellent service. And they understand customers don’t want to tip on taxes or fees. If the service didn’t measure up, or if no service was provided at all, don’t be afraid to select “no tip.”

🛑 Know When Not to Tip

Tipping is for service, not self-service. A few examples:

- ✅ Full-service dining, bartenders, hair stylists, rideshare drivers.

- ❌ Self-service counters, takeout pickups, coffee shops where you walk to the counter.

If you carried your own drink from the barista station or waited in line for a sandwich, you already did the work. No tip is necessary.

⚠️ Examples of Poor Service Worth Less — or No — Tip

Here are some real-world scenarios where a server’s lack of attention justifies reducing or eliminating the tip:

- Ignored at the table: You sit down for dinner with friends. The waiter fills water glasses and serves drinks, but once empty, no refills come. One friend wants another drink, but the waiter is nowhere to be found. The food arrives with no new drinks, and only much later does the waiter ask about refills. This is a lost opportunity for the restaurant — attentive servers drive both better service and higher sales.

- Incorrect and incomplete order: You ask for a hamburger very well-done and crisp bacon, with soup to start. After a long wait, the burgers arrive undercooked, the bacon is fatty, and the soup is forgotten. Pressed for time, you eat what you can and cancel the soup. In this case, leaving only a token $1 tip is fair — poor attention to detail and missed orders should not be rewarded with a full gratuity.

🌟 Examples of Great Service Worth a Generous Tip

Tipping generously still makes sense when servers demonstrate attentiveness and care:

- Consistent attention: My wife and I went to dinner a few days ago, and the delightful young lady waiting on us returned several times during the meal to ask if we needed anything. She refilled our water glasses without being asked and brought extra condiments. That kind of proactive service is exactly what we expect in exchange for a generous tip — which she happily received.

- Going above and beyond: On another occasion, my wife’s dinner was served cool. The attentive waiter checked in and, upon hearing our concern, had the kitchen prepare an entirely new meal. He returned with the hot replacement quickly and even offered dessert at no cost. That level of service turned a problem into a positive experience — and he was rewarded accordingly.

These examples highlight the heart of tipping: attention to the customer. Great service inspires generosity, while indifference or mistakes don’t merit the same reward.

🎯 Return to the Spirit of Tipping

Tipping began as a token of appreciation for someone who went above and beyond. It was never meant to be an automatic surcharge on every transaction. By tipping thoughtfully — based on service, not guilt — you bring tipping back to its original purpose.

✅ Bottom Line: Tip fatigue is real, but consumers can push back. Do the math, use the custom option, and don’t hesitate to reward good service generously — or reduce tips when service falls short. When you tip, make it intentional — a fair reflection of the service you received, not a forced donation to a broken system.ng back to what it was intended to be — a reflection of service, not a product of social pressure.

8. Corporate and Expense Account Policies

Tipping isn’t just a personal decision; for decades, it has also been a business expense that companies have managed through strict guidelines. In the pre-digital era, when employees traveled for work, many corporations issued policies capping tips at 10–15%. Some companies even encouraged their staff to stay closer to 10%, arguing that tips were meant as a modest gesture, not a major line item.

🏢 Why Companies Capped Tips

Businesses wanted to control expenses and avoid the appearance of waste. An employee submitting a dinner receipt with a 20% tip in the 1980s or 1990s would often see the reimbursement cut back to the company-approved level. Tipping was framed as a reasonable expense, not an open-ended obligation.

📲 Clash with Today’s POS-Driven Expectations

Fast forward to today, and employees on work trips face POS screens suggesting 20%, 25%, or even 30%. This creates a conflict:

- Employees may feel pressured to tip higher because of social expectations or visible prompts.

- Companies may push back, refusing to reimburse amounts above their policy threshold.

It’s a new kind of tension — the digital era normalizing gratuities well above what many businesses consider reasonable.

✈️ The Corporate Counterweight to Tipflation

Corporate travel policies could become one of the most effective forces in reining in tipflation. If large companies continue to cap tips at 15% for expense reimbursement, employees will either:

- Enter custom amounts at POS terminals, resisting nudged percentages, or

- Pay out of pocket for any amount above the cap — a natural deterrent to over-tipping.

Either way, corporate guidelines provide a counterbalance to the inflated tip culture now pushed by restaurants and POS vendors.

✅ Bottom Line: For decades, companies treated tipping as a modest, capped expense. Today’s 20–30% prompts clash with those long-standing norms. Corporate policies — still rooted in 10–15% limits — may help check the runaway growth of tipflation, especially in business dining.

9. Millennials, where does your generation fall on the tipping question?

At RetireCoast, our Millennial Hub explores the fine line between living a rich life and maintaining a disciplined budget. One of the most significant “stealth” drains on discretionary spending in 2026 isn’t the price of the coffee itself—it’s the math we do when the iPad flips around.

Tipping has moved from a quiet gesture of gratitude to a high-pressure digital interaction. How you handle that screen says a lot about your generation’s financial habits.

The “Guilt Gap”: Millennials and the 30% Button

If you’ve ever felt a bead of sweat form while a barista watches you choose a tip amount, you’re likely a Millennial. Data shows Millennials are the most sensitive to the “social pressure” of digital screens. While they tip less frequently than their parents, they leave the highest average percentages—often hitting that 25% or 30% button simply to avoid the perceived judgment of clicking “Custom” or “No Tip.”

In the context of budgeting, this “Guilt Gap” is a significant leak. Recent 2025 studies show the average person spends over $280 a year on “guilt tips” alone—money that could otherwise be fueling an emergency fund or a high-yield savings account.

9.1 Quiz about your tipping habits

Here is a 10-question quiz designed to help you explore your tipping habits and how they align with the generational trends we discussed for the RetireCoast Millennial Hub.

The Tipping Point: Exploring Your Habits

How do you stack up against the "Guilt Gap"?

10. Conclusion: Taking Back Control of Tipping

Over the past forty years, tipping in America has evolved from a token of gratitude into a near-mandatory surcharge, inflated by technology, rising menu prices, and shifting tax policies. What was once 10% on a modest dinner is now 20–30% on meals that cost three times as much — and often calculated on top of taxes and fees.

Servers today are doing better than ever: wages are higher, menu inflation automatically boosts tip dollars, POS systems nudge diners upward, and federal tax exemptions allow a large share of their income to go untaxed.

Meanwhile, the average customer — who may be struggling with stagnant wages and higher living costs — is left footing a larger bill. It’s no surprise that “tip fatigue” has become part of the national conversation.

But diners still hold the power. By tipping fairly — based on service, not guilt — you can reward attentiveness and professionalism without letting a glowing tablet dictate your generosity. Custom tips, pre-tax calculations, and the courage to say “no” when service isn’t delivered can bring tipping back to its original purpose: a reflection of service quality, not a forced donation to a broken system.

Even the data shows that pushback is underway. A Fox Business report citing Toast’s restaurant payment data found that average tips have already slipped from 19.8% in 2021 to 18.8% in 2024. Consumers are quietly resisting the pressure, and if enough people continue to stand their ground, the culture of automatic 20–30% gratuities may finally start to recede.

In the end, tipping should be your decision — not the POS vendor’s, not the restaurant’s, and not the culture’s. Consumers can push back, and when they do, tipping may return to what it was always meant to be: a simple, genuine “thank you” for good service.

💡 RetireCoast Resources

RetireCoast offers tailored resources for both Millennials and Gen X to improve financial literacy and prepare for retirement.

- Millennials: Check out 2025: Your Best Practical Guide to Financial Literacy — packed with actionable advice on budgeting, credit, and long-term investing.

- Gen X: Explore our full Gen X Blog Series Directory — a collection of guides, strategies, and tools designed for mid-career planning and retirement security.

👉 The takeaway: watching what you spend on meals — especially avoiding over-tipping — can free up money that works harder for your future.

FAQ: What Should I Do If…

What should I do if the POS machine only gives me tip options of 20% or higher?

Use the “custom tip” button. Enter the amount you want to pay based on the meal subtotal before taxes and fees. You are not obligated to pick the pre-set buttons.

What should I do if the server is standing next to me while I calculate the tip?

Don’t feel pressured. It’s your money and your choice. A good server will appreciate any fair tip. Take your time, enter the amount you feel is right, and don’t let social pressure sway you.

What should I do if the service was poor or the order was wrong?

Reduce the tip or skip it altogether. Tipping is meant to reward service. If drinks weren’t refilled, food was incorrect, or requests were ignored, reflect that in the tip.

What should I do if the bill includes a credit card fee or service charge?

Calculate your tip on the pre-tax meal subtotal only. Don’t tip on taxes or added fees—they don’t reflect the quality of service.

What should I do if I’m at a self-service restaurant or coffee shop with a tip screen?

You don’t need to tip. Tipping is for service, not self-service. If you picked up your own order and there was no table service, skip the tip without guilt.

What should I do if I want to tip fairly but also save money for retirement?

Set a personal tipping policy (e.g., 12–15% on the pre-tax subtotal for good service). Put the savings into a Roth IRA or 401(k). Small choices add up over time.

What should I do if my company reimburses tips only up to 15%?

Enter a custom tip that matches company policy. If you tip more, you may need to cover the extra yourself. Many companies still cap reimbursement at 10–15%.

Should I pay cash or use a credit card?

If you have a rewards card that gives you cash back or points, use it—the rewards can offset or cover the credit card fee. If not, paying cash may be better to avoid extra costs.

PODCAST

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.