Last updated on February 15th, 2026 at 08:46 pm

How Returning to Work or Starting a Business After Retirement Can Boost Your Income and Purpose

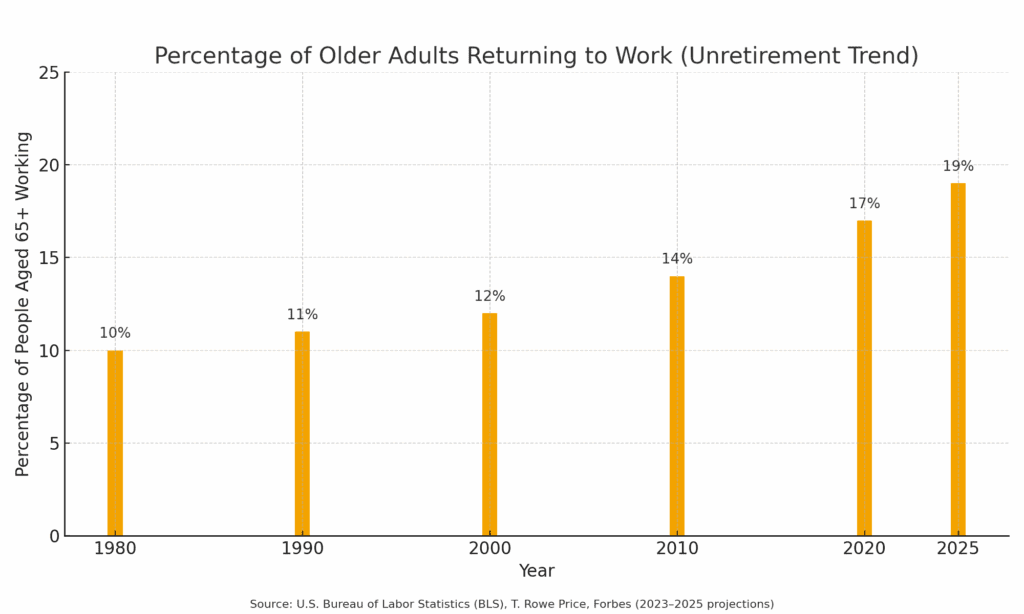

Are you bored with retirement? Need extra income? Crave social interaction? If so, you’re not alone. A growing trend among older adults in the United States shows that more and more retired people are choosing to re-enter the job market. Whether driven by financial considerations, personal interests, or a desire for meaningful work, unretirement is becoming an attractive option.

This trend, part of the broader “Great Unretirement” movement, reflects a shift in how retirement years are being viewed. According to the U.S. Bureau of Labor Statistics, the number of older workers in part-time and full-time positions has steadily increased over the past year.

In many cases, older employees are using their life experience and skill sets to launch their own business for the first time or explore new career paths in leadership positions, gig work, or remote work.

📊 Why people unretire

| Reason | Percentage of Retirees |

|---|---|

| Rising Cost of Living | 51% |

| Insufficient Retirement Savings | 37% |

| Social and Emotional Benefits | 45% |

| Health Care Costs | Not specified |

| Inflation and Economic Uncertainty | Not specified |

| Social Security Concerns | Not specified |

| Boredom and Lack of Routine | Not specified |

Note: Percentages are based on available data; some reasons are supported by qualitative insights.

These factors illustrate that unretirement is a multifaceted decision influenced by both economic pressures and personal desires for engagement and purpose.

See how returning to work may affect Social Security benefits, taxes, and your net income.

Addressing a financial need

For some, it’s about addressing a financial need. Inflation, market volatility, and underperforming retirement plans have pushed many baby boomers to seek financial stability in their later years. Financial experts from firms like T. Rowe Price suggest that supplemental income can improve financial security and reduce reliance on Social Security benefits, especially for those who haven’t reached full retirement age.

Others are motivated by the desire for personal satisfaction, the chance to learn new skills, and the mental health benefits of continued engagement.

As younger workers enter the workforce, older colleagues are finding that mentoring, consulting, or starting a new business provides a strong sense of purpose. Websites like Next Avenue and the Richard M. Schulze Family Foundation highlight the positive impact that older entrepreneurs can have on their communities.

This article is written by someone who has authored dozens of pieces on retirement, retirement savings, and starting a business in affordable locations. If you’re considering unretirement, this is a good time to explore your options.

Why So Many Older Adults Are Choosing to Unretire

The idea of traditional retirement is being redefined. In the past, retirement often meant leaving a full-time job permanently. Today, many older workers see it as a transition to a different way of life rather than an end. Here’s why more retired workers are exploring unretirement and considering new ventures:

1. Financial Necessity & Extra Income

For many, the primary reason is financial. A bear market, inflation, and rising healthcare costs have placed pressure on retirement savings. Financial advisors emphasize the importance of a flexible financial plan.

According to a recent spending study published by Oregon State University, many retirees return to work because they didn’t save enough money in the first place. Earning income through part-time work, consulting, or an online business helps ease the burden.

2. Social Engagement & Sense of Purpose

Human beings are social by nature. The loss of daily social interaction in retirement can lead to loneliness and declining mental health. Retired people often seek volunteer work, part-time positions, or start their own business to reconnect with their communities and rediscover a sense of purpose.

Opportunities

3. The Opportunity to Explore New Things

Unretirement offers the chance to try something you’ve never done before—perhaps something you were too busy for during your career. Whether it’s a new business, a creative project, or learning about financial services to help family members, older adults are showing a strong work ethic and the right mindset to embrace new interests.

4. A Shift in the Job Market & the Rise of Flexible Work

With the rise of remote work and gig work, older employees can now find part-time roles that suit their lifestyle. They can also create new career paths by tapping into leadership, consulting, and entrepreneurial opportunities.

In contrast to younger people looking to climb the corporate ladder, many older entrepreneurs are more focused on balance and fulfillment.

5. Unretirement on the Mississippi Gulf Coast

While this article is relevant to all older workers in North America, it’s worth noting that some are choosing to unretire in low-cost, high-quality-of-life locations like the Mississippi Gulf Coast.

Known for its laid-back vibe, golf courses, and supportive community, it’s an ideal setting for older entrepreneurs to launch new ventures and enjoy the good life without the high price tag.

Whether your primary motivation is financial need, personal satisfaction, or both, unretirement might be the best way to find meaning and opportunity in your later years. And if you’re wondering how to get started, the rest of this guide will walk you through it step by step.

The Pros and Cons of Unretirement

Choosing to unretire is a deeply personal decision. For many older adults, it brings renewed energy, a stronger sense of purpose, and additional income. But it’s not without challenges. Let’s take a look at the key pros and cons of returning to work or starting a business after retirement:

Pros

- Financial Stability: Unretiring can help you close gaps in your retirement savings, delay Social Security benefits for higher payouts, and improve your overall financial plan.

- Social Interaction: Re-engaging with coworkers, clients, or the community improves social health and combats isolation, especially for retired workers.

- Mental Health Benefits: Staying mentally and physically active can reduce stress, depression, and cognitive decline in later years.

- Personal Satisfaction: Exploring new interests or starting a new business can be deeply fulfilling, especially for those leaving the status quo behind.

- Opportunities for Remote or Flexible Work: The job market now offers more part-time and remote work options, making it easier to find meaningful roles that fit your schedule.

- Valuable Use of Life Experience: Your background and leadership skills are often welcomed by younger generations and can be put to use in mentoring or consulting.

Cons

- Health Issues: Some retirees return to work only to realize that health limitations make it difficult to sustain full-time work or certain job types.

- Higher Tax Bracket: Earning more money could push you into a higher tax bracket or impact your Social Security benefits, depending on your age and income.

- Reduced Free Time: Going back to work, especially full-time, can cut into the leisure time you expected in retirement.

- Technology Gap: For some older workers, keeping pace with evolving technology or learning new skill sets can be challenging.

- Loss of Retirement Benefits: Returning to work may affect pension payouts or delayed retirement credits, depending on your financial services provider.

Understanding the trade-offs is essential. If you approach unretirement with the right mindset, a clear understanding of your financial needs, and personal goals, it can be the start of a rewarding new chapter.

Up next, we’ll explore the best types of businesses and income-generating opportunities for those seeking unretirement on their own terms.

Should You Take a Job or Start a Business? Pros and Cons of Each Path

If you’ve decided that unretirement is right for you, the next step is figuring out how to re-enter the world of work. Should you find a part-time or full-time job? Or should you start your own business? There is no one-size-fits-all answer, but here are the pros and cons of each path to help you decide:

Taking a Job

Pros:

- Immediate Income: A job provides steady income quickly—ideal for those with immediate financial needs.

- Less Risk: You don’t need to invest your own money or take on the responsibilities of ownership.

- Structure and Stability: Traditional employment often comes with benefits, predictable hours, and support from a team.

- Skill Utilization: Leverage your existing experience in a leadership, advisory, or mentorship role.

Cons:

- Limited Flexibility: You’ll have to follow someone else’s schedule, which can be restrictive.

- Age Bias: Some industries may be less welcoming to older workers.

- Physical and Mental Demands: A full-time job may be more strenuous than expected, especially for those with health concerns.

Starting a Business

Pros:

- Complete Flexibility: Set your own hours, work remotely, and design your business around your lifestyle.

- Pursue Your Passions: Turn hobbies or personal interests into income-generating ventures.

- Potential for Greater Earnings: While not guaranteed, a successful business can out-earn a part-time job.

- Personal Fulfillment: Many older entrepreneurs find deep satisfaction in building something of their own.

Cons:

- Financial Risk: Start-up costs, market competition, and the time it takes to become profitable can be challenges.

- Learning Curve: You may need to learn new skills or technologies, which could be intimidating at first.

- No Guaranteed Income: Unlike a job, business income can be unpredictable, especially in the beginning.

Both paths offer the opportunity to improve your financial outlook, engage with others, and stay active. The best way forward depends on your goals, your energy, your financial considerations, and your appetite for risk and learning.

In the next section, we’ll explore some of the most successful types of businesses for older adults looking to unretire.

Where Will You Unretire? Relocating for Opportunity and Affordability

One of the biggest decisions you’ll make as part of your unretirement journey is where to begin your next chapter. For many older workers, relocating to a low-cost area can open doors to more than just affordable living—it can also create the perfect environment to start a business or find rewarding part-time work.

Why Relocation Might Be the Right Move:

- Lower Cost of Living: Moving to a region with lower housing costs, lower taxes, and overall affordability can stretch your retirement savings further. It may also allow you to invest more in a business or take a lower-paying job without financial stress.

- Favorable Business Climate: Certain states and regions, like the Mississippi Gulf Coast, offer business-friendly regulations, local grants or support networks, and a growing demand for services—all ideal for older entrepreneurs.

- Available Jobs for Older Adults: Some communities have recognized the value of experienced workers and actively seek out older employees to fill part-time roles that younger workers may not be interested in.

- Quality of Life: Relocating can also bring a better climate, scenic surroundings, a slower pace, and access to outdoor activities like golf, fishing, and walking trails that support a healthy lifestyle.

What About Staying Put?

There are also advantages to unretiring in your current location:

- Established Networks: You already know the area, have professional and social connections, and understand the local job market.

- Family Proximity: Staying near children or grandchildren can be a strong motivator for many retirees.

- Avoiding Moving Costs: Relocation comes with both financial and emotional costs, including selling a home, finding new healthcare providers, and adjusting to a new environment.

The best decision comes down to your financial goals, lifestyle preferences, and available opportunities. But if you’re looking for a fresh start and a more supportive environment for entrepreneurship, a move to a place like the Mississippi Gulf Coast might just be the key to building your new path.

Next, we’ll take a look at the most successful business ideas for older adults entering the world of unretirement.

Try our Unretirement Impact Calculator to explore your options →How Unretirement Affects Your Social Security Benefits

Before deciding to take a job or start a business during unretirement, it’s important to understand how earned income can affect your Social Security benefits, especially if you began collecting early.

1. If You Claimed Benefits Early (Before Full Retirement Age):

If you began receiving Social Security at age 62, the earliest possible age, you are subject to the earnings limit. In 2025, if you earn more than $22,320 (estimate based on recent thresholds), your benefits may be reduced by $1 for every $2 earned above the limit. Once you reach full retirement age, those reductions stop.

2. Reaching Full Retirement Age (FRA):

Once you hit full retirement age (between 66 and 67, depending on your birth year), you can earn as much as you want with no penalty. Any previously withheld benefits due to earnings will be recalculated, and your monthly benefit amount may increase.

3. Business Income Considerations:

If you’re self-employed or running a small business, your net earnings count toward the Social Security earnings test. However, business owners can often deduct expenses that reduce reportable income, which may help keep you under the penalty threshold before FRA.

Social Security

4. Social Security Disability Benefits (SSDI):

If you are receiving Social Security Disability Insurance (SSDI), returning to work or earning income could affect your eligibility. SSA provides a Trial Work Period (TWP), allowing you to test your ability to work for up to 9 months without losing benefits. However, earning above a set threshold (about $1,110/month in 2025 for non-blind individuals) after that trial period could disqualify you from receiving disability benefits.

5. Income Taxes on Social Security:

Any additional income from unretirement—whether job-based or business-based—can also increase the portion of your Social Security that is taxed. Up to 85% of your benefits may be taxable depending on your total income.

6. How Income Affects Medicare Costs:

Your Medicare premiums—particularly for Part B (medical insurance) and Part D (prescription drug coverage)—may increase if your income goes above certain thresholds. This is called IRMAA (Income-Related Monthly Adjustment Amount). Higher income from wages, self-employment, or investment earnings can result in a higher monthly premium, so it’s important to include this in your financial planning.

What Should You Do?

Before jumping into unretirement, speak with a financial advisor or review guidance from the Social Security Administration and Medicare.gov to understand how working will impact your benefits. You may be able to adjust your strategy, such as delaying benefit claims or structuring business income to reduce the impact.

Understanding these rules is essential to protecting your retirement income while exploring new opportunities through work or business.

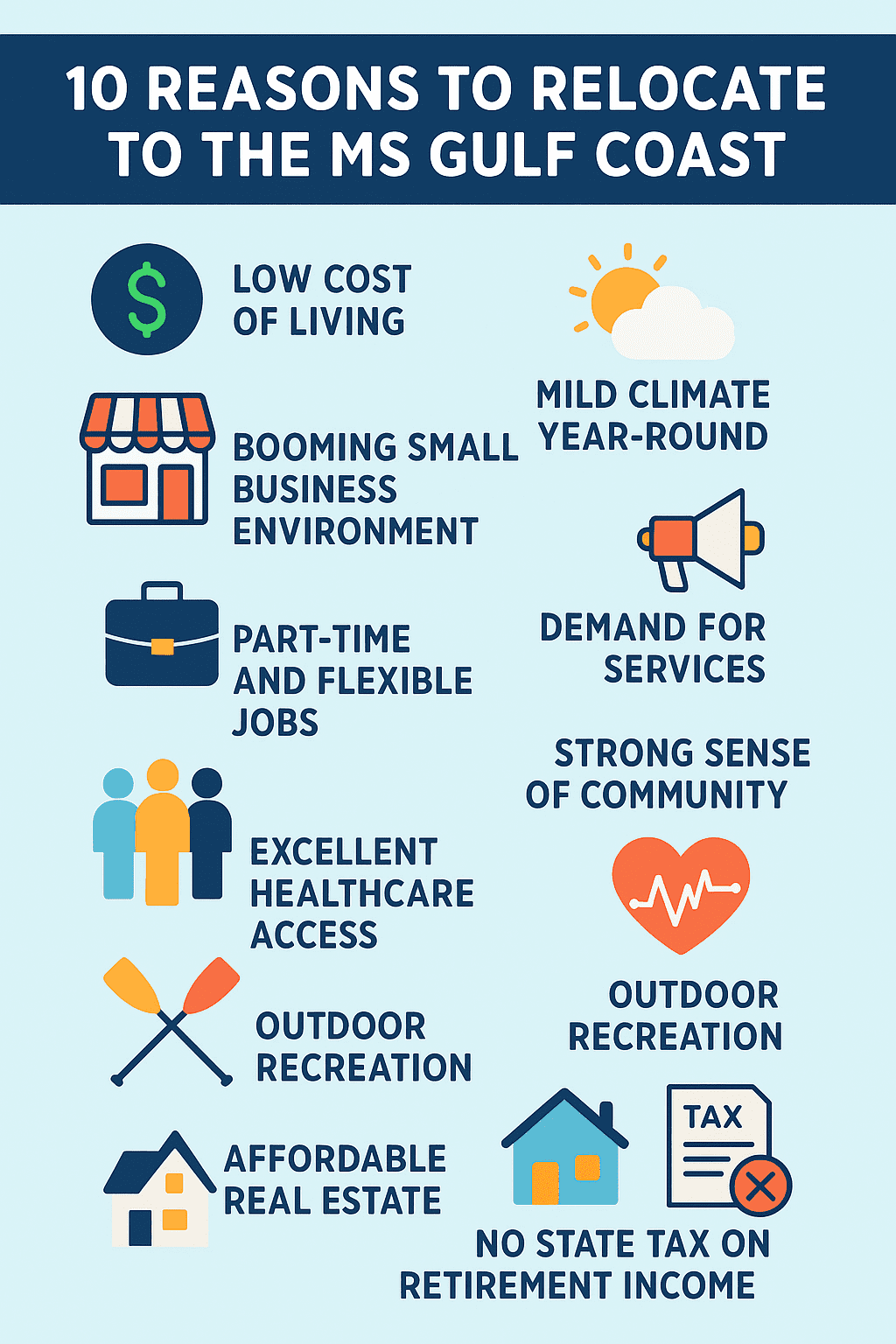

Why the Mississippi Gulf Coast Is a Prime Example of Unretirement Done Right

While retirees can choose to relocate anywhere in the United States, the Mississippi Gulf Coast stands out as one of the most practical, welcoming, and cost-effective places to begin your unretirement journey.

Whether you’re starting a new business or seeking part-time work, the region offers a rare combination of affordability, opportunity, and quality of life that’s especially attractive to older adults.

10 Reasons

Here are 10 compelling reasons to consider moving to the Mississippi Gulf Coast as part of your unretirement plan:

- Extremely Low Cost of Living – From housing to groceries to taxes, your dollars go further here than in most other states. RetireCoast has detailed this in articles like “Cost of Living on the Mississippi Gulf Coast”.

- Mild Climate Year-Round – Enjoy long summers, short winters, and outdoor-friendly weather that supports an active lifestyle without extreme heat or cold.

- Booming Small Business Environment – Business-friendly policies, affordable permits, and a growing local economy make this a great place to start a small venture. See “Starting a Business After Retirement”.

- Demand for Services – Many retirees and locals prefer working with small, local service providers, creating built-in demand for businesses in home services, consulting, caregiving, and more.

- Plentiful Part-Time and Flexible Jobs – Many local employers actively hire older workers who bring experience and reliability to the workforce.

- Strong Sense of Community – Small towns and coastal cities like Ocean Springs, Gulfport, and Bay St. Louis foster welcoming environments where retirees quickly feel at home. Learn more in “Small Towns of the Mississippi Gulf Coast”.

- Excellent Healthcare Access – The area features several well-rated hospitals, clinics, and specialty centers tailored to senior care.

- Access to Outdoor Activities – The Gulf Coast offers miles of beaches, walking trails, fishing spots, and golf courses—perfect for mental and physical well-being.

- Affordable Real Estate – You can still find affordable homes here, whether buying or renting. “Real Estate on the Mississippi Gulf Coast” breaks down your options.

- No State Tax on Retirement Income – Mississippi does not tax Social Security benefits, pensions, or IRA withdrawals—offering major financial advantages.

A foundation for successful retirement

These advantages don’t just support a better lifestyle—they provide the foundation for successful unretirement, whether your goal is to earn extra income, stay active, or finally pursue that business idea you’ve been thinking about.

To further reinforce the unretirement trend and why the Mississippi Gulf Coast makes sense, leading financial and lifestyle experts have weighed in on the broader topic:

- T. Rowe Price explains in “Unretiring: Why Recent Retirees Want to Go Back to Work“ that retirees often return for both financial reasons and to maintain social and mental engagement.

- Forbes discusses “Why Retirees Are ‘Unretiring‘” to restore purpose, find extra income, and take part in meaningful work.

- Kiplinger offers insights in “Thinking About Unretiring in 2025? Here’s What You Need to Know,” including financial planning tips and the value of flexible work options.

- SafeMoney’s article “Unretirement: Why Retirees Are Returning to Work“ outlines how older workers are adapting their financial strategies while staying active.

- Capital One’s “Unretirement: Working After Retirement” piece highlights how many retirees re-enter the workforce for social interaction, structure, and personal fulfillment.

For a deeper dive into life on the coast and starting a business in retirement, RetireCoast.com offers dozens of articles that explore relocation, entrepreneurship, and retirement strategies customized for this unique region.

Next, we’ll explore specific business ideas that are well-suited for older adults in transition.

Business Ideas Perfect for Unretired Entrepreneurs

Now that you’re ready to take the leap, let’s look at some of the most accessible and rewarding business ideas for retirees seeking purpose, income, and flexibility. Whether you’re pursuing a long-time passion or discovering a new path, these ideas are suited for older adults with experience, discipline, and a desire to engage in meaningful work.

Business ideas

Here are several business ideas that align well with the goals of unretirement:

- Consulting – Leverage decades of career experience to help businesses or individuals navigate challenges in your area of expertise.

- Freelance Writing or Editing – Ideal for those with a knack for communication. Work from home, set your hours, and pick projects that interest you.

- Property Management or Vacation Rentals – Perfect for retirees in tourist areas like the Gulf Coast. You can manage your own properties or offer services to others.

- Home Services or Handyman Work – There’s steady demand for honest, reliable help in areas like light carpentry, painting, or general repair.

- Tutoring or Test Prep – Share your knowledge with younger generations through in-person or online tutoring.

- E-commerce or Online Store – Sell crafts, antiques, curated products, or digital downloads through platforms like Etsy or Shopify.

- Life Coaching or Retirement Coaching – Help others navigate transitions using your own life experience.

- Pet Services – Dog walking, grooming, or pet-sitting can be both profitable and fulfilling.

- Event Planning – From small weddings to retirement parties, there’s always a need for organized help behind the scenes.

- Local Tour Guide – If you love your community, offer walking tours or cultural experiences that showcase what makes your area special.

Tailor to your financial plan

Each of these ideas can be tailored to fit your energy level, goals, and financial plan. You can scale them up or down based on your interests, and many of them require minimal startup costs.

For encouragement and step-by-step guidance, explore these RetireCoast articles on building a business after retirement:

- “The Ultimate Guide to Starting a Business After Retirement”

- “Forming a Business: Step-by-Step for Retirees”

- “Low-Cost Business Ideas for Retirees”

- “Starting a Business in a New State”

- “Starting a Business on a Budget”

Unretiring doesn’t mean going back to the grind—it means moving forward in a different way, with freedom, confidence, and a sense of purpose. Your business could be the next big thing in your life, and there’s no better time to begin.

Conclusion: Unretirement on Your Terms

Unretirement isn’t about going backward—it’s about moving forward in a different way. It’s about taking everything you’ve learned throughout your life and career and applying it to something that brings personal satisfaction, financial stability, and renewed purpose.

Whether you’re motivated by the need for extra income, a desire for social engagement, or the excitement of starting something new, unretirement offers the flexibility and opportunity to design your next chapter on your own terms. From part-time work to launching a new business, your options are broader and more accessible than ever. Your website will be key to your business success. Read this article.

And if you’re considering relocating to make unretirement more enjoyable and affordable, the Mississippi Gulf Coast stands out as a welcoming and practical destination. With its low cost of living, strong sense of community, and business-friendly environment, it provides an ideal foundation for your second act. Check out this article if you are a military retiree.

RetireCoast.com is here to guide you every step of the way. With articles, resources, and checklists specifically designed for retirees exploring business and relocation, you’ll find the tools and encouragement you need to thrive.

Now is the time to take the next step. Reclaim your purpose. Discover new interests. Create a business you can be proud of. Unretire your way—and let this be your most rewarding season yet.

Unretirement FAQ

Understanding Unretirement

1. What is unretirement?

Unretirement refers to the decision to return to work or start a business after retiring from a full-time career. It’s a growing trend among retirees who seek purpose, income, or engagement.

2. Why do people unretire?

People unretire for various reasons: financial necessity, boredom, desire for social interaction, or the fulfillment of personal or professional goals.

3. Is unretiring becoming more common?

Yes. According to the U.S. Bureau of Labor Statistics, the number of older adults rejoining the workforce has steadily increased over the past decade, driven by economic factors and lifestyle preferences.

4. Can I unretire and still collect Social Security?

Yes, but if you are under full retirement age, your benefits may be temporarily reduced depending on your income. The Social Security Administration provides guidelines for earnings limits.

5. Is it better to get a job or start a business after retirement?

That depends on your goals, risk tolerance, and lifestyle. A job offers immediate income and structure, while starting a business offers flexibility, independence, and long-term growth potential.

Unretirement Lifestyle & Opportunities

6. What are the pros of unretirement?

Pros include extra income, improved mental and physical health, social connection, intellectual stimulation, and a renewed sense of purpose.

7. What are the cons of unretirement?

Potential downsides include reduced leisure time, physical strain, adjusting to a new schedule, or re-entering a competitive job market.

8. Are there age discrimination laws to protect unretired workers?

Yes. The Age Discrimination in Employment Act (ADEA) protects workers aged 40 and older from workplace discrimination based on age.

9. What types of jobs are best for unretirees?

Popular choices include consulting, retail, teaching/tutoring, customer service, part-time remote work, and seasonal jobs.

10. What are good business ideas for unretired adults?

Great options include online stores, coaching/consulting, property management, handyman services, pet care, and local tourism.

Financial, Legal & Location Considerations

11. Do I need to update my resume if I’m returning to work?

Yes. Highlight recent volunteer work, certifications, tech skills, and clearly explain your career gap due to retirement.

12. Will returning to work affect my Medicare benefits?

Generally, no. But if your income increases significantly, it could impact your Medicare premiums. Always check with a financial advisor.

13. How can I prepare financially for unretirement?

Create a budget, understand how earnings will affect benefits and taxes, and consult a financial advisor to update your retirement plan.

14. Where are the best places to unretire?

Affordable, business-friendly areas like the Mississippi Gulf Coast are ideal. Look for regions with low taxes, a strong job market, and senior support services.

15. How can I tell if unretirement is right for me?

Ask yourself: Do I miss working? Do I want extra income? Do I feel unfulfilled? If you answered yes to any, it may be time to explore unretirement options.

PODCAST

Discover more from RetireCoast.com

Subscribe to get the latest posts sent to your email.